TIDMHFI

Hydrogen Future Industries plc

("HFI", the "Group" or the "Company")

Final Results for the 13 Months Ended 31 July 2022

Hydrogen Future Industries plc (AQSE:HFI), a developer of proprietary wind and

water-based green hydrogen production systems, presents its audited financial

results for the 13 months ended 31 July 2022.

Highlights

* Shares admitted to trading on Aquis Stock Exchange Growth Market on 1

December 2021

* Raised gross proceeds of £2.23 million to pursue a strategy to identify

investment opportunities within the Hydrogen Economy

* Announced on 29 March 2022 the formation of a wholly owned subsidiary, HFI

Energy Systems Limited ("HESL"), to develop proprietary wind and

water-based hydrogen production systems, incorporating hydrogen compression

and storage

* Appointed Timothy Blake as Chief Executive Officer of HESL to lead this

development

* Cash balance at period end of £1.38 million

Daniel Maling, Non-Executive Chairman, commented:

"HFI has made progress since listing on the Aquis Stock Exchange Growth Market

in December 2021. We have entered the green hydrogen development space and

wasted no time in progressing the development of our first system. Our

development activities are being led by a recognised expert in wind turbine

systems, Timothy Blake; we have built and installed our first prototype in

Montana; and we have acquired valuable patents which strengthen our

intellectual property. With positive results already being achieved from

prototype testing, I believe we are well on our way to the Company's goal of

producing cheaper green hydrogen."

This announcement contains inside information for the purposes of the UK Market

Abuse Regulation and the Directors of the Company are responsible for the

release of this announcement.

Chairman's Statement

Introduction

I am pleased to present the financial results for the 13 months ended 31 July

2022, a period which included the admission in December 2021 of the Company's

shares to the Aquis Stock Exchange ("AQSE") Growth Market as a Special Purpose

Acquisition Company and, in March 2022, the formation of a wholly owned

subsidiary, HFI Energy Systems Limited ("HESL"), to develop proprietary wind

and water-based hydrogen production systems, incorporating hydrogen compression

and storage.

Alongside the AQSE listing, Hydrogen Future Industries ("HFI") successfully

raised £2.23 million as investors supported the Company's strategy to invest in

hydrogen, widely regarded as the 'future fuel' and essential in achieving net

zero emissions. In March 2022, HFI became actively engaged in the development

of proprietary wind and water-based hydrogen production systems and we are

making exciting progress on this technology.

The Hydrogen Economy

The 'Hydrogen Economy' refers to a vision that the Company shares of using

hydrogen as a clean, low-carbon energy resource to meet a portion of the

world's energy needs. The potential of hydrogen to replace traditional fossil

fuels and form a substantial part of a global clean energy portfolio is already

being realised - particularly within transportation sectors - and the Hydrogen

Council predicts the global hydrogen market will grow to US$2.5 trillion by

2050, meeting 18% of global energy demand.

A limiting factor to the expansive growth of the Hydrogen Economy has been the

high cost of production of green hydrogen, which refers to hydrogen produced

entirely from renewable sources, and this is largely due to the cost of

renewable energy generation. The cost of green hydrogen production currently

sits at anywhere between US$4 and US$6 per kilogram and must be reduced to

under US$2 to meet global targets this decade.

This is precisely what we aim to achieve through HESL's development of our

wind-based hydrogen production system.

HFI Energy Systems Limited ("HESL")

HESL, a wholly owned subsidiary of HFI, was formed in March 2022 in

collaboration with wind turbine engineer, and now HESL Chief Executive Officer,

Timothy Blake to develop and commercialise proprietary technologies based on

development work carried out by Mr Blake which the Company's Directors believe

will have a significant positive impact on the hydrogen production market by

materially lowering the cost of green hydrogen production.

The most advanced system under development is a wind-based hydrogen production

system combined with electrolyser technologies which aims to generate hydrogen

for under $2 per kilogram (the "System").

A key element of the System is its proprietary wind turbine, which has been

designed with notably distinct features which allow the turbines to be more

efficient than current open rotor turbines due to modified aerodynamics, with

cowling directing air flow across the rotor blades to create a multiple factor

increase in wind speed. The cowling also directs the flow of wind out and away

from the rear of the turbine, reducing the potential for still air to block the

flow through the turbines.

The Directors believe the increased efficiency of the turbine could in turn

increase the efficiency and ultimately lower the cost of hydrogen production.

We will seek in due course to incorporate hydrogen compression and on-demand

energy storage technology, allowing energy to be stored in the form of hydrogen

at a fraction of the cost of lithium-ion battery storage, solving the

challenges faced by current windfarms during periods of reduced energy demand.

The System aims to generate hydrogen from a choice of feed stocks including

waste or contaminated water, saline or fresh water, and remediation processes,

meaning it can be operated in a variety of settings, including offshore,

mining, and industrial.

Financial Review

For the year ended 31 July 2022, the Company reported a net loss of

approximately £700k mostly relating to administrative expenses in connection

with the listing on Aquis Stock Exchange Growth Market, due diligence in

relation to prospective investments, and development activities related to the

System. The Company's cash position at 31 July 2022 was £1.38 million.

The independent audit report draws attention to note 2.2 in the financial

statements which indicates that, whilst forecast cash inflows are in advanced

stages of negotiation, there is no certainty regarding the quantum or timing of

these cashflows. As stated in note 2.2, these events or conditions indicate

that a material uncertainty exists that may cast significant doubt on the

Group's and Parent Company's ability to continue as a going concern. The

auditor's opinion is not modified in respect of this matter. The Independent

Auditor's Report is set out in full below.

Post Period End

On 5 October 2022, HFI announced the acquisition of a suite of international

patents which are relevant to the System by the Company's joint venture

subsidiary HFI IP Holdings Limited. The patents acquired cover a range of works

including ducted wind turbine rotor configurations; a dynamic telescopic tower

to optimise wind farm energy production and reduce maintenance cost; a variable

hydraulic drive and electro-magnetic clutch to increase efficiency and lower

cost of energy production; and the conversion of stored energy to green

hydrogen. These patents significantly enhance the intellectual property around

the System and have potential wider commercial applications beyond HFI's

systems which could represent opportunities for early cash flow.

On 1 November 2022, the Company announced the commencement of testing of the

wind element of the System in the form of a 1 metre diameter prototype ("the

Prototype") in Montana, USA.

The Prototype is being tested in an area selected for its consistent wind

speeds and regulatory support for wind turbine development and wind farm

placement. HFI has a local development facility where the turbines have been

fabricated and mounted onto towers for testing in local wind speeds. The power

output from the turbines will be compared to predicted results. The cowling and

rotor blades are a product of aerodynamic development and have been 3D printed

on site.

The first stage of the outdoor test programme - a 20-hour live test - was

successfully completed, confirming the aerodynamics align to the wind direction

as planned, there was no distinguishing noise from the rotor blades, and there

was no fouling of the blades with the cowling.

Outlook

The testing HFI is undertaking in Montana will hopefully confirm the efficiency

of the key elements of the System, confirming the results of earlier wind

tunnel testing. Additionally, given the considerable efficiency gains we

believe our turbine will offer compared to existing open rotor wind turbines in

use today, the commercial applications for the HFI turbine may not be limited

to hydrogen and could be applied to the wider wind energy sector.

The wind turbine is the key first element of our System as cheaper energy

should ultimately result in lower cost hydrogen. During the period ahead we

intend to gather data from the 1 metre diameter prototype and plan for the next

phase of testing with a larger turbine and with hydrogen production capability

integrated. With positive results already being achieved, I believe we are

progressing to the Company's target of producing cheaper green hydrogen.

Daniel Maling

Non-Executive Chairman

22 December 2022

Enquiries:

Hydrogen Future Industries plc

Daniel Maling +44 (0)20 3475 6834

David Ormerod

Vigo Consulting (Investor Relations)

Ben Simons +44 (0) 20 7390 0230

Peter Jacob

Cairn Financial Advisers LLP (AQSE

Corporate Adviser)

Ludovico Lazzaretti +44 (0) 20 72130 880

Liam Murray

Peterhouse Capital Limited (Broker)

Duncan Vasey +44 (0) 20 7469 0930

Independent auditor's report to the members of Hydrogen Future Industries PLC

Opinion

We have audited the financial statements of Hydrogen Future Industries plc (the

"Parent Company") and its subsidiaries (the "Group") for the period ended 31

July 2022, which comprise:

* the Group statement of comprehensive income for the period ended 31 July

2022;

* the Group and Parent Company statements of financial position as at 31 July

2022;

* the Group and Parent Company statements of changes in equity for the year

then ended;

* the Group and Parent Company statements of cash flows for the year then

ended; and

* the notes to the financial statements, including significant accounting

policies.

The financial reporting framework that has been applied in the preparation of

the financial statements is applicable law and UK-adopted international

accounting standards.

In our opinion the financial statements:

* give a true and fair view of the state of the Group's and of the Parent

Company's affairs as at 31 July 2022 and of the Group's loss for the period

then ended;

* have been properly prepared in accordance with UK-adopted international

accounting standards;

* have been prepared in accordance with the requirements of the Companies Act

2006.

Basis for opinion

We conducted our audit in accordance with International Standards on Auditing

(UK) (ISAs (UK)) and applicable law. Our responsibilities under those standards

are further described in the Auditor's responsibilities for the audit of the

financial statements section of our report. We are independent of the Group and

the Parent Company in accordance with the ethical requirements that are

relevant to our audit of the financial statements in the UK, including the

FRC's Ethical Standard as applied to listed entities, and we have fulfilled our

other ethical responsibilities in accordance with these requirements. We

believe that the audit evidence we have obtained is sufficient and appropriate

to provide a basis for our opinion.

Material uncertainty related to going concern

We draw attention to note 2.2 in the financial statements, which indicates that

whilst forecast cash inflows are in advance stages of negotiation there is no

certainty regarding the quantum or timing of these cashflows. As stated in note

2.2, these events or conditions indicate that a material uncertainty exists

that may cast significant doubt on the Company's ability to continue as a going

concern. Our opinion is not modified in respect of this matter.

In auditing the financial statements, we have concluded that the Directors' use

of the going concern basis of accounting in the preparation of the financial

statements is appropriate but there is a material uncertainty in relation to

this matter. Our evaluation of the Directors' assessment of the Group's and

Parent Company's ability to continue to adopt the going concern basis of

accounting included:

* Reviewing management's financial projections which covered a period of at

least 12 months from the date of approval of the financial statements.

* Challenging management on the assumptions underlying those projections

particularly on the nature and timing of forecast cash inflows.

* Obtaining the latest management accounts post period end to benchmark how

the Group is performing toward achieving the forecast.

* Performing sensitivity analysis and reviewing the client's own sensitised

forecasts to consider the impact on the Group's ability to continue as a

going concern.

* Assessing the completeness and accuracy of the matters described in the

going concern disclosure within the significant accounting policies as set

out on note 2.2.

Our responsibilities and the responsibilities of the Directors with respect to

going concern are described in the relevant sections of this report.

Overview of our audit approach

Materiality

In planning and performing our audit we applied the concept of materiality. An

item is considered material if it could reasonably be expected to change the

economic decisions of a user of the financial statements. We used the concept

of materiality to both focus our testing and to evaluate the impact of

misstatements identified.

Based on our professional judgement, we determined overall materiality for the

Group financial statements as a whole to be £35,000, based on 5% of Group loss

before tax. Materiality for the Parent Company financial statements as a whole

was set at £25,000 based on 2% of net assets.

We use a different level of materiality ('performance materiality') to

determine the extent of our testing for the audit of the financial statements.

Performance materiality is set based on the audit materiality as adjusted for

the judgements made as to the entity risk and our evaluation of the specific

risk of each audit area having regard to the internal control environment. This

is set at £25,000 for the Group and £17,500 for the parent.

Where considered appropriate performance materiality may be reduced to a lower

level, such as, for related party transactions and Directors' remuneration.

We agreed to report to it all identified errors in excess of £2,000. Errors

below that threshold would also be reported to it if, in our opinion as

auditor, disclosure was required on qualitative grounds.

Overview of the scope of our audit

Our scoping of the Group audit was tailored to enable us to give an opinion on

the financial statements as a whole. The Parent company was subject to a full

scope audit. The subsidiaries incorporated in the final 3 months of the period

where subject to audit considerations sufficient for our reporting on the

group.

Key Audit Matters

Key audit matters are those matters that, in our professional judgement, were

of most significance in our audit of the financial statements of the current

period and include the most significant assessed risks of material misstatement

(whether or not due to fraud) that we identified. These matters included those

which had the greatest effect on: the overall audit strategy, the allocation of

resources in the audit; and directing the efforts of the engagement team. These

matters were addressed in the context of our audit of the financial statements

as a whole, and in forming our opinion thereon, and we do not provide a

separate opinion on these matters.

Except for the matter described in the material uncertainty relating to going

concern section of our report above, we have not determined any other matters

to be included as key audit matters to be communicated in our report.

Other information

The Directors are responsible for the other information contained within the

annual report. The other information comprises the information included in the

annual report, other than the financial statements and our auditor's report

thereon. Our opinion on the financial statements does not cover the other

information and, except to the extent otherwise explicitly stated in our

report, we do not express any form of assurance conclusion thereon.

Our responsibility is to read the other information and, in doing so, consider

whether the other information is materially inconsistent with the financial

statements or our knowledge obtained in the audit or otherwise appears to be

materially misstated. If we identify such material inconsistencies or apparent

material misstatements, we are required to determine whether this gives rise to

a material misstatement in the financial statements themselves. If, based on

the work we have performed, we conclude that there is a material misstatement

of this other information, we are required to report that fact. We have nothing

to report in this regard.

Opinion on other matter prescribed by the Companies Act 2006

In our opinion based on the work undertaken in the course of our audit

* the information given in the strategic report and the Directors' report for

the financial year for which the financial statements are prepared is

consistent with the financial statements; and

* the strategic report and the Directors' report have been prepared in

accordance with applicable legal requirements.

Matters on which we are required to report by exception

In light of the knowledge and understanding of the Group and the Parent Company

and their environment obtained in the course of the audit, we have not

identified material misstatements in the strategic report or the Directors'

report.

We have nothing to report in respect of the following matters where the

Companies Act 2006 requires us to report to you if, in our opinion:

* adequate accounting records have not been kept by the parent company, or

returns adequate for our audit have not been received from branches not

visited by us; or

* the parent company financial statements are not in agreement with the

accounting records and returns; or

* certain disclosures of Directors' remuneration specified by law are not

made; or

* we have not received all the information and explanations we require for

our audit.

Responsibilities of the Directors for the financial statements

As explained more fully in the Directors' responsibilities statement the

Directors are responsible for the preparation of the financial statements and

for being satisfied that they give a true and fair view, and for such internal

control as the Directors determine is necessary to enable the preparation of

financial statements that are free from material misstatement, whether due to

fraud or error.

In preparing the financial statements, the Directors are responsible for

assessing the Group's and Parent Company's ability to continue as a going

concern, disclosing, as applicable, matters related to going concern and using

the going concern basis of accounting unless the Directors either intend to

liquidate the Group or the Parent Company or to cease operations, or have no

realistic alternative but to do so.

Auditor's responsibilities for the audit of the financial statements

Our objectives are to obtain reasonable assurance about whether the financial

statements as a whole are free from material misstatement, whether due to fraud

or error, and to issue an auditor's report that includes our opinion.

Reasonable assurance is a high level of assurance, but is not a guarantee that

an audit conducted in accordance with ISAs (UK) will always detect a material

misstatement when it exists. Misstatements can arise from fraud or error and

are considered material if, individually or in the aggregate, they could

reasonably be expected to influence the economic decisions of users taken on

the basis of these financial statements.

Irregularities, including fraud, are instances of non-compliance with laws and

regulations. We design procedures in line with our responsibilities, outlined

above, to detect material misstatements in respect of irregularities, including

fraud. The extent to which our procedures are capable of detecting

irregularities, including fraud is detailed below however the primary

responsibility for the prevention and detection of fraud lies with management

and those charged with governance of the Company.

As part of the audit planning process we assessed the different areas of the

financial statements, including disclosures, for the risk of material

misstatement. This included considering the risk of fraud where Director

enquires were made of management and those charged with governance concerning

both whether that had any knowledge of actual suspected fraud and their

assessment of the susceptibility of fraud.

We considered the risk was greater in areas which involve significant

management estimate or judgement. Based on this assessment we designed audit

procedures to focus on key areas of estimate or judgement, this included

specific testing of journal transactions both at the period end and throughout

the year.

We use data analytic techniques to identify any unusual transactions or

unexpected relationships, including consider the risk of undisclosed related

party transactions.

Owing to the inherent limitations of an audit, there is an unavoidable risk

that some material misstatement of the financial statements may not be detected

even though the audit properly planned in accordance with the ISAs (UK).

The potential effects of inherent limitations are particularly significant in

the case of misstatement resulting from fraud because fraud may involve

sophisticated and carefully organised schemes designed to conceal it, including

deliberate failure to record transactions, collusion or intentional

misrepresentations being made to us.

A further description of our responsibilities is available on the Financial

Reporting Council's website at: www.frc.org.uk/auditorsresponsibilities. This

description forms part of our auditor's report.

Use of our report

This report is made solely to the Company's members, as a body, in accordance

with Chapter 3 of Part 16 of the Companies Act 2006. Our audit work has been

undertaken so that we might state to the Company's members those matters we are

required to state to them in an auditor's report and for no other purpose. To

the fullest extent permitted by law, we do not accept or assume responsibility

to anyone other than the Company and the Company's members as a body, for our

audit work, for this report, or for the opinions we have formed.

John Charlton

(Senior Statutory Auditor)

for and on behalf of

Crowe U.K. LLP

Statutory Auditor

55 Ludgate Hill

London EC4M 7JW

22 December 2022

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE 13 MONTH PERIODED 31 JULY 2022

Audited

Period ending 31 July

2022

Note £'000

Continuing Operations

Revenue from continuing operations

-

-

Expenditure

Costs associated with listing 4 (159)

Administrative expenses (541)

Operating loss 4 (700)

Loss before taxation (700)

Taxation 7 -

Loss after taxation (700)

Total comprehensive loss for the year (700)

attributable to shareholders from continuing

operations

Basic & dilutive earnings per share - pence 8

(3.433)

The notes form an integral part of these consolidated financial statements.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 JULY 2022

Audited

As at 31 July

2022

Note £'000

NON-CURRENT ASSETS

Fixed assets 9 18

Right of use assets 11 22

TOTAL NON-CURRENT ASSETS 40

CURRENT ASSETS

Cash and cash equivalents 12 1,383

Trade and other receivables 13 210

TOTAL CURRENT ASSETS 1,593

TOTAL ASSETS 1,633

EQUITY

Share capital 15 298

Share premium 15 1,900

Share based payment reserve 16 31

Retained earnings (700)

TOTAL EQUITY 1,529

NON-CURRENT LIABILITIES

Lease liability 11 5

TOTAL NON-CURRENT LIABILITIES 5

CURRENT LIABILITIES

Trade and other payables 14 82

Lease liability 11 17

TOTAL CURRENT LIABILITIES 99

TOTAL LIABILITIES 104

TOTAL EQUITY AND LIABILITIES 1,633

The notes form an integral part of these consolidated financial statements

The financial statements were approved and authorised for issue by the board on

22 December 2022 and were signed on its behalf by:

David Ormerod

Executive Director

PARENT COMPANY STATEMENT OF FINANCIAL POSITION

AS AT 31 JULY 2022

Audited

As at 31 July

2022

Note £'000

NON-CURRENT ASSETS

Right of use assets 11 22

TOTAL NON-CURRENT ASSETS 22

CURRENT ASSETS

Cash and cash equivalents 12 1,294

Trade and other receivables 13 536

TOTAL CURRENT ASSETS 1,830

TOTAL ASSETS 1,852

EQUITY

Share capital 15 298

Share premium 15 1,900

Share based payment reserve 16 31

Retained earnings (477)

TOTAL EQUITY 1,752

NON-CURRENT LIABILITIES

Lease liability 11 5

TOTAL NON-CURRENT LIABILITIES 5

CURRENT LIABILITIES

Trade and other payables 14 78

Lease liability 11 17

TOTAL CURRENT LIABILITIES 95

TOTAL LIABILITIES 100

TOTAL EQUITY AND LIABILITIES 1,852

The Company has taken advantage of section 408 of the Companies Act 2006 and

consequently a profit and loss account has not been presented for the Company.

The Company's loss for the financial period was £476,555.

The notes form an integral part of these consolidated financial statements

The financial statements were approved and authorised for issue by the board on

22 December 2022 and were signed on its behalf by:

David Ormerod

Executive Director

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

AS AT 31 JULY 2022

Share Share Share based Foreign Retained Total

capital premium payment exchange earnings equity

reserve reserve

£'000 £'000 £'000 £'000 £'000 £'000

Loss for period - - - - (700) (700)

Total comprehensive - - - - (700) (700)

income for the year

Transactions with

owners in own

capacity

Ordinary shares - - - - - -

issued on

incorporation*

Ordinary shares 298 2,007 - - - 2,304

issued in the period

Advisor warrants - - 31 - - 31

Share issue costs (107) (107)

Transactions with 298 1,900 31 - - 2,229

owners in own

capacity

Balance at 31 July 298 1,900 31 - (700) 1,529

2022

*£500 of shares credited to share capital on incorporation not accounted for

above but included in overall reconciliation of equity accounts

PARENT COMPANY STATEMENT OF CHANGES IN EQUITY

AS AT 31 JULY 2022

Share capital Share Share Retained Total

premium based earnings equity

payment

reserve

£'000 £'000 £'000 £'000 £'000

Loss for period - - - (477) (477)

Total comprehensive income - - - (477) (477)

for the year

Transactions with owners in

own capacity

Ordinary shares issued on - - - - -

incorporation*

Ordinary shares issued in 298 2,007 - - 2,305

the period

Advisor warrants - - 31 - 31

Share issue costs (107) - - (107)

Transactions with owners in 298 1,900 31 - 2,229

own capacity

Balance at 31 July 2022 298 1,900 31 (477) 1,752

*£500 of shares credited to share capital on incorporation not accounted for

above but included in overall reconciliation of equity accounts

CONSOLIDATED STATEMENT OF CASHFLOWS

FOR THE 13 MONTH PERIODED 31 JULY 2022

Audited

Period ending

31 July

2022

Note £'000

Cash flow from operating activities

Loss for the financial year 4 (700)

Adjustments for:

Share based payment reserves 16 31

Changes in working capital:

(Increase) in trade and other receivables 13 (210)

Increase in trade and other payables 14 82

Net cash outflow from operating activities (797)

Cash flows from investing activities

Investment in fixed assets 9 (18)

Net cash flow from investing activities (18)

Cash flows from financing activities

Proceeds from issue of shares 15 2,305

Share issue costs 15 (107)

Net cash flow from financing activities 2,198

Net increase in cash and cash equivalents 1,383

Cash and cash equivalents at beginning of the -

period

Foreign exchange impact on cash -

Cash and cash equivalents at end of the period 12 1,383

The notes form an integral part of these consolidated financial statements

PARENT COMPANY STATEMENT OF CASHFLOWS

FOR THE 13 MONTH PERIODED 31 JULY 2022

Audited

Period ending

31 July

2022

Note £'000

Cash flow from operating activities

Loss for the financial year (477)

Adjustments for:

Share based payment reserves 16 31

Changes in working capital:

(Increase) in trade and other receivables 13 (536)

Increase in trade and other payables 14 78

Net cash outflow from operating activities (904)

Cash flows from financing activities

Proceeds from issue of shares 15 2,305

Share issue costs 15 (107)

Net cash flow from financing activities 2,198

Net increase in cash and cash equivalents 1,294

Cash and cash equivalents at beginning of -

the period

Foreign exchange impact on cash -

Cash and cash equivalents at end of the 12 1,294

period

The notes form an integral part of these consolidated financial statements

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

AS AT 31 JULY 2022

1. General Information

The Company was incorporated on 13 July 2021 in England and Wales with

Registered Number 13508782 under the Companies Act 2006. The principal activity

of the Group is to seek suitable investment opportunities with a particular

focus on the hydrogen industry. Once the Group has identified suitable

opportunities as it has begun to do so in the period, it will look to the

commercialisation of proprietary wind and water-based green hydrogen systems.

The address of its registered office is Eccleston Yards, 25 Eccleston Place,

London SW1W 9NF, United Kingdom.

The Company commenced trading on the Aquis Stock Exchange ("AQSE") Growth

Market on 1 December 2021.

2. Accounting policies

The principal accounting policies applied in preparation of these consolidated

financial statements ("financial statements") are set out below. These policies

have been consistently applied unless otherwise stated.

2.1 Basis of preparation

The financial statements for the period ended 31 July 2022 have been prepared

by Hydrogen Future Industries Plc in accordance with UK-adopted International

Accounting Standards ('IFRS'). The financial statements have been prepared

under the historical cost convention.

The preparation of financial statements in conformity with IFRS requires

management to make judgements, estimates and assumptions that affect the

application of policies and reported amounts in the financial statements. The

areas involving a higher degree of judgement or complexity, or areas where

assumptions or estimates are significant to the financial statements, are

disclosed in Note 2.15.

The financial statements present the results for the Group and Company for the

period ended 31 July 2022. No comparative figures have been presented as the

financial statements cover the period from incorporation on 13 July 2022

The principal accounting policies are set out below and have, unless otherwise

stated, been applied consistently in the financial statements. The financial

statements are prepared in Pounds Sterling, which is the Group's presentational

currency, and presented to the nearest £'000.

2.2 Going concern

The financial statements have been prepared on a going concern basis, which

assumes that the Group will continue to meet its liabilities as they fall due.

The Group has cash and cash equivalents of £1.383m (Company: £1.294m) at 31

July 2022 following a successful IPO in December 2021. The Directors have

prepared detailed forecasts and analysis that account for their best estimate

of committed expenditure and expected cash inflows and are of the view this is

sufficient to fund the Group's expenditure over the next 12 months from the

date of approval of these financial statements.

Whilst forecast cash inflows are in advance stages of negotiation there is no

certainty regarding the quantum or timing of these cashflows and therefore the

Directors have identified a material uncertainty which may cast doubt over the

Group's ability to continue as a going concern. The financial statements do not

include any adjustments that would result if the Group were unable to continue

as a going concern.

2.3 Cash and cash equivalents

Cash and cash equivalents comprise cash at bank and in hand, and demand

deposits with banks and other financial institutions.

2.4 Equity

Share capital is determined using the nominal value of shares that have been

issued.

The Share premium account includes any premiums received on the initial issuing

of the share capital. Any transaction costs associated with the issuing of new

shares are deducted from the Share premium account, net of any related income

tax benefits.

Accumulated losses includes all current period results as disclosed in the

income statement.

2.5 Foreign currency translation

(i) Functional and presentation currency

Items included in the individual financial statements of each of the Group's

entities are measured using the currency of the primary economic environment in

which the entity operates ('the functional currency'). The consolidated

financial statements are presented in £ Sterling, which is the Company's

presentational currency. The individual financial statements of each of the

Company's wholly owned subsidiaries are prepared in the currency of the primary

economic environment in which it operates (its functional currency). IAS 21 The

Effects of Changes in Foreign Exchange Rates requires that assets and

liabilities be translated using the exchange rate at period end, and income,

expenses and cash flow items are translated using the rate that approximates

the exchange rates at the dates of the transactions (i.e. the average rate for

the period).

2.6 Basis of consolidation

The consolidated financial statements incorporate the financial statements of

the Company and entities controlled by the Company (its subsidiaries) made up

to 31 July each year. Per IFRS 10, control is achieved when the Company:

* has the power over the investee;

* is exposed, or has rights, to variable returns from its involvement with

the investee; and

* has the ability to use its power to affects its returns.

The Company reassesses whether or not it controls an investee if facts and

circumstances indicate that there are changes to one or more of the three

elements of control listed above. When the Company has less than a majority of

the voting rights of an investee, it considers that it has power over the

investee when the voting rights are sufficient to give it the practical ability

to direct the relevant activities of the investee unilaterally. The Company

considers all relevant facts and circumstances in assessing whether or not the

Company's voting rights in an investee are sufficient to give it power,

including:

* the size of the Company's holding of voting rights relative to the size and

dispersion of holdings of the other vote holders;

* potential voting rights held by the Company, other vote holders or other

parties;

* rights arising from other contractual arrangements; and

* any additional facts and circumstances that indicate that the Company has,

or does not have, the current ability to direct the relevant activities at

the time that decisions need to be made, including voting patterns at

previous shareholders' meetings.

Consolidation of a subsidiary begins when the Company obtains control over the

subsidiary and ceases when the Company loses control of the subsidiary.

Specifically, the results of subsidiaries acquired or disposed of during the

year are included in profit or loss from the date the Company gains control

until the date when the Company ceases to control the subsidiary. Where

necessary, adjustments are made to the financial statements of subsidiaries to

bring the accounting policies used into line with the Group's accounting

policies.

All intragroup assets and liabilities, equity, income, expenses and cash flows

relating to transactions between the members of the Group are eliminated on

consolidation.

2.7 Property, plant and equipment

Property, plant and equipment are stated at historical cost less accumulated

depreciation and any accumulated impairment losses.

When the Company acquires any plant and equipment it is stated in the accounts

at its cost of acquisition less depreciation and any impairments.

Depreciation is charged to write off the costs less estimated residual value of

plant and equipment on a straight line basis over their estimated useful lives

being:

* Plant and equipment 5 - 7 years

* Computer equipment 4 years

Estimated useful lives and residual values are reviewed each year and amended

as required.

2.8 Financial instruments

IFRS 9 requires an entity to address the classification, measurement and

recognition of financial assets and liabilities.

a. Classification

The Company classifies its financial assets in the following measurement

categories:

* those to be measured subsequently at fair value (either through OCI or

through profit or loss);

* those to be measured at amortised cost; and

* those to be measured subsequently at fair value through profit or loss.

The classification depends on the Company's business model for managing the

financial assets and the contractual terms of the cash flows.

For assets measured at fair value, gains and losses will be recorded either in

profit or loss or in OCI. For investments in equity instruments that are not

held for trading, this will depend on whether the Company has made an

irrevocable election at the time of initial recognition to account for the

equity investment at fair value through other comprehensive income (FVOCI).

b. Recognition

Purchases and sales of financial assets are recognised on trade date (that is,

the date on which the Company commits to purchase or sell the asset). Financial

assets are derecognised when the rights to receive cash flows from the

financial assets have expired or have been transferred and the Company has

transferred substantially all the risks and rewards of ownership.

c. Measurement

At initial recognition, the Company measures a financial asset at its fair

value plus, in the case of a financial asset not at fair value through profit

or loss (FVPL), transaction costs that are directly attributable to the

acquisition of the financial asset.

Transaction costs of financial assets carried at FVPL are expensed in profit or

loss.

Debt instruments

Amortised cost: Assets that are held for collection of contractual cash flows,

where those cash flows represent solely payments of principal and interest, are

measured at amortised cost. Interest income from these financial assets is

included in finance income using the effective interest rate method. Any gain

or loss arising on derecognition is recognised directly in profit or loss and

presented in other gains/(losses) together with foreign exchange gains and

losses. Impairment losses are presented as a separate line item in the

statement of profit or loss.

Equity instruments

The Company subsequently measures all equity investments at fair value. Where

the Company's management has elected to present fair value gains and losses on

equity investments in OCI, there is no subsequent reclassification of fair

value gains and losses to profit or loss following the derecognition of the

investment.

d. Impairment

The Company assesses, on a forward-looking basis, the expected credit losses

associated with any debt instruments carried at amortised cost. The impairment

methodology applied depends on whether there has been a significant increase in

credit risk. For trade receivables, the Company applies the simplified approach

permitted by IFRS 9, which requires expected lifetime losses to be recognised

from initial recognition of the receivables.

2.9 Leases

The lease payments are discounted using the interest rate implicit in the

lease. If that rate cannot be readily determined, which is generally the case

for leases in the Company, the lessee's incremental borrowing rate is used,

being the rate that the individual lessee would have to pay to borrow the funds

necessary to obtain an asset of similar value to the right-of-use asset in a

similar economic environment with similar terms, security and conditions. In

all instances the leases were discounted using the incremental borrowing rate.

Lease payments are allocated between principal and finance cost. The finance

cost is charged to profit or loss over the lease period. Right-of-use assets

are measured at cost which comprises the following:

* The amount of the initial measurement of the lease liability;

* Any lease payments made at or before the commencement date less any lease

incentives received;

* Any initial direct costs; and

* Restoration costs.

Right-of-use assets are depreciated over the shorter of the asset's useful life

and the lease term on a straight line basis. If the Company is reasonably

certain to exercise a purchase option, the right-of-use asset is depreciated

over the underlying asset's useful life.

Lease payments to be made under reasonably certain extension options are also

included in the measurement of the liability.

Payments associated with short-term leases (term less than 12 months) and all

leases of low-value assets (generally less than £5k) are recognised on a

straight-line basis as an expense in profit or loss. The short term lease

exemption has been utilised by the Company in relation to property leases held

in the US based subsidiary HFI ES US Inc. These leases are on a rolling

month-month basis and hence there is no long term commitment entered into.

2.10 Intangible assets

Intangible assets acquired as part of a business combination or asset

acquisition are initially measured at their fair value at the date of

acquisition. Intangible assets acquired separately are initially recognised at

cost.

Amortisation is charged to write off the cost less estimated residual value of

plant and equipment on a straight line basis over their estimated useful lives

which are:

* Brand and trade names 10 years

* Customer relationships 10 years

* Software 5 years

Estimated useful lives and residual values are reviewed each year and amended

as required.

Other intangible assets are tested for impairment whenever events or changes in

circumstances indicate that the carrying amount might not be recoverable. An

impairment loss is recognised for the amount by which the asset's carrying

amount exceeds its recoverable amount. The recoverable amount is the higher of

an asset's fair value less costs of disposal and value in use. For the purposes

of assessing impairment, assets are grouped at the lowest levels for which

there are separately identifiable cash inflows which are largely independent of

the cash inflows from other assets or group of assets (cash-generating units).

2.11 Intangible assets

Expenditure on internally developed products is capitalised if it can be

demonstrated that:

- it is technically feasible to develop the product for it to be sold

- adequate resources are available to complete the development

- there is an intention to complete and sell the product

- the Group is able to sell the product

- sale of the product will generate future economic benefits, and - expenditure

on the project can be measured reliably.

Capitalised development costs are amortised over the periods the Group expects

to benefit from selling the products developed. The amortisation expense is

included within the administrative expenses, in the consolidated statement of

comprehensive income.

Development expenditure not satisfying the above criteria and expenditure on

the research phase of internal projects are recognised in the consolidated

statement of comprehensive income as incurred.

2.12 Taxation

Tax currently payable is based on taxable profit for the period. Taxable profit

differs from profit as reported in the income statement because it excludes

items of income and expense that are taxable or deductible in other years and

it further excludes items that are never taxable or deductible. The liability

for current tax is calculated using tax rates that have been enacted or

substantively enacted by the balance sheet date.

No deferred tax assets in respect of tax losses have not been recognised in the

accounts because there is currently insufficient evidence of the timing of

suitable future taxable profits against which they can be recovered.

2.13 Share based payments

The Company has made awards of warrants on its unissued share capital to

certain parties in return for services provided to the Company. The valuation

of these warrants involved making a number of critical estimates relating to

price volatility, future dividend yields, expected life of the options and

interest rates. These assumptions have been integrated into the Black Scholes

Option Pricing model in this instance to derive a value for any share-based

payments. These assumptions are described in more detail in note 16.

The expense charged to the Statement of Comprehensive Income during the year in

relation to share based payments was £30,939.

2.14 New standards and interpretations not yet adopted

At the date of approval of these financial statements, the following standards

and interpretations which have not been applied in these financial statements

were in issue but not yet effective (and in some cases have not yet been

adopted by the UK):

Standard Impact on initial application Effective date

Annual Improvements 2018-2020 Cycle 1 January 2023

IAS 1 Classification of liabilities 1 January 2023

Current or Non-current

IAS 8 Accounting estimates 1 January 2023

IAS 12 Deferred tax arising from a 1 January 2023

single transaction

The effect of these amended Standards and Interpretations which are in issue

but not yet mandatorily effective is not expected to be material.

The Directors are evaluating the impact that these standards may have on the

financial statements of Company.

2.15 Critical accounting judgements and key sources of estimation uncertainty

The preparation of the financial statements in conformity with IFRSs requires

management to make judgements, estimates and assumptions that affect the

application of accounting policies and the reported amounts of assets,

liabilities, income and expense. Actual results may differ from these

estimates. Estimates and underlying assumptions are reviewed on an ongoing

basis. Revisions to accounting estimates are recognised in the period in which

the estimates are revised and in any future periods affected. The areas

involving a higher degree of judgement or complexity, or areas where

assumptions and estimates are significant to the financial statements, are

disclosed below:

* Share Based Payments: valuation of warrants valued using Black Scholes

method

3. Segmental analysis

The Group manages its operations in one segment, being the development of

proprietary wind and water-based green hydrogen production systems.

4. Operating Loss

Operating loss for the Group is stated after charging:

Period ending

31 July 2022

£'000

Costs associated with listing (159)

Professional fees (52)

Directors fees (70)

Salary & wages (90)

Insurance (34)

Travel & entertainment (7)

Exclusivity fees (15)

Share based payments (31)

Other administrative expenses (242)

(700)

5. Employees

The average number of persons employed by the Group (including Directors)

during the period ended 31 July 2022 was:

No of employees

3

3

The aggregate payroll costs of these persons (including Directors) were as

follows:

£'000

Wages and salaries* 160

160

6. Auditor's Remuneration

Auditor's remuneration Period ending

31 July

2022

£'000

In respect of the audit of the Company accounts 35

Other non-audit services 20

Total 55

7. Taxation

Period ending

31 July

2022

£'000

The charge / (credit) for the year is made up

as follows:

Corporation taxation on the results for the -

year

Taxation charge / credit for the year -

A reconciliation of the tax charge / credit

appearing in the income statement to the tax

that would result from applying the standard

rate of tax to the results for the year is:

Loss per accounts (700)

Tax credit at the standard rate of (133)

corporation tax in the UK of 19%

Tax effect of capital items disallowed for 30

corporation tax purposes

Tax losses for which no deferred tax is 103

recognised

-

The Company has total carried forward losses of £699,974. The taxed value of

the unrecognised deferred tax asset is £102,995 and these losses do not expire.

No deferred tax assets in respect of tax losses have not been recognised in the

accounts because there is currently insufficient evidence of the timing of

suitable future taxable profits against which they can be recovered.

On 23 September 2022, the Chancellor announced that he has cancelled the

planned corporation tax increase and rather than rising to 25 per cent from

April 2023, the rate will remain at 19 per cent for all firms, regardless of

the amount of profit made.

8. Earnings per share

The calculation of the basic and diluted earnings per share is calculated by

dividing the profit or loss for the year by the weighted average number of

ordinary shares in issue during the year.

Audited

Period ending

31 July

2022

£

Net loss for the period attributable to ordinary equity holders for

continuing operations (£) (699,974)

Weighted average number of ordinary shares in issue

20,388,381

Basic and diluted earnings per share for continuing operations (pence)

(3.433)

There is no difference between the diluted loss per share and the basic loss

per share presented. Share options and warrants could potentially dilute basic

earnings per share in the future but were not included in the calculation of

diluted earnings per share as they are anti-dilutive for the year presented.

9. Fixed assets

Group Total

Property, plant Computer Total

& equipment equipment £ £'000

£'000 '000

Cost

Opening balance - - -

Additions in the period 3 15 18

At 31 July 2022 3 15 18

Depreciation

Opening balance - - -

Charge for the period - - -

At 31 July 2022 - - -

Net book value 31 July 2022 3 15 18

Net book value 31 July 2022 3 15 18

10. Intangibles

On 5 October 2022 the Group successfully completed the acquisition of a suite

of international patents which are relevant to the systems being developed by

the Company. The board believes the patents may have commercial applications

within both the Group's future wind based green hydrogen production systems and

the wider wind energy generation sector. The payment of $150,000 USD was made

during the period as a loan and then subsequently re-assigned as consideration

for the patents along with other equity consideration. The $150,000 is included

in prepayments currently and will be transferred to Intangibles on completion

of the transaction on 5 October 2022 after the year end (Note 23).

The Group is also investing heavily into the development of wind turbine

technology. The current phase of development does not support the

capitalisation of these resources as of yet under IAS 38 - Intangible assets

however once satisfied the Group will reassess in relation to capitalisation.

Further details of the nature of the expected future development capitalisation

is included in the Strategic report which can be found in the Annual Report on

the Company's website.

11. Leases

Company Group

July 2022 July 2022

£'000 £'000

Right-of-use assets

Motor vehicles 22 22

22 22

Lease liabilities

Current 5 5

Non-current 17 17

22 22

Right of use assets

A reconciliation of the carrying amount of the right-of-use asset is as

follows:

Company Group

July 2022 July 2022

£'000 £'000

Motor vehicles

Opening balance - -

Additions 22 22

Depreciation - -

22 22

Lease liabilities

A reconciliation of the carrying amount of the lease liabilities is as follows:

Company Group

July 2022 July 2022

£'000 £'000

Opening balance - -

Additions 22 22

Finance charge - -

22 22

12. Cash and cash equivalents

Company Group

July 2022 July 2022

£'000 £'000

Cash at bank 1,294 1,383

1,294 1,383

Majority of the cash is held with Alpha FX foreign exchange trading platform

who utilise the banking facilities of Lloyds Banking Group Plc (credit ratings:

S&P's BBB+, A3, Fitch A). Daily working capital amounts are held through the

Wise online banking platform in the UK and Rocky Mountain Online Bank in the

US. These online banking platforms do not currently have credit ratings

available.

The denomination of amounts in foreign currencies is as follows:

Company Group

July 2022 July 2022

£'000 £'000

USD 32 71

GBP 1,262 1,312

1,294 1,383

13. Trade and other receivables

Company Group

July 2022 July 2022

£'000 £'000

Intercompany receivables 326 -

Prepayments 140 140

VAT receivable 70 70

536 210

14. Trade and other payables

Company Group

July 2022 July 2022

£'000 £'000

Trade creditors 36 36

Accruals 42 42

Employer obligations - 4

78 82

15. Share capital and share premium

Ordinary Share Share Total

shares capital premium

# £'000 £'000 £'000

Issue of ordinary shares on 50,000 1 - 1

incorporation1

Issue of ordinary shares 2 5,850,000 58 - 58

Issue of ordinary shares 3 1,600,000 16 - 16

Issue of ordinary shares4 22,300,000 223 2,007 2,230

Share issue costs - - (107) (107)

At 31 July 2022 29,800,000 298 1,900 2,198

1 On incorporation on 13 July 2021, the Company issued 50,000 ordinary shares

of £0.01 at their nominal value of £0.01.

2 On 10 September 2021, the Company issued 5,850,000 ordinary shares at their

nominal value of £0.01.

3 On 23 September 2021, the Company issued 1,600,000 ordinary shares at their

nominal value of £0.01.

4 On admission to the Aquis Stock Exchange Growth Market on 1 December 2021,

22,300,000 shares were issued at a placing price of £0.10.

There is currently an authorised share capital limit in place for the Company

which is subject to review at the next Annual General Meeting.

16. Share based payment reserves

Company Group

July 2022 July 2022

£'000 £'000

Broker warrants issued 1 6 6

Advisor warrants issued2 25 25

At 31 July 2022 31 31

On 10 September 2021, 7.5 million warrants were issued linked to existing

shares that vested on admission (10 December 2021). Each warrant entitles the

holder to subscribe for one share at a price of £0.05 for a period of two years

from admission. These warrants have not been valued separately as their value

is included in the consideration transferred for the shares.

1 On 29 October 2021, the Company entered into an agreement to issue 150,000

broker warrants to Peterhouse Capital Limited subject to and conditional on

admission. The broker warrants are exercisable at the price of £0.10 per

ordinary share and are exercisable, either in whole or part, for a period of

three years from the date of admission.

2 On 29 October 2021, the Company entered into an agreement to issue 400,000

advisor warrants to Cairn Financial Advisors LLP subject to and conditional on

admission. The advisor warrants are exercisable at the price of £0.05 per

ordinary share and are exercisable, either in whole or part, for a period of 5

years from the date of admission.

The estimated fair values of options which fall under IFRS 2, and the inputs

used in the Black-Scholes pricing model to calculate those fair values are as

follows:

Date of grant Number of Share Exercise Expected Expected Risk free Expected

warrants price price volatility life rate dividends

1 December 2021 150,000 £0.10 £0.10 59.00% 3 20.00% 0.00%

1 December 2021 400,000 £0.10 £0.05 59.00% 5 20.00% 0.00%

The total warrants issued in September 2021 were issued alongside the placing

of ordinary shares and, as such, are not fair valued separately.

Warrants

Number of warrants Exercise Expiry date

price

Grant Date

10 September 2021 7,500,000 £0.05 10 December 2023

1 December 2021 150,000 £0.10 1 December 2024

1 December 2021 400,000 £0.05 1 December 2026

As at 31 July 2022 8,050,000

17. Investments

Name Holding Business Country of Registered Address

Activity Incorporation

HFI Energy 100% Research & England & Wales Eccleston Yards, 25

Systems Ltd development Eccleston Place, London

SW1W 9NF

HFI Energy 100% Research & United States 16 Nugget Court,

Systems US Inc development of America Whitehall, MT 59759

HFI IP Holdings 51% IP holding England & Wales Eccleston Yards, 25

Ltd company Eccleston Place, London

SW1W 9NF

HFI Development 100% Research & England & Wales Eccleston Yards, 25

Ltd development Eccleston Place, London

SW1W 9NF

18. Financial Instruments and Risk Management

Principal financial instruments

The principal financial instruments used by the Group from which the financial

risk arises are as follows:

As at 31 July 2022

£'000

Financial Assets

Cash and cash equivalents 1,383

Trade and other receivables* 70

1,453

Financial Liabilities

Trade payables and accruals 82

82

*Trade and other receivables exclude prepayments

The financial liabilities are payable within one year.

General objectives and policies

In the Directors report the overall objective of the Board is to set policies

that seek to reduce risk as far as practical without unduly affecting the

Group's competitiveness and flexibility. Further details regarding these

policies are:

Policy on financial risk management

The Company's principal financial instruments comprise cash and cash

equivalents, trade and other receivables and intangible assets. The Company's

accounting policies and methods adopted, including the criteria for

recognition, the basis on which income and expenses are recognised in respect

of each class of financial asset, financial liability and equity instrument are

set out in note 2 - "Accounting Policies".

The Company does not use financial instruments for speculative purposes. The

carrying value of all financial assets and liabilities approximates to their

fair value.

Derivatives, financial instruments and risk management

The Company does not use derivative instruments or other financial instruments

to manage its exposure to fluctuations in foreign currency exchange rates,

interest rates and commodity prices.

Foreign currency risk management

The Company does have foreign currency exposure as the functional currency of

its subsidiary HFI Energy Systems Us Inc ("HFI US") is USD. The Company

regularly sends funds to the HFI US to pay for operational expenditure relating

to its research and development activities. Although funds are sent regularly

the absolute value of funds is not considered by the Directors to be large

enough to require additional risk mitigation. The Directors have assessed the

foreign currency risk as moderate but will continue to assess this risk at

regular intervals going forward.

Credit risk

Credit risk refers to the risk that a counterparty will default on its

contractual obligations resulting in financial loss to the Company. The Company

has adopted a policy of only dealing with creditworthy counterparties. The

Company's exposure and the credit ratings of its counterparties are monitored

by the Board of Directors to ensure that the aggregate value of transactions is

spread amongst approved counterparties.

The Company's principal financial assets are cash and cash equivalents and

trade and other receivables.

Cash equivalents include amounts held on deposit with financial institutions.

The credit risk on liquid funds held in current accounts and available on

demand is limited because the Group's counterparties are banks with high

credit-ratings assigned by international credit-rating agencies. The majority

of the Group's funds are held with Lloyds Bank are reputable high street bank

and only small working capital amounts are held via online institutions.

The Company applies IFRS 9 to measure expected credit losses for receivables,

these are regularly monitored and assessed. The Group does not generate revenue

so there is minimal credit risk in relation to receivables.

The Company's maximum exposure to credit risk is limited to the carrying amount

of financial assets recorded in the financial statements.

Liquidity risk

During the period ended 31 July 2022, the Group was financed by cash raised

through equity funding. Funds raised surplus to immediate requirements are held

as cash deposits in Sterling.

In managing liquidity risk, the main objective of the Group is to ensure that

it has the ability to pay all of its liabilities as they fall due. The Group

monitors its levels of working capital to ensure that it can meet its

liabilities as they fall due.

The table below shows the undiscounted cash flows on the Company's financial

liabilities as at 31 July 2022 on the basis of their earliest possible

contractual maturity.

Total Within 2 Within 2-6

£'000 months months

At 31 July 2022

Trade payables 82 33 49

Capital management

The Group considers its capital to be equal to the sum of its total equity. The

Group monitors its capital using a number of key performance indicators

including cash flow projections, working capital ratios, the cost to achieve

development milestones and potential revenue from partnerships and ongoing

licensing activities.

The Group's objective when managing its capital is to ensure it obtains

sufficient funding for continuing as a going concern. The Group funds its

capital requirements through the issue of new shares to investors.

19. Financial assets and liabilities

Financial assets at Financial liabilities Total

amortised cost at amortised cost £'000

£'000 £'000

At 31 July 2022

Trade and other receivables* 70 - 70

Cash and cash equivalents 1,383 1,383

Trade and other payables - (82) (82)

1,453 (82) 1,371

*Trade and other receivables exclude prepayments

20. Related Party Transactions

Directors Shares & Warrants

On incorporation, the Company issued 50,000 ordinary shares of £0.01 at £0.01

per ordinary share to Orana Corporate LLP, an entity of which Director Daniel

Maling is a partner.

Subsequently, shares were subscribed to the founding shareholders and 1,750,000

transferred to Directors, including 1,000,000 shares to Daniel Maling, 500,000

shares to David Ormerod and 250,000 shares to Fungai Ndoro. Daniel Maling,

David Ormerod and Fungai Ndoro were all Directors of the Company at the end of

the period. All of the shares held by Daniel Maling, David Ormerod and Fungai

Ndoro were paid up during the period.

In connection with the founders' shares, subscribers were issued with warrants

on a 1:1 basis. Consequently, the Directors held the following warrants at

period end:

* Daniel Maling: 1,000,000

* David Ormerod: 500,000

* Fungai Ndoro: 250,000

The warrants give the Directors the option to subscribe for ordinary shares on

a 1:1 basis at £0.05 for a period of 2 years from vesting. Subsequent to period

end the Directors were issued additional options (Note 23).

Key management personnel remuneration

Base salary Pension Total

£ Contribution £

£

David Ormerod 30,954 - 30,954

Daniel Maling 23,216 - 23,216

Fungai Ndoro 15,477 - 15,477

69,647 - 69,647

Service Agreements

Orana Corporate LLP, of which Director Daniel Maling is a partner, has a

service agreement with the Company for the provision of accounting and company

secretarial services as well as corporate finance services in relation to the

listing. In the period, Orana Corporate LLP accrued £65,163 for these services

from the Company of which £12,120 was owed at year end.

Proposed investment in LGT Hydrogen

On 15 December 2021 the Company signed a term sheet with LGT Hydrogen Limited

to finalise a formal investment agreement to acquire 23.1% of the issued share

capital of LGT Hydrogen. On signing of the agreement $150,000 USD was

transferred granting the Company a 3 month exclusivity period. Although the

transaction was not completed in the initial format the payment was used in the

acquisition of patents in 2022 (Note 23). LGT Hydrogen Directors Eamonn McCann

and Jonathan Colville are both shareholders in the Company. HFI Energy Systems

Ltd CEO Timothy Blake is also a past Director of LGT Hydrogen.

21. Ultimate Controlling Party

As at 31 July 2022, there was no ultimate controlling party of the Company.

22. Capital Commitments

Initial funding commitment

Through the employment of HFI Energy Systems Ltd CEO, Timothy Blake, the

Company has committed to providing $1 million USD in funding for the purposes

of assisting the development of hydrogen systems.

23. Events Subsequent to period end

Acquisition of patents

On 10 October 2022 announced the successful acquisition of a suite of

international patents which are relevant to the systems being developed by the

Company, by its joint venture subsidiary HFI IP Holdings Limited. The patents

acquired can be viewed at the Company's page on the AQSE website and were

transferred in exchange for the following consideration:

* the issue to HW Power Limited ("HW") of 5,200,000 new ordinary shares in

HFI at an issue price of 10 pence per share;

* the forgiving of a loan made to HW by the Company on 16 December 2021

of US$150,000 which was to acquire exclusivity rights for the acquisition

of the patents;

* additional aggregate cash payments of £33,000 and

* the issue to HW of warrants over a further 2,500,000 new ordinary shares in

the Company with an exercise price of 12 pence per warrant, which will

expire three years from the date of issue

Incorporation HFI Consulting Limited

On 2 September 2022 a new subsidiary, HFI Consulting Limited ("HFI Con") was

incorporated. HFI Con has 100 shares with a nominal value of £0.01 and is

wholly owned by the Company.

Issue of options

On 4 November 2022 a total of 6,000,000 options were granted to the Directors

of the Company, the CEO of HFI Energy Systems Ltd (Timothy Blake) and a

financial consultant (Ryan Neates). These options vest immediately and are

exercisable for a period of 5 years from the issue date at a price of £0.10.

Breakdown of options issued is detailed below:

* Timothy Blake: 3,000,000

* David Ormerod: 1,000,000

* Daniel Maling: 1,000,000

* Fungai Ndoro: 500,000

* Ryan Neates 500,000

Note:

Certain statements made in this announcement are forward-looking statements.

These forward-looking statements are not historical facts but rather are based

on the Company's current expectations, estimates, and projections about its

industry; its beliefs; and assumptions. Words such as 'anticipates,' 'expects,'

'intends,' 'plans,' 'believes,' 'seeks,' 'estimates,' and similar expressions

are intended to identify forward-looking statements. These statements are not a

guarantee of future performance and are subject to known and unknown risks,

uncertainties, and other factors, some of which are beyond the Company's

control, are difficult to predict, and could cause actual results to differ

materially from those expressed or forecasted in the forward-looking

statements. The Company cautions security holders and prospective security

holders not to place undue reliance on these forward-looking statements, which

reflect the view of the Company only as of the date of this announcement. The

forward-looking statements made in this announcement relate only to events as

of the date on which the statements are made. The Company will not undertake

any obligation to release publicly any revisions or updates to these

forward-looking statements to reflect events, circumstances, or unanticipated

events occurring after the date of this announcement except as required by law

or by any appropriate regulatory authority.

END

(END) Dow Jones Newswires

December 23, 2022 02:00 ET (07:00 GMT)

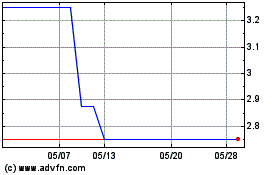

Hydrogen Future Industries (AQSE:HFI)

過去 株価チャート

から 10 2024 まで 11 2024

Hydrogen Future Industries (AQSE:HFI)

過去 株価チャート

から 11 2023 まで 11 2024