Expert Reveals Top 15 Crypto Predictions For 2025 You Need To Know

2024年12月24日 - 12:30AM

NEWSBTC

In a thread on X, Hitesh Malviya, co-founder of DYOR—a free

on-chain analytics platform—unveiled his set of crypto predictions

for the year 2025. Malviya outlines pivotal trends and shifts

expected to shape the crypto landscape. Below are the top 15

predictions that stakeholders and enthusiasts should closely

monitor. Top 15 Crypto Predictions For 2025 #1 US Regulation Of the

Crypto Market In 2025 Malviya anticipates the formalization of the

United States’ regulatory framework for cryptocurrencies by 2025.

“The US crypto regulation framework has been under discussion for

the past two years, but we’re yet to see any approval on it,” he

states. He further predicts that during the Trump presidency,

favorable regulations will emerge, significantly bolstering sectors

with robust cash flows, particularly decentralized finance (DeFi).

#2 Sustained Memecoin Popularity Despite anticipated regulatory

interventions, Malviya expects the memecoin sector to regain its

momentum. “Most of the memes will eventually have a short term hit

when the regulation framework is introduced in the USA, as I don’t

see them becoming part of it,” he explains. He further forecasts

that regulation will “eventually create a clear divide between

hyperspeculative trading assets and assets with some sort of

fundamental value associated with them.” Nonetheless, like in 2024,

the “majority of people will choose memes over fundamentally backed

assets, even if they are not recognized by the government,” Malviya

predicts, adding, “meme mania will only grow—more participants will

join in the hope of changing their lives. The casino will only get

bigger with time.” #3 Expansion Of Hyperspeculative Markets Beyond

memecoins, Malviya foresees significant growth in hyperspeculative

markets, particularly within prediction markets for events, news,

affairs and almost everything. “Memes are not the most

hyper-speculative market that crypto offers—prediction markets are

the bigger fish in the pond. […] Prediction market platforms like

Polymarket will eventually capture the largest audience in 2025,”

he notes. #4 DeFi Renaissance A resurgence in DeFi is a cornerstone

of Malviya’s predictions. He projects that DeFi will become a focal

point for mature investors, with total value locked (TVL) in DeFi

protocols surpassing $250 billion by the end of 2025. “Money

markets like AAVE will eventually attract more TVL,” Malviya

asserted, highlighting the role of Donald Trump’s crypto project

World Liberty Financial as a key growth catalyst. “Some DeFi coins

will also hit $30B-$50B market caps next year,” the expert added.

Related Reading: Is The Crypto Bull Run Over? Top Exec Discusses

The Market Crash #5 On-Chain Commodities Trading The integration of

commodities into blockchain ecosystems is expected to gain

traction. Malviya forecasts, “Different types of commodities will

eventually be offered for trading on many DEXs in 2025.” Ostium

Labs is identified by the expert as an early mover in this domain,

with expectations that numerous projects will launch on-chain

commodity trading platforms. #6 Stablecoin Market Cap Reaches $500

Billion The stablecoin sector is poised for substantial growth,

with Malviya forecasting a market capitalization of $500 billion.

“Many new stablecoins will eventually capture some market share

from big players like USDC and USDT,” he remarked. The Reserve

Protocol, facilitating asset-backed stablecoins, is singled out as

a promising initiative within this expansion. #7 Rise of AI Art

NFTs Artificial Intelligence-driven art NFTs are projected to

garner significant attention. “Some AI artists, like Refik Anadol,

can steal the maximum attention from NFT art collectors next year,”

Malviya predicts. He anticipates that AI Art NFT collections may

achieve floor prices reaching 100 Ethereum (ETH). Related Reading:

Bitwise Exec Reveals His Personal Top 3 Crypto Predictions For 2025

#8 Staking-Driven Airdrop Mechanisms Malviya forecasts that Polygon

and EigenLayer are going to have a series of major token launches

next year. “I am anticipating that Polygon and EigenLayer staking

will probably bring a couple of ecosystem airdrops for holders,” he

explained. #9 Peak And Decline Of Initial AI Offerings (IAOs) The

initial phase of IAOs is expected to reach its zenith, followed by

a contraction. “IAOs are currently going through the first phase,”

Malviya noted, cautioning that oversaturation will lead to the

decline of many AI agents. “Only a few agents with quality data

training and a clear purpose will manage to survive the AI agent

winter, which is going to happen at some point next year,” the

expert cautions. #10 Perpetual Bull Market Perception Malviya

suggests that the bull market will persist in perception but will

not be as straightforward as in the past where every altcoin surged

at the same time. “That’s the saddest part of this prediction

list—most people will remain delusional about a bull market, just

like they are now. The market’s nature will remain rotational for a

few more months,” he stated. He foresees a major correction

resembling a bear cycle, yet expects an unexpected recovery

influenced by potential black swan events: “I am expecting a major

correction, which might resemble a bear cycle in 2025, but it will

surprise people with an unexpected recovery, aligned with some

potential black swan events.” #11 Focus On Privacy-Based Projects

Post-regulatory clarity under Trump, privacy-centric projects are

projected to gain prominence. “Confidential transactions and

private computation would become a necessity at some point,”

Malviya emphasized. Projects like Nillion are expected to attract

substantial attention within the DeFi and DeAI sectors, catering to

the growing demand for privacy solutions. #12 SUI Surpassing Solana

In Daily Transactions The SUI blockchain, leveraging the SocialFi

narrative, is anticipated to eclipse Solana in daily transaction

volumes. “SUI is currently cooking the SocialFi narrative. Most of

the application activities on SUI come from their SocialFi app,

which directly deals with the creator economy. I am expecting that

some of the apps from SUI will eventually crack the creator economy

code and bring the masses onchain, eventually surpassing Solana in

daily transaction metrics.” #13 Intense Competition Among

Alternative Virtual Machines (AltVMs) The battle among AltVMs is

set to intensify, with Malviya identifying contenders like Monad,

MegaETH, Berachain, HyperVM, Sonic, and Sei. “One of them will

capture 75% of the market share within 12 months after launch,” he

predicts, attributing success to community support and developer

relationships. Malviya expresses a particular interest in MegaEth

Labs as a potential market leader. #14 Mainstream Adoption Of Web3

Wallets Web3 wallets are expected to achieve mainstream status,

facilitated by enhanced user onboarding and intuitive interfaces.

“Web3 wallets are going to become super easy for onboarding and

usage next year,” Malviya states. The emergence of super apps,

alongside Web3 wallets from major exchanges like OKX and Binance,

is projected to drive widespread adoption through mobile platforms.

#15 DEXs Capturing 30% Of Trading Volume Finally, Malviya foresees

decentralized exchanges (DEXs) substantially increasing their share

of trading volumes. “DEX/CEX trading volume ratio sits at 15% right

now. I am expecting it to double in the next 12 months,” he

asserts. The shift towards on-chain trading is attributed to the

advantages of self-custody and improved onboarding technologies

like account abstraction, leading to an anticipated rise in

on-chain user activity. At press time, Bitcoin traded at $96,139.

Featured image from iStock, chart from TradingView.com

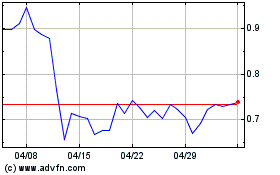

Polygon (COIN:MATICUSD)

過去 株価チャート

から 11 2024 まで 12 2024

Polygon (COIN:MATICUSD)

過去 株価チャート

から 12 2023 まで 12 2024