Alaska Energy Metals Corporation (TSX-V: AEMC, OTCQB: AKEMF)

(“

AEMC” or “

Alaska Energy Metals”

or the “

Company”) announces that it is canceling

the non-brokered offering of up to $5 million in a combination of

special warrants (the “

Special Warrants”) and/or

units (the “

Units”), to be issued at the price of

$0.17 per Special Warrant or Unit, as applicable, announced on

August 9, 2024. Due to market prices, the Company will now

undertake a non-brokered offering of Special Warrants and/or Units

at the price of $0.15 per Special Warrant or Unit, as applicable,

for aggregate gross proceed of up to $5 million (the

“

Offering”).

Each Special Warrant will automatically convert

into one Unit of the Company, as described below. Each Unit shall

consist of one common share of the Company (a

“Share”) and one common share purchase warrant (a

“Warrant”). Each Warrant shall entitle the holder

thereof to acquire one Share at a price of $0.20 per Share for a

period of three years following the date of issue.

Each Special Warrant will automatically convert,

for no additional consideration, into Units on the date that is the

earlier of (i) the date that is three business days following the

date on which the Company files a prospectus supplement to a short

form base shelf prospectus with the applicable securities

regulatory authorities qualifying distribution of the Units

underlying the Special Warrants (the “Prospectus

Supplement”), and (ii) the date that is four months and

one day after the closing of the Offering.

The Company will use its commercially reasonable

efforts to file the Prospectus Supplement within 60 days of the

closing of the Offering (not including the date of closing),

provided, however, that there is no assurance that a Prospectus

Supplement will be filed with the securities commissions, prior to

the expiry of the statutory four-month hold period.

The Company will pay cash finder’s fees of 7% of

the gross proceeds to certain finders. As additional compensation

the Company will issue that number of non-transferable broker

warrants (each a “Broker Warrant”) as is equal to

7% of the Special Warrants or Units issued. Each Broker Warrant

will be exercisable for one Share at the exercise price of $0.20

for a period of three years.

The Company anticipates closing the Offering

prior to August 31, 2024 (the “Closing Date”) and

completion of the Offering is subject to certain conditions

including, but not limited to the receipt of all necessary

approvals, including the approval of the TSX Venture Exchange (the

“TSXV”).

Prior to the filing of the Prospectus Supplement

and the automatic conversion of the Special Warrants, the

securities issued under the Offering will be subject to a

four-month hold period from the Closing Date in addition to any

other restrictions under applicable law. Any Units issued directly

upon the closing of the Offering will be subject to a four-month

hold period, in accordance with applicable securities laws.

The net proceeds from the Offering will be used

for Canwell prospect and Eureka deposit drilling at the Nikolai

Nickel Project in Alaska, metallurgical studies, non-flow-through

costs associated with the Company’s Angliers-Belleterre nickel

project in Quebec, working capital and marketing purposes.

It is anticipated that insiders of the Company

may participate in the Offering, and such Special Warrants and/or

Units issued to insiders may be subject to a four-month hold period

pursuant to applicable policies of the TSXV. The issuance of

Special Warrants and/or Units to insiders will be considered a

"related party transaction" within the meaning of Multilateral

Instrument 61-101 – Protection of Minority Security Holders in

Special Transactions ("MI 61-101"). The Company is

relying on exemptions from the formal valuation requirements of MI

61-101 pursuant to section 5.5(a) and the minority shareholder

approval requirements of MI 61-101 pursuant to section 5.7(1)(a) in

respect of such insider participation as the fair market value of

the transaction, insofar as it involves interested parties, does

not exceed 25% of the Company's market capitalization.

For additional information,

visit: https://alaskaenergymetals.com/

About Alaska Energy

MetalsAlaska Energy Metals Corporation is an Alaska-based

corporation with offices in Anchorage and Vancouver working to

sustainably deliver the critical materials needed for national

security and a bright energy future, while generating superior

returns for shareholders.

AEMC is focused on delineating and developing

the large-scale, bulk tonnage, polymetallic Eureka deposit

containing nickel, copper, cobalt, chromium, iron, platinum,

palladium, and gold. Located in Interior Alaska near existing

transportation and power infrastructure, its flagship project,

Nikolai, is well-situated to become a significant domestic source

of strategic energy-related metals for North America. AEMC also

holds a secondary project, ‘Angliers-Belleterre,’ in western

Quebec. Today, material sourcing demands excellence in

environmental performance, carbon mitigation, and the responsible

management of human and financial capital. AEMC works every day to

earn and maintain the respect and confidence of the public and

believes that ESG performance is measured by action and led from

the top.

ON BEHALF OF THE BOARD“Gregory Beischer”Gregory

Beischer, President & CEO

FOR FURTHER INFORMATION, PLEASE CONTACT:Sarah

Mawji, Public RelationsVenture

StrategiesEmail: sarah@venturestrategies.com

Forward-Looking StatementsSome

statements in this news release may contain forward-looking

information (within the meaning of Canadian securities

legislation), including, without limitation, the closing of the

Offering, receipt of approval for the offering including the

approval of the TSXV, the statements as to the filing of the

Prospectus Supplement, the use of proceeds, to drill exploratory

drill holes at the Canwell prospects and Eureka deposit, and to

perform metallurgical studies. These statements address future

events and conditions and, as such, involve known and unknown

risks, uncertainties, and other factors which may cause the actual

results, performance, or achievements to be materially different

from any future results, performance, or achievements expressed or

implied by the statements. Forward-looking statements speak only as

of the date those statements are made. Although the Company

believes the expectations expressed in such forward-looking

statements are based on reasonable assumptions, such statements are

not guaranteeing of future performance and actual results may

differ materially from those in the forward-looking statements.

Factors that could cause the actual results to differ materially

from those in forward-looking statements include regulatory

actions, market prices, and continued availability of capital and

financing, and general economic, market or business conditions.

Investors are cautioned that any such statements are not guarantees

of future performance and actual results or developments may differ

materially from those projected in the forward-looking statements.

Forward-looking statements are based on the beliefs, estimates and

opinions of the Company's management on the date the statements are

made. Except as required by applicable law, the Company assumes no

obligation to update or to publicly announce the results of any

change to any forward-looking statement contained or incorporated

by reference herein to reflect actual results, future events or

developments, changes in assumptions, or changes in other factors

affecting the forward-looking statements. If the Company updates

any forward-looking statement(s), no inference should be drawn that

it will make additional updates with respect to those or other

forward-looking statements.

This news release does not constitute an offer

for sale, or a solicitation of an offer to buy, in the United

States or to any “U.S Person” (as such term is defined in

Regulation S under the U.S. Securities Act of 1933, as amended (the

“1933 Act”)) of any equity or other securities of

the Company. The securities of the Company have not been, and will

not be, registered under the 1933 Act or under any state securities

laws and may not be offered or sold in the United States or to a

U.S. Person absent registration under the 1933 Act and applicable

state securities laws or an applicable exemption therefrom.

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

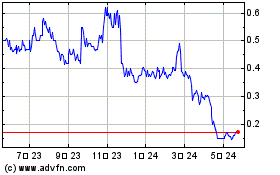

Alaska Energy Metals (TSXV:AEMC)

過去 株価チャート

から 12 2024 まで 1 2025

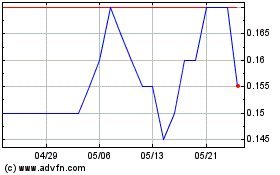

Alaska Energy Metals (TSXV:AEMC)

過去 株価チャート

から 1 2024 まで 1 2025