11 June 2024, 08:00 CET

ArcelorMittal (‘the Company’ or ‘the Issuer’) priced yesterday

an offering of US$500 million aggregate principal amount of 6.00%

notes due 17 June 2034 and US$500 million aggregate principal

amount of 6.35% notes due 17 June 2054 (the ‘Notes’).

The net proceeds to ArcelorMittal (before expenses), amounting

to approximately $989,290,000, will be used for general corporate

purposes.

The offering is scheduled to close on 17 June 2024, subject to

satisfaction of customary conditions.

The Issuer has filed a registration statement (including

a prospectus) with the SEC for the offering to which this

communication relates. Before you invest, you should read the

prospectus in that registration statement and other documents the

Issuer has filed with the SEC for more complete information about

the Issuer and this offering. You may get these documents for free

by visiting EDGAR on the SEC Web site at www.sec.gov.

Alternatively, the Issuer, any underwriter or any dealer

participating in the offering will arrange to send you the

prospectus if you request it by contacting J.P. Morgan Securities

LLC by calling collect at 1-212-834-4533; BofA Securities, Inc. by

calling 1-800-294-1322; Citigroup Global Markets Inc. by calling

toll-free: 1-800-831-9146; Goldman Sachs & Co. LLC by calling

toll-free: 1-866-471-2526; RBC Capital Markets, LLC. by calling

toll-free: 1-866-375-6829; or SMBC Nikko Securities America, Inc.

by calling toll free: 1-888-868-6856.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy any securities, nor will there be

any sale of securities in any state or jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such state or

jurisdiction.

This press release may contain forward-looking information and

statements about ArcelorMittal and its subsidiaries. These

statements include financial projections and estimates and their

underlying assumptions, statements regarding plans, objectives and

expectations with respect to future operations, products and

services, and statements regarding future performance.

Forward-looking statements may be identified by the words

"believe," "expect," "anticipate," "target" or similar expressions.

Although ArcelorMittal's management believes that the expectations

reflected in such forward-looking statements are reasonable,

investors and holders of ArcelorMittal's securities are cautioned

that forward-looking information and statements are subject to

numerous risks and uncertainties, many of which are difficult to

predict and generally beyond the control of ArcelorMittal, that

could cause actual results and developments to differ materially

and adversely from those expressed in, or implied or projected by,

the forward-looking information and statements. These risks and

uncertainties include those discussed or identified in the filings

with the Luxembourg Stock Market Authority for the Financial

Markets (Commission de Surveillance du Secteur Financier) and the

United States Securities and Exchange Commission (the "SEC") made

or to be made by ArcelorMittal, including ArcelorMittal's Annual

Report on Form 20-F for the year ended December 31, 2023 filed on

February 28, 2024, and ArcelorMittal’s first quarter earnings

release furnished to the SEC on Form 6-K on May 28, 2024 filed with

the SEC. ArcelorMittal undertakes no obligation to publicly update

its forward-looking statements, whether as a result of new

information, future events, or otherwise.

No communication and no information in respect of the offering

of securities may be distributed to the public in any jurisdiction

where a registration or approval is required. The offering or

subscription of securities may be subject to specific legal or

regulatory restrictions in certain jurisdictions. ArcelorMittal

takes no responsibility for any violation of any such restrictions

by any person.

This press release is an advertisement and does not comprise a

prospectus for the purposes of Regulation (EU) 2017/1129, amended

(the “Prospectus Regulation”), or the Prospectus Regulation as it

forms part of domestic law in the United Kingdom by virtue of the

European Union (Withdrawal) Act 2020, as amended. This press

release does not constitute or form part of, and should not be

construed as, an offer to sell, or the solicitation or invitation

of any offer to buy or subscribe for, any securities in any

jurisdiction or an inducement to enter into investment activity. No

part of this press release, nor the fact of its distribution,

should form the basis of, or be relied on in connection with, any

contract or commitment or investment decision whatsoever. Any

purchase of any securities should be made solely on the basis of

the offering memorandum prepared in connection with the issuance of

securities by ArcelorMittal, which will contain the definitive

terms of the securities transactions described herein.

This press release is only addressed to and directed at persons

in member states of the European Economic Area who are not Retail

Investors and should not be acted upon or relied upon in any member

state of the European Economic Area by persons who are Retail

Investors. For these purposes, (a) a Retail Investor means a person

who is one (or more) of: (i) a retail client as defined in point

(11) of Article 4(1) of Directive 2014/65/EU (as amended, "EU MiFID

II"); or (ii) a customer within the meaning of Directive (EU)

2016/97 (as amended), where that customer would not qualify as a

professional client as defined in point (10) of Article 4(1) of EU

MiFID II; or (iii) not a qualified investor (as defined in the

Prospectus Regulation ; and (b) the expression an “offer” includes

the communication in any form and by any means of sufficient

information on the terms of the offer and the Notes to be offered

so as to enable an investor to decide to purchase or subscribe for

the Notes. This press release is only addressed to and directed at

persons in the United Kingdom who are not Retail Investors and

should not be acted upon or relied upon the United Kingdom by

persons who are Retail Investors. For these purposes, (a) a Retail

Investor means a person who is one (or more) of: (i) a retail

client, as defined in point (8) of Article 2 of Regulation (EU) No

2017/565 as it forms part of domestic law by virtue of the European

Union (Withdrawal) Act 2018 (the "EUWA"); or (ii) a customer within

the meaning of the provisions of the Financial Services and Markets

Act 2000 (as amended, “FSMA”) and any rules or regulations made

under the FSMA to implement Directive (EU) 2016/97, where that

customer would not qualify as a professional client, as defined in

point (8) of Article 2(1) of Regulation (EU) No 600/2014 as it

forms part of domestic law by virtue of the EUWA; or (iii) not a

qualified investor, as defined in Article 2 of the Prospectus

Regulation as it forms part of domestic law by virtue of the EUWA;

and (b) the expression an “offer” includes the communication in any

form and by any means of sufficient information on the terms of the

offer and the Notes to be offered so as to enable an investor to

decide to purchase or subscribe for the Notes.

This press release is directed only at persons in the United

Kingdom having professional experience in matters relating to

investments who fall within the definition of “investment

professionals” in Article 19(5) of the Financial Services and

Markets Act 2000 (Financial Promotion) Order 2005 and to those

persons to whom it can otherwise lawfully be distributed.

No PRIIPs key information document (KID) has been prepared as

not available to retail investors in EEA or the UK.

ENDS

About ArcelorMittal

ArcelorMittal is one of the world’s leading integrated steel and

mining companies with a presence in 60 countries and primary

steelmaking operations in 15 countries. It is the largest steel

producer in Europe, among the largest in the Americas, and has a

growing presence in Asia through its joint venture AM/NS India.

ArcelorMittal sells its products to a diverse range of customers

including the automotive, engineering, construction and machinery

industries, and in 2023 generated revenues of $68.3 billion,

produced 58.1 million metric tonnes of crude steel and 42.0 million

tonnes of iron ore.

Our purpose is to produce smarter steels for people and planet.

Steels made using innovative processes which use less energy, emit

significantly less carbon and reduce costs. Steels that are

cleaner, stronger and reusable. Steels for the renewable energy

infrastructure that will support societies as they transform

through this century. With steel at our core, our inventive people

and an entrepreneurial culture at heart, we will support the world

in making that change.

ArcelorMittal is listed on the stock exchanges of New York (MT),

Amsterdam (MT), Paris (MT), Luxembourg (MT) and on the Spanish

stock exchanges of Barcelona, Bilbao, Madrid and Valencia

(MTS).

http://corporate.arcelormittal.com/

| |

|

| Contact

information ArcelorMittal Investor Relations |

|

| |

|

| General |

+44 20 7543

1128 |

| Retail |

+44 20 3214

2893 |

| SRI |

+44 20 3214

2801 |

|

Bonds/CreditE-mail |

+33 171 921

026investor.relations@arcelormittal.com |

|

|

|

|

|

|

| Contact

information ArcelorMittal Corporate Communications |

|

| Paul

WeighTel:E-mail: |

+44 20

3214 2419press@arcelormittal.com |

|

|

|

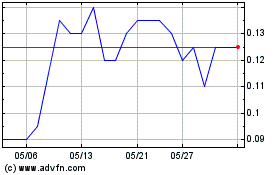

Metallis Resources (TSXV:MTS)

過去 株価チャート

から 10 2024 まで 11 2024

Metallis Resources (TSXV:MTS)

過去 株価チャート

から 11 2023 まで 11 2024