false 0000813828 0000813828 2024-11-08 2024-11-08 0000813828 us-gaap:CommonStockMember 2024-11-08 2024-11-08 0000813828 us-gaap:CommonClassBMember 2024-11-08 2024-11-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 8, 2024

Paramount Global

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-09553 |

|

04-2949533 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification Number) |

|

|

|

| 1515 Broadway |

|

|

| New York, New York |

|

10036 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (212) 258-6000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbols |

|

Name of each exchange

on which registered |

| Class A Common Stock, $0.001 par value |

|

PARAA |

|

The Nasdaq Stock Market LLC |

| Class B Common Stock, $0.001 par value |

|

PARA |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 8, 2024, Paramount Global issued a press release announcing earnings for the third quarter ended September 30, 2024. A copy of the press release is furnished herewith as Exhibit 99 and is incorporated by reference herein in its entirety.

The information furnished pursuant to this Item 2.02, including Exhibit 99, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filings under the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

| PARAMOUNT GLOBAL |

|

|

| By: |

|

/s/ Caryn K. Groce |

|

|

Name: |

|

Caryn K. Groce |

|

|

Title: |

|

Executive Vice President,

Acting General Counsel and Secretary |

Date: November 8, 2024

Exhibit 99 EARNINGS PRESS RELEASE | November 8, 2024 PARAMOUNT REPORTS Q3

2024 EARNINGS RESULTS « Meaningful Progress Advancing Strategic Goals – Significant Improvement in Direct-To-Consumer: Adjusted OIBDA Improved $287 Million Year-Over-Year to $49 Million – Continued Momentum at Paramount+: Revenue

Growth of 25% Year-Over-Year and 3.5 Million Subscriber Additions in the Quarter – Streamlined Organization: Advancing $500 Million in Annual Run Rate Cost Savings « Skydance Transactions Expected to Close in First Half of 2025 STATEMENT

FROM GEORGE CHEEKS, CHRIS MCCARTHY & BRIAN ROBBINS, CO-CEOS Our hit content drove strong performance in Q3 where Paramount+ added 3.5 million new subscribers, solidifying our position as the #4 global SVOD service. Our DTC segment successfully

delivered profitability for the second quarter in a row, improving by more than $1 billion over the past four quarters, and, across the company, we continue to successfully execute non-content cost reductions that will result in $500 million in

annual run rate savings. With two very strong quarters under our belt, it’s evident that we have clear momentum and that our plan is working thanks to our very talented teams and creative partners. $ IN MILLIONS, EXCEPT PER SHARE AMOUNTS Three

Months Ended September 30 Nine Months Ended September 30 GAAP 2024 2023 B/(W)% 2024 2023 B/(W)% Revenue $ 6,731 $ 7,133 ( 6)% $ 21,229 $ 22,014 ( 4) % ▪ TV Media 4,298 4,567 ( 6) % 13,800 14,917 ( 7) % ▪ Direct-to-Consumer 1,860 1,692 10

% 5,619 4,867 15 % ▪ Filmed Entertainment 590 891 ( 34)% 1,874 2,310 ( 19)% ▪ Eliminations (17) (17) — % (64) (80) 20 % (a) Operating income (loss) $ 337 $ 621 (46) % $ (5,398) $ (855) n/m (a) Diluted EPS from continuing operations

attributable to Paramount $ (.01) $ .36 n/m $ (9.04) $ (2.04) n/m (b) Non-GAAP Adjusted OIBDA $ 858 $ 716 20 % $ 2,712 $ 1,870 45 % Adjusted diluted EPS from continuing operations attributable to Paramount $ .49 $ .30 63 % $ 1.65 $ .48 n/m (a)

During the second quarter of 2024, we recorded a goodwill impairment charge for our Cable Networks reporting unit of $5.98 billion. (b) Non-GAAP measures are detailed in the Supplemental Disclosures at the end of this release. *Simon & Schuster,

which was sold in October 2023, has been presented as a discontinued operation in the companyʼs consolidated financial statements. B/(W) – Better/(Worse); n/m - not meaningful

Q3 2024 EARNINGS – SEGMENTS DIRECT-TO-CONSUMER OVERVIEW DTC

profitability improved significantly year-over-year. Sports, including the return of the NFL and UEFA, originals like Tulsa King, which saw the biggest global debut in platform history for season 2, and Mayor of Kingstown, as well as post-theatrical

releases, such as A Quiet Place: Day One and IF, all drove acquisition in the quarter. Pluto TV continues to benefit from strong engagement resulting in increased monetization. Q3 FINANCIALS ▪ DTC revenue increased 10% year-over-year. –

DTC subscription revenue grew 7%, driven by year-over-year subscriber growth and pricing increases for Paramount+. – DTC advertising revenue rose 18%, reflecting growth from Paramount+ and Pluto TV. Lioness Tulsa King – Paramount+

revenue grew 25%, driven by year-over-year subscriber growth and ARPU expansion. ▪ Paramount+ subscribers increased 3.5 million in the quarter to 72 million. ▪ Paramount+ global ARPU expanded 11% year-over-year. Landman Mayor of

Kingstown ▪ DTC adjusted OIBDA increased $287 million year-over-year to $49 million, reflecting revenue growth and cost efficiencies. Three Months Ended September 30 $ IN MILLIONS 2024 2023 $ B/(W) % Revenue $ 1,860 $ 1,692 $ 168 10 % ▪

Advertising 507 430 77 18 ▪ Subscription 1,343 1,258 85 7 ▪ Licensing 10 4 6 15 0 Expenses 1,811 1,930 119 6 Adjusted OIBDA $ 49 $ (238) $ 287 n/m n/m - not meaningful Nine Months Ended September 30 $ IN MILLIONS 2024 2023 $ B/(W) %

Revenue $ 5,619 $ 4,867 $ 752 15 % ▪ Advertising 1,540 1,269 271 21 ▪ Subscription 4,069 3,594 475 13 ▪ Licensing 10 4 6 15 0 Expenses 5,830 6,040 210 3 Adjusted OIBDA $ (211) $ (1,173) $ 962 82 % *We calculate average revenue per

subscriber (“ARPU”) as total Paramount+ revenues during the applicable period divided by the average of Paramount+ subscribers at the beginning and end of the period, further divided by the number of months in the period. 2

Q3 2024 EARNINGS – SEGMENTS TV MEDIA OVERVIEW TV Media benefited

from a powerful combination of sports, news and entertainment. CBS live news channels saw strong growth in minutes viewed year-over-year, The Daily Show continued to grow across streaming, linear and social platforms, MTV’s Video Music Awards

had its biggest audience in four years, and The Challenge delivered its highest share in franchise history. Q3 FINANCIALS ▪ TV Media revenue decreased 6% to $4.3 billion, primarily driven by lower affiliate revenue and fluctuations in

licensing revenue. – TV Media advertising revenue decreased 2%, reflecting declines in the linear advertising market, partially offset by higher political advertising, and the recognition of revenue underreported by an The Daily Show MTV Video

Music Awards international sales partner in prior periods. – TV Media affiliate and subscription revenue decreased 7%, driven by subscriber declines and a 2-percentage point decrease from the absence of pay-per-view boxing events, partially

offset by price increases. – TV Media licensing and other revenue decreased 12%, reflecting a Yellowstone The Challenge lower volume of licensing in the secondary market. ▪ TV Media adjusted OIBDA decreased 19% to $936 million. Three

Months Ended September 30 $ IN MILLIONS 2024 2023 $ B/(W) % Revenue $ 4,298 $ 4,567 $ (269) ( 6)% ▪ Advertising 1,666 1,703 (37) (2) ▪ Affiliate and subscription 1,872 2,004 (132) (7) ▪ Licensing and other 760 860 (100) ( 12)

Expenses 3,362 3,418 56 2 Adjusted OIBDA $ 936 $ 1,149 $ (213) ( 19)% $ IN MILLIONS Nine Months Ended September 30 2024 2023 $ B/(W) % Revenue $ 13,800 $ 14,917 $ (1,117) (7) % ▪ Advertising 5,981 5,905 76 1 ▪ Affiliate and subscription

5,778 6,082 (304) ( 5) ▪ Licensing and other 2,041 2,930 (889) ( 30) Expenses 10,401 11,268 867 8 Adjusted OIBDA $ 3,399 $ 3,649 $ (250) (7)% 3

Q3 2024 EARNINGS – SEGMENTS FILMED ENTERTAINMENT OVERVIEW Paramount

Pictures’ diverse film slate continued to deliver with the success of A Quiet Place: Day One, which set a franchise record for the biggest opening at the global box office and has grossed $261 million worldwide to date. Transformers One has

grossed $127 million at the global box office to date. Q3 FINANCIALS ▪ Filmed Entertainment revenue decreased 34% to $590 million. – Theatrical revenue decreased 71%, reflecting the number and timing of releases in the quarter compared

to the prior year. – Licensing and other revenue decreased 6%, as lower revenue from home entertainment and the licensing of film library titles were partially offset by higher studio facility revenue compared to last year, which was impacted

by the labor strikes. ▪ Filmed Entertainment adjusted OIBDA increased $52 million versus the prior year period, which was impacted by the labor strikes. Three Months Ended September 30 $ IN MILLIONS 2024 2023 $ B/(W) % Revenue $ 590 $ 891 $

(301) ( 34) % ▪ Advertising 2 5 (3) ( 60) ▪ Theatrical 108 377 (269) (71) ▪ Licensing and other 480 509 (29) (6) Expenses 587 940 353 38 Adjusted OIBDA $ 3 $ (49) $ 52 n/m n/m - not meaningful Nine Months Ended September 30 $ IN

MILLIONS 2024 2023 $ B/(W) % Revenue $ 1,874 $ 2,310 $ (436) (19)% ▪ Advertising 10 21 (11) (52) ▪ Theatrical 399 735 (336) (46) ▪ Licensing and other 1,465 1,554 (89) ( 6) Expenses 1,928 2,453 525 21 Adjusted OIBDA $ (54) $ (143)

$ 89 62 % 4

Q3 2024 EARNINGS – SKYDANCE TRANSACTIONS SKYDANCE TRANSACTIONS

Completion of the Skydance transactions is subject to regulatory approvals and customary closing conditions. The transactions are anticipated to close in the first half of 2025. Until then, Paramount continues to operate in the normal course of

business. 5

ABOUT PARAMOUNT Paramount (NASDAQ: PARA; PARAA) is a leading global media,

streaming and entertainment company that creates premium content and experiences for audiences worldwide. Driven by iconic consumer brands, its portfolio includes CBS, Paramount Pictures, Nickelodeon, MTV, Comedy Central, BET, Paramount+ and Pluto

TV. The company holds one of the industry’s most extensive libraries of TV and film titles. In addition to offering innovative streaming services and digital video products, Paramount provides powerful capabilities in production, distribution

and advertising solutions. For more information about Paramount, please visit www.paramount.com and follow @ParamountCo on social platforms. PARA-IR CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS This communication contains both historical

and forward-looking statements, including statements related to our future results, performance and achievements. All statements that are not statements of historical fact are, or may be deemed to be, forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. Similarly, statements that describe our objectives, plans or goals are or may be forward-looking statements. These forward-looking statements reflect our current expectations concerning future

results and events; generally can be identified by the use of statements that include phrases such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “foresee,”

“likely,” “will,” “may,” “could,” “estimate” or other similar words or phrases; and involve known and unknown risks, uncertainties and other factors that are difficult to predict and which

may cause our actual results, performance or achievements to be different from any future results, performance or achievements expressed or implied by these statements. These risks, uncertainties and other factors include, among others: risks

related to our streaming business; the adverse impact on our advertising revenues as a result of advertising market conditions, changes in consumer viewership and deficiencies in audience measurement; risks related to operating in highly competitive

and dynamic industries, including cost increases; the unpredictable nature of consumer behavior, as well as evolving technologies and distribution models; risks related to our ongoing changes in business strategy, including investments in new

businesses, products, services, technologies and other strategic activities; the potential for loss of carriage or other reduction in or the impact of negotiations for the distribution of our content; damage to our reputation or brands; losses due

to asset impairment charges for goodwill, intangible assets, FCC licenses and content; liabilities related to discontinued operations and former businesses; risks related to environmental, social and governance (ESG) matters; evolving business

continuity, cybersecurity, privacy and data protection and similar risks; content infringement; domestic and global political, economic and regulatory factors affecting our businesses generally; disruptions to our operations as a result of labor

disputes; the inability to hire or retain key employees or secure creative talent; volatility in the prices of the Companyʼs common stock; potential conflicts of interest arising from our ownership structure with a controlling stockholder;

business uncertainties, including the effect of the Skydance transactions on the Companyʼs employees, commercial partners, clients and customers, and contractual restrictions while the Skydance transactions are pending; prevention, delay or

reduction of the anticipated benefits of the Skydance transactions as a result of the conditions to closing the Skydance transactions; the Transaction Agreementʼs limitation on our ability to pursue alternatives to the Skydance transactions;

risks related to a failure to complete the Skydance transactions, including payment of a termination fee and negative reactions from the financial markets and from our employees, commercial partners, clients and customers; risks related to change in

control or other provisions in certain agreements that may be triggered by the Skydance transactions; litigation relating to the Skydance transactions potentially preventing or delaying the closing of the Skydance transactions and/or resulting in

payment of damages; challenges realizing synergies and other anticipated benefits expected from the Skydance transactions, including integrating the Companyʼs and Skydanceʼs businesses successfully; potential unforeseen direct and indirect

costs as a result of the Skydance transactions; any negative effects of the announcement, pendency or consummation of the Skydance transactions on the market price of the Companyʼs common stock and New Paramount Class B Common Stock; and other

factors described in our news releases and filings with the Securities and Exchange Commission, including but not limited to our most recent Annual Report on Form 10-K and reports on Form 10-Q and Form 8-K. There may be additional risks,

uncertainties and factors that we do not currently view as material or that are not necessarily known. The forward-looking statements included in this communication are made only as of the date of this report, and we do not undertake any obligation

to publicly update 6 any forward-looking statements to reflect subsequent events or circumstances.

Q3 2024 EARNINGS – FINANCIAL STATEMENTS PARAMOUNT GLOBAL AND

SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited; in millions, except per share amounts) Three Months Ended Nine Months Ended September 30 September 30 2024 2023 2024 2023 Revenues $ 6,731 $ 7,133 $ 21,229 $ 22,014 Costs and expenses:

Operating 4,342 4,681 13,745 14,872 Programming charges — — 1,118 2,371 Selling, general and administrative 1,531 1,736 4,772 5,272 Depreciation and amortization 96 105 297 310 Impairment charges 104 — 6,100 — Restructuring

and transaction-related costs 321 (10) 595 44 Total costs and expenses 6,394 6,512 26,627 22,869 Operating income (loss) 337 621 (5,398) (855) Interest expense (209) (232) (645) (698) Interest income 31 29 111 97 Gain (loss) from investments —

— (4) 168 Other items, net (39) (42) (126) (148) Earnings (loss) from continuing operations before income taxes and equity in loss of investee companies 120 376 (6,062) (1,436) (Provision for) benefit from income taxes (45) (40) 342 436 Equity

in loss of investee companies, net of tax (59) (75) (221) (259) Net earnings (loss) from continuing operations 16 261 (5,941) (1,259) Net earnings from discontinued operations, net of tax 5 48 14 166 Net earnings (loss) (Paramount and noncontrolling

interests) 21 309 (5,927) (1,093) Net earnings attributable to noncontrolling interests (20) (14) (39) (29) Net earnings (loss) attributable to Paramount $ 1 $ 295 $ (5,966) $ (1,122) Amounts attributable to Paramount: Net earnings (loss) from

continuing operations $ (4) $ 247 $ (5,980) $ (1,288) Net earnings from discontinued operations, net of tax 5 48 14 166 Net earnings (loss) attributable to Paramount $ 1 $ 295 $ (5,966) $ (1,122) Basic net earnings (loss) per common share

attributable to Paramount: Net earnings (loss) from continuing operations $ (.01) $ .36 $ (9.04) $ (2.04) Net earnings from discontinued operations $ .01 $ .07 $ .02 $ .25 Net earnings (loss) $ — $ .43 $ (9.02) $ (1.79) (a) Diluted net

earnings (loss) per common share attributable to Paramount: Net earnings (loss) from continuing operations $ (.01) $ .36 $ (9.04) $ (2.04) Net earnings from discontinued operations $ .01 $ .07 $ .02 $ .25 Net earnings (loss) $ — $ .43 $ (9.02)

$ (1.79) Weighted average number of common shares outstanding: Basic 667 652 663 651 Diluted 670 652 663 651 (a) In periods prior to the conversion of our 5.75% Series A Mandatory Convertible Preferred Stock to shares of our Class B Common Stock on

April 1, 2024, diluted net earnings (loss) per common share (“EPS”) excludes the effect of its assumed conversion since it would have been antidilutive. As a result, in the calculations of diluted EPS the weighted average number of

diluted shares outstanding do not include the assumed issuance of shares upon conversion of preferred stock, and preferred stock dividends recorded for the nine months ended September 30, 2024 of $14 million and for the three and nine months ended

September 30, 2023 of $14 million and $43 million, respectively, are deducted from net earnings (loss) from continuing operations and net earnings (loss). 8

Q3 2024 EARNINGS – FINANCIAL STATEMENTS PARAMOUNT GLOBAL AND

SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (Unaudited; in millions, except per share amounts) At At September 30, 2024 December 31, 2023 ASSETS Current Assets: Cash and cash equivalents $ 2,443 $ 2,460 Receivables, net 6,327 7,115 Programming and

other inventory 1,664 1,414 Prepaid expenses and other current assets 1,484 1,677 Current assets of discontinued operations 7 37 Total current assets 11,925 12,703 Property and equipment, net 1,545 1,666 Programming and other inventory 13,948 13,851

Goodwill 10,508 16,516 Intangible assets, net 2,450 2,589 Operating lease assets 1,029 1,183 Deferred income tax assets, net 1,387 1,242 Other assets 3,458 3,793 Total Assets $ 46,250 $ 53,543 LIABILITIES AND STOCKHOLDERS’ EQUITY Current

Liabilities: Accounts payable $ 826 $ 1,100 1,954 2,104 Accrued expenses Participants’ share and royalties payable 2,485 2,702 1,697 1,842 Accrued programming and production costs 824 746 Deferred revenues 125 1 Debt Other current liabilities

1,443 1,161 Total current liabilities 9,354 9,656 Long-term debt 14,495 14,601 Participants’ share and royalties payable 1,254 1,394 1,322 1,337 Pension and postretirement benefit obligations Deferred income tax liabilities, net 35 503

Operating lease liabilities 1,076 1,256 208 204 Program rights obligations 1,431 1,542 Other liabilities Commitments and contingencies Paramount stockholders’ equity: 5.75% Series A Mandatory Convertible Preferred Stock, par value $.001 per

share; — — 25 shares authorized; 10 (2023) shares issued Class A Common Stock, par value $.001 per share; 55 shares authorized; — — 41 (2024 and 2023) shares issued Class B Common Stock, par value $.001 per share; 5,000

shares authorized; 1 1 1,129 (2024) and 1,115 (2023) shares issued 33,364 33,210 Additional paid-in capital Treasury stock, at cost; 503 (2024 and 2023) shares of Class B Common Stock (22,958) (22,958) Retained earnings 7,745 13,829 Accumulated

other comprehensive loss (1,524) (1,556) Total Paramount stockholders’ equity 16,628 22,526 Noncontrolling interests 447 524 Total Equity 17,075 23,050 Total Liabilities and Equity $ 46,250 $ 53,543 9

Q3 2024 EARNINGS – FINANCIAL STATEMENTS PARAMOUNT GLOBAL AND

SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited; in millions) Nine Months Ended September 30 2024 2023 Operating Activities: $ (5,927) $ (1,093) Net loss (Paramount and noncontrolling interests) 14 166 Less: Net earnings from

discontinued operations, net of tax (5,941) (1,259) Net loss from continuing operations Adjustments to reconcile net loss from continuing operations to net cash flow provided by (used for) operating activities from continuing operations: 1,118 2,371

Programming charges 297 310 Depreciation and amortization 6,100 — Impairment charges (622) (592) Deferred tax benefit 175 131 Stock-based compensation 4 (168) (Gain) loss from investments 228 259 Equity in loss of investee companies, net of

tax and distributions (775) (1,226) Change in assets and liabilities 584 (174) Net cash flow provided by (used for) operating activities from continuing operations — 205 Net cash flow provided by operating activities from discontinued

operations 584 31 Net cash flow provided by operating activities Investing Activities: Investments (248) (184) Capital expenditures (151) (213) Other investing activities 34 56 (365) (341) Net cash flow used for investing activities from continuing

operations 48 (3) Net cash flow provided by (used for) investing activities from discontinued operations (317) (344) Net cash flow used for investing activities Financing Activities: — 45 Proceeds from issuance of debt — (239) Repayment

of debt (29) (43) Dividends paid on preferred stock (102) (351) Dividends paid on common stock (21) (21) Payment of payroll taxes in lieu of issuing shares for stock-based compensation (120) (97) Payments to noncontrolling interests (26) (38) Other

financing activities (298) (744) Net cash flow used for financing activities 14 (24) Effect of exchange rate changes on cash and cash equivalents (17) (1,081) Net decrease in cash and cash equivalents Cash and cash equivalents at beginning of year

2,460 2,885 $ 2,443 $ 1,804 Cash and cash equivalents at end of period 10

Q3 2024 EARNINGS – Supplemental Disclosures SUPPLEMENTAL

DISCLOSURES REGARDING NON-GAAP FINANCIAL MEASURES (Unaudited; in millions, except per share amounts) Results for the three and nine months ended September 30, 2024 and 2023 included certain items identified as affecting comparability. Adjusted

operating income before depreciation and amortization (“Adjusted OIBDA”), adjusted earnings from continuing operations before income taxes, adjusted provision for income taxes, adjusted net earnings from continuing operations

attributable to Paramount, adjusted diluted EPS from continuing operations, and adjusted effective income tax rate (together, the “adjusted measures”) exclude the impact of these items and are measures of performance not calculated in

accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP” or “GAAP”). We use these measures to, among other things, evaluate our operating performance. These measures are among the

primary measures used by management for planning and forecasting of future periods, and they are important indicators of our operational strength and business performance. In addition, we use Adjusted OIBDA to, among other things, value prospective

acquisitions. We believe these measures are relevant and useful for investors because they allow investors to view performance in a manner similar to the method used by our management; provide a clearer perspective on our underlying performance; and

make it easier for investors, analysts and peers to compare our operating performance to other companies in our industry and to compare our year- over-year results. Because the adjusted measures are measures of performance not calculated in

accordance with U.S. GAAP, they should not be considered in isolation of, or as a substitute for, operating income (loss), earnings (loss) from continuing operations before income taxes, (provision for) benefit from income taxes, net earnings (loss)

from continuing operations attributable to Paramount, diluted EPS from continuing operations, and effective income tax rate, as applicable, as indicators of operating performance. These measures, as we calculate them, may not be comparable to

similarly titled measures employed by other companies. The following tables reconcile the adjusted measures to their most directly comparable financial measures in accordance with U.S. GAAP. The tax impacts on the items identified as affecting

comparability in the tables below have been calculated using the tax rate applicable to each item. Three Months Ended September 30 Nine Months Ended September 30 Three Months Ended September 30 $ IN MILLIONS 2024 2023 2024 2023 2024 2023 $ B/(W) %

Revenue $ 4,298 $ 4,567 $ (269) (6) % Operating income (loss) (GAAP) $ 337 $ 621 $ (5,398) $ (855) ▪ Advertising 1,666 1,703 (37) (2) Depreciation and amortization 96 105 297 310 (a) ▪ Affiliate and subscription 1,872 2,004 (132) (7)

Programming charges — — 1,118 2,371 (a) ▪ Licensing and other 760 860 (100) (12) Impairment charges 104 — 6,100 — Expenses 3,362 3,418 56 2 (a) 321 (10) 595 44 Restructuring and transaction-related costs Adjusted OIBDA

$ 936 $ 1,149 $ (213) (19) % Adjusted OIBDA (Non-GAAP) $ 858 $ 716 $ 2,712 $ 1,870 Nine Months Ended September 30 $ IN MILLIONS (a) See notes on the following tables for additional information on items affecting comparability. 2024 2023 $ B/(W) %

Revenue $ 13,800 $ 14,917 $ (1,117) (7) % ▪ Advertising 5,981 5,905 76 1 ▪ Affiliate and subscription 5,778 6,082 (304) (5) ▪ Licensing and other 2,041 2,930 (889) (30) Expenses 10,401 11,268 867 8 Adjusted OIBDA $ 3,399 $ 3,649 $

(250) (7) % 11 Source: Nielsen Media Research

Q3 2024 EARNINGS – Supplemental Disclosures SUPPLEMENTAL

DISCLOSURES REGARDING NON-GAAP FINANCIAL MEASURES (Continued) (Unaudited; in millions, except per share amounts) Three Months Ended September 30, 2024 Net Earnings (Loss) Earnings from from Continuing Diluted EPS from Continuing Operations

Continuing Operations Before Provision for Attributable to Income Taxes Income Taxes Paramount Operations (c) Reported (GAAP) $ 120 $ (45) $ (4) $ (.01) Items affecting comparability: (a) Impairment charges 104 (26) 78 .12 (b) Restructuring and

transaction-related costs 321 (66) 255 .38 — Discrete tax items — (2) (2) (c) Adjusted (Non-GAAP) $ 545 $ (139) $ 327 $ .49 (a) Reflects a charge to reduce the carrying values of FCC licenses to their estimated fair values. (b) Reflects

severance charges associated with streamlining our organization and the exit of our CEO, and costs related to the Skydance transactions. (c) The reported effective income tax rate for the three months ended September 30, 2024 was 37.5% and the

adjusted effective income tax rate, which is calculated as the adjusted provision for income taxes of $139 million divided by adjusted earnings from continuing operations before income taxes of $545 million, was 25.5%. These adjusted measures

exclude the items affecting comparability FBI described above. Three Months Ended September 30, 2023 Net Earnings from Earnings from Continuing Continuing Operations Diluted EPS from Operations Before Provision for Attributable to Continuing Income

Taxes Income Taxes Paramount Operations (c) Reported (GAAP) $ 376 $ (40) $ 247 $ .36 Items affecting comparability: (a) Transaction-related costs (10) 3 (7) (.01) (b) Discrete tax items — (33) (33) (.05) (c) Adjusted (Non-GAAP) $ 366 $ (70) $

207 $ .30 (a) Reflects a benefit from an insurance recovery related to stockholder litigation associated with the 2019 merger of Viacom Inc. (‘Viacom”) and CBS Corporation (“CBS”). (b) Primarily reflects the benefit from

guidance issued in the third quarter of 2023 by the Internal Revenue Service (“IRS”) that resulted in additional foreign taxes from 2022 being eligible for a foreign tax credit, and amounts realized in connection with the filing of our

tax returns in certain international jurisdictions. Three Months Ended September 30 $ IN MILLIONS (c) The reported effective income tax rate for the three months ended September 30, 2023 was 10.6% and the adjusted effective income tax 2024 2023 $

B/(W) % rate, which is calculated as the adjusted provision for income taxes of $70 million divided by adjusted earnings from continuing operations before income taxes of $366 million, was 19.1%. These adjusted measures exclude the items affecting

comparability Revenue $ 4,298 $ 4,567 $ (269) (6) % described above. ▪ Advertising 1,666 1,703 (37) (2) ▪ Affiliate and subscription 1,872 2,004 (132) (7) ▪ Licensing and other 760 860 (100) (12) Expenses 3,362 3,418 56 2 Adjusted

OIBDA $ 936 $ 1,149 $ (213) (19) % Nine Months Ended September 30 $ IN MILLIONS 2024 2023 $ B/(W) % Revenue $ 13,800 $ 14,917 $ (1,117) (7) % ▪ Advertising 5,981 5,905 76 1 ▪ Affiliate and subscription 5,778 6,082 (304) (5) ▪

Licensing and other 2,041 2,930 (889) (30) Expenses 10,401 11,268 867 8 Adjusted OIBDA $ 3,399 $ 3,649 $ (250) (7) % 12 Source: Nielsen Media Research

Q3 2024 EARNINGS – Supplemental Disclosures SUPPLEMENTAL

DISCLOSURES REGARDING NON-GAAP FINANCIAL MEASURES (Continued) (Unaudited; in millions, except per share amounts) Nine Months Ended September 30, 2024 Net Earnings Earnings (Loss) (Loss) from from Continuing Continuing Operations Benefit from

Operations Diluted EPS from Before Income (Provision for) Attributable to Continuing Taxes Income Taxes Paramount Operations (e) (f) Reported (GAAP) $ (6,062) $ 342 $ (5,980) $ (9.04) Items affecting comparability: (a) 1.27 Programming charges 1,118

(275) 843 (b) Impairment charges 8.61 6,100 (375) 5,725 (c) Restructuring and transaction-related costs .71 595 (121) 474 Loss from investment (1) 3 — 4 (d) Discrete tax items — 47 47 .07 Impact of antidilution — — —

..03 (e) (f) $ 1.65 Adjusted (Non-GAAP) $ 1,755 $ (383) $ 1,112 (a) In connection with our strategic decision to focus on content with mass global appeal, we decided to rationalize original content on our FBI streaming services, especially

internationally, and improve the efficiency of our linear network programming. As a result, we reviewed our expansive global content portfolio and removed select content from our platforms. In addition, we decided not to move forward with certain

titles and therefore abandoned some development projects and terminated certain programming agreements. Accordingly, we recorded programming charges relating to these actions. (b) Reflects a goodwill impairment charge for our Cable Networks

reporting unit of $5.98 billion, as well as charges totaling $119 million to reduce the carrying values of FCC licenses to their estimated fair values. (c) Consists of severance costs associated with streamlining our organization and the exit of our

former CEO; the impairment of lease assets; and costs related to the Skydance transactions. (d) Primarily attributable to the establishment of a valuation allowance on a deferred tax asset that is not expected to be realized because of a reduction

in our deferred tax liabilities caused by the second quarter goodwill impairment charge. This impact was partially offset by amounts realized in connection with the filing of our tax returns in certain international jurisdictions. (e) The reported

effective income tax rate for the nine months ended September 30, 2024 was 5.6% and the adjusted effective income tax rate, which is calculated as the adjusted provision for income taxes of $383 million divided by adjusted earnings from continuing

operations before income taxes of $1.76 billion, was 21.8%. These adjusted measures exclude the items affecting comparability described above. (f) For the nine months ended September 30, 2024, the weighted average number of common shares outstanding

used in the calculation of reported diluted EPS from continuing operations is 663 million and in the calculation of adjusted diluted EPS from continuing operations is 665 million. The dilutive impact was excluded in the calculation of reported

diluted EPS from continuing operations because it would have been antidilutive since we reported a net loss from continuing operations. Three Months Ended September 30 $ IN MILLIONS 2024 2023 $ B/(W) % Revenue $ 4,298 $ 4,567 $ (269) (6) % ▪

Advertising 1,666 1,703 (37) (2) ▪ Affiliate and subscription 1,872 2,004 (132) (7) ▪ Licensing and other 760 860 (100) (12) Expenses 3,362 3,418 56 2 Adjusted OIBDA $ 936 $ 1,149 $ (213) (19) % Nine Months Ended September 30 $ IN

MILLIONS 2024 2023 $ B/(W) % Revenue $ 13,800 $ 14,917 $ (1,117) (7) % ▪ Advertising 5,981 5,905 76 1 ▪ Affiliate and subscription 5,778 6,082 (304) (5) ▪ Licensing and other 2,041 2,930 (889) (30) Expenses 10,401 11,268 867 8

Adjusted OIBDA $ 3,399 $ 3,649 $ (250) (7) % 13 Source: Nielsen Media Research

Q3 2024 EARNINGS – Supplemental Disclosures SUPPLEMENTAL

DISCLOSURES REGARDING NON-GAAP FINANCIAL MEASURES (Continued) (Unaudited; in millions, except per share amounts) Nine Months Ended September 30, 2023 Net Earnings Earnings (Loss) (Loss) from from Continuing Continuing Operations Benefit from

Operations Diluted EPS from Before Income (Provision for) Attributable to Continuing Taxes Income Taxes Paramount Operations (e) Reported (GAAP) $ (1,436) $ 436 $ (1,288) $ (2.04) Items affecting comparability: (a) Programming charges 2,371 (582)

1,789 2.74 (b) Restructuring and transaction-related costs 44 (11) 33 .05 (c) Gain from investment (168) 60 (108) (.16) (d) Discrete tax items — (67) (67) (.11) (e) Adjusted (Non-GAAP) $ 811 $ (164) $ 359 $ .48 (a) Comprised of programming

charges recorded in connection with the integration of Showtime into Paramount+ and initiatives to rationalize and right-size our international operations to align with our streaming strategy and close or globalize certain of our international

channels. These initiatives resulted in a change in strategy for certain content, which led to content being removed from our platforms or FBI abandoned, the write-off of development costs, distribution changes, and termination of programming

agreements. (b) Consists of severance costs associated with the implementation of initiatives to transform and streamline our operations following our 2022 operating segment realignment and as we integrated Showtime into Paramount+ and a benefit

from an insurance recovery related to stockholder litigation associated with the 2019 merger of Viacom and CBS. (c) Reflects a gain recognized on our retained interest in Viacom18 following the discontinuance of equity method accounting resulting

from the dilution of our interest from 49% to 13%. (d) Primarily reflects tax benefits from the resolution of an income tax matter in a foreign jurisdiction, guidance issued in the third quarter of 2023 by the IRS that resulted in additional foreign

taxes from 2022 being eligible for a foreign tax credit, and amounts realized in connection with the filing of our tax returns in certain international jurisdictions. (e) The reported effective income tax rate for the nine months ended September 30,

2023 was 30.4% and the adjusted effective income tax rate, which is calculated as the adjusted provision for income taxes of $164 million divided by adjusted earnings from continuing operations before income taxes of $811 million, was 20.2%. These

adjusted measures exclude the items affecting comparability described above. Three Months Ended September 30 $ IN MILLIONS 2024 2023 $ B/(W) % Revenue $ 4,298 $ 4,567 $ (269) (6) % ▪ Advertising 1,666 1,703 (37) (2) ▪ Affiliate and

subscription 1,872 2,004 (132) (7) ▪ Licensing and other 760 860 (100) (12) Expenses 3,362 3,418 56 2 Adjusted OIBDA $ 936 $ 1,149 $ (213) (19) % Nine Months Ended September 30 $ IN MILLIONS 2024 2023 $ B/(W) % Revenue $ 13,800 $ 14,917 $

(1,117) (7) % ▪ Advertising 5,981 5,905 76 1 ▪ Affiliate and subscription 5,778 6,082 (304) (5) ▪ Licensing and other 2,041 2,930 (889) (30) Expenses 10,401 11,268 867 8 Adjusted OIBDA $ 3,399 $ 3,649 $ (250) (7) % 14 Source:

Nielsen Media Research

Q3 2024 EARNINGS – Supplemental Disclosures SUPPLEMENTAL

DISCLOSURES REGARDING NON-GAAP FINANCIAL MEASURES (Continued) (Unaudited; in millions) Free Cash Flow Free cash flow is a non-GAAP financial measure. Free cash flow reflects our net cash flow provided by (used for) operating activities from

continuing operations less capital expenditures. We deduct capital expenditures when we calculate free cash flow because investment in capital expenditures is a use of cash that is directly related to our operations. Our net cash flow provided by

(used for) operating activities from continuing operations is the most directly comparable U.S. GAAP financial measure. Management believes free cash flow provides investors with an important perspective on the cash available to us to service debt,

pay dividends, make strategic acquisitions and investments, maintain our capital assets, satisfy our tax obligations, and fund ongoing operations and working capital needs. We believe the presentation of free cash flow is relevant and useful for

investors because it allows investors to evaluate the cash generated from our underlying operations in a manner similar to the method used by management. Free cash flow is one of the quantitative performance metrics used in determining our annual

incentive compensation awards. In addition, free cash flow is a primary measure used externally by our investors, analysts and industry peers for purposes of valuation and comparison of our operating performance to other companies in our industry.

FBI As free cash flow is not a measure calculated in accordance with U.S. GAAP, free cash flow should not be considered in isolation of, or as a substitute for, either net cash flow provided by (used for) operating activities from continuing

operations as a measure of liquidity or net earnings (loss) as a measure of operating performance. Free cash flow, as we calculate it, may not be comparable to similarly titled measures employed by other companies. The following table presents a

reconciliation of our net cash flow provided by (used for) operating activities from continuing operations to free cash flow. Three Months Ended Nine Months Ended September 30 September 30 2024 2023 2024 2023 Net cash flow provided by (used for)

operating activities from continuing operations (GAAP) $ 265 $ 450 $ 584 $ (174) Capital expenditures (51) (73) (151) (213) Free cash flow (Non-GAAP) $ 214 $ 377 $ 433 $ (387) Three Months Ended September 30 $ IN MILLIONS 2022 2021 $ B/(W) % Revenue

$ 4,948 $ 5,220 $ (272) (5) % ▪ Advertising 1,973 2,039 (66) (3) ▪ Affiliate and subscription 2,000 2,108 (108) (5) ▪ Licensing and other 975 1,073 (98) (9) Expenses 3,717 3,835 118 3 Adjusted OIBDA $ 1,231 $ 1,385 $ (154) (11) %

Nine Months Ended September 30 $ IN MILLIONS 2022 2021 $ B/(W) % Revenue $ 15,849 $ 16,432 $ (583) (4) % ▪ Advertising 6,668 7,230 (562) (8 ) ▪ Affiliate and subscription 6,156 6,303 (147) (2) ▪ Licensing and other 3,025 2,899 126

4 Expenses 11,694 11,778 84 1 Adjusted OIBDA $ 4,155 $ 4,654 $ (499) (11) % 15 Source: Nielsen Media Research

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassBMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

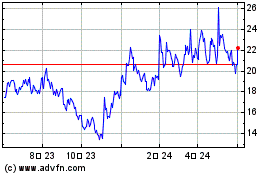

Paramount Global (NASDAQ:PARAA)

過去 株価チャート

から 10 2024 まで 11 2024

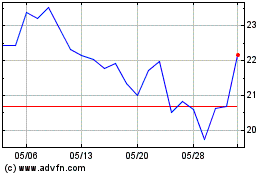

Paramount Global (NASDAQ:PARAA)

過去 株価チャート

から 11 2023 まで 11 2024