0001564708false00015647082024-11-072024-11-070001564708us-gaap:CommonClassAMember2024-11-072024-11-070001564708us-gaap:CommonClassBMember2024-11-072024-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 7, 2024

NEWS CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | | |

| Delaware | | 001-35769 | | 46-2950970 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

1211 Avenue of the Americas, New York, New York 10036

(Address of principal executive offices, including zip code)

(212) 416-3400

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, par value $0.01 per share | | NWSA | | The Nasdaq Global Select Market |

| Class B Common Stock, par value $0.01 per share | | NWS | | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 7, 2024, News Corporation (the “Company”) released its financial results for the quarter ended September 30, 2024. A copy of the Company’s press release is attached as Exhibit 99.1 to this Form 8-K and incorporated herein by reference.

The information in this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On November 7, 2024, the Company announced that Susan Panuccio will depart from her role as Chief Financial Officer on January 1, 2025, and will be succeeded by Lavanya Chandrashekar. Ms. Panuccio will continue as Senior Advisor through June 29, 2025, to help ensure a smooth transition and to support the incoming Chief Financial Officer.

Ms. Chandrashekar, 52, has nearly 30 years of experience in international finance and investor relations, and has most recently served as Chief Financial Officer of Diageo plc, a global beverage alcohol company, from 2021 to September 2024, after serving as Global Head of Investor Relations from 2020 to 2021 and Chief Financial Officer, Diageo North America from 2018 to 2021. She has also held senior finance positions at the Procter & Gamble Company and Mondelēz International, Inc. Ms. Chandrashekar does not have any family relationships with any of the Company’s directors or executive officers and since the beginning of the Company’s last fiscal year, there have been no transactions between the Company and Ms. Chandrashekar or any member of her immediate family that would require disclosure under Item 404 of Regulation S-K.

On November 7, 2024, the Company and Ms. Panuccio entered into a separation agreement that provides for Ms. Panuccio’s continued service through June 29, 2025 and the payment of those separation benefits set forth in the employment agreement between her and the Company dated May 11, 2023, except that Ms. Panuccio’s fiscal 2025 annual bonus will be calculated based on actual performance results for the fiscal year (rather than based on target performance levels). Such separation benefits are subject to Ms. Panuccio’s compliance with confidentiality, non-disparagement and non-solicitation covenants contained in her employment agreement, and the separation agreement contains a customary release of claims.

In connection with her appointment, on November 7, 2024, Ms. Chandrashekar and the Company entered into an employment agreement (the “Chandrashekar Agreement”) for a term from January 1, 2025 through the third anniversary of such effective date. The Chandrashekar Agreement provides for (i) an annual base salary of $1,400,000; (ii) an annual bonus with a target of $2,500,000; and (iii) an annual long-term equity incentive with a target grant date value of $2,600,000; with approximately 78% of Ms. Chandrashekar’s target compensation being “at risk.” The Chandrashekar Agreement also provides for a one-time equity bonus with a target grant date value of $2,600,000 (to be awarded 70% in performance stock units and 30% in restricted stock units) and a $500,000 payment to assist with Ms. Chandrashekar’s relocation to the New York City metropolitan area. All bonus payments and equity grants are subject to the Company’s claw-back policies.

If Ms. Chandrashekar’s employment is terminated by the Company other than for cause (as defined in the Chandrashekar Agreement), death or disability, or by Ms. Chandrashekar for Good Reason (as defined in the Chandrashekar Agreement), the Chandrashekar Agreement provides that Ms. Chandrashekar will receive (i) her then-current base salary and target annual bonus paid in the same manner as though she continued to be employed for 24 months following the date of termination; (ii) a pro rata portion of her target annual bonus for the fiscal year of termination (a “Pro-rated Annual Bonus”); (iii) continued vesting of equity incentive awards granted prior to the date of termination in the same manner as though she continued to be employed for two years following the date of termination; and (iv) Company-paid premiums under the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended, for the executive and her eligible dependents for up to 18 months following the date of termination. If Ms. Chandrashekar’s employment is terminated due to her death or disability, she or her beneficiary or estate, as applicable, would be entitled to: (i) salary continuation for up to 12 months (and, in the case of disability, continuation of other benefits as well); (ii) any Pro-rated Annual Bonus; and (iii) (A) in the case of disability, treatment of her outstanding equity incentive awards pursuant to the terms of applicable plan documents or (B) in the case of death, continued vesting of equity incentive awards granted prior to the date of termination in the same manner as though she continued to be employed for a period of one year following the date of termination. If, following the completion of the term under the Chandrashekar Agreement on January 1, 2028, Ms. Chandrashekar is not offered a new employment agreement by the Company on terms at least as favorable to her as the terms set forth in the Chandrashekar Agreement, and Ms. Chandrashekar is subsequently terminated without cause, then she will be entitled to receive the payments and benefits summarized above with respect to a termination other than for cause (using the same base salary and target annual bonus as in effect immediately prior

to the expiration of the term on January 1, 2028). Payment of any compensation or benefits upon termination is subject to Ms. Chandrashekar’s execution of the Company’s then-standard separation agreement and general release and continued compliance with the terms therein. The Chandrashekar Agreement contains confidentiality, non-competition and other covenants to protect the Company.

In addition, the Chandrashekar Agreement provides that if Ms. Chandrashekar is entitled to receive any “excess parachute payments” under Section 280G of the Internal Revenue Code of 1986, as amended, in connection with a change in control, those payments will either be (i) reduced below the applicable threshold or (ii) paid in full, whichever is more favorable for Ms. Chandrashekar on a net after-tax basis. Ms. Chandrashekar is not entitled to any golden parachute excise tax or other tax “gross-up” payments.

Also on November 7, 2024, Kelly Ayotte informed the Company of her decision not to stand for re-election as a Director of the Company at the 2024 annual meeting of stockholders and any adjournment or postponement thereof (the “2024 Annual Meeting”) in connection with her election as the Governor of New Hampshire. Ms. Ayotte’s decision to depart from the Board did not result from any disagreement with the Company on any matter relating to its operations, policies or practices. Ms. Ayotte will continue to serve on the Board until the time of the 2024 Annual Meeting. Effective as of Ms. Ayotte’s departure, the size of the Board shall be reduced to six members.

Ms. Ayotte had been included as a nominee of the Board in the Company’s definitive proxy statement and proxy card for the 2024 Annual Meeting. In light of her anticipated departure from the Board, Ms. Ayotte is no longer standing for re-election to the Board at the 2024 Annual Meeting, and the Company’s proxy materials are hereby deemed amended to remove Ms. Ayotte as a nominee for the 2024 Annual Meeting. The Company’s slate of nominees otherwise remains unchanged. Previously voted proxies remain valid, other than with respect to Ms. Ayotte as she is no longer standing for re-election, and those eligible to vote at the 2024 Annual Meeting may continue to use their proxy cards to vote their shares as to the Board’s remaining nominees and the other matters being voted on at the 2024 Annual Meeting.

Item 7.01 Regulation FD Disclosure.

A copy of the Company’s press release announcing the change in the Company’s Chief Financial Officer is attached as Exhibit 99.2 to this Form 8-K and incorporated herein by reference.

The information in this Item 7.01, including Exhibit 99.2, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | | |

| | NEWS CORPORATION

(REGISTRANT) |

| | | |

| | | |

| | By: | | /s/ Michael L. Bunder |

| | | | Michael L. Bunder |

| | | | Senior Vice President, Deputy General Counsel and Corporate Secretary |

Dated: November 7, 2024

NEWS CORPORATION REPORTS FIRST QUARTER RESULTS FOR FISCAL 2025

FISCAL 2025 FIRST QUARTER KEY FINANCIAL HIGHLIGHTS

•First quarter revenues were the highest for a first quarter since separation at $2.58 billion, a 3% increase compared to $2.50 billion in the prior year, driven by growth at the Digital Real Estate Services, Book Publishing and Dow Jones segments

•Net income in the quarter was $144 million, a significant improvement compared to net income of $58 million in the prior year

•Total Segment EBITDA was the highest for a first quarter since separation at $415 million, compared to $364 million in the prior year

•In the quarter, reported EPS were $0.21 as compared to $0.05 in the prior year - Adjusted EPS were $0.21 compared to $0.16 in the prior year

•REA Group posted record revenues for the quarter of $318 million, a 22% increase compared to the prior year, primarily driven by robust Australian residential performance

•Dow Jones’ growth continued to be underpinned by robust performance in its professional information business, where revenue increased 8%, driven by growth of 16% at Risk & Compliance and 11% at Dow Jones Energy

•Book Publishing revenues grew 4% in the quarter, while Segment EBITDA increased 25%, driven by record digital book sales, which grew 15%, and strong backlist performance

NEW YORK, NY – November 7, 2024 – News Corporation (“News Corp” or the “Company”) (Nasdaq: NWS, NWSA; ASX: NWS, NWSLV) today reported financial results for the three months ended September 30, 2024.

Commenting on the results, Chief Executive Robert Thomson said:

“We have begun Fiscal 2025 robustly, with record first quarter revenue, strong net income and record first quarter profitability. Revenue rose 3 percent year-over-year to $2.58 billion, while our net income jumped 148 percent to $144 million. Total Segment EBITDA surged 14 percent to $415 million, and our EPS were 21 cents compared to 5 cents in same quarter last year. That we have achieved these record first quarter results in macro-conditions which are far from auspicious is compelling evidence of the successful transformation of News Corp over the past decade.

Meanwhile, the just-completed election has highlighted the importance of trusted journalism in a media maelstrom in which some journalists mistake virtue signaling for virtue. Artificial intelligence recycles informational infelicities and it is critical that journalistic inputs have integrity, which is why our partnership with OpenAI is so crucial and why we intend to sue AI companies abusing and misusing our trusted journalism.

Dow Jones and the New York Post have started proceedings against the perplexing Perplexity, which is selling products based on our journalism, and we are diligently preparing for further action against other companies that have ingested our archives and are synthesizing our intellectual property.”

FIRST QUARTER RESULTS

The Company reported fiscal 2025 first quarter total revenues of $2.58 billion, a 3% increase compared to $2.50 billion in the prior year period, primarily driven by higher Australian residential revenues at REA Group, higher digital book sales combined with improved returns at the Book Publishing segment and continued growth in the professional information business at the Dow Jones segment, in addition to a $35 million, or 1%, positive impact from foreign currency fluctuations. The increase was partly offset by lower revenues at the News Media segment. Adjusted Revenues (which excludes the foreign currency impact, acquisitions and divestitures as defined in Note 2) increased 2% compared to the prior year.

Net income for the quarter was $144 million, a 148% increase compared to $58 million in the prior year, primarily driven by higher Other, net, higher Total Segment EBITDA and lower impairment and restructuring charges. These impacts were partially offset by higher income tax expense and higher depreciation and amortization.

The Company reported first quarter Total Segment EBITDA of $415 million, a 14% increase compared to $364 million in the prior year primarily due to strong contributions from REA Group within the Digital Real Estate Services segment, despite $12 million of deal costs related to the withdrawn offer to acquire Rightmove, as well as the Book Publishing segment. The increase was partly offset by higher costs at the Subscription Video Services segment primarily driven by the Hubbl product. Adjusted Total Segment EBITDA (as defined in Note 2) increased 12%.

Net income per share attributable to News Corporation stockholders was $0.21 as compared to $0.05 in the prior year.

Adjusted EPS (as defined in Note 3) were $0.21 compared to $0.16 in the prior year.

SEGMENT REVIEW

| | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended

September 30, | | |

| 2024 | | 2023 | | % Change | | | | | | |

| (in millions) | | Better/ (Worse) | | | | |

| Revenues: | | | | | | | | | | | |

| Dow Jones | $ | 552 | | | $ | 537 | | | 3 | % | | | | | | |

| Digital Real Estate Services | 457 | | | 403 | | | 13 | % | | | | | | |

| Book Publishing | 546 | | | 525 | | | 4 | % | | | | | | |

| Subscription Video Services | 501 | | | 486 | | | 3 | % | | | | | | |

| News Media | 521 | | | 548 | | | (5) | % | | | | | | |

| Other | — | | | — | | | — | % | | | | | | |

| Total Revenues | $ | 2,577 | | | $ | 2,499 | | | 3 | % | | | | | | |

| | | | | | | | | | | |

| Segment EBITDA: | | | | | | | | | | | |

| Dow Jones | $ | 131 | | | $ | 124 | | | 6 | % | | | | | | |

| Digital Real Estate Services | 140 | | | 122 | | | 15 | % | | | | | | |

| Book Publishing | 81 | | | 65 | | | 25 | % | | | | | | |

| Subscription Video Services | 92 | | | 93 | | | (1) | % | | | | | | |

| News Media | 16 | | | 14 | | | 14 | % | | | | | | |

| Other | (45) | | | (54) | | | 17 | % | | | | | | |

| Total Segment EBITDA | $ | 415 | | | $ | 364 | | | 14 | % | | | | | | |

| | | | | | | | | | | |

Dow Jones

Revenues in the quarter increased $15 million, or 3%, compared to the prior year, driven by continued growth in the professional information business, as well as higher content licensing revenue. Digital revenues at Dow Jones in the quarter represented 82% of total revenues compared to 81% in the prior year. Adjusted Revenues increased 2%.

Circulation and subscription revenues increased $23 million, or 5%, primarily driven by an 8% increase in professional information business revenues, led by 16% growth in Risk & Compliance revenues to $81 million and 11% growth in Dow Jones Energy revenues to $68 million. Circulation revenues increased 1% compared to the prior year, as the continued growth in digital-only subscriptions was mostly offset by lower print volume. Digital circulation revenues accounted for 72% of circulation revenues for the quarter, compared to 70% in the prior year.

During the first quarter, total average subscriptions to Dow Jones’ consumer products were over 5.9 million, an 11% increase compared to the prior year. Digital-only subscriptions to Dow Jones’ consumer products grew 15% to over 5.3 million. Total subscriptions to The Wall Street Journal grew 7% compared to the prior year, to nearly 4.3 million average subscriptions in the quarter. Digital-only subscriptions to The Wall Street Journal grew 10% to over 3.8 million average subscriptions in the quarter, and represented 90% of total Wall Street Journal subscriptions.

| | | | | | | | | | | | | | | | | |

| For the three months ended September 30, |

| 2024 | | 2023 | | % Change |

| (in thousands, except %) | | | | | Better/(Worse) |

| The Wall Street Journal | | | | | |

| Digital-only subscriptions | 3,811 | | | 3,457 | | | 10 | % |

| Total subscriptions | 4,255 | | | 3,991 | | | 7 | % |

| Barron’s Group | | | | | |

| Digital-only subscriptions | 1,325 | | | 1,055 | | | 26 | % |

| Total subscriptions | 1,446 | | | 1,197 | | | 21 | % |

| Total Consumer | | | | | |

| Digital-only subscriptions | 5,325 | | | 4,611 | | | 15 | % |

| Total subscriptions | 5,908 | | | 5,308 | | | 11 | % |

Advertising revenues decreased $6 million, or 7%, primarily due to a 10% decline in print advertising revenues and a 5% decline in digital advertising revenues driven by lower advertising spend in the technology and finance sectors. Digital advertising accounted for 67% of total advertising revenues in the quarter, compared to 66% in the prior year.

Segment EBITDA for the quarter increased $7 million, or 6%, primarily as a result of the higher revenues discussed above and lower newsprint, production and distribution costs, partially offset by higher marketing and employee costs. Adjusted Segment EBITDA increased 5%.

Digital Real Estate Services

Revenues in the quarter increased $54 million, or 13%, compared to the prior year, driven by strong performance at REA Group. Segment EBITDA in the quarter increased $18 million, or 15%, compared to the prior year, due to higher contribution from REA Group, despite $12 million of deal costs related to the withdrawn offer to acquire Rightmove, and included a $3 million, or 3%, positive impact from foreign currency fluctuations. The increase was partly offset by modestly lower contribution from Move. Adjusted Revenues and Adjusted Segment EBITDA (as defined in Note 2) increased 11% and 13%, respectively.

In the quarter, revenues at REA Group increased $57 million, or 22%, to $318 million, primarily driven by higher Australian residential revenues due to price increases, increased depth penetration and an increase in national listings, a $7 million, or 3%, positive impact from foreign currency fluctuations and higher revenue from REA India. Australian national residential buy listing volumes in the quarter increased 7% compared to the prior year, with listings in Sydney and Melbourne up 11% and 9%, respectively.

Move’s revenues in the quarter decreased $2 million, or 1%, to $140 million, primarily as a result of lower real estate revenues. Real estate revenues, which represented 77% of total Move revenues, decreased 4%, driven by the ongoing impact of the macroeconomic environment on the housing market, which led to lower lead and transaction volumes. Revenues from the referral model, which includes the ReadyConnect Concierge℠ product, and the core lead generation product decreased due to these factors. The decline was partially offset by strong growth in seller, new homes and rentals, including the partnership with Zillow, and increased advertising revenues. Based on Move’s internal data, average monthly unique users of Realtor.com®’s web and mobile sites for the fiscal first quarter grew 2% compared to the prior year to 77 million. Lead volume was down 1% year over year as it continues to be impacted by high mortgage rates.

Book Publishing

Revenues in the quarter increased $21 million, or 4%, compared to the prior year, primarily driven by higher digital and backlist book sales and improved returns. Key titles in the quarter included Hillbilly Elegy by J.D. Vance, A Death in Cornwall by Daniel Silva and The Au Pair Affair by Tessa Bailey. Bible sales were also strong. Adjusted Revenues increased 3%.

Digital sales increased 15% compared to the prior year, driven by 26% growth from audiobook sales, which benefited from the continued contribution from the Spotify partnership and strong market conditions, in addition to higher e-book sales, which increased 7% compared to the prior year. Digital sales represented 25% of Consumer revenues for the quarter compared to 22% in the prior year. Backlist sales represented approximately 64% of Consumer revenues in the quarter compared to 61% in the prior year.

Segment EBITDA for the quarter increased $16 million, or 25%, compared to the prior year, primarily due to the higher revenues discussed above, partially offset by higher employee costs.

Subscription Video Services

Revenues of $501 million in the quarter increased $15 million, or 3%, compared with the prior year, primarily driven by higher revenues from Kayo and BINGE from increases in both volume and pricing, and an $11 million, or 2%, positive impact from foreign currency fluctuations, partly offset by the impact from fewer residential broadcast subscribers. Adjusted Revenues of $490 million increased 1% compared to the prior year. Foxtel Group streaming subscription revenues represented 34% of total segment circulation and subscription revenues in the quarter, as compared to 30% in the prior year.

As of September 30, 2024, Foxtel’s total closing paid subscribers were over 4.6 million, a 1% increase compared to the prior year, driven by growth in Kayo and BINGE subscribers, partly offset by fewer residential broadcast subscribers. Broadcast subscriber churn in the quarter was 11.0% compared to 11.4% in the prior year, while Broadcast ARPU for the quarter continued to increase, up 4% year-over-year to A$89 (US$60).

| | | | | | | | | | | |

| As of September 30, |

| 2024 | | 2023 |

| (in 000's) |

| Broadcast Subscribers | | | |

| Residential | 1,185 | | | 1,310 | |

| Commercial | 237 | | | 233 | |

Streaming Subscribers - Total (Paid) | | | |

| Kayo | 1,511 (1,499) | | 1,411 (1,403) |

| BINGE | 1,571 (1,552) | | 1,506 (1,449) |

Foxtel Now | 134 (131) | | 167 (161) |

| | | |

| | | |

Total Subscribers - Total (Paid) | 4,658 (4,622) | | 4,646 (4,573) |

Segment EBITDA of $92 million in the quarter decreased $1 million, or 1%, compared with the prior year, primarily due to $11 million of Hubbl costs, higher sports programming costs related to contractual increases and higher production costs, partially offset by declines in other costs, including marketing and entertainment programming costs, and the higher revenues discussed above. Adjusted Segment EBITDA decreased 3%.

News Media

Revenues in the quarter decreased $27 million, or 5%, as compared to the prior year, including a positive $12 million, or 2%, impact from foreign currency fluctuations, primarily driven by lower other revenues from the transfer of third-party printing revenue contracts to News UK’s joint venture with DMG Media and lower advertising revenues. Adjusted Revenues for the segment decreased 7% compared to the prior year.

Circulation and subscription revenues decreased $4 million, or 1%, compared to the prior year, primarily due to lower print volumes, partially offset by cover price increases and the $6 million, or 3%, positive impact from foreign currency fluctuations.

Advertising revenues decreased $10 million, or 5%, compared to the prior year, primarily due to lower print advertising revenues at News Corp Australia and lower digital advertising revenues at News UK mainly driven by a decline in traffic at some mastheads due to algorithm changes at certain platforms, partially offset by a $5 million, or 2%, positive impact from foreign currency fluctuations.

In the quarter, Segment EBITDA increased $2 million, or 14%, compared to the prior year, driven by cost savings at News UK as a result of the combination of its printing operations with those of DMG Media and other cost savings initiatives, including lower Talk costs, largely offset by the lower revenues discussed above. Adjusted Segment EBITDA increased 7%.

Digital revenues represented 39% of News Media segment revenues in the quarter, compared to 37% in the prior year, and represented 37% of the combined revenues of the newspaper mastheads. Digital subscribers and users across key properties within the News Media segment are summarized below:

•Closing digital subscribers at News Corp Australia as of September 30, 2024 were 1,127,000 (979,000 for news mastheads), compared to 1,049,000 (937,000 for news mastheads) in the prior year (Source: Internal data)

•The Times and Sunday Times closing digital subscribers, including the Times Literary Supplement, as of September 30, 2024 were 600,000, compared to 572,000 in the prior year (Source: Internal data).

•The Sun’s digital offering reached 80 million global monthly unique users in September 2024, compared to 134 million in the prior year (Source: Meta Pixel)

•New York Post’s digital network reached 103 million unique users in September 2024, compared to 127 million in the prior year (Source: Google Analytics)

CASH FLOW

The following table presents a reconciliation of net cash provided by (used in) operating activities to free cash flow:

| | | | | | | | | | | |

| For the three months ended

September 30, |

| 2024 | | 2023 |

| (in millions) |

| Net cash provided by (used in) operating activities | $ | 64 | | | $ | (55) | |

| Less: Capital expenditures | (95) | | | (124) | |

| Free cash flow | $ | (31) | | | $ | (179) | |

Net cash provided by operating activities of $64 million for the three months ended September 30, 2024 was $119 million higher than net cash used in operating activities of $(55) million in the prior year, primarily due to lower working capital and higher Total Segment EBITDA, as noted above, partly offset by higher tax payments.

Free cash flow in the three months ended September 30, 2024 was $(31) million compared to $(179) million in the prior year. The improvement in free cash flow was primarily due to higher cash provided by operating activities, as mentioned above, in addition to lower capital expenditures.

Free cash flow is a non-GAAP financial measure. Free cash flow is defined as net cash provided by (used in) operating activities, less capital expenditures. Free cash flow may not be comparable to similarly titled measures reported by other companies, since companies and investors may differ as to what items should be included in the calculation of free cash flow.

Free cash flow does not represent the total increase or decrease in the cash balance for the period and should be considered in addition to, not as a substitute for, the net change in cash and cash equivalents as presented in the Company’s consolidated statements of cash flows prepared in accordance with GAAP, which incorporates all cash movements during the period. The Company believes free cash flow provides useful information to management and investors about the Company’s liquidity and cash flow trends.

OTHER ITEMS

Strategic Review

In response to third party interest, the Company is continuing to assess strategic and financial options for the Foxtel Group, including its capital structure and assets. There is no assurance regarding the timing of any action or transaction, nor that the strategic review will result in a transaction or other strategic change.

COMPARISON OF NON-GAAP TO U.S. GAAP INFORMATION

Adjusted Revenues, Total Segment EBITDA, Adjusted Total Segment EBITDA, Adjusted Segment EBITDA, adjusted net income attributable to News Corporation stockholders, Adjusted EPS, constant currency revenues and free cash flow are non-GAAP financial measures contained in this earnings release. The Company believes these measures are important tools for investors and analysts to use in assessing the Company’s underlying business performance and to provide for more meaningful comparisons of the Company’s operating performance between periods. These measures also allow investors and analysts to view the Company’s business from the

same perspective as Company management. These non-GAAP measures may be different than similar measures used by other companies and should be considered in addition to, not as a substitute for, measures of financial performance calculated in accordance with GAAP. Reconciliations for the differences between non-GAAP measures used in this earnings release and comparable financial measures calculated in accordance with U.S. GAAP are included in Notes 1, 2, 3 and 4 and the reconciliation of net cash provided by (used in) operating activities to free cash flow is included above.

Conference call

News Corporation’s earnings conference call can be heard live at 5:00 p.m. EST on November 7, 2024. To listen to the call, please visit http://investors.newscorp.com.

Annual Meeting of Stockholders

News Corporation’s 2024 Annual Meeting of Stockholders will be held exclusively via live webcast on Wednesday, November 20, 2024, beginning at 1:00 p.m. EST. The webcast can be accessed at www.virtualshareholdermeeting.com/NWS2024. A replay will be available at the same location for a period of time following the meeting.

Cautionary Statement Concerning Forward-Looking Statements

This document contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements regarding trends and uncertainties affecting the Company’s business, results of operations and financial condition, the Company’s strategy and strategic initiatives, including potential acquisitions, investments and dispositions, the Company’s cost savings initiatives and the outcome of contingencies such as litigation and investigations. These statements are based on management’s views and assumptions regarding future events and business performance as of the time the statements are made. Actual results may differ materially from these expectations due to the risks, uncertainties and other factors described in the Company’s filings with the Securities and Exchange Commission. More detailed information about factors that could affect future results is contained in our filings with the Securities and Exchange Commission. The “forward-looking statements” included in this document are made only as of the date of this document and we do not have and do not undertake any obligation to publicly update any “forward-looking statements” to reflect subsequent events or circumstances, and we expressly disclaim any such obligation, except as required by law or regulation.

About News Corporation

News Corp (Nasdaq: NWS, NWSA; ASX: NWS, NWSLV) is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services. The company comprises businesses across a range of media, including: information services and news, digital real estate services, book publishing and subscription video services in Australia. Headquartered in New York, News Corp operates primarily in the United States, Australia, and the United Kingdom, and its content and other products and services are distributed and consumed worldwide. More information is available at: www.newscorp.com.

Contacts:

| | | | | |

| Investor Relations | Corporate Communications |

| Michael Florin | Arthur Bochner |

| 212-416-3363 | 646-422-9671 |

| mflorin@newscorp.com | abochner@newscorp.com |

| |

| Anthony Rudolf |

|

| 212-416-3040 | |

| arudolf@newscorp.com |

|

NEWS CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited; in millions, except per share amounts)

| | | | | | | | | | | | | | | |

| | | For the three months ended

September 30, |

| | | | | 2024 | | 2023 |

| Revenues: | | | | | | | |

| Circulation and subscription | | | | | $ | 1,157 | | | $ | 1,129 | |

| Advertising | | | | | 381 | | | 391 | |

| Consumer | | | | | 521 | | | 502 | |

| Real estate | | | | | 357 | | | 311 | |

| Other | | | | | 161 | | | 166 | |

| Total Revenues | | | | | 2,577 | | | 2,499 | |

| Operating expenses | | | | | (1,263) | | | (1,273) | |

| Selling, general and administrative | | | | | (899) | | | (862) | |

| Depreciation and amortization | | | | | (189) | | | (171) | |

| Impairment and restructuring charges | | | | | (24) | | | (38) | |

| Equity losses of affiliates | | | | | (3) | | | (2) | |

| Interest expense, net | | | | | (18) | | | (23) | |

| Other, net | | | | | 23 | | | (35) | |

| Income before income tax expense | | | | | 204 | | | 95 | |

| Income tax expense | | | | | (60) | | | (37) | |

| Net income | | | | | 144 | | | 58 | |

| Net income attributable to noncontrolling interests | | | | | (25) | | | (28) | |

| Net income attributable to News Corporation stockholders | | | | | $ | 119 | | | $ | 30 | |

| | | | | | | |

| Weighted average shares outstanding: | | | | | | | |

| Basic | | | | | 569.2 | | | 572.3 | |

| Diluted | | | | | 571.2 | | | 574.1 | |

| | | | | | | |

| Net income attributable to News Corporation stockholders per share, basic and diluted | | | | | $ | 0.21 | | | $ | 0.05 | |

| | | | | | | |

NEWS CORPORATION

CONSOLIDATED BALANCE SHEETS

(Unaudited; in millions)

| | | | | | | | | | | |

| As of September 30, 2024 | | As of June 30, 2024 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 1,778 | | | $ | 1,960 | |

| Receivables, net | 1,698 | | | 1,503 | |

| Inventory, net | 378 | | | 296 | |

| Other current assets | 652 | | | 613 | |

| Total current assets | 4,506 | | | 4,372 | |

| | | |

| Non-current assets: | | | |

| Investments | 458 | | | 430 | |

| Property, plant and equipment, net | 1,919 | | | 1,914 | |

| Operating lease right-of-use assets | 965 | | | 958 | |

| Intangible assets, net | 2,324 | | | 2,322 | |

| Goodwill | 5,258 | | | 5,186 | |

Deferred income tax assets, net | 323 | | | 332 | |

| Other non-current assets | 1,174 | | | 1,170 | |

| Total assets | $ | 16,927 | | | $ | 16,684 | |

| | | |

| LIABILITIES AND EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 374 | | | $ | 314 | |

| Accrued expenses | 1,213 | | | 1,231 | |

| Deferred revenue | 559 | | | 551 | |

| Current borrowings | 194 | | | 54 | |

| Other current liabilities | 929 | | | 905 | |

| Total current liabilities | 3,269 | | | 3,055 | |

| | | |

| Non-current liabilities: | | | |

| Borrowings | 2,706 | | | 2,855 | |

| Retirement benefit obligations | 130 | | | 125 | |

Deferred income tax liabilities, net | 112 | | | 119 | |

| Operating lease liabilities | 1,036 | | | 1,027 | |

| Other non-current liabilities | 508 | | | 492 | |

| Commitments and contingencies | | | |

| | | |

| | | |

| Equity: | | | |

| Class A common stock | 4 | | | 4 | |

| Class B common stock | 2 | | | 2 | |

| Additional paid-in capital | 11,157 | | | 11,254 | |

| Accumulated deficit | (1,779) | | | (1,889) | |

| Accumulated other comprehensive loss | (1,131) | | | (1,251) | |

| Total News Corporation stockholders' equity | 8,253 | | | 8,120 | |

| Noncontrolling interests | 913 | | | 891 | |

| Total equity | 9,166 | | | 9,011 | |

| Total liabilities and equity | $ | 16,927 | | | $ | 16,684 | |

NEWS CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited; in millions)

| | | | | | | | | | | |

| For the three months ended

September 30, |

| 2024 | | 2023 |

| Operating activities: | | | |

| Net income | $ | 144 | | | $ | 58 | |

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: | | | |

| Depreciation and amortization | 189 | | | 171 | |

| Operating lease expense | 25 | | | 24 | |

| Equity losses of affiliates | 3 | | | 2 | |

| Impairment charges | — | | | 21 | |

| Deferred income taxes | 14 | | | 13 | |

| Other, net | (23) | | | 36 | |

| Change in operating assets and liabilities, net of acquisitions: | | | |

| | | |

| Receivables and other assets | (107) | | | (128) | |

| Inventories, net | (68) | | | (55) | |

| Accounts payable and other liabilities | (113) | | | (197) | |

| Net cash provided by (used in) operating activities | 64 | | | (55) | |

| Investing activities: | | | |

| Capital expenditures | (95) | | | (124) | |

| | | |

| Acquisitions, net of cash acquired | (12) | | | (20) | |

| | | |

| Purchases of investments in equity affiliates and other | (51) | | | (31) | |

| | | |

| | | |

| Proceeds from sales of investments in equity affiliates and other | 22 | | | 16 | |

| | | |

| Net cash used in investing activities | (136) | | | (159) | |

| Financing activities: | | | |

| Borrowings | 153 | | | 925 | |

| Repayment of borrowings | (185) | | | (933) | |

| Repurchase of shares | (38) | | | (29) | |

| Dividends paid | (35) | | | (28) | |

| | | |

| Other, net | (42) | | | — | |

Net cash used in financing activities | (147) | | | (65) | |

| Net change in cash and cash equivalents | (219) | | | (279) | |

| | | |

| Cash and cash equivalents, beginning of year | 1,960 | | | 1,833 | |

| Effect of exchange rate changes on cash and cash equivalents | 37 | | | (25) | |

| Cash and cash equivalents, end of period | $ | 1,778 | | | $ | 1,529 | |

| | | |

NOTE 1 – TOTAL SEGMENT EBITDA

Segment EBITDA is defined as revenues less operating expenses and selling, general and administrative expenses. Segment EBITDA does not include: depreciation and amortization, impairment and restructuring charges, equity losses of affiliates, interest (expense) income, net, other, net and income tax (expense) benefit. Management believes that Segment EBITDA is an appropriate measure for evaluating the operating performance of the Company’s business segments because it is the primary measure used by the Company’s chief operating decision maker to evaluate the performance of and allocate resources within the Company’s businesses. Segment EBITDA provides management, investors and equity analysts with a measure to analyze the operating performance of each of the Company’s business segments and its enterprise value against historical data and competitors’ data, although historical results may not be indicative of future results (as operating performance is highly contingent on many factors, including customer tastes and preferences).

Total Segment EBITDA is a non-GAAP measure and should be considered in addition to, not as a substitute for, net income (loss), cash flow and other measures of financial performance reported in accordance with GAAP. In addition, this measure does not reflect cash available to fund requirements and excludes items, such as depreciation and amortization and impairment and restructuring charges, which are significant components in assessing the Company’s financial performance. The Company believes that the presentation of Total Segment EBITDA provides useful information regarding the Company’s operations and other factors that affect the Company’s reported results. Specifically, the Company believes that by excluding certain one-time or non-cash items such as impairment and restructuring charges and depreciation and amortization, as well as potential distortions between periods caused by factors such as financing and capital structures and changes in tax positions or regimes, the Company provides users of its consolidated financial statements with insight into both its core operations as well as the factors that affect reported results between periods but which the Company believes are not representative of its core business. As a result, users of the Company’s consolidated financial statements are better able to evaluate changes in the core operating results of the Company across different periods. The following table reconciles net income to Total Segment EBITDA for the three months ended September 30, 2024 and 2023:

| | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended September 30, |

| 2024 | | 2023 | | Change | | % Change |

| (in millions) | | |

| Net income | $ | 144 | | | $ | 58 | | | $ | 86 | | | 148 | % |

| Add: | | | | | | | |

Income tax expense | 60 | | | 37 | | | 23 | | | 62 | % |

| Other, net | (23) | | | 35 | | | (58) | | | ** |

| Interest expense, net | 18 | | | 23 | | | (5) | | | (22) | % |

| Equity losses of affiliates | 3 | | | 2 | | | 1 | | | 50 | % |

| Impairment and restructuring charges | 24 | | | 38 | | | (14) | | | (37) | % |

| Depreciation and amortization | 189 | | | 171 | | | 18 | | | 11 | % |

| Total Segment EBITDA | $ | 415 | | | $ | 364 | | | $ | 51 | | | 14 | % |

| | | | | | | |

**Not meaningful

NOTE 2 – ADJUSTED REVENUES, ADJUSTED TOTAL SEGMENT EBITDA AND ADJUSTED SEGMENT EBITDA

The Company uses revenues, Total Segment EBITDA and Segment EBITDA excluding the impact of acquisitions, divestitures, fees and costs, net of indemnification, related to the claims and investigations arising out of certain conduct at The News of the World (the “U.K. Newspaper Matters”), charges for other significant, non-ordinary course legal or regulatory matters (“litigation charges”) and foreign currency fluctuations (“Adjusted Revenues,” “Adjusted Total Segment EBITDA” and “Adjusted Segment EBITDA,” respectively) to evaluate the performance of the Company’s core business operations exclusive of certain items that impact the comparability of results from period to period such as the unpredictability and volatility of currency fluctuations. The Company calculates the impact of foreign currency fluctuations for businesses reporting in currencies other than the U.S. dollar by multiplying the results for each quarter in the current period by the difference between the average exchange rate for that quarter and the average exchange rate in effect during the corresponding quarter of the prior year and totaling the impact for all quarters in the current period.

The calculation of Adjusted Revenues, Adjusted Total Segment EBITDA and Adjusted Segment EBITDA may not be comparable to similarly titled measures reported by other companies, since companies and investors may differ as to what type of events warrant adjustment. Adjusted Revenues, Adjusted Total Segment EBITDA and Adjusted Segment EBITDA are not measures of performance under generally accepted accounting principles and should not be construed as substitutes for amounts determined under GAAP as measures of performance. However, management uses these measures in comparing the Company’s historical performance and believes that they provide meaningful and comparable information to investors to assist in their analysis of our performance relative to prior periods and our competitors.

The following table reconciles reported revenues and reported Total Segment EBITDA to Adjusted Revenues and Adjusted Total Segment EBITDA for the three months ended September 30, 2024 and 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenues | | | Total Segment EBITDA |

| For the three months ended September 30, | | | For the three months ended September 30, |

| 2024 | | 2023 | | Difference | | | 2024 | | 2023 | | Difference |

| (in millions) | | | (in millions) |

| As reported | $ | 2,577 | | | $ | 2,499 | | | $ | 78 | | | | $ | 415 | | | $ | 364 | | | $ | 51 | |

| Impact of acquisitions | (2) | | | — | | | (2) | | | | 1 | | | — | | | 1 | |

| | | | | | | | | | | | |

| Impact of foreign currency fluctuations | (35) | | | — | | | (35) | | | | (8) | | | — | | | (8) | |

| | | | | | | | | | | | |

| Net impact of U.K. Newspaper Matters | — | | | — | | | — | | | | 2 | | | 3 | | | (1) | |

| As adjusted | $ | 2,540 | | | $ | 2,499 | | | $ | 41 | | | | $ | 410 | | | $ | 367 | | | $ | 43 | |

| | | | | | | | | | | | |

Foreign Exchange Rates

Average foreign exchange rates used in the calculation of the impact of foreign currency fluctuations for the three months ended September 30, 2024 and 2023 are as follows:

| | | | | | | | | | | |

| Fiscal Year 2025 |

| Q1 | | | | | | |

| U.S. Dollar per Australian Dollar | $0.67 | | | | | | |

| U.S. Dollar per British Pound Sterling | $1.30 | | | | | | |

| | | | | | | |

| Fiscal Year 2024 |

| Q1 | | | | | | |

| U.S. Dollar per Australian Dollar | $0.65 | | | | | | |

| U.S. Dollar per British Pound Sterling | $1.27 | | | | | | |

Adjusted Revenues and Adjusted Segment EBITDA by segment for the three months ended September 30, 2024 and 2023 are as follows:

| | | | | | | | | | | | | | | | | |

| For the three months ended September 30, |

| 2024 | | 2023 | | % Change |

| (in millions) | | Better/(Worse) |

| Adjusted Revenues: | | | | | |

| Dow Jones | $ | 549 | | | $ | 537 | | | 2 | % |

| Digital Real Estate Services | 449 | | | 403 | | | 11 | % |

| Book Publishing | 543 | | | 525 | | | 3 | % |

| Subscription Video Services | 490 | | | 486 | | | 1 | % |

| News Media | 509 | | | 548 | | | (7) | % |

| Other | — | | | — | | | — | % |

| Adjusted Total Revenues | $ | 2,540 | | | $ | 2,499 | | | 2 | % |

| | | | | |

| Adjusted Segment EBITDA: | | | | | |

| Dow Jones | $ | 130 | | | $ | 124 | | | 5 | % |

| Digital Real Estate Services | 138 | | | 122 | | | 13 | % |

| Book Publishing | 80 | | | 65 | | | 23 | % |

| Subscription Video Services | 90 | | | 93 | | | (3) | % |

| News Media | 15 | | | 14 | | | 7 | % |

| Other | (43) | | | (51) | | | 16 | % |

| Adjusted Total Segment EBITDA | $ | 410 | | | $ | 367 | | | 12 | % |

| | | | | |

The following tables reconcile reported revenues and Segment EBITDA by segment to Adjusted Revenues and Adjusted Segment EBITDA by segment for the three months ended September 30, 2024 and 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended September 30, 2024 |

| As Reported | | Impact of Acquisitions | | | Impact of Foreign Currency Fluctuations | | | Net Impact of U.K. Newspaper Matters | | As Adjusted |

| (in millions) |

| Revenues: | | | | | | | | | | | |

| Dow Jones | $ | 552 | | | $ | (1) | | | | $ | (2) | | | | $ | — | | | $ | 549 | |

| Digital Real Estate Services | 457 | | | (1) | | | | (7) | | | | — | | | 449 | |

| Book Publishing | 546 | | | — | | | | (3) | | | | — | | | 543 | |

| Subscription Video Services | 501 | | | — | | | | (11) | | | | — | | | 490 | |

| News Media | 521 | | | — | | | | (12) | | | | — | | | 509 | |

| Other | — | | | — | | | | — | | | | — | | | — | |

| Total Revenues | $ | 2,577 | | | $ | (2) | | | | $ | (35) | | | | $ | — | | | $ | 2,540 | |

| | | | | | | | | | | |

| Segment EBITDA: | | | | | | | | | | | |

| Dow Jones | $ | 131 | | | $ | — | | | | $ | (1) | | | | $ | — | | | $ | 130 | |

| Digital Real Estate Services | 140 | | | 1 | | | | (3) | | | | — | | | 138 | |

| Book Publishing | 81 | | | — | | | | (1) | | | | — | | | 80 | |

| Subscription Video Services | 92 | | | — | | | | (2) | | | | — | | | 90 | |

| News Media | 16 | | | — | | | | (1) | | | | — | | | 15 | |

| Other | (45) | | | — | | | | — | | | | 2 | | | (43) | |

| Total Segment EBITDA | $ | 415 | | | $ | 1 | | | | $ | (8) | | | | $ | 2 | | | $ | 410 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended September 30, 2023 |

| As Reported | | Impact of Acquisitions | | | Impact of Foreign Currency Fluctuations | | | Net Impact of U.K. Newspaper Matters | | As Adjusted |

| (in millions) |

| Revenues: | | | | | | | | | | | |

| Dow Jones | $ | 537 | | | $ | — | | | | $ | — | | | | $ | — | | | $ | 537 | |

| Digital Real Estate Services | 403 | | | — | | | | — | | | | — | | | 403 | |

| Book Publishing | 525 | | | — | | | | — | | | | — | | | 525 | |

| Subscription Video Services | 486 | | | — | | | | — | | | | — | | | 486 | |

| News Media | 548 | | | — | | | | — | | | | — | | | 548 | |

| Other | — | | | — | | | | — | | | | — | | | — | |

| Total Revenues | $ | 2,499 | | | $ | — | | | | $ | — | | | | $ | — | | | $ | 2,499 | |

| | | | | | | | | | | |

| Segment EBITDA: | | | | | | | | | | | |

| Dow Jones | $ | 124 | | | $ | — | | | | $ | — | | | | $ | — | | | $ | 124 | |

| Digital Real Estate Services | 122 | | | — | | | | — | | | | — | | | 122 | |

| Book Publishing | 65 | | | — | | | | — | | | | — | | | 65 | |

| Subscription Video Services | 93 | | | — | | | | — | | | | — | | | 93 | |

| News Media | 14 | | | — | | | | — | | | | — | | | 14 | |

| Other | (54) | | | — | | | | — | | | | 3 | | | (51) | |

| Total Segment EBITDA | $ | 364 | | | $ | — | | | | $ | — | | | | $ | 3 | | | $ | 367 | |

| | | | | | | | | | | |

NOTE 3 – ADJUSTED NET INCOME (LOSS) ATTRIBUTABLE TO NEWS CORPORATION STOCKHOLDERS AND ADJUSTED EPS

The Company uses net income (loss) attributable to News Corporation stockholders and diluted earnings per share (“EPS”) excluding expenses related to U.K. Newspaper Matters, litigation charges, impairment and restructuring charges and “Other, net”, net of tax, recognized by the Company or its equity method investees, as well as the settlement of certain pre-Separation tax matters (“adjusted net income (loss) attributable to News Corporation stockholders” and “adjusted EPS,” respectively), to evaluate the performance of the Company’s operations exclusive of certain items that impact the comparability of results from period to period, as well as certain non-operational items. The calculation of adjusted net income (loss) attributable to News Corporation stockholders and adjusted EPS may not be comparable to similarly titled measures reported by other companies, since companies and investors may differ as to what type of events warrant adjustment. Adjusted net income (loss) attributable to News Corporation stockholders and adjusted EPS are not measures of performance under generally accepted accounting principles and should not be construed as substitutes for consolidated net income (loss) attributable to News Corporation stockholders and net income (loss) per share as determined under GAAP as a measure of performance. However, management uses these measures in comparing the Company’s historical performance and believes that they provide meaningful and comparable information to investors to assist in their analysis of our performance relative to prior periods and our competitors.

The following table reconciles reported net income attributable to News Corporation stockholders and reported diluted EPS to adjusted net income attributable to News Corporation stockholders and adjusted EPS for the three months ended September 30, 2024 and 2023:

| | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended September 30, 2024 | | For the three months ended September 30, 2023 |

| (in millions, except per share data) | Net income attributable to stockholders | | EPS | | Net income attributable to stockholders | | EPS |

| Net income | $ | 144 | | | | | $ | 58 | | | |

| Net income attributable to noncontrolling interests | (25) | | | | | (28) | | | |

| Net income attributable to News Corporation stockholders | $ | 119 | | | $ | 0.21 | | | $ | 30 | | | $ | 0.05 | |

| U.K. Newspaper Matters | 2 | | | 0.01 | | | 3 | | | 0.01 | |

| | | | | | | |

Impairment and restructuring charges(a) | 24 | | | 0.04 | | | 38 | | | 0.06 | |

| | | | | | | |

| Other, net | (23) | | | (0.04) | | | 35 | | | 0.06 | |

| Tax impact on items above | (3) | | | (0.01) | | | (19) | | | (0.03) | |

| Impact of noncontrolling interest on items above | (1) | | | — | | | 3 | | | 0.01 | |

| As adjusted | $ | 118 | | | $ | 0.21 | | | $ | 90 | | | $ | 0.16 | |

(a)During the three months ended September 30, 2023, the Company recognized non-cash impairment charges of $21 million at the News Media segment related to the write-down of fixed assets associated with the combination of News UK’s printing operations with those of DMG Media.

NOTE 4 – CONSTANT CURRENCY REVENUES

The Company believes that the presentation of revenues excluding the impact of foreign currency fluctuations (“constant currency revenues”) provides useful information regarding the performance of the Company’s core business operations exclusive of distortions between periods caused by the unpredictability and volatility of currency fluctuations. The Company calculates the impact of foreign currency fluctuations for businesses reporting in currencies other than the U.S. dollar as described in Note 2.

Constant currency revenues are not measures of performance under generally accepted accounting principles and should not be construed as substitutes for revenues as determined under GAAP as measures of performance. However, management uses these measures in comparing the Company’s historical performance and believes that they provide meaningful and comparable information to investors to assist in their analysis of our performance relative to prior periods and our competitors.

The following tables reconcile reported revenues to constant currency revenues for the three months ended September 30, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q1 Fiscal 2024 | | Q1 Fiscal 2025 | | FX impact | | Q1 Fiscal 2025 constant currency | | % Change - reported | | % Change - constant currency |

| ($ in millions) | | Better/(Worse) |

| Consolidated results: | | | | | | | | | | | |

| Circulation and subscription | $ | 1,129 | | | $ | 1,157 | | | $ | 18 | | | $ | 1,139 | | | 2 | % | | 1 | % |

| Advertising | 391 | | | 381 | | | 6 | | | 375 | | | (3) | % | | (4) | % |

| Consumer | 502 | | | 521 | | | 3 | | | 518 | | | 4 | % | | 3 | % |

| Real estate | 311 | | | 357 | | | 6 | | | 351 | | | 15 | % | | 13 | % |

| Other | 166 | | | 161 | | | 2 | | | 159 | | | (3) | % | | (4) | % |

| Total revenues | $ | 2,499 | | | $ | 2,577 | | | $ | 35 | | | $ | 2,542 | | | 3 | % | | 2 | % |

| | | | | | | | | | | |

| Dow Jones: | | | | | | | | | | | |

| Circulation and subscription | $ | 436 | | | $ | 459 | | | $ | 2 | | | $ | 457 | | | 5 | % | | 5 | % |

| Advertising | 91 | | | 85 | | | — | | | 85 | | | (7) | % | | (7) | % |

| Other | 10 | | | 8 | | | — | | | 8 | | | (20) | % | | (20) | % |

| Total Dow Jones segment revenues | $ | 537 | | | $ | 552 | | | $ | 2 | | | $ | 550 | | | 3 | % | | 2 | % |

| | | | | | | | | | | |

| Digital Real Estate Services: | | | | | | | | | | | |

| Circulation and subscription | $ | 3 | | | $ | 2 | | | $ | — | | | $ | 2 | | | (33) | % | | (33) | % |

| Advertising | 35 | | | 38 | | | — | | | 38 | | | 9 | % | | 9 | % |

| Real estate | 311 | | | 357 | | | 6 | | | 351 | | | 15 | % | | 13 | % |

| Other | 54 | | | 60 | | | 1 | | | 59 | | | 11 | % | | 9 | % |

| Total Digital Real Estate Services segment revenues | $ | 403 | | | $ | 457 | | | $ | 7 | | | $ | 450 | | | 13 | % | | 12 | % |

| | | | | | | | | | | |

| REA Group revenues | $ | 261 | | | $ | 318 | | | $ | 7 | | | $ | 311 | | | 22 | % | | 19 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q1 Fiscal 2024 | | Q1 Fiscal 2025 | | FX impact | | Q1 Fiscal 2025 constant currency | | % Change - reported | | % Change - constant currency |

| ($ in millions) | | Better/(Worse) |

| Book Publishing: | | | | | | | | | | | |

| Consumer | $ | 502 | | | $ | 521 | | | $ | 3 | | | $ | 518 | | | 4 | % | | 3 | % |

| Other | 23 | | | 25 | | | — | | | 25 | | | 9 | % | | 9 | % |

| Total Book Publishing segment revenues | $ | 525 | | | $ | 546 | | | $ | 3 | | | $ | 543 | | | 4 | % | | 3 | % |

| | | | | | | | | | | |

| Subscription Video Services: | | | | | | | | | | | |

| Circulation and subscription | $ | 415 | | | $ | 425 | | | $ | 10 | | | $ | 415 | | | 2 | % | | — | % |

| Advertising | 62 | | | 65 | | | 1 | | | 64 | | | 5 | % | | 3 | % |

| Other | 9 | | | 11 | | | — | | | 11 | | | 22 | % | | 22 | % |

| Total Subscription Video Services segment revenues | $ | 486 | | | $ | 501 | | | $ | 11 | | | $ | 490 | | | 3 | % | | 1 | % |

| | | | | | | | | | | |

| News Media: | | | | | | | | | | | |

| Circulation and subscription | $ | 275 | | | $ | 271 | | | $ | 6 | | | $ | 265 | | | (1) | % | | (4) | % |

| Advertising | 203 | | | 193 | | | 5 | | | 188 | | | (5) | % | | (7) | % |

| Other | 70 | | | 57 | | | 1 | | | 56 | | | (19) | % | | (20) | % |

| Total News Media segment revenues | $ | 548 | | | $ | 521 | | | $ | 12 | | | $ | 509 | | | (5) | % | | (7) | % |

| | | | | | | | | | | |

| News UK | | | | | | | | | | | |

| Circulation and subscription | $ | 144 | | | $ | 146 | | | $ | 4 | | | $ | 142 | | | 1 | % | | (1) | % |

| Advertising | 59 | | | 50 | | | 2 | | | 48 | | | (15) | % | | (19) | % |

| Other | 25 | | | 11 | | | — | | | 11 | | | (56) | % | | (56) | % |

| Total News UK revenues | $ | 228 | | | $ | 207 | | | $ | 6 | | | $ | 201 | | | (9) | % | | (12) | % |

| | | | | | | | | | | |

| News Corp Australia | | | | | | | | | | | |

| Circulation and subscription | $ | 107 | | | $ | 103 | | | $ | 2 | | | $ | 101 | | | (4) | % | | (6) | % |

| Advertising | 93 | | | 90 | | | 2 | | | 88 | | | (3) | % | | (5) | % |

| Other | 38 | | | 41 | | | 1 | | | 40 | | | 8 | % | | 5 | % |

| Total News Corp Australia revenues | $ | 238 | | | $ | 234 | | | $ | 5 | | | $ | 229 | | | (2) | % | | (4) | % |

Susan Panuccio to Depart News Corp in 2025, with Lavanya Chandrashekar Joining the Company as New Chief Financial Officer

Panuccio’s departure comes after two successful decades at News Corp, including transformational leadership as Chief Financial Officer

Chandrashekar comes to News Corp after a successful run as CFO of Diageo and 25-plus years in global finance

New York, NY (November 7, 2024) – News Corp (NASDAQ: NWS, NWSA; ASX: NWS; NWSLV) announced today that Susan Panuccio will step down from her role as Chief Financial Officer on January 1, 2025, and will be succeeded by Lavanya Chandrashekar. Ms. Panuccio will continue in an advisory capacity for six months to help ensure a smooth transition and to support Ms. Chandrashekar.

Ms. Panuccio has been a key leader during a period of rapid expansion and transformation for News Corp since becoming Chief Financial Officer in March 2017. During her tenure, News Corp has achieved record results, and transitioned into a diversified digital- and subscription-first business. The company has generated very healthy free cash flows, successfully completed two debt offerings at attractive rates and boosted capital returns through its $1 billion repurchase program. Under Ms. Panuccio’s leadership, News Corp made several strategic investments within the company’s key growth pillars, including expansion of B2B at Dow Jones, while streamlining costs and adding high margin, content licensing revenues from tech platforms. During her time at News Corp, the company’s share price has risen over 140% since March 1, 2017, materially outpacing sector performance during that period.

“Susan’s steadfast leadership, sharp instincts and strategic mindset have helped guide News Corp through a remarkable period of growth. We will miss Susan deeply, and I am personally grateful for her partnership over the years,” said News Corp Chief Executive Robert Thomson. “Susan’s work not just here in New York, but in leadership roles in Australia and the United Kingdom, has been transformational for News Corp, and her impact cannot be understated. Her thoughtfulness and care for the company have continued through the succession process, and I am pleased to have her continued support for the remainder of this fiscal year.”

“After nearly eight years in this role and over two decades at News Corp, I am going to take some much-desired time off to spend with my family,” said Ms. Panuccio. “It has been a privilege to help Robert lead News Corp’s transformation into the global news and information powerhouse it is today, and I truly believe that the company has an incredibly bright future ahead. I have been so fortunate over the years to have had the support of both Rupert and Lachlan, together with our Board of Directors, and I would like to sincerely thank them all.”

The Board of Directors, in consultation with Ms. Panuccio, has executed a well planned succession process to identify and transition responsibility to her successor. Ms. Chandrashekar has nearly 30 years of experience in international finance and investor relations, and has held senior positions at blue chip consumer facing companies, including Procter & Gamble, Mondelēz and Diageo, where she was Chief Financial Officer from 2021 to September of 2024. During her tenure at Diageo, Ms. Chandrashekar led the company through

a period of profitable and accelerated growth, with the company growing at a 10.5% CAGR. An innovative global executive, Ms. Chandrashekar spearheaded and launched a multi-faceted global digital transformation program for Diageo. Her passion for mission and culture enabled the development and elevation of talent across the company.

“I am thrilled to welcome Lavanya to News Corp, and look forward to her joining our leadership team,” said News Corp Chief Executive Robert Thomson. “Lavanya’s mix of financial acumen, global experience and proven integrity were compelling characteristics of her professional personality. Lavanya has meaningful experience leading transformation initiatives, and her support will be welcome as News Corp continues its ambitious journey.”

“I have tremendous respect for News Corp and its leadership team, and am honored to join them,” said Ms. Chandrashekar. “I am fortunate to be joining this company during an exciting period of growth and transformation, and look forward to taking on the challenge of helping to shepherd News Corp into the future.”

###

About News Corp

News Corp (Nasdaq: NWS, NWSA; ASX: NWS, NWSLV) is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services. The company comprises businesses across a range of media, including: information services and news, digital real estate services, book publishing and subscription video services in Australia. Headquartered in New York, News Corp operates primarily in the United States, Australia, and the United Kingdom, and its content and other products and services are distributed and consumed worldwide. More information is available at: http://www.newscorp.com.

Contacts

News Corp Corporate Communications

Arthur Bochner

646-422-9671

abochner@newscorp.com

News Corp Investor Relations

Michael Florin

212-416-3363

mflorin@newscorp.com

Anthony Rudolf

212-416-3040

arudolf@newscorp.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassBMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

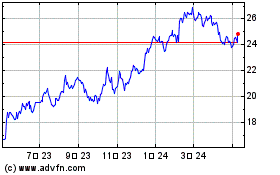

News (NASDAQ:NWSA)

過去 株価チャート

から 11 2024 まで 12 2024

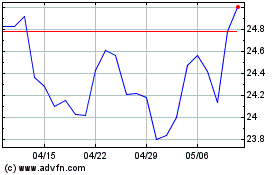

News (NASDAQ:NWSA)

過去 株価チャート

から 12 2023 まで 12 2024