Ethereum Active Addresses Surge By 36% In Support Of Bullish Price Action – Details

2024年12月9日 - 6:00AM

NEWSBTC

Shortly after surging above $4,000 on December 6, Ethereum (ETH)

has sunk into a state of consolidation showing no significant price

action over the last day. With growing speculations over the

altcoin’s next price movement, CryptoQuant analyst Burak Kesmeci

has shared a report that suggests a sustained price rally by

Ethereum. Related Reading: Ethereum Price Breakout: Charting The

Uncertain Part Of ETH To $18,000 US Election Results Drive Ethereum

Active Addresses To 417,000 Following the US elections of November

5, Ethereum, alongside a host of other cryptocurrencies, has

experienced massive price gains driven primarily by the emergence

of pro-crypto candidate Donald Trump as the US

President-elect. According to Burak Kesmeci, the results of

the US elections removed much uncertainty around the crypto market

while encouraging investment as evidenced by price gains of several

tokens. Notably, Ethereum, known as the “Father of altcoins”, has

recorded a price growth of 70% since November 5 reaching a local

peak of $4,077. As with all price rallies, there is

continuous speculation on Ethereum’s ability to maintain its

current upward price trajectory. Joining the discourse, Kesmeci has

drawn a bullish inference from the asset’s change in active

address. The CryptoQuant analyst highlights that during

Ethereum’s recent price surge, active addresses on its network

increased by 36.26% from 306,000 on November 5, to its current

value of 417,000. This development indicates that the price

increase of Ethereum was based on an equal rise in organic demand

and market interest by investors and blockchain users. In

conclusion, Burak Kesmeci states the growth in Ethereum active

addresses backs the recent price rally as “healthy and

sustainable”. Importantly, it is also a bullish signal that

indicates ETH is likely to experience a long-term price surge.

Related Reading: Ethereum To Pull A BTC 2021-Like Rally? Analyst

Shares Massive Prediction ETH Price Overview According to data from

CoinMarketCap, Ethereum trades at $4,006 reflecting a slight loss

of 0.54% in the past 24 hours. For long-term investors, the

prominent altcoin remains in profit based on gains of 7.36% and

39.31% in the last seven and 30 days, respectively. If ETH

breaks upward following its current consolidation, the altcoin will

face significant resistance at $4,100. However, moving past this

price zone opens a potential pathway to $4,900 which lies around

Ethereum’s all-time high at $4,891. Aside from a rise in Ethereum

active addresses, other developments continue to contribute to the

heightened bullish sentiments around the second-largest

cryptocurrency. This includes an increase in the inflows to the

Ethereum spot ETFs, as backed by a cumulative total net inflow of

$1.41 billion. In addition, the altseason appears to be

kicking off with widespread gains tipped to occur in early 2025.

Featured image from Forbes, chart from Tradingview

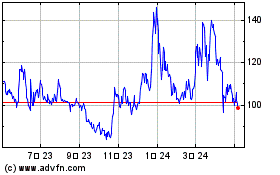

Quant (COIN:QNTUSD)

過去 株価チャート

から 11 2024 まで 12 2024

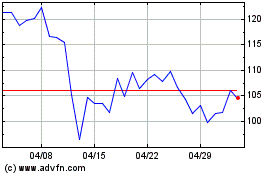

Quant (COIN:QNTUSD)

過去 株価チャート

から 12 2023 まで 12 2024