Battle For The Halving Block: Bitcoin Users Spend Record $2.4 Million On Block 840,000

2024年4月21日 - 6:00AM

NEWSBTC

With Bitcoin finally completing its fourth-year halving cycle, many

users are aggressively competing for halving blocks, paying

exorbitant amounts of fees to mine a single block. Bitcoin

Mining Pool Pays Over $2.4 Million In Block Fees Earlier today, the

840,000th block was added to the Bitcoin blockchain, triggering the

onslaught of the highly anticipated halving event. While the price

of BTC did not witness a dramatic change following the halving,

transaction fees spiked to unprecedented highs. Related

Reading: Ripple CEO Walks Back $5 Trillion Crypto Marker

Prediction, Unveils New Target Amidst the massive competition, a

mining pool identified as ViaBTC had successfully mined the

840,000th Bitcoin block. Cumulatively, BTC users had spent a

staggering $37.7 BTC in mining fees, equivalent to $2.4 million,

recording the highest fee ever paid for a Bitcoin block.

According to reports from mempool, after ViaBTC had produced the

840,000th block, the protocol had initiated an automated reduction

of miners’ reward by half, from 6.25 BTC to 3.125 BTC per block. In

addition to the fees, ViaBTC had received a total payout of 40.7

BTC, valued at approximately $2.6 million, for mining the historic

block. While it may seem that Bitcoin miners had thrown

caution to the wind by spending over $2.4 million on a single

block, the 840,000th block had a major significance within the

cryptocurrency space. The historic Bitcoin block is said to hold

the first Satoshis, ‘sats,’ the smallest units of BTC following the

halving. There are several of these “epic sats,” that appear

after the halving event, coveted as a rare collector’s item among

cryptocurrency enthusiasts. Some even speculate that these Bitcoin

fragments could be potentially worth millions of dollars.

Including the hype surrounding these fragmented BTC, much of the

competition for the Bitcoin blocks, following the halving has been

attributed to the new Runes Protocol which launched at the same

time as the Bitcoin halving. Degens Rush To Secure Infamous

Rune Tokens The Runes Protocol, created by Casey Rodamor, a Bitcoin

developer, has sent shockwaves through the cryptocurrency

community, as degens are avidly competing to etch and mint tokens

directly on the Bitcoin network. While mining pools were

mining new Bitcoin blocks, degens had paid over 78.6 BTC valued at

$4.95 million to mint the rarest Runes. This exponential surge in

fees has been an unprecedented event, highlighting the increased

adoption and participation of the Bitcoin network. Related Reading:

Shiba Inu Burn Rate Sees 81% Daily Increase, But Why Is

Participation Low? According to reports from Ord.io, a Rune labeled

as ‘Decentralized’ was acquired for a fee of 7.99 BTC, equivalent

to $510,760. While another titled ‘Dog-Go-To-The-Moon’ was obtained

for a fee of 6.73 BTC, worth approximately $429,831. Leonidas,

protocol developer and host of the groundbreaking Ordinals, a

system for numbering “epic sats,” has declared the Runes Protocol a

remarkable success as degens have “single-handedly offset the drop

in miner rewards from the halving.” He concluded that Runes have

significantly impacted Bitcoin’s security budget, potentially

playing a major role in ensuring the network’s sustainability. BTC

price sitting at $63,700 after halving | Source: BTCUSD on

Tradingview.com Featured image from Watcher Guru, chart from

Tradingview.com

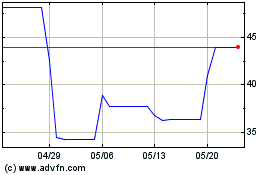

Ordinals (COIN:ORDIUSD)

過去 株価チャート

から 11 2024 まで 12 2024

Ordinals (COIN:ORDIUSD)

過去 株価チャート

から 12 2023 まで 12 2024