NONE false 0001871745 0001871745 2024-01-17 2024-01-17 0001871745 dsaq:UnitsMember 2024-01-17 2024-01-17 0001871745 us-gaap:CommonClassAMember 2024-01-17 2024-01-17 0001871745 us-gaap:WarrantMember 2024-01-17 2024-01-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 17, 2024

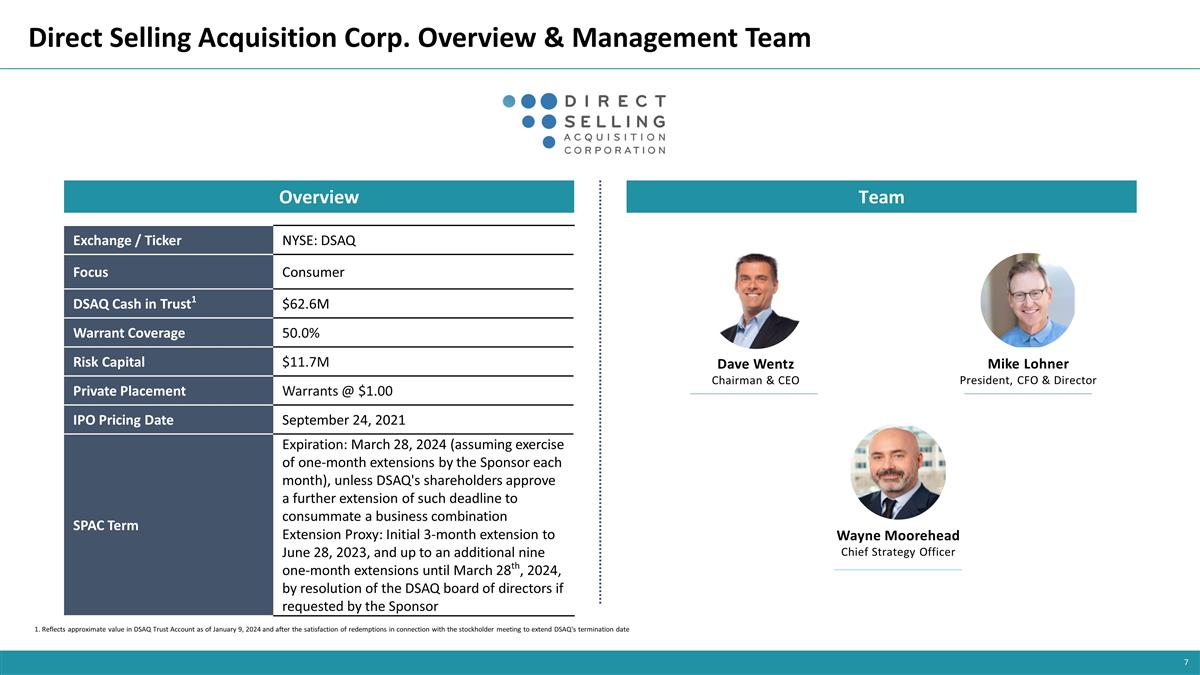

DIRECT SELLING ACQUISITION CORP.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-40831 |

|

86-3676785 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

5800 Democracy Drive Plano, TX |

|

75024 |

| (Address of principal executive offices) |

|

(Zip Code) |

(214) 380-6020

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Units, each consisting of one share of Class A common stock and one-half of one redeemable warrant |

|

DSAQ.U |

|

The New York Stock Exchange |

| Class A common stock, par value $0.0001 per share |

|

DSAQ |

|

The New York Stock Exchange |

| Redeemable warrants, each warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share |

|

DSAQ.W |

|

OTC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry Into a Material Definitive Agreement. |

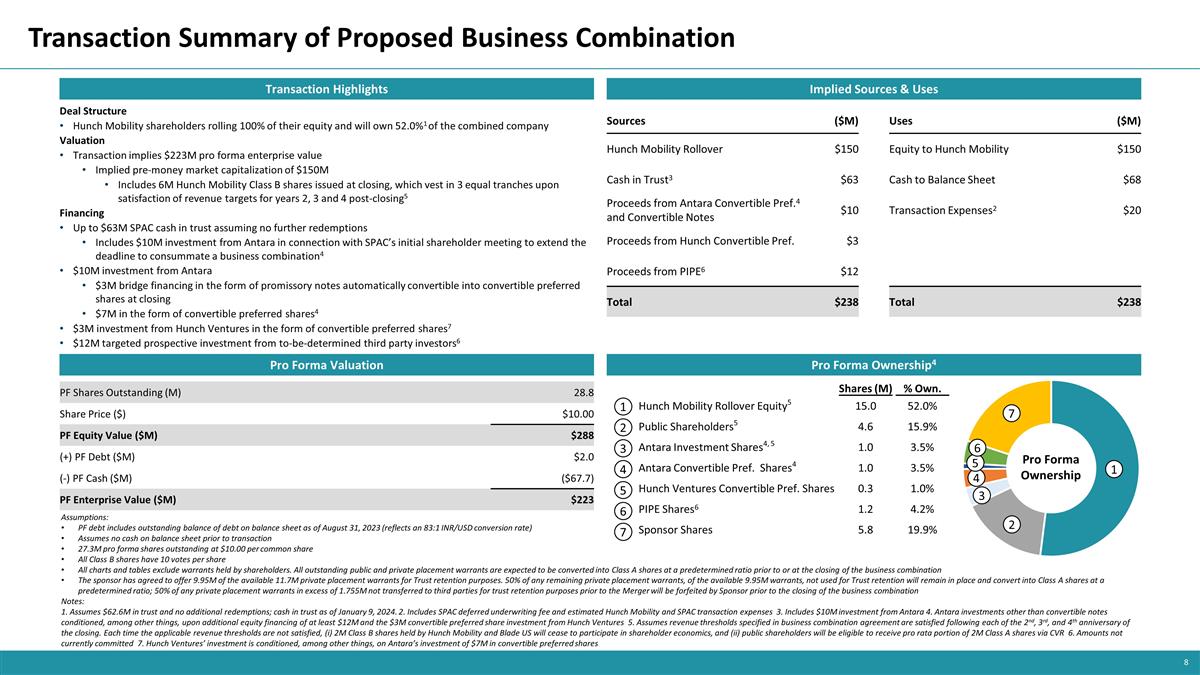

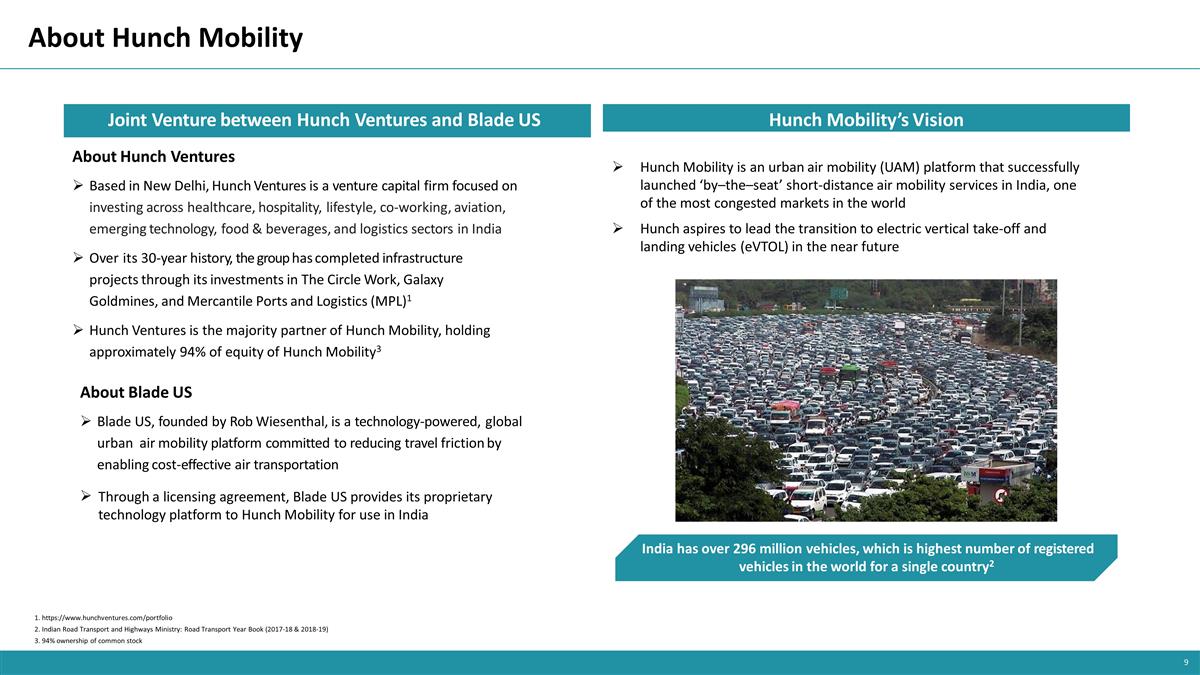

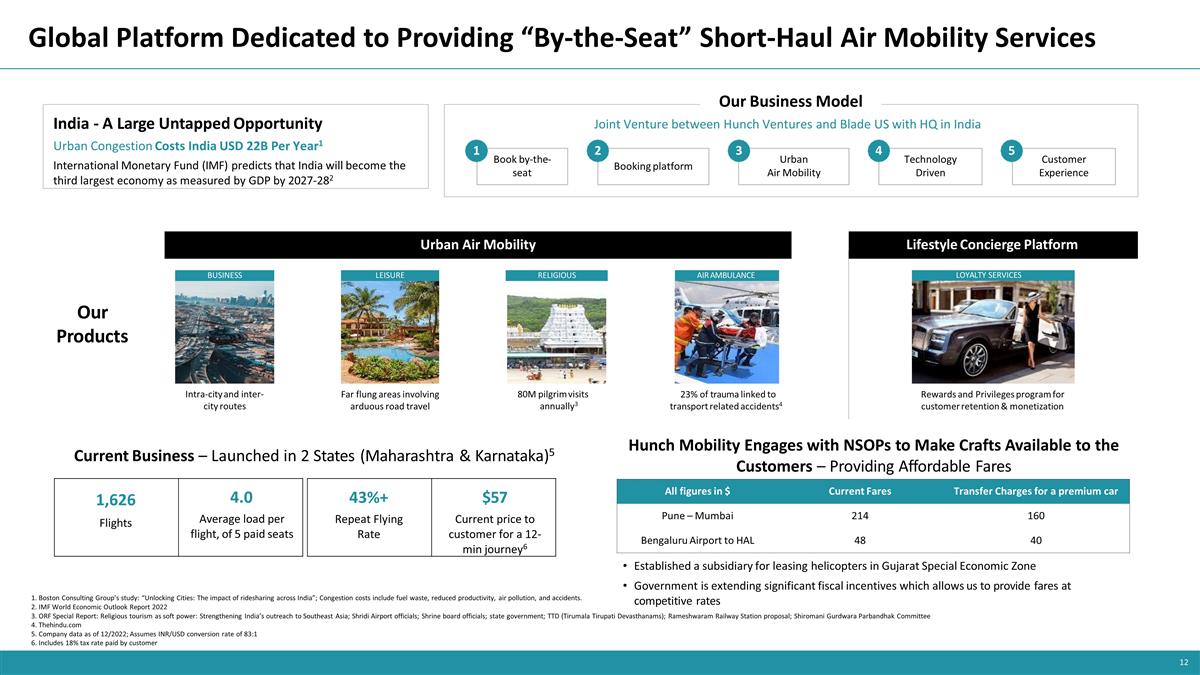

On January 17, 2024, Direct Selling Acquisition Corp., a Delaware corporation (the “Company”), entered into a Business Combination Agreement (the “Business Combination Agreement”), by and among Aeroflow Urban Air Mobility Private Limited, a private limited company incorporated under the laws of India and a direct wholly owned subsidiary of PubCo (“IndiaCo”), Hunch Technologies Limited, a private limited company incorporated in Ireland with registered number 607449 (“PubCo”), FlyBlade (India) Private Limited, a private limited company incorporated under the laws of India (“Hunch Mobility”), and HTL Merger Sub LLC, a Delaware limited liability company and a direct wholly owned subsidiary of PubCo (“Merger Sub”).

The transactions contemplated by the Business Combination Agreement, including the Merger (as defined below), and the transactions contemplated by the related transaction documents contemplated by the Business Combination Agreement (collectively, the “Transactions”), will constitute a “Business Combination” as contemplated by the Company’s Amended and Restated Certificate of Incorporation filed with the Delaware Secretary of State on August 23, 2021 (as amended on March 27, 2023). The Merger and the Transactions were unanimously approved by the board of directors of the Company on January 17, 2024. Capitalized terms used but not defined in this Current Report on Form 8-K have the meanings given to them in the Business Combination Agreement.

The Business Combination Agreement

Reorganization Transactions

Prior to the execution of the Business Combination Agreement, PubCo, IndiaCo and Hunch Mobility consummated a series of reorganization transactions pursuant to which, among other things, Hunch Mobility transferred all of its assets and liabilities (other than certain excluded assets and liabilities) to IndiaCo on a slump sale basis as a going concern.

In connection with the Merger, prior to the closing of the Transactions (the “Closing”), PubCo will complete a reorganization (such transactions, the “Pre-Closing Reorganization”), pursuant to which, among other things, (i) after receipt of applicable governmental and regulatory consents, Hunch Mobility shall transfer all of the equity securities of Transhermes Aero IFSC Private Limited, a wholly owned subsidiary of Hunch Mobility incorporated in Gujarat International Finance Tec-City under the (Indian) International Financial Services Centres Authority Act, 2019 to IndiaCo, (ii) Hunch Mobility shall promptly undertake any and all steps necessary to complete its voluntary liquidation/winding-up process in accordance with applicable law and (iii) PubCo shall consummate a reverse share split, pursuant to which all equity securities of PubCo will, following the consummation of the Pre-Closing Reorganization and immediately prior to the Merger, be consolidated and result in the aggregate number of Class A ordinary shares in the share capital of PubCo (the “PubCo Class A Ordinary Shares”) and Class B ordinary shares in the share capital of PubCo (the “PubCo Class B Ordinary Shares”) issued and outstanding on a fully-diluted, as converted and as exercised basis (excluding equity securities issued or issuable pursuant to the Convertible Note (as defined below)) being equal to the Pre-Closing Reorganization Consideration, which, in the aggregate, is anticipated to be equal to approximately $150 million.

The Merger

Following the Pre-Closing Reorganization and pursuant to the Business Combination Agreement, at the Closing, Merger Sub will merge with and into the Company (the “Merger”), pursuant to which the separate corporate existence of Merger Sub will cease, with the Company being the surviving corporation and becoming a wholly owned subsidiary of PubCo.

In connection with the Merger, each (i) share of Class A common stock of the Company, par value $0.0001 per share (each, a “DSAQ Class A Share”), (ii) share of Class B common stock of the Company, par value $0.0001 per share (each, a “DSAQ Class B Share”), and (iii) convertible preferred share of the Company that will be issued pursuant to the Investor Subscription Agreement (as defined below) (each, a “DSAQ Preferred Share” and together with the DSAQ Class A Shares and DSAQ Class B Shares, the “DSAQ Shares”), issued and outstanding immediately prior to the effective time of the Merger (the “Effective Time”), other than those held in treasury, will be automatically cancelled and extinguished and converted into the right to receive: (A) with respect to each DSAQ Class A Share and DSAQ Class B Share, one (1) PubCo Class A Ordinary Share, one (1) CVR I, one (1) CVR II and one (1) CVR III, which are described in further detail below, and (B) with respect to each DSAQ Preferred Share, one (1) PubCo Preferred Share. All DSAQ Shares held in treasury will be canceled and extinguished without consideration.

Each unit of the Company issued in the IPO that is outstanding immediately prior to the Effective Time will be automatically separated and the holder thereof will be deemed to hold one (1) DSAQ Class A Share and one-half (1/2) of a public warrant of the Company, which underlying securities will be converted as described above.

At the Effective Time, unless otherwise amended by the DSAQ Warrant Amendment, without any further action, each warrant of the Company that is outstanding immediately prior to the Effective Time shall remain outstanding but shall be assumed by PubCo and automatically adjusted to become (A) with respect to each public warrant of the Company, one (1) public warrant of PubCo and (B) with respect to each private placement warrant of the Company, one (1) private placement warrant of PubCo, each of which shall be subject to substantially the same terms and conditions applicable prior to such conversion; except that each such warrant shall be exercisable (or will become exercisable in accordance with its terms) for (i) one (1) PubCo Class A Ordinary Share, (ii) one (1) CVR I, (iii) one (1) CVR II and (iv) one (1) CVR III, in lieu of DSAQ Class A Shares (subject to the PubCo warrant agreement). If the DSAQ Warrant Amendment is approved, then immediately prior to the Effective Time, each warrant of the Company will automatically convert into one-fifth (1/5) of one DSAQ Class A Share (with no fractional shares being issued if less than five (5) warrants are held).

Registration Statement/Proxy Statement

In connection with the Transactions, the Company and PubCo will prepare and file a registration statement on Form F-4 (the “Registration Statement/Proxy Statement”) with the SEC, which will include a prospectus of PubCo and a proxy statement/prospectus for the Company’s stockholder meeting to solicit the vote of the Company’s stockholders to, among other things, adopt the Business Combination Agreement and approve the Transactions.

In addition, as promptly as practicable following the time at which the Registration Statement/Proxy Statement is declared effective under the Securities Act, the Company will solicit the vote or consent of registered holders of warrants of the Company to adopt and approve an amendment to the Company’s warrant agreement to provide that, effective immediately prior to the Effective Time, each warrant of the Company will automatically convert into one-fifth (1/5) of one DSAQ Class A Share (with no fractional shares being issued if less than five (5) warrants are held).

Representations, Warranties and Covenants

The parties to the Business Combination Agreement have made representations, warranties and covenants that are customary for transactions of this nature. The representations and warranties of the respective parties to the Business Combination Agreement will not survive the Closing. The covenants of the respective parties to the Business Combination Agreement will also not survive the Closing, except for those covenants that by their terms expressly apply in whole or in part after the Closing.

In connection with the foregoing, the Company, through its board of directors, shall recommend to the Company’s stockholders and warrantholders the adoption and approval of the Business Combination Agreement and the transactions contemplated thereby (including the Merger), and the approval and adoption of the DSAQ Warrant Amendment, respectively. Notwithstanding the foregoing, if, at any time prior to obtaining the requisite approval of the Company’s stockholders with respect to the Business Combination, the Company’s board of directors determines in good faith, after consultation with its outside legal counsel, that a Blade Group Material Adverse Effect has occurred on or after the date of the Business Combination Agreement and, as a result, the failure to change its recommendation would be inconsistent with the board of directors’ fiduciary duties under applicable law, the Company’s board of directors may effect a change of recommendation, subject to certain conditions.

Exclusivity

Each of the Company, PubCo, IndiaCo, Hunch Mobility and Merger Sub has agreed that from the date of the Business Combination Agreement to the earlier of the closing of the Merger and the termination of the Business Combination Agreement, no party will: (i) solicit, initiate, encourage (including by means of furnishing or disclosing information), knowingly facilitate (including by commencing due diligence), discuss or negotiate, directly or indirectly, any inquiry, proposal or offer (written or oral) with respect to an alternative transaction, (ii) furnish or disclose any non-public information to any person in connection with, or that could reasonably be expected to lead to, an alternative transaction, (iii) enter into any contract or other arrangement or understanding regarding an alternative transaction, (iv) make any filings with the SEC in connection with a public offering of any equity securities or other securities of the Blade Group (or any affiliate or successor of the Blade Group) or (v) otherwise cooperate in any way with, or assist or participate in, or knowingly facilitate or encourage any effort or attempt by any person (other than the Principal Shareholders and the Blade Group) to do or seek to do any of the foregoing or seek to circumvent such covenant or further any alternative transaction.

Conditions to Closing

Mutual Conditions

The obligations of the parties to the Business Combination Agreement to consummate the Transactions are conditioned upon the following mutual conditions:

| |

a) |

the absence of any law or other legal restraint or prohibition issued by any court of competent jurisdiction or other governmental authority preventing the consummation of the Transactions; |

| |

b) |

the effectiveness under the Securities Act of 1933, as amended (the “Securities Act”), of the Registration Statement/Proxy Statement and that no stop order will have been issued by the SEC and remain in effect with respect to the Registration Statement/Proxy Statement; |

| |

c) |

obtaining, at the special meeting of Company stockholders where a quorum is present, the vote of the holders of a majority of the outstanding DSAQ Shares entitled to vote thereon to adopt and approve the Business Combination Agreement and the transactions contemplated thereby (including the Merger); |

| |

d) |

the PubCo Class A Ordinary Shares that constitute the consideration for the Business Combination having been approved for listing on a stock exchange, subject only to notice of issuance; |

| |

e) |

the entry by PubCo into a composition agreement with the Revenue Commissioners of Ireland and a special eligibility agreement for securities with the Depositary Trust Company in respect of PubCo Class A Ordinary Shares and, if the Company’s warrants are assumed pursuant to the Business Combination Agreement, PubCo warrants, both of which shall be in full force and effect and enforceable in accordance with their respective terms; and |

| |

f) |

PubCo, DSAC Partners LLC, a Delaware limited liability company (“Sponsor”), and the Principal Shareholders (as defined below) shall have executed a registration rights agreement, containing customary demand and piggyback registration rights, in a form reasonably acceptable to PubCo, the Sponsor and the Principal Shareholders. |

Conditions of PubCo, IndiaCo, Hunch Mobility and Merger Sub

The obligations of PubCo, IndiaCo, Hunch Mobility and Merger Sub to consummate the Transactions are conditioned upon, among other things:

| |

a) |

the consummation of the transactions contemplated by the Investor Subscription Agreement (as defined below); and |

| |

b) |

An affiliate of Investor (as defined below) being the beneficial owner of at least 955,100 DSAQ Class A Shares and not electing to have such DSAQ Class A Shares redeemed by the Company in connection with the Company’s special meeting. |

Conditions of the Company

The obligations of the Company to consummate the Transactions are conditioned upon, among other things:

| |

a) |

the absence of a Blade Group Material Adverse Effect; |

| |

b) |

the Pre-Closing Reorganization having been completed; and |

| |

c) |

the consummation of the transactions contemplated by the Hunch Subscription Agreement. |

Termination

The Business Combination Agreement may be terminated at any time prior to the Closing by mutual written consent of the Company and PubCo and in certain other circumstances, including if the Closing has not occurred on or prior to March 28, 2024 (subject to automatic extension to June 28, 2024 in the event that the Company obtains an extension of the deadline by which the Company must complete a business combination in accordance with its governing documents) and the primary cause of the failure for the Closing to have occurred on or prior to such date is not due to a breach of the Business Combination Agreement by the party seeking to terminate.

The foregoing description of the Business Combination Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Business Combination Agreement, a copy of which is included as Exhibit 2.1 to this Current Report on Form 8-K, and incorporated herein by reference. The Business Combination Agreement contains representations, warranties and covenants that the respective parties made to each other as of the date of such agreement or other specific dates. The assertions embodied in those representations, warranties and covenants were made for purposes of the contract among the respective parties to the Business Combination Agreement and are subject to important qualifications and limitations agreed to by the contracting parties in connection with negotiating the Business Combination Agreement. The Business Combination Agreement has been attached to provide investors with information regarding its terms. It is not intended to provide any other factual information about the Company or any other party to the Business Combination Agreement. In particular, the representations, warranties, covenants and agreements contained in the Business Combination Agreement, which were made only for purposes of the Business Combination Agreement and as of specific dates, were solely for the benefit of the respective parties to the Business Combination Agreement, may be subject to limitations agreed upon by the parties thereto (including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the respective parties to the Business Combination Agreement instead of establishing these matters as facts) and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to the Company’s investors and security holders. Company investors and security holders are not third-party beneficiaries under the Business Combination Agreement and should not rely on the representations,

warranties or covenants of any party to the Business Combination Agreement. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Business Combination Agreement, which subsequent information may or may not be fully reflected in the Company’s public disclosures.

Note Purchase Agreement and Convertible Notes

Concurrently with the execution and delivery of the Business Combination Agreement, PubCo entered into a convertible note purchase agreement (the “Note Purchase Agreement”) with an investor with majority economic, non-voting interest in the Sponsor (“Investor” or the “Holder”), and IndiaCo, pursuant to which PubCo will issue to the Holder three senior unsecured convertible notes with an aggregate principal amount of $3,000,000 (each a “Convertible Note”, and together the “Convertible Notes”). Within twenty-four (24) hours of the execution of the Business Combination Agreement, or at such other time and place upon which the parties shall agree in writing (the “Initial Closing Date”), PubCo shall execute and deliver a Convertible Note with an aggregate principal amount of $1,000,000 to the Holder, which is automatically convertible into 100,000 PubCo Preferred Shares upon the Effective Time (the “Initial Convertible Note”). Following the Initial Closing Date, PubCo shall execute and deliver, and the Holder shall fund, two additional Convertible Notes in two monthly installments at subsequent closings (each an “Installment Closing”). The two Installment Closings shall be held: (i) on the day one (1) month following the Initial Closing Date and (ii) on the day two (2) months following the Initial Closing Date, at such time and place as shall be approved by PubCo and the Holder, with an additional aggregate principal amount of $2,000,000 on the same terms and conditions as those contained in the Initial Convertible Note. The PubCo Preferred Shares issuable upon conversion of the Convertible Notes, pursuant to their terms, shall be convertible into PubCo Class A Ordinary Shares. Interest shall accrue on the unpaid principal balance of each Convertible Note, together with any interest accrued but unpaid thereon (the “Outstanding Amount”), at an annual rate equal to 10% per annum, until the Outstanding Amount is paid or the closing of the Business Combination. Each Convertible Note’s first interest payment date will be the first three-month anniversary of the date of each respective Convertible Note. Pursuant to the Note Purchase Agreement, the proceeds from the issuance of the Convertible Notes will be used: (i) up to $750,000 solely for working capital purposes for the operation of IndiaCo’s business, (ii) the remaining aggregate proceeds of the Convertible Notes other than the proceeds used in accordance with clause (i) solely for the acquisition of aircraft and (iii) in each case of clauses (i) and (ii) in compliance with all applicable laws.

The Outstanding Amount of each Convertible Note shall be automatically due and payable in full on the date that is the earlier of (1) three (3) business days following the termination of the Business Combination Agreement and (2) 363 days from the date of issuance of each respective Convertible Note (as applicable, the “Maturity Date”). If PubCo fails to pay any amount due pursuant to each Convertible Note within five business days of each respective Maturity Date, interest shall accrue at the rate of 17% per annum on the Outstanding Amount until the entire Outstanding Amount is paid in full.

The foregoing descriptions of the Note Purchase Agreement and Convertible Notes do not purport to be complete and are qualified in their entirety by reference to the full text of the Note Purchase Agreement and form of Convertible Note. A copy of the Note Purchase Agreement is included as Exhibit 10.1 to this Current Report on Form 8-K and a copy of the form of Convertible Note is included as Exhibit A of the Note Purchase Agreement, each of which is incorporated herein by reference.

Investor Subscription Agreement

Concurrently with the execution and delivery of the Business Combination Agreement, the Company entered into a subscription agreement (the “Investor Subscription Agreement”) with Investor.

Pursuant to the Investor Subscription Agreement, Investor agreed to subscribe for and purchase, and the Company agreed to issue and sell to Investor, immediately prior to the Closing, an aggregate of 700,000 DSAQ Preferred Shares for a purchase price of $10.00 per share, for aggregate gross proceeds of $7,000,000.

The closing of the Investor Subscription Agreement will be conditioned on (i) the consummation of the transactions contemplated by the Hunch Subscription Agreement and (ii) the consummation of additional investments in an aggregate investment amount of $12,000,000 (“Minimum Additional Investment”), for DSAQ Preferred Shares, DSAQ Class A Shares, PubCo Preferred Shares or PubCo Ordinary Shares, issued to investors (the “Additional Investors”), on terms and conditions that are not materially more advantageous to any such Additional Investors than Investor hereunder, unless such terms and conditions are consented to by Investor. For avoidance of doubt, the Minimum Additional Investment shall not include any investments pursuant to the Investor Subscription Agreement, the acquisition of the Retained Shares (as defined the Investor Subscription Agreement) or the Hunch Subscription Agreement.

The Investor Subscription Agreement contains customary conditions to closing, including, among other things, the consummation of the Business Combination. The Investor Subscription Agreement also provides that the Company will grant Investor certain customary registration rights.

The foregoing description of the Investor Subscription Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Investor Subscription Agreement, a copy of which is included as Exhibit 10.2 to this Current Report on Form 8-K and incorporated herein by reference.

Hunch Subscription Agreement

Concurrently with the execution and delivery of the Business Combination Agreement, Quick Response Services Provider LLP (“QRSP”) entered into a subscription agreement (the “Hunch Subscription Agreement”) with PubCo.

Pursuant to the Hunch Subscription Agreement, QRSP agreed to subscribe for and purchase, and PubCo agreed to issue and sell to QRSP, immediately prior to the Closing, an aggregate of 300,000 PubCo Preferred Shares for a purchase price of $10.00 per share, for aggregate gross proceeds of $3,000,000.

The closing of the Hunch Subscription Agreement will be conditioned on the consummation of the transactions contemplated by the Investor Subscription Agreement. The Hunch Subscription Agreement also contains customary conditions to closing, including, among other things, the consummation of the Business Combination. The Hunch Subscription Agreement also provides that PubCo will grant QRSP certain customary registration rights.

The foregoing description of the Hunch Subscription Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Hunch Subscription Agreement, a copy of which is included as Exhibit 10.3 to this Current Report on Form 8-K and incorporated herein by reference.

Principal Shareholder Support Agreement

Concurrently with the execution and delivery of the Business Combination Agreement, the Company, Quick Response Services Provider LLP, a limited liability partnership incorporated under the laws of India (“Hunch”), and Blade Urban Air Mobility Inc., a Delaware corporation (together with Hunch, the

“Principal Shareholders” and each, a “Principal Shareholder”), and PubCo have entered into that Principal Shareholder Support Agreement (the “Principal Shareholder Support Agreement”) pursuant to which each Principal Shareholder has agreed, among other things: (i) to support and vote or consent to the requisite transaction proposals and (ii) not to transfer any equity security of PubCo until the earlier to occur of (a) the Closing, (b) such date and time as the Business Combination Agreement is validly terminated in accordance with its terms and (c) the mutual agreement of the parties thereto, in each case subject to the terms and conditions set forth therein.

The foregoing description of the Principal Shareholder Support Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Principal Shareholder Support Agreement, a copy of which is included as Exhibit 10.4 to this Current Report on Form 8-K and incorporated herein by reference.

Sponsor Support Agreement

Concurrently with the execution and delivery of the Business Combination Agreement, the Sponsor, the Company, PubCo and, for certain limited purposes, certain of the Company’s directors, executive officers and affiliates (such individuals, the “Insiders”) have entered into a Sponsor Support Agreement (the “Sponsor Support Agreement”).

Pursuant to the Sponsor Support Agreement, the Sponsor has, among other things, agreed to (i) support and vote in favor of the requisite transaction proposals; (ii) waive all adjustments to the conversion ratio set forth in Company’s amended and restated certificate of incorporation with respect to its DSAQ Class B Shares, (iii) be bound by certain transfer restrictions with respect to their DSAQ Class B Shares and the warrants of the Company, as applicable, prior to Closing and (iv) the forfeiture, transfer or conversion into DSAQ Class A Shares, as applicable of warrants of the Company under the terms and conditions set forth therein. Specifically, the Sponsor has agreed to make available up to 9,950,000 private placement warrants of the Company (or, if the DSAQ Warrant Amendment is approved, the PubCo Class A Ordinary Shares corresponding thereto) to existing stockholders of the Company in exchange for such stockholders agreeing not to redeem their DSAQ Class A Shares in connection with the Company’s stockholder meeting. If less than all such private placement warrants (or, if the DSAQ Warrant Amendment is approved, the PubCo Class A Ordinary Shares corresponding thereto) are so transferred, then the Sponsor shall (i) retain 50% of such private placement warrants not so transferred and (ii) forfeit 50% of such private placement warrants not so transferred. If the DSAQ Warrant Amendment is not approved, any such retained private placement warrants may, at the Sponsor’s election, be surrendered to the Company prior to the Closing in exchange for one (1) DSAQ Class A Share for every five (5) private placement warrants so surrendered. If the DSAQ Warrant Amendment is approved, each such private placement warrant retained will automatically convert into one-fifth (1/5) of one DSAQ Class A Share (with no fractional shares being issued if less than five (5) warrants are held).

The foregoing description of the Sponsor Support Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Sponsor Support Agreement, a copy of which is included as Exhibit 10.5 to this Current Report on Form 8-K and incorporated herein by reference.

Contingent Value Rights Agreement

Concurrently with the consummation of the Business Combination Agreement, PubCo will enter into a Contingent Value Rights Agreement (the “CVR Agreement”) with a rights agent (“Rights Agent”) pursuant to which the holders of DSAQ Class A Shares and DSAQ Class B Shares outstanding as of immediately prior to the Effective Time will receive one (1) CVR I, one (1) CVR II and one (1) CVR III (each, a “CVR”) for each one whole DSAQ Share held by such stockholder on such date. Each CVR I represents the right of the holder thereof to receive its pro rata share of 2,000,000 newly issued PubCo

Class A Ordinary Shares, and each CVR I shall be exercised automatically upon PubCo’s delivery of the CVR Payment Notice (as defined in the CVR Agreement) to the Rights Agent, notifying the Rights Agent that, during the 12 month period ending on the final day of the month in which the second anniversary of the Closing occurs, the consolidated revenues of PubCo and its subsidiaries was less than $50 million. Each CVR II represents the right of the holder thereof to receive its pro rata share of 2,000,000 newly issued PubCo Class A Ordinary Shares, and each CVR II shall be exercised automatically upon PubCo’s delivery of the CVR Payment Notice to the Rights Agent, notifying the Rights Agent that, during the 12 month period ending on the final day of the month in which the third anniversary of the Closing occurs, the consolidated revenues of PubCo and its subsidiaries was less than $142 million. Each CVR III represents the right of the holder thereof to receive its pro rata share of 2,000,000 newly issued PubCo Class A Ordinary Shares, and each CVR III shall be exercised automatically upon PubCo’s delivery of the CVR Payment Notice, notifying the Rights Agent that, during the 12 month period ending on the final day of the month in which the fourth anniversary of the Closing occurs, the consolidated revenues of PubCo and its subsidiaries was less than $263 million.

The contingent payments under the CVR Agreement, if they become payable, will become payable to the Rights Agent for subsequent distribution to the holders of the CVRs. There can be no assurance that any payment of any PubCo Ordinary Shares will be made or that any holders of CVRs will receive any amounts with respect thereto.

The right to the contingent payments contemplated by the CVR Agreement is a contractual right only. The CVRs will not be evidenced by a certificate or other instrument. The CVRs will not be transferable. The CVRs will not have any voting or dividend rights and will not represent any equity or ownership interest in PubCo or any of its affiliates. No interest will accrue on any amounts payable in respect of the CVRs.

The foregoing description of the CVR Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the CVR Agreement, a copy of which is included as Exhibit E to the Business Combination Agreement in Exhibit 2.1 to this Current Report on Form 8-K, each of which are incorporated herein by reference.

| Item 3.02 |

Unregistered Sales of Equity Securities. |

The disclosure set forth above in Item 1.01 of this Current Report on Form 8-K is incorporated by reference herein. The Convertible Note issued pursuant to the Note Purchase Agreement and shares of Convertible Preferred Stock to be issued pursuant to the Investor Subscription Agreement, have not been registered under the Securities Act in reliance upon the exemption provided in Section 4(a)(2) thereof. The PubCo Preferred Shares to be issued pursuant to the Hunch Subscription Agreement, have not been registered under the Securities Act in reliance upon the exemption provided in Regulation S thereof.

| Item 7.01 |

Regulation FD Disclosure. |

On January 18, 2024, the Company and Hunch Mobility issued a joint press release in the United States announcing the execution of the Business Combination Agreement. A copy of the press release is furnished herewith as Exhibits 99.1 and incorporated herein by reference.

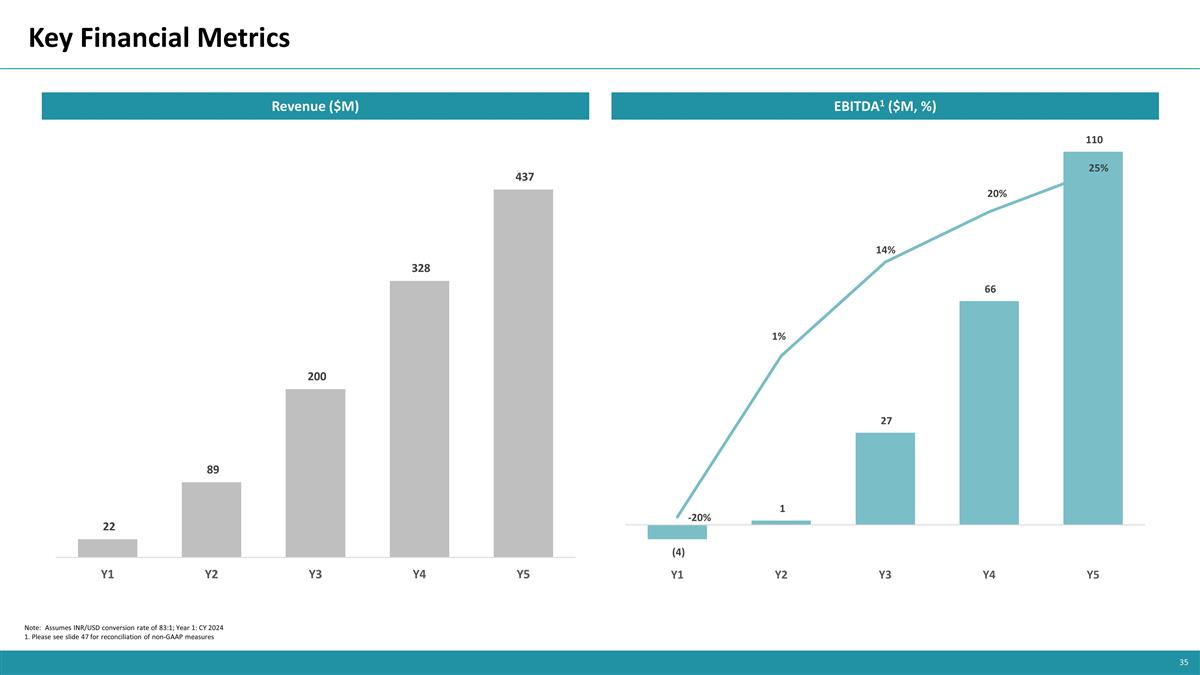

Furnished herewith as Exhibit 99.2 and incorporated into this Item 7.01 by reference herein is the investor presentation, dated January 2024, that the Company and Hunch Mobility have prepared in connection with the announcement of the Business Combination.

Additional Information about the Transaction and Where to Find It.

This filing relates to the proposed business combination involving the Company, Hunch Mobility, IndiaCo, PubCo and Merger Sub. In connection with the proposed business combination, the Company

and PubCo intend to file with the SEC a Registration Statement/Proxy Statement, which will include a preliminary proxy statement/ prospectus of the Company and a preliminary prospectus of PubCo relating to the shares to be issued in connection with the proposed business combination. This filing is not a substitute for the Registration Statement/Proxy Statement, the definitive proxy statement/final prospectus or any other document that PubCo or the Company has filed or will file with the SEC or send to its stockholders in connection with the proposed business combination. This filing does not contain all the information that should be considered concerning the proposed business combination and other matters and is not intended to form the basis for any investment decision or any other decision in respect of such matters.

BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, THE COMPANY’S STOCKHOLDERS AND OTHER INTERESTED PARTIES ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE AND ANY AMENDMENTS THERETO AND ANY OTHER DOCUMENTS FILED BY THE COMPANY OR PUBCO WITH THE SEC IN CONNECTION WITH THE PROPOSED BUSINESS COMBINATION OR INCORPORATED BY REFERENCE THEREIN IN THEIR ENTIRETY BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE PROPOSED BUSINESS COMBINATION BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED BUSINESS COMBINATION AND THE PARTIES TO THE PROPOSED BUSINESS COMBINATION.

After the Registration Statement/Proxy Statement is declared effective, the definitive proxy statement will be mailed to stockholders of the Company as of a record date to be established for voting on the proposed business combination. Additionally, the Company and PubCo will file other relevant materials with the SEC in connection with the Business Combination. Copies of the Registration Statement/Proxy Statement, the definitive proxy statement/final prospectus and all other relevant materials for the proposed business combination filed or that will be filed with the SEC may be obtained, when available, free of charge at the SEC’s website at www.sec.gov. The Company’s stockholders may also obtain copies of the definitive proxy statement/prospectus, when available, without charge, by directing a request to Direct Selling Acquisition Corp., 5800 Democracy Drive, Plano, TX 75024.

Participants in the Solicitation of Proxies

This filing may be deemed solicitation material in respect of the proposed business combination. The Company, Hunch Mobility, IndiaCo, PubCo, Merger Sub and their respective directors and executive officers, under SEC rules, may be deemed to be participants in the solicitation of proxies from the Company’s stockholders in connection with the proposed business combination. Security holders and investors may obtain more detailed information regarding the names and interests in the proposed business combination of the Company’s directors and officers in the Company’s filings with the SEC, including the Company’s initial public offering prospectus, which was filed with the SEC on September 27, 2021, the Company’s subsequent annual report on Form 10-K and quarterly reports on Form 10-Q. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to the Company’s stockholders in connection with the business combination will be included in the definitive proxy statement/prospectus relating to the proposed business combination when it becomes available. You may obtain free copies of these documents, when available, as described in the preceding paragraphs.

No Offer or Solicitation

This filing is for information purposes only and is not intended to and does not constitute, or form part of, an offer, invitation or the solicitation of an offer or invitation to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of any securities, or the solicitation of any vote or approval in any

jurisdiction, pursuant to the proposed business combination or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. The proposed business combination will be implemented solely pursuant to the Business Combination Agreement, filed as an exhibit to this Current Report on Form 8-K, which contains the full terms and conditions of the proposed business combination. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act.

Forward-Looking Statements

All statements other than statements of historical facts contained in this filing are forward-looking statements. Forward-looking statements may generally be identified by the use of words such as “anticipate,” “believe,” “envision,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue,” “contemplate” or the negative or plural of these words, or other similar expressions that are predictions or indicate future events or prospects, although not all forward-looking statements contain these words. These forward-looking statements include, but are not limited to, statements regarding the financial position, business strategy and the plans and objectives of management for future operations including as they relate to the proposed business combination and related transactions, pricing and market opportunity, the satisfaction of closing conditions to the proposed business combination and related transactions, the level of redemptions by the Company’s public stockholders and the timing of the completion of the proposed business combination, including the anticipated closing date of the proposed business combination and the use of the cash proceeds therefrom. These statements are based on various assumptions, whether or not identified in this filing, and on the current expectations of the Company, IndiaCo, Hunch Mobility and PubCo’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and may differ from such assumptions, and such differences may be material. Many actual events and circumstances are beyond the control of the Company, IndiaCo, Hunch Mobility and PubCo.

These forward-looking statements are subject to a number of risks and uncertainties, including (i) changes in domestic and foreign business, market, financial, political and legal conditions; (ii) the inability of the parties to successfully or timely consummate the proposed business combination, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the proposed business combination, or that the approval of the stockholders of Hunch Mobility or the Company is not obtained; (iii) the ability to acquire and maintain the listing of PubCo’s securities on a stock exchange ; (iv) the inability to complete any private placement financing, the amount of any private placement financing or the completion of any private placement financing with terms unfavorable to you; (v) the risk that the proposed business combination disrupts current plans and operations the Company, Hunch Mobility, IndiaCo or PubCo as a result of the announcement and consummation of the proposed business combination and related transactions; (vi) the risk that any of the conditions to closing of the business combination are not satisfied in the anticipated manner or on the anticipated timeline or are waived by any of the parties thereto; (vii) the failure to realize the anticipated benefits of the proposed business combination and related transactions, which may be affected by, among other things, the ability of the PubCo to grow and manage growth profitably, grow its customer base and retain its management and key employees; (viii) risks relating to the uncertainty of the costs related to the proposed business combination; (ix) risks related to the rollout of Hunch Mobility, IndiaCo and PubCo’s business strategy and the timing of expected business milestones, including, but not limited to, the use of electrical vertical aircraft; (x) Hunch Mobility’s limited operating history and history of net losses; (xi) the evolution and growth of the markets in which PubCo operates; (xii) changes in applicable laws or regulations; (xiii) the

ability of PubCo to adhere to legal and regulatory requirements and to receive any needed regulatory approvals or licenses; (xiv) cybersecurity risks, data loss and other breaches of PubCo’s network security and the disclosure of personal information; (xv) the effects of competition on Hunch Mobility, IndiaCo and PubCo’s business; (xvi) risks related to domestic and international political and macroeconomic uncertainty, including the continued economic growth of the Indian sub-continent, the impacts of climate change, the Russia-Ukraine conflict, consumer preferences, supply chain issues and inflation; (xvii) risks related to PubCo’s third party aircraft operators; (xviii) PubCo’s reliance on technology leased from Blade Air Mobility, Inc.; (xix) the limited geographic scope of PubCo’s operations to the Indian sub-continent; (xx) the outcome of any legal proceedings that may be instituted against Hunch Mobility, IndiaCo, the Company, PubCo or any of their respective directors or officers, following the announcement of the proposed business combination; (xxi) the amount of redemption requests made by the Company’s public stockholders; (xxii) the ability of the Company to issue equity, if any, in connection with the proposed business combination or to otherwise obtain financing in the future; (xxiii) risks related to Hunch Mobility, IndiaCo and PubCo’s industry; and (xxiv) those factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 and subsequent Quarterly Reports on Form 10-Q, in each case, under the heading “Risk Factors,” and other documents of the Company or PubCo to be filed with the SEC, including the proxy statement/prospectus. If any of these risks materialize or Hunch Mobility, IndiaCo, PubCo’s or the Company’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that Hunch Mobility, IndiaCo, PubCo and the Company do not presently know or that they currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect the Company, Hunch Mobility, IndiaCo and PubCo’s expectations, plans or forecasts of future events and views as of the date of this filing. The Company, Hunch Mobility, IndiaCo and PubCo anticipate that subsequent events and developments will cause their assessments to change. The Company, Hunch Mobility, IndiaCo and PubCo undertake no obligation to update any forward-looking statements made in this communication to reflect events or circumstances after the date of this presentation or to reflect new information or the occurrence of unanticipated events, except as required by law. However, while the Company, Hunch Mobility, IndiaCo or PubCo may elect to update these forward-looking statements at some point in the future, each of them specifically disclaim any obligation to do so, unless required by applicable law. If the Company, Hunch Mobility, IndiaCo or PubCo do update one or more forward looking statements, no inference should be drawn that they will make additional updates thereto or with respect to other forward-looking statements. These forward-looking statements should not be relied upon as representing the Company Hunch Mobility, IndiaCo or PubCo’s assessments as of any date subsequent to the date of this filing. Accordingly, undue reliance should not be placed upon the forward-looking statements. The Company, Hunch Mobility, IndiaCo and PubCo may not actually achieve the plans, intentions, or expectations disclosed in these forward-looking statements, and you should not place undue reliance on these forward-looking statements. These forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, or investments.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits. The following exhibits are provided as part of this Form 8-K:

|

|

|

| 10.1 |

|

Note Purchase Agreement, dated as of January 17, 2024, by and among Aeroflow Urban Air Mobility Private Limited, Hunch Technologies Limited, FlyBlade (India) Private Limited and Antara Capital Master Fund LP |

|

|

| 10.2 |

|

Investor Subscription Agreement, dated as of January 17, 2024, by and between Direct Selling Acquisition Corp. and Antara Capital Master Fund LP. |

|

|

| 10.3 |

|

Hunch Subscription Agreement, dated as of January 17, 2024, by and between Quick Response Services Provider LLP and Hunch Technologies Limited. |

|

|

| 10.4 |

|

Principal Shareholder Agreement, dated as of January 17, 2024, by and among Direct Selling Acquisition Corp., Hunch Technologies Limited and certain Principal Shareholders. |

|

|

| 10.5 |

|

Sponsor Support Agreement, dated as of January 17, 2024, by and among DSAC Partners LLC, Direct Selling Acquisition Corp., Hunch Technologies Limited, and other parties. |

|

|

| 99.1 |

|

Press Release, dated January 18, 2024. |

|

|

| 99.2 |

|

Investor Presentation, dated January 2024. |

| † |

Certain of the exhibits and schedules to this exhibit have been omitted in accordance with Regulation S-K Item 601(b)(2). The Company agrees to furnish supplementally a copy of all omitted exhibits and schedules to the SEC upon its request. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

| Dated: January 18, 2024 |

|

|

|

DIRECT SELLING ACQUISITION CORP. |

|

|

|

|

|

|

|

|

By: |

|

/s/ Dave Wentz |

|

|

|

|

Name: |

|

Dave Wentz |

|

|

|

|

Title: |

|

Chairman and Chief Executive Officer |

Exhibit 2.1

BUSINESS COMBINATION AGREEMENT

by and among

DIRECT

SELLING ACQUISITION CORP.,

AEROFLOW URBAN AIR MOBILITY PRIVATE LIMITED,

HUNCH TECHNOLOGIES LIMITED,

FLYBLADE (INDIA) PRIVATE LIMITED

and

HTL MERGER SUB

LLC,

dated as of

January 17, 2024

TABLE OF CONTENTS

|

|

|

|

|

|

|

| |

|

|

|

Page |

|

|

|

ARTICLE I |

|

|

|

|

|

|

CERTAIN DEFINITIONS |

|

|

|

|

|

|

|

| Section 1.01 |

|

Definitions |

|

|

4 |

|

| Section 1.02 |

|

Construction |

|

|

26 |

|

| Section 1.03 |

|

Knowledge |

|

|

27 |

|

| Section 1.04 |

|

Equitable Adjustments |

|

|

27 |

|

|

|

|

|

|

ARTICLE II |

|

|

|

|

|

|

THE MERGER AND RELATED TRANSACTIONS; CLOSING |

|

|

|

|

|

|

|

| Section 2.01 |

|

The Transactions |

|

|

28 |

|

| Section 2.02 |

|

Closing |

|

|

30 |

|

| Section 2.03 |

|

Withholding Rights |

|

|

31 |

|

| Section 2.04 |

|

Fractional Shares |

|

|

32 |

|

| Section 2.05 |

|

PubCo Class B Ordinary Share Consideration and Redesignation to PubCo Class A Ordinary

Shares |

|

|

32 |

|

|

|

|

|

|

ARTICLE III |

|

|

|

|

|

|

REPRESENTATIONS AND WARRANTIES RELATING TO THE BLADE

GROUP |

|

|

|

|

|

|

|

| Section 3.01 |

|

Corporate Organization; Due Authorization |

|

|

34 |

|

| Section 3.02 |

|

Governing Documents |

|

|

35 |

|

| Section 3.03 |

|

Consents and Requisite Governmental Approvals; No Violations |

|

|

35 |

|

| Section 3.04 |

|

Capitalization |

|

|

36 |

|

| Section 3.05 |

|

Subsidiaries |

|

|

37 |

|

| Section 3.06 |

|

Financial Statements |

|

|

38 |

|

| Section 3.07 |

|

Undisclosed Liabilities |

|

|

38 |

|

| Section 3.08 |

|

Litigation |

|

|

38 |

|

| Section 3.09 |

|

Compliance with Laws |

|

|

39 |

|

| Section 3.10 |

|

Material Contracts |

|

|

40 |

|

| Section 3.11 |

|

Blade Group Benefit Plans |

|

|

44 |

|

| Section 3.12 |

|

Labor Matters |

|

|

45 |

|

| Section 3.13 |

|

Taxes |

|

|

46 |

|

| Section 3.14 |

|

Insurance |

|

|

48 |

|

| Section 3.15 |

|

Permits |

|

|

49 |

|

| Section 3.16 |

|

Property |

|

|

49 |

|

| Section 3.17 |

|

Intellectual Property; IT Security; Data Privacy |

|

|

51 |

|

| Section 3.18 |

|

Environmental Matters |

|

|

53 |

|

| Section 3.19 |

|

Absence of Changes |

|

|

54 |

|

| Section 3.20 |

|

Transactions with Affiliates |

|

|

54 |

|

| Section 3.21 |

|

Brokers |

|

|

54 |

|

| Section 3.22 |

|

Business Activities |

|

|

54 |

|

| Section 3.23 |

|

Investment Company Act |

|

|

55 |

|

| Section 3.24 |

|

Information Supplied |

|

|

55 |

|

| Section 3.25 |

|

Hunch Reorganization |

|

|

55 |

|

i

|

|

|

|

|

|

|

|

|

ARTICLE IV |

|

|

|

|

|

|

REPRESENTATIONS AND WARRANTIES RELATING TO DSAQ |

|

|

|

|

|

|

|

| Section 4.01 |

|

Corporate Organization |

|

|

57 |

|

| Section 4.02 |

|

Due Authorization |

|

|

57 |

|

| Section 4.03 |

|

Consents and Requisite Government Approvals; No Violations |

|

|

57 |

|

| Section 4.04 |

|

Capitalization |

|

|

58 |

|

| Section 4.05 |

|

Trust Account |

|

|

59 |

|

| Section 4.06 |

|

SEC Filings |

|

|

60 |

|

| Section 4.07 |

|

Internal Controls; Listing; Financial Statements |

|

|

60 |

|

| Section 4.08 |

|

No Undisclosed Liabilities |

|

|

62 |

|

| Section 4.09 |

|

Litigation |

|

|

62 |

|

| Section 4.10 |

|

Compliance with Laws |

|

|

62 |

|

| Section 4.11 |

|

Material Contracts |

|

|

62 |

|

| Section 4.12 |

|

Business Activities |

|

|

63 |

|

| Section 4.13 |

|

Employee Benefit Plans |

|

|

63 |

|

| Section 4.14 |

|

Taxes |

|

|

63 |

|

| Section 4.15 |

|

Absence of Changes |

|

|

64 |

|

| Section 4.16 |

|

Transactions with Affiliates |

|

|

64 |

|

| Section 4.17 |

|

Investment Company Act |

|

|

65 |

|

| Section 4.18 |

|

DSAQ Recommendation |

|

|

65 |

|

| Section 4.19 |

|

Brokers |

|

|

65 |

|

| Section 4.20 |

|

Information Supplied |

|

|

65 |

|

|

|

|

|

|

ARTICLE V |

|

|

|

|

|

|

COVENANTS OF THE BLADE GROUP |

|

|

|

|

|

|

|

| Section 5.01 |

|

Conduct of Business of the Blade Group During the Interim Period |

|

|

65 |

|

| Section 5.02 |

|

Trust Account Waiver |

|

|

70 |

|

| Section 5.03 |

|

DSAQ D&O Indemnification and Insurance |

|

|

70 |

|

| Section 5.04 |

|

Blade Group D&O Indemnification and Insurance |

|

|

71 |

|

| Section 5.05 |

|

Financial Information |

|

|

72 |

|

| Section 5.06 |

|

Stock Exchange Listing |

|

|

73 |

|

| Section 5.07 |

|

Pre-Closing Reorganization |

|

|

73 |

|

| Section 5.08 |

|

Employee Matters |

|

|

74 |

|

| Section 5.09 |

|

Termination of Blade Group Related Party Contracts |

|

|

74 |

|

| Section 5.10 |

|

Hunch Reorganization |

|

|

74 |

|

| Section 5.11 |

|

Indian Foreign Exchange Control Laws |

|

|

74 |

|

| Section 5.12 |

|

Re-Registration of PubCo |

|

|

74 |

|

| Section 5.13 |

|

Approval of this Agreement |

|

|

74 |

|

| Section 5.14 |

|

Capital Reduction |

|

|

74 |

|

| Section 5.15 |

|

Intellectual Property and Data Protection |

|

|

75 |

|

ii

|

|

|

|

|

|

|

|

|

ARTICLE VI |

|

|

|

|

|

|

COVENANTS OF DSAQ |

|

|

|

|

|

|

|

| Section 6.01 |

|

Conduct of DSAQ During the Interim Period |

|

|

75 |

|

| Section 6.02 |

|

Shareholder Litigation |

|

|

77 |

|

| Section 6.03 |

|

DSAQ Public Filings |

|

|

77 |

|

| Section 6.04 |

|

Trust Account Proceeds and Redemptions |

|

|

77 |

|

| Section 6.05 |

|

De-Listing |

|

|

77 |

|

| Section 6.06 |

|

No Change of Recommendation |

|

|

77 |

|

|

|

|

|

|

ARTICLE VII |

|

|

|

|

|

|

JOINT COVENANTS |

|

|

|

|

|

|

|

| Section 7.01 |

|

Post-Closing PubCo Board |

|

|

78 |

|

| Section 7.02 |

|

Efforts to Consummate |

|

|

79 |

|

| Section 7.03 |

|

PIPE Subscriptions |

|

|

80 |

|

| Section 7.04 |

|

Registration Statement/Proxy Statement; DSAQ Special Meeting; Warrantholder Meeting |

|

|

81 |

|

| Section 7.05 |

|

Exclusive Dealing |

|

|

83 |

|

| Section 7.06 |

|

Tax Matters |

|

|

85 |

|

| Section 7.07 |

|

Confidentiality; Access to Information; Publicity; Notification of Certain Matters |

|

|

86 |

|

| Section 7.08 |

|

Post-Closing Cooperation; Further Assurances |

|

|

89 |

|

| Section 7.09 |

|

Extension |

|

|

89 |

|

|

|

|

|

|

ARTICLE VIII |

|

|

|

|

|

|

CONDITIONS TO OBLIGATIONS |

|

|

|

|

|

|

|

| Section 8.01 |

|

Conditions to Obligations of the Parties |

|

|

90 |

|

| Section 8.02 |

|

Additional Conditions to the Obligations of PubCo, IndiaCo, Blade India and Merger Sub |

|

|

90 |

|

| Section 8.03 |

|

Additional Conditions to Obligations of DSAQ |

|

|

91 |

|

| Section 8.04 |

|

Frustration of Conditions |

|

|

92 |

|

|

|

|

|

|

ARTICLE IX |

|

|

|

|

|

|

TERMINATION |

|

|

|

|

|

|

|

| Section 9.01 |

|

Termination |

|

|

92 |

|

| Section 9.02 |

|

Effect of Termination |

|

|

93 |

|

|

|

|

|

|

ARTICLE X |

|

|

|

|

|

|

MISCELLANEOUS |

|

|

|

|

|

|

|

| Section 10.01 |

|

Waiver |

|

|

94 |

|

| Section 10.02 |

|

Notices |

|

|

94 |

|

| Section 10.03 |

|

Assignment |

|

|

95 |

|

| Section 10.04 |

|

Rights of Third Parties |

|

|

95 |

|

| Section 10.05 |

|

Expenses |

|

|

95 |

|

| Section 10.06 |

|

Governing Law |

|

|

96 |

|

| Section 10.07 |

|

Captions; Counterparts |

|

|

96 |

|

| Section 10.08 |

|

Exhibits and Schedules |

|

|

96 |

|

| Section 10.09 |

|

Entire Agreement |

|

|

96 |

|

| Section 10.10 |

|

Amendments |

|

|

97 |

|

iii

|

|

|

|

|

|

|

| Section 10.11 |

|

Severability |

|

|

97 |

|

| Section 10.12 |

|

Jurisdiction |

|

|

97 |

|

| Section 10.13 |

|

Waiver of Jury Trial |

|

|

97 |

|

| Section 10.14 |

|

Enforcement |

|

|

98 |

|

| Section 10.15 |

|

Non-Recourse |

|

|

98 |

|

| Section 10.16 |

|

Nonsurvival of Representations, Warranties and Covenants |

|

|

98 |

|

| Section 10.17 |

|

Acknowledgements |

|

|

99 |

|

| Section 10.18 |

|

Conflicts and Privilege |

|

|

100 |

|

EXHIBITS

|

|

|

| Exhibit A |

|

Form of Principal Shareholder Support Agreement |

| Exhibit B |

|

Form of Sponsor Support Agreement |

| Exhibit C |

|

Pre-Closing Reorganization |

| Exhibit D |

|

Form of PubCo New Articles of Association |

| Exhibit E |

|

Form of CVR Agreement |

iv

BUSINESS COMBINATION AGREEMENT

THIS BUSINESS COMBINATION AGREEMENT (this “Agreement”) is made and entered into as of January 17, 2024, by and among

Direct Selling Acquisition Corp., a Delaware corporation (“DSAQ”), Aeroflow Urban Air Mobility Private Limited, a private limited company incorporated under the laws of India and a direct wholly owned Subsidiary of PubCo

(“IndiaCo”), Hunch Technologies Limited, a private limited company incorporated in Ireland with registered number 607449 (“PubCo”), FlyBlade (India) Private Limited, a private limited company incorporated under the

laws of India (“Blade India”), and HTL Merger Sub LLC, a Delaware limited liability company and a direct wholly owned Subsidiary of PubCo (“Merger Sub”). DSAQ, IndiaCo, Hunch, Blade US, PubCo, Blade India and Merger

Sub are collectively referred to herein as the “Parties” and each individually as a “Party”.

RECITALS

WHEREAS,

(a) DSAQ is a blank check company incorporated as a Delaware corporation for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one (1) or more

businesses, (b) PubCo is a company owned by Quick Response Services Provider LLP, a company incorporated and registered in India (“Hunch”), and Blade Urban Air Mobility Inc., a Delaware corporation (“Blade US”

and, together with Hunch, the “Principal Shareholders” and each, a “Principal Shareholder”), and (c) each of Merger Sub and IndiaCo is a newly incorporated, direct wholly owned Subsidiary of PubCo;

WHEREAS, pursuant to DSAQ’s Governing Documents, DSAQ is required to provide an opportunity for its stockholders to have their

outstanding DSAQ Class A Shares redeemed on the terms and subject to the conditions set forth therein in connection with obtaining the Required DSAQ Stockholder Approval at the Special Meeting;

WHEREAS, concurrently with the execution of this Agreement, the Principal Shareholders are entering into support agreements (each, a

“Principal Shareholder Support Agreement”), substantially in the form attached hereto as Exhibit A, pursuant to which, among other things, the Principal Shareholders are agreeing to (a) support the Transactions and

(b) be bound by certain transfer restrictions with respect to any Equity Securities of PubCo held by the Principal Shareholders prior to the consummation of the Transactions, in each case, subject to the terms and conditions set forth in such

Principal Shareholder Support Agreement;

WHEREAS, concurrently with the execution of this Agreement, DSAC Partners LLC, a Delaware

limited liability company (“Sponsor”), is entering into the support agreement substantially in the form attached hereto as Exhibit B (the “Sponsor Support Agreement”), pursuant to which, among other things,

Sponsor is agreeing to (a) support and vote in favor of all of the Transaction Proposals, (b) waive all adjustments to the conversion ratio set forth in DSAQ’s Governing Documents with respect to its DSAQ Class B Shares, (c) be

bound by certain transfer restrictions with respect to their DSAQ Class B Shares and DSAQ Warrants, as applicable, prior to Closing and (d) the forfeiture, transfer or conversion into DSAQ Class A Shares, as applicable, of the number of

DSAQ Warrants as specified in the Sponsor Support Agreement;

1

WHEREAS, concurrently with the execution of this Agreement, certain investment vehicles

affiliated with Antara Capital LP (collectively, “Antara”) and DSAQ are entering into a subscription agreement (the “Antara Subscription Agreement”) pursuant to which, among other things, Antara is agreeing to

subscribe for and accept, and DSAQ is agreeing to issue to Antara, on the Closing Date and prior to the Merger, DSAQ Preferred Shares in exchange for a subscription price of $10.00 per DSAQ Preferred Share, for an aggregate investment amount of

$7,000,000 (the “Antara PIPE Investment”), on the terms and subject to the conditions set forth in the Antara Subscription Agreement, and in connection with the Merger, each DSAQ Preferred Share issued in the Antara PIPE Investment

shall be automatically cancelled and extinguished and converted into the right to receive one (1) PubCo Preferred Share on the terms and subject to the conditions set forth in this Agreement;

WHEREAS, concurrently with the execution of this Agreement, Hunch and PubCo are entering into a subscription agreement (the “Hunch

Subscription Agreement”) pursuant to which, among other things, Hunch is agreeing to subscribe for and accept, and PubCo is agreeing to issue to Hunch, on the Closing Date and prior to the Merger and the Antara PIPE Investment, PubCo

Preferred Shares in exchange for a subscription price of $10.00 per PubCo Preferred Share, for an aggregate investment amount of $3,000,000 (the “Hunch PIPE Investment”), on the terms and subject to the conditions set forth in the

Hunch Subscription Agreement;

WHEREAS, from time to time following the date hereof and prior to the Closing, certain investors (for the

avoidance of doubt, not including Antara or Hunch) (collectively, the “PIPE Investors”), DSAQ and PubCo may enter into subscription agreements (each, a “PIPE Subscription Agreement”) pursuant to which, among other

things, the PIPE Investors will agree to subscribe for and accept on the Closing Date and prior to the Merger, and DSAQ will agree to issue to each such PIPE Investor on the Closing Date, Equity Securities of DSAQ, on the terms and subject to the

conditions set forth in the applicable PIPE Subscription Agreement (such investment in the aggregate, the “PIPE Investment”), and in connection with the Merger, each Equity Security of DSAQ, issued in the PIPE Investment shall be

automatically cancelled and extinguished and converted into the right to receive one (1) identical Equity Security of PubCo, on the terms and subject to the conditions set forth in this Agreement;

WHEREAS, prior to the date hereof, the Principal Shareholders, together with PubCo, Blade India, and their respective Subsidiaries, completed

the Hunch Reorganization, pursuant to which, among other things, (i) the Principal Shareholders subscribed for 24,697,973 PubCo Class A Ordinary Shares and 16,465,315 PubCo Class B Ordinary Shares (“Issued PubCo

Securities”) in exchange for an amount equal to the Formation Consideration, (ii) PubCo contributed the IndiaCo Consideration to IndiaCo in exchange for all of the Equity Securities of IndiaCo (except 1 (one) equity share of IndiaCo,

which will be held by Amit Dutta as nominee and the beneficial ownership of such 1 (one) equity share of IndiaCo will be in the name of PubCo in accordance with (Indian) Companies Act 2013), (iii) Blade India transferred all of its assets and

liabilities (other than certain excluded assets and liabilities not transferred pursuant to the terms of the Business Transfer Agreement) to IndiaCo on a slump sale basis as a going concern pursuant to the Business Transfer Agreement in exchange for

an amount equal to the Slump Sale Consideration, and (iv) Blade India’s board of directors approved the voluntary liquidation/winding up of Blade India in accordance with applicable Laws;

WHEREAS, following the Hunch Reorganization and following the date of this Agreement, Antara shall make the Bridge Investment thereof,

pursuant to which PubCo will issue to Antara three (3) convertible promissory notes (the “Convertible Notes”, as amended and otherwise modified prior to the date hereof), and pursuant to the terms and conditions thereof, the

Convertible Notes, to the extent outstanding as of immediately prior to the Closing, shall convert into the Note Conversion Shares at the Closing (the “Note Conversion”);

2

WHEREAS, prior to the Closing Date, and in connection with the Merger, PubCo intends to

effect the Pre-Closing Reorganization, pursuant to which, among other things, (i) Blade India shall transfer all of the Equity Securities of Transhermes to IndiaCo in exchange for the Share Acquisition Consideration, and (ii) the Issued

PubCo Securities owned by the Principal Shareholders and any other issued and outstanding and unissued Equity Securities of PubCo will undergo a reverse share split such that the Issued PubCo Securities owned by the Principal Shareholders and any

other issued and outstanding Equity Securities of PubCo will, following the consummation of the Pre-Closing Reorganization and immediately prior to the Merger, be consolidated and result in the aggregate number of PubCo Class A Ordinary Shares

and PubCo Class B Ordinary Shares issued and outstanding on a fully-diluted, as converted and as exercised basis (excluding Equity Securities issued or issuable pursuant to the Bridge Investment) being equal to the Pre-Closing Reorganization

Consideration;

WHEREAS, on the Closing Date, (a) in accordance with the DGCL and the DLLCA and other applicable Laws, Merger Sub

shall merge with and into DSAQ, with DSAQ surviving the Merger as the Surviving SPAC and a wholly owned Subsidiary of PubCo, (b) by virtue of the Merger, each share of capital stock of Merger Sub shall be automatically cancelled and

extinguished and converted into one (1) Surviving SPAC Share, (c) by virtue of the Merger (i) each DSAQ Unit shall be automatically separated, and the holder thereof shall be deemed to hold one (1) DSAQ Class A Share and

one-half (1/2) of a Public Warrant, and (ii) each DSAQ Share then issued and outstanding (other than those described in Section 2.01(b)(vi)(4)) shall be automatically cancelled and extinguished and converted into the right to

receive (x) with respect to each DSAQ Class A Share, the Per Share DSAQ Class A Common Consideration, (y) with respect to each DSAQ Class B Share, the Per Share DSAQ Class B Common Consideration and (z) with respect to each

DSAQ Preferred Share, the Per Share DSAQ Preferred Consideration, and (d) at the Effective Time, unless otherwise amended by the DSAQ Warrant Amendment, each outstanding Public Warrant and each outstanding Private Placement Warrant shall be

assumed by PubCo and shall thereafter be exercisable for one (1) PubCo Class A Ordinary Share and (y) one (1) CVR I, one (1) CVR II and one (1) CVR III;

WHEREAS, simultaneously with the Closing, PubCo, Sponsor, the Principal Shareholders and certain other Persons will enter into a registration

rights agreement, in a form reasonably acceptable to PubCo, Sponsor and the Principal Shareholders (the “Registration Rights Agreement”), pursuant to which, among other things, Sponsor, each Principal Shareholder and certain other

Persons will be granted certain registration rights with respect to their respective PubCo Class A Ordinary Shares and, if applicable, PubCo Warrants issued to them pursuant to this Agreement or the other Transaction Documents, in each case, on

the terms and subject to the conditions set forth in the Registration Rights Agreement;

WHEREAS, the board of directors of DSAQ (the

“DSAQ Board”) has, among other things, (a) determined that this Agreement and the transactions contemplated hereby, including the Merger, are advisable, and in the best interest of, DSAQ and the holders of DSAQ Shares,

(b) approved and declared advisable this Agreement and the transactions contemplated hereby, including the Merger, (c) directed that this Agreement be submitted to the holders of DSAQ Shares for their adoption and (d) resolved to

recommend the adoption and approval of this Agreement and the transactions contemplated hereby, including the Merger, by the holders of DSAQ Shares entitled to vote thereon (the “DSAQ Recommendation”);

3

WHEREAS, concurrently with the execution and delivery of this Agreement, each Principal

Shareholder is approving this Agreement and the Transactions (the “Required Principal Shareholder Approval”), in each case, on the terms and subject to the conditions set forth therein, pursuant to written resolutions (the

“Principal Shareholder Written Consent”);

WHEREAS, the board of directors of each of PubCo (the “PubCo

Board”), Merger Sub, IndiaCo and Blade India have each approved this Agreement, the other Transaction Documents to which PubCo, Merger Sub, IndiaCo or Blade India, respectively, is or will be a party and the Transactions (including the

Merger);

WHEREAS, PubCo, as the holder of the requisite Equity Securities of Merger Sub and IndiaCo, has approved this Agreement, the

other Transaction Documents to which Merger Sub or IndiaCo, as applicable, is a party and the Transactions (including the Merger);

WHEREAS, the Principal Shareholders, as the holders of the requisite Equity Securities of Blade India, have approved this Agreement, the other

Transaction Documents to which Blade India is a party and the Transactions and the Hunch Reorganization; and

WHEREAS, each of the Parties

intends for U.S. federal (and applicable state and local) income Tax purposes that the Merger, together with the Pre-Closing Reorganization and Note Conversion, be treated as an exchange described in Section 351 of the Code, and that the Merger

qualify as an exchange eligible for the exception to Section 367(a)(1) of the Code set forth in Treasury Regulations Section 1.367(a)-3(c)(1) (assuming the requirements of Treasury Regulation Section 1.367(a)-3(c)(1)(iii) are met)

(collectively, the “U.S. Intended Tax Treatment”).

NOW, THEREFORE, in consideration of the foregoing and the respective

representations, warranties, covenants and agreements set forth in this Agreement, and intending to be legally bound, the Parties hereby agree as follows:

ARTICLE I

CERTAIN DEFINITIONS

Section 1.01 Definitions . For purposes of this Agreement, the following capitalized terms have the following meanings:

“2022 Blade Group Audited Financial Statements” has the meaning specified in Section 5.05(a).

“2023 Blade Group Audited Financial Statements” has the meaning specified in Section 5.05(a).

“2024 Blade Group Audited Financial Statements” has the meaning specified in Section 5.05(a).

“Actual Fraud” means actual and intentional fraud with respect to the making of the representations set forth in Article

III or Article IV, as applicable, that involves a misrepresentation (by a member of the Blade Group, with respect to the representations and warranties made by such member of the Blade Group in Article III, and by DSAQ, with

respect to Article IV), with the actual knowledge that the applicable representation and warranty was actually breached when made, with the specific intent that (a) in the case of fraud by DSAQ, the Blade Group relies thereon and

(b) in the case of fraud by a member of the Blade Group or the Principal Shareholders, DSAQ

4

rely thereon, and in either such case, the party to whom the false representation was made suffered damage by reason of such reliance. For the avoidance of doubt, “Actual Fraud” does