false

0001389545

0001389545

2025-01-03

2025-01-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of earliest event reported: January 3, 2025

NovaBay Pharmaceuticals, Inc.

(Exact Name of Registrant as Specified in Charter)

|

Delaware

(State of Other Jurisdiction of Incorporation)

|

001-33678

(Commission File Number)

|

68-0454536

(I.R.S. Employer Identification No.)

|

2000 Powell Street, Suite 1150, Emeryville, CA 94608

(Address of Principal Executive Offices) (Zip Code)

(510) 899-8800

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

Common Stock, par value $0.01 per share

|

Trading Symbol(s)

NBY

|

Name of Each Exchange On Which Registered

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On January 3, 2025, NovaBay Pharmaceuticals, Inc. (the “Company”) entered into a Trademark Acquisition Agreement, (the “Trademark Acquisition Agreement”), by and between the Company and Phase One Health LLC, a Tennessee limited liability company (“Phase One”), that provides for the purchase by Phase One of the Company’s wound care product trademarks NeutroPhase, PhaseOne and OmniPhase (collectively, the “Trademarks”), for a purchase price of $500,000 (the “Wound Care Transaction”). In connection with the Wound Care Transaction, the Company also entered into a Transition Services Agreement, dated January 3, 2025, by and between the Company and Phase One (the “Transition Services Agreement”), pursuant to which the Company will: (i) provide limited transition services to Phase One until January 10, 2025; (ii) sell the Company’s existing wound care inventory from an outstanding purchase order (the “Inventory”) to Phase One for an aggregate payment of $126,000; and (iii) provide its remaining empty wound care product bottles to Phase One. In addition, the Transition Services Agreement provides that the existing supplier and distributor relationship between the Company and PhaseOne will be terminated upon the closing of the Wound Care Transaction.

As previously disclosed, the Company entered into a separate agreement to sell the Company’s eyecare products under the Avenova brand and related assets, which represents substantially all of the assets of the Company, pursuant to the Asset Purchase Agreement dated September 19, 2024, by and between the Company and PRN Physician Recommended Nutriceuticals, LLC, a Delaware limited liability company (“PRN”), as amended on November 5, 2024 by that certain Amendment No. 1 to Asset Purchase Agreement (the “Asset Sale Transaction”), which remains subject to stockholder approval. The Trademarks sold pursuant to the Trademark Acquisition Agreement and the Inventory sold pursuant to the Transition Services Agreement were assets of the Company’s wound care business that were excluded from the Asset Sale Transaction.

Additional information regarding the Asset Sale Transaction is included in the Current Reports on Form 8-K that were filed by the Company with the Securities and Exchange Commission (the “SEC”) on September 20, 2024 and November 6, 2024 and in the Company’s definitive proxy statement on Schedule 14A for the Special Meeting filed with the SEC on October 16, 2024 (the “Special Meeting Proxy Statement”), as supplemented from time to time, including by the supplement to the Special Meeting Proxy Statement dated as of November 12, 2024 (the “Proxy Supplement”).

The Trademark Acquisition Agreement contains representations, warranties and agreements of the parties that are customary for a transaction of this nature. The Company also agreed to provide limited indemnification to Phase One under the Trademark Acquisition Agreement for losses arising from a third-party claim involving a material breach or nonperformance of representations, warranties, covenants, agreements and obligations of the Company contained in the Trademark Acquisition Agreement. The Company’s liability for any such losses is limited to 50% of the purchase price for the Trademarks.

The foregoing description of the Trademark Acquisition Agreement and the Transition Services Agreement contains only a brief description of the material terms and does not purport to be a complete description of the rights and obligations of the parties to the Trademark Acquisition Agreement and the Transition Services Agreement, and such description is qualified in its entirety by reference to the full text of the Trademark Acquisition Agreement and the Transition Services Agreement, copies of which are filed as Exhibits 2.1 and 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 2.01 Completion of Acquisition or Disposition of Assets.

On January 8, 2025, the Company completed the sale to Phase One of (i) the Trademarks pursuant to the Trademark Acquisition Agreement for a purchase price of $500,000 and (ii) the Inventory pursuant to the Transition Services Agreement for $126,000. The Company intends to use the proceeds from the sale of the Trademarks and the Inventory for the Company’s working capital needs to fund its ongoing operations and expenses, as well as for general corporate purposes. The information disclosed in Item 1.01 of this Current Report on Form 8-K is incorporated herein into this Item 2.01 by reference.

Additional Matters

The documents described or referred to above and/or attached as an exhibit to, or incorporated by reference to, this Current Report on Form 8-K (collectively, the “Form 8-K Documents”) contain customary representations and warranties of the Company to such agreements that may be subject to limitations, qualifications or exceptions agreed upon by the parties, and may be subject to a contractual standard of materiality that differs from the materiality standard that applies to reports and documents filed with the SEC. In particular, in review of the representations and warranties contained in the Trademark Acquisition Agreement, it is important to bear in mind that the representations and warranties of the Company were (i) to, and solely for the benefit of Phase One and (ii) negotiated by the parties in connection with the Wound Care Transaction and with the principal purpose of allocating contractual risk between the parties in the Wound Care Transaction. The representations and warranties, other provisions of the Form 8-K Documents or any description of these provisions should not be read alone, but instead should be read only in conjunction with the information provided in and documents referred to in this Current Report on Form 8-K and in the other reports, statements and filings that the Company publicly files with the SEC.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit No.

|

|

Description

|

|

2.1*

|

|

|

|

10.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

*Certain schedules were omitted as well as certain confidential portions of the agreement by means of marking such portions with brackets (due to such confidential portions not being material and being the type of information that the Company treats as private or confidential) pursuant to Item 601 of Regulation S-K promulgated by the SEC. The Company agrees to supplementally furnish a copy of any omitted schedule or confidential portions of an exhibit to the SEC upon request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

NovaBay Pharmaceuticals, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Justin M. Hall

|

|

|

|

|

Justin M. Hall

|

|

|

|

|

Chief Executive Officer and General Counsel

|

|

Dated: January 10, 2025

Exhibit 2.1

CERTAIN IDENTIFIED INFORMATION HAS BEEN EXCLUDED FROM THIS EXHIBIT BECAUSE IT IS BOTH (I) NOT MATERIAL AND (II) IS THE TYPE OF INFORMATION THAT THE REGISTRANT TREATS AS PRIVATE OR CONFIDENTIAL. THE REDACTED TERMS HAVE BEEN MARKED WITH THE FOLLOWING MARKING: [Redacted.]

TRADEMARK ACQUISITION AGREEMENT

This TRADEMARK ACQUISITION AGREEMENT (this “Agreement”), dated as of January 3, 2025, is made by and between NovaBay Pharmaceuticals, Inc., a Delaware corporation (“Seller”), and Phase One Health, LLC, a Tennessee limited liability company (“Buyer”).

WHEREAS, Seller wishes to sell to Buyer, and Buyer wishes to purchase from Seller, all right, title, and interest in and to certain Trademarks (as defined below) and related rights, together with the goodwill connected with the use of and symbolized by such Trademarks, subject to the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the mutual covenants and agreements set forth herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1. Purchase and Sale of Trademarks. Subject to the terms and conditions set forth herein, Seller hereby irrevocably sells, assigns, transfers, and conveys to Buyer, and Buyer hereby accepts, all right, title, and interest in and to the following (collectively, “Acquired Rights”), together with the goodwill associated therewith and symbolized thereby:

(a) the trademarks listed on Schedule 1 (“Trademarks”) and all registrations, applications for registration, and renewals of such Trademarks (collectively, the “Acquired Marks”).

(b) all claims and causes of action with respect to any of the Acquired Marks, including all rights to and claims for damages, restitution, and injunctive and other legal and equitable relief for past, present, and future infringement, dilution, violation, breach, or default; and

(c) all other rights, privileges, and protections of any kind whatsoever of Seller accruing under any of the foregoing provided by any applicable law, treaty, or other international convention throughout the world.

2. Purchase Price.

(a) The aggregate purchase price for the Acquired Rights shall be Five Hundred Thousand US Dollars (US$500,000.00) (the “Purchase Price”).

(b) As a condition precedent to payment and the sale of the Acquired Rights to Buyer, Seller shall perform the obligation set forth in Section 2(c) of the Transition Services Agreement that the parties are executing contemporaneously with this Agreement (the “Transition Services Agreement”), and Seller shall confirm the completion of such performance to Buyer. Buyer shall acquire the Acquired Rights and pay the non-refundable Purchase Price to Seller within three (3) days following both of the parties’ full execution of this Agreement and the Transition Services Agreement, and the performance of Seller’s obligation under Section 2(c) of the Transition Services Agreement. Payment shall be made in US dollars by wire transfer of immediately available funds to the account designated by Seller to Buyer in writing. The sale of the Acquired Rights shall be effective only upon the payment to Seller of the Purchase Price as provided in the preceding sentence.

3. Deliverables. Upon execution of this Agreement and receipt of the Purchase Price, Seller shall deliver to Buyer the following:

(a) an assignment in the form of Exhibit A (the “Assignment”) duly executed by Seller; and

(b) the complete prosecution files for all the Acquired Marks, reasonably available to Seller, and in such form and medium as reasonably requested by Buyer, and all such other documents, correspondence, and information as are reasonably requested by Buyer to register, own, or otherwise use the Acquired Rights, including any renewal fees due and deadlines for actions to be taken concerning prosecution and maintenance of all the Acquired Marks in the ninety (90) day period following the date hereof; and

(c) copies of all consents, permissions, and agreements necessary for the transfer of the Acquired Marks to Buyer.

4. Further Assurances; Recordation.

(a) From and up to sixty (60) days after the date hereof or such other reasonable period mutually agreed upon by the parties, each of the parties hereto shall execute and deliver such additional documents, instruments, conveyances, and assurances, and take such further actions as may be reasonably required to carry out the provisions hereof and give effect to the transactions contemplated by this Agreement and the documents to be delivered hereunder.

5. Representations and Warranties of Seller. Seller represents and warrants to Buyer that the statements contained in this Section 5, are true and correct as of the date hereof:

(a) Authority of Seller; Enforceability. Seller has the full right, power, and authority to enter into this Agreement and perform its obligations hereunder. The execution, delivery, and performance of this Agreement by Seller have been duly authorized by all necessary organizational action of Seller, and when executed and delivered by both parties, this Agreement will constitute a legal, valid, and binding obligation of Seller, enforceable against Seller in accordance with its terms and conditions subject to limitations on enforcement and other remedies imposed by or arising under or in connection with (i) applicable bankruptcy, insolvency, reorganization, moratorium or other similar laws now or hereafter in effect relating to or affecting rights of creditors generally, and (ii) rules of law and general principles of equity, including those governing specific performance, injunctive relief and other equitable remedies.

(b) No Conflicts; Consents. The execution, delivery, and performance by Seller of this Agreement, and the consummation of the transactions contemplated hereby, do not and will not: (i) violate or conflict with the certificate of incorporation, by-laws, or other organizational documents of Seller; (ii) violate or conflict with any judgment, order, decree, statute, law, ordinance, rule, or regulation; (iii) conflict with, or result in (with or without notice or lapse of time or both), any violation of or default under, or give rise to a right of termination, acceleration, or modification of any obligation or loss of any benefit under, any contract or other instrument to which this Agreement or any of the Acquired Rights are subject; or (iv) result in the creation or imposition of any encumbrances on the Acquired Rights. No consent, approval, waiver, or authorization is required to be obtained by Seller from any person or entity (including any governmental authority) in connection with the execution, delivery, and performance by Seller of this Agreement, or to enable Buyer to register, own, and use the Acquired Rights.

(c) Ownership. Seller owns all right, title and interest in and to the Acquired Rights, free and clear of liens, security interests and other encumbrances. To the best of Seller’s actual knowledge after reasonable inquiry, Seller is in full compliance with all legal requirements applicable to the Acquired Rights and Seller’s ownership and use thereof.

(d) Registrations and Applications. Schedule 1 contains a correct, current, and complete list of the Acquired Marks, specifying as to each, as applicable: the word mark and/or design, the record owner, the jurisdiction in which it has been granted or filed, the registration or application serial number, and the registration or application date. All required filings and fees related to the trademark registrations listed on Schedule 1 have been timely filed with and paid to the USPTO, and all such trademark registrations have at all times been and remain in good standing.

(e) Validity and Enforceability. The Acquired Rights are valid, subsisting, and enforceable in all applicable jurisdictions set forth in Schedule 1, and are not subject to any pending or, to Seller’s knowledge, threatened challenge or claim to the contrary. No event or circumstance (including any failure to exercise adequate quality control or any assignment in gross without the accompanying goodwill) has occurred or exists that has resulted in, or would reasonably be expected to result in, the abandonment of any Acquired Mark.

(f) Non-Infringement. The registration, ownership, and exercise of the Acquired Rights, to Seller’s knowledge, do not and will not infringe or otherwise violate the US intellectual property or other US rights of any third party or violate any applicable regulation or law. To Seller’s knowledge, no person has infringed or otherwise violated, or is currently infringing or otherwise violating, any of the Acquired Rights.

(g) Legal Actions. There are no actions (including any opposition or cancellation proceedings) settled, pending, or, to Seller’s knowledge, threatened (including in the form of offers to obtain a license): (i) alleging any infringement, misappropriation, dilution, or other violation of the intellectual property rights of any third party based on the use or exploitation of any Acquired Rights; (ii) challenging the validity, enforceability, registrability, or ownership of any Acquired Rights or Seller’s rights with respect thereto; or (iii) by Seller or any third party alleging any infringement or other violation by any third party of any Acquired Rights.

(h) No Other Representations or Warranties. Except for the representations and warranties contained in this Section 5, Seller has not made and makes no other express or implied representation or warranty, either oral or written, whether arising by law or otherwise, including with respect to the ownership, registration, validity, enforcement, or use of the Acquired Rights, all of which are expressly disclaimed.

6. Indemnification.

(a) Survival. All representations, warranties, covenants, and agreements contained herein and all related rights to indemnification shall continue in full force and effect following the date hereof for a period of three (3) months.

(b) Seller shall defend, indemnify, and hold harmless Buyer, Buyer’s affiliates, and their respective shareholders, directors, officers, and employees (each, a “Buyer Indemnified Party”) from and against all actual losses, damages, liabilities, deficiencies, claims, actions, judgments, settlements, interest, awards, penalties, fines, fees, costs, or expenses of whatever kind, including reasonable attorneys’ fees, that are actually incurred (collectively, “Losses”), arising out of or in connection with any third-party claim, suit, action, or proceeding (each, a “Third-Party Claim”) related to any material breach or nonperformance of any representation, warranty, covenant, agreement, or obligation of Seller contained in this Agreement. Seller’s aggregate liability to a Buyer Indemnified Party for Losses under this Agreement shall not exceed an amount equal to fifty percent (50%) of the Purchase Price.

(c) A Buyer Indemnified Party shall promptly notify Seller upon becoming aware of a Third-Party Claim with respect to which Seller is obligated to provide indemnification under this Section 6 (“Indemnified Claim”). Seller shall promptly assume control of the defense and investigation of the Indemnified Claim, with counsel of its own choosing, and the Buyer Indemnified Party shall reasonably cooperate with Seller in connection therewith. The Buyer Indemnified Party may participate in the defense of such Indemnified Claim, with counsel of its own choosing and at its own cost and expense. Seller shall not settle any Indemnified Claim on behalf of any Buyer Indemnified Party involving terms that adversely affect the rights of any Buyer Indemnified Party without the Buyer Indemnified Party's prior written consent (which consent shall not be unreasonably withheld, conditioned, or delayed). Neither the Buyer Indemnified Party's failure to perform any obligation under this Section 6(c) nor any act or omission of the Buyer Indemnified Party in the defense or settlement of any Indemnified Claim shall relieve Seller of its obligations under this Section 6, including with respect to any Losses, except to the extent that Seller can demonstrate that it has been materially prejudiced as a result thereof.

7. Confidentiality.

(a) Confidentiality and Use. Neither party shall disclose to any third party (other than their respective employees in their capacity as such) any information with respect to the financial terms of this Agreement, except as may be required for such party to comply with applicable law or regulation (including as provided below) or for Seller to confirm the consent and collateral release of the Acquired Rights under the terms of its Secured Promissory Note, dated November 5, 2024, with PRN Physician Recommended Nutriceuticals, LLC, as lender. Seller agrees: (i) not to use any information in its possession after the date hereof that is of a sensitive, proprietary, or confidential nature, whether written or oral, to the extent it specifically concerns the Acquired Rights, other than as strictly necessary to exercise its rights or perform its obligations under this Agreement; and (ii) to maintain such non-public information regarding the Acquired Rights in strict confidence, and not to use or disclose such information without Buyer’s prior written consent. Notwithstanding the foregoing, Buyer acknowledges that Seller will be required to, and will, file a Current Report on Form 8-K disclosing this Agreement and the transaction contemplated hereby and does hereby consent to such filing and any associated disclosure.

(b) Compelled Disclosures. If either party is compelled to disclose any information with respect to the financial terms of this Agreement, or Seller is compelled to disclose any information that is of a sensitive, proprietary, or confidential nature concerning the Acquired Rights, by judicial or administrative process or by other requirements of law, such party shall: (i) promptly notify the other party in writing; (ii) disclose only that portion of such information which it is advised by counsel in writing is legally required to be disclosed; and (iii) use reasonable best efforts to obtain an appropriate protective order or other reasonable assurance that confidential treatment will be accorded such information.

8. Miscellaneous.

(a) Interpretation. For purposes of this Agreement, (i) the words “include,” “includes,” and “including” are deemed to be followed by the words “without limitation”; (ii) the word “or” is not exclusive; and (iii) the words “herein,” “hereof,” “hereby,” “hereto,” and “hereunder” refer to this Agreement as a whole. Unless the context otherwise requires, references herein: (x) to Sections, Schedules, and Exhibits refer to the Sections of, and Schedules and Exhibits attached to, this Agreement; (y) to an agreement, instrument, or other document means such agreement, instrument, or other document as amended, supplemented, and modified from time to time to the extent permitted by the provisions thereof; and (z) to a statute means such statute as amended from time to time and includes any successor legislation thereto and any regulations promulgated thereunder. This Agreement is intended to be construed without regard to any presumption or rule requiring construction or interpretation against the party drafting an instrument or causing any instrument to be drafted. The Schedules and Exhibits referred to herein are intended to be construed with, and as an integral part of, this Agreement to the same extent as if they were set forth verbatim herein.

(b) Notices. All notices, requests, consents, claims, demands, waivers, and other communications hereunder shall be in writing and shall be deemed to have been given: (i) when delivered by hand (with written confirmation of receipt); (ii) when received by the addressee if sent by a nationally recognized overnight courier (receipt requested); (iii) on the date sent by email of a PDF document (with confirmation of transmission) if sent during normal business hours of the recipient; and (iv) on the third day after the date mailed, by certified or registered mail (in each case, return receipt requested, postage prepaid). Such communications must be sent to the respective parties at the following addresses or at such other address for a party as shall be specified in a notice given in accordance with this Section 8(b):

if to Seller:

NovaBay Pharmaceuticals, Inc.

2000 Powell Street, Suite 1150

Emeryville, CA 94608

Attn: Justin M. Hall

Email: [Redacted.]

with a copy (which will not constitute notice) to:

Squire Patton Boggs (US) LLP

2550 M St NW

Washington, DC 20037

Attn: Abby E. Brown

Email: [Redacted.]

if to Buyer:

Phase One Health, LLC

2815 Brick Church Pike

Nashville, TN 37207

Attn: Jeffrey Nugent

Email: [Redacted.]

with a copy (which will not constitute notice) to:

Bradley Arant Boult Cummings LLP

1221 Broadway, Suite 2400

Nashville, TN 37203

Attention: Jacob W. Neu

Email: [Redacted.]

(c) Entire Agreement. This Agreement, together with the Transition Services Agreement executed contemporaneously by the parties hereto and documents to be delivered hereunder, and all related exhibits and schedules constitute the sole and entire agreement of the parties to this Agreement with respect to the subject matter contained herein and therein, and supersede all prior and contemporaneous understandings and agreements, both written and oral, with respect to such subject matter. In the event of any inconsistency between the statements in the body of this Agreement, the documents to be delivered hereunder, and the related exhibits and schedules (other than an exception expressly set forth as such in the related exhibits or schedules), the statements in the body of this Agreement shall control.

(d) Severability. If any term or provision of this Agreement is invalid, illegal, or unenforceable in any jurisdiction, such invalidity, illegality, or unenforceability shall not affect any other term or provision of this Agreement or invalidate or render unenforceable such term or provision in any other jurisdiction.

(e) Successors and Assigns. This Agreement shall be binding upon and shall inure to the benefit of the parties hereto and their respective successors and assigns.

(f) Governing Law; Venue. All matters arising out of or relating to this Agreement shall be governed by and construed in accordance with the internal laws of the State of Delaware without giving effect to any choice or conflict of law provision or rule. Any legal suit, action, or proceeding arising out of or relating to this Agreement or the transactions contemplated hereby shall be instituted in the federal courts of the United States of America or the courts of the State of Delaware in each case located in the City of Wilmington, and each party irrevocably submits to the exclusive jurisdiction of such courts in any such legal suit, action, or proceeding. Each party waives their respective right to a trial by jury relating to any claim or cause of action pursuant to this Agreement.

(g) Amendment and Modification. This Agreement may only be amended, modified, or supplemented by an agreement in writing signed by each party hereto.

(h) Waiver. No waiver by any party of any of the provisions hereof shall be effective unless explicitly set forth in writing and signed by the party so waiving. Except as otherwise set forth in this Agreement, no failure to exercise, or delay in exercising, any right, remedy, power or privilege arising from this Agreement shall operate or be construed as a waiver thereof; and any single or partial exercise of any right, remedy, power or privilege hereunder shall not preclude any other or further exercise thereof or the exercise of any other right, remedy, power or privilege.

(i) Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together shall be deemed to be one and the same agreement. A signed copy of this Agreement delivered by facsimile, email, or other means of electronic transmission shall be deemed to have the same legal effect as delivery of an original signed copy of this Agreement.

IN WITNESS WHEREOF, Seller and Buyer have caused this Agreement to be executed as of the date first written above by their respective duly authorized officers.

| |

NovaBay Pharmaceuticals, Inc. |

|

| |

By: /s/ Justin M. Hall, Esq. |

|

| |

Name: Justin M. Hall, Esq. |

|

| |

Title: CEO |

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Phase One Health, LLC |

|

| |

By: /s/ Jeffrey Nugent |

|

| |

Name: Jeffrey Nugent |

|

| |

Title: President and CEO |

|

EXHIBIT A

ASSIGNMENT OF TRADEMARKS

For good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, NovaBay Pharmaceuticals, Inc., a Delaware corporation located at 2000 Powell Street, Suite 1150 Emeryville, CA 94608 (“Seller”), hereby sells, assigns, transfers, and conveys to Phase One Health, LLC, a Tennessee limited liability company, located at 2815 Brick Church Pike, Nashville, TN 37207 (“Buyer”), pursuant to the Trademark Acquisition Agreement dated as of , by and between Seller and Buyer, all right, title, and interest in and to the trademarks set forth on Schedule 1 attached hereto and incorporated by this reference herein, together with the goodwill associated therewith and symbolized thereby, and all claims and causes of action with respect to any of the foregoing, including without limitation all rights to and claims for damages, restitution, and injunctive and other legal and equitable relief for past, present, and future infringement or other violation, and all other rights, privileges, and protections of any kind whatsoever of Seller accruing under any of the foregoing provided by any applicable law, treaty or other international convention.

Seller hereby authorizes the Commissioner for Trademarks in the United States Patent and Trademark Office and the officials of corresponding entities or agencies in any applicable jurisdictions to record and register this Assignment of Trademarks upon request by Buyer.

IN WITNESS WHEREOF, the undersigned has caused this Assignment of Trademarks to be executed on this day of , by its duly authorized officer.

| |

NovaBay Pharmaceuticals, Inc. |

|

| |

By: |

|

|

| |

Name: |

|

|

| |

Title: |

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| AGREED TO AND ACCEPTED: |

Phase One Health, LLC |

|

| |

By: |

|

|

| |

Name: |

|

|

| |

Title: |

|

|

Exhibit 10.1

TRANSITION SERVICES AGREEMENT

This Transition Services Agreement (this “Agreement”) dated as of January 3, 2025, is made by and between NovaBay Pharmaceuticals, Inc., a Delaware corporation (the “Seller”), and Phase One Health, LLC, a Tennessee limited liability company (the “Buyer”).

WHEREAS, in connection with the transactions contemplated by that certain Trademark Acquisition Agreement (the “Purchase Agreement”), dated as of the date hereof, by and among the Buyer, the Seller and the owner of the Seller, the Buyer and the Seller desire to enter into this Agreement; and

WHEREAS, the Buyer desires for the Seller to sell the Inventory (as defined below) and provide certain services to the Buyer and the Seller is willing to sell the Inventory and provide such services to the Buyer, in each case, on the terms and conditions set forth in this Agreement. Capitalized terms used and not otherwise defined in this Agreement have the meanings ascribed to them in the Purchase Agreement.

NOW, THEREFORE, in consideration of the mutual covenants contained herein, and intending to be legally bound hereby, the parties hereto agree as follows:

1. Term. The Seller shall provide services to the Buyer hereunder for the period commencing on the date hereof, and ending January 10, 2025 (the “Term”); provided, however, that the Buyer may terminate any one or more of the services at any time upon reasonable prior notice to the Seller, which shall be provided at least ten (10) days prior to the termination of such services.

2. Duties.

(a) Within three (3) days of execution of this Agreement, the Buyer shall deliver to the Seller one hundred twenty-six thousand dollars ($126,000.00) (the “Inventory Purchase Price”) as payment for the inventory in connection with Purchase Order No. 2024-03 (dated December 18, 2023) (the “Inventory”). The Buyer shall arrange and be responsible for the prompt loading and shipment of the entire Inventory to occur from the Seller’s warehouse location that is identified to the Buyer (the “Seller’s Warehouse”) to a destination that is determined by the Buyer. Such loading and shipment of the Inventory shall occur within two (2) days of payment of the Inventory Purchase Price to the Seller. For avoidance of doubt, the sale of the Inventory to the Buyer will occur and become final only after full payment of the Inventory Purchase Price has been received by the Seller.

(b) Promptly upon receipt of the Inventory Purchase Price set forth in Section 2(a), the Buyer shall arrange and be responsible for the prompt loading and shipment of all the Seller’s inventory of empty PHASEONE ® 235 mL bottles in its possession and located at the Seller’s Warehouse to the Buyer’s desired destination. Such loading and shipment shall occur within two (2) days of payment of the Inventory Purchase Price to the Seller.

(c) The Seller shall amend its 510(k) pre-clearance submission number K113820 to cover PHASEONE within its scope.

(d) The Seller and the Buyer acknowledge that the Amended and Restated Private Label Agreement, dated February 25, 2019 between the parties shall terminate upon payment of the Inventory Purchase Price as provided hereunder.

3. Independent Contractor Status.

(a) The Seller acknowledges and agrees that (i) the Seller alone will be responsible for remitting, withholding and/or paying federal, state, local and any other applicable taxes on the amounts paid by the Buyer hereunder, and (ii) the Buyer will not withhold any amounts from the payments made by it hereunder relating to any such taxes. The Seller shall defend, indemnify and hold harmless the Buyer and its subsidiaries and affiliates, and each of their respective officers, directors and employees from and against all claims, liabilities and expenses (including reasonable attorney’s fees, costs and disbursements) relating to any failure by the Seller to declare, collect, remit and pay on a timely basis all such taxes, payments and contributions that are owing by the Seller in respect of the amounts paid by the Buyer to the Seller.

(b) Each party acknowledges and agrees that none of the Seller’s employees, personnel, members or agents is an “employee” (or person of similar status) of the Buyer or any of its affiliates for purposes of the Internal Revenue Code of 1986, as amended, or for purposes of participation in any employee benefit plans of the Buyer or any of its affiliates. Each party further acknowledges and agrees that its employees, personnel, members and agents have no right to participate, and shall not participate, in any employee benefit plans, programs or policies of the Buyer or any of its affiliates.

(c) The Seller shall be an independent contractor of the Buyer, and this Agreement shall not be construed to create any association, partnership, joint venture, employee, or agency relationship between the Seller and the Buyer for any purpose. The Seller shall have no authority, and shall not hold itself out as having any authority, to bind the Buyer and shall not make any agreements or representations on the Buyer’s behalf without the Buyer’s prior written consent.

4. Representations. Each party represents and warrants to the other party that (a) it is not subject to any contract, arrangement, policy or understanding, or to any statute, governmental rule or regulation, that in any way limits its ability to enter into and fully perform its obligations under this Agreement, and (b) it is not otherwise unable to enter into and fully perform its obligations under this Agreement.

5. Binding Effect; Assignment. This Agreement shall inure to the benefit of and be binding upon the parties hereto and their respective heirs, executors, personal representatives, estates, successors and assigns. Notwithstanding the provisions of the immediately preceding sentence, neither party shall assign all or any portion of this Agreement without the prior written consent of the other party.

6. Notices. Unless otherwise provided herein, all communications under this Agreement shall be delivered pursuant to the notice provisions set forth in the Purchase Agreement.

7. Amendments; Waivers. This Agreement may not be modified unless such amendment is agreed to in writing and signed by each of the parties hereto. No waiver by either party hereto at any time of any breach by the other party hereto, or compliance with, any condition or provision of this Agreement to be performed by such other party shall be deemed a waiver of similar or dissimilar provisions or conditions at the same or at any prior or subsequent time.

8. Governing Law. This Agreement shall in all respects be governed by, and construed in accordance with, the laws (excluding conflict of laws rules and principles) of the State of Delaware applicable to agreements made and to be performed entirely within Delaware, including all matters of construction, validity and performance.

9. Severability. If any provision of this Agreement, or any application thereof to any circumstances, is invalid, in whole or in part, such provision or application shall to that extent be severable and shall not affect other provisions or applications of this Agreement.

10. Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed to be an original, but all of which together will constitute one and the same instrument.

11. Entire Agreement. This Agreement and the Purchase Agreement contain the entire agreement between the parties hereto concerning the subject matter hereof and supersede all prior agreements, understandings, discussions, negotiations and undertakings, whether written or oral, between the parties hereto relating to such subject matter.

IN WITNESS WHEREOF, the Seller and the Buyer have caused this Agreement to be executed as of the date first above written by their respective duly authorized officers.

| |

NovaBay Pharmaceuticals, Inc. |

|

| |

By: |

/s/ Justin M. Hall, Esq. |

|

| |

Name: |

Justin M. Hall, Esq. |

|

| |

Title: |

CEO |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

Phase One Health, LLC |

|

| |

|

|

| |

By: |

/s/ Jeffrey Nugent |

|

| |

Name: |

Jeffrey Nugent |

|

| |

Title: |

President and CEO |

|

v3.24.4

Document And Entity Information

|

Jan. 03, 2025 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

NovaBay Pharmaceuticals, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jan. 03, 2025

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-33678

|

| Entity, Tax Identification Number |

68-0454536

|

| Entity, Address, Address Line One |

2000 Powell Street

|

| Entity, Address, Address Line Two |

Suite 1150

|

| Entity, Address, City or Town |

Emeryville

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

94608

|

| City Area Code |

510

|

| Local Phone Number |

899-8800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

NBY

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001389545

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

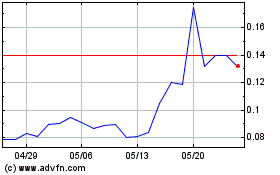

NovaBay Pharmaceuticals (AMEX:NBY)

過去 株価チャート

から 12 2024 まで 1 2025

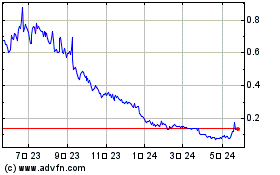

NovaBay Pharmaceuticals (AMEX:NBY)

過去 株価チャート

から 1 2024 まで 1 2025