Expion360 Inc. (Nasdaq: XPON) (“Expion360” or the “Company”),

an industry leader in lithium-ion battery power storage solutions,

today reported its financial and operational results for the second

quarter ended June 30, 2024.

Second Quarter & Subsequent 2024

Financial & Operational Highlights

- Q2 2024 revenue totaled $1.3

million, up 32% sequentially from Q1 2024.

- Q2 2024 net loss totaled $2.2

million compared to a net loss of $1.5 million in the prior year

period as the Company continued to invest in new product

development and launches.

- Closed a firm commitment

underwritten public offering with gross proceeds to the Company of

approximately $10.0 million, before deducting underwriting

discounts and other estimated expenses payable by the Company.

- Announced e-commerce retail

partnership with Tractor Supply Company (“Tractor Supply”), the

largest rural lifestyle retailer in the U.S., to offer Expion360

products online for shipment to customers in 49 states.

- Announced partnership with K-Z

Recreational Vehicles (“K-Z RV”), a subsidiary of Thor Industries,

Inc., for integration of Expion360’s 51.2V 60Ah Edge Vertical Heat

Conduction™ (“VHC™”) heated batteries and new Group 27 12.8V 100Ah

VHC™ heated batteries into K-Z RV's premium offerings.

- Launched the Edge™ battery

available in both 12.8V and 51.2V configurations, featuring a slim

profile that maximizes available space without compromising

performance and is now available for preorder with shipments

expected to commence in Q3 2024.

- Received substantial preorders of

next generation Group 27 and GC2 series lithium iron phosphate

(“LiFePO4") batteries, which now include our proprietary VHC™

internal heating technology, a patent-pending innovation. Expion360

began taking pre-orders of the new Group 27 and GC2 batteries in Q1

2024 and commenced deliveries in May 2024.

- Released specifications for Home

Energy Storage Solutions.

Management Commentary

"The second quarter of 2024 was highlighted by

an important new partnership, the launch of our next generation

battery products, and continued sequential revenue growth,” said

Brian Schaffner, Chief Executive Officer of Expion360. “Taken

together, we are successfully scaling our efforts through the

introduction of new technologies, entering new retail markets, and

expanding into complementary verticals with a portfolio servicing

marine, overland and light electric vehicles. We also have two

energy storage products currently under development, which includes

undergoing the process to obtain UL safety certifications, in

addition to other requirements for various Authorities Having

Jurisdiction.

“Sales grew sequentially for a second

consecutive quarter, improving 32% from Q1 2024, while year over

year sales continued to be impacted by the downturn in the RV

market. However, the RV market is now gaining increased momentum,

with RV shipments in June 2024 up 8.4% compared to June 2023

according to the RV Industry Association. We are leveraging our

products’ superior capacity and flexibility to lead acid

competitors and introducing new batteries and improved

technologies, to capture market share as RV industry demand

returns.

“These new products and technologies include our

next generation Group 27 and GC2 batteries, which started being

delivered to customers in the second quarter of 2024. These

batteries include our proprietary VHC™ internal heating technology,

a patent-pending innovation representing a significant breakthrough

in battery performance, particularly in cold climates. We also

launched the Edge™ battery, available in both 12.8V and 51.2V

configurations, incorporating VHC™ and featuring Integrated

SmartTalk™ Bluetooth and controller area network communication,

allowing users to monitor battery performance in real-time. The

Edge™ features a slim profile with dimensions of just 4.2 inches in

height, 17.5 inches in width, and 21.9 inches in length, offering

flexibility for installation in a variety of applications and

maximizing available space without compromising performance.

“Our products can be found at more than 300

resellers across the United States, consisting of dealers,

wholesalers, private-label customers and original equipment

manufacturers (“OEMs”) who then sell our products to end consumers.

We recently announced a partnership with K-Z RV for integration of

Expion360’s 51.2V 60Ah Edge VHC heated batteries and new Group 27

12.8V 100Ah VHC™ heated batteries into K-Z RV's premium offerings,

and a new e-commerce retail partnership with Tractor Supply, the

largest rural lifestyle retailer in the United States, to offer

Expion360 products online for shipment to customers in 49 states.

We believe our lithium battery line and accessories will be

attractive to Tractor Supply customers shopping online to outfit

and upgrade their outdoor lifestyles, and the partnership expands

our market presence across the country.

“Looking ahead, as the RV market recovers, we

are well positioned for new orders with our expanding portfolio of

advanced batteries, supported by strong marketing initiatives. We

are working to secure additional partnerships to expand our list of

major resellers and enhance our market penetration.

“Most recently, we closed a public offering with

gross proceeds to the Company of approximately $10.0 million. The

net proceeds from the offering were used, in part, to fully repay

the unsecured convertible promissory note issued to 3i, LP. In

addition, the Company and Tumim Stone Capital, LLC mutually agreed

to terminate the common stock purchase agreement establishing an

equity line of credit, effective immediately upon the closing of

the public offering. Importantly, we anticipate using proceeds from

the offering to provide necessary funding to further develop our

new e360 Home Energy Storage Solutions targeting home and small

commercial solar users and installers. Our two LiFePO4 battery

storage solutions enable residential and small business customers

to create their own stable micro-energy grid and lessen the impact

of increasing power fluctuations and outages. We believe consumer

uptake of home energy storage has the potential to scale rapidly

with the introduction of products that improve price, flexibility,

and integration, while creating an opportunity to generate

meaningful recurring revenue streams and enable margin expansion in

a market that is expected to surpass $123 billion globally by

2029,” concluded Mr. Schaffner.

Second Quarter 2024 Financial

Summary

For the second quarter of 2024, net sales

totaled $1.3 million, a decrease of 25.9% from $1.7 million in the

prior year period. The decrease was primarily attributable to the

lingering effects of the year over year downturn in the RV market,

combined with customers limiting orders in anticipation of the

availability of our new products with enhanced features.

Gross profit for the second quarter of 2024

totaled $0.3 million or 25.5% as a percentage of sales, as compared

to $0.5 million or 26.3% as a percentage of sales in the prior year

period. The decrease in gross profit was primarily attributable to

decreases in sales which drove higher fixed overhead costs per

unit.

Selling, general and administrative expenses

were $2.0 million in both the second quarter of 2024 and the second

quarter of 2023.

Net loss for the second quarter of 2024 totaled

$2.2 million, or $(0.30) per share, and net loss of $1.5 million,

or $(0.21) per share in the prior year period.

First Half 2024 Financial

Summary

For the six months ended June 30, 2024, net

sales totaled $2.2 million, a decrease of 30.4% from $3.2 million

in the prior year period.

Gross profit for the six months ended June 30,

2024, totaled $0.5 million or 24.4% as a percentage of sales,

compared to $0.9 million or 27.8% as a percentage of sales in the

prior year period.

Selling, general and administrative expenses

increased to $4.2 million from $4.1 million in the prior year

period.

Net loss for the six months ended June 30, 2024,

totaled $4.4 million, or $(0.61) per share, compared to a net loss

of $3.5 million, or $(0.50) per share in the prior year period.

Cash and cash equivalents totaled $0.9 million

at June 30, 2024, compared to $3.9 million at December 31,

2023.

On August 8, 2024, the Company closed a public

offering with gross proceeds of approximately $10.0 million.

Subsequent to the closing of the public offering, 14,598,000

pre-funded warrants have been exercised for shares.

Second Quarter 2024 Results Conference

Call

Brian Schaffner, Chief Executive Officer and

Greg Aydelott, Chief Financial Officer of Expion360 will host the

conference call, followed by a question-and-answer period. The

conference call will be accompanied by a presentation, which can be

viewed during the webcast or accessed via the investor relations

section of the Company’s website here.

To access the call, please use the following

information:

|

|

|

|

Date: |

Wednesday, August 14, 2024 |

|

Time: |

4:30 p.m. Eastern Time (1:30 p.m. Pacific Time) |

|

Dial-in: |

1-844-825-9789 |

|

International Dial-in: |

1-412-317-5180 |

|

Conference Code: |

10191292 |

|

Webcast: |

https://viavid.webcasts.com/starthere.jsp?ei=1681427&tp_key=b45018adfd |

|

|

|

A telephone replay will be available commencing

approximately three hours after the call and will remain available

through August 28, 2024, by dialing 1-844-512-2921 from the U.S.,

or 1-412-317-6671 from international locations, and entering replay

pin number: 10191292. The replay can also be viewed through the

webcast link above and the presentation utilized during the call

will be available via the investor relations section of the

Company’s website here.

About Expion360

Expion360 is an industry leader in premium

lithium iron phosphate (LiFePO4) batteries and accessories for

recreational vehicles and marine applications, with residential and

industrial applications under development. On December 19, 2023,

the Company announced its entrance into the home energy storage

market with the introduction of two premium LiFePO4 battery storage

systems that enable residential and small business customers to

create their own stable micro-energy grid and lessen the impact of

increasing power fluctuations and outages. Please find the press

release here.

The Company’s lithium-ion batteries feature half

the weight of standard lead-acid batteries while delivering three

times the power and ten times the number of charging cycles.

Expion360 batteries also feature better construction and

reliability compared to other lithium-ion batteries on the market

due to their superior design and quality materials. Specially

reinforced, fiberglass-infused, premium ABS and solid mechanical

connections help provide top performance and safety. With Expion360

batteries, adventurers can enjoy the most beautiful and remote

places on Earth even longer.

The Company is headquartered in Redmond, Oregon.

Expion360 lithium-ion batteries are available today through more

than 300 dealers, wholesalers, private-label customers, and OEMs

across the country. To learn more about the Company,

visit expion360.com.

Edge, VHC, Vertical Heat Conduction and

SmartTalk are trademarks of Expion360.

© 2024 Expion360. All rights reserved.

Forward-Looking Statements and Safe

Harbor Notice

This press release contains certain

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, which statements are

subject to considerable risks and uncertainties. The Company

intends such forward-looking statements to be covered by the safe

harbor provisions contained in the Private Securities Litigation

Reform Act of 1995. All statements other than statements of

historical facts included in this press release, including

statements about our beliefs and expectations, are "forward-looking

statements" and should be evaluated as such. Examples of such

forward-looking statements include, statements that use

forward-looking words such as "projected," "expect," "possibility,”

“believe,” “aim,” “goal,” “plan,” and "anticipate," or similar

expressions. Forward-looking statements included in this press

release include, but are not limited to, statements relating to the

Company’s expectations about the Company’s operations, future

development plans, growth prospects, product pipeline and

development, anticipated timing of commercial availability of its

products, beliefs about market size and opportunity, including

customer base, and market conditions, and the anticipated use of

proceeds from the offering. Forward-looking statements are subject

to and involve risks, uncertainties, and assumptions that may cause

the Company’s actual results, performance or achievements to be

materially different from any future results, performance or

achievements predicted, assumed or implied by such forward-looking

statements.

The Company cautions that forward-looking

statements are not historical facts and makes no guarantee of

future performance. Forward-looking statements are based on

estimates and opinions of management at the time statements are

made. The information set forth herein speaks only as of the date

hereof. The Company and its management are under no obligation, and

expressly disclaim any obligation, to update, alter or otherwise

revise any forward-looking statements following the date of this

press release, whether as a result of new information, future

events or otherwise, except as required by law.

Company Contact: Brian Schaffner,

CEO 541-797-6714 Email Contact

External Investor Relations:

Chris Tyson, Executive Vice President MZ Group - MZ North America

949-491-8235 XPON@mzgroup.us www.mzgroup.us

|

|

|

Expion360 Inc. Balance

Sheets |

|

|

|

|

June 30, 2024 (unaudited) |

|

December 31, 2023 |

|

Assets |

|

|

|

|

Current Assets |

|

|

|

|

Cash and cash equivalents |

$ |

902,323 |

|

|

$ |

3,932,698 |

|

|

Accounts receivable, net |

|

353,006 |

|

|

|

154,935 |

|

|

Inventory |

|

3,361,832 |

|

|

|

3,825,390 |

|

|

Prepaid/in-transit inventory |

|

719,286 |

|

|

|

163,948 |

|

|

Prepaid expenses and other current assets |

|

216,660 |

|

|

|

189,418 |

|

|

Total current assets |

|

5,553,107 |

|

|

|

8,266,389 |

|

|

|

|

|

|

|

Property and equipment |

|

1,212,984 |

|

|

|

1,348,326 |

|

|

Accumulated depreciation |

|

(467,259 |

) |

|

|

(430,295 |

) |

|

Property and equipment, net |

|

745,725 |

|

|

|

918,031 |

|

|

|

|

|

|

|

Other Assets |

|

|

|

|

Operating leases - right-of-use asset |

|

2,399,736 |

|

|

|

2,662,015 |

|

|

Deposits |

|

58,896 |

|

|

|

58,896 |

|

|

Total other assets |

|

2,458,632 |

|

|

|

2,720,911 |

|

|

Total assets |

$ |

8,757,464 |

|

|

$ |

11,905,331 |

|

|

|

|

|

|

|

Liabilities and stockholders' equity |

|

|

|

|

Current liabilities |

|

|

|

|

Accounts payable |

$ |

432,550 |

|

|

$ |

286,985 |

|

|

Customer deposits |

|

14,094 |

|

|

|

17,423 |

|

|

Accrued expenses and other current liabilities |

|

278,843 |

|

|

|

292,515 |

|

|

Convertible note payable |

|

2,050,757 |

|

|

|

2,082,856 |

|

|

Current portion of operating lease liability |

|

541,145 |

|

|

|

522,764 |

|

|

Current portion of stockholder promissory notes |

|

700,000 |

|

|

|

762,500 |

|

|

Current portion of long-term debt |

|

31,990 |

|

|

|

50,839 |

|

|

Total current liabilities |

|

4,049,379 |

|

|

|

4,015,882 |

|

|

|

|

|

|

|

Long-term-debt, net of current portion |

|

215,731 |

|

|

|

298,442 |

|

|

Operating lease liability, net of current portion |

|

1,967,593 |

|

|

|

2,241,325 |

|

|

Total liabilities |

$ |

6,232,703 |

|

|

$ |

6,555,649 |

|

|

Stockholders' equity |

|

|

|

|

Preferred stock, par value $0.001 per share; 20,000,000 authorized;

zero shares issued and outstanding |

|

- |

|

|

|

- |

|

|

Common stock, par value $0.001 per share; 200,000,000 shares

authorized; 7,559,530 and 6,922,912 issued and outstanding as of

June 30, 2024 and December 31, 2023, respectively |

|

7,560 |

|

|

|

6,923 |

|

|

Additional paid-in capital |

|

28,026,138 |

|

|

|

26,438,524 |

|

|

Accumulated deficit |

|

(25,508,937 |

) |

|

|

(21,095,765 |

) |

|

Total stockholders' equity |

|

2,524,761 |

|

|

|

5,349,682 |

|

| Total

liabilities and stockholders' equity |

$ |

8,757,464 |

|

|

$ |

11,905,331 |

|

| |

|

|

|

|

|

|

|

|

Expion360 Inc. Statements of Operations

(Unaudited) |

|

|

|

|

For the Three Months Ended June 30, |

|

For the Six Months Ended June 30, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Net sales |

$ |

1,278,109 |

|

|

$ |

1,725,123 |

|

|

$ |

2,249,967 |

|

|

$ |

3,232,300 |

|

|

Cost of sales |

|

952,646 |

|

|

|

1,270,724 |

|

|

|

1,701,982 |

|

|

|

2,334,454 |

|

|

Gross profit |

|

325,463 |

|

|

|

454,399 |

|

|

|

547,985 |

|

|

|

897,846 |

|

|

Selling, general and administrative |

|

2,004,260 |

|

|

|

1,951,664 |

|

|

|

4,193,734 |

|

|

|

4,072,559 |

|

|

Loss from operations |

|

(1,678,797 |

) |

|

|

(1,497,265 |

) |

|

|

(3,645,749 |

) |

|

|

(3,174,713 |

) |

|

|

|

|

|

|

|

|

|

|

Other expense |

|

|

|

|

|

|

|

|

Interest income |

|

(18,596 |

) |

|

|

(47,764 |

) |

|

|

(45,460 |

) |

|

|

(67,897 |

) |

|

Interest expense |

|

250,560 |

|

|

|

26,399 |

|

|

|

503,846 |

|

|

|

64,576 |

|

|

Loss on sale of property and equipment |

|

- |

|

|

|

3,426 |

|

|

|

306 |

|

|

|

3,426 |

|

|

Settlement expense |

|

309,000 |

|

|

|

- |

|

|

|

309,000 |

|

|

|

281,680 |

|

|

Other (income) / expense |

|

11 |

|

|

|

(500 |

) |

|

|

(1,189 |

) |

|

|

(394 |

) |

|

Total other (income) / expense |

|

540,975 |

|

|

|

(18,439 |

) |

|

|

766,503 |

|

|

|

281,391 |

|

|

Loss before income taxes |

|

(2,219,772 |

) |

|

|

(1,478,826 |

) |

|

|

(4,412,252 |

) |

|

|

(3,456,104 |

) |

|

|

|

|

|

|

|

|

|

|

Franchise taxes / (refund) |

|

460 |

|

|

|

(38 |

) |

|

|

920 |

|

|

|

(38 |

) |

|

Net loss |

$ |

(2,220,232 |

) |

|

$ |

(1,478,788 |

) |

|

$ |

(4,413,172 |

) |

|

$ |

(3,456,066 |

) |

|

|

|

|

|

|

|

|

|

|

Net loss per share (basic and diluted) |

$ |

(0.30 |

) |

|

$ |

(0.21 |

) |

|

$ |

(0.61 |

) |

|

$ |

(0.50 |

) |

|

Weighted-average number of common shares outstanding |

|

7,357,300 |

|

|

|

6,910,491 |

|

|

|

7,182,121 |

|

|

|

6,862,747 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expion360 Inc. Statements of Cash Flows

(Unaudited) |

|

|

|

|

For the Six Months Ended June 30, |

|

|

2024 |

|

2023 |

|

Cash flows from operating activities |

|

|

|

|

|

|

|

|

|

Net loss |

$ |

(4,413,172 |

) |

|

$ |

(3,456,066 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

Depreciation |

|

94,866 |

|

|

|

101,992 |

|

|

Amortization of convertible note costs |

|

333,572 |

|

|

|

- |

|

|

Loss on sales of property and equipment |

|

306 |

|

|

|

3,426 |

|

|

Decrease in allowance for doubtful accounts |

|

- |

|

|

|

(18,804 |

) |

|

Stock-based settlement |

|

209,000 |

|

|

|

251,680 |

|

|

Stock-based compensation |

|

438,923 |

|

|

|

- |

|

|

|

|

|

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Increase in accounts receivable |

|

(198,071 |

) |

|

|

(92,359 |

) |

|

(Increase) / decrease in inventory |

|

463,558 |

|

|

|

(437,190 |

) |

|

Increase in prepaid/in-transit inventory |

|

(555,338 |

) |

|

|

(19,243 |

) |

|

Increase in prepaid expenses and other current assets |

|

(27,242 |

) |

|

|

(12,178 |

) |

|

Increase in deposits |

|

- |

|

|

|

(2,795 |

) |

|

Increase / (decrease) in accounts payable |

|

145,566 |

|

|

|

(10,759 |

) |

|

Increase / (decrease) in customer deposits |

|

(3,329 |

) |

|

|

156,881 |

|

|

Increase / (decrease) in accrued expenses and other current

liabilities |

|

98,166 |

|

|

|

(589 |

) |

|

Increase in right-of-use assets and lease liabilities |

|

6,929 |

|

|

|

14,477 |

|

|

Net cash used in operating activities |

|

(3,406,266 |

) |

|

|

(3,521,527 |

) |

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

Purchases of property and equipment |

|

(10,550 |

) |

|

|

(34,250 |

) |

|

Net proceeds from sales of property and equipment |

|

87,684 |

|

|

|

37,964 |

|

|

Net cash provided by investing activities |

|

77,134 |

|

|

|

3,714 |

|

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

Principal payments on convertible note |

|

(365,671 |

) |

|

|

- |

|

|

Principal payments on long-term debt |

|

(101,560 |

) |

|

|

(136,965 |

) |

|

Principal payments on stockholder promissory notes |

|

(62,500 |

) |

|

|

- |

|

|

Net proceeds from exercise of warrants |

|

(4 |

) |

|

|

49,777 |

|

|

Net proceeds from issuance of common stock |

|

828,492 |

|

|

|

- |

|

|

Net cash provided by / (used in) financing activities |

|

298,757 |

|

|

|

(87,188 |

) |

|

|

|

|

|

|

Net change in cash and cash equivalents |

|

(3,030,375 |

) |

|

|

(3,605,001 |

) |

|

Cash and cash equivalents, beginning |

|

3,932,698 |

|

|

|

7,201,244 |

|

|

Cash and cash equivalents, ending |

$ |

902,323 |

|

|

$ |

3,596,243 |

|

| |

|

|

|

|

|

|

|

|

|

For the Six Months Ended June 30, |

|

Supplemental disclosure of cash flow

information: |

2024 |

|

2023 |

|

Cash paid for interest |

$ |

67,070 |

|

|

$ |

64,798 |

|

|

Cash paid / (refunded) for franchise taxes |

$ |

- |

|

|

$ |

(39 |

) |

|

|

|

|

|

|

|

Non-cash financing activities: |

|

|

|

|

|

Acquisition/modification of operating lease right-of-use asset and

lease liability |

$ |

- |

|

|

$ |

(13,993 |

) |

|

Issuance of common stock for payment on accrued interest |

$ |

75,811 |

|

|

$ |

- |

|

|

Issuance of common stock for payment on accrued compensation |

$ |

36,029 |

|

|

$ |

- |

|

|

Issuance of common stock for settlement shares and vested RSUs |

$ |

65 |

|

|

$ |

- |

|

|

|

|

|

|

|

|

|

|

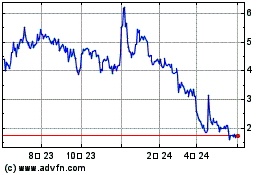

Expion360 (NASDAQ:XPON)

過去 株価チャート

から 11 2024 まで 12 2024

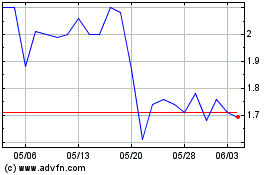

Expion360 (NASDAQ:XPON)

過去 株価チャート

から 12 2023 まで 12 2024