Farmland Partners Announces Promotion of Susan Landi to CFO

2024年5月29日 - 5:10AM

ビジネスワイヤ(英語)

Staff Reduction Part of Company’s

Cost-Cutting Initiative

Farmland Partners Inc. (NYSE: FPI) (the “Company” or “FPI”)

today announced that Susan Landi has been appointed to the

Company’s executive team as Chief Financial Officer (“CFO”) and

Treasurer. Ms. Landi, the senior accounting professional at FPI for

over four years, assumed her new role on May 28, 2024. Ms. Landi’s

responsibilities will include overseeing the Company's finance,

accounting, treasury, and SEC financial reporting functions.

Ms. Landi succeeds James Gilligan, who has stepped down as CFO

upon mutual agreement with the Company and will remain as an

employee with the Company through June 30, 2024 to ensure a smooth

transition.

“Susan is the perfect person to build upon the great work James

did during his tenure. Susan knows FPI’s finances and the farmland

business well, she has a strong track record of driving positive

results, and she’s already proven herself to be an invaluable

member of our close-knit team. I’m excited for Susan and look

forward to working with her as CFO,” said FPI Chief Executive

Officer Luca Fabbri. “James is a consummate professional who should

be proud of the job he’s done leading FPI’s finance department

since October 2021. We wish him nothing but success moving

forward.”

Mr. Fabbri, who also served as the Company’s CFO from 2014 to

2021, explained that the staffing change is part of the Company’s

ongoing efforts to reduce expenses and improve shareholder

returns.

Ms. Landi has been an accounting and audit professional since

2002, serving at Moss Adams and Hein & Associates prior to

joining the Company in 2019. She received a B.S. in Accounting from

Saint Vincent College and a M.B.A. from the University of Colorado,

and she is a Certified Public Accountant.

About Farmland Partners Inc.

Farmland Partners Inc. is an internally managed real estate

company that owns and seeks to acquire high-quality North American

farmland and makes loans to farmers secured by farm real estate. As

of the date of this release, the Company owns and/or manages

approximately 177,400 acres in 17 states, including Arkansas,

California, Colorado, Florida, Illinois, Indiana, Iowa, Kansas,

Louisiana, Mississippi, Missouri, Nebraska, North Carolina, Ohio,

Oklahoma, South Carolina, and Texas. In addition, the Company owns

land and buildings for four agriculture equipment dealerships in

Ohio leased to Ag Pro under the John Deere brand. The Company has

approximately 26 crop types and over 100 tenants. The Company

elected to be taxed as a real estate investment trust, or REIT, for

U.S. federal income tax purposes, commencing with the taxable year

ended December 31, 2014. Additional information:

www.farmlandpartners.com or (720) 452-3100.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the federal securities laws, including, without

limitation, statements with respect to our outlook and the outlook

for the farm economy generally, proposed and pending acquisitions

and dispositions, financing activities, crop yields and prices and

anticipated rental rates. Forward-looking statements generally can

be identified by the use of forward-looking terminology such as

“may,” “should,” “could,” “would,” “predicts,” “potential,”

“continue,” “expects,” “anticipates,” “future,” “intends,” “plans,”

“believes,” “estimates” or similar expressions or their negatives,

as well as statements in future tense. Although the Company

believes that the expectations reflected in such forward-looking

statements are based upon reasonable assumptions, beliefs and

expectations, such forward-looking statements are not predictions

of future events or guarantees of future performance and our actual

results could differ materially from those set forth in the

forward-looking statements. Some factors that might cause such a

difference include the following: the on-going war in Ukraine and

its impact on the world agriculture market, world food supply, the

farm economy, and our tenants’ businesses; general volatility of

the capital markets and the market price of the Company’s common

stock; changes in the Company’s business strategy, availability,

terms and deployment of capital; the Company’s ability to refinance

existing indebtedness at or prior to maturity on favorable terms,

or at all; availability of qualified personnel; changes in the

Company’s industry, interest rates or the general economy; adverse

developments related to crop yields or crop prices; the degree and

nature of the Company’s competition; the timing, price or amount of

repurchases, if any, under the Company's share repurchase program;

the ability to consummate acquisitions or dispositions under

contract; and the other factors described in the section entitled

“Risk Factors” in the Company’s Annual Report on Form 10-K for the

year ended December 31, 2023, and the Company’s other filings with

the Securities and Exchange Commission. Any forward-looking

information presented herein is made only as of the date of this

press release, and the Company does not undertake any obligation to

update or revise any forward-looking information to reflect changes

in assumptions, the occurrence of unanticipated events, or

otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240528567201/en/

Phillip Hayes phayes@farmlandpartners.com

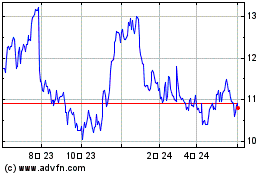

Farmland Partners (NYSE:FPI)

過去 株価チャート

から 11 2024 まで 12 2024

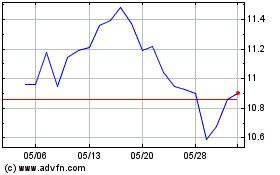

Farmland Partners (NYSE:FPI)

過去 株価チャート

から 12 2023 まで 12 2024