0001773751false00017737512024-08-052024-08-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 5, 2024

HIMS & HERS HEALTH, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-38986 | | 98-1482650 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| |

2269 Chestnut Street, #523 | | 94123 |

| San Francisco | , | California | | (Zip Code) |

| (Address of principal executive offices) | | |

Registrant’s telephone number, including area code: (415) 851-0195

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol | | Name of each exchange on which registered |

| | | | |

| Class A common stock, $0.0001 par value | | HIMS | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02. | Results of Operations and Financial Condition. |

On August 5, 2024, Hims & Hers Health, Inc. (the "Company") issued a press release announcing its results of operations for the quarter ended June 30, 2024. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference in this Item 2.02.

The information in this Current Report on Form 8-K and Exhibit 99.1 is being furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| | | | | | | | |

| Item 9.01. | | Financial Statements and Exhibits. |

(d) Exhibits

| | | | | | | | |

| Exhibit No. | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data file (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| HIMS & HERS HEALTH, INC. |

| | |

| | |

DATE: August 5, 2024 | By: | | /s/ Oluyemi Okupe |

| | | Oluyemi Okupe |

| | | Chief Financial Officer |

| | | (Principal Financial Officer) |

Hims & Hers Health, Inc. Reports Second Quarter 2024 Financial Results

Revenue of $315.6 million, up 52% year-over-year in Q2 2024

Net income of $13.3 million; Adjusted EBITDA of $39.3 million in Q2 2024

Subscribers grew to 1.9 million, up 43% year-over-year in Q2 2024

Raises full year 2024 revenue guidance to a range of $1.37 billion to $1.40 billion and Adjusted EBITDA guidance to a range of $140 million to $155 million

SAN FRANCISCO, August 5, 2024 – Hims & Hers Health, Inc. (“Hims & Hers” or the “Company”, NYSE: HIMS), the leading health and wellness platform, today announced financial results for the second quarter ended June 30, 2024 in a shareholder letter that is posted at investors.hims.com.

"Our second quarter results mark an acceleration in what was already an incredible trajectory. During the quarter, subscribers on our platform approached 1.9 million, increasing 43% year-over-year," said Andrew Dudum, co-founder and CEO. "We believe access to life-changing solutions should be simple, convenient, affordable, and designed for the individual. As we expand the capabilities on our platform, we are only more convinced that we can help an individual in every household in the country feel great.”

Yemi Okupe, CFO, stated, “An approach to democratizing access to high-quality personalized solutions on our platform at an affordable price continues to resonate with consumers. We are seeing this improve our ability to attract new users to longer-tenured specialties, while also allowing us to more rapidly scale new specialties. During the second quarter, these dynamics drove an acceleration in revenue growth and record profitability levels. We are updating our full year outlook to reflect this improving momentum and continue to believe we are on a clear path toward serving tens of millions of customers as we scale this increasingly powerful and efficient model."

Key Business Metrics

(In Thousands, Except for Monthly Online Revenue per Average Subscriber and AOV, Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | % Change | | 2024 | | 2023 | | % Change |

| Subscribers (end of period) | | 1,864 | | | 1,300 | | | 43 | % | | 1,864 | | | 1,300 | | | 43 | % |

| Monthly Online Revenue per Average Subscriber | | $ | 57 | | | $ | 53 | | | 8 | % | | $ | 56 | | | $ | 55 | | | 2 | % |

| | | | | | | | | | | | |

| Net Orders | | 2,527 | | | 2,109 | | | 20 | % | | 4,988 | | | 4,156 | | | 20 | % |

| AOV | | $ | 121 | | | $ | 95 | | | 27 | % | | $ | 115 | | | $ | 93 | | | 24 | % |

Revenue

(In Thousands, Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | % Change | | 2024 | | 2023 | | % Change |

| Online Revenue | | $ | 306,843 | | | $ | 201,178 | | | 53 | % | | $ | 574,604 | | | $ | 385,353 | | | 49 | % |

| Wholesale Revenue | | 8,805 | | | 6,734 | | | 31 | % | | 19,215 | | | 13,329 | | | 44 | % |

| Total revenue | | $ | 315,648 | | | $ | 207,912 | | | 52 | % | | $ | 593,819 | | | $ | 398,682 | | | 49 | % |

Second Quarter 2024 Financial Highlights

•Revenue was $315.6 million for the second quarter of 2024 compared to $207.9 million for the second quarter of 2023, an increase of 52% year-over-year.

•Gross margin was 81% for the second quarter of 2024 compared to 82% for the second quarter of 2023.

•Net income was $13.3 million for the second quarter of 2024 compared to a net loss of $(7.2) million for the second quarter of 2023.

•Adjusted EBITDA was $39.3 million for the second quarter of 2024 compared to $10.6 million for the second quarter of 2023.

•Net cash provided by operating activities was $53.6 million for the second quarter of 2024 compared to $16.8 million for the second quarter of 2023.

•Free Cash Flow was $47.6 million for the second quarter of 2024 compared to $10.0 million for the second quarter of 2023.

Reconciliations of Adjusted EBITDA and Free Cash Flow, non-GAAP measures, to net income (loss) and net cash provided by operating activities, respectively, their most comparable financial measures under generally accepted accounting principles in the United States (“U.S. GAAP”), have been provided in this press release in the accompanying tables. Additional information about Adjusted EBITDA and Free Cash Flow is also included below under the heading “Non-GAAP Financial Measures”.

Financial Outlook

Hims & Hers is providing the following guidance:

For the third quarter 2024, we expect:

•Revenue of $375 million to $380 million.

•Adjusted EBITDA of $35 million to $40 million, reflecting an Adjusted EBITDA margin of 9% to 11%.

For the full year 2024, we expect:

•Revenue of $1.37 billion to $1.40 billion.

•Adjusted EBITDA of $140 million to $155 million, reflecting an Adjusted EBITDA margin of 10% to 11%.

The guidance provided above constitutes forward-looking statements and actual results may differ materially. Refer to the “Cautionary Note Regarding Forward-Looking Statements” safe harbor section below for information on the factors that could cause our actual results to differ materially from these forward-looking statements.

We have relied upon the exception in Item 10(e)(1)(i)(B) of Regulation S-K and have not reconciled forward-looking Adjusted EBITDA to its most directly comparable U.S. GAAP measure, net income (loss), because we cannot predict with reasonable certainty the ultimate outcome of certain components of such reconciliations, including market-related assumptions that are not within our control, or others that may arise, without unreasonable effort. For these reasons, we are unable to assess the probable significance of the unavailable information, which could materially impact the amount of future net income (loss). See “Non-GAAP Financial Measures” for additional important information regarding Adjusted EBITDA.

Conference Call

Hims & Hers will host a conference call to review the second quarter 2024 results on August 5, 2024, at 5:00 p.m. ET. The conference call can be accessed by dialing +1 (888) 510-2630 for U.S. participants and +1 (646) 960-0137 for international participants, and referencing conference ID #1704296. A live audio webcast will be available online at investors.hims.com. A replay of the call will be available via webcast for on-demand listening shortly after the completion of the call at the same link.

About Hims & Hers Health, Inc.

Hims & Hers is the leading health and wellness platform on a mission to help the world feel great through the power of better health.

We believe how you feel in your body and mind transforms how you show up in life. That’s why we’re building a future where nothing stands in the way of harnessing this power. Hims & Hers normalizes health & wellness challenges—and innovates on their solutions—to make feeling happy and healthy easy to achieve. No two people are the same, so the Company provides access to personalized care designed for results.

For more information, please visit investors.hims.com.

Cautionary Note Regarding Forward-Looking Statements

This press release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements can be identified by the use of forward-looking terminology, including the words “believe,” “estimate,” “anticipate,” “expect,” “assume,” “imply,” “intend,” “plan,” “may,” “will,” “potential,” “project,” “predict,” “continue,” “could,” “confident,” “confidence,” or “should,” or, in each case, their plural, their negative or other variations or comparable terminology. There can be no assurance that actual results will not materially differ from expectations. Such statements include, but are not limited to, any statements relating to our financial outlook and guidance, including our mission to drive top-line growth and profitability and our ability to attain our medium- and long-term financial targets; our expected future financial and business performance, including with respect to the Hims & Hers platform, our marketing campaigns, investments in innovation, and our infrastructure, and the underlying assumptions with respect to the foregoing; the closing of our acquisition of a 503B compounding outsourcing facility; statements relating to events and trends relevant to us, including with respect to our financial condition, results of operations, short- and long-term business operations, objectives, and financial needs; expectations regarding our mobile applications, market acceptance, user experience, customer retention, brand development, our ability to invest and generate a return on any such investment, customer acquisition costs, operating efficiencies and leverage (including our fulfillment capabilities), the effect of any pricing decisions, changes in our product or offering mix, the timing and market acceptance of any new products or offerings, the timing and anticipated effect of any pending acquisitions, the success of our business model, our market opportunity, our ability to scale our business, the growth of certain of our specialties, our ability to innovate on and expand the scope of our offerings and experiences, including through the use of data analytics and artificial intelligence, our ability to reinvest into the customer experience, and our ability to comply with the extensive, complex and evolving legal and regulatory requirements applicable to our business, including without limitation state and federal healthcare, privacy and consumer protection laws and regulations, and the effect or outcome of any litigation or governmental actions that may arise in relation to any such legal and regulatory requirement. These statements are based on management’s current expectations, but actual results may differ materially due to various factors.

The forward-looking statements contained in this press release are based on our current expectations and beliefs concerning future developments and their potential effects on us. Future developments affecting us may not be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) and other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the “Risk Factors” section of each of our most recently filed Quarterly Report on Form 10-Q, our most recently filed Annual Report on Form 10-K, and any of our subsequent filings with the Securities and Exchange Commission (the “Commission”).

Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. We undertake no obligation (and expressly disclaim any obligation) to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. These risks and others described in the “Risk Factors” section of each of our most recently filed Quarterly Report on Form 10-Q, our most recently filed Annual Report on Form 10-K, and any of our subsequent filings with the Commission may not be exhaustive.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and developments in the industry in which we operate may differ materially from those made in or suggested by the forward-looking statements contained in reports we have filed or will file with the Commission, including our most recently filed Annual Report on Form 10-K, our most recently filed Quarterly Report on Form 10-Q, and any of our subsequent filings with the Commission. In addition, even if our results of operations, financial condition and liquidity, and developments in the industry in which we operate are consistent with the forward-looking statements

contained in such reports, those results or developments may not be indicative of results or developments in subsequent periods.

Key Business Metrics

“Online Revenue” represents the sales of products and services on our platform, net of refunds, credits, and chargebacks, and includes revenue recognition adjustments recorded pursuant to U.S. GAAP, primarily relating to deferred revenue and returns reserve. Online Revenue is generated by selling directly to consumers through our websites and mobile applications. Our Online Revenue consists of products and services purchased by customers directly through our online platform. The majority of our Online Revenue is subscription-based, where customers agree to be billed on a recurring basis to have products and services automatically delivered to them.

“Wholesale Revenue” represents non-prescription product sales to retailers through wholesale purchasing agreements. Wholesale Revenue also includes non-prescription product sales to third-party platforms through consignment arrangements. In addition to being revenue generative and profitable, wholesale partnerships and consignment arrangements have the added benefit of generating brand awareness with new customers in physical environments and on third-party platforms.

“Subscribers” are customers who have one or more “Subscriptions” pursuant to which they have agreed to be automatically billed on a recurring basis at a defined cadence. The Subscription billing cadence is typically defined as a number of days (for example, billed every 30 days or every 90 days), which are excluded from our reporting when payment has not occurred at the contracted billing cadence. Subscribers can cancel Subscriptions in between billing periods to stop receiving additional products and/or services and can reactivate Subscriptions to continue receiving additional products and/or services.

“Monthly Online Revenue per Average Subscriber” is defined as Online Revenue divided by “Average Subscribers”, which amount is then further divided by the number of months in a period. “Average Subscribers” are calculated as the sum of the Subscribers at the beginning and end of a given period divided by 2.

“Net Orders” are defined as the number of online customer orders minus transactions related to refunds, credits, chargebacks, and other negative adjustments. Net Orders represent transactions made on our platform during a defined period of time and exclude revenue recognition adjustments recorded pursuant to U.S. GAAP.

Average Order Value (“AOV”) is defined as Online Revenue divided by Net Orders (each as defined above).

CONDENSED CONSOLIDATED BALANCE SHEETS

(In Thousands, Except Share and Per Share Data, Unaudited)

| | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

| | | |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 129,295 | | | $ | 96,663 | |

| Short-term investments | 97,997 | | | 124,318 | |

| Inventory | 40,588 | | | 22,464 | |

| Prepaid expenses and other current assets | 23,038 | | | 21,608 | |

| Total current assets | 290,918 | | | 265,053 | |

| Restricted cash | 856 | | | 856 | |

| Goodwill | 110,881 | | | 110,881 | |

| Property, equipment, and software, net | 49,540 | | | 36,143 | |

| Intangible assets, net | 17,133 | | | 18,574 | |

| Operating lease right-of-use assets | 11,034 | | | 9,588 | |

| Other long-term assets | 138 | | | 91 | |

| Total assets | $ | 480,500 | | | $ | 441,186 | |

| Liabilities and stockholders' equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 57,099 | | | $ | 43,070 | |

| Accrued liabilities | 28,948 | | | 28,972 | |

| Deferred revenue | 20,990 | | | 7,733 | |

| Earn-out payable | — | | | 7,412 | |

| Operating lease liabilities | 1,634 | | | 1,281 | |

| Total current liabilities | 108,671 | | | 88,468 | |

| Operating lease liabilities | 9,841 | | | 8,667 | |

| Other long-term liabilities | 22 | | | 22 | |

| Total liabilities | 118,534 | | | 97,157 | |

| Commitments and contingencies | | | |

| Stockholders' equity: | | | |

Common stock – Class A shares, par value $0.0001, 2,750,000,000 shares authorized and 208,417,651 and 205,104,120 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively; Class V shares, par value $0.0001, 10,000,000 shares authorized and 8,377,623 shares issued and outstanding as of June 30, 2024 and December 31, 2023 | 22 | | | 21 | |

| Additional paid-in capital | 705,862 | | | 712,307 | |

| Accumulated other comprehensive loss | (168) | | | (124) | |

| Accumulated deficit | (343,750) | | | (368,175) | |

| Total stockholders' equity | 361,966 | | | 344,029 | |

| Total liabilities and stockholders' equity | $ | 480,500 | | | $ | 441,186 | |

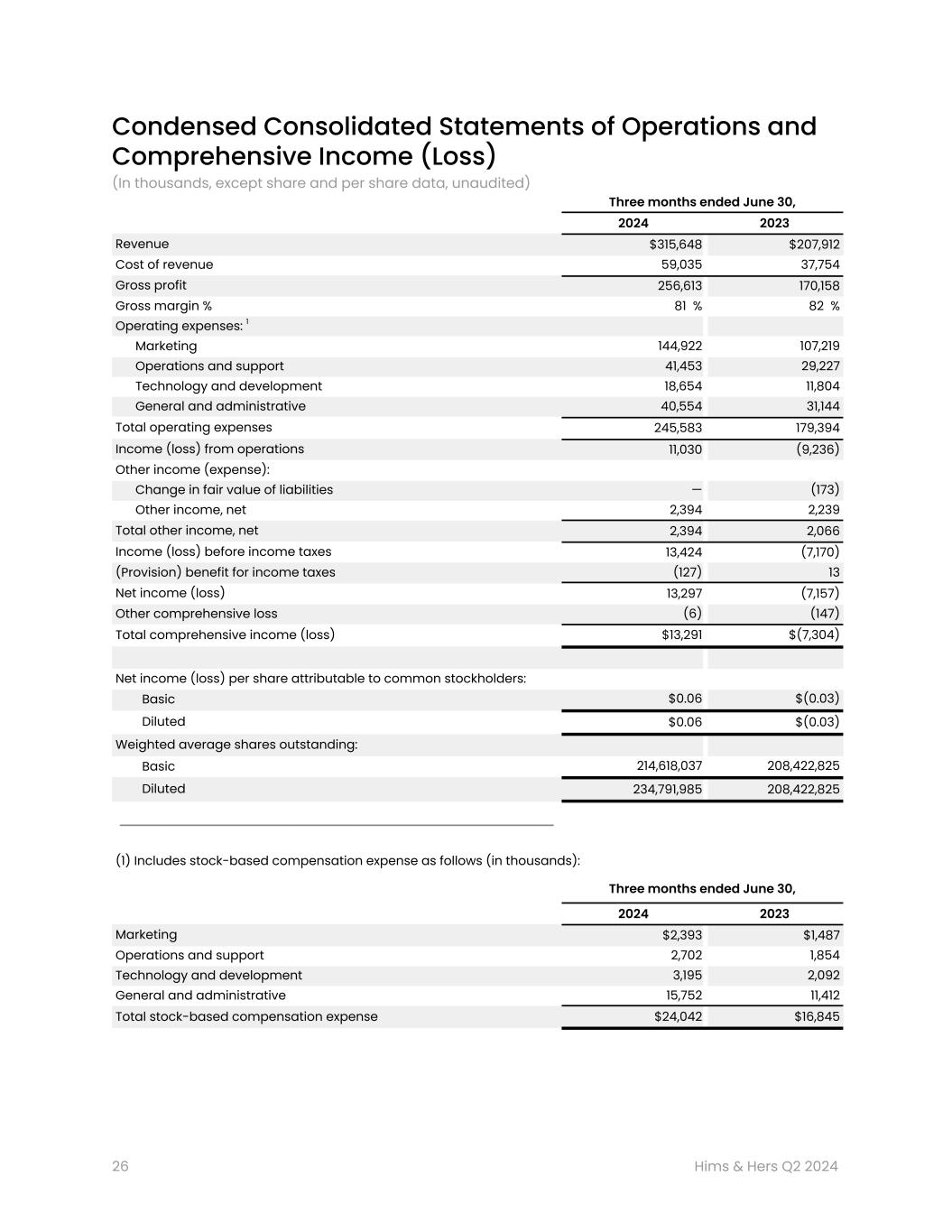

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

(In Thousands, Except Share and Per Share Data, Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | | $ | 315,648 | | | $ | 207,912 | | | $ | 593,819 | | | $ | 398,682 | |

| Cost of revenue | | 59,035 | | | 37,754 | | | 108,111 | | | 75,099 | |

| Gross profit | | 256,613 | | | 170,158 | | | 485,708 | | | 323,583 | |

| Gross margin % | | 81 | % | | 82 | % | | 82 | % | | 81 | % |

Operating expenses:(1) | | | | | | | | |

| Marketing | | 144,922 | | | 107,219 | | | 275,475 | | | 204,464 | |

| Operations and support | | 41,453 | | | 29,227 | | | 80,200 | | | 55,409 | |

| Technology and development | | 18,654 | | | 11,804 | | | 33,978 | | | 22,552 | |

| General and administrative | | 40,554 | | | 31,144 | | | 75,122 | | | 61,657 | |

| Total operating expenses | | 245,583 | | | 179,394 | | | 464,775 | | | 344,082 | |

| Income (loss) from operations | | 11,030 | | | (9,236) | | | 20,933 | | | (20,499) | |

| Other income (expense): | | | | | | | | |

| Change in fair value of liabilities | | — | | | (173) | | | — | | | (468) | |

| Other income, net | | 2,394 | | | 2,239 | | | 4,894 | | | 4,116 | |

| Total other income, net | | 2,394 | | | 2,066 | | | 4,894 | | | 3,648 | |

| Income (loss) before income taxes | | 13,424 | | | (7,170) | | | 25,827 | | | (16,851) | |

| (Provision) benefit for income taxes | | (127) | | | 13 | | | (1,402) | | | (373) | |

| Net income (loss) | | 13,297 | | | (7,157) | | | 24,425 | | | (17,224) | |

| Other comprehensive (loss) income | | (6) | | | (147) | | | (44) | | | 19 | |

| Total comprehensive income (loss) | | $ | 13,291 | | | $ | (7,304) | | | $ | 24,381 | | | $ | (17,205) | |

| | | | | | | | |

| Net income (loss) per share attributable to common stockholders: | | | | | | | | |

| Basic | | $ | 0.06 | | | $ | (0.03) | | | $ | 0.11 | | | $ | (0.08) | |

| Diluted | | $ | 0.06 | | | $ | (0.03) | | | $ | 0.11 | | | $ | (0.08) | |

| Weighted average shares outstanding: | | | | | | | | |

| Basic | | 214,618,037 | | | 208,422,825 | | | 214,035,065 | | | 207,785,104 | |

| Diluted | | 234,791,985 | | | 208,422,825 | | | 232,583,676 | | | 207,785,104 | |

______________ (1)Includes stock-based compensation expense as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Marketing | | $ | 2,393 | | | $ | 1,487 | | | $ | 4,297 | | | $ | 2,483 | |

| Operations and support | | 2,702 | | | 1,854 | | | 4,857 | | | 3,008 | |

| Technology and development | | 3,195 | | | 2,092 | | | 5,400 | | | 3,553 | |

| General and administrative | | 15,752 | | | 11,412 | | | 28,520 | | | 21,968 | |

| Total stock-based compensation expense | | $ | 24,042 | | | $ | 16,845 | | | $ | 43,074 | | | $ | 31,012 | |

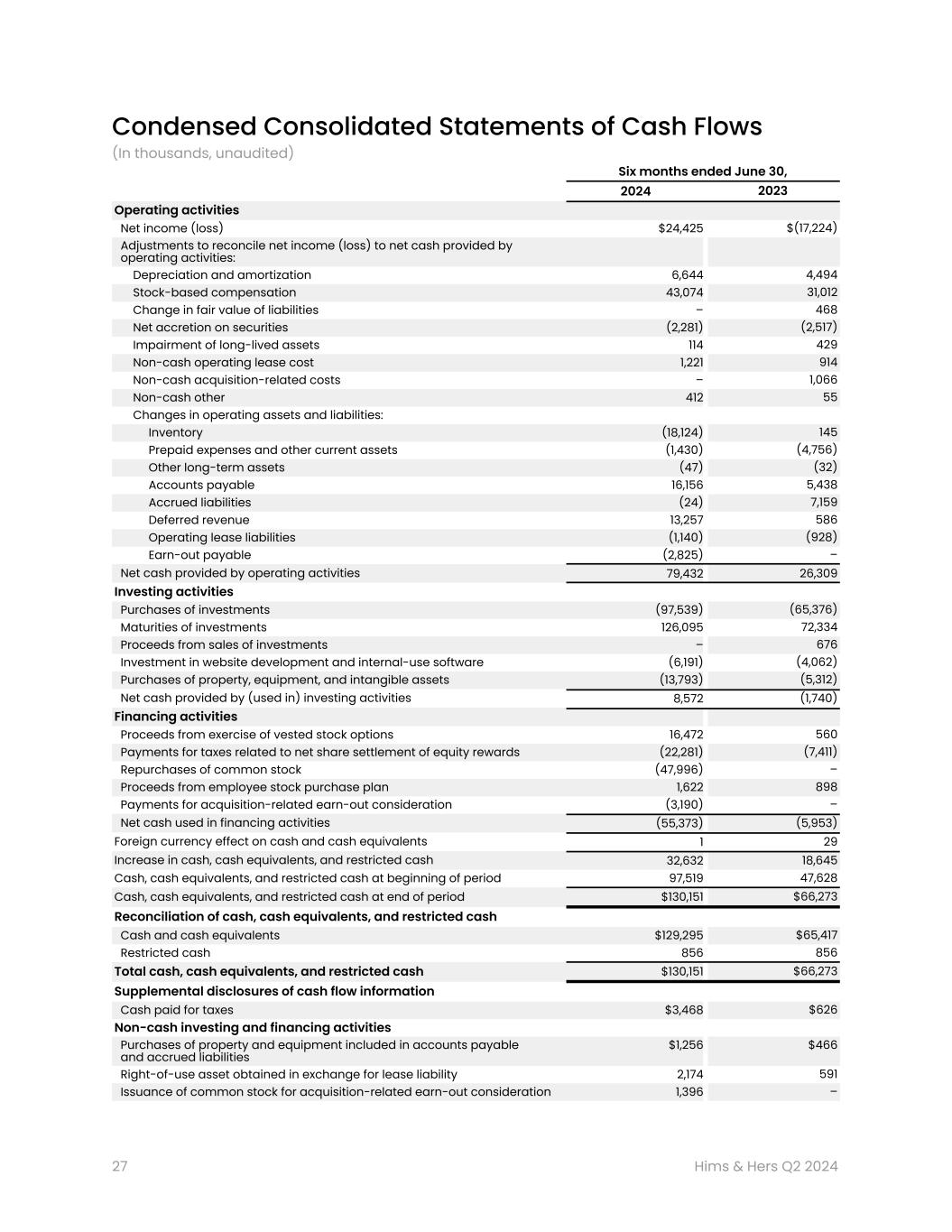

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In Thousands, Unaudited)

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2024 | | 2023 |

| Operating activities | | | |

| Net income (loss) | $ | 24,425 | | | $ | (17,224) | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | |

| Depreciation and amortization | 6,644 | | | 4,494 | |

| Stock-based compensation | 43,074 | | | 31,012 | |

| Change in fair value of liabilities | — | | | 468 | |

| Net accretion on securities | (2,281) | | | (2,517) | |

| Impairment of long-lived assets | 114 | | | 429 | |

| Non-cash operating lease cost | 1,221 | | | 914 | |

| Non-cash acquisition-related costs | — | | | 1,066 | |

| Non-cash other | 412 | | | 55 | |

| Changes in operating assets and liabilities: | | | |

| Inventory | (18,124) | | | 145 | |

| Prepaid expenses and other current assets | (1,430) | | | (4,756) | |

| Other long-term assets | (47) | | | (32) | |

| Accounts payable | 16,156 | | | 5,438 | |

| Accrued liabilities | (24) | | | 7,159 | |

| Deferred revenue | 13,257 | | | 586 | |

| Operating lease liabilities | (1,140) | | | (928) | |

| Earn-out payable | (2,825) | | | — | |

| Net cash provided by operating activities | 79,432 | | | 26,309 | |

| Investing activities | | | |

| Purchases of investments | (97,539) | | | (65,376) | |

| Maturities of investments | 126,095 | | | 72,334 | |

| Proceeds from sales of investments | — | | | 676 | |

| Investment in website development and internal-use software | (6,191) | | | (4,062) | |

| Purchases of property, equipment, and intangible assets | (13,793) | | | (5,312) | |

| Net cash provided by (used in) investing activities | 8,572 | | | (1,740) | |

| Financing activities | | | |

| Proceeds from exercise of vested stock options | 16,472 | | | 560 | |

| Payments for taxes related to net share settlement of equity awards | (22,281) | | | (7,411) | |

| Repurchases of common stock | (47,996) | | | — | |

| Proceeds from employee stock purchase plan | 1,622 | | | 898 | |

| Payments for acquisition-related earn-out consideration | (3,190) | | | — | |

| Net cash used in financing activities | (55,373) | | | (5,953) | |

| Foreign currency effect on cash and cash equivalents | 1 | | | 29 | |

| Increase in cash, cash equivalents, and restricted cash | 32,632 | | | 18,645 | |

| Cash, cash equivalents, and restricted cash at beginning of period | 97,519 | | | 47,628 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 130,151 | | | $ | 66,273 | |

| Reconciliation of cash, cash equivalents, and restricted cash | | | |

| Cash and cash equivalents | $ | 129,295 | | | $ | 65,417 | |

| Restricted cash | 856 | | | 856 | |

| Total cash, cash equivalents, and restricted cash | $ | 130,151 | | | $ | 66,273 | |

| Supplemental disclosures of cash flow information | | | |

| Cash paid for taxes | $ | 3,468 | | | $ | 626 | |

| Non-cash investing and financing activities | | | |

| Purchases of property and equipment included in accounts payable and accrued liabilities | $ | 1,256 | | | $ | 466 | |

| Right-of-use asset obtained in exchange for lease liability | 2,174 | | | 591 | |

| Issuance of common stock for acquisition-related earn-out consideration | 1,396 | | | — | |

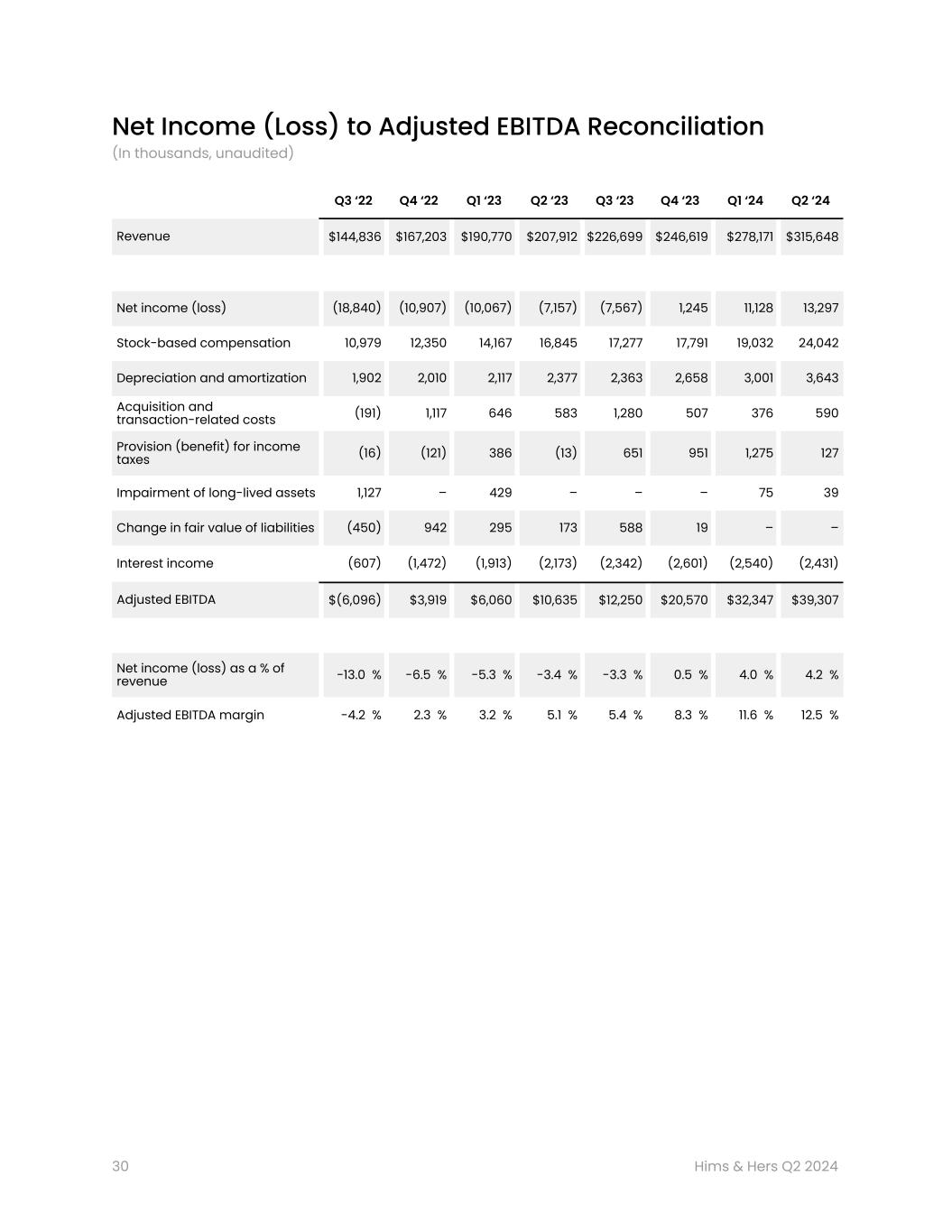

Non-GAAP Financial Measures

In addition to our financial results determined in accordance with U.S. GAAP, we present Adjusted EBITDA (which is a non-GAAP financial measure), Adjusted EBITDA margin (which is a non-GAAP ratio), and Free Cash Flow (which is a non-GAAP financial measure) each as defined below. We use Adjusted EBITDA, Adjusted EBITDA margin, and Free Cash Flow to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe that Adjusted EBITDA, Adjusted EBITDA margin, and Free Cash Flow, when taken together with the corresponding U.S. GAAP financial measures, provide meaningful supplemental information regarding our performance by excluding certain items that may not be indicative of our business, results of operations, or outlook. We consider Adjusted EBITDA, Adjusted EBITDA margin, and Free Cash Flow to be important measures because they help illustrate underlying trends in our business and our historical operating performance on a more consistent basis. We believe that the use of Adjusted EBITDA, Adjusted EBITDA margin, and Free Cash Flow is helpful to our investors as they are used by management in assessing the health of our business, our operating performance, and our liquidity.

However, non-GAAP financial information is presented for supplemental informational purposes only, has limitations as an analytical tool, and should not be considered in isolation or as a substitute for financial information presented in accordance with U.S. GAAP. In addition, other companies, including companies in our industry, may calculate similarly-titled non-GAAP financial measures or ratios differently or may use other financial measures or ratios to evaluate their performance, all of which could reduce the usefulness of Adjusted EBITDA, Adjusted EBITDA margin, and Free Cash Flow as tools for comparison. Reconciliations are provided below to the most directly comparable financial measures stated in accordance with U.S. GAAP. Investors are encouraged to review our U.S. GAAP financial measures and not to rely on any single financial measure to evaluate our business.

Adjusted EBITDA is a key performance measure that our management uses to assess our operating performance. Because Adjusted EBITDA facilitates internal comparisons of our historical operating performance on a more consistent basis, we use this measure for business planning purposes. “Adjusted EBITDA” is defined as net income (loss) before stock-based compensation, depreciation and amortization, acquisition and transaction-related costs (which includes (i) consideration paid for employee compensation with vesting requirements incurred directly as a result of acquisitions, inclusive of revaluation of earn-out consideration recorded in general and administrative expenses, and (ii) transaction professional services), income taxes, impairment of long-lived assets, change in fair value of liabilities, and interest income. “Adjusted EBITDA margin” is defined as Adjusted EBITDA divided by revenue.

Some of the limitations of Adjusted EBITDA include (i) Adjusted EBITDA does not properly reflect capital commitments to be paid in the future, and (ii) although depreciation and amortization are non-cash charges, the underlying assets may need to be replaced and Adjusted EBITDA does not reflect these capital expenditures. In evaluating Adjusted EBITDA, you should be aware that in the future we will incur expenses similar to the adjustments in this presentation. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by these expenses or any unusual or non-recurring items. We compensate for these limitations by providing specific information regarding the U.S. GAAP items excluded from Adjusted EBITDA. When evaluating our performance, you should consider Adjusted EBITDA in addition to, and not as a substitute for, other financial performance measures, including our net income (loss) and other U.S. GAAP results.

Net Income (Loss) to Adjusted EBITDA Reconciliation

(In Thousands, Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Revenue | $ | 315,648 | | | $ | 207,912 | | | $ | 593,819 | | | $ | 398,682 | |

| | | | | | | |

| Net income (loss) | 13,297 | | | (7,157) | | | 24,425 | | | (17,224) | |

| Stock-based compensation | 24,042 | | | 16,845 | | | 43,074 | | | 31,012 | |

| Depreciation and amortization | 3,643 | | | 2,377 | | | 6,644 | | | 4,494 | |

| Acquisition and transaction-related costs | 590 | | | 583 | | | 966 | | | 1,229 | |

| Provision (benefit) for income taxes | 127 | | | (13) | | | 1,402 | | | 373 | |

| Impairment of long-lived assets | 39 | | | — | | | 114 | | | 429 | |

| Change in fair value of liabilities | — | | | 173 | | | — | | | 468 | |

| Interest income | (2,431) | | | (2,173) | | | (4,971) | | | (4,086) | |

| Adjusted EBITDA | $ | 39,307 | | | $ | 10,635 | | | $ | 71,654 | | | $ | 16,695 | |

| | | | | | | |

| Net income (loss) as a % of revenue | 4 | % | | (3) | % | | 4 | % | | (4) | % |

| Adjusted EBITDA margin | 12 | % | | 5 | % | | 12 | % | | 4 | % |

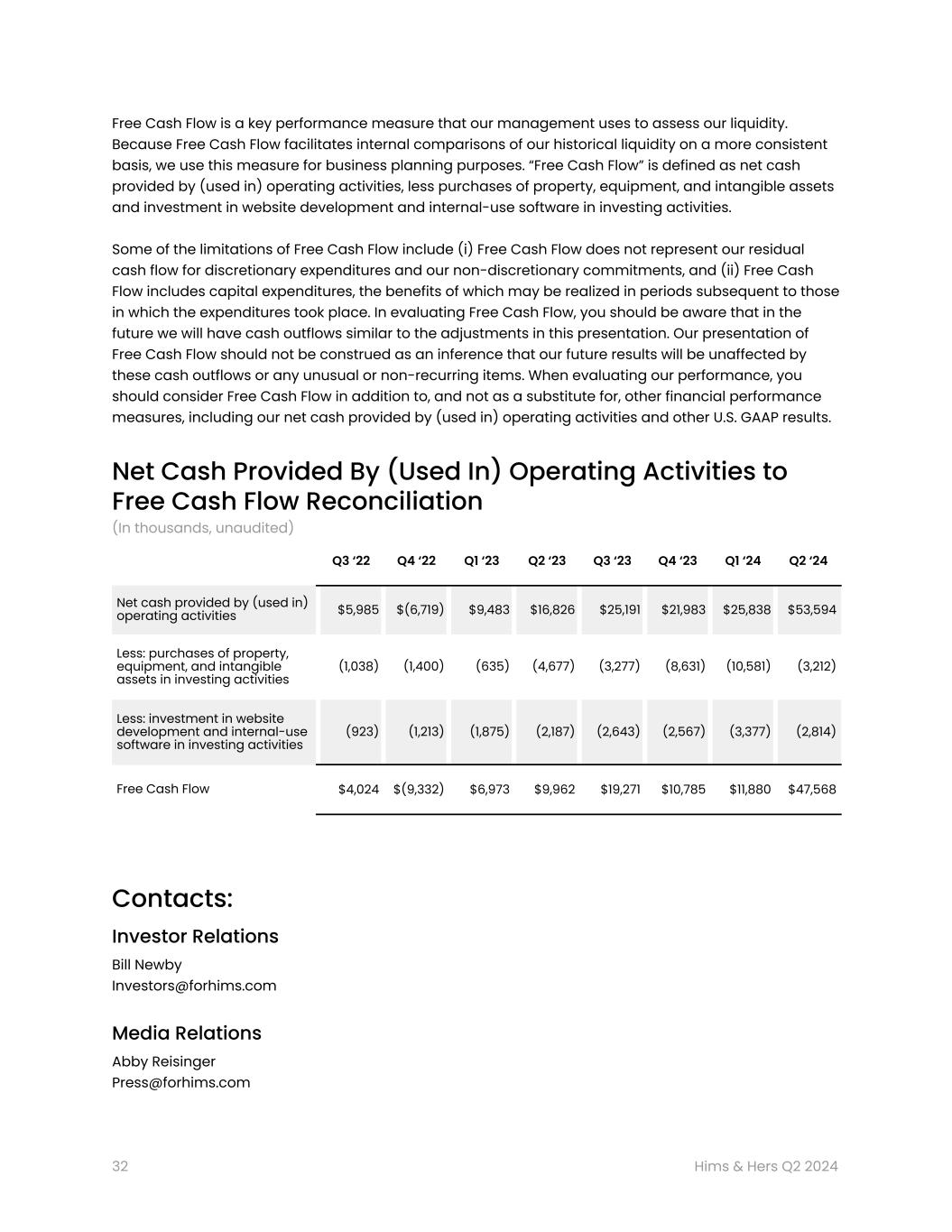

Free Cash Flow is a key performance measure that our management uses to assess our liquidity. Because Free Cash Flow facilitates internal comparisons of our historical liquidity on a more consistent basis, we use this measure for business planning purposes. “Free Cash Flow” is defined as net cash provided by operating activities, less purchases of property, equipment, and intangible assets and investment in website development and internal-use software in investing activities.

Some of the limitations of Free Cash Flow include (i) Free Cash Flow does not represent our residual cash flow for discretionary expenditures and our non-discretionary commitments, and (ii) Free Cash Flow includes capital expenditures, the benefits of which may be realized in periods subsequent to those in which the expenditures took place. In evaluating Free Cash Flow, you should be aware that in the future we will have cash outflows similar to the adjustments in this presentation. Our presentation of Free Cash Flow should not be construed as an inference that our future results will be unaffected by these cash outflows or any unusual or non-recurring items. When evaluating our performance, you should consider Free Cash Flow in addition to, and not as a substitute for, other financial performance measures, including our net cash provided by operating activities and other U.S. GAAP results.

Net Cash Provided By Operating Activities to Free Cash Flow Reconciliation

(In Thousands, Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Net cash provided by operating activities | | $ | 53,594 | | | $ | 16,826 | | | $ | 79,432 | | | $ | 26,309 | |

| Less: purchases of property, equipment, and intangible assets in investing activities | | (3,212) | | | (4,677) | | | (13,793) | | | (5,312) | |

| Less: investment in website development and internal-use software in investing activities | | (2,814) | | | (2,187) | | | (6,191) | | | (4,062) | |

| Free Cash Flow | | $ | 47,568 | | | $ | 9,962 | | | $ | 59,448 | | | $ | 16,935 | |

Contacts:

Investor Relations

Bill Newby

Investors@forhims.com

Media Relations

Abby Reisinger

Press@forhims.com

Feeling good in your body & mind transforms how you show up in life. That’s why we’re on a mission to help the world feel great through the power of better health. 2 Hims & Hers Q2 2024

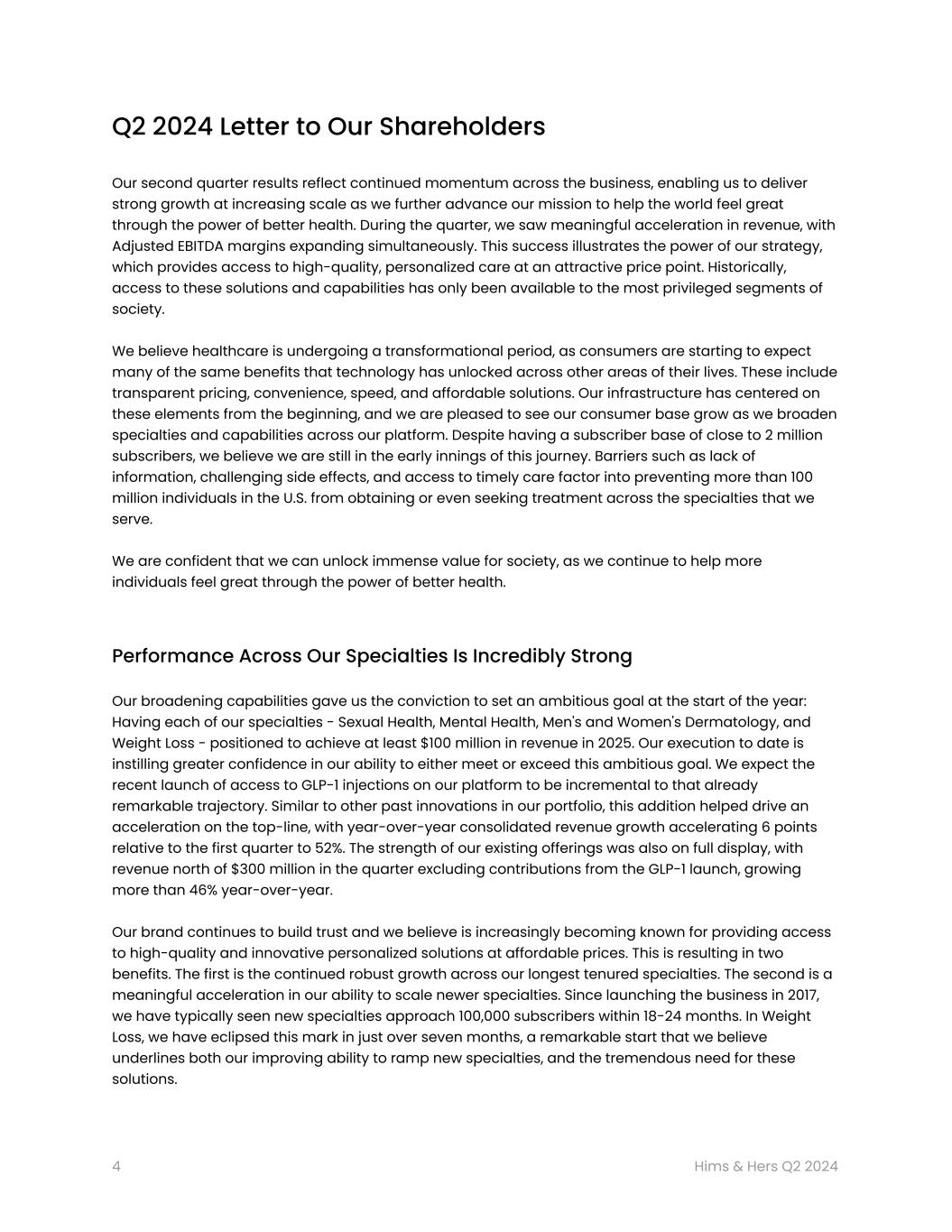

Key Financial Highlights Q2 2024 Q2 2023 Growth Revenue $315.6M $207.9M 52% YoY Net Income (Loss) $13.3M $(7.2)M Adj. EBITDA* $39.3M $10.6M 270% YoY Operating Cash Flow $53.6M $16.8M 219% YoY Free Cash Flow* $47.6M $10.0M 377% YoY Subscribers1 (End of Period) 1.9M 1.3M 43% YoY Monthly Online Revenue per Avg. Subscriber1 $57 $53 8% YoY * This is a non-GAAP financial measure. Please refer to pages 29-32 for definitions and reconciliations to the corresponding U.S. GAAP financial measure. (1) Refer to pages 22-23 for definitions for Subscribers and Monthly Online Revenue per Average Subscriber. 3 Hims & Hers Q2 2024

Q2 2024 Letter to Our Shareholders Our second quarter results reflect continued momentum across the business, enabling us to deliver strong growth at increasing scale as we further advance our mission to help the world feel great through the power of better health. During the quarter, we saw meaningful acceleration in revenue, with Adjusted EBITDA margins expanding simultaneously. This success illustrates the power of our strategy, which provides access to high-quality, personalized care at an attractive price point. Historically, access to these solutions and capabilities has only been available to the most privileged segments of society. We believe healthcare is undergoing a transformational period, as consumers are starting to expect many of the same benefits that technology has unlocked across other areas of their lives. These include transparent pricing, convenience, speed, and affordable solutions. Our infrastructure has centered on these elements from the beginning, and we are pleased to see our consumer base grow as we broaden specialties and capabilities across our platform. Despite having a subscriber base of close to 2 million subscribers, we believe we are still in the early innings of this journey. Barriers such as lack of information, challenging side effects, and access to timely care factor into preventing more than 100 million individuals in the U.S. from obtaining or even seeking treatment across the specialties that we serve. We are confident that we can unlock immense value for society, as we continue to help more individuals feel great through the power of better health. Performance Across Our Specialties Is Incredibly Strong Our broadening capabilities gave us the conviction to set an ambitious goal at the start of the year: Having each of our specialties - Sexual Health, Mental Health, Men's and Women's Dermatology, and Weight Loss - positioned to achieve at least $100 million in revenue in 2025. Our execution to date is instilling greater confidence in our ability to either meet or exceed this ambitious goal. We expect the recent launch of access to GLP-1 injections on our platform to be incremental to that already remarkable trajectory. Similar to other past innovations in our portfolio, this addition helped drive an acceleration on the top-line, with year-over-year consolidated revenue growth accelerating 6 points relative to the first quarter to 52%. The strength of our existing offerings was also on full display, with revenue north of $300 million in the quarter excluding contributions from the GLP-1 launch, growing more than 46% year-over-year. Our brand continues to build trust and we believe is increasingly becoming known for providing access to high-quality and innovative personalized solutions at affordable prices. This is resulting in two benefits. The first is the continued robust growth across our longest tenured specialties. The second is a meaningful acceleration in our ability to scale newer specialties. Since launching the business in 2017, we have typically seen new specialties approach 100,000 subscribers within 18-24 months. In Weight Loss, we have eclipsed this mark in just over seven months, a remarkable start that we believe underlines both our improving ability to ramp new specialties, and the tremendous need for these solutions. 4 Hims & Hers Q2 2024

We Expect An Expanding Portfolio of Personalized Solutions to Drive Ongoing Subscriber Growth Consumers are increasingly drawn to the convenience our platform brings, alongside access to an expanding breadth of high-quality personalized offerings and clinically excellent providers. We ended the second quarter with nearly 1.9 million subscribers on the platform, adding more than 155,000 net new members since the first quarter. This momentum underlines a tremendous opportunity in front of us. As we solidify our leadership position in each specialty, our ability to continuously remove barriers that prevent millions of people from accessing high quality care also expands. The expanding portfolio of personalized offerings available on our platform is at the core of these trends. Over 785,000 subscribers are now utilizing a personalized solution, up more than 160% relative to last year. Our ability to leverage years of customer learnings and feedback to address common customer pain points and concerns has been key to maintaining strong subscriber growth. Continued innovation across personalized offerings is driving strong and, in some cases, even accelerating growth across our longer tenured specialties. These solutions are able to address unique consumer needs, including the ability to target multiple conditions with one solution, balance side effects and efficacy through unique dosing, and support adherence with a variety of form factors. Signs continue to point to higher retention when we unlock value across these dimensions for consumers. Over the last year, we have expanded the number of personalized offerings within our Sexual Health specialty by more than 70%. Recently, we expanded our ability to serve men who face concurrent challenges with erectile dysfunction and premature ejaculation with a single solution. This has been additive to an innovation pipeline over the past year that has included additional form factors and our first foray into supporting cardiovascular disease via access to a combination treatment. During the second quarter, this expanding portfolio led to subscribers on a personalized solution within Sexual 5 Hims & Hers Q2 2024

Health increasing more than 3x year-over-year. Similar dynamics can be seen in Men's and Women's Dermatology, where more than 85% of new subscribers during the quarter subscribed to a personalized solution. We anticipate continued tailwinds from the expansion of the portfolio of personalized solutions offered on our platform in the second half of the year. Soon we expect to launch access to yet another multi-condition offering, targeting two of the longest tenured conditions treatable via our platform, hair loss and erectile dysfunction. Both are top of mind for a substantial portion of the male population. We expect the value of a simple daily solution that treats both conditions for as low as $49 each month to have a notable impact on both customer acquisition and retention. We have seen this occur consistently when we unlock access to new offerings on the platform that make certain conditions more approachable, while also making holistic care more affordable. In the coming months, we are excited to launch access to new form factors such as gummies, as well as additional multi-condition treatments across several of our specialties. Our belief is that enabling providers to offer a broader set of personalized solutions will support greater adherence to treatment, ultimately enabling higher retention on our platform. Additionally, we believe this will empower a broader set of consumers that are suffering with conditions in specialties that we serve to seek treatment. 6 Hims & Hers Q2 2024

7 Hims & Hers Q2 2024

Weight-Related Challenges Have a Substantial Impact on Society Since our founding, we have applied our approach to categories that are highly emotionally resonant, chronic in nature, and impact tens of millions of individuals. Often these categories are also underserved by the traditional healthcare system, resulting in a significant disconnect between the number of individuals experiencing a condition and those searching for a solution. Our mission, to help the world feel great through the power of better health, seeks to eliminate that disconnect. Weight loss fulfills each of these requirements - it is highly emotionally resonant, chronic in nature, and impacts a meaningful number of individuals. Obesity's impact on our society is clear: It not only impacts how an individual feels about themselves, but has also been proven to increase risk of serious health conditions like cardiovascular disease, mental health issues, diabetes, and certain cancers. In the US alone, it is estimated that over 100 million adults struggle with weight-related challenges, resulting in a significant economic and social strain, which in 2018 was estimated to represent nearly $1.4 trillion1. We believe that capabilities across our platform, as well as our mission, align perfectly with helping consumers address their weight-related challenges and improve their overall health. Consumers Are Met With Numerous Roadblocks in their Weight Loss Journey It is only recently that obesity has started to become recognized across society as a medical condition, rather than the result of certain lifestyle choices. GLP-1s are an innovative solution that have brought this dynamic to the forefront of American society. However, the ability to navigate the healthcare system and access treatment is both cumbersome and frustrating. As a result, many of the more than 100 million individuals suffering with weight-related challenges across the US do not seek medical treatment. Individuals that do seek treatment are often met with considerable roadblocks in their weight management journey including: ● Lack of information: It is difficult for many consumers to understand what solutions are available to meet their needs, which makes it even more challenging to understand the solution that is right for them. ● Accessibility: The ability to quickly access a provider knowledgeable on a breadth of weight loss solutions is often challenging for all but the most persistent or wealthiest consumers. Wait times for providers often extend for months and shortages for medications across the country have prevented consistent, reliable access to treatment for those fortunate enough to access a provider. ● Affordability: The price of medication is out of reach for many consumers, especially as many insurance companies will not cover the cost of treatment. Historically, GLP-1s have come at an average list price of over $1,000 a month. Given the median individual income across the country is approximately $48,000, many consumers are met with a choice: pay for a treatment they need but cannot afford or forgo treatment to pay for basic needs1. (1) Note: See page 33 for sources 8 Hims & Hers Q2 2024

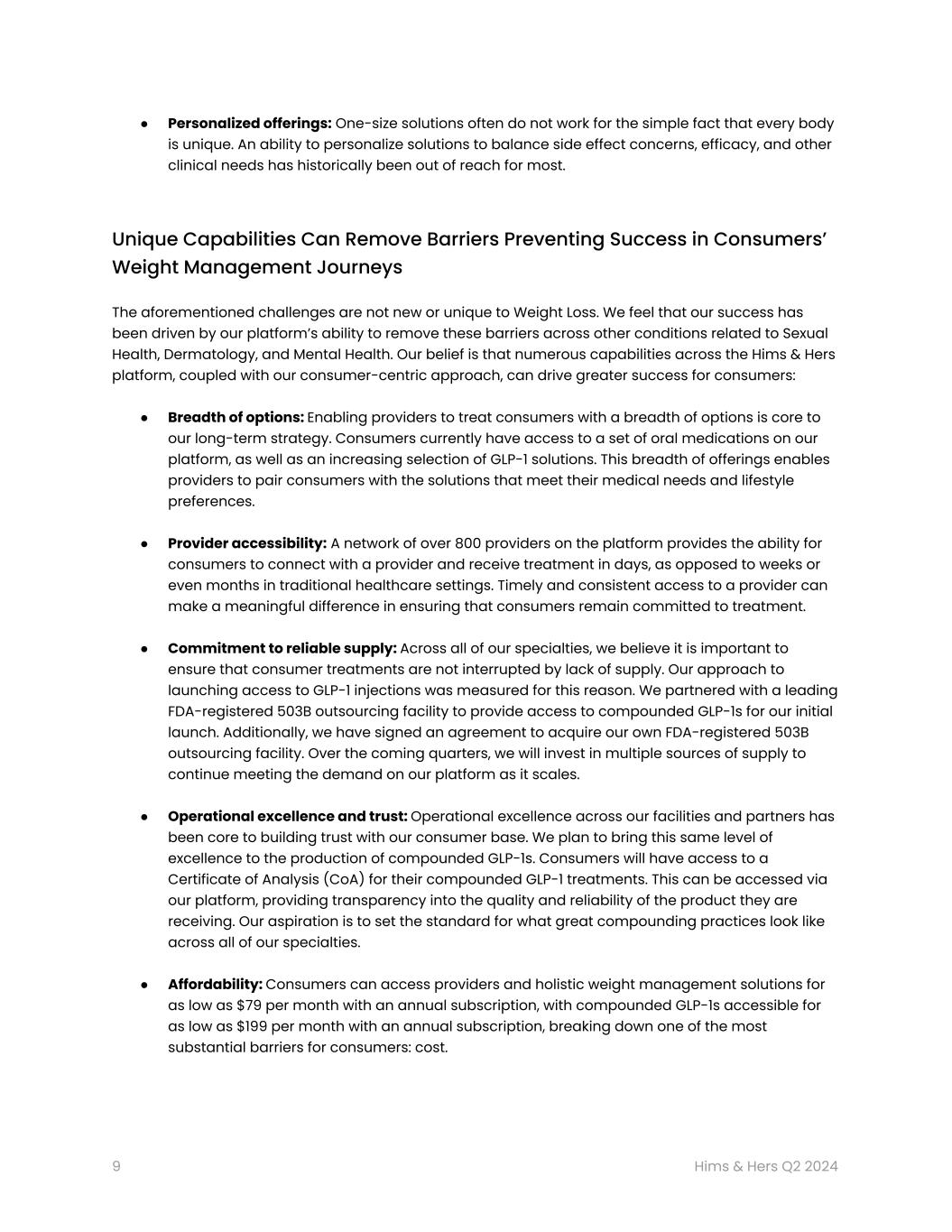

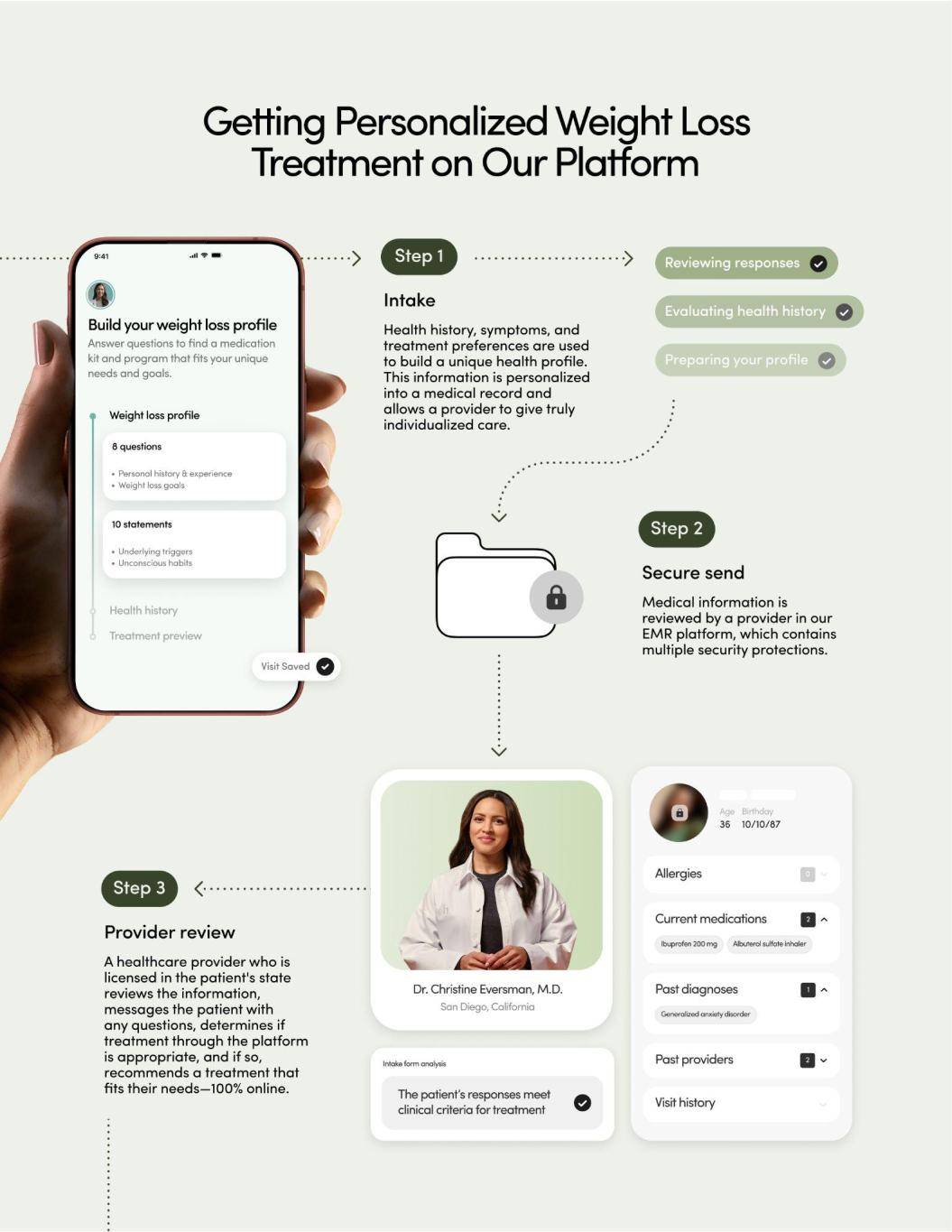

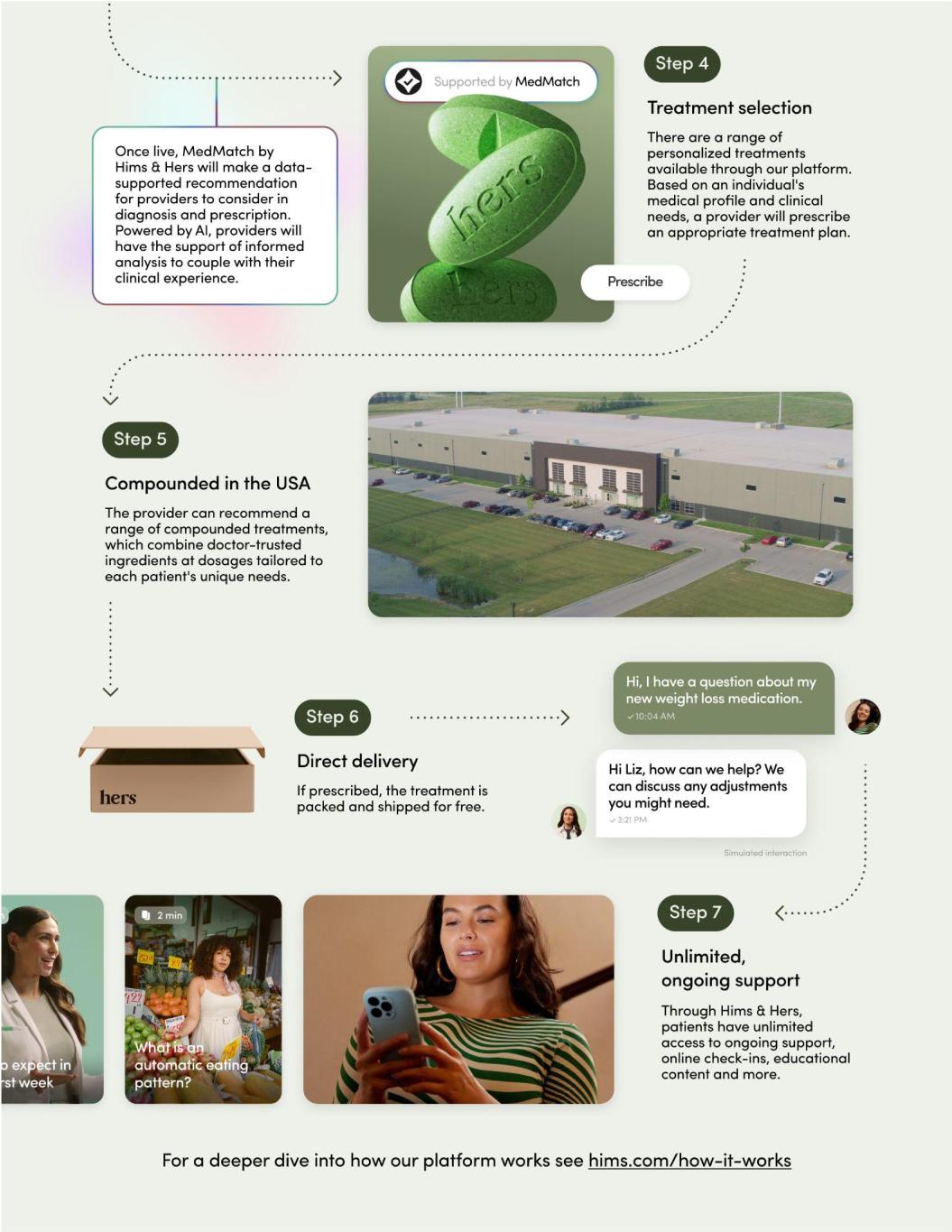

● Personalized offerings: One-size solutions often do not work for the simple fact that every body is unique. An ability to personalize solutions to balance side effect concerns, efficacy, and other clinical needs has historically been out of reach for most. Unique Capabilities Can Remove Barriers Preventing Success in Consumers’ Weight Management Journeys The aforementioned challenges are not new or unique to Weight Loss. We feel that our success has been driven by our platform’s ability to remove these barriers across other conditions related to Sexual Health, Dermatology, and Mental Health. Our belief is that numerous capabilities across the Hims & Hers platform, coupled with our consumer-centric approach, can drive greater success for consumers: ● Breadth of options: Enabling providers to treat consumers with a breadth of options is core to our long-term strategy. Consumers currently have access to a set of oral medications on our platform, as well as an increasing selection of GLP-1 solutions. This breadth of offerings enables providers to pair consumers with the solutions that meet their medical needs and lifestyle preferences. ● Provider accessibility: A network of over 800 providers on the platform provides the ability for consumers to connect with a provider and receive treatment in days, as opposed to weeks or even months in traditional healthcare settings. Timely and consistent access to a provider can make a meaningful difference in ensuring that consumers remain committed to treatment. ● Commitment to reliable supply: Across all of our specialties, we believe it is important to ensure that consumer treatments are not interrupted by lack of supply. Our approach to launching access to GLP-1 injections was measured for this reason. We partnered with a leading FDA-registered 503B outsourcing facility to provide access to compounded GLP-1s for our initial launch. Additionally, we have signed an agreement to acquire our own FDA-registered 503B outsourcing facility. Over the coming quarters, we will invest in multiple sources of supply to continue meeting the demand on our platform as it scales. ● Operational excellence and trust:Operational excellence across our facilities and partners has been core to building trust with our consumer base. We plan to bring this same level of excellence to the production of compounded GLP-1s. Consumers will have access to a Certificate of Analysis (CoA) for their compounded GLP-1 treatments. This can be accessed via our platform, providing transparency into the quality and reliability of the product they are receiving. Our aspiration is to set the standard for what great compounding practices look like across all of our specialties. ● Affordability:Consumers can access providers and holistic weight management solutions for as low as $79 per month with an annual subscription, with compounded GLP-1s accessible for as low as $199 per month with an annual subscription, breaking down one of the most substantial barriers for consumers: cost. 9 Hims & Hers Q2 2024

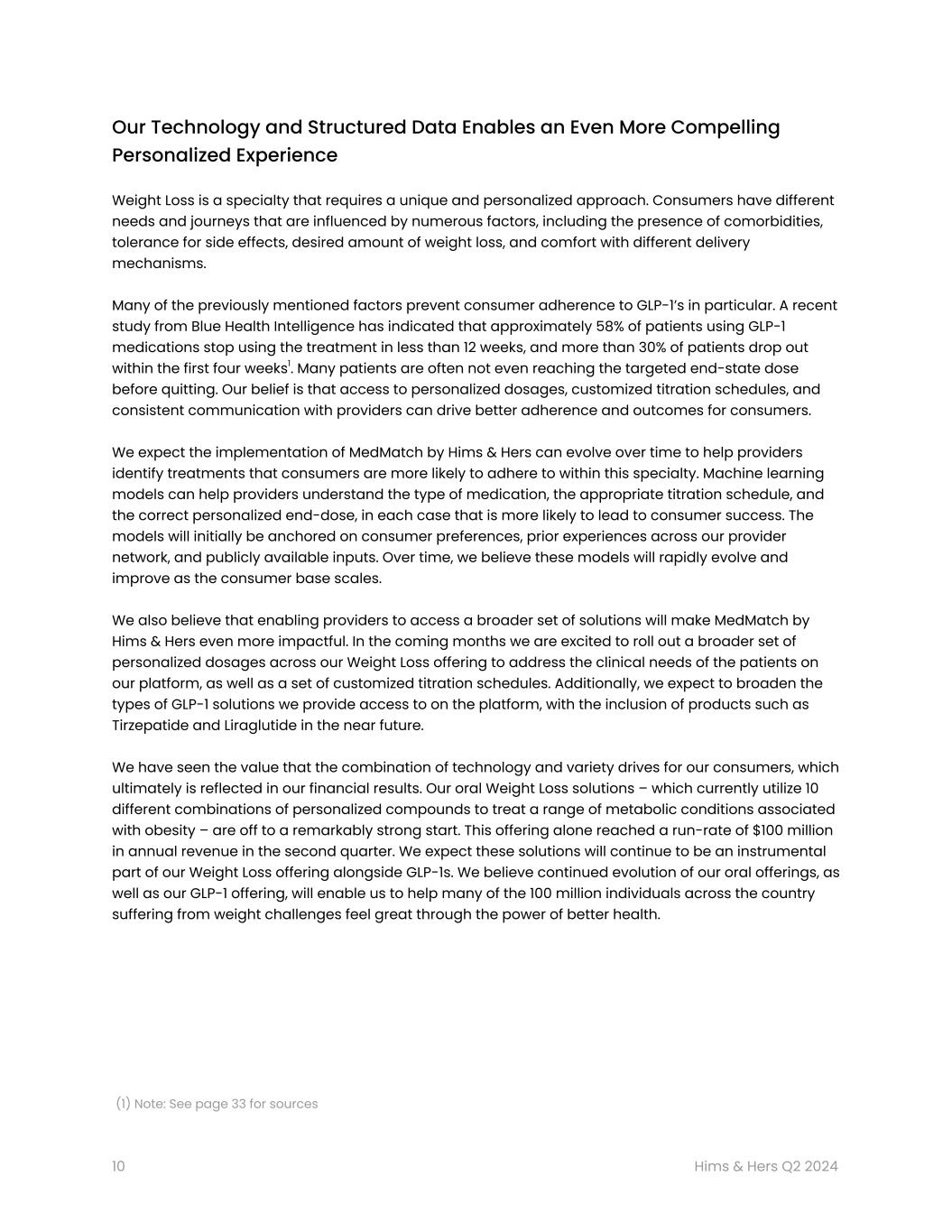

Our Technology and Structured Data Enables an Even More Compelling Personalized Experience Weight Loss is a specialty that requires a unique and personalized approach. Consumers have different needs and journeys that are influenced by numerous factors, including the presence of comorbidities, tolerance for side effects, desired amount of weight loss, and comfort with different delivery mechanisms. Many of the previously mentioned factors prevent consumer adherence to GLP-1’s in particular. A recent study from Blue Health Intelligence has indicated that approximately 58% of patients using GLP-1 medications stop using the treatment in less than 12 weeks, and more than 30% of patients drop out within the first four weeks1. Many patients are often not even reaching the targeted end-state dose before quitting. Our belief is that access to personalized dosages, customized titration schedules, and consistent communication with providers can drive better adherence and outcomes for consumers. We expect the implementation of MedMatch by Hims & Hers can evolve over time to help providers identify treatments that consumers are more likely to adhere to within this specialty. Machine learning models can help providers understand the type of medication, the appropriate titration schedule, and the correct personalized end-dose, in each case that is more likely to lead to consumer success. The models will initially be anchored on consumer preferences, prior experiences across our provider network, and publicly available inputs. Over time, we believe these models will rapidly evolve and improve as the consumer base scales. We also believe that enabling providers to access a broader set of solutions will make MedMatch by Hims & Hers even more impactful. In the coming months we are excited to roll out a broader set of personalized dosages across our Weight Loss offering to address the clinical needs of the patients on our platform, as well as a set of customized titration schedules. Additionally, we expect to broaden the types of GLP-1 solutions we provide access to on the platform, with the inclusion of products such as Tirzepatide and Liraglutide in the near future. We have seen the value that the combination of technology and variety drives for our consumers, which ultimately is reflected in our financial results. Our oral Weight Loss solutions – which currently utilize 10 different combinations of personalized compounds to treat a range of metabolic conditions associated with obesity – are off to a remarkably strong start. This offering alone reached a run-rate of $100 million in annual revenue in the second quarter. We expect these solutions will continue to be an instrumental part of our Weight Loss offering alongside GLP-1s. We believe continued evolution of our oral offerings, as well as our GLP-1 offering, will enable us to help many of the 100 million individuals across the country suffering from weight challenges feel great through the power of better health. (1) Note: See page 33 for sources 10 Hims & Hers Q2 2024

11 Hims & Hers Q2 2024

12 Hims & Hers Q2 2024

Investment in Our Infrastructure Allows Us to Scale Capabilities and Capacity Across Each Specialty Our goal is to create a platform capable of serving tens of millions of individuals while maintaining the exceptional customer experience the Hims & Hers brand has become known for. Our ongoing investments in our underlying infrastructure allow us to provide access to these solutions at scale, and the increasing demand we see each quarter highlights the critical importance of these initiatives. With our expansion into compounded sterile medications, we recently signed an agreement to acquire a 503B outsourcing facility, which will help us serve the strong customer demand we are seeing in Weight Loss, and also position us to address new categories in the future. This is a natural expansion of our existing capabilities from our affiliated pharmacies and represents our first step to verticalizing this piece of the supply chain. We anticipate this will significantly expand the level of customization and breadth of offerings we can provide our customers, while also positioning us to recognize meaningful efficiencies over time. Executing on this type of integration is a core competency of our teams allowing us to drive further accessibility for a broadening selection of solutions and to continue to pass value back to our customers. This investment also complements our ongoing efforts to enhance the scope and capabilities of our existing infrastructure by incorporating robotics and specialized software which will enable much of the upcoming innovation on the platform. As we have noted previously, we expect these investments will continue over the next three years. The foundation of our approach continues to center on providing a spectrum of solutions that our providers can leverage to best meet each individual’s needs. Strong business performance is resulting in an expanding free cash flow profile alongside our ongoing infrastructure investments. Our top priority for allocating our capital is reinvesting our cash flow into initiatives that accelerate our ability to scale and provide differentiated services across our platform. We expect that we will generate cash flow in the coming years in excess of what is required to continue scaling our platform and strengthen our balance sheet. As a result, we are excited to announce a new program to repurchase up to $100 million of our Class A common stock. We have the ability to utilize this program over the next three years to partially offset dilution from stock-based compensation, as well as to take advantage of periods of time when we believe there is a meaningful disconnect between the market value and intrinsic value of our stock. 13 Hims & Hers Q2 2024

14 Hims & Hers Q2 2024

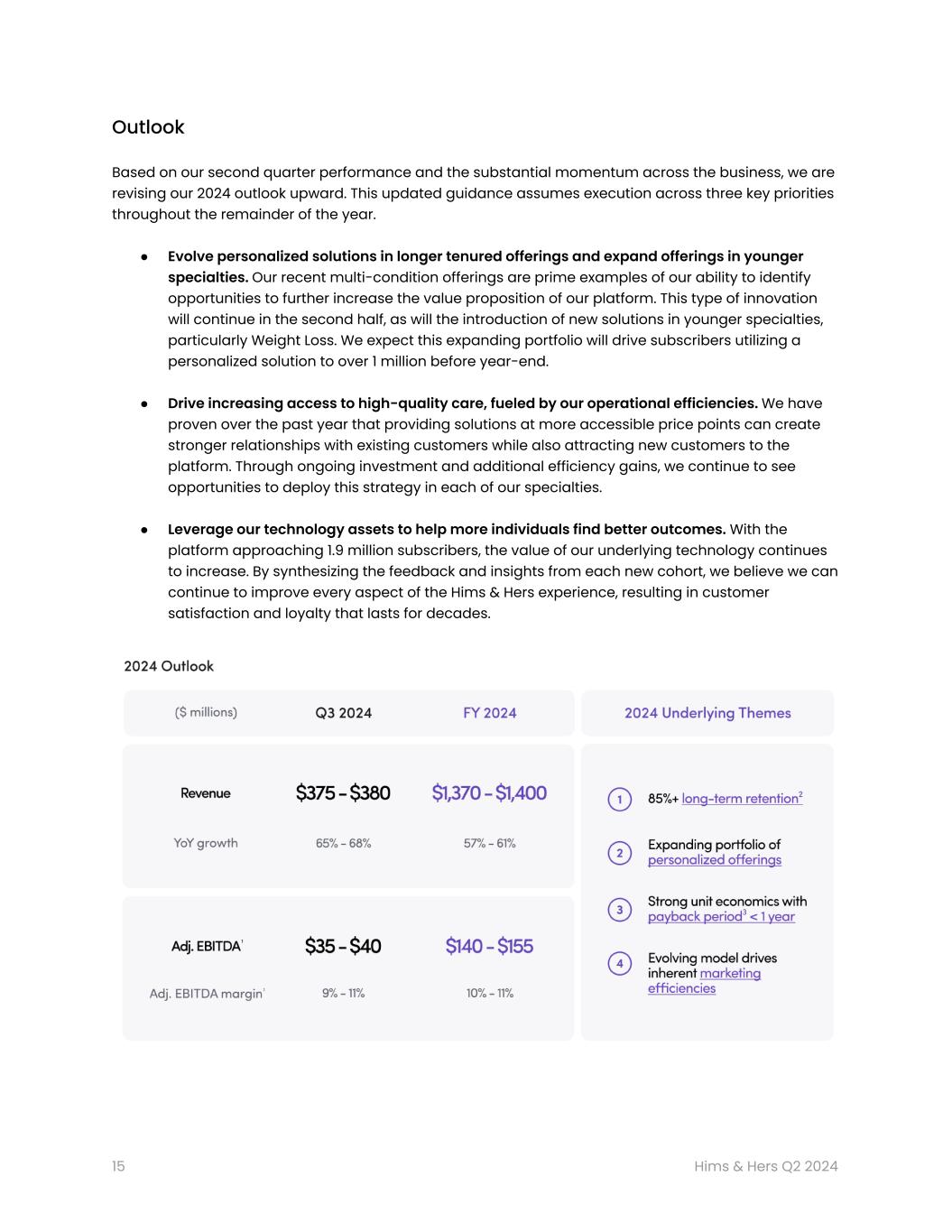

Outlook Based on our second quarter performance and the substantial momentum across the business, we are revising our 2024 outlook upward. This updated guidance assumes execution across three key priorities throughout the remainder of the year. ● Evolve personalized solutions in longer tenured offerings and expand offerings in younger specialties. Our recent multi-condition offerings are prime examples of our ability to identify opportunities to further increase the value proposition of our platform. This type of innovation will continue in the second half, as will the introduction of new solutions in younger specialties, particularly Weight Loss. We expect this expanding portfolio will drive subscribers utilizing a personalized solution to over 1 million before year-end. ● Drive increasing access to high-quality care, fueled by our operational efficiencies.We have proven over the past year that providing solutions at more accessible price points can create stronger relationships with existing customers while also attracting new customers to the platform. Through ongoing investment and additional efficiency gains, we continue to see opportunities to deploy this strategy in each of our specialties. ● Leverage our technology assets to helpmore individuals find better outcomes.With the platform approaching 1.9 million subscribers, the value of our underlying technology continues to increase. By synthesizing the feedback and insights from each new cohort, we believe we can continue to improve every aspect of the Hims & Hers experience, resulting in customer satisfaction and loyalty that lasts for decades. 15 Hims & Hers Q2 2024

For fiscal year 2024, we now expect to achieve $1.37-$1.40 billion in revenue and $140-$155 million in Adjusted EBITDA. We also continue to anticipate that 2024 will mark our first full year of net income profitability as a company. This building momentum and the investments we are making alongside it further our conviction that we are on a clear path to achieve our long-term Adjusted EBITDA margin target of at least 20% before 2030. As we see growth re-accelerate in response to our expanding portfolio of solutions, we remain steadfast in our commitment to our mission: to help the world feel great through the power of better health. We could not be more excited by the progress we’re making toward our ambitious goal of every household in the US becoming a Hims & Hers household. Achieving this kind of scale demands an ongoing commitment to investing in the capabilities of our infrastructure and platform, ensuring a consistently excellent experience for our growing customer base. We believe our approach is changing the way our customers engage with their health and we look forward to extending this exceptional experience to an ever-expanding audience in the second half of 2024. Andrew Dudum CEO and Co-Founder Note: 2024 financial targets are provided as of the Hims & Hers Health, Inc. earnings release dated August 5, 2024. (1) This is a non-GAAP financial measure. Please refer to pages 29-32 for definitions. We have relied upon the exception in Item 10(e)(1)(i)(B) of Regulation S-K and have not reconciled forward-looking Adjusted EBITDA to its most directly comparable U.S. GAAP measure, net income (loss), because we cannot predict with reasonable certainty the ultimate outcome of certain components of such reconciliations, including market-related assumptions that are not within our control, or others that may arise, without unreasonable effort. For these reasons, we are unable to assess the probable significance of the unavailable information, which could materially impact the amount of future net income (loss). See “Non-GAAP Financial Measures” for additional important information regarding Adjusted EBITDA. (2) Online revenue retention from subscriptions with a tenure of at least 2 years. (3) Payback period defined as the time it takes quarterly cumulative online gross profit generated by Hims & Hers online customers to exceed the quarterly customer acquisition costs to acquire those customers. 16 Hims & Hers Q2 2024

17 Hims & Hers Q2 2024

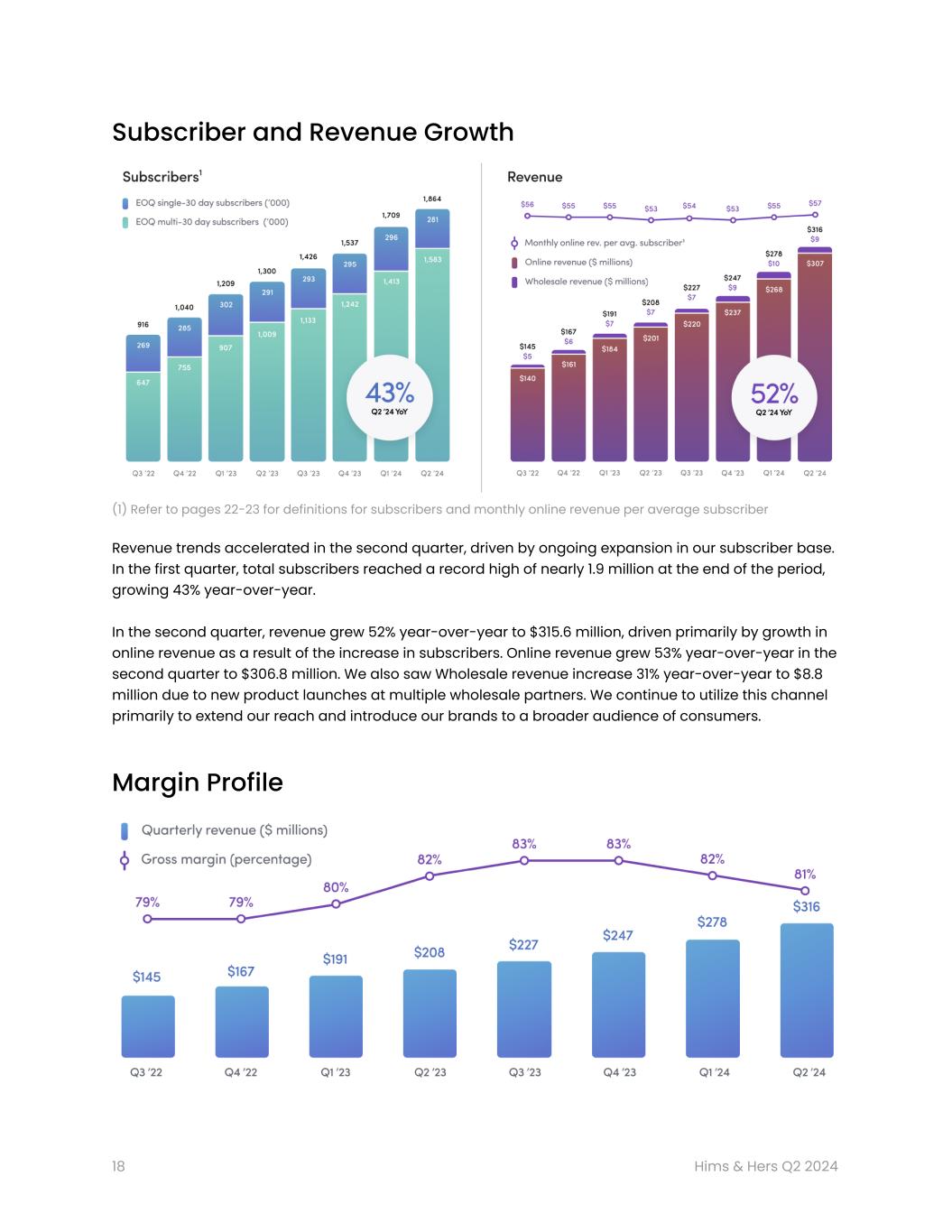

Subscriber and Revenue Growth (1) Refer to pages 22-23 for definitions for subscribers and monthly online revenue per average subscriber Revenue trends accelerated in the second quarter, driven by ongoing expansion in our subscriber base. In the first quarter, total subscribers reached a record high of nearly 1.9 million at the end of the period, growing 43% year-over-year. In the second quarter, revenue grew 52% year-over-year to $315.6 million, driven primarily by growth in online revenue as a result of the increase in subscribers. Online revenue grew 53% year-over-year in the second quarter to $306.8 million. We also saw Wholesale revenue increase 31% year-over-year to $8.8 million due to new product launches at multiple wholesale partners. We continue to utilize this channel primarily to extend our reach and introduce our brands to a broader audience of consumers. Margin Profile 18 Hims & Hers Q2 2024

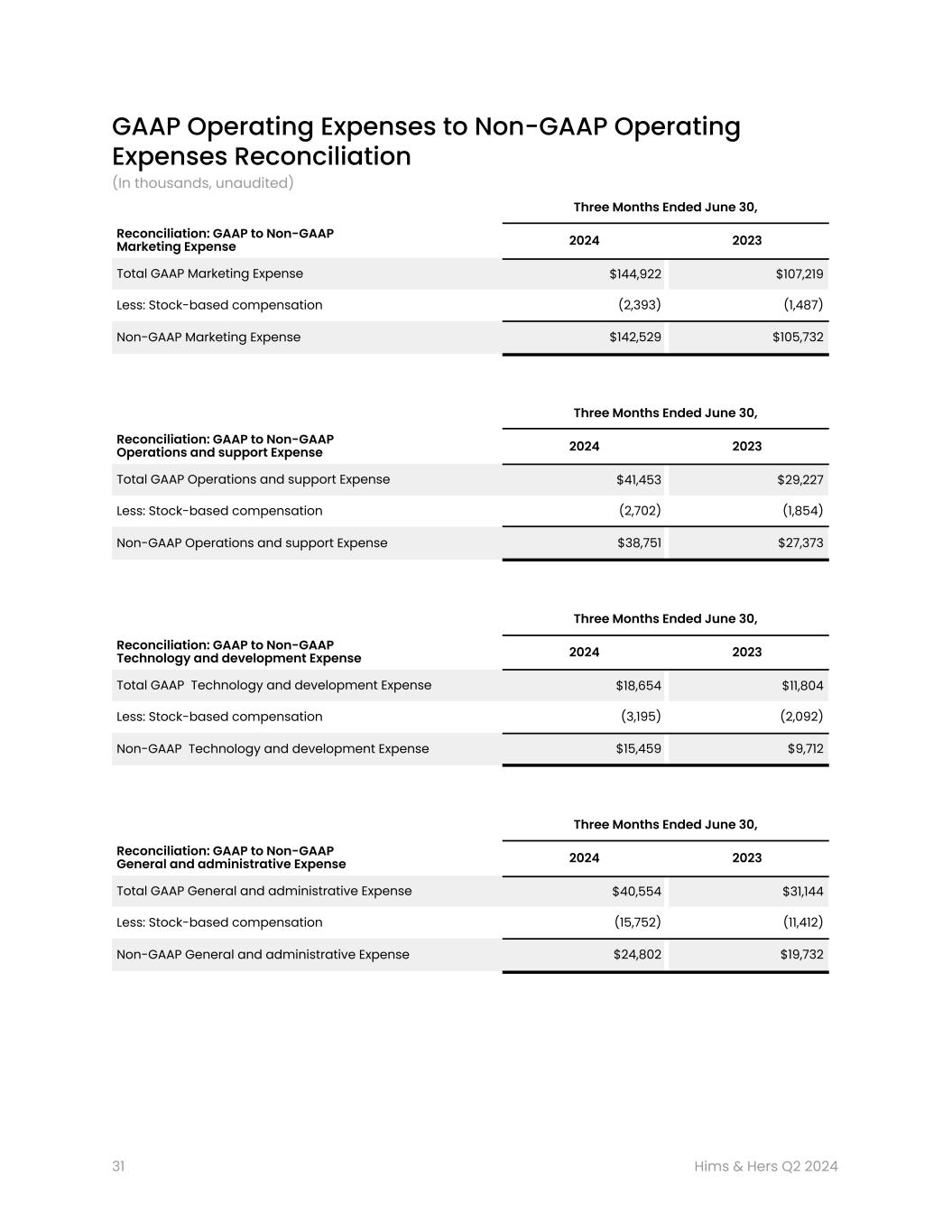

Second quarter gross margin of 81% decreased modestly year-over-year, while declining slightly more than 100 basis points relative to the first quarter of 2024. Both the year-over-year and sequential declines were primarily the result of higher costs related to new offerings during the quarter, which were somewhat offset by ongoing benefits from economies of scale, in part due to increased volume at our Affiliated Pharmacies. (1) Please refer to page 29-32 for reconciliation to the corresponding US GAAP financial measure We report four categories of operating expenses: Marketing, Operations and support, Technology and development, and General and administrative. Non-GAAP operating expenses represent GAAP expenses adjusted for stock-based compensation. On a GAAP basis, second quarter Marketing expenses decreased from 51% to 46% of revenue year-over-year. On a non-GAAP basis, Marketing expenses decreased from 51% to 45% of revenue. During the second quarter of 2024, we achieved significant Marketing leverage as we benefited from efficiencies related to new product launches as well as improving organic customer acquisition trends. GAAP Operations and support expenses decreased from 14% to 13% of revenue in the second quarter. On a non-GAAP basis, Operations and support expenses decreased from 13% to 12% of revenue. Relative to the prior year, we saw revenue growth outpace investments made across staffing, fulfillment, and processing largely in order to accommodate higher volume through our Affiliated Pharmacies. Technology and development expenses during the second quarter were largely flat as a percentage of revenue relative to the prior year. GAAP Technology and development expenses were 6% of revenue. On a non-GAAP basis, Technology and development expenses were 5% of revenue in the second quarter. 19 Hims & Hers Q2 2024

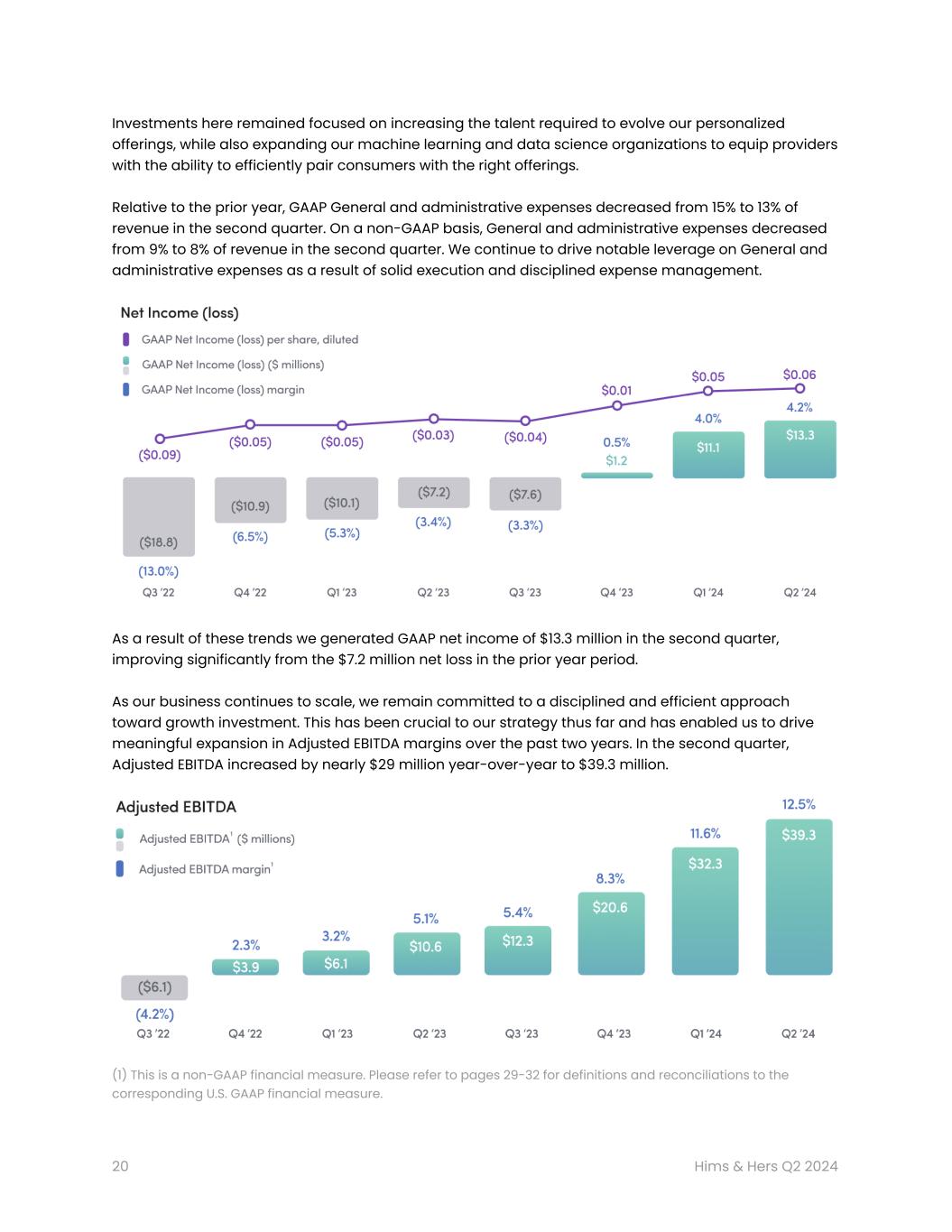

Investments here remained focused on increasing the talent required to evolve our personalized offerings, while also expanding our machine learning and data science organizations to equip providers with the ability to efficiently pair consumers with the right offerings. Relative to the prior year, GAAP General and administrative expenses decreased from 15% to 13% of revenue in the second quarter. On a non-GAAP basis, General and administrative expenses decreased from 9% to 8% of revenue in the second quarter. We continue to drive notable leverage on General and administrative expenses as a result of solid execution and disciplined expense management. As a result of these trends we generated GAAP net income of $13.3 million in the second quarter, improving significantly from the $7.2 million net loss in the prior year period. As our business continues to scale, we remain committed to a disciplined and efficient approach toward growth investment. This has been crucial to our strategy thus far and has enabled us to drive meaningful expansion in Adjusted EBITDA margins over the past two years. In the second quarter, Adjusted EBITDA increased by nearly $29 million year-over-year to $39.3 million. (1) This is a non-GAAP financial measure. Please refer to pages 29-32 for definitions and reconciliations to the corresponding U.S. GAAP financial measure. 20 Hims & Hers Q2 2024

Cash Flow and Balance Sheet In the second quarter, net cash provided by operating activities was $53.6 million, an increase of 219% year-over-year. Free cash flow in the second quarter was $47.6 million, an increase of 377% year-over-year. The year-over-year increase in both was primarily driven by revenue growth, improved net income margins, and some working capital tailwinds. At the end of the second quarter, we had over $227 million of cash, cash equivalents, and short-term investments and no debt on our balance sheet. In November of 2023, we announced a share repurchase authorization of up to $50 million of our Class A common stock. During the second quarter, we repurchased approximately $20 million of Class A common stock and have now fully utilized this authorization. Subsequent to quarter-end we authorized a new share repurchase program of $100 million, which can be utilized over the course of the next 3 years. We expect this new program will allow us to continue to capitalize on moments of disconnect between market value of our common stock and what we believe is the intrinsic value, while also giving us the ability to offset ongoing dilution as a result of stock-based compensation. (1) This is a non-GAAP financial measure. Please refer to pages 29-32 for definitions and reconciliations to the corresponding U.S. GAAP financial measure. 21 Hims & Hers Q2 2024

Conference Call Hims & Hers will host a conference call to review second quarter 2024 results on August 5, 2024, at 5:00 p.m. ET. The conference call can be accessed by dialing +1 (888) 510-2630 for U.S. participants and +1 (646) 960-0137 for international participants, and referencing conference ID #1704296. A live audio webcast will be available online at investors.hims.com. A replay of the call will be available via webcast for on-demand listening shortly after the completion of the call at the same link. About Hims & Hers Health, Inc. Hims & Hers is the leading health and wellness platform on a mission to help the world feel great through the power of better health. We believe how you feel in your body and mind transforms how you show up in life. That’s why we’re building a future where nothing stands in the way of harnessing this power. Hims & Hers normalizes health & wellness challenges—and innovates on their solutions—to make feeling happy and healthy easy to achieve. No two people are the same, so the Company provides access to personalized care designed for results. For more information, please visit investors.hims.com. Key Business Metrics “Online Revenue” represents the sales of products and services on our platform, net of refunds, credits, and chargebacks, and includes revenue recognition adjustments recorded pursuant to U.S. GAAP, primarily relating to deferred revenue and returns reserve. Online Revenue is generated by selling directly to consumers through our websites and mobile applications. Our Online Revenue consists of products and services purchased by customers directly through our online platform. The majority of our Online Revenue is subscription-based, where customers agree to be billed on a recurring basis to have products and services automatically delivered to them. “Wholesale Revenue” represents non-prescription product sales to retailers through wholesale purchasing agreements. Wholesale Revenue also includes non-prescription product sales to third-party platforms through consignment arrangements. In addition to being revenue generative and profitable, wholesale partnerships and consignment arrangements have the added benefit of generating brand awareness with new customers in physical environments and on third-party platforms. “Subscribers” are customers who have one or more “Subscriptions” pursuant to which they have agreed to be automatically billed on a recurring basis at a defined cadence. The Subscription billing cadence is typically defined as a number of days (for example, billed every 30 days or every 90 days), which are excluded from our reporting when payment has not occurred at the contracted billing cadence. Subscribers can cancel Subscriptions in between billing periods to stop receiving additional 22 Hims & Hers Q2 2024

products and/or services and can reactivate Subscriptions to continue receiving additional products and/or services. “Monthly Online Revenue per Average Subscriber” is defined as Online Revenue divided by “Average Subscribers”, which amount is then further divided by the number of months in a period. “Average Subscribers” are calculated as the sum of the Subscribers at the beginning and end of a given period divided by 2. Forward-Looking Statements This shareholder letter includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements can be identified by the use of forward-looking terminology, including the words “believes,” “estimates,” “anticipates,” “expects,” “intends,” “plans,” “assume,” “may,” “will,” “likely,” “potential,” “projects,” “predicts,” “continue,” “goal,” “strategy,” “future,” “forecast,” “target,” “outlook,” “project,” “confidence,” or “should,” or, in each case, their negative or other variations or comparable terminology. There can be no assurance that actual results will not materially differ from expectations. Such statements include, but are not limited to, any statements relating to our financial outlook and guidance, including our mission to drive top-line revenue growth and profitability and our ability to attain our medium- and long-term financial targets; our expected future financial and business performance, including with respect to the Hims & Hers platform, our marketing campaigns, investments in innovation, and our infrastructure, and the underlying assumptions with respect to the foregoing; the closing of our acquisition of a 503B compounding outsourcing facility; statements relating to events and trends relevant to us, including with respect to our financial condition, results of operations, short- and long-term business operations, objectives, strategy, and financial needs; expectations regarding our mobile applications, market acceptance, user experience, customer retention, brand development, our ability to invest and generate a return on any such investment, customer acquisition costs, operating efficiencies and leverage (including our fulfillment capabilities), the effect of any pricing decisions, changes in our product or offering mix, the timing and market acceptance of any new products or offerings, the timing and anticipated effect of any pending acquisitions, the success of our business model, our market opportunity, our ability to scale our business, the growth of certain of our specialties, our ability to innovate on and expand the scope of our offerings and experiences, including through the use of data analytics and artificial intelligence, our ability to reinvest into the customer experience, and our ability to comply with the extensive, complex and evolving legal and regulatory requirements applicable to our business, including without limitation state and federal healthcare, privacy and consumer protection laws and regulations, and the effect or outcome of any litigation or governmental actions that may arise in relation to any such legal and regulatory requirements. These statements are based on management’s current expectations, but actual results may differ materially due to various factors. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, the forward-looking statements contained in this letter are based on our current expectations, assumptions and beliefs concerning future developments and their potential effects on us. Future developments affecting us may not be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) and other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but 23 Hims & Hers Q2 2024

are not limited to, those factors described in the Risk Factors and other sections of our most recently filed Quarterly Report on Form 10-Q, our most recently filed Annual Report on Form 10-K, and other current and periodic reports we file from time to time with the Securities and Exchange Commission (the “Commission”). Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. The forward-looking statements contained in this letter are made only as of August 5, 2024. We undertake no obligation (and expressly disclaim any obligation) to update or revise any forward-looking statements, or to update the reasons actual results could differ materially from those anticipated in the forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and developments in the industry in which we operate may differ materially from those made in or suggested by the forward-looking statements contained in reports we have filed or will file with the Commission, including our most recently filed Quarterly Report on Form 10-Q, our most recently filed Annual Report on Form 10-K, and other current and periodic reports we file from time to time. In addition, even if our results of operations, financial condition and liquidity, and developments in the industry in which we operate are consistent with the forward-looking statements contained in such reports, those results or developments may not be indicative of results or developments in subsequent periods. We include statements and information in this letter concerning our industry and the markets in which we operate, including our market opportunity, which are based on information from independent industry organizations and other third-party sources (including industry publications, surveys and forecasts). While we believe these third-party sources to be reliable as of the date of this letter, we have not independently verified any third-party information and such information is inherently imprecise. 24 Hims & Hers Q2 2024

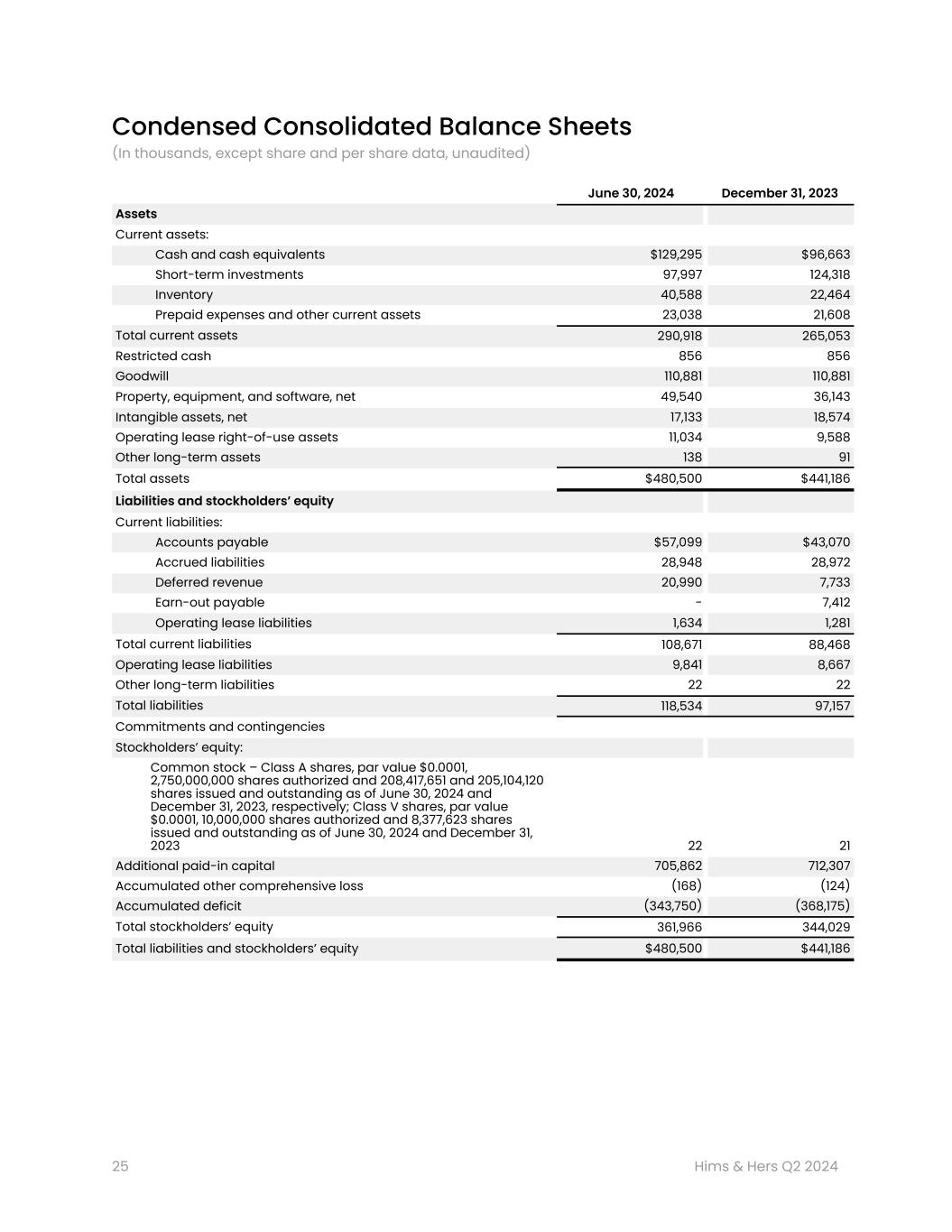

Condensed Consolidated Balance Sheets (In thousands, except share and per share data, unaudited) June 30, 2024 December 31, 2023 Assets Current assets: Cash and cash equivalents $129,295 $96,663 Short-term investments 97,997 124,318 Inventory 40,588 22,464 Prepaid expenses and other current assets 23,038 21,608 Total current assets 290,918 265,053 Restricted cash 856 856 Goodwill 110,881 110,881 Property, equipment, and software, net 49,540 36,143 Intangible assets, net 17,133 18,574 Operating lease right-of-use assets 11,034 9,588 Other long-term assets 138 91 Total assets $480,500 $441,186 Liabilities and stockholders’ equity Current liabilities: Accounts payable $57,099 $43,070 Accrued liabilities 28,948 28,972 Deferred revenue 20,990 7,733 Earn-out payable - 7,412 Operating lease liabilities 1,634 1,281 Total current liabilities 108,671 88,468 Operating lease liabilities 9,841 8,667 Other long-term liabilities 22 22 Total liabilities 118,534 97,157 Commitments and contingencies Stockholders’ equity: Common stock – Class A shares, par value $0.0001, 2,750,000,000 shares authorized and 208,417,651 and 205,104,120 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively; Class V shares, par value $0.0001, 10,000,000 shares authorized and 8,377,623 shares issued and outstanding as of June 30, 2024 and December 31, 2023 22 21 Additional paid-in capital 705,862 712,307 Accumulated other comprehensive loss (168) (124) Accumulated deficit (343,750) (368,175) Total stockholders’ equity 361,966 344,029 Total liabilities and stockholders’ equity $480,500 $441,186 25 Hims & Hers Q2 2024

Condensed Consolidated Statements of Operations and Comprehensive Income (Loss) (In thousands, except share and per share data, unaudited) Threemonths ended June 30, 2024 2023 Revenue $315,648 $207,912 Cost of revenue 59,035 37,754 Gross profit 256,613 170,158 Gross margin % 81 % 82 % Operating expenses: 1 Marketing 144,922 107,219 Operations and support 41,453 29,227 Technology and development 18,654 11,804 General and administrative 40,554 31,144 Total operating expenses 245,583 179,394 Income (loss) from operations 11,030 (9,236) Other income (expense): Change in fair value of liabilities — (173) Other income, net 2,394 2,239 Total other income, net 2,394 2,066 Income (loss) before income taxes 13,424 (7,170) (Provision) benefit for income taxes (127) 13 Net income (loss) 13,297 (7,157) Other comprehensive loss (6) (147) Total comprehensive income (loss) $13,291 $(7,304) Net income (loss) per share attributable to common stockholders: Basic $0.06 $(0.03) Diluted $0.06 $(0.03) Weighted average shares outstanding: Basic 214,618,037 208,422,825 Diluted 234,791,985 208,422,825 (1) Includes stock-based compensation expense as follows (in thousands): Threemonths ended June 30, 2024 2023 Marketing $2,393 $1,487 Operations and support 2,702 1,854 Technology and development 3,195 2,092 General and administrative 15,752 11,412 Total stock-based compensation expense $24,042 $16,845 26 Hims & Hers Q2 2024