Tree Island Steel Announces Second Quarter 2024 Results

2024年8月2日 - 5:30AM

Tree Island Steel (''Tree Island'' or the ''Company'') (TSX: TSL)

announced today its financial results for the three months ended

June 30, 2024.

For the three-month period ended June 30, 2024,

revenues, net of freight and distribution costs, decreased by $9.6

million to $54.0 million, compared to $63.6 million in 2023. Gross

profit for the quarter decreased to $4.6 million, from $9.1 million

in the same period in 2023. Adjusted EBITDA amounted to $2.9

million, compared to $6.8 million during the same period in 2023.

The largest drivers for the decreased earnings are the lower

average selling prices and reduced spread over raw material costs.

To a lesser extent, the shutdown of Etiwanda facility last year

also impacted the volumes and revenue.

For the six months ended June 30, 2024,

revenues, net of freight and distribution costs, decreased by $28.4

million to $110.5 million compared to $138.9 million in 2023 and

gross profit decreased to $9.4 million from $20.9 million. The

decrease is for the same factors as in the quarter. This resulted

in an Adjusted EBITDA of $6.0 million, compared to $16.6 million

during the same period in 2023.

“The first half of the year was challenged with

customers conservatively managing their inventories and selling

prices trending lower, resulting in further compression in our

gross profit margins. We expect these headwinds to continue into

the second half of the year. The Company is continuing to address

operational challenges that have the potential to impact its future

operating results and cashflows, including the ongoing trade cases

in Canada and the US and increasing environmental and regulatory

compliance requirements. As noted last quarter, these market

conditions require careful management to maintain the Company’s

operating results,” commented Nancy Davies, Chief Operating Officer

of Tree Island Steel.

|

RESULTS FROM OPERATIONS |

|

|

Three Months Ended |

|

Six Months Ended |

|

($'000 unless otherwise stated) |

June 30, |

|

June 30, |

|

|

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

|

Revenue |

57,718 |

|

67,263 |

|

|

118,308 |

|

147,011 |

|

|

Freight and distribution costs |

(3,732 |

) |

(3,672 |

) |

|

(7,769 |

) |

(8,150 |

) |

|

Subtotal |

53,986 |

|

63,591 |

|

|

110,539 |

|

138,861 |

|

|

Cost of sales |

(48,013 |

) |

(53,304 |

) |

|

(98,421 |

) |

(115,461 |

) |

|

Depreciation |

(1,365 |

) |

(1,205 |

) |

|

(2,682 |

) |

(2,534 |

) |

|

Gross profit |

4,608 |

|

9,082 |

|

|

9,436 |

|

20,866 |

|

|

Selling, general and administrative expenses |

(3,288 |

) |

(3,352 |

) |

|

(6,679 |

) |

(6,836 |

) |

|

Operating income |

1,320 |

|

5,730 |

|

|

2,757 |

|

14,030 |

|

|

Foreign exchange gain (loss) |

202 |

|

(125 |

) |

|

584 |

|

18 |

|

|

Loss on disposition of property, plant and equipment disposal |

‐ |

|

(31 |

) |

|

‐ |

|

(97 |

) |

|

Site closure costs |

‐ |

|

(1,040 |

) |

|

‐ |

|

(1,340 |

) |

|

Reorganization costs |

(11 |

) |

(2097 |

) |

|

(11 |

) |

(2,097 |

) |

|

Interest Income |

128 |

|

253 |

|

|

335 |

|

390 |

|

|

Financing Expenses |

(568 |

) |

(371 |

) |

|

(1,128 |

) |

(807 |

) |

|

Income before income taxes |

1,071 |

|

2,319 |

|

|

2,537 |

|

10,097 |

|

|

Income tax expense |

(461 |

) |

(668 |

) |

|

(1,301 |

) |

(2,596 |

) |

|

Net income |

610 |

|

1,651 |

|

|

1,236 |

|

7,501 |

|

|

Net income per share |

0.02 |

|

0.06 |

|

|

0.05 |

|

0.27 |

|

|

Dividends per share |

0.03 |

|

0.05 |

|

|

0.06 |

|

0.10 |

|

|

|

|

|

|

|

|

|

|

|

June 30, |

|

|

|

|

December 31, |

|

|

Financial position as at: |

|

2024 |

|

|

|

2023 |

|

|

Total assets |

|

173,583 |

|

|

|

174,260 |

|

|

Total non‐current financial liabilities |

|

30,312 |

|

|

|

28,439 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|

($'000 unless otherwise stated) |

June 30, |

|

June 30, |

|

|

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

|

Operating income 5,730 |

1,320 |

|

5,730 |

|

|

2,757 |

|

14,030 |

|

|

Add back depreciation |

1,365 |

|

1,205 |

|

|

2,682 |

|

2,534 |

|

|

Foreign exchange (loss) gain |

202 |

|

(125 |

) |

|

584 |

|

18 |

|

|

Adjusted EBITDA1 |

2,887 |

|

6,810 |

|

|

6,023 |

|

16,582 |

|

|

|

|

|

|

|

|

1 See definition on Adjusted EBITDA in Section 2 NON‐IFRS

MEASURES of the June 30, 2024, MD&A.

About Tree Island Steel

Tree Island Steel, headquartered in Richmond,

British Columbia since 1964, through its operating facilities in

Canada and the United States, produces wire products for a diverse

range of industrial, residential construction, commercial

construction and agricultural applications. Its products include

galvanized wire, bright wire; a broad array of fasteners, including

packaged, collated and bulk nails; stucco reinforcing products;

concrete reinforcing mesh; fencing and other fabricated wire

products. The Company markets these products under the Tree

Island®, Halsteel®, K-Lath®, TI Wire®, ToughStrand® and ToughPanel®

brand names.

Forward-Looking Statements

This press release includes forward-looking

information with respect to Tree Island including its business,

operations and strategies, its dividend policy and the declaration

and payment of dividends thereunder as well as financial

performance and conditions. The use of forward-looking words such

as, "may," "will," "expect" or similar variations generally

identify such statements. Any statements that are contained herein

that are not statements of historical fact may be deemed to be

forward-looking statements. Although management believes that

expectations reflected in forward-looking statements are

reasonable, such statements involve risks and uncertainties

including risks and uncertainties discussed under the heading “Risk

Factors” in Tree Island’s most recent annual information form and

management discussion and analysis.

The forward-looking statements contained herein

reflect management’s current beliefs and are based upon certain

assumptions that management believes to be reasonable based on the

information currently available to management. By their very

nature, forward-looking statements involve inherent risks and

uncertainties, both general and specific, and a number of factors

could cause actual events or results to differ materially from the

results discussed in the forward-looking statements. In evaluating

these forward-looking statements, prospective investors should

specifically consider various factors including the risks outlined

herein under the heading “Risk Factors” which may cause actual

results to differ materially from any forward-looking statement.

Such risks and uncertainties include, but are not limited to:

general economic, market and business conditions, public health

epidemics, the economy and potentially its supply chain, the

cyclical nature of our business and demand for our products, impact

of any tax reassessments or appeals therefrom, financial condition

of our customers, competition, deterioration in Tree Island Steel’s

liquidity, leverage, and restrictive covenants, disruption in the

supply of raw materials, volatility in the costs of raw materials,

dependence on the construction industry, transportation costs and

availability, foreign exchange fluctuations, labour relations,

trade actions, dependence on key personnel and skilled workers,

reliance on key customers, environmental matters, intellectual

property risks, energy costs, un-insured loss, credit risk,

operating risk, management of growth, success of acquisition and

integration strategies, and other risks and uncertainties set forth

in our publicly filed materials.

This press release has been reviewed by the

Company's Board of Directors and its Audit Committee and contains

information that is current as of the date of this press release,

unless otherwise noted. Events occurring after that date could

render the information contained herein inaccurate or misleading in

a material respect. Readers are cautioned not to place undue

reliance on this forward-looking information and management of the

Company undertakes no obligation to update publicly or revise any

forward-looking information, whether as a result of new

information, future events or otherwise except as required by

applicable securities laws.

For further information contact:Ali Mahdavi,

Investor RelationsTree Island Steel(416) 962-3300e-mail:

amahdavi@treeisland.comWebsite: www.treeisland.com

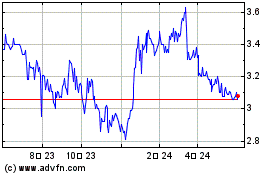

Tree Island Steel (TSX:TSL)

過去 株価チャート

から 12 2024 まで 1 2025

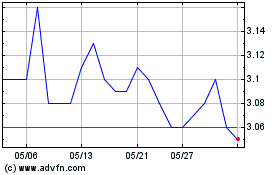

Tree Island Steel (TSX:TSL)

過去 株価チャート

から 1 2024 まで 1 2025