false

0001230869

0001230869

2024-11-08

2024-11-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): November

8, 2024

ASA

Gold and Precious Metals Limited

(Exact

Name of Registrant as Specified in Charter)

| Bermuda |

|

811-21650 |

|

98-6000252 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification

No.) |

| |

|

|

|

|

|

| |

Three Canal Plaza,

Suite 600 |

Portland |

Maine |

04101 |

|

| |

(Street

Address) |

(City) |

(State) |

(Zip

Code) |

|

Registrant’s

telephone number, including area code (207) 347-2000

Not

Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class: |

Trading

symbol(s) |

Name

of exchange on which registered |

| Common

Shares, par value $1.00 per share |

ASA |

New

York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

7.01 | Regulation FD Disclosure. |

The Board of Directors

(the “Board”) of ASA Gold and Precious Metals Limited, a Bermuda limited liability company (the “Fund”), is comprised

of four members. Two directors were initially elected in April 2024 upon the nomination of Fund shareholders (the “New Directors”),

and two directors were reelected in April 2024 upon the nomination of the then-constituted Fund Board (the “Legacy Directors”).

The members of the Board have retained separate counsel in connection with fund governance issues and have requested reimbursement under

the Fund’s bye-laws for their counsel expenses. Information regarding certain governance issues is available in the attached excerpts

from an October 14, 2024 letter from counsel to the New Directors to counsel to the Legacy Directors, in the attached November 1, 2024

letter from counsel to the Legacy Directors to counsel to the New Directors and in the attached November 7, 2024 letter from counsel to

the New Directors to counsel to the Legacy Directors.

The information contained

in this Item 7.01 is being “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Exchange

Act, or otherwise subject to the liability of that Section or Sections 11 and 12(a)(2) of the Securities Act. The information contained

in this Item 7.01 shall not be incorporated by reference into any registration statement or other document pursuant to the Securities

Act or into any filing or other document pursuant to the Exchange Act, except as otherwise expressly stated in any such filing.

| Item

9.01 | Financial

Statements and Exhibits. |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed

on its behalf by the undersigned hereunto duly authorized.

Date:

November 8, 2024

| |

ASA

GOLD AND PRECIOUS METALS LIMITED |

|

| |

|

|

|

| |

By: |

/s/

Axel Merk |

|

| |

Name: |

Axel

Merk |

|

| |

Title: |

Chief

Operating Officer |

|

ASA Gold and Precious Metals Limited 8-K

Exhibit 99.1

Excerpts

from October 14 Letter:

EMAIL:

LMARKSESTERMAN@OLSHANLAW.COM

DIRECT

DIAL: 212.451.2257

October

14, 2024

BY

EMAIL

[ ]

| Re: | ASA

Gold & Precious Metals Ltd. |

[ ]

We

represent Paul Kazarian and Ketu Desai (the “New Directors”), in their capacities as directors of ASA Gold

and Precious Metals Limited (“ASA” or the “Company”), a Bermuda exempted limited liability

company and closed-end management investment company registered under Bermuda’s Companies Act 1981, as amended (the “BCA”),

and the U.S. Investment Company Act of 1940, as amended (the “ICA”). We write regarding the misconduct of ASA

directors Mary Joan Hoene and William Donovan (the “Continuing Directors”)… As detailed below, the Continuing

Directors have engaged in an egregious manipulation of the Company’s corporate machinery to entrench and empower themselves,

and have used sham committees to exclude the New Directors from what should be Board deliberations, thereby preventing the New

Directors from exercising their rights and responsibilities. The Continuing Directors’ conduct blatantly violates their

fiduciary duties as directors under the BCA and the most basic corporate governance standards…

The

Continuing Director’s [ ] conduct has caused and is causing harm to the Company and its shareholders. The New Directors

therefore expect that: … (ii) the Board retain non-conflicted counsel to advise on such matters; (iii) the Board, advised

by non-conflicted counsel, promptly meet to review the formation, propriety and potential disbandment of the rights plan committee

(the “Sham Rights Plan Committee”) and the litigation committee (the “Sham Litigation Committee”,

and together with the Sham Rights Plan Committee, the “Sham Committees”); and (iv) the Nominating, Audit and

Ethics Committee of the Board (the “Nominating Committee”) resume its proper functioning and promptly review

and evaluate all candidates for election as directors received by the Company and make recommendations to the Board concerning

the election of directors for the 2025 AGM (as defined below).

| 1. | The

Prior Board [ ] Formed the Sham Committees to Entrench Themselves and Exclude the New Directors from Fundamental Board Matters |

In

December 2023,… Saba Capital Management, L.P.’s (together with its affiliates, “Saba”) deliver[ed]

[] a requisition to nominate five director candidates for election at the Company’s 2024 annual general meeting of shareholders

(the “2024 AGM”) on December 1, 2023…

The

Company scheduled the 2024 AGM for April 26, 2024. On April 12, 2024, Institutional Shareholder Services Inc. (“ISS”)

recommended that shareholders vote for the election of Saba director candidates Messrs. Desai and Kazarian to the Board.

By

April 26, 2024, it would have become apparent to the Prior Board that the New Directors would be elected. Shortly before the Company

commenced the 2024 AGM, the Prior Board [ ] adopted resolutions to

create the Sham Committees. The Board’s resolutions governing the formation of these committees (the “April 26

Resolutions”) state that they were formed purportedly in response to the upcoming expiration of the Rights Plan and

Saba Litigation.

October

14, 2024

Page

2

The

timing of the Sham Committees’ formation alone raises serious question about whether the Prior Board’s conduct was

consistent with the directors’ duties under Bermuda law. If such committees were necessary and appropriate, the Prior Board

would have formed them months earlier when the Rights Plan was adopted or Saba filed its lawsuit. The only material change in

the Prior Board’s circumstances since January 31, 2024, appears to be that earlier on April 26, 2024, the Prior Board would

have almost certainly received a final shareholder vote for the 2024 AGM and therefore have known with near certainty that Messrs.

Kazarian and Desai would be elected as directors imminently. Seeing the writing on the wall, the Prior Board took preemptive action

to entrench the Continuing Directors and perpetuate their will on the reconstituted Board following the 2024 AGM.

Indeed,

the April 26 Resolutions acknowledge that the Sham Committees were formed for the improper purpose of entrenching the decisions

of the Prior Board by conferring exclusive power for the Continuing Directors – i.e., Ms. Hoene and Mr. Donovan –

and excluding the New Directors by depriving them of their full rights and ability to carry out their fiduciary duties as directors

under Bermuda law. The Resolutions state:

“(noting

in particular that Saba intends to nominate persons to the Board at the Company’s 2024 Annual General Meeting of Shareholders

and that there may be a need for the said committees to obtain independent legal advice and to consider privileged legal advice

in respect of the Rights Plan, the Saba Litigation and any course of conduct of new members of the Board that is inconsistent

with the best interests of the Company in the view of the Board as currently constituted).”1

Plainly

stated, the two directors who lost the election – Bruce Hansen and Alexander Merk – conspired with Ms. Hoene and Mr.

Donovan to ignore what shareholders had decided to be in the best interest of the Company. The Prior Board’s actions –

setting up a committee system that provides for differential treatment of ASA’s directors, granting exclusive powers related

to the Rights Plan and the Saba Litigation to the Sham Committees and seeking to exclude peremptorily the New Directors –

are improper uses of Board power under Bermuda law and reflects a fundamental misunderstanding of a Bermuda director’s role,

rights and obligations.

Section

97 of the BCA imposes a duty of good faith on directors, as well as a duty of skill and care. Bermuda directors also have a common

law duty to, among other things, act in the best interests of the company and not for any collateral purpose, including a director’s

entrenchment.2 Similarly in the United States, courts generally disfavor discriminatory treatment of different subsets

of directors.3

1

The April 26 Resolutions (emphasis added). [ ].

2 See,

e.g., Stena Finance BV and Temple Holdings Ltd v Sea Containers Ltd and Others, [1989] Bda LR 71 (SC) (wherein the Bermuda

Supreme Court considered whether a shareholders’ rights plan was implemented for, among other reasons, the improper collateral

purpose of “entrenching the existing management”).

3 See,

e.g., Carmody v. Toll Brothers, Inc., 723 A.2d 1180, 1192 (Del. Ch. 1998) (striking down a dead hand pill that materially

interfered with the ability of directors to manage the corporation because it would limit the right of new directors to vote on

whether to redeem the pill, and would improperly “embed structural power-related distinctions between groups of directors.”);

KLM v. Checchi, 1997 WL 525861 (Del. Ch. July 23, 1997) (court not convinced that a

minority shareholder’s threat to enforce contractual rights justifies cutting that shareholder’s designated directors

out of meetings to discuss poison pills).

October

14, 2024

Page

3

Importantly,

each Sham Committee was purportedly formed pursuant to bye-law 71 of the Company’s Amended and Restated Bye-Laws (the “Bye-Laws”),

which permits the Board to form committees with certain powers, authorities or discretions of the Board to the extent specifically

delegated by the Board and permitted under the BCA. But the April 26 Resolutions go well beyond what the BCA permits, as they

purport to authorize the Sham Committees to act “exclusively [] on behalf of the Board” and to “make determinations

and [] cause the Company to take actions” with respect to the Rights Plan and the Saba Litigation.

Bermuda

law does not allow a board faction to use delegation to committees in order to exclude certain directors, against their will,

from participating in discussions related to the company’s governance.4 Directors likewise may not fully delegate

fundamental decision-making authority to committees, as all directors of a board have “the duty to supervise the discharge

of the delegated functions.”5 While the authorities for those legal principles are English decisions, we are

advised that the Bermuda courts will also apply these same principles.

Moreover,

the Prior Board [ ] cannot attempt to justify the formation of the Sham Committees by claiming that the New Directors are conflicted.6

First, Ms. Hoene and Mr. Donovan are themselves conflicted, as they are named as defendants in the Saba Litigation, which

challenges their decision to approve and renew the Rights Plan. Second, under Bermuda law, a director conflict is not a basis

to exclude that director from participating in board deliberations if the conflict is disclosed. It is also legally improper to

assume that a director will breach their common law duty to avoid conflicts of interest by potentially disclosing confidential

information of the Company, and therefore a director cannot be excluded unless such director agrees it is in best interests of

the Company to do so.7

4

Buckley on the Companies Acts (Lexis+ UK), Division P, Companies Act 1985, Tables at A72.4.

5 Re

Barings plc (No 5), Secretary of State for Trade and Industry v Baker (No 5), [1999] 1 BCLC 433 at p 489 (Ch), aff’d

[2000] 1 BCLC 523 (CA) at p 536 (“Whilst directors are entitled (subject to the articles of association of the company)

to delegate particular functions to those below them in the management chain, and to trust their competence and integrity to a

reasonable extent, the exercise of the power of delegation does not absolve a director from the duty to supervise the discharge

of the delegated functions”).

6

As discussed below, the New Directors strongly disagree with any claim that the New Directors are conflicted.

7

Buckley on the Companies Acts (Lexis+ UK), Division P, Companies Act 1985, Tables at A72.4.

October

14, 2024

Page

4

| 2. | The

Continuing Directors’ Bad Faith Effort to Expand of the Purview of the Sham Litigation Committee, and the Highly Inappropriate

Conduct of the Continuing Directors [ ] at the Sept. 24 Meeting |

On

September 19, 2024, Saba submitted to the Company a notice of requisition, pursuant to Section 79 of the BCA (the “2025

Saba Nomination Notice”), to nominate a slate of the following individuals, Ketu Desai, Paul Kazarian, Karen Caldwell

and Neal Neilinger (the “Saba Nominees”), for election as directors at the Company’s 2025 annual general

meeting of shareholders (the “2025 AGM”).

The

Board had scheduled a regular meeting for Sept. 24, 2024 (the “Sept. 24 Meeting”). Just before the Sept. 24

Meeting began, the Continuing Directors, purportedly on behalf of the [ ], ambushed the New Directors by delivering a previously

unannounced proposal for a resolution of Saba’s Nomination Notice (the “2025 AGM Proposal” or the “Proposal”)

to the New Directors. Ms. Hoene, Mr. Donovan … then attempted to negotiate the 2025 AGM Proposal with the New Directors

at the Sept. 24 Meeting in an attempt to “settle” the 2025 Saba Nomination Notice – despite Mr. Kazarian attending

the Sept. 24 Meeting in his capacity as an ASA director and Mr. Desai having no authority to bind Saba.

Our

clients were extremely shocked and disappointed in Ms. Hoene and Messrs. Donovan… In particular, Ms. Hoene and Mr. Donovan,

claiming the guise of the Litigation Committee [ ], took an adversarial position to the New Directors regarding the election of

directors at the 2025 AGM. Their Proposal, which was prepared in secret and purports to negotiate on behalf of the Company regarding

the composition of the Board, includes a slate of director candidates selected by the Sham Litigation Committee. The 2025 AGM

Proposal also addresses the renewal of the management contract with the Company’s investment adviser, a critical Board matter

under the ICA. These subject matter areas are clearly beyond any conception of the Litigation Committee’s mandate.

Even

more concerning, [ ], acting on behalf of the Sham Litigation Committee and in direct conflict to the New Directors and Board

as a whole, suggested that the Company would “hold up” the 2025 AGM if the New Directors did not agree to nominate

Ms. Hoene and Mr. Donovan at the 2025 AGM under the terms of the 2025 AGM Proposal. [ ] threatened weaponization of ASA’s

corporate machinery to advance the Continuing Directors’ self-interests is unethical, outrageous… Mr. Donovan then

intimated that holding up the 2025 AGM would not be necessary because the Sham Litigation Committee would select the Company’s

slate of nominees, thereby ensuring that the Continuing Directors would be included on the Company’s slate without full

Board approval. When it became clear that Messrs. Kazarian and Desai would not succumb to pressure, Ms. Hoene resorted to impugning

Mr. Desai’s independence – referring to him as a “cipher,” denigrating his abilities and maligning his

independence.

The

discussion and purported negotiation of the 2025 AGM Proposal during the Sept. 24 Meeting displays a critical lack of

understanding of the New Directors’ roles and relationship to the Company. Messrs. Kazarian and Desai are

independent directors duly elected by the shareholders of the Company, and they are subject to their full obligations and

fiduciary duties and entitled to their full rights and privileges as directors under Bermuda law. Both are

sophisticated directors who fully understand their fiduciary duties under Bermuda law. When the New Directors attend a Board

meeting, they act in their capacities as independent directors of the Company. The fact that Saba originally nominated Mr.

Desai for election does not diminish his independence or capacity as a director, and he has no authority to act on behalf of

Saba. While Mr. Kazarian is affiliated with Saba, this does not diminish or otherwise negatively affect his status as a full

independent member of the Board. Shareholders routinely seek to have representatives elected or appointed to a

company’s board of directors – this is not a novel situation – and Mr. Kazarian has observed proper ethical

walls to distinguish his roles and capacities as a member of the Board

and a representative of Saba. For example, after Mr. Kazarian’s appointment to the Board, he sent emails to Ms. Hoene and

Mr. Merk introducing them to Michael D’Angelo, Saba’s General Counsel, explaining that he would serve as the Company’s

point of contact for Saba going forward. In addition, Saba disclosed this association to the Company’s shareholders in connection

with the 2024 AGM. Despite the foregoing, the Continuing Directors [ ] are attempting to treat the New Directors as indistinguishable

from Saba.

October

14, 2024

Page

5

Furthermore,

even if the Litigation Committee were validly constituted, which it is not, the April 26 Resolutions do not

delegate authority to the Litigation Committee to recommend actions with respect to Board composition at the 2025 AGM,

deliver the Proposal or unilaterally select the Company’s slate of directors. The Litigation Committee’s mandate

is specifically limited to matters and actions concerning “the Saba Litigation or other litigation relating to

the Rights Plan or any other rights plan adopted by the Company.”

Ms.

Hoene’s and Messrs. Donovan’s [ ] threats at the Sept. 24 Meeting to hijack the review and determination of director

candidates on behalf of the Company, as evidenced by the delivery of the 2025 AGM Proposal, inappropriately seek to strip the

full Board of its duty to oversee and make the final determinations as to the Company’s slate – a determination on

which all serving directors are entitled to have input. Directors must retain the duty and obligation to supervise and have final

authority over functions delegated to board committees.

Instead

of addressing the 2025 Saba Nomination Notice as a Board issue, and properly following the Board’s corporate governance

processes, the Continuing Directors [ ] have instead opted to contort the Sham Litigation Committee’s mandate to contend

that it has the authority to identify a slate of directors purportedly on behalf of the Company, but in reality, to advance their

own self-interests. The determination of the Company’s slate is a fundamental determination that must reflect the input

and decisions of the entire Board acting as a whole and cannot be entirely delegated to a committee. Indeed, under ASA’s

governing documents and proper corporate governance functioning, the Nominating Committee reviews and evaluates director candidates

and then makes a recommendation to the full Board, which has the authority to approve the final director slate. As experienced

directors and members of the Nominating Committee, Ms. Hoene and Mr. Donovan are fully aware of these requirements.8

The

Sham Committees were formed for an improper purpose – specifically to entrench the Company’s existing management by

excluding the New Directors and depriving them of their full rights, duties and obligations under Bermuda law. The Continuing

Directors’ actions at the Sept. 24 Meeting and delivery of the 2025 AGM Proposal amplify and expose this bad faith entrenching

purpose. The Board, advised by non-conflicted counsel, must promptly meet to review the formation, propriety and potential disbandment

of the Sham Committees.

…

8 The

2025 AGM Proposal is inconsistent with corporate governance standards (which reflect the SEC’s position on governance best

practices) under the ICA, which state, “The disinterested directors of the fund select and nominate any other disinterested

director of the fund.” ICA Rule 0-1(a)(7)(ii).

October

14, 2024

Page

6

| 4. | The

Nomination Committee Should Resume Proper Functioning and the Full Board Should Meet to Attempt to Determine and Approve the Company’s

2025 AGM Slate |

The

Nominating Committee, currently consisting of Ms. Hoene and Messrs. Donovan and Desai, is the proper committee empowered with

the authority to consider candidates for recommendation to the Board. Specifically, the Charter for the Nominating Committee (the

“Nominating Committee Charter”) states that the Board has delegated to the Nominating Committee the authority,

responsibility and duty to “consider candidates for recommendation to the Board from any source deemed appropriate by the

Committee, including… the Company’s shareholders,” and to make a recommendation to the Board after reviewing

and evaluating the candidates.9

The

Nominating Committee Charter further requires the Nominating Committee to conduct an impartial review of shareholder nominated

candidates provided that such nominating shareholder has compiled with certain procedural requirements.10 While the

Nominating Committee has held meetings to conduct its audit and ethics duties, to the New Directors’ knowledge, since Mr.

Desai was elected to the Board, it has not held a meeting where Board composition, potential director candidates for the 2025

AGM or the 2025 Saba Nomination Notice and the Saba Nominees have been discussed or considered. Instead, the Continuing Directors

– to the exclusion of the Nominating Committee and the full Board – have seemingly reviewed the Saba Nominees behind

closed doors and delivered the 2025 AGM Proposal in response.

Notably,

Ms. Hoene and Mr. Donovan serve on both the Nominating Committee and the Sham Litigation Committee. The Sham Litigation Committee’s

attempted hijacking of the Nominating Committee’s authority appears to be motivated by the desire to improperly exclude

Mr. Desai from such review. But the fact that Mr. Desai is included as a Saba Nominee does not provide a basis to exclude Mr.

Desai from participating in Nominating Committee deliberations. Under the BCA and the Bye-Laws, Mr. Desai is not required to recuse

himself from deliberations concerning the Saba Nominees. Indeed, nominating committees frequently review and make recommendations

as to the re-nomination of incumbent directors, including those serving on such committees. The Continuing Directors cannot continue

to exclude Mr. Desai from the review of director candidates by failing to convene the Nominating Committee.

The

Board should promptly resume its proper corporate governance functions, and the Nominating Committee should promptly meet to review

all received director candidates and issue recommendations to the full Board. If the full Board is unable to agree on recommendations

with respect to the Company’s slate for the 2025 AGM, then the Company should not pick sides and instead should issue proxy

materials that do not include any director candidate recommendations from the Company.

9

See Sections C.8.c and c of the Nominating Committee Charter.

10

Id. at Section E.

October

14, 2024

Page

7

For

the avoidance of doubt, given the Continuing Directors previous and ongoing involvement in improper entrenchment tactics, including

the adoption and renewal of the Rights Plan, the formation of the Sham Committees, the inappropriate delivery of the 2025 AGM

Proposal and their threats to manipulate ASA’s corporate machinery for their own personal benefit, the New Directors

will not support a proposed Company slate that includes Ms. Hoene and Mr. Donovan as director candidates. However, the

New Directors encourage the Nominating Committee to fully and faithfully execute its mandate and to consider other

additional director candidates, in particular credible candidates who value sound corporate governance practices.11

…

We

look forward to ASA’s return to proper corporate governance, and the Board and the Nominating Committee resuming their proper

functioning for the benefit of the Fund and all shareholders.

Accordingly,

our clients expect the following:

…

2. The Board should retain non-conflicted counsel to advise on Corporate Matters;

3. The

Board, advised by non-conflicted counsel, should promptly meet to review the formation, propriety and potential disbandment of

the Sham Committees; and

4. The

Nominating Committee resume its proper functioning, and thereafter, all members of the Board immediately meet and confer with

respect to the Nominating Committee’s recommendations regarding the Company’s slate of director candidates for the

2025 AGM.

We

look forward to your prompt response.

11 If

Ms. Hoene and Mr. Donovan, in their capacity as shareholders, want to nominate a slate of director candidates for election at

the 2025 AGM, they need to comply with the BCA and Bye-Laws, including the requirement of having at least 5% ownership or not

less than 100 shareholders support the nomination.

ASA Gold and Precious Metals Limited 8-K

Exhibit

99.2

|

ROPES &

GRAY LLP

PRUDENTIAL

TOWER

800 BOYLSTON

STREET

BOSTON, MA

02199-3600

WWW.ROPESGRAY.COM |

| November 1, 2024 |

Amy D. Roy |

| |

T +1 617 951 7445 |

| |

amy.roy@ropesgray.com |

BY E-MAIL

Lori Marks-Esterman,

Esq.

Olshan Frome Wolosky

LLP

1325 Avenue of the Americas

New York, NY 10019

| Re: | ASA Gold and Precious

Metals Limited |

Dear Ms. Marks-Esterman:

We

represent Mary Joan Hoene and William Donovan (the “Legacy Directors”) in their capacities as directors of ASA Gold

and Precious Metals Limited (“ASA” or the “Company”) and as members of the Litigation Committee (the “Litigation

Committee”) and the Rights Plan Committee (the “Rights Plan Committee”) of the Board of Directors (the “Board”)

of the Company. I write in response to your letter of October 14, 2024 (the “October 14 Letter”) addressed to Skadden,

Arps, Slate, Meagher & Flom LLP (“Skadden”) as it relates to the Legacy Directors. We understand that Skadden

has separately responded to the October 14 Letter as it relates to that firm’s representation of the Company.

The

October 14 Letter’s assertions of purported “misconduct” by the Legacy Directors are wholly unfounded, and we

reject them categorically. The allegations are premised on many factual mischaracterizations and basic disregard for the governance

requirements for a closed-end fund registered under the Investment Company Act of 1940 (the “ICA”) and the record

of the Legacy Directors’ efforts to engage with the New Directors on the latter’s views about the Company. The Legacy

Trustees have always acted in good faith and in a manner they reasonably believe to be in the best interest of the Company and

its shareholders, including taking actions they reasonably believe are necessary to ensure the Company’s compliance with

the ICA and other laws.

| Lori Marks-Esterman, Esq. |

- 2 - |

November

1, 2024 |

First,

as explained in the litigation captioned Saba Capital Master Fund, Ltd. v. ASA Gold and Precious Metals, Ltd., No. 24-cv-690

(SDNY) (the “Litigation”), the Legacy Directors reasonably believe that the efforts of Saba Capital Management, L.P.

(“Saba”) to gain control of the Board in furtherance of its closed-end fund “arbitrage” strategy –

and its apparent goal of replacing Merk Investments LLC (“Merk”) and most likely becoming ASA’s investment adviser

– are contrary to the best interests of the Company and its shareholders. At least one court has already recognized that

Saba’s short-term arbitrage profit-taking is detrimental to the objectives of long-term fund shareholders, and that closed-end

fund board members have legitimate business reasons for adopting measures to protect long-term shareholders from harm caused by

Saba’s strategy.1 Consistent with these views, when Saba accumulated a significant minority position in ASA’s

outstanding shares, nominated a slate of candidates to the Board, and stated its belief that ASA should terminate its current

investment adviser, the then-board (including the Legacy Directors) determined it was in the best interests of the Company and

its shareholders to adopt a limited-duration shareholder rights plan in December 2023. As described at length in the Litigation

briefing, a key goal of the rights plan in the face of Saba’s effort to gain creeping control of the Company was to create

an incentive for Saba to negotiate with the Board regarding the future of the Company, to protect the interests of all shareholders

and ASA’s strategic focus on long-term capital appreciation in the global gold-mining industry. For similar reasons, the

then-board adopted a new plan in April 2024 and established by board resolution the Rights Plan Committee. When the Legacy Directors,

acting as the Rights Plan Committee, adopted a new plan in August 2024, it was likewise based upon the Legacy Directors’

reasonable business judgment that Saba’s efforts to gain control of the Board are adverse to the interests of the Company

and its shareholders considering the detrimental impact of Saba’s short-term arbitrage strategy on other investors. The

Legacy Directors have accordingly followed up on these steps with efforts to engage with the New Directors to learn their views

and explore whether reasonable compromise could be reached. Contrary to the assertions in the October 14 Letters, none of these

actions was taken to “entrench and empower” the Legacy Directors.

Neither

the Rights Plan Committee nor the Litigation Committee is a “sham” committee as claimed in the October 14 Letter.

Each committee was validly established by resolution of the then-board in April 2024 pursuant to Bye-law 71 of the Company’s

Amended and Restated Bye-laws (the “Bye-laws”) following considerable evaluation of the purpose of and need for such

committees – i.e., to reasonably and legitimately protect all shareholders’ interests. Each committee will

remain in existence and is authorized to act under its delegated authority unless and until a majority of the current Board (or

a future one) votes to dissolve it or otherwise change the authority delegated to it. The fact that your clients, current directors

Paul Kazarian and Ketu Desai (together, the “New Directors”), may disagree with certain of the actions taken by the

Committees does not in any way call into question their validity or their delegated authority to act on behalf of the Board and

the Company. Nor does the fact that the views of the Board appear to be evenly divided on the continuation

of the Committees undermine their validity in any way, given that previously-adopted measures will remain in place under Bye-law

72 in the event of an evenly-divided vote on a proposal to rescind it. Under these circumstances, there is simply no basis to

accuse the Legacy Directors of “manipulation of the Company’s corporate machinery” as claimed in the October

14 Letter. These allegations amount to an aggressive and unfounded effort to eliminate by threat legitimate and necessary oversight.

1

In granting partial summary judgment against Saba in connection with its claim for breach of fiduciary duty against certain

Eaton Vance closed-end funds and their independent trustees, a Massachusetts Superior Court found that the “Trustees had

a legitimate business reason for their action … that the purpose of the Bylaw Amendments was to protect Funds’ retail

shareholders from the harm they perceived that activist hedge funds like Saba could cause if they gained a concentrated minority

of shares, forced short-term liquidity events, and thereby threatened retail investors’ interest in the Funds and the Funds’

viability” as long-term investment vehicles. Eaton Vance Senior Income Tr. v. Saba Cap. Master Fund, Ltd.,

No. 2084CV01533-BLS2, 2023 WL 1872102, at *11 (Mass. Super. Ct. Jan. 21, 2023). In its trial ruling rejecting Saba’s challenge

to a majority-of-outstanding-shares voting standard, the court found that “Saba’s activist objectives are generally

inconsistent with the Funds’ investment objectives. The goal of monetizing the discount to [net asset value] differs from

the goal of managing a stable pool of assets for a steady income stream over a long period of time.” Findings of Fact, Conclusions

of Law, and Order for Judgment, Eaton Vance Senior Income Tr. v. Saba Cap. Master Fund, Ltd., No. 2084CV01533-BLS2,

slip op. at 13 (Mass. Super. Ct. Oct. 21, 2024).

| Lori Marks-Esterman, Esq. |

- 3 - |

November

1, 2024 |

To

the contrary, it is the New Directors who are transparently attempting to utilize their Board positions to further particular

interests – namely, Saba’s arbitrage agenda and its apparent goal of replacing Merk and most likely becoming ASA’s

investment adviser (to provide itself a fee revenue stream, as it has done in other closed-end funds) – rather than protecting

the best interests of the Company and all of its shareholders. As the New Directors are aware, several important fund governance

actions will be required in the coming weeks and months for the Company to continue ordinary operations and to remain in compliance

with the ICA and other laws, including without limitation the scheduling of the Company’s Annual General Meeting (“AGM”);

the determination of Board nominees; the issuance of the Company’s proxy statement in connection with the AGM; the approval

of the continuance of the existing investment advisory agreement or a new advisory agreement; and disclosure of material developments

in connection with potential disagreements among the directors. Given the unique circumstance of a board with evenly divided views

on some or all of these issues, the Legacy Directors have attempted to initiate a good faith dialogue with the New Directors on

these issues in an effort to find a path to compromise. This was the purpose of the talking points circulated by the Corporate

Secretary in advance of the September 25, 2024 Board meeting – to provide a potential structure for discussion purposes

at the Board meeting as to how compromise on the upcoming governance actions might be reached. In fact, it was suggested that

the Board continue to review and consider the elements of the proposal and be prepared for discussion at the next Board

meeting, in October. The New Directors declined even to engage in such a discussion, and the October 14 Letter now mischaracterizes

the circulation of the talking points as an “ambush” – which is demonstrably inaccurate.

The

Legacy Directors are gravely concerned that the New Directors, based on their actions to date, are unwilling to participate in

good faith exploration of potential compromise on the governance actions that are necessary for the Company to remain in ordinary

operation and comply with applicable laws (e.g., AGM, nominees, proxy statements, advisory agreement). Nevertheless, the

Legacy Directors remain willing and anxious to keep trying, as they believe there is a path to a timely compromise on these questions,

even acknowledging that disagreements will likely remain over other issues such as the continuation of the Litigation Committee

and Rights Plan Committee. There is still time to reach agreement on the necessary governance actions before the Company is put

at unnecessary risk of violating the law and being unable to continue ordinary operations.

| Lori Marks-Esterman, Esq. |

- 4 - |

November

1, 2024 |

On

a related but separate note, the Legacy Directors believe there is an urgent legal requirement for the Company to make disclosure

public on Form 8-K about the potential inability of the Board to reach agreement on the governance actions discussed above. Although

they remain hopeful agreement can be reached on these matters, they must acknowledge there is no

guarantee it will be. The Legacy Directors thus believe the present risk of a negative outcome, including the consequences of

the Company violating the law and/or having to cease ordinary operations (for instance, if the continuance of the existing advisory

agreement or a new advisory agreement is not approved by the Board prior to the expiration of the current term of the advisory

agreement in [March] 2025), is information material to shareholders and potential shareholders that must be publicly disclosed.

We understand that in recent discussions on this topic, counsel to the New Directors have asserted that no such disclosure is

necessary or, in the alternative, that a detailed recitation of the New Directors’ allegations discussed above should be

included (and presumably the Legacy Directors’ responses thereto). We ask the New Directors and their counsel to reconsider

this position, including that a likely Board impasse on these critical matters is not material to an investment in the Company’s

shares at this point requiring disclosure.2 Shareholders should be made aware of the Board’s potential inability

to reach agreement, but there is no need for disclosure of the parties’ respective positions underlying the disagreement.

We have attached for consideration some potential language for a Form 8-K disclosure.

We

look forward to hearing from you, and to working with you in what we believe can be a productive manner going forward.

Very truly yours,

Amy D. Roy

| cc: |

Robert A. Skinner |

| |

George M. Silfen |

| |

Jennifer Gonzalez |

2

See, e.g., Section 202.05 of the New York Stock Exchange Listed Company Manual (“A listed company is expected

to release quickly to the public any news or information which might reasonably be expected to materially affect the market for

its securities. This is one of the most important and fundamental purposes of the listing agreement which the company enters into

with the Exchange.”). In addition, we point out that Regulation FD generally requires the Fund to disclose publicly any

material nonpublic information that the Fund or persons acting on its behalf (e.g., directors) has disclosed to various

categories of recipients, including shareholders (e.g., Saba) where it is reasonably foreseeable that the shareholder will

purchase or sell the Fund’s securities on the basis of the information.

| Lori Marks-Esterman, Esq. |

- 5 - |

November

1, 2024 |

Potential 8-K

language for discussion

The

Board of Directors (the “Board”) of ASA Gold and Precious Metals Limited, a Bermuda limited liability company (the

“Fund”), is comprised of four members. Two directors were initially elected in April 2024 upon the nomination of Fund

shareholders, and two directors were reelected in April 2024 upon the nomination of the then-constituted Fund Board. There is

a risk that the Board will be unable to reach a required majority vote to approve certain Fund governance and management matters

critical to the continued ordinary operations of the Fund, including the approval of the continuance of the Fund’s existing

investment advisory agreement or the approval of a new advisory agreement prior to the expiration of the current one-year term

of the existing advisory agreement in [March] 2025. This situation may also result in a material increase in expenses borne by

Fund shareholders. For instance, the members of the Board have retained separate counsel in connection with fund governance issues

and have requested reimbursement under the Fund’s bye-laws for their counsel expenses.

The

information contained in this Item 7.01 is being “furnished” and shall not be deemed “filed” for purposes

of Section 18 of the Exchange Act, or otherwise subject to the liability of that Section or Sections 11 and 12(a)(2) of the Securities

Act. The information contained in this Item 7.01 shall not be incorporated by reference into any registration statement or other

document pursuant to the Securities Act or into any filing or other document pursuant to the Exchange Act, except as otherwise

expressly stated in any such filing.

ASA Gold and Precious Metals Limited 8-K

Exhibit

99.3

EMAIL:

LMARKSESTERMAN@OLSHANLAW.COM

DIRECT

DIAL: 212.451.2257

November

7, 2024

BY

EMAIL

Ropes

& Gray

Prudential

Tower

800

Boylston Street

Boston,

MA 02199-3600

| Re: | ASA

Gold & Precious Metals Ltd. |

Dear

Amy:

Thank

you for the call earlier this week. We look forward to continuing the dialogue. We write to address certain issues raised your

November 1, 2024 letter (the “November 1 Letter”).1

Your

November 1 Letter improperly presumes that the Litigation Committee and the Rights Plan Committee are valid. You purport to rely

on the Company’s Amended and Restated Bye-Laws to justify your position, but conveniently ignore that the Committees’

stripping of the directors’ rights is prohibited by Bermuda law. Further, though you assert that the Committees were formed

to “protect all shareholders’ interests,” you also ignore that the Committees – formed hours before the

2024 AGM – seek to perpetuate the will of the outgoing Board, over the express desires of ASA’s shareholders who voted

on the Board’s composition at the 2024 AGM and elected Messrs. Kazarian and Desai as directors. The Committees were structured

to contradict the clear will of the Company’s shareholders, and to seek to preserve and entrench the will of a former Board

that its shareholders did not reelect. To be clear, it is our position that any actions previously taken or to be taken by the

Committees going forward are unlawful. In the event that the Legacy Directors do not agree to disband the Committees, or the Board

is unable to reach a resolution regarding the Committees and the Legacy Directors purport to act under the guise of the Committees,

the New Directors will take all steps necessary to enforce their rights as directors.

Likewise,

your November 1 Letter attacks the New Directors for advocating a change in the Company’s investment manager. This ignores

that any new investment adviser to the Company will be subject to the approval of ASA’s shareholders, and further ignores

that Messrs. Kazarian and Desai ran on a campaign that included criticism of Merk Investments LLC (“Merk”)

and a recommendation to terminate the Investment Advisory Agreement between the Company and Merk. ASA’s shareholders overwhelmingly

elected Messrs. Kazarian and Desai to ASA’s Board on a platform of replacing Merk, and voted to not reelect Mr. Merk.

| 1 | All

capitalized terms not defined herein are as defined in our October 14th letter. |

Your

November 1 Letter thus repeatedly ignores a crucial fact: there was an election in which the New Directors were voted onto the

Board by shareholders. What the Legacy Directors are seeking with the Committees is to perpetuate the dead hand control of the

Company by the pre-election board. That is a true corruption of sound governance principles.

Finally,

your November 1 Letter states that our clients’ allegations in our October 14th letter “are premised on

… [a] basic disregard for the governance requirements for a closed-end fund registered under the Investment Company Act

of 1940.” Quite the contrary, these allegations reflect that our clients are in fact serving the Company as independent

watchdogs (as is directed by the Securities and Exchange Commission) seeking to advance the best interests of the Company’s

shareholders.

We

look forward to discussing these issues further at the November 12, 2024 Board meeting.

| Very truly

yours, | |

| | | |

| |  | |

| | Lori Marks-Esterman | |

| cc: | Robert A. Skinner, Ropes & Gray LLP

Jennifer Gonzalez, K&L Gates, LLP

Paul Kazarian, Director |

Ketu

Desai, Director

Rebecca

L. Van Derlaske, Olshan Frome Wolosky LLP

George M. Silfen, Kramer Levin Naftalis & Frankel LLP

Keith Robinson, Carey Olsen

Bermuda Limited

Matthew

Summers, Carey Olsen Bermuda Limited

v3.24.3

Cover

|

Nov. 08, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 08, 2024

|

| Entity File Number |

811-21650

|

| Entity Registrant Name |

ASA

Gold and Precious Metals Limited

|

| Entity Central Index Key |

0001230869

|

| Entity Tax Identification Number |

98-6000252

|

| Entity Incorporation, State or Country Code |

D0

|

| Entity Address, Address Line One |

Three Canal Plaza,

Suite 600

|

| Entity Address, Address Line Two |

Suite 600

|

| Entity Address, City or Town |

Portland

|

| Entity Address, State or Province |

ME

|

| Entity Address, Postal Zip Code |

04101

|

| City Area Code |

(207) 347-2000

|

| Local Phone Number |

347-2000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Shares, par value $1.00 per share

|

| Trading Symbol |

ASA

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Information, Former Legal or Registered Name |

Not

Applicable

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

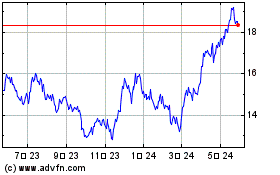

ASA Gold and Precious Me... (NYSE:ASA)

過去 株価チャート

から 11 2024 まで 12 2024

ASA Gold and Precious Me... (NYSE:ASA)

過去 株価チャート

から 12 2023 まで 12 2024