0001610618false00016106182024-08-132024-08-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 13, 2024

Cidara Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-36912 | | 46-1537286 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (Commission File Number) | | (I.R.S. Employer

Identification Number) |

6310 Nancy Ridge Drive, Suite 101

San Diego, California 92121

(858) 752-6170

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, Par Value $0.0001 Per Share | | CDTX | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

In this report, “Cidara Therapeutics,” “Cidara,” “Company,” “we,” “us” and “our” refer to Cidara Therapeutics, Inc.

Item 2.02 Results of Operations and Financial Condition.

On August 13, 2024, we issued a press release reporting our financial results for the second quarter ended June 30, 2024. The full text of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

In accordance with General Instruction B-2 of Form 8-K, the information contained or incorporated herein, including the press release filed as Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, except as expressly set forth by specific reference in such filing to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | | |

| 99.1 | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | Cidara Therapeutics, Inc. |

| | | |

| Date: August 13, 2024 | | | /s/ Jeffrey Stein, Ph.D. |

| | | | Jeffrey Stein, Ph.D. |

| | | | President and Chief Executive Officer

(Principal Executive Officer) |

Cidara Therapeutics Provides Corporate Update and Reports Second Quarter 2024 Financial Results

SAN DIEGO, August 13, 2024 — Cidara Therapeutics, Inc. (Nasdaq: CDTX) (the Company), a biotechnology company using its proprietary Cloudbreak® platform to develop drug-Fc conjugate (DFC) immunotherapies designed to save lives and improve the standard of care for patients facing serious diseases, today reported financial results for the second quarter ended June 30, 2024, and provided an update on its corporate activities and product pipeline.

“We continue to focus on our Cloudbreak DFC platform with the advancement of CD388 and other programs,” said Jeffrey Stein, Ph.D., president and chief executive officer of Cidara. “Our Phase 2b study to evaluate the efficacy and safety of CD388, a long-acting drug candidate that provides season-long, universal protection from influenza, is on track to start in the fall of 2024 during the Northern Hemisphere influenza season with 4,000 subjects to be enrolled in the United States and 1,000 subjects to be enrolled in the United Kingdom. We believe that CD388 has important advantages over vaccines to provide long-term protection against both seasonal and pandemic strains of influenza with a single dose per flu season.”

Recent Corporate Highlights

•Reacquired exclusive global development and commercial rights to CD388: In April 2024, Cidara entered into a definitive agreement with J&J Innovative Medicine, previously Janssen Pharmaceuticals, Inc., one of the Janssen Pharmaceutical Companies of Johnson & Johnson (Janssen), to reacquire the exclusive global development and commercial rights to CD388, which is in development for the prevention of all strains of influenza A and B (Janssen License Agreement). Cidara is finalizing the protocol for a Phase 2b clinical trial, which the Company intends to initiate in the fall of 2024 during the Northern Hemisphere influenza season.

•Closed $240.0 million private placement: In April 2024 and in conjunction with the reacquisition of CD388, Cidara closed a definitive agreement for the sale of preferred stock in a $240.0 million private placement (Private Placement) led by RA Capital Management, with significant participation from Bain Capital Life Sciences, Biotech Value Fund and Canaan Partners. The proceeds from the Private Placement were used to fund the upfront payment of $85.0 million under the agreement with Janssen and the remainder of the gross proceeds of $155.0 million are expected to provide runway beyond topline data from CD388’s planned Phase 2b trial.

•Divested rezafungin to its former licensee, Mundipharma: In April 2024, Cidara entered into an asset purchase agreement with Napp Pharmaceutical Group Limited (Napp), a member of the international network of Mundipharma independent associated companies (Mundipharma), for the divestiture of rezafungin (Purchase Agreement). Cidara estimates that it will achieve approximately $128.0 million in cost savings over the patent life of rezafungin. On July 18, 2024, Cidara received a notice of satisfaction from Mundipharma that it had completed the required performance obligations under a transition services agreement and, accordingly, the $11.1 million development milestone advance previously made to Cidara, and reimbursable to Mundipharma, was forgiven by Mundipharma.

•IND Clearance for CBO421: Cidara received investigational new drug application (IND) clearance for CBO421 in July 2024.

Second Quarter 2024 Financial Results

•Revenue totaled $0.3 million and $1.3 million for the three and six months ended June 30, 2024, respectively, compared to $5.1 million and $11.3 million for the same periods in 2023, respectively. Revenue for the three and six months ended June 30, 2024 and 2023 related to research and development and clinical supply services provided to Janssen under the preexisting Janssen Collaboration Agreement. The Janssen Collaboration Agreement was terminated upon the effectiveness of the Janssen License Agreement on April 24, 2024.

•Cash and cash equivalents totaled $164.4 million as of June 30, 2024, compared with $35.8 million as of December 31, 2023.

•Acquired in-process research and development expenses were $84.9 million for the three and six months ended June 30, 2024 and related to an upfront payment of $85.0 million paid to Janssen under the Janssen License Agreement, on April 24, 2024, plus $0.4 million in direct transaction costs, offset by a settlement gain of $0.5 million to settle the preexisting Janssen Collaboration Agreement relationship.

•Research and development expenses were $6.7 million and $12.6 million for the three and six months ended June 30, 2024, respectively, compared to $8.7 million and $18.4 million for the same periods in 2023, respectively. The decrease in research and development expenses for the three and six months ended June 30, 2024, compared to the three and six months ended June 30, 2023 is primarily due to lower nonclinical expenses associated with our Cloudbreak platform, offset by higher personnel costs supporting our Cloudbreak platform.

•Selling, general and administrative (SG&A) expenses were $4.7 million and $8.3 million for the three and six months ended June 30, 2024, respectively, compared to $3.2 million and $6.8 million for the same period in 2023, respectively. The SG&A expenses for all periods primarily relate to consulting, personnel and legal costs.

•On April 24, 2024, Cidara entered into the Purchase Agreement with Napp, pursuant to which we sold to Napp all of its rezafungin assets and related contracts. We completed all conditions of the sale on April 24, 2024. We determined that the sale of rezafungin represented a strategic shift that will have a major effect on our operations and financial results. Accordingly, the sale of rezafungin is classified as discontinued operations. Net income from discontinued operations for the three months ended June 30, 2024, was $3.0 million and net income from discontinued operations for the six months ended June 30, 2024 was $0.9 million, compared to net loss from discontinued operations of $7.5 million and net income from discontinued operations of $2.5 million for the same periods in 2023, respectively.

•Net loss for the three and six months ended June 30, 2024 was $91.2 million and $101.5 million, respectively, compared to a net loss of $13.6 million and $10.6 million for the same periods in 2023, respectively.

•During the three and six months ended June 30, 2024, Cidara did not sell shares of common stock pursuant to its at-the-market sales agreement.

•As of June 30, 2024, Cidara had 4,568,991 shares of common stock outstanding, 240,000 shares of Series A Convertible Voting Preferred Stock outstanding, which are convertible into 16,800,000 shares of common stock, and 2,104,472 shares of Series X Convertible Preferred Stock outstanding, which are convertible into 1,052,236 shares of common stock.

•On July 18, 2024, the Company’s stockholders approved the issuance of up to 16,800,000 shares of common stock upon conversion of 240,000 shares of Series A Convertible Voting Preferred Stock issued in the Private Placement completed in April 2024. On July 19, 2024, the Company issued 2,469,250 shares of common stock upon automatic conversion of 35,275 shares of Series A Convertible Voting Preferred Stock. Cidara had 7,038,241 shares of common stock issued and outstanding immediately following this automatic conversion.

About Cidara Therapeutics

Cidara Therapeutics is using its proprietary Cloudbreak® platform to develop novel drug-Fc conjugates (DFCs). These targeted immunotherapies offer the unique opportunity to create “single molecule cocktails” comprised of targeted small molecules and peptides coupled to a human antibody fragment (Fc). DFCs are designed to save lives and improve the standard of care for patients facing cancers and other serious diseases by inhibiting specific disease targets while simultaneously engaging the immune system. Cidara is headquartered in San Diego, California. For more information, please visit www.cidara.com.

Forward-Looking Statements

This release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. “Forward-looking statements” describe future expectations, plans, results, or strategies and are generally preceded by words such as “anticipates,” “expect,” “intends,” “may,” “plan” or “will”. Forward-looking statements in this release include, but are not limited to, statements related to whether we will start a Phase 2b clinical trial for CD388 in the fall of 2024, whether and when we may initiate a clinical trial for CBO421 following IND clearance, and whether CD388 or CBO421 will ultimately be approved for commercial sale by regulators in the U.S. or any country or will generate any revenue. Such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, such as unanticipated delays in or negative results from Cidara’s preclinical or clinical trials, delays in action by regulatory authorities, and other obstacles on the enrollment of patients or other aspects of CD388, or other DFC development. These and other risks are identified under the caption “Risk Factors” in Cidara’s most recent Quarterly Report on Form 10-Q and other filings subsequently made with the SEC. All forward-looking statements contained in this press release speak only as of the date on which they were made and are based on management’s assumptions and estimates as of such date. Cidara does not undertake any obligation to publicly update any forward-looking statements, whether as a result of the receipt of new information, the occurrence of future events or otherwise.

INVESTOR CONTACT:

Brian Ritchie

LifeSci Advisors

(212) 915-2578

britchie@lifesciadvisors.com

MEDIA CONTACT:

Veronica Eames

LifeSci Communications

(646) 970-4682

veames@lifescicomms.com

CIDARA THERAPEUTICS, INC.

Condensed Consolidated Statements of Operations (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

(In thousands, except share and per share data) | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues: | | | | | | | |

| Collaboration revenue | $ | 302 | | | $ | 5,090 | | | $ | 1,275 | | | $ | 11,310 | |

| | | | | | | |

| Total revenues | 302 | | | 5,090 | | | 1,275 | | | 11,310 | |

| Operating expenses: | | | | | | | |

| | | | | | | |

| Acquired in-process research and development | 84,883 | | | — | | | 84,883 | | | — | |

| Research and development | 6,657 | | | 8,657 | | | 12,576 | | | 18,367 | |

| Selling, general and administrative | 4,746 | | | 3,181 | | | 8,342 | | | 6,834 | |

| Total operating expenses | 96,286 | | | 11,838 | | | 105,801 | | | 25,201 | |

| Loss from operations | (95,984) | | | (6,748) | | | (104,526) | | | (13,891) | |

| Other income, net: | | | | | | | |

| | | | | | | |

| Interest income, net | 1,774 | | | 623 | | | 2,139 | | | 855 | |

| Total other income, net | 1,774 | | | 623 | | | 2,139 | | | 855 | |

| Net loss from continuing operations before income tax expense | (94,210) | | | (6,125) | | | (102,387) | | | (13,036) | |

| Income tax expense | — | | | (40) | | | — | | | (40) | |

| Net loss from continuing operations | (94,210) | | | (6,165) | | | (102,387) | | | (13,076) | |

Income (loss) from discontinued operations (including loss on disposal of discontinued operations of $1,799 during the three and six months ended June 30, 2024), net of income taxes | 3,001 | | | (7,459) | | | 852 | | | 2,465 | |

| Net loss and comprehensive loss | $ | (91,209) | | | $ | (13,624) | | | $ | (101,535) | | | $ | (10,611) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Basic and diluted net loss per common share from continuing operations | $ | (20.65) | | | $ | (1.37) | | | $ | (22.50) | | | $ | (3.10) | |

| Basic and diluted net earnings (loss) per common share from discontinued operations | 0.66 | | | (1.65) | | | 0.19 | | | 0.59 | |

| Basic and diluted net loss per common share | $ | (19.99) | | | $ | (3.02) | | | $ | (22.31) | | | $ | (2.51) | |

| | | | | | | |

| Shares used to compute basic and diluted net earnings (loss) per common share | 4,563,772 | | | 4,505,813 | | | 4,550,774 | | | 4,220,511 | |

Condensed Consolidated Balance Sheet Data

| | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

| (In thousands) | (unaudited) | | |

| Cash and cash equivalents | $ | 164,369 | | | $ | 35,778 | |

| Total assets | 173,357 | | | 67,030 | |

| Total liabilities | 42,421 | | | 75,240 | |

| Total stockholders’ equity (deficit) | 130,936 | | | (8,210) | |

Cover Page

|

Aug. 13, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 13, 2024

|

| Entity Registrant Name |

Cidara Therapeutics, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-36912

|

| Entity Tax Identification Number |

46-1537286

|

| Entity Address, Address Line One |

6310 Nancy Ridge Drive,

|

| Entity Address, Address Line Two |

Suite 101

|

| Entity Address, City or Town |

San Diego,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92121

|

| City Area Code |

858

|

| Local Phone Number |

752-6170

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, Par Value $0.0001 Per Share

|

| Trading Symbol |

CDTX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001610618

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

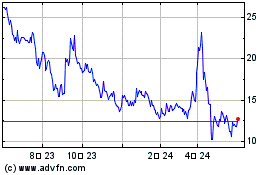

Cidara Therapeutics (NASDAQ:CDTX)

過去 株価チャート

から 10 2024 まで 11 2024

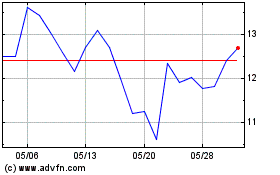

Cidara Therapeutics (NASDAQ:CDTX)

過去 株価チャート

から 11 2023 まで 11 2024