Form 8-K - Current report

2024年11月26日 - 9:01PM

Edgar (US Regulatory)

KOHLS Corp false 0000885639 0000885639 2024-11-26 2024-11-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 26, 2024

KOHL’S CORPORATION

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Wisconsin |

|

001-11084 |

|

39-1630919 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| N56 W17000 Ridgewood Drive |

|

|

| Menomonee Falls, Wisconsin |

|

53051 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: 262 703-7000

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $.01 par value |

|

KSS |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 |

Results of Operations and Financial Condition. |

On November 26, 2024, Kohl’s Corporation (the “Company”) issued a press release reporting its earnings for the quarter ended November 2, 2024 and provided updated earnings guidance for fiscal 2024. A copy of the press release is attached as Exhibit 99.1 and incorporated by reference herein. A copy of the presentation materials for the November 26, 2024 quarterly earnings conference call is attached as Exhibit 99.2 and incorporated by reference herein.

| Item 7.01 |

Regulation FD Disclosure. |

See Item 2.02.

The information in Items 2.02 and 7.01, including the exhibits attached hereto, is furnished solely pursuant to Items 2.02 and 7.01 of Form 8-K. Consequently, such information is not deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities of that section. Further, the information in Items 2.02 and 7.01, including the exhibits, shall not be deemed to be incorporated by reference into the filings of the registrant under the Securities Act of 1933.

As previously announced, on November 13, 2024, the Board of Directors of the Company declared a quarterly cash dividend of $0.50 per share. The dividend will be paid on December 24, 2024, to all shareholders of record at the close of business on December 11, 2024.

Cautionary Statement Regarding Forward-Looking Information and Non-GAAP Measures

This current report on Form 8-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The Company intends forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “intends,” “anticipates,” “plans,” or similar expressions to identify forward-looking statements. Forward-looking statements include the information under “Updated 2024 Financial and Capital Allocation Outlook.” Such statements are subject to certain risks and uncertainties, which could cause the Company’s actual results to differ materially from those anticipated by the forward-looking statements. These risks and uncertainties include, but are not limited to, risks described more fully in Item 1A in the Company’s Annual Report on Form 10-K, which is expressly incorporated herein by reference, and other factors as may periodically be described in the Company’s filings with the SEC. Forward-looking statements relate to the date initially made, and the Company undertakes no obligation to update them.

In the attached presentation materials, the Company provides information regarding adjusted free cash flow, which is not a recognized term under U.S. generally accepted accounting principles (“GAAP”) and does not purport to be an alternative to net income as a measure of operating performance. A reconciliation of adjusted free cash flow is provided in the presentation materials attached hereto as Exhibit 99.2. The Company believes that the use of this non-GAAP financial measure provides investors with enhanced visibility into its results with respect to the impact of certain costs. Because not all companies use identical calculations, this presentation may not be comparable to other similarly titled measures of other companies.

| Item 9.01 |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

KOHL’S CORPORATION |

|

|

|

|

| Date: November 26, 2024 |

|

|

|

By: |

|

/s/ Jennifer Kent |

|

|

|

|

|

|

Jennifer Kent

Senior Executive Vice President,

Chief Legal Officer and Corporate Secretary |

Exhibit 99.1

Kohl’s Reports Third Quarter Fiscal 2024 Financial Results

MENOMONEE FALLS, Wis.—(BUSINESS WIRE)—November 26, 2024— Kohl’s Corporation (NYSE:KSS) today reported results for the third quarter

ended November 2, 2024.

| |

• |

Net sales decreased 8.8% and comparable sales decreased 9.3% |

| |

• |

Diluted earnings per share of $0.20 |

| |

• |

Updates full year 2024 financial outlook |

| |

• |

Kohl’s Board announces CEO transition process |

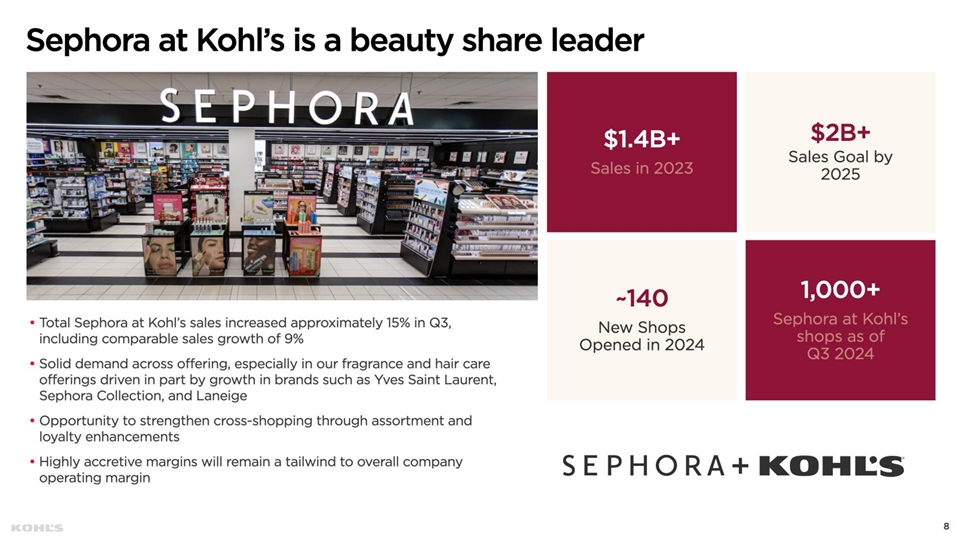

Tom Kingsbury, Kohl’s chief executive officer, said “Our third quarter results did not meet our expectations as sales remained soft in our apparel

and footwear businesses. Although we had a strong collective performance across our key growth areas, including Sephora, home decor, gifting, and impulse, and also benefited from the opening of Babies “R” Us shops in 200 of our stores,

these were unable to offset the declines in our core business. Importantly, we delivered gross margin expansion and managed expenses tightly in the quarter.”

“We are not satisfied with our performance in 2024 and are taking aggressive action to reverse the sales declines. We must execute at a higher level and

ensure we are putting the customer first in everything we do. We are approaching our financial outlook for the year more conservatively given the third quarter underperformance and our expectation for a highly competitive holiday season,”

Kingsbury continued.

CEO Transition Process

As announced on November 25, 2024, Chief Executive Officer Tom Kingsbury plans to step down as CEO, effective January 15, 2025. He will stay on in an

advisory role to the new CEO and retain his position on Kohl’s Board of Directors (the “Board”) through his retirement in May 2025. The Board appointed retail veteran Ashley Buchanan as CEO and Board member, effective January 15,

2025.

Third Quarter 2024 Results

Comparisons refer to the 13-week period ended November 2, 2024 versus the

13-week period ended October 28, 2023

| |

• |

Net sales decreased 8.8% year-over-year, to $3.5 billion, with comparable sales down 9.3%.

|

| |

• |

Gross margin as a percentage of net sales was 39.1%, an increase of 20 basis points.

|

| |

• |

Selling, general & administrative (SG&A) expenses decreased 5.1%

year-over-year, to $1.3 billion. As a percentage of total revenue, SG&A expenses were 34.8%, an increase of 125 basis points year-over-year. |

| |

• |

Operating income was $98 million compared to $157 million in the prior year. As a percentage

of total revenue, operating income was 2.7%, a decrease of 120 basis points year-over-year. |

| |

• |

Net income was $22 million, or $0.20 per diluted share. This compares to net income of

$59 million, or $0.53 per diluted share in the prior year. |

| |

• |

Inventory was $4.1 billion, a decrease of 3% year-over-year. |

| |

• |

Operating cash flow was a use of $195 million. |

Nine Months Fiscal Year 2024 Results

Comparisons refer to the 39-week period ended November 2, 2024 versus the

39-week period ended October 28, 2023

| |

• |

Net sales decreased 6.1% year-over-year, to $10.2 billion, with comparable sales down 6.4%.

|

| |

• |

Gross margin as a percentage of net sales was 39.4%, an increase of 42 basis points.

|

| |

• |

Selling, general & administrative (SG&A) expenses decreased 3.4%

year-over-year, to $3.8 billion. As a percentage of total revenue, SG&A expenses were 34.8%, an increase of 95 basis points year-over-year. |

| |

• |

Operating income was $307 million compared to $418 million in the prior year. As a percentage

of total revenue, operating income was 2.8%, a decrease of 79 basis points year-over-year. |

| |

• |

Net income was $61 million, or $0.55 per diluted share. This compares to net income of

$131 million, or $1.18 per diluted share in the prior year. |

| |

• |

Operating cash flow was $52 million. |

| |

• |

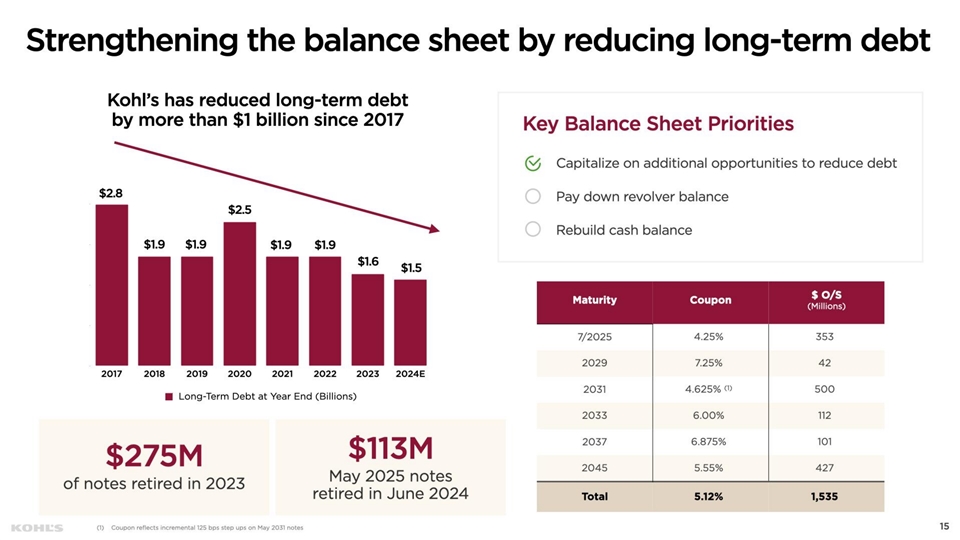

Long-term debt was reduced by $113 million through the redemption of the remaining 9.50% notes due

May 15, 2025. |

Updated 2024 Financial and Capital Allocation Outlook

For the full year 2024, which has 52 weeks compared to 53 weeks in full year 2023, the Company currently expects the following:

| |

• |

Net sales: A decrease of (7%) to a decrease of (8%) |

| |

• |

Comparable sales: A decrease of (6%) to a decrease of (7%) |

| |

• |

Operating margin: In the range of 3.0% to 3.2% |

| |

• |

Diluted EPS: In the range of $1.20 to $1.50 |

| |

• |

Capital Expenditures: Approximately $500 million, including expansion of Sephora partnership and

other store-related investments |

| |

• |

Dividend: On November 13, 2024, Kohl’s Board of Directors declared a quarterly cash dividend

on the Company’s common stock of $0.50 per share. The dividend is payable December 24, 2024 to shareholders of record at the close of business on December 11, 2024. |

Third Quarter 2024 Earnings Conference Call

Kohl’s will host its quarterly earnings conference call at 9:00 am ET on November 26, 2024. A webcast of the conference call and the related

presentation materials will be available via the Company’s web site at investors.kohls.com, both live and after the call.

Cautionary

Statement Regarding Forward-Looking Information

This press release contains “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. The Company intends forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “anticipates,” “plans,”

or similar expressions to identify forward-looking statements. Forward-looking statements include the information under “Updated 2024 Financial and Capital Allocation Outlook.” Such statements are subject to certain risks and

uncertainties, which could cause the Company’s actual results to differ materially from those anticipated by the forward-looking statements. These risks and uncertainties include, but are not limited to, risks described more fully in Item 1A in

the Company’s Annual Report on Form 10-K, which are expressly incorporated herein by reference, and other factors as may periodically be described in the Company’s filings with the SEC.

Forward-looking statements relate to the date initially made, and the Company undertakes no obligation to update them.

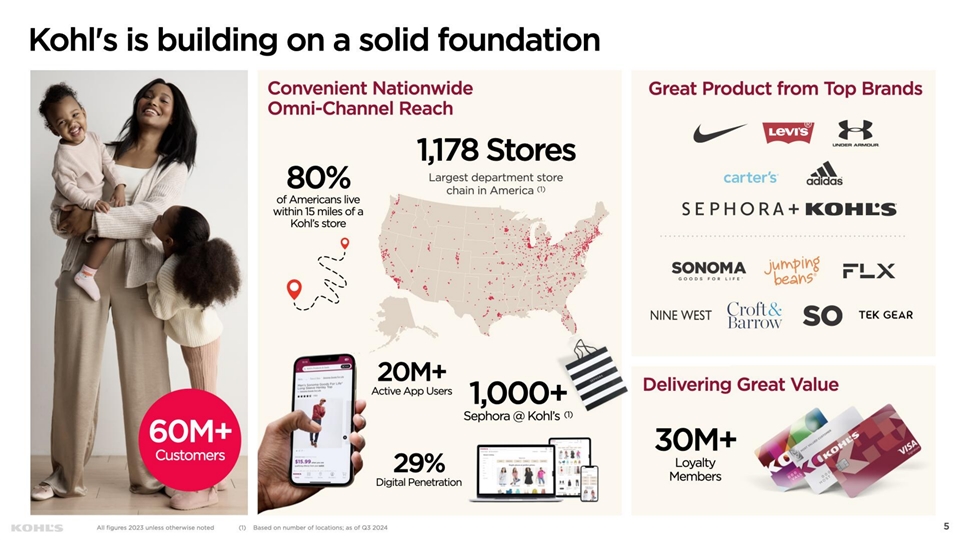

About Kohl’s

Kohl’s (NYSE: KSS) is a leading omnichannel retailer built on a foundation that combines great brands, incredible value and convenience for

our customers. Kohl’s is uniquely positioned to deliver against its long-term strategy and its purpose to take care of families’ realest moments. Kohl’s serves millions of families in its more than 1,100 stores in 49 states, online at

Kohls.com, and through the Kohl’s App. With a large national footprint, Kohl’s is committed to making a positive impact in the communities it serves. For a list of store locations or to shop online, visit Kohls.com. For more

information about Kohl’s impact in the community or how to join our winning team, visit Corporate.Kohls.com.

Contacts

Investor Relations:

Jill Timm, (262) 703-2203, jill.timm@kohls.com

Media:

Jen Johnson, (262) 703-5241, jen.johnson@kohls.com

KOHL’S CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| (Dollars in Millions, Except per Share Data) |

|

November 2,

2024 |

|

|

October 28,

2023 |

|

|

November 2,

2024 |

|

|

October 28,

2023 |

|

| Net sales |

|

$ |

3,507 |

|

|

$ |

3,843 |

|

|

$ |

10,210 |

|

|

$ |

10,876 |

|

| Other revenue |

|

|

203 |

|

|

|

211 |

|

|

|

614 |

|

|

|

644 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenue |

|

|

3,710 |

|

|

|

4,054 |

|

|

|

10,824 |

|

|

|

11,520 |

|

| Cost of merchandise sold |

|

|

2,137 |

|

|

|

2,349 |

|

|

|

6,188 |

|

|

|

6,638 |

|

| Gross margin rate |

|

|

39.1 |

% |

|

|

38.9 |

% |

|

|

39.4 |

% |

|

|

39.0 |

% |

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general, and administrative |

|

|

1,291 |

|

|

|

1,360 |

|

|

|

3,769 |

|

|

|

3,902 |

|

| As a percent of total revenue |

|

|

34.8 |

% |

|

|

33.5 |

% |

|

|

34.8 |

% |

|

|

33.9 |

% |

| Depreciation and amortization |

|

|

184 |

|

|

|

188 |

|

|

|

560 |

|

|

|

562 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

98 |

|

|

|

157 |

|

|

|

307 |

|

|

|

418 |

|

| Interest expense, net |

|

|

76 |

|

|

|

89 |

|

|

|

245 |

|

|

|

262 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income taxes |

|

|

22 |

|

|

|

68 |

|

|

|

62 |

|

|

|

156 |

|

| (Benefit) Provision for income taxes |

|

|

— |

|

|

|

9 |

|

|

|

1 |

|

|

|

25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

22 |

|

|

$ |

59 |

|

|

$ |

61 |

|

|

$ |

131 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average number of shares: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

111 |

|

|

|

110 |

|

|

|

111 |

|

|

|

110 |

|

| Diluted |

|

|

112 |

|

|

|

111 |

|

|

|

112 |

|

|

|

111 |

|

| Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.20 |

|

|

$ |

0.54 |

|

|

$ |

0.55 |

|

|

$ |

1.19 |

|

| Diluted |

|

$ |

0.20 |

|

|

$ |

0.53 |

|

|

$ |

0.55 |

|

|

$ |

1.18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

KOHL’S CORPORATION

CONSOLIDATED BALANCE SHEETS

(Unaudited)

|

|

|

|

|

|

|

|

|

| (Dollars in Millions) |

|

November 2,

2024 |

|

|

October 28,

2023 |

|

| Assets |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

174 |

|

|

$ |

190 |

|

| Merchandise inventories |

|

|

4,099 |

|

|

|

4,239 |

|

| Other |

|

|

344 |

|

|

|

291 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

4,617 |

|

|

|

4,720 |

|

| Property and equipment, net |

|

|

7,472 |

|

|

|

7,861 |

|

| Operating leases |

|

|

2,500 |

|

|

|

2,492 |

|

| Other assets |

|

|

465 |

|

|

|

394 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

15,054 |

|

|

$ |

15,467 |

|

|

|

|

|

|

|

|

|

|

| Liabilities and Shareholders’ Equity |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

1,873 |

|

|

$ |

1,918 |

|

| Accrued liabilities |

|

|

1,245 |

|

|

|

1,324 |

|

| Borrowings under revolving credit facility |

|

|

749 |

|

|

|

625 |

|

| Current portion of: |

|

|

|

|

|

|

|

|

| Long-term debt |

|

|

353 |

|

|

|

111 |

|

| Finance leases and financing obligations |

|

|

80 |

|

|

|

84 |

|

| Operating leases |

|

|

93 |

|

|

|

94 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

4,393 |

|

|

|

4,156 |

|

| Long-term debt |

|

|

1,174 |

|

|

|

1,638 |

|

| Finance leases and financing obligations |

|

|

2,533 |

|

|

|

2,714 |

|

| Operating leases |

|

|

2,799 |

|

|

|

2,780 |

|

| Deferred income taxes |

|

|

78 |

|

|

|

107 |

|

| Other long-term liabilities |

|

|

273 |

|

|

|

321 |

|

| Shareholders’ equity: |

|

|

3,804 |

|

|

|

3,751 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and shareholders’ equity |

|

$ |

15,054 |

|

|

$ |

15,467 |

|

|

|

|

|

|

|

|

|

|

KOHL’S CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

|

|

|

|

|

|

|

|

|

| |

|

Nine Months Ended |

|

| (Dollars in Millions) |

|

November 2,

2024 |

|

|

October 28,

2023 |

|

| Operating activities |

|

|

|

|

|

|

|

|

| Net income |

|

$ |

61 |

|

|

$ |

131 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

560 |

|

|

|

562 |

|

| Share-based compensation |

|

|

25 |

|

|

|

31 |

|

| Deferred income taxes |

|

|

(33 |

) |

|

|

(25 |

) |

| Non-cash lease expense |

|

|

67 |

|

|

|

70 |

|

| Other non-cash items |

|

|

2 |

|

|

|

13 |

|

| Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

| Merchandise inventories |

|

|

(1,216 |

) |

|

|

(1,046 |

) |

| Other current and long-term assets |

|

|

(75 |

) |

|

|

66 |

|

| Accounts payable |

|

|

739 |

|

|

|

588 |

|

| Accrued and other long-term liabilities |

|

|

(2 |

) |

|

|

58 |

|

| Operating lease liabilities |

|

|

(76 |

) |

|

|

(69 |

) |

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

|

|

52 |

|

|

|

379 |

|

|

|

|

|

|

|

|

|

|

| Investing activities |

|

|

|

|

|

|

|

|

| Acquisition of property and equipment |

|

|

(367 |

) |

|

|

(495 |

) |

| Proceeds from sale of real estate |

|

|

2 |

|

|

|

15 |

|

| Other |

|

|

2 |

|

|

|

(11 |

) |

|

|

|

|

|

|

|

|

|

| Net cash used in investing activities |

|

|

(363 |

) |

|

|

(491 |

) |

|

|

|

|

|

|

|

|

|

| Financing activities |

|

|

|

|

|

|

|

|

| Net borrowings under revolving credit facility |

|

|

657 |

|

|

|

540 |

|

| Shares withheld for taxes on vested restricted shares |

|

|

(10 |

) |

|

|

(13 |

) |

| Dividends paid |

|

|

(166 |

) |

|

|

(165 |

) |

| Repayment of long-term borrowings |

|

|

(113 |

) |

|

|

(164 |

) |

| Premium paid on redemption of debt |

|

|

(5 |

) |

|

|

— |

|

| Finance lease and financing obligation payments |

|

|

(62 |

) |

|

|

(68 |

) |

| Proceeds from financing obligations |

|

|

1 |

|

|

|

19 |

|

|

|

|

|

|

|

|

|

|

| Net cash provided by financing activities |

|

|

302 |

|

|

|

149 |

|

|

|

|

|

|

|

|

|

|

| Net (decrease) increase in cash and cash equivalents |

|

|

(9 |

) |

|

|

37 |

|

| Cash and cash equivalents at beginning of period |

|

|

183 |

|

|

|

153 |

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents at end of period |

|

$ |

174 |

|

|

$ |

190 |

|

|

|

|

|

|

|

|

|

|

Update images w/Fall/Winter theme Exhibit 99.2 Q3 November 26,

2024

16

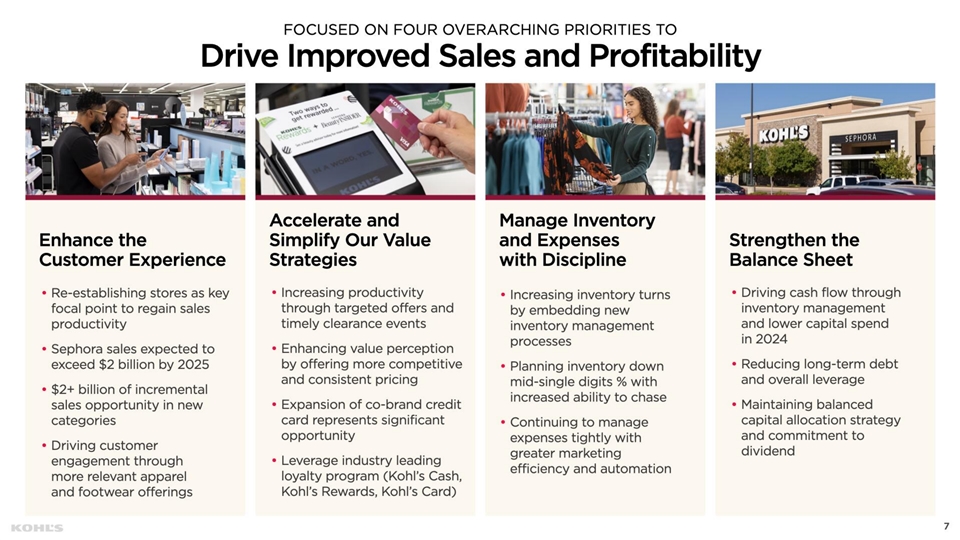

“We have taken significant action to reposition Kohl’s for

future growth. And while we are making progress against our strategic priorities, our efforts have yet to fully yield the intended outcome due in part to a continued challenging consumer environment. During the second quarter, our customers

exhibited more discretion in their spending, which pressured our sales even as customers transacted more frequently. This overshadowed strong performance in our key growth areas, including Sephora, home decor, gifting, and impulse. In spite of this,

we continued to execute well operationally, enabling us to deliver a 13% increase in earnings driven by gross margin expansion and strong inventory and expense management.” ” However, We “Our third quarter results did not meet our

expectations as sales remained soft in our apparel and footwear businesses. Although we had a strong collective performance across our key growth areas, including Sephora, home decor, gifting, and impulse, and also benefited from the opening

of Babies “R” Us shops in 200 of our stores, these were unable to offset the declines in our core business. Importantly, we delivered gross margin expansion and managed expenses tightly in the quarter. “We are not satisfied

with our performance in 2024 and are taking aggressive action to reverse the sales declines. Our conviction in our strategy remains strong, however we must execute at a higher level and ensure we are putting the customer first in everything we

do. We are approaching our financial outlook for the year more conservatively given the third quarter underperformance and our expectation for a highly competitive holiday season,” ” “We have taken significant action to

reposition Kohl’s for future growth. And while we are making progress against our strategic priorities, our efforts have yet to fully yield the intended outcome due in part to a continued challenging consumer environment and softness in some

of our core businesses. During the second quarter, our customers exhibited more discretion in their spending, which pressured our sales even as customers transacted more frequently. This overshadowed strong performance in our key growth areas,

including Sephora, home decor, gifting, and impulse. In spite of this, we continued to execute well operationally, enabling us to deliver a 13% increase in earnings driven by gross margin expansion and strong inventory and expense management.”

“Looking ahead, we are focused on ensuring that the substantial work that we’ve done across product, value, and experience is fully recognized by both new and existing customers. We will also capitalize on new opportunities such as our

partnership with Babies “R” Us and continue to benefit from our key growth areas. Our conviction in our strategy remains strong and our operating discipline, solid cash flow generation, and healthy balance sheet will continue to support

us as we work to return Kohl’s to growth.”

1,178 Stores Q3 2024 Pls add FLX logo

, ~ 15% Q3 growth of more than 9% Q3 Solid demand fragrance and hair

care growth in Yves Saint Laurent, , and Laneige

50% 25% Impulse sales in Q3 grew more than 40% as we introduced queuing

lines in 200 additional stores Initial sales contribution from our partnership with Babies “R” Us as we opened ~200 Q3 40% in-store baby shops and expanded our baby gear and accessories presence on 200 Kohls.com Expanded gifting

assortment in Q3 to prepare for the holiday season

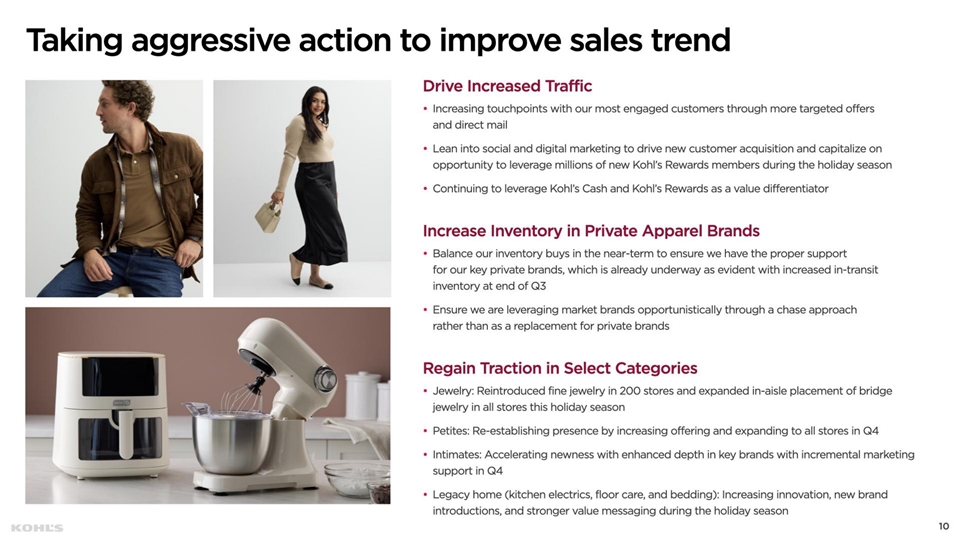

Increasing touchpoints with our most engaged customers through more

targeted offers and direct mail Building Increasing relevancy of apparel & footwear offerings in 2024 Increase Inventory in Private Apparel Brands ● Balance our inventory buys in the near-term to ensure we have the proper support for our

key private brands, which is already underway as evident with increased in-transit inventory at end of Q3 ● Ensure we are leveraging market brands opportunistically through a chase approach rather than as a replacement for private brands

Repositioning Juniors offering next to Regain Traction in Select Categories Sephora in stores to better capitalize ● Jewelry: Reintroducing fine jewelry in 200 stores and expanded in-aisle Q3 on cross shopping opportunities in placement of

bridge jewelry in all stores this holiday season 2024 ● Petites: Re-establishing presence by increasing offering and expanding to all stores in Q4 ● Intimates: Accelerating newness in key brands with incremental marketing support in Q4

Q1 2024 with positive sales growth ● Legacy home: Increasing innovation, new brand introductions, and stronger value messaging during the competitive holiday season Drive Increased Traffic ● Increasing our promotional activity, while

also deploying more targeted offers and direct mail ● Marketing efforts focused on maximizing impact during key shopping days ● Continuing to leverage Kohl’s Cash and Kohl’s Rewards as a value differentiator Legacy home

(kitchen electrics, floor care, and bedding): Women’s ● Strengthening young men’s ● Driving infant and category through newborn apparel the introduction of sales through new brands ● Continuing to Babies “R”

Us including amplify polished cross shopping Aeropostale and casual through Quiksilver private and market brands

(7%) to (8%) (6%) to (7%) (5.5%) to (6.5%) vs. 2023 (3%) to (5%) vs.

2023 3.0% to 3.2% 3.4% to 3.8% 3.0% to 3.3% $1.20 to $1.50 Dividend: $0.50 quarterly dividend payable December 24, 2024

as well as seasonally relevant businesses like toys, jewelry, and home

Holiday Well-positioned to deliver the great experience and holiday value that customers expect from Kohl’s in stores and digitally Compelling holiday assortment with expanded selection across apparel (sweaters, fleece, dresses) and gifting

(Sephora, toys, jewelry, cozy bedding) Key growth categories of Sephora, home decor, gifting, impulse, and Babies “R” Us increase in importance in Q4 Amplifying Kohl’s Cash and Rewards to drive engagement and maximize important

holiday shopping days 13

Coupon reflects incremental 125 bps step ups on May 2031

notes

16 Q3

Q3 Q3 Q3 net sales declined (8.8%) versus Q3 2023 and comparable sales

declined (9.3%) Q3 results did not meet our expectations as sales remained soft in our core apparel and footwear businesses Gross margin increased 20 bps to last year driven by inventory management and lower freight expense, partially offset by

higher digital penetration and increased promotional activity SG&A expense declined (5.1%) benefiting from tightly managed expenses across the organization, Strong collective performance Delivered continued strong performance in our key growth

especially in corporate and store-related expenses areas, including Sephora, home decor, gifting, and impulse, and also benefited from the opening of Babies Operating income of $98M and net income of $22M or $0.20 per diluted share “R”

Us shops in 200 of our stores Expanded gross margin by 20 basis points and managed expenses down approximately (5%) Reduced inventory by (3%) as compared to last year despite in-transit inventory increasing more than 40% 17

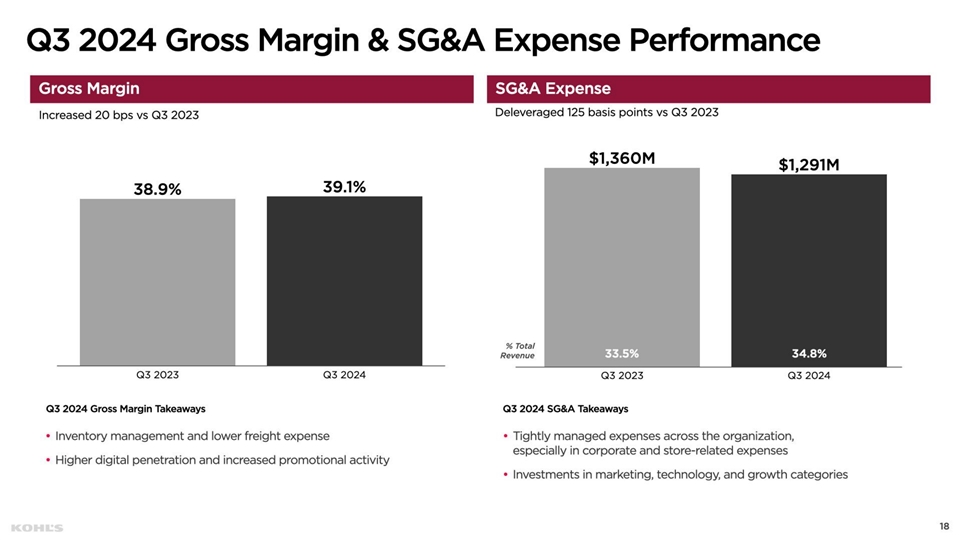

Q3 Deleveraged 125 basis points vs Q3 2023 Increased 20 bps vs Q3 2023

$1,360M 39.1% $1,291M 38.9% 33.5% 34.8% Q3 Q3 Q3 Q3 Q3 Q3 Inventory management and lower freight expense Tightly managed expenses across the organization, especially in corporate and store-related expenses Higher digital penetration and increased

promotional activity Investments in marketing, technology and growth categories 18 technology, and growth

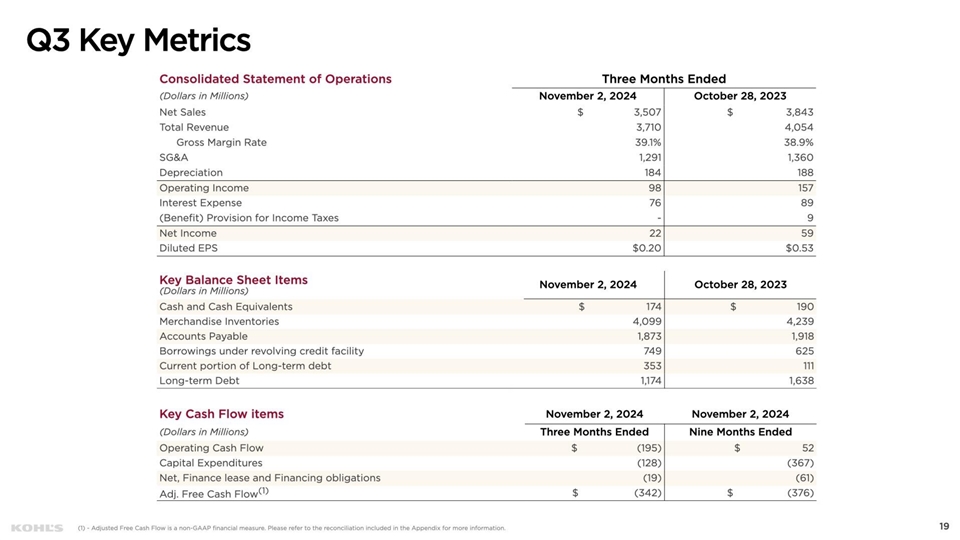

Updated w/ link in notes Q3 (Benefit) Provision for Income Taxes

19

20 21

21 22

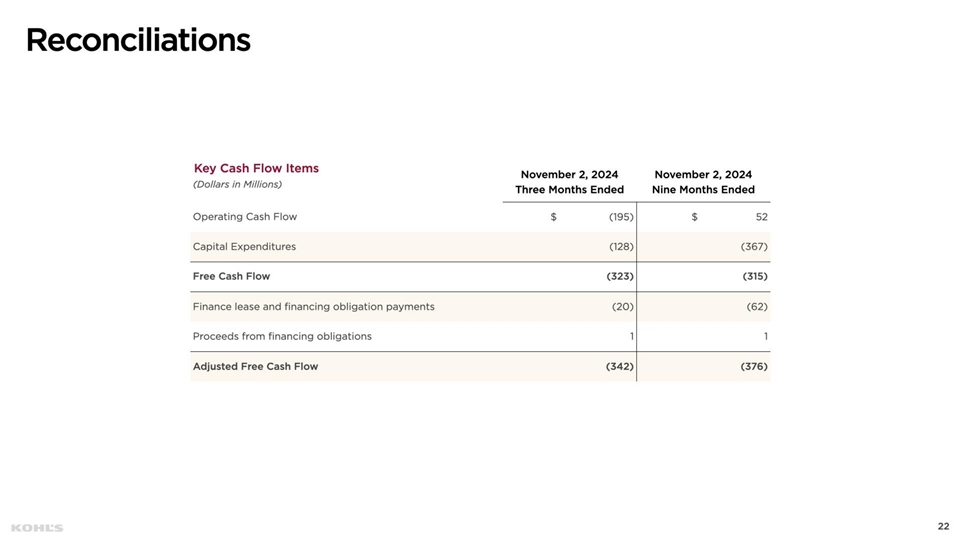

Update with link in description (rows 74-81) (20) (62) 1 1

22

Update images w/Fall/Winter theme

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Kohls (NYSE:KSS)

過去 株価チャート

から 11 2024 まで 12 2024

Kohls (NYSE:KSS)

過去 株価チャート

から 12 2023 まで 12 2024