Verde AgriTech Plc (TSX: “NPK”) (OTCQB: “AMHPF”)

("Verde” or the “Company”) is pleased to announce sales results for

2018 and expansion plans for 2019.

SalesVerde has received orders

that match its total production capacity for 2018. The Company has

been operating its plant 24 hours a day and 7 days a week in order

to fulfill existing orders for Super Greensand® for the 2018

planting season.

The Company has sold almost 40 thousand tonnes

of Super Greensand® this season, this is approximately 10 times

what was sold in 2017. In 2018, over 150 farmers have purchased the

product, intended for crops including soybeans, corn, sugarcane,

coffee, cotton, banana and carrots. The states supplied now include

Minas Gerais, Goiás, São Paulo, Mato Grosso do Sul and Mato

Grosso.

In Brasil, Super Greensand® is sold under the

brand name of K Forte (the “Product”). Both the Product and Super

Greensand® share the same source and are processed identically,

sharing equal benefits to soil and plant.

Verde will be producing Super Greensand® until

late November, when the planting season ends and the raining season

starts. From November to March, Verde will switch to the processing

and selling of Alpha (see PR April 20, 2016). Alpha is applied

after the crops have started to grow, it is sprayed onto crops’

leaves, from where the plant absorbs its nutrients.

Expansion Plans

In 2019, Verde aims to continue the use of its

existing plant to produce 200 thousand tonnes per annum of Product

and, in parallel, it will start construction of a new processing

facility capable of producing an added 600 thousand tonnes per

annum. The total of 800 thousand tonnes per annum capacity is

expected to be reached in early 2020. Financing for the expansion

is budgeted to be a mix of accumulated cashflow and subsidized-debt

from Brazil’s development bank (BNDES).

Verde’s President & CEO, Cristiano Veloso,

commented: “Though it pains us to turn away buyers because we have

now reached maximum production capacity, we are even more

determined to accelerate our expansion and supply an ever greater

numbers of Brazilian farmers. Even when Verde achieves 800 thousand

tonnes of product a year, we will represent a mere 1.5% of the

total Brazilian market for potash and roughly half of the added

growth in potash demand of the past years. Our expansions are only

just beginning.”

About Verde AgriTech

Verde AgriTech promotes sustainable and

profitable agriculture through the development of its Cerrado Verde

Project. Cerrado Verde, located in the heart of Brazil’s largest

agricultural market, is the source of a potassium-rich deposit from

which the Company intends to produce solutions for crop nutrition,

crop protection, soil improvement and increased sustainability.

For additional information please

contact:Cristiano Veloso, President &

Chief Executive OfficerTel: +55 (31) 3245 0205; Email:

cv@verdeagritech.com www.verdeagritech.com

| www.supergreensand.com

Visit and subscribe to our YouTube

Channelwww.youtube.com/verdeagritech

Cautionary Language and Forward Looking

Statements

All Mineral Reserve and Mineral Resources

estimates reported by the Company were estimated in accordance with

the Canadian National Instrument 43-101 and the Canadian Institute

of Mining, Metallurgy, and Petroleum Definition Standards (May 10,

2014). These standards differ significantly from the requirements

of the U.S. Securities and Exchange Commission. Mineral Resources

which are not Mineral Reserves do not have demonstrated economic

viability.

This document contains "forward-looking

information" within the meaning of Canadian securities legislation

and "forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995. This

information and these statements, referred to herein as

"forward-looking statements" are made as of the date of this

document. Forward-looking statements relate to future events or

future performance and reflect current estimates, predictions,

expectations or beliefs regarding future events and include, but

are not limited to, statements with respect to:

- the estimated amount and grade of

Mineral Resources and Mineral Reserves;

- the PFS representing a viable

development option for the Project;

- estimates of the capital costs of

constructing mine facilities and bringing a mine into production,

of sustaining capital and the duration of financing payback

periods;

- the estimated amount of future

production, both produced and sold; and,

- estimates of operating costs and

total costs, net cash flow, net present value and economic returns

from an operating mine.

Any statements that express or involve

discussions with respect to predictions, expectations, beliefs,

plans, projections, objectives or future events or performance

(often, but not always, using words or phrases such as "expects",

"anticipates", "plans", "projects", "estimates", "envisages",

"assumes", "intends", "strategy", "goals", "objectives" or

variations thereof or stating that certain actions, events or

results "may", "could", "would", "might" or "will" be taken, occur

or be achieved, or the negative of any of these terms and similar

expressions) are not statements of historical fact and may be

forward-looking statements.

All forward-looking statements are based on

Verde's or its consultants' current beliefs as well as various

assumptions made by them and information currently available to

them. The most significant assumptions are set forth above, but

generally these assumptions include:

- the presence of and continuity of

resources and reserves at the Project at estimated grades;

- the geotechnical and metallurgical

characteristics of rock conforming to sampled results; including

the quantities of water and the quality of the water that must be

diverted or treated during mining operations;

- the capacities and durability of

various machinery and equipment;

- the availability of personnel,

machinery and equipment at estimated prices and within the

estimated delivery times;

- currency exchange rates;

- Super Greensand® sales prices,

market size and exchange rate assumed;

- appropriate discount rates applied

to the cash flows in the economic analysis;

- tax rates and royalty rates

applicable to the proposed mining operation;

- the availability of acceptable

financing under assumed structure and costs;

- anticipated mining losses and

dilution;

- reasonable contingency

requirements;

- success in realizing proposed

operations;

- receipt of permits and other

regulatory approvals on acceptable terms; and

- the fulfilment of environmental

assessment commitments and arrangements with local

communities.

Although management considers these assumptions

to be reasonable based on information currently available to it,

they may prove to be incorrect. Many forward-looking statements are

made assuming the correctness of other forward looking statements,

such as statements of net present value and internal rates of

return, which are based on most of the other forward-looking

statements and assumptions herein. The cost information is also

prepared using current values, but the time for incurring the costs

will be in the future and it is assumed costs will remain stable

over the relevant period.

By their very nature, forward-looking statements

involve inherent risks and uncertainties, both general and

specific, and risks exist that estimates, forecasts, projections

and other forward-looking statements will not be achieved or that

assumptions do not reflect future experience. We caution readers

not to place undue reliance on these forward-looking statements as

a number of important factors could cause the actual outcomes to

differ materially from the beliefs, plans, objectives,

expectations, anticipations, estimates assumptions and intentions

expressed in such forward-looking statements. These risk factors

may be generally stated as the risk that the assumptions and

estimates expressed above do not occur as forecast, but

specifically include, without limitation: risks relating to

variations in the mineral content within the material identified as

Mineral Resources and Mineral Reserves from that predicted;

variations in rates of recovery and extraction; the geotechnical

characteristics of the rock mined or through which infrastructure

is built differing from that predicted, the quantity of water that

will need to be diverted or treated during mining operations being

different from what is expected to be encountered during mining

operations or post closure, or the rate of flow of the water being

different; developments in world metals markets; risks relating to

fluctuations in the Brazilian Real relative to the Canadian dollar;

increases in the estimated capital and operating costs or

unanticipated costs; difficulties attracting the necessary work

force; increases in financing costs or adverse changes to the terms

of available financing, if any; tax rates or royalties being

greater than assumed; changes in development or mining plans due to

changes in logistical, technical or other factors; changes in

project parameters as plans continue to be refined; risks relating

to receipt of regulatory approvals; delays in stakeholder

negotiations; changes in regulations applying to the development,

operation, and closure of mining operations from what currently

exists; the effects of competition in the markets in which Verde

operates; operational and infrastructure risks and the additional

risks described in Verde's Annual Information Form filed with SEDAR

in Canada (available at www.sedar.com) for the year ended December

31, 2016. Verde cautions that the foregoing list of factors that

may affect future results is not exhaustive.

When relying on our forward-looking statements

to make decisions with respect to Verde, investors and others

should carefully consider the foregoing factors and other

uncertainties and potential events. Verde does not undertake to

update any forward-looking statement, whether written or oral, that

may be made from time to time by Verde or on our behalf, except as

required by law.

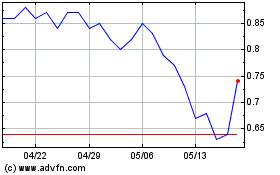

Verde Agritech (TSX:NPK)

過去 株価チャート

から 11 2024 まで 12 2024

Verde Agritech (TSX:NPK)

過去 株価チャート

から 12 2023 まで 12 2024