UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14D-9

SOLICITATION/RECOMMENDATION STATEMENT

UNDER SECTION 14(d)(4) OF THE SECURITIES

EXCHANGE ACT OF 1934

(Amendment No. 4)

MILLICOM INTERNATIONAL CELLULAR S.A.

(Name of Subject Company)

MILLICOM INTERNATIONAL CELLULAR S.A.

(Name of Person Filing Statement)

Common Shares, par value $1.50 per share

(Title of Class of Securities)

L6388F110

(CUSIP Number of Class of Securities)

Mauricio Ramos

Chair of the Board

Millicom International Cellular S.A.

2, Rue du Fort Bourbon,

L-1249 Luxembourg

Grand Duchy of Luxembourg

Phone: +352 691 750960 / +1 908 463 8588

(Name, address, and telephone numbers of person

authorized to receive notices and communications

on behalf of the persons filing statement)

With copies to:

William H. Aaronson

Michael Senders

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, New York 10017

(212) 450-4000

| ¨ |

|

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

INTRODUCTION

This Amendment No. 4 (this “Amendment”)

amends and supplements the Solicitation/Recommendation Statement filed on July 15, 2024 under cover of Schedule 14D-9, as amended by Amendment

No. 1, Amendment No. 2 and Amendment No. 3 thereto (together with the exhibits attached hereto and thereto, and as amended from time

to time, the “Schedule 14D-9”), by Millicom International Cellular S.A., a public limited liability company (société

anonyme) organized and established under the laws of the Grand Duchy of Luxembourg (“Luxembourg”), having its registered

office at 2, Rue du Fort Bourbon, L-1249 Luxembourg, Luxembourg, with corporate registration number B40630 with the Luxembourg Trade and

Companies Registry (R.C.S. Luxembourg) (the “Company”), with the Securities and Exchange Commission (the “SEC”).

Except as otherwise set forth in this Amendment,

capitalized terms used but not otherwise defined herein have the meanings ascribed to such terms in the Schedule 14D-9.

On July 1, 2024, pursuant to a Tender Offer Statement

and Rule 13e-3 Transaction Statement filed under cover of Schedule TO filed with the SEC (together with any amendments or supplements

thereto, including the amendments thereto filed by the Filing Parties with the SEC on July 18, 2024, August 5, 2024, August 12, 2024,

August 13, 2024, August 15, 2024 and August 23, 2024, the “Schedule TO”), Purchaser offered to purchase, through

separate but concurrent offers in Sweden (the “Swedish Offer”) and the United States (the “US Offer”

and, together with the Swedish Offer, the “Offers”), all of the issued and outstanding common shares (CUSIP L6388F110),

par value $1.50 per share (each, a “Common Share” and, collectively, the “Common Shares”), including

Swedish Depositary Receipts (ISIN: SE0001174970) representing Common Shares (each of which represents one Common Share) (each, an “SDR”

and, collectively, the “SDRs” and, together with the Common Shares, the “Shares”), of the Company

that are not already owned by the Purchaser Group and its affiliates, for $24.00 per Common Share and $24.00 per SDR (each such amount,

as adjusted for certain dividends pursuant to the terms set forth in the Offers, and with respect to the Swedish Offer, as converted into

SEK based on a USD/SEK exchange rate as close to the settlement date of the Swedish Offer as Purchaser is able to achieve, the “Original

Offer Price”), upon the terms and subject to the conditions set forth in the Offer to Purchase and the Transmittal Documents.

On August 2, 2024, Purchaser revised the Offers

to increase the Original Offer Price to $25.75 per Common Share and $25.75 per SDR (each such amount, without interest and less any withholding

taxes that may be applicable, and as adjusted for certain dividends pursuant to the terms set forth in the Offers, and with respect to

the Swedish Offer, as converted into SEK based on a USD/SEK exchange rate as close to the settlement date of the Swedish Offer as Purchaser

is able to achieve, the “Revised Offer Price”).

On August 14, 2024, Purchaser revised the Offers

to waive certain conditions to completion of the Offers (including the Minimum Tender Condition) and to extend the Offer Period until

one minute after 10:59 a.m. EST, or one minute after 4:59 p.m. CEST, on August 22, 2024.

On August 23, 2024, Purchaser announced that the

Offers and the withdrawal rights expired as scheduled on August 22, 2024, at one minute after 10:59 a.m. EST or one minute after 4:59

p.m. CEST, and were not further extended. Purchaser further announced that (i) as of such time, all remaining conditions to the Offers

were satisfied and the Offers were completed, (ii) Purchaser has been advised that a total of 19,269,377 Shares were validly tendered

and not properly withdrawn, (iii) all such Shares have been accepted for payment by Purchaser, (iv) together with Purchaser’s 49,966,734

Shares held prior to the Offers, Purchaser will hold 69,236,111 Shares, representing approximately 40.42% of all outstanding Shares and

(v) settlement for the Shares tendered in the Offers is expected to be initiated in accordance with the terms of the Offers around September

2, 2024.

The Schedule 14D-9 (including this Amendment)

relates to the Offers, as revised by Purchaser through August 23, 2024.

For all purposes of the Schedule 14D-9, references

to the “Swedish Offer,” the “US Offer” and the “Offers” are to the Offers, as revised by Purchaser

through August 23, 2024.

References in this Amendment to the Company’s “shareholders”

include both holders of Common Shares and holders of SDRs unless otherwise specified.

Except as otherwise set forth in this Amendment,

the information set forth in the Schedule 14D-9 remains unchanged and is incorporated herein by reference as relevant to the items in

this Amendment.

ITEM 1. SUBJECT COMPANY INFORMATION

The following sentence is hereby added to the end of the section of

the Schedule 14D-9 entitled “Item 1. Subject Company Information—Securities”:

As of July 30, 2024, there were 172,096,305 Shares outstanding

(including 789,807 Shares held in treasury).

ITEM 2. IDENTITY AND BACKGROUND OF FILING PERSON

The following paragraph is hereby added to the

section of the Schedule 14D-9 entitled “Item 2. Identity and Background of Filing Person” immediately after the paragraph

beginning “According to the Schedule TO, the address of Purchaser is 53, boulevard Royal, L-2449 Luxembourg, Luxembourg…”:

On August 23, 2024, by way of a press

release, Purchaser announced the results of the Offers. Purchaser further announced that (i) all remaining conditions to the Offers had

been satisfied and the Offers had been completed, (ii) Purchaser has accepted for payment all of the Shares that were validly tendered

and not properly withdrawn and (iii) settlement for such Shares is expected to be initiated in accordance with the terms of the Offers

around September 2, 2024.

ITEM 4. THE SOLICITATION OR RECOMMENDATION

The following paragraphs are hereby added to the section of the Schedule

14D-9 entitled “Item 4. The Solicitation or Recommendation—Background of the Offers” in chronological order:

On August 23, 2024, Purchaser issued

a press release in which, among other things, it announced that (i) all remaining conditions to the Offers had been satisfied and the

Offers had been completed, (ii) Purchaser has accepted for payment all of the Shares that were validly tendered and not properly withdrawn

and (iii) settlement for such Shares is expected to be initiated in accordance with the terms of the Offers around September 2, 2024.

On August 23, 2024, the Filing Parties

filed Amendment No. 8 to the Schedule TO with the SEC.

ITEM 9. EXHIBITS

Item 9 of the Schedule 14D-9 is hereby

amended and supplemented by adding the following exhibits:

* Filed herewith.

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify

that the information set forth in this Schedule 14D-9 is true, complete and correct.

| |

|

|

|

| |

MILLICOM INTERNATIONAL CELLULAR S.A. |

| |

|

| |

|

|

| |

By: |

|

/s/ Salvador Escalón |

| |

|

|

Name: Salvador Escalón

Title: Executive Vice President, Chief Legal and Compliance Officer |

Date: August 26, 2024

Exhibit (a)(5)(S)

Millicom announces extension of consent

solicitations

Luxembourg, August 15, 2024 –

Millicom International Cellular S.A. (“Millicom”) today announced the extension of the period during which it will solicit

consents (each, a “Consent”) from the holders of record on August 2, 2024 of its 6.625% Senior Notes due 2026 (CUSIP No.

600814 AP2 and ISIN No. XS1894610119), 5.125% Senior Notes due 2028 (CUSIP Nos. 600814 AN7 and L6388G AB6), 6.250% Senior Notes due 2029

(CUSIP Nos. 600814 AQ0 and L6388G HV5), 4.500% Senior Notes due 2031 (CUSIP Nos. 600814 AR8 and L6388G HX1) and 7.375% Senior Notes due

2032 (CUSIP Nos. 600814 AS6 and L6388G JA9) (collectively, the “Notes”) to amend (the “Proposed Amendments”)

certain provisions of the indentures governing the Notes (the “Indentures”).

The consent solicitations for each series of

Notes (collectively, the “Consent Solicitations” and, with respect to each series, a “Consent Solicitation”)

are being made solely on the terms and subject to the conditions set forth in the consent solicitation statement dated August 5, 2024,

as amended by this announcement (the “Consent Solicitation Statement”).

Millicom hereby amends the Consent Solicitation Statement

by extending the period during which it will solicit Consents to 5:00 p.m., New York City time, on August 23, 2024, unless further extended

(such time and date, with respect to each series of Notes, as may be extended, an “Expiration Date”). Except as specifically

provided herein, Millicom does not intend to, nor shall it, modify the Consent Solicitation Statement in any other manner.

Atlas Luxco S.à r.l., a Luxembourg

limited liability company (société à responsibilité limitée) (the “Purchaser”)

has offered to purchase, through separate but concurrent offers in Sweden and the United States, all of the issued and outstanding common

shares (including common shares represented by Swedish depositary receipts) (the “Shares”) of Millicom pursuant to the Tender

Offer Statement and Rule 13e-3 Transaction Statement on Schedule TO filed by Atlas Luxco S.à r.l. and other members of the purchaser

group with the U.S. Securities and Exchange Commission on July 1, 2024 (the “Offers”). The Proposed Amendments are being

sought in connection with the proposed acquisition by the Purchaser in the Offers of that number of Shares as a result of which the Purchaser

would become the beneficial owner, directly or indirectly, of more than 50% of the Shares of the Company (the “Acquisition”).

The

consummation of the Acquisition would constitute a “Change of Control,” as defined in the Indentures. Were a “Rating

Decline” (as defined in the Indentures) also to occur, then the Change of Control and Rating Decline would constitute a “Change

of Control Triggering Event” and require Millicom to make an offer, in the manner contemplated by the applicable Indenture, to

each holder of the Notes to purchase all or any part of such holder’s Notes at a purchase price equal to 101% of the aggregate

principal amount of Notes purchased, plus accrued and unpaid interest, if any, to the date of purchase (such payment, a “Change

of Control Payment”).

The Proposed Amendments, if they become effective, would amend the Indentures such that the consummation of

the Acquisition would not constitute a Change of Control, and that, as a result, a Change of Control Triggering Event would not occur

even if the Acquisition were to be consummated and there were to be a Rating Decline, and holders of the Notes would therefore not be

entitled to receive any Change of Control Payment in connection with the consummation of the Acquisition.

Approving the Proposed Amendments

in respect of an Indenture requires Consents from holders of at least a majority in aggregate outstanding principal amount of the series

of Notes governed by such Indenture, excluding any Notes owned by Millicom or its affiliates (the “Requisite Consents”).

Each Consent Solicitation is a separate Consent Solicitation to the Proposed Amendments with respect to the applicable Indenture. If

the Requisite Consents are received and not validly revoked in respect of one series of Notes, then the Indenture that governs that series

of Notes will be amended by the execution of a Supplemental Indenture setting forth the Proposed Amendments.

Millicom will pay a cash

payment equal to $2.50 per $1,000 principal amount of Notes (the “Consent Fee”) to holders of the Notes for which Consents

to the Proposed Amendments have been validly delivered (and not validly revoked) prior to the Expiration Date. If the conditions to the

consummation of the Consent Solicitation for a series of Notes described in the Consent Solicitation Statement are satisfied or waived,

Millicom expects to pay the related Consent Fee promptly after the consummation of the Acquisition, which may not occur for a significant

period of time.

Holders of a series of Notes who do not deliver a Consent prior to the applicable Expiration Date or who validly revoke

their Consent will not receive the Consent Fee, even though the Proposed Amendments, if they become effective, will bind all holders

of such series of Notes and any subsequent holders.

Millicom reserves the right to modify or terminate the terms of the Consent Solicitations

at any time. This press release will also be posted on the website of the Luxembourg Stock Exchange.

The information and tabulation agent

for the Consent Solicitations is D.F. King. Any questions or requests for assistance may be directed to D.F. King, at +1 212-269-5550

(Banks and Brokers) or +1 888-288-0951 (All Others - US toll free) or by e-mail to micc@dfking.com.

Millicom has retained BNP Paribas

Securities Corp. and J.P. Morgan Securities LLC to act as solicitation agents in connection with the Consent Solicitations. Questions

regarding the Consent Solicitations may be directed to BNP Paribas Securities Corp. at +1 (212) 841-3059 or by email to dl.us.liability.management@us.bnpparibas.com

or to J.P. Morgan Securities LLC at +1 (212) 834-7279.

This announcement does not constitute an offer to sell or issue, or the solicitation

of an offer to buy or subscribe for, securities (including the Notes) in any jurisdiction.

-END-

For further information, please contact

Press:

Sofía

Corral, Director Corporate Communications

press@millicom.com |

Investors:

Michel

Morin, VP Investor Relations

investors@millicom.com |

About Millicom

Millicom (NASDAQ U.S.: TIGO, Nasdaq Stockholm:

TIGO_SDB) is a leading provider of fixed and mobile telecommunications services in Latin America. Through our TIGO® and Tigo Business®

brands, we provide a wide range of digital services and products, including TIGO Money for mobile financial services, TIGO Sports for

local entertainment, TIGO ONEtv for pay TV, high-speed data, voice, and business-to-business solutions such as cloud and security. As

of June 30, 2024, Millicom, including its Honduras Joint Venture, employed approximately 15,000 people, and provided mobile and fiber-cable

services through its digital highways to more than 45 million customers, with a fiber-cable footprint of about 14 million homes passed.

Founded in 1990, Millicom International Cellular S.A. is headquartered in Luxembourg.

Exhibit (a)(5)(T)

Millicom announces expiration of consent

solicitations

Luxembourg, August 23, 2024 –

Millicom International Cellular S.A. (“Millicom”) today announced the expiration of its previously announced solicitation

of consents from the holders of record on August 2, 2024 of its 6.625% Senior Notes due 2026, 5.125% Senior Notes due 2028, 6.250% Senior

Notes due 2029, 4.500% Senior Notes due 2031 and 7.375% Senior Notes due 2032 (collectively, the “Notes”) to amend certain

provisions of the indentures governing the Notes (the “Proposed Amendments”), and that the Proposed Amendments will not be

made.

This announcement does not constitute an

offer to sell or issue, or the solicitation of an offer to buy or subscribe for, securities (including the Notes) in any jurisdiction.

-END-

For further information, please contact

Press:

Sofía

Corral, Director Corporate

Communications

press@millicom.com |

Investors:

Michel

Morin, VP Investor Relations investors@millicom.com |

About Millicom

Millicom (NASDAQ U.S.: TIGO, Nasdaq Stockholm:

TIGO_SDB) is a leading provider of fixed and mobile telecommunications services in Latin America. Through our TIGO® and Tigo Business®

brands, we provide a wide range of digital services and products, including TIGO Money for mobile financial services, TIGO Sports for

local entertainment, TIGO ONEtv for pay TV, high-speed data, voice, and business-to-business solutions such as cloud and security. As

of June 30, 2024, Millicom, including its Honduras Joint Venture, employed approximately 15,000 people, and provided mobile and fiber-cable

services through its digital highways to more than 45 million customers, with a fiber-cable footprint of about 14 million homes passed.

Founded in 1990, Millicom International Cellular S.A. is headquartered in Luxembourg.

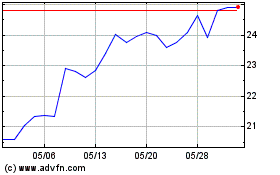

Millicom International C... (NASDAQ:TIGO)

過去 株価チャート

から 10 2024 まで 11 2024

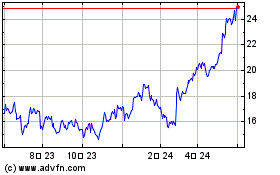

Millicom International C... (NASDAQ:TIGO)

過去 株価チャート

から 11 2023 まで 11 2024