Bitcoin Coinbase Premium Giving Potential Buy Signal, Quant Says

2024年12月25日 - 7:00AM

NEWSBTC

A quant has explained how the latest trend in the Bitcoin Coinbase

Premium Index could imply a buying opportunity for the asset.

Bitcoin Coinbase Premium Index Has Plunged To -0.221% In a

CryptoQuant Quicktake post, an analyst talked about the latest

development in the Bitcoin Coinbase Premium Index. The “Coinbase

Premium Index” refers to a metric that keeps track of the

percentage difference between the BTC price on Coinbase (USD pair)

and that on Binance (USDT pair). When the value of this metric is

positive, it means the cryptocurrency is trading at a higher rate

on Coinbase than on Binance. Such a trend implies there is a higher

buying pressure or a lower selling pressure present on the former

as compared to the latter. Related Reading: Dogecoin & Other

Memecoins No Longer Grabbing Social Media Attention: Santiment On

the other hand, the indicator being under the zero mark suggests

that Binance users are participating in a higher amount of buying

than Coinbase ones as they have pushed BTC to a higher value there.

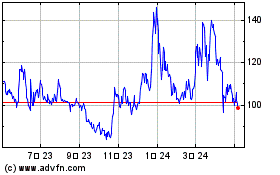

Now, here is a chart that shows the trend in the Bitcoin Coinbase

Premium Index over the last few months: From the graph, it’s

visible that the Bitcoin Coinbase Premium Index has seen a sharp

decline into the negative region recently, meaning that sellers

have appeared on Coinbase. Alongside this selling, the BTC price

has also witnessed a decline, which would suggest the negative

premium could be the source of it. The cryptocurrency has actually

been following the indicator in this manner throughout the year,

with its price going up and down alongside buying and selling

shifts on Coinbase. The reason behind this relationship potentially

lies in the fact that Coinbase is home to US-based institutional

investors, who have had a significant presence in the market this

year. The Coinbase Premium Index being red right now would

naturally imply these giant investors are selling. Considering that

BTC’s price has been following the metric, this would be a bearish

signal for the asset. There exists another pattern, however, that

could imply a different outcome for Bitcoin. As the quant has

highlighted in the chart, the metric has seen a rebound whenever

its value has gone to the -0.2% mark during the past year. Related

Reading: Bitcoin To Top Above $168,500 Based On This Indicator,

Analyst Reveals The explanation behind the pattern may be that it’s

usually around this level of selling that new buyers show up and

decide to accumulate on the dip, pushing the metric as well as the

price up in the process. The current value of the indicator is

sitting at -0.221%, so it’s possible that Bitcoin could be close to

reaching a bottom, if it hasn’t already formed one. This would only

be, of course, if the institutional investors think that the bull

run is still on. BTC Price Bitcoin briefly went under the $93,000

level yesterday, but it seems the coin has found a rebound as its

price is now trading around $94,100. Featured image from Dall-E,

CryptoQuant.com, chart from TradingView.com

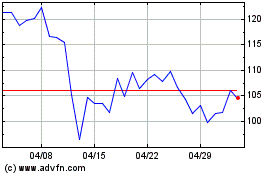

Quant (COIN:QNTUSD)

過去 株価チャート

から 11 2024 まで 12 2024

Quant (COIN:QNTUSD)

過去 株価チャート

から 12 2023 まで 12 2024