false

0001083743

0001083743

2024-05-31

2024-05-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): May 31, 2024

FLUX

POWER HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-31543 |

|

92-3550089 |

(State

or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

| 2685

S. Melrose Drive, Vista, California |

|

92081 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

877-505-3589

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| Common

Stock, $0.001 par value |

|

FLUX |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement

On

May 31, 2024, Fux Power Holdings, Inc. (the “Registrant”), Flux Power, Inc., a wholly-owned subsidiary of the Registrant

(“Flux” and together with the Registrant, the “Company”), entered into a certain Amendment No. 3 to Loan and

Security Agreement (the “Third Amendment”) with Gibraltar Business Capital, LLC (“GBC”), which amended certain

terms of the Loan and Security Agreement dated July 28, 2023, as amended, relating to the EBITDA Minimum financial covenant of the Company.

In

consideration for the Third Amendment, the Company agreed to pay GBC a non-refundable amendment fee of $50,000 in cash.

The

foregoing description of the Third Amendment does not purport to be a complete description of the terms and is qualified in its entirety

by reference to the full text of the Third Amendment, which is attached hereto as Exhibit 10.1 to this Current Report on Form 8-K and

incorporated by reference herein. On June 4, 2024, the Company intended to report and file the Third Amendment on Form 8-K with the

Securities and Exchange Commission (the “SEC”). The Company is now filing this Form 8-K upon notification that its Edgar

agent inadvertently missed filing such Form 8-K with the SEC.

Item

9.01 Financial Statements and Exhibits.

Exhibit

Index

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Flux

Power Holdings, Inc. |

| |

a

Nevada corporation |

| |

|

|

| |

By:

|

/s/

Ronald F. Dutt |

| |

|

Ronald

F. Dutt, |

| |

|

Chief

Executive Officer |

| |

|

|

| Dated:

August 14, 2024 |

|

|

Exhibit

10.1

AMENDMENT

NO. 3 TO LOAN AND SECURITY AGREEMENT

THIS

AMENDMENT NO. 3 TO LOAN AND SECURITY AGREEMENT (this “Amendment”), dated as of May 31, 2024, is by and among FLUX

POWER, INC., a California corporation (“Flux”), and FLUX POWER HOLDINGS, INC., a Nevada corporation (“Holdings”

and, together with Flux, individually and collectively, jointly and severally, the “Borrower”), and GIBRALTAR BUSINESS

CAPITAL, LLC, a Delaware limited liability company (the “Lender”).

W I T N E S S E T H:

WHEREAS,

Borrower and Lender have entered into certain financing arrangements, pursuant to which, among other things, Lender may make loans and

advances to Borrower, as set forth in that certain Loan and Security Agreement, dated as of July 28, 2023, by and among Borrower and

Lender (as amended, restated, supplemented or modified from time to time, the “Loan Agreement” and together with all

other agreements, documents and instruments referred to therein or at any time executed and/or delivered in connection therewith or related

thereto, as amended, restated, supplemented or modified from time to time, collectively, the “Loan Documents”); and

WHEREAS,

Borrower has requested that Lender agree to make certain modifications to the Loan Agreement, and Lender is willing to agree to make

such modifications, subject to the terms and conditions and to the extent set forth in this Amendment.

NOW,

THEREFORE, in consideration of the foregoing, and the respective agreements, warranties and covenants contained herein, the parties hereto

agree, covenant and warrant as follows:

1. Interpretation.

All capitalized terms used herein shall have the meanings assigned thereto in the Loan Agreement unless otherwise defined herein.

2. Amendment

to Loan Agreement. Effective as of the date hereof, Section 10.1 of the Loan Agreement is hereby amended and restated in its entirety

to read as follows:

“10.1 Minimum

EBITDA. At all times during a Financial Covenant Trigger Period, the Borrower shall have, on an aggregate basis, for each of the

applicable periods set forth below, EBITDA of no less than (or in the case of any negative numbers below, which are indicated inside

of parenthesis, worse than) the corresponding amount set forth below:

| Trailing three-month period ending April 30, 2024 | |

$ | (1,673,250 | ) |

| Trailing three-month period ending May 31, 2024 | |

$ | (1,673,250 | ) |

| Trailing three-month period ending June 30, 2024 | |

$ | (1,673,250 | ) |

| Trailing three-month period ending July 31, 2024 | |

$ | (730,250 | ) |

| Trailing three-month period ending August 31, 2024 | |

$ | (730,250 | ) |

| Trailing three-month period ending September 30, 2024 | |

$ | (730,250 | ) |

| Trailing three-month period ending October 31, 2024 | |

$ | (448,500 | ) |

| Trailing three-month period ending November 30, 2024 | |

$ | (448,500 | ) |

| Trailing three-month period ending December 31, 2024 | |

$ | (448,500 | ) |

| Trailing three-month period ending January 31, 2025 | |

$ | 153,000 | |

| Trailing three-month period ending February 28, 2025 | |

$ | 153,000 | |

| Trailing three-month period ending March 31, 2025 | |

$ | 153,000 | |

| Trailing three-month period ending April 30, 2025 | |

$ | 977,500 | |

| Trailing three-month period ending May 31, 2025 | |

$ | 977,500 | |

| Trailing three-month period ending June 30, 2025 | |

$ | 977,500 | |

| Trailing twelve-month period ending July 31, 2025 and ending on the last day of each month thereafter | |

$ | 1,441,600 | |

3. Amendment

Fee. In consideration of the amendments made hereunder, and for other good and valuable consideration, the receipt and sufficiency

of which is hereby acknowledged, concurrently with the execution of this Agreement, Borrower shall pay to Lender an amendment fee in

the amount of $50,000 (the “Amendment Fee”). The Amendment Fee is fully earned, due and payable on the date hereof

and shall not be subject to rebate, refund or proration for any reason whatsoever.

4. Conditions

to Effectiveness. The effectiveness of this Amendment is subject to satisfaction of the following conditions precedent:

4.1 Amendment.

Lender shall have received a counterpart of this Amendment duly executed by Borrower.

4.2 Amendment

Fee. Lender shall have received the Amendment Fee.

4.3 Representations

and Warranties. After giving effect to this Amendment, the representations and warranties of Borrower contained in the Loan Agreement,

this Amendment and the other Loan Documents shall be true and correct on and as of the date hereof (except for representations and warranties

that expressly relate to an earlier date in which case such representations and warranties shall be true and correct as of such earlier

date).

4.4 No

Defaults. After giving effect to this Amendment, no Default or Event of Default shall have occurred and be continuing.

5. Provisions

of General Application.

5.1 Effect

of this Amendment. Except as modified pursuant hereto, no other changes or modifications to the Loan Documents are intended or implied

and in all other respects the Loan Documents are hereby specifically ratified, restated and confirmed by all parties hereto as of the

effective date hereof. To the extent of conflict between the terms of this Amendment and the other Loan Documents, the terms of this

Amendment shall control.

5.2 Legal

Expenses. Borrower shall pay on demand all fees and expenses incurred by Borrower in connection with the preparation, negotiation

and execution of this Amendment and all related documents.

5.3 Further

Assurances. The parties hereto shall execute and deliver such additional documents and take such additional action as may be necessary

or desirable to effectuate the provisions and purposes of this Amendment.

5.4 Merger.

This Amendment and the documents executed in connection herewith represent the entire expression of the agreement of Borrower and Lender

regarding the matters set forth herein. No modification, rescission, waiver, release or Amendment of any provision under the Loan Documents

shall be made, except by a written agreement signed by Borrower and Lender.

5.5 Binding

Effect; No Third-Party Beneficiaries. This Amendment shall be binding upon and inure to the benefit of each of the parties hereto

and their respective successors and assigns. This Amendment is solely for the benefit of each of the parties hereto and their respective

successors and assigns, and no other person shall have any right, benefit, priority or interest under, or because of the existence of,

this Amendment.

5.6 Severability.

Any provision of this Amendment held by a court of competent jurisdiction to be invalid or unenforceable shall not impair or invalidate

the remainder of this Amendment and the effect thereof shall be confirmed to the provision so held to be invalid or unenforceable.

5.7 Governing

Law. The rights and obligations hereunder of each of the parties hereto shall be governed by and interpreted and determined in accordance

with the internal laws of the State of Illinois (without giving effect to principles of conflict of laws).

5.8 Counterparts.

This Amendment and any notices delivered under this Amendment, may be executed by means of (a) an electronic signature that complies

with the federal Electronic Signatures in Global and National Commerce Act, state enactments of the Uniform Electronic Transactions Act,

or any other relevant and applicable electronic signatures law; (b) an original manual signature; or (c) a faxed, scanned, or photocopied

manual signature. Each electronic signature or faxed, scanned, or photocopied manual signature shall for all purposes have the same validity,

legal effect, and admissibility in evidence as an original manual signature. Lender reserves the right, in its sole discretion, to accept,

deny, or condition acceptance of any electronic signature on this Amendment or on any notice delivered to Lender under this Amendment.

This Amendment and any notices delivered under this Amendment may be executed in any number of counterparts, each of which shall be deemed

to be an original, but such counterparts shall, together, constitute only one instrument. Delivery of an executed counterpart of a signature

page of this Amendment and any notices as set forth herein will be as effective as delivery of a manually executed counterpart of this

Amendment or notice.

[Signature

Page Follows]

IN

WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed and delivered by their authorized officers as of the

day and year first above written.

| BORROWER: |

FLUX

POWER, INC. |

| |

|

|

| |

By:

|

/s/

Ronald Dutt |

| |

Name:

|

Ronald

Dutt |

| |

Title:

|

Chief

Executive Officer/President |

| |

|

|

| |

FLUX

POWER HOLDINGS, INC. |

| |

|

|

| |

By:

|

/s/

Ronald Dutt |

| |

Name: |

Ronald

Dutt |

| |

Title:

|

Chief

Executive Officer/President |

| LENDER: |

GIBRALTAR

BUSINESS CAPITAL, LLC |

| |

|

|

| |

By:

|

/s/

Jean R. Elie Jr. |

| |

Name: |

Jean

R. Elie Jr. |

| |

Title:

|

Senior

Vice President |

[Signature

Page to Amendment No. 3 to Loan Agreement]

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

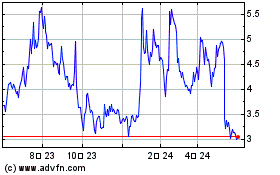

Flux Power (NASDAQ:FLUX)

過去 株価チャート

から 10 2024 まで 11 2024

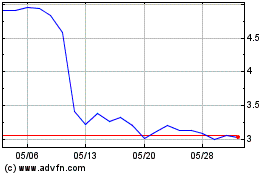

Flux Power (NASDAQ:FLUX)

過去 株価チャート

から 11 2023 まで 11 2024