Is Bitcoin Ready to Soar? Key Indicators Signal Potential $72K Target

2024年8月23日 - 7:00AM

NEWSBTC

Bitcoin is seeing an uptick following its recent reclaim above the

$60,000 mark in the past day. Amid this price performance, renowned

crypto analyst Mags on Elon Musk’s social media platform

X shared his latest asset analysis. According to Mags,

Bitcoin could be poised for a major rally, driven by factors

related to the USDT dominance (USDT.D) and the forming

technical chart patterns. Related Reading: September 10: A

Bitcoin Game Changer, Says Hedge Fund Founder Bitcoin On The Verge

Of A $72,000 Rally? Mags explained that the inverse correlation

between USDT dominance and Bitcoin’s price is a key indicator to

watch. USDT dominance refers to the market share of Tether (USDT)

in the overall cryptocurrency market, and its movements can often

signal shifts in Bitcoin’s price. Mags pointed out that USDT.D

recently broke down from a strong trendline support and is

currently testing the point of breakdown, which could lead to

forming a bear channel. Meanwhile, Bitcoin forms a broadening wedge

pattern, typically seen as a bullish continuation signal. If USDT.D

continues to decline, Mags anticipates that Bitcoin could see a

notable “leg up,” potentially pushing the price to $72,000 or

higher. #Bitcoin pump incoming ? If you’ve been paying attention to

USDT.D, you already know about the inverse correlation between

USDT.D and BTC. Looking at the chart, USDT.D broke down a strong

trendline support and is currently testing the point of breakdown

with a possible… pic.twitter.com/lqZ6SPCgaQ — Mags

(@thescalpingpro) August 22, 2024 Volatility on the Rise: A

Catalyst for BTC’s Next Move? In addition to the technical

indicators, another factor contributing to the growing anticipation

of a Bitcoin price surge is the recent increase in market

volatility. Bitcoin’s volatility has surpassed levels not seen in

the past months and has continued to rise, which could be a

potential catalyst for Bitcoin to see a significant break out

towards the upside. Crypto analyst Daan Crypto

Trades highlighted this development in a recent X post, noting

that after a period of low volatility, Bitcoin’s volatility levels

are ramping back up, approaching the levels seen earlier this

year during the asset’s all-time highs. Related Reading: Bitcoin’s

MVRV Ratio Nears Critical Death Cross: Will The Market See A

Bearish Shift? Daan Crypto Trades emphasized that this volatility

increase is needed to end Bitcoin’s consolidation, potentially

leading to a decisive price movement in one direction or the other.

#Bitcoin After a big slump in volatility levels, it’s now ramping

back up and getting close to levels we saw earlier this year at the

all time highs. It’s what’s eventually needed to put an end to this

massive consolidation in one way or another

pic.twitter.com/CHoZXHk5K4 — Daan Crypto Trades (@DaanCrypto)

August 21, 2024 Featured image created with DALL-E, Chart from

TradingView

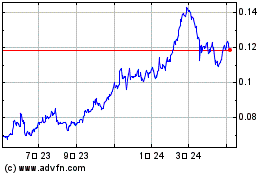

TRON (COIN:TRXUSD)

過去 株価チャート

から 7 2024 まで 8 2024

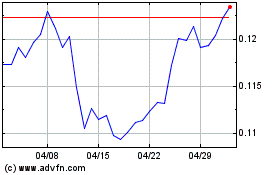

TRON (COIN:TRXUSD)

過去 株価チャート

から 8 2023 まで 8 2024