FALSE000175876600017587662024-09-112024-09-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________

FORM 8-K

_______________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date Earliest Event Reported): October 1, 2024

_______________________________________

STEM, INC.

(Exact name of registrant as specified in its charter)

_______________________________________

| | | | | | | | | | | | | | |

| Delaware | | 001-39455 | | 85-1972187 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

Four Embarcadero Center, Suite 710, San Francisco, California 94111

(Address of principal executive offices including zip code)

1-877-374-7836

Registrant’s telephone number, including area code

_______________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e- 4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.0001 | | STEM | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

Item 7.01 | Regulation FD Disclosure. |

On October 1, 2024, Stem, Inc. (the "Company") issued a press release announcing the outcome of its previously announced business strategy review. A copy of the press release is attached as Exhibit 99 and incorporated into this Item 7.01 by reference.

The information in this Item 7.01 (including Exhibit 99) is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| | | | | |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

The following exhibit is furnished as part of this report:

| | | | | | | | |

| Exhibit No. | | Description |

| 99 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| STEM, INC. |

| | |

Date: October 1, 2024 | By: | /s/ Saul R. Laureles |

| | Name: | Saul R. Laureles |

| | Title: | Chief Legal Officer and Corporate Secretary |

_____________________________________________________________________________________________

Stem Announces New Software and Services-Centric Strategy

to Drive Scalable Growth and Profitability

Refined go-to-market strategy and leadership structure emphasizing software and services; expanding energy consulting offerings

Actions expected to drive more scalable, recurring, and profitable revenue streams with improved working capital and cash flow profile

Company to provide additional details on strategy roadmap on third quarter 2024 earnings call

SAN FRANCISCO, October 1, 2024 – Stem, Inc. (NYSE: STEM) (the “Company,” Stem” or “we”), a global leader in artificial intelligence (AI)-driven clean energy software and services, today announced the outcome of its previously announced review of the Company’s strategy led by the Board’s Software Strategy Working Group, which worked closely with the Stem management team. The Company expects its new strategic priorities will drive more predictable recurring revenue at significantly higher gross margins than the Company has previously realized and will enable more scalable growth.

“We are pleased to introduce Stem’s new strategy, which marks an important milestone for the Company as we shift to a more predictable software and services-focused business and accelerate a new path to profitable, scalable growth,” said David Buzby, Stem’s Interim Chief Executive Officer and Executive Chair of the Board of Directors. “Our new strategy will build on our industry-leading software and services to create tangible value for our customers. We believe we are well positioned to serve the tremendous global growth in renewable energy with our AI-enabled software, edge device, and services capabilities, and we are energized by the work ahead.”

Doran Hole, Chief Financial Officer and Executive Vice President of Stem, said, “We are confident that our new strategy will drive more predictable recurring business, shorten our runway to revenue, significantly improve gross margin profile, and lower our working capital usage. As we assess our cost structure, we will seek to maximize profitability and operating leverage, while still delivering exceptional value to customers with our talented employee base.”

Executing on Our New Strategic Priorities

Our four key strategic priorities are:

#1. Shift to Software and Services-Centric Business to Drive Predictable, Recurring, High-Margin Revenue

We will shift to a more predictable business, leading with our differentiated suite of software and services, with recurring revenue and higher margins. This go-to-market approach is expected to drive several critical benefits versus the Company’s previous

strategy, which was more reliant on hardware resale. These benefits include reduced lumpiness in financial performance, lowered business and operational complexity, improved predictability and accelerated collection of cash flow, and reduced impact by outside market factors such as project delays.

Importantly, we are not abandoning our existing hardware commitments, but are changing how we engage with our customers in the future.

#2. Expanding and Emphasizing Energy Services as a Competitive Differentiator and Enable More Predictable Revenue

Our re-focused strategy leads with consultative energy services as the entry point into project-based customer relationships. This will create more predictable revenue that is less dependent on factors beyond our control, such as supply chain, financing, and interconnection and permitting delays.

This relationship-based service will leverage some of our key strengths, including market experience, technical expertise, and software and edge device capabilities, to improve speed to market and financial results for our customers. We will build on our strong service reputation to develop relationships that enable repeatable, higher margin revenue.

#3. Deliver Enhanced AI-enabled Software and Edge Device Capabilities

We will prioritize our AI-enabled software and edge device capabilities to drive a product-led, customer-focused culture of innovation and delivery. Our software solutions will build on our award-winning, hardware-agnostic PowerTrackTM and Athena® platforms, which help to maximize value for solar and storage customers. We will combine these capabilities into a single platform that spans asset management and optimization software across both solar and storage assets, and other technologies over time.

This strategic priority identifies Stem’s PowerTrack solar monitoring and control capabilities, first added to our product portfolio through the acquisition of AlsoEnergy in 2022, as a commercial and strategic core from which we will develop new products and features and target new customer segments.

We expect that this renewed strategic focus and combined platform will generate additional value for our large base of 16,000 existing customers, while driving new opportunities with both “greenfield” and “brownfield” customers.

#4. Updating Our Approach to Battery Hardware Resales

We will provide hardware procurement advisory services as a subset of our broad service offerings, rather than procure hardware as our primary go-to-market approach. Going forward, we will procure hardware for customers only when doing so meets

stringent profitability criteria, requires zero working capital, and is accompanied by our software and edge devices.

We expect that our new standard contractual terms will drive cash flow-positive payments so that hardware purchases will no longer burden our balance sheet or negatively impact our cash position. We will continue to work through our backlog of approximately $1.6 billion, upholding our commitment to our customers.

Third Quarter 2024 Earnings Conference Call

As previously announced, Stem will host its third quarter 2024 earnings conference call on October 30, 2024 to discuss its latest financial and operating performance, the execution of its new strategy, and 2024 guidance.

About Stem

Stem (NYSE: STEM) is a global leader in AI-enabled software and services that enable its customers to plan, deploy, and operate clean energy assets. The company offers a complete set of solutions that transform how solar and energy storage projects are developed, built, and operated, including an integrated suite of software and edge products, and full lifecycle services from a team of leading experts. More than 16,000 global customers rely on Stem to maximize the value of their clean energy projects and portfolios. Learn more at stem.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This press release contains “forward-looking statements” within the meaning of the U.S. federal securities laws — that is, statements about the future, not about past events. Such statements often contain words such as “expect,” “may,” “can,” “estimate,” “intend,” “anticipate,” “will,” “potential,” “projected" and other similar words. Forward-looking statements address matters that are, to varying degrees, uncertain, such as forecasts or expectations regarding management’s vision for the future of Stem; projections relating to our future financial results, growth, our products and services, and our ability to transition to new business models; statements about the benefits of other strategic, restructuring, technology, and capital allocation commitments and initiatives; and other statements that are not historical facts. These statements are subject to risks and uncertainties beyond Stem’s control, including, but not limited to our ability to implement our strategic initiatives; our inability to comply with, and the effect on our business of, evolving legal standards and regulations, including those concerning data protection, consumer privacy, sustainability, and evolving labor standards; risks relating to the development and performance of our energy storage systems and software-enabled services; our inability to retain or upgrade current customers, further penetrate existing markets or expand into new markets; the risk that our business, financial condition and results of operations may be adversely affected by other political, economic, business and competitive factors; and other risks and uncertainties discussed in our most recent Forms 10-K, 10-Q and 8-K filed with or furnished to the SEC. Statements in this press release are made only as of the date of this release, and

Stem disclaims any intention or obligation to update publicly or revise such statements, whether as a result of new information, future events, or otherwise, except as required by law.

###

Stem Investor Contacts

Ted Durbin, Stem

Marc Silverberg, ICR

IR@stem.com

Stem Media Contact

Suraya Akbarzad, Stem

press@stem.com

Source: Stem, Inc.

v3.24.3

Cover

|

Sep. 11, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 01, 2024

|

| Entity Registrant Name |

STEM, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39455

|

| Entity Tax Identification Number |

85-1972187

|

| Entity Address, Address Line One |

Four Embarcadero Center, Suite 710,

|

| Entity Address, City or Town |

San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94111

|

| City Area Code |

877

|

| Local Phone Number |

374-7836

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.0001

|

| Trading Symbol |

STEM

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001758766

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

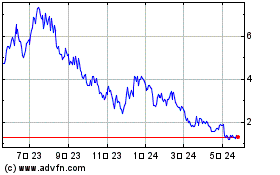

Stem (NYSE:STEM)

過去 株価チャート

から 11 2024 まで 12 2024

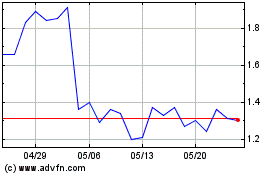

Stem (NYSE:STEM)

過去 株価チャート

から 12 2023 まで 12 2024