false

0001682149

0001682149

2024-10-16

2024-10-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): October 16, 2024

WISA TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-38608 |

|

30-1135279 |

(State or other jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification Number) |

|

15268 NW Greenbrier Pkwy

Beaverton, OR |

|

97006 |

| (Address of registrant’s principal executive office) |

|

(Zip code) |

(408) 627-4716

(Registrant’s telephone

number, including area code)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of

the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, par value $0.0001 per share |

|

WISA |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange

Act of 1934.

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 |

Results of Operation and Financial Condition. |

On October 16, 2024,

WiSA Technologies, Inc. (the “Company”) issued a press release announcing certain business and financial information,

including preliminary revenue estimates for the quarter ended September 30, 2024.

The

press release is attached as Exhibit 99.1 to this Current Report on Form 8-K (“Form 8-K”) and is incorporated

herein by reference.

The information in Item 2.02 of this Form 8-K,

including Exhibit 99.1, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall

it be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange

Act, whether made before, on or after the date hereof, regardless of any general incorporation language except as expressly set forth

by specific reference in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: October 17, 2024 |

WISA TECHNOLOGIES, INC. |

| |

|

|

| |

By: |

/s/ Brett Moyer |

| |

|

Name: |

Brett Moyer |

| |

|

Title: |

Chief Executive Officer |

Exhibit 99.1

WiSA

Technologies Pre-Announces Q3 2024 Sequential Revenue Growth of

Over 200% as WiSA E IP Licensee Begins Product Shipments

- Preliminary

Q3 2024 revenue is estimated at $1.0 million to $1.2 million, up from $0.3 million in Q2 2024 -

BEAVERTON,

Ore., October 16, 2024 – WiSA

Technologies, Inc. (NASDAQ: WISA) (the “Company” or “WiSA”), a

leading provider of immersive, wireless sound technology for intelligent devices and next-generation home entertainment systems, today

reported preliminary Q3 2024 revenue of $1.0 million to $1.2 million, driven by sales of its WiSA multichannel wireless audio technology.

“In Q3 2024, we expect WiSA to

deliver over 200% sequential revenue growth, driven by both WiSA HT and our new WiSA E IP being in production with a multi-national licensee,”

said Brett Moyer, CEO of WiSA Technologies. “This specific licensee, which is one of the five current WiSA E licensees signed

to date, has integrated our WiSA E software into their source device and our WiSA E module in their speakers. Activation of the WiSA

E transmit functionality triggers royalty payments back and generates additional revenue from the sale of WiSA E-enabled receiver modules

using a Realtek Wi-Fi chip. We expect to build momentum with continued shipments to this customer with additional deployments anticipated

in 2025.”

“To date, we’ve secured

five WiSA E licensing agreements, with a goal of reaching eight by the end of 2024. WiSA has effectively licensed a significant portion

of Android-based HDTVs and is actively building an ecosystem of WiSA E-enabled speaker systems. We’re well-positioned to penetrate

multiple end markets through top-tier licensing partners, leading the industry by expanding premium audio experiences and fostering a

connected ecosystem that enhances the way users enjoy sound across devices,” added Moyer.

Q3

2024 Results and Investor Conference Call

The

Company plans to file its Form 10-Q for the third quarter ended September 30, 2024, on November 14, 2024, and will host

an investor conference call the following morning.

The

estimated revenue information in this press release is preliminary and subject to completion. Such preliminary financial information

is the responsibility of management and has been prepared in good faith on a consistent basis with prior periods. However, the Company

has not completed its financial closing procedures for the period ended September 30, 2024 and, as such, the preliminary financial

information contained herein constitutes forward-looking statements subject to the risks and uncertainties set forth below. Actual results

could be materially different from this preliminary financial information. As a result, prospective investors should exercise caution

in relying on this information and should not draw any inferences from this information regarding the Company's financial information

that is not provided. This preliminary financial information should not be viewed as a substitute for full financial statements prepared

in accordance with United States generally accepted accounting principles.

About

WiSA Technologies, Inc.

WiSA is a leading provider of immersive, wireless sound technology

for intelligent devices and next-generation home entertainment systems. Working with leading CE brands and manufacturers such as Harman

International, a division of Samsung; LG; Hisense; TCL; Bang & Olufsen; Platin Audio; and others, the company delivers immersive

wireless sound experiences for high-definition content, including movies and video, music, sports, gaming/esports, and more. WiSA Technologies, Inc.

is a founding member of WiSA™ (the Wireless Speaker and Audio Association) whose mission is to define wireless audio interoperability

standards as well as work with leading consumer electronics companies, technology providers, retailers, and ecosystem partners to evangelize

and market spatial audio technologies driven by WiSA Technologies, Inc. The company is headquartered in Beaverton, OR with sales

teams in Taiwan, China, Japan, Korea, and California.

Safe

Harbor Statement

This press

release contains forward-looking statements, which are not historical facts, within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Our actual results, performance or

achievements may differ materially from those expressed or implied by these forward-looking statements. In some cases, you can identify

forward-looking statements by the use of words such as “may,” “could,” “expect,” “intend,”

“plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,”

“potential,” “continue,” “likely,” “will,” “would” and variations of these

terms and similar expressions, or the negative of these terms or similar expressions. Such forward-looking statements, including the

estimated revenue for the third fiscal quarter of 2024, the estimated growth in revenue, and the intention to capitalize on additional

revenue, licensing and business opportunities are necessarily based upon estimates and assumptions that, while considered reasonable

by us and our management, are inherently uncertain. As a result, readers are cautioned not to place undue reliance on these forward-looking

statements. Actual results may differ materially from those indicated by these forward-looking statements as a result of risks and uncertainties,

including but not limited to, the continued and successful growth of our business, our ability to capitalize on additional business opportunities;

risks related to our current liquidity position and the need to obtain additional financing to support ongoing operations, our ability

to continue as a going concern, our ability to maintain the listing of our common stock on Nasdaq and other drivers, our ability to predict

the timing of design wins entering production and the potential future revenue associated with design wins, the ability to predict customer

demand for existing and future products and to secure adequate manufacturing capacity, consumer demand conditions affecting customers’

end markets, the ability to hire, retain and motivate employees, the effects of competition, including price competition, technological,

regulatory and legal developments, and developments in the economy and financial markets and other risks identified from time to time

in the Company’s Securities and Exchange Commission (“SEC”) reports, including the Company’s Annual Report on

Form 10-K, Quarterly Reports on Form 10-Q and other reports filed with the SEC. The Company does not undertake or accept any

obligation or undertaking to publicly release any updates or revisions to any forward-looking statements to reflect any changes in its

expectations or any change in events, conditions or circumstances on which any such statement is based.

Contacts

David

Barnard, LHA Investor Relations, 415-433-3777, wisa@lhai.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

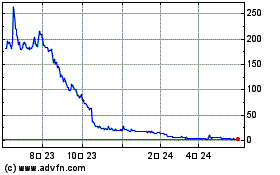

WiSA Technologies (NASDAQ:WISA)

過去 株価チャート

から 11 2024 まで 12 2024

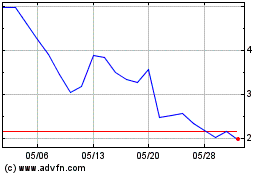

WiSA Technologies (NASDAQ:WISA)

過去 株価チャート

から 12 2023 まで 12 2024