UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2024

Commission File Number: 001-38851

POWERBRIDGE TECHNOLOGIES CO., LTD.

Advanced Business Park, 9th Fl, Bldg C2,

29 Lanwan Lane, Hightech District,

Zhuhai, Guangdong 519080, China

(Address of Principal Executive Office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

CONTENTS

Entry into a series of Material Definitive Agreements

On November 24, 2023, Powerbridge Technologies Co., Ltd. (the “Company”)

entered into a series of securities purchase agreements (the “SPAs”) separately with certain individual investors, Rong Li,

Xiaohong Guo, Yuhong Xu, Jian Zeng, Jie Ding, Mengmeng Zhang, Ping Tang, Xiaochun Yang, Pang Kai Xin, Yumei Xu, Jing Zhou and Yongheng

Wu (the “Purchasers”). Pursuant to the SPAs, the Company agreed to sell the Purchasers an aggregate of 130,463,140 Class A

ordinary shares, $0.40 par value per share, of the Company for an aggregate purchase price of $40.0 million, with an offering price of

approximately $0.3 per share (the “Offering”). The net proceeds to the Company from such Offering will be approximately $40.0

million. The offering was closed on December 29, 2023 (the “Closing”).

The Class A ordinary shares were offered, and will be issued, pursuant

to the prospectus included in the Company’s Registration Statement on Form F-3 (Registration No. 333-253395), filed with the Securities

and Exchange Commission (the “Commission”) on February 23, 2021, and a prospectus supplement to be filed with the Commission

within 30 days after the date of Closing.

The form of the SPAs is filed as Exhibit 99.1 to this Current Report

on Form 6-K. The foregoing is only a brief description of the material terms of the SPAs, and does not purport to be a complete description

of the rights and obligations of the parties thereunder and is qualified in its entirety by reference to such exhibits.

Corporate Governance

Pursuant to the home country rule exemption set forth under Nasdaq

Listing Rule 5615, the board of directors of the Company elects to follow the Company’s home country rules for exemption from the

requirement to obtain shareholder approval for issuance of securities, other than in a public offering, equal to 20% or more of the outstanding

share capital or the voting power outstanding at a price that is less than the minimum price defined therein under Nasdaq Listing Rule

5635(d).

Other than those described above and disclosed in the Company’s

annual report on Form 20-F, there are no significant differences between the Company’s corporate governance practices and those

followed by U.S. domestic companies under Nasdaq Capital Market corporate governance listing standards.

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities

and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: January 25, 2024

| |

POWERBRIDGE TECHNOLOGIES CO., LTD. |

| |

|

|

| |

By: |

/s/ Stewart Lor |

| |

|

Stewart Lor |

| |

|

Chief Executive Officer |

2

Exhibit 99.1

SECURITIES PURCHASE AGREEMENT

This SECURITIES PURCHASE AGREEMENT (the “Agreement”) is

made as of November 24, 2023 by and among Powerbridge Technologies Co. Ltd., a Cayman Islands exempted company (the “Company”),

and [Name of the Purchaser] (the “Purchaser”).

WHEREAS, subject to the terms and conditions set forth in this Agreement

and pursuant to an effective registration statement under the Securities Act of 1933, as amended (the “Securities Act”),

the Company desires to issue and sell to the Purchaser, and the Purchaser desires to purchase from the Company, securities of the Company

as more fully described in this Agreement.

NOW THEREFORE, in consideration of the mutual agreements, representations,

warranties and covenants herein contained, as well as other good and valuable consideration, the receipt and sufficiency of which are

hereby acknowledged and accepted, and intending to be legally bound hereby, the parties hereto agree as follows:

| 1. | Definitions. As used in this Agreement, the

following terms shall have the following respective meanings: |

| (a) | “Affiliate” means, with respect to any Person, any

other Person directly or indirectly controlling, controlled by or under common control with

such Person. For purposes of this definition, “control” when used with respect

to any Person means the power to direct the management and policies of such Person, directly

or indirectly, whether through the ownership of voting securities, by contract or otherwise,

and the terms “controlling” and “controlled” have correlative meanings. |

| (b) | “Company Intellectual Property” shall mean all of

the Intellectual Property owned by the Company or any of its Subsidiaries. |

| (c) | “Company Options” shall mean options to purchase Ordinary

Share under any of the Company Stock Option Plans. |

| (d) | “Company Stock Option Plan” shall mean each stock

option plan, stock award plan, stock appreciation right plan, phantom stock plan, stock option,

other equity or equity-based compensation plan, equity or other equity based award to any

employee, whether payable in cash, shares or otherwise (to the extent not issued pursuant

to any of the foregoing plans), or other plan or contract of any nature with any employee

pursuant to which any stock, option, warrant or other right to purchase or acquire share

capital of the Company or right to payment based on the value of Company share capital has

been granted or otherwise issued. |

| (e) | “Exchange Act” shall mean the U.S. Securities Exchange

Act of 1934, as amended. |

| (f) | “FCPA” shall mean the Foreign Corrupt Practices Act

of 1977, as amended. |

| (g) | “GAAP” shall mean United States generally accepted

accounting principles. |

| (h) | “Governmental Entity” shall mean any national, provincial,

state, municipal, local government, any instrumentality, subdivision, court, administrative

agency or commission or other governmental authority or instrumentality, or any quasi-governmental

or private body exercising any regulatory, taxing, importing or other governmental or quasi-governmental

authority. |

| (i) | “Intellectual Property” shall mean the rights associated

with or arising under any of the following anywhere in the world: (i) patents and applications

therefor; (ii) copyrights, copyright registrations and applications therefor, and all other

corresponding rights in works of authorship, however denominated; (iii) rights in industrial

designs and any registrations and applications therefor; (iv) trademark rights and corresponding

rights in trade names, logos and service marks, trademarks or service marks, and registrations

and applications therefor; (v) trade secrets rights and corresponding rights in confidential

business and technical information and know-how (“Trade Secrets”); and (vi) any

similar or equivalent rights to any of the foregoing anywhere in the world (as applicable). |

| (j) | “Knowledge” of any Person that is not an individual

means the knowledge of such Person’s directors and officers. |

| (k) | “Legal Requirements” shall mean any national, provincial,

state, municipal, local or other law, statute, constitution, principle of common law, resolution,

ordinance, code, order, edict, decree, rule, regulation, ruling or requirement issued, enacted,

adopted, promulgated, implemented or otherwise put into effect by or under the authority

of any Governmental Entity. |

| (l) | “Lien” shall mean any pledge, claim, lien, charge,

encumbrance, option and security interest of any kind or nature whatsoever. |

| (m) | “Market Price” means 70% multiplied by the lowest

daily VWAPs during the twenty (20) Trading Days preceding the date of this Agreement. |

| (n) | “Material Adverse Effect” shall mean, when used in

connection with an entity, any change, event, violation, inaccuracy, circumstance or effect

(any such item, an “Effect”), that could have or reasonably be expected to result

in: (i) a material adverse effect on the legality, validity or enforceability of any Transaction

Document, (ii) a material adverse effect on the results of operations, assets, business,

prospects or condition (financial or otherwise) of the Company and the Subsidiaries, taken

as a whole, or (iii) a material adverse effect on the Company’s ability to perform

in any material respect on a timely basis its obligations under any Transaction Document. |

| (o) | “Nasdaq” shall mean the Nasdaq Capital Market. |

| (p) | “Ordinary Share” shall mean the ordinary shares of

the Company, par value US$0.40 per share. |

| (q) | “Permits” shall mean all permits, licenses, variances,

exemptions, orders and approvals from Governmental Entities. |

| (r) | “Person” shall mean any individual, corporation (including

any non-profit corporation), general partnership, limited partnership, limited liability

partnership, joint venture, estate, trust, company (including any limited liability company

or joint stock company), firm or other enterprise, association, organization, entity or Governmental

Entity. |

| (s) | “PRC” shall mean the People’s Republic of China

and solely for the purposes of this Agreement, exclude Hong Kong SAR, Macao SAR and Taiwan. |

| (t) | “Prospectus” means the final prospectus filed for

the Registration Statement. |

| (u) | “Prospectus Supplement” means the supplement to the

Prospectus complying with Rule 424(b) of the Securities Act that is filed with the SEC and

delivered by the Company to the Purchaser at the Closing. |

| (v) | “Registration Statement” means the effective registration

statement on Form F-3 with SEC (file No. 333-253395), which registers the sale of the Securities

to the Purchasers. |

| (w) | “Rule 424” means Rule 424 promulgated by the SEC pursuant

to the Securities Act, as such Rule may be amended or interpreted from time to time, or any

similar rule or regulation hereafter adopted by the SEC having substantially the same purpose

and effect as such Rule. |

| (x) | “SEC” shall mean the U.S. Securities and Exchange

Commission. |

| (y) | “Securities” means the Ordinary Shares. |

| (z) | “Securities Act” shall mean the Securities Act of

1933, as amended. |

| (aa) | “Subsidiaries” shall mean, when used with respect

to any party, any corporation or other organization, whether incorporated or unincorporated,

at least a majority of the securities or other interests of which having by their terms ordinary

voting power to elect a majority of the board of directors or others performing similar functions

with respect to such corporation or other organization is directly or indirectly owned or

controlled by such party or by any one or more of its Subsidiaries, or by such party and

one or more of its Subsidiaries. For the avoidance of doubt, the Subsidiaries of the Company

shall include any variable interest entity over which the Company or any of its Subsidiaries

effects control pursuant to contractual arrangements and which is consolidated with the Company

in accordance with generally accepted accounting principles applicable to the Company. |

| (bb) | “Trading Day” means any day on which the Company’s

principal market is open for trading. |

| (cc) | “VWAP” means the volume weighted average price of

the Ordinary Shares on the principal market for a particular Trading Day or set of Trading

Days, as the case may be, as reported by Bloomberg. |

| (a) | Purchase and Sale of the Purchase Shares. At the Closing, the

Company hereby agrees to sell to the Purchaser, and the Purchaser hereby agrees to purchase

[number of shares] shares of the ordinary shares of the Company, with a par value

of US$0.40 each (the “Purchase Shares”), for a purchase price per share equal

to the lesser of (a) the closing share price of the Company’s Ordinary Shares on Nasdaq

of the day preceding the date of this Agreement, and (b) the Market Price. |

| (b) | Closing. At the closing (the “Closing”), the Company

shall issue and sell the Purchase Shares to the Purchaser. The Closing shall take place remotely

through the exchange of signature pages and documents electronically or by facsimile. The

Closing shall take place on the date of this Agreement or a later date as mutually agreed

upon by all parties. In connection with the Closing, the Company shall issue the Purchase

Shares to the Purchaser; the Purchaser shall purchase from the Company the Purchase Shares

and, upon receipt of such Purchase Shares, shall pay to the Company the purchase price in

the aggregate of US$[total purchase price]. The Purchaser shall pay the aggregate

purchase price to the Company or its designee(s), by wire transfer, on the date of Closing

or a later date as mutually agreed upon by all parties. Upon issuance and payment therefor

as provided herein, such Purchase Shares shall be validly issued and fully paid and non-assessable. |

| (c) | Company Deliveries. At the Closing, the Company shall deliver

to the Purchaser the following: |

| (i) | this Agreement duly executed by the Company; |

| (ii) | a book-entry account statement representing the Purchase Shares

being purchased by such Purchaser at the Closing; |

| (iii) | a final and complete form of the Prospectus Supplement to be

filed pursuant to Rule 424(b). |

| (d) | Purchaser Deliveries. At the Closing, the Purchaser shall deliver

to the Company the following: |

| (i) | this Agreement duly executed by such Purchaser; |

| (ii) | the purchase price for the Purchase Shares, made by wire transfer

of U.S. Dollars to a bank account of the Company in accordance with the Company’s wire

instructions. |

| 3. | Representations and Warranties of the Company. Except

as set forth in the Company SEC filings, the Company hereby represents and warrants to the

Purchaser as follows: |

| (a) | Organization; Good Standing; Qualification; Subsidiaries.

The Company and each of its Subsidiaries is a corporation or other organization duly organized, validly existing and in good standing

(when such concept is applicable) under the laws of the jurisdiction of its incorporation or organization, has the requisite power and

authority to own, lease and operate its properties and to carry on its business as now being conducted as described in the Company SEC

filings. The Company is duly qualified and in good standing to do business in each jurisdiction in which the nature of its business or

the ownership or leasing of its properties makes such qualification necessary, other than in such jurisdictions where the failure to

be so qualified and in good standing, individually or in the aggregate, would not reasonably be expected to have a Material Adverse Effect

on the Company. The Company owns, directly or indirectly, all of the share capital or other equity interests of each Subsidiary free

and clear of any Liens, and all of the issued and outstanding shares of share capital of each Subsidiary are validly issued and are fully

paid, non-assessable and free of preemptive and similar rights to subscribe for or purchase securities. |

| (i) | Share capital. (i) As of the date hereof, the authorized share

capital of the Company consists of 500,000,000 Ordinary Shares with a par value of US$0.40

each, of which as of the date hereof, 5,440,429 Ordinary Shares are issued and outstanding.

All of the outstanding shares of the share capital of Company are duly authorized and validly

issued, fully paid and nonassessable and not subject to any preemptive rights. |

| (ii) | Equity Incentive Plan. As of the date hereof: 50,542 Ordinary

Shares are reserved for future issuance under the Company Stock Option Plan. All Ordinary

Shares subject to issuance under the Company Stock Option Plans, upon issuance on the terms

and conditions specified in the instruments pursuant to which they are issuable (including

payment of the exercise price therefor), would be duly authorized and validly issued, fully

paid and nonassessable. Except for outstanding Company Options, there are no outstanding

or authorized restricted stock unit, stock appreciation, phantom stock, profit participation

or other forms of stock-based awards with respect to the Company. |

| (iii) | Other Securities. All outstanding Ordinary Shares, all outstanding

Company Options, and all outstanding shares of share capital of each Subsidiary of the Company

have been issued and granted in compliance in all material respects with all applicable securities

laws and other material Legal Requirements. |

| (c) | Authorization; Non-Contravention. |

| (i) | Authorization. All corporate action on the part of the Company

necessary for the authorization, execution and delivery of this Agreement, the performance

of all obligations of the Company hereunder, and the authorization, issuance, sale and delivery

of the Purchase Shares has been taken prior to the date hereof, and this Agreement, when

validly executed by the Purchaser, constitutes a valid and legally binding obligation of

the Company, enforceable in accordance with its terms, except (i) as limited by applicable

bankruptcy, insolvency, reorganization, moratorium and other laws of general application

affecting the enforcement of creditors’ rights generally, (ii) as limited by laws relating

to the availability of specific performance, injunctive relief or other equitable remedies,

and (iii) to the extent the indemnification provisions contained therein may be limited by

applicable federal or state securities laws. |

| (ii) | Non-Contravention. The execution, delivery and performance by

the Company of this Agreement and the consummation by the Company of the transactions contemplated

hereby and thereby (including, without limitation, the issuance of the Purchase Shares) will

not (i) result in a violation of the Company’s constitutional documents (each as amended

to date), (ii) conflict with, or constitute a default (or an event which with notice or lapse

of time or both would become a default) under, or give to others any rights of termination,

amendment, acceleration or cancellation of, any agreement, indenture or instrument to which

the Company or any Subsidiary is a party, or (iii) subject to the consents set forth in Section

3(f), result in a violation of any Legal Requirement applicable to the Company or by

which any property or asset of the Company or any Subsidiary is bound or affected. |

| (d) | SEC Filings; Financial Statements; Internal Controls. |

| (i) | SEC Filings. As of the date hereof, the Company has filed all the

registration statements, prospectuses, reports, schedules, forms, statements and other documents

(including exhibits and all other information incorporated by reference) required to be filed

by it with the SEC. All such registration statements, prospectuses, reports, schedules, forms,

statements and other documents in the form filed with the SEC have been made available to

the Purchaser or are publicly available in the Interactive Data Electronic Applications database

of the SEC. All such required registration statements, prospectuses, reports, schedules,

forms, statements and other documents, as amended, are referred to herein as the “Company

SEC filings.” As of their respective dates (or if subsequently amended or supplemented,

on the date of such amendment or supplement), the Company SEC filings (i) were prepared in

accordance and complied in all material respects with the requirements of the Securities

Act or the Exchange Act, as the case may be, and the rules and regulations of the SEC thereunder

applicable to such Company SEC filings, and (ii) did not contain any untrue statement of

a material fact or omit to state a material fact required to be stated therein or necessary

in order to make the statements therein, in the light of the circumstances under which they

were made, not misleading. None of the Company’s Subsidiaries is required to file any

forms, reports or other documents with the SEC. No executive officer of the Company has failed

to make the certifications required of him or her under Section 302 or 906 of the Sarbanes-Oxley

Act of 2002, as amended, and the rules and regulations promulgated thereunder, with respect

to any Company SEC Filings. Neither the Company nor any of its executive officers has received

notice from any Governmental Entity challenging or questioning the accuracy, completeness,

form or manner of filing of such certifications. |

| (ii) | Financial Statements. Each of the consolidated financial statements

(including, in each case, any related notes thereto) contained in the Company SEC filings

(the “Company Financials”): (i) complied in all material respects with the published

rules and regulations of the SEC with respect thereto; (ii) was prepared in accordance with

GAAP applied on a consistent basis throughout the periods involved (except as may be indicated

in the notes thereto or, in the case of unaudited interim financial statements, for normal

and recurring year-end adjustments and as may be permitted by the SEC on Form 10-K, 20-F,

6-K or any successor or like form under the Exchange Act); and (iii) fairly presented in

all material respects the consolidated financial position of the Company and its consolidated

Subsidiaries as at the respective dates thereof and the consolidated results of the Company’s

operations and cash flows for the periods indicated. |

| (iii) | Sarbanes-Oxley and Internal Controls. To the Knowledge of the

Company, the Company and the Subsidiaries are in compliance with any and all applicable requirements

of the Sarbanes-Oxley Act of 2002 that are effective as of the date hereof, and any and all

applicable rules and regulations promulgated by the SEC thereunder that are effective as

of the date hereof and as of the Closing. The Company has established and maintains, adheres

to and enforces a system of internal accounting controls which are effective in providing

reasonable assurance regarding the reliability of financial reporting and the preparation

of financial statements in accordance with GAAP, including policies and procedures that (i)

require the maintenance of records that in reasonable detail accurately and fairly reflect

the transactions and dispositions of the assets of the Company and its Subsidiaries, (ii)

provide reasonable assurance that transactions are recorded as necessary to permit preparation

of financial statements in accordance with GAAP, and that receipts and expenditures of the

Company and its Subsidiaries are being made only in accordance with appropriate authorizations

of management and the board of directors of the Company (the “Board”), and (iii)

provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition,

use or disposition of the assets of the Company and its Subsidiaries. Neither the Company

nor, to the Knowledge of the Company, the Company’s independent auditors, has identified

or been made aware of (A) any significant deficiency or material weakness, in each case which

has not been subsequently remediated, in the system of internal accounting controls utilized

by the Company and its Subsidiaries, taken as a whole, or (B) any fraud that involves the

Company’s management or other employees who have a role in the preparation of financial

statements or the internal accounting controls utilized by the Company. |

| (e) | Governmental Consents. No consent, approval, order or authorization

of, or registration, declaration or filing with any Governmental Entity is required to be obtained or made by the Company in connection

with the execution and delivery of this Agreement and the transactions contemplated hereby, except for those that have been obtained

on or prior to the date hereof. |

| (f) | Nasdaq. The Ordinary Shares are listed on Nasdaq. There are

no proceedings to revoke or suspend such listing and the Company has not received any notice from Nasdaq, nor does the Company have Knowledge

of any reason that the Company does not or will not meet the listing or maintenance requirements for continuing listing on Nasdaq. |

| (g) | Valid Issuance of Securities. The Purchase Shares have been

duly authorized, and when issued, sold and delivered in accordance with the terms of this Agreement and upon payment of the purchase

price therefor, will be validly issued, fully paid and nonassessable, and free and clear of all Liens (other than restrictions on transfer

imposed by U.S. law (both state and federal) or other applicable securities laws). The Company has reserved from its duly authorized

share capital the maximum number of Ordinary Shares issuable pursuant to this Agreement. |

| (h) | Offering. The Company has prepared and filed the Registration

Statement in conformity with the requirements of the Securities Act, which became effective on February 23, 2021, including the Prospectus,

and such amendments and supplements thereto as may have been required to the date of this Agreement. The Registration Statement is effective

under the Securities Act and no stop order preventing or suspending the effectiveness of the Registration Statement or suspending or

preventing the use of the Prospectus has been issued by the SEC and no proceedings for that purpose have been instituted or, to the knowledge

of the Company, are threatened by the SEC. The Company, if required by the rules and regulations of the SEC, shall file the Prospectus

Supplement with the SEC pursuant to Rule 424(b). The Company was at the time of the filing of the Registration Statement eligible to

use Form F-3. The Company is eligible to use Form F-3 under the Securities Act and it meets the transaction requirements with respect

to the aggregate market value of securities being sold pursuant to this offering. |

| (i) | No Material Adverse Effect. Since June 30, 2023, no event

or circumstance has occurred that, individually or in the aggregate, has had or could reasonably be expected to have a Material Adverse

Effect on the Company. |

| (j) | Intellectual Property. The Company and its Subsidiaries own

or possess adequate rights or licenses to use all material trademarks, trade names, service marks, service mark registrations, service

names, patents, patent rights, copyrights, inventions, licenses, approvals, governmental authorizations, trade secrets and other intellectual

property rights (collectively, “Intellectual Property”) necessary to conduct their respective businesses as now conducted. |

| (i) | The Company and each of its Subsidiaries has taken reasonable steps

consistent with applicable industry practice to protect and preserve the confidentiality

of material confidential information that they wish to, or are obligated by third parties

to, protect as Trade Secrets, and, to the Knowledge of the Company, there is no misappropriation

from the Company of such Trade Secrets by any Person, except where such misappropriation

could not reasonably be expected to have a Material Adverse Effect on the Company. |

| (ii) | To the Knowledge of the Company, none of the Company or any of

its Subsidiaries or any of its or their current products or services is infringing upon or

otherwise violating the Intellectual Property of any third party, except where such infringement

could not reasonably be expected to have a Material Adverse Effect on the Company. |

| (iii) | As of the date of this Agreement, the Company has not received

written notice of any suit, claim, action, investigation or proceeding made, conducted or

brought by a third party that has been served upon or, to the Knowledge of the Company, filed

or threatened in writing with respect to any alleged infringement or other violation in any

material respect by the Company or any of its Subsidiaries or any of its or their current

products or services or other operation of the Company’s or its Subsidiaries’

business of the Intellectual Property of such third party. As of the date of this Agreement,

to the Knowledge of the Company, there is no pending or threatened claim challenging the

validity or enforceability of, or contesting the Company’s or any of its Subsidiaries’

rights with respect to, any of the material Company Intellectual Property. |

| (iv) | The execution and delivery of this Agreement by the Company, and

the consummation of the transactions contemplated hereby, will not result in (i) the Company

or its Subsidiaries granting to any third party any rights or licenses to any Company Intellectual

Property, (ii) any right of termination or cancellation under any Company Intellectual Property

Agreement, or (iii) the imposition of any Lien on any Company Intellectual Property, except

where any of the foregoing (in clauses (i) through (iii)) would not have a Company Material

Adverse Effect. |

| (i) | Compliance. Neither the Company nor any of its Subsidiaries is

in conflict with, or in default or in violation of any Legal Requirement applicable to the

Company or any of its Subsidiaries or by which the Company or any of its Subsidiaries or

any of their respective businesses or properties is bound or affected, except for conflicts,

violations and defaults that would not have a Material Adverse Effect on the Company. As

of the date hereof, no material investigation or review by any Governmental Entity is pending

or, to the Knowledge of the Company, has been threatened in a writing delivered to the Company

or any of its Subsidiaries, against the Company or any of its Subsidiaries. There is no judgment,

injunction, order or decree binding upon the Company or any of its Subsidiaries which has

or would reasonably be expected to have a Material Adverse Effect on the Company. |

| (ii) | Permits. The Company and its Subsidiaries hold, to the extent

legally required, all Permits that are required for the operation of the business of the

Company, as currently conducted, the failure to hold which would reasonably be expected to

have a Material Adverse Effect on the Company (collectively, “Company Permits”).

As of the date hereof, no suspension or cancellation of any of the Company Permits is pending

or, to the Knowledge of Company, threatened. The Company and its Subsidiaries comply in all

material respects with the terms of the Company Permits. |

| (l) | Litigation. As of the date hereof, there are no claims, suits,

actions or proceedings or, to the Knowledge of the Company, pending or threatened in writing against the Company or any of its Subsidiaries,

before any court, governmental department, commission, agency, instrumentality or authority, or any arbitrator that seeks to restrain

or enjoin the consummation of the transactions contemplated hereby or which would reasonably be expected, either singularly or in the

aggregate with all such claims, actions or proceedings, to have a Material Adverse Effect on the Company. |

| (m) | Foreign Corrupt Practices. Neither the Company nor any Subsidiary,

nor to the Knowledge of the Company or any Subsidiary, any agent or other Person acting on behalf of the Company or any Subsidiary, has

(i) directly or indirectly, used any funds for unlawful contributions, gifts, entertainment or other unlawful expenses related to foreign

or domestic political activity, (ii) made any unlawful payment to foreign or domestic government officials or employees or to any foreign

or domestic political parties or campaigns from corporate funds, (iii) failed to disclose fully any contribution made by the Company

or any Subsidiary (or made by any Person acting on its behalf of which the Company is aware) which is in violation of law, or (iv) violated

in any material respect any provision of FCPA. |

| (n) | Foreign Private Issuer. The Company is a “foreign private issuer”

within the meaning of Rule 405 under the Securities Act. |

| 4. | Representations, Warranties and Covenants of the Purchaser.

The Purchaser represents and warrants to the Company as follows: |

| (a) | Authorization. All corporate action on the part of the Purchaser

necessary for the authorization, execution and delivery of this Agreement, and the performance

of all obligations of the Purchaser hereunder, has been taken prior to the date hereof, and

this Agreement, when validly executed by the Company, constitutes a valid and legally binding

obligation of the Purchaser, enforceable in accordance with its terms, except (i) as limited

by applicable bankruptcy, insolvency, reorganization, moratorium and other laws of general

application affecting the enforcement of creditors’ rights generally, and (ii) as limited

by laws relating to the availability of specific performance, injunctive relief or other

equitable remedies. |

| (b) | Purchase Entirely for Own Account. The Purchase Shares to be purchased

by the Purchaser will be acquired for investment for the Purchaser’s own account, and

not as a nominee or agent and the Purchaser has no present intention of selling, granting

any participation in, or otherwise distributing the same. The Purchaser is not a party to

any contract, understanding, agreement or arrangement with any person to sell, transfer or

otherwise dispose of any of the Purchase Shares purchased by it. |

| (c) | Receipt of Information. The Purchaser has had an opportunity to

ask questions of, and receive answers from, the Company regarding the terms and conditions

of the issuance and sale of the Purchase Shares, and the business, properties, prospects

and financial condition of the Company, and to obtain additional information (to the extent

the Company possessed such information or could acquire such information without unreasonable

effort or expense) necessary to verify the accuracy of any information furnished to it or

to which it had access. The foregoing, however, does not limit or modify the representations

and warranties of the Company in Section 3 of this Agreement or the right of the Purchaser

to rely thereon. The Purchaser acknowledges and understands that no Person other than the

Company has been authorized to give any representations not contained in this Agreement in

connection with the issuance and sale of the Purchase Shares and, if given or made, such

information or representation must not be relied upon as having been authorized by the Company. |

| (d) | Governmental Consents. No consent, approval, order or authorization

of, or registration, declaration or filing with, any Governmental Entity is required to be

obtained or made by the Purchaser in connection with the execution and delivery of this Agreement

and the transactions contemplated hereby. |

| (e) | Organization. The Purchaser is a limited liability company duly

organized and validly existing in good standing under the laws of the jurisdiction in which

it is organized, and has the requisite organizational power and authority to own its properties

and to carry on its business as now being conducted. |

| 5. | Conditions Precedent to Closing. |

| (a) | Conditions to the Obligation of the Purchaser to Consummate the

Closing. The obligation of the Purchaser to consummate the Closing and to purchase and pay

for the Purchase Shares pursuant to this Agreement and the Prospectus and the Prospectus

Supplement is subject to the satisfaction of the following conditions precedent: |

| (i) | Representations and Warranties; Covenants. |

| (1) | Each of the representations and warranties of the Company in Section

3 shall be true and correct in all respects as of the date of this Agreement and as of the

date of the Closing as though made at that time. |

| (2) | The Company shall have performed, satisfied and complied in all material

respects with the covenants, agreements and conditions required by this Agreement prior to

the date of Closing. |

| (ii) | Qualifications. All authorizations, approvals or permits, if any,

of any Governmental Entity that are required in connection with the lawful issuance, sale

and purchase of the Purchase Shares, and the purchase and the procurement of foreign exchange

for payment of the Purchase Price, pursuant to this Agreement shall have been duly obtained

and effective as of the Closing. |

| (iii) | A final and complete form of the Prospectus Supplement, to be

used in connection with the issuance and sale of the Purchase Shares to the Purchaser, shall

have been delivered to the Purchaser and to be filed by the Company within thirty (30) days

after the date of Closing pursuant to Rule 424(b). |

| (b) | Conditions to the Obligation of the Company to Consummate the

Closing. The obligation of the Company to consummate the Closing and to issue and sell the

Purchase Shares to the Purchaser at the Closing is subject to the satisfaction of the following

conditions precedent: |

| (i) | Representations and Warranties; Covenants. |

| (1) | Each of the representations and warranties of the Purchaser in Section

4 shall be true and correct in all respects as of the date of this Agreement and as

of the date of the Closing as though made at that time. |

| (2) | The Purchaser shall have performed, satisfied and complied in all

material respects with the covenants, agreements and conditions required by this Agreement

prior to the date of Closing. |

| (ii) | Qualifications. All authorizations, approvals or permits, if any,

of any Governmental Entity that are required in connection with the lawful issuance and sale

of the Purchase Shares pursuant to this Agreement shall be duly obtained and effective as

of the Closing. |

| 6. | Miscellaneous Provisions. |

| (a) | Publicity. None of the parties to this Agreement shall make, issue,

or release any announcement, whether to the public generally, or to any of its suppliers

or customers, with respect to this Agreement or the transactions provided for herein, or

make any statement or acknowledgment of the existence of, or reveal the status of, this Agreement

or the transactions provided for herein, without the prior consent of the other parties,

which shall not be unreasonably withheld or delayed, provided, that nothing in this Section

6(a) shall prevent any of the parties hereto from making such public announcements as

it may consider necessary in order to satisfy any Legal Requirements applicable to it, but

to the extent not inconsistent with such Legal Requirements, it shall provide the other parties

with an opportunity to review and comment on any proposed public announcement before it is

made. |

| (i) | Any notices, reports or other correspondence (hereinafter collectively

referred to as “correspondence”) required or permitted to be given hereunder

shall be sent by international courier, facsimile, electronic mail or delivered by hand to

the party to whom such correspondence is required or permitted to be given hereunder. Where

a notice is sent by overnight courier, service of the notice shall be deemed to be effected

by properly addressing, and sending such notice through an internationally recognized express

courier service, delivery fees pre-paid, and to have been effected three (3) business days

following the day the same is sent as aforesaid. Where a notice is delivered by facsimile,

electronic mail, by hand or by messenger, service of the notice shall be deemed to be effected

upon delivery; provided that facsimile or electronic mail alone does not constitute an effective

notice. |

| (ii) | All correspondence shall be addressed as follows: |

Powerbridge Technologies Co., Ltd.

Address: Advanced Business Park, 9th Fl, Bldg C2

29 Lanwan Lane, Hightech District,

Zhuhai, Guangdong 519080, China

Address:

Attention:

Email:

| (iii) | Any entity may change the address to which correspondence to

it is to be addressed by notification as provided for herein. |

| (c) | Captions. The captions and paragraph headings of this Agreement

are solely for the convenience of reference and shall not affect its interpretation. |

| (d) | Severability. Should any part or provision of this Agreement be

held unenforceable or in conflict with the applicable laws or regulations of any jurisdiction,

the invalid or unenforceable part or provisions shall be replaced with a provision which

accomplishes, to the extent possible, the original business purpose of such part or provision

in a valid and enforceable manner, and the remainder of this Agreement shall remain binding

upon the parties hereto. |

| (e) | Governing Law; Arbitration. |

| (i) | This Agreement shall be governed by and construed in accordance

with the internal and substantive laws of the State of New York. |

| (ii) | Other than as set forth in Section 6(e)(iii), each of the

parties hereto irrevocably agrees that any dispute or controversy arising out of, relating

to, or concerning any interpretation, construction, performance or breach of this Agreement,

shall be submitted to arbitration, which shall be conducted in Hong Kong under the auspices

of the Hong Kong International Arbitration Centre (“HKIAC”) in accordance with

the HKIAC Administered Arbitration Rules then in effect. If submitted to arbitration in any

jurisdiction, the decision of the arbitrator shall be final, conclusive and binding on the

parties to the arbitration. Judgment may be entered on the arbitrator’s decision in

any court having jurisdiction. The parties to the arbitration shall each pay an equal share

of the costs and expenses of such arbitration, and each party shall separately pay for its

respective counsel fees and expenses; provided, however, that the prevailing party in any

such arbitration shall be entitled to recover from the non-prevailing party its reasonable

costs and attorney fees. |

| (f) | Amendment. This Agreement may not be amended, modified or terminated,

and no rights or provisions may be waived, except with the written consent of the Company

and Purchaser. |

| (g) | Expenses. Each party will bear its own costs and expenses in connection

with the drafting and negotiation of this Agreement. |

| (h) | Assignment. This Agreement shall be binding upon and inure to

the benefit of the parties and their successors and permitted assigns. The Company may not

assign this Agreement or any rights or obligations hereunder without the prior written consent

of the Purchaser (except by merger, stock sale, consolidation, reorganization or similar

transaction) and the Purchaser may not assign any or all of its rights under this Agreement

without the prior written consents of the Company. Any purported assignment in violation

of this Section shall be void. |

| (i) | Survival. The respective representations and warranties given

by the parties hereto shall terminate upon the earlier of (i) the first anniversary of the

Closing, and (ii) the date on which this Agreement is terminated in accordance with Section

6(m) of this Agreement. Notwithstanding any applicable statute of limitations, any claim

with respect to the failure of a representation or warranty to be true and correct (other

than as a result of fraud or willful misconduct) that is not asserted within such timeframes

may not be pursued and is hereby irrevocably waived after such time. |

| (j) | Waiver. At any time prior to the Closing, any party may (i) extend

the time for the performance of any obligation or other act of any other party, (ii) waive

any inaccuracy in the representations and warranties of any other party contained herein

or in any document delivered pursuant hereto and (iii) waive compliance with any agreement

of any other party or any condition to its own obligations contained herein. Any such extension

or waiver shall be valid if set forth in an instrument in writing signed by the party or

parties to be bound thereby. No failure or delay by any party in exercising any right, power

or privilege hereunder shall operate as a waiver thereof, nor shall any single or partial

exercise thereof preclude any other or further exercise thereof or the exercise of any other

right, power or privilege. |

| (k) | Entire Agreement. This Agreement constitutes the entire agreement

between the parties hereto respecting the subject matter hereof and supersedes all prior

agreements, negotiations, understandings, representations and statements respecting the subject

matter hereof, whether written or oral. No modification, alteration, waiver or change in

any of the terms of this Agreement shall be valid or binding upon the parties hereto unless

made in writing and in accordance with the provisions of Section 6(f) hereof. |

| (l) | Counterparts; Reproductions. This Agreement may be executed in

any number of counterparts, each of which shall be an original, but all of which together

shall constitute one instrument. A facsimile, portable document file (PDF) or other reproduction

of this Agreement may be executed by one or more parties and delivered by such party by facsimile,

electronic mail or any similar electronic transmission pursuant to which the signature of

or on behalf of such party can be seen. Such execution and delivery shall be considered valid,

binding and effective for all purposes. |

| (i) | This Agreement may be terminated, and the transactions contemplated

hereby abandoned at any time, by mutual consent of the Company and the Purchaser. This Agreement

may also be terminated (x) by the Purchaser, by written notice to the Company, or (y) by

the Company, by written notice to the Purchaser; provided, however, that no such termination

will affect the right of any party to sue for any breach by any other party (or parties),

and provided, further, that the right of any party to terminate this Agreement shall not

be available to any party who’s action or failure to act has been a principal cause

of or resulted in the failure of the Closing to occur on or before such date and such action

or failure to act constitutes a material breach of this Agreement. |

| (ii) | If terminated, this Agreement shall become void and there shall

be no liability or obligation on the part of any party hereto or their respective officers,

directors or affiliates; provided, however, that (1) each party shall remain liable for any

breach of this Agreement prior to its termination, and (2) the provisions of this Section

6 shall remain in full force and effect and survive any termination. |

| (n) | Further Assurances. Each party agrees (i) to furnish upon request

to each other such further information, (ii) to execute and deliver to each other such other

documents, and (iii) to do such other acts and things, all as the other party may reasonably

request for the purpose of carrying out the intent of this Agreement and the documents referred

to in this Agreement. |

| (o) | WAIVER OF JURY TRIAL. IN ANY ACTION, SUIT, OR PROCEEDING IN ANY

JURISDICTION BROUGHT BY ANY PARTY AGAINST ANY OTHER PARTY, THE PARTIES EACH KNOWINGLY AND

INTENTIONALLY, TO THE GREATEST EXTENT PERMITTED BY APPLICABLE LAW, HEREBY ABSOLUTELY, UNCONDITIONALLY,

IRREVOCABLY AND EXPRESSLY WAIVES FOREVER TRIAL BY JURY. |

(Remainder of Page Intentionally Left Blank)

IN WITNESS WHEREOF, the parties hereto have executed this Agreement

as of the date first written above.

| |

THE

COMPANY |

| |

|

|

| |

POWERBRIDGE

TECHNOLOGIES CO. LTD. |

| |

|

|

| |

By: |

|

| |

Name: |

|

| |

Title: |

|

IN WITNESS WHEREOF, the parties hereto have executed this Agreement

as of the date first written above.

| |

THE

PURCHASER |

| |

|

|

| |

By: |

|

| |

Name: |

|

| |

Title: |

|

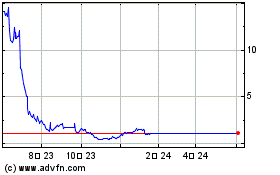

Powerbridge Technologies (NASDAQ:PBTS)

過去 株価チャート

から 11 2024 まで 12 2024

Powerbridge Technologies (NASDAQ:PBTS)

過去 株価チャート

から 12 2023 まで 12 2024