Form 8-K - Current report

2025年1月30日 - 4:24AM

Edgar (US Regulatory)

0001490906FALSE00014909062025-01-282025-01-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

January 28, 2025

| | | | | | | | | | | | | | |

| | | | |

| CAPITOL FEDERAL FINANCIAL, INC. |

|

| (Exact name of Registrant as specified in its Charter) |

| | | | | | | | |

| | |

| Maryland | 001-34814 | 27-2631712 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | | | | |

| 700 South Kansas Avenue, | Topeka | Kansas | 66603 |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code

(785) 235-1341

| | | | | | | | | | | | | | |

| N/A |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | CFFN | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.07 SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

Capitol Federal Financial, Inc. (the “Company”) held its Annual Meeting of Stockholders on January 28, 2025 (the “Annual Meeting”). Holders of record of the Company’s common stock at the close of business on December 6, 2024 were entitled to vote on four items at the Annual Meeting. Stockholders elected John B. Dicus, James G. Morris, and Jeffrey R. Thompson each to a three-year term as director. The stockholders approved, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in the Company’s proxy statement for the Annual Meeting (the "Say on Pay Vote"). The stockholders ratified the appointment of KPMG LLP as the Company’s independent auditors for the fiscal year ending September 30, 2025. Stockholders did not approve an amendment of the Company's charter to declassify the Board of Directors. The final voting results of each item are set forth below.

| | | | | | | | | | | | | | | | | | | | | | | |

| Number of Votes |

| For | | Withheld | | Abstained | | Broker Non-Votes |

| Proposal 1. | | | | | | | |

| Election of the following directors for the terms indicated: | | | | | | |

| John B. Dicus (three years) | 91,688,813 | | | 4,485,248 | | | 153,919 | | | 15,396,798 | |

| James G. Morris (three years) | 86,350,675 | | | 9,838,762 | | | 138,544 | | | 15,396,798 | |

| Jeffrey R. Thompson (three years) | 80,176,985 | | | 16,006,718 | | | 144,277 | | | 15,396,798 | |

| | | | | | | |

| The following directors had their term of office continue after the meeting: |

| Michel' Philipp Cole | | | | | | | |

| Michael T. McCoy, M.D. | | | | | | | |

| Jeffrey M. Johnson | | | | | | | |

| Morris J. Huey, II | | | | | | | |

| Carlton A. Ricketts | | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Number of Votes |

| For | | Against | | Abstained | | Broker Non-Votes |

| Proposal 2. | | | | | | | |

| Stockholder approval, on advisory basis, of executive compensation | 90,911,598 | | | 5,092,073 | | | 324,309 | | | 15,396,798 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Number of Votes |

| For | | Against | | Abstained | | Broker Non-Votes |

| Proposal 3. | | | | | | | |

| Ratification of KPMG LLP as independent auditors | 111,038,191 | | | 568,073 | | | 118,514 | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Number of Votes | | | | |

| For | | Against | | | | |

| Proposal 4. | | | | | | | |

| Amendment to Charter for Board of Directors declassification | 87,062,453 | | | 24,662,325 | | | | | |

| | | | | | | |

| Approval of an Amendment requires the affirmative vote of the holders of at least eighty percent (80%) of the voting power of the outstanding shares of the Company’s common stock (after giving effect to the 10% voting limitation in Article 5.D. of the Company’s charter) as of the voting record date for the annual meeting which represents 101,476,289 shares for fiscal year 2024. Abstentions and Non Broker votes are treated as votes against. The Amendment to the Company's charter failed to pass. |

ITEM 7.01 REGULATION FD DISCLOSURE

Attached hereto as Exhibit 99 and incorporated herein by reference are the slides from the Company's presentation at the Annual Meeting on January 28, 2025.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

Exhibit 104 – Cover page interactive data file (embedded within the Inline XBRL document)

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| |

| CAPITOL FEDERAL FINANCIAL, INC. |

| Date: January 29, 2025 | By: /s/ Kent G. Townsend | |

| | |

| | |

| Kent G. Townsend, Executive Vice-President, | |

| Chief Financial Officer, and Treasurer | |

John B. Dicus, Chairman, President & CEO Michel’ Philipp Cole, ABC Morris J. Huey, II Jeffrey M. Johnson Michael T. McCoy, M.D. James G. Morris Carlton A. Ricketts Jeffrey R. Thompson Board of Directors 2

Management John B. Dicus, Chairman, President & CEO Anthony S. Barry, Chief Corporate Services Officer Natalie G. Haag, General Counsel & Corporate Secretary Rick C. Jackson, Chief Lending Officer William J. Skrobacz, Jr., Chief Retail Operations Officer Kent G. Townsend, Chief Financial Officer 3

Safe Harbor Disclosure Except for the historical information contained in this presentation, the matters discussed herein may be deemed to be "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements about our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions. The words "may," "could," "should," "would," "will," "believe," "anticipate," "estimate," "expect," "intend," "plan," and similar expressions are intended to identify forward-looking statements. Forward- looking statements involve risks and uncertainties, including: changes in policies or the application or interpretation of laws and regulations by regulatory agencies and tax authorities; other governmental initiatives affecting the financial services industry; changes in accounting principles, policies or guidelines; fluctuations in interest rates and the effects of inflation or a potential recession, whether caused by Federal Reserve action or otherwise; the impact of bank failures or adverse developments at other banks and related negative press about the banking industry in general on investor or depositor sentiment; demand for loans in Capitol Federal Financial, Inc.’s market areas; the future earnings and capital levels of Capitol Federal Savings Bank and the impact of the pre-1988 bad debt recapture, which could affect the ability of Capitol Federal Financial, Inc. to pay dividends in accordance with its dividend policies; competition; and other risks detailed from time to time in documents filed or furnished by Capitol Federal Financial, Inc. with the Securities and Exchange Commission (“SEC”). Actual results may differ materially from those currently expected. These forward-looking statements represent Capitol Federal Financial, Inc.’s judgment as of the date of this presentation. Capitol Federal Financial, Inc. disclaims, however, any intent or obligation to update these forward-looking statements. 4

Selected Balance Sheet Data September 30, 2024 2023 (in thousands) Total Assets $ 9,527,608 $ 10,177,461 Total Loans $ 7,907,338 $ 7,970,949 Total Securities $ 856,266 $ 1,384,482 Total Deposits $ 6,129,982 $ 6,051,220 Total Borrowings $ 2,179,564 $ 2,879,125 Total Stockholders' Equity $ 1,032,270 $ 1,044,054 5

Strategic Securities Transaction • In October 2023, the Company completed a strategic securities transaction by selling $1.30 billion of securities representing 94% of the portfolio. • The Company recognized an impairment loss of $145.5 million, after tax, in fiscal year 2023. An additional $10.0 million after tax loss was recorded in 2024 as the securities were sold in October 2023. 6

Financial Performance FY 2024 Without Strategic Securities Actual Transaction (GAAP) (Non-GAAP) Net Income (in thousands) $ 38,010 $ 48,099 Earnings Per Share (basic & diluted) $ 0.29 $ 0.37 Return on Average Assets 0.40% 0.50% Return on Average Equity 3.69% 4.66% Efficiency Ratio 66.91% 61.97% 7

Financial Performance FY 2024 Net Interest Margin 1.77% Operating Expense Ratio 1.17% Non-performing Assets to Total Assets 0.11% Equity to Total Assets 10.83% 8

Number of shares repurchased 1,246,110 Average price per share $ 6.00 Total amount repurchased $ 7,475,387 *Paid in February, May, August, and November. Calendar Year 2024 Dividends and Share Repurchases Total regular quarterly dividends* $ 44,274,413 9

(in m ill io ns ) $1,916.9 $1,968.7 $428.5 $436.0 $1,488.4 $1,532.7 2023 2024 $0.0 $400.0 $800.0 $1,200.0 $1,600.0 $2,000.0 $2,400.0 Cumulative Cash Returned to Stockholders Stockholder Dividends $10.98/sh per share Share Repurchases 39,992,307 shares Avg. Price of $10.90 10

Payment of Dividends • CFFN declared a regular quarterly dividend of $0.085 per share on January 28, 2025. • For fiscal year 2025, it is the intent of our Board and management to pay out the regular quarterly cash dividend of $0.085 per share, totaling $0.34 per share for the year. • Because of the $50.1 million of cash at the Company level at September 30, 2024, management and the Board believe that cash is at a sufficient level to pay our four quarterly cash dividends in fiscal year 2025 of $0.085 per share without requiring a distribution from the Bank to the Company and thus triggering an additional tax obligation. 11

Long-Term Strategy • Commercial Banking • Deposit Services • Single-Family Portfolio Lender • Excellent Asset Quality • Strong Cost Controls • Strong Capital Position • Stockholder Value • Interest Rate Risk Management 12

Questions & Answers

Chairman Emeritus, Jack C. Dicus May 16, 1933 - June 19, 2024

Thank you for attending

Financial Performance FY 2024 Non-GAAP Reconciliation For the Year Ended September 30, 2024 Without Strategic Strategic Securities Actual Securities Transaction (GAAP) Transaction (Non-GAAP) Net Income (in thousands) $ 38,010 $ (10,089) $ 48,099 Earnings Per Share (basic & diluted) $ 0.29 $ (0.08) $ 0.37 Return on Average Assets 0.40% (0.10%) 0.50% Return on Average Equity 3.69% (0.97%) 4.66% Efficiency Ratio 66.91% 4.94% 61.97%

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

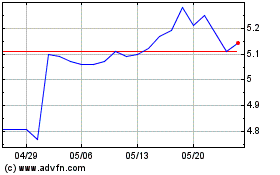

Capitol Federal Financial (NASDAQ:CFFN)

過去 株価チャート

から 1 2025 まで 2 2025

Capitol Federal Financial (NASDAQ:CFFN)

過去 株価チャート

から 2 2024 まで 2 2025