false

0001499961

0001499961

2024-10-22

2024-10-22

0001499961

muln:CommonStockParValue0.001Member

2024-10-22

2024-10-22

0001499961

muln:RightsToPurchaseSeriesA1JuniorParticipatingPreferredStockMember

2024-10-22

2024-10-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

| Date of Report (Date of earliest event reported): |

October 22, 2024 |

MULLEN AUTOMOTIVE INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-34887 |

|

86-3289406 |

(State or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

| (IRS Employer

Identification No.) |

1405 Pioneer Street, Brea, California 92821

(Address, including zip code, of principal executive offices)

| Registrant’s telephone number, including area code |

(714) 613-1900 |

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 |

|

MULN |

|

The Nasdaq Stock Market, LLC

(Nasdaq Capital Market) |

| Rights to Purchase Series A-1 Junior Participating Preferred Stock |

|

None |

|

The Nasdaq Stock Market, LLC

(Nasdaq Capital Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01. |

Entry into a Material

Definitive Agreement. |

On

October 24, 2024, Bollinger Motors, Inc. (“Bollinger Motors”), a majority-owned consolidated subsidiary of Mullen

Automotive Inc. (the “Company”), issued to Robert Bollinger (the “Lender”) an Amended and Restated

Secured Promissory Note (the “Note”) for a principal amount of $10.0 million. The Note amends and restates a $5.0

million Secured Promissory Note issued by Bollinger Motors to the Lender on October 22, 2024. The Note is intended to provide additional

capital for Bollinger Motors production and sale of the B4, Class 4 EV truck.

The

Note bears interest at a rate of 15% per annum and has a maturity date of October 30, 2026. An initial interest-only payment is due on

November 29, 2024, and then on the first day of each month starting January 1, 2025, based on a payment schedule. The Note is secured

by the assets of Bollinger Motors, excluding inventory and certain intellectual property. Upon an event of default, such as a failure

to pay when due, a breach of any representation, warranty or covenant, bankruptcy, a material adverse change, or any other material breach

of the Note, the principal amount of the Note, together with all accrued interest, will become immediately due and payable. The Note

contains customary representations, warranties and covenants, including among other things and subject to certain exceptions, covenants

that restrict Bollinger Motors from incurring additional indebtedness or allowing any encumbrance with respect to the collateral for

the Note, other than certain permitted debt and liens (as described in the Note), disposing of any collateral and selling all or substantially

all of the assets or voting securities of Bollinger Motors.

The

foregoing description of the Note is qualified, in its entirety, by reference to the Note, a copy of which is attached as Exhibit 10.1

to this Current Report on Form 8-K and is incorporated by reference in response to this Item 1.01.

|

Item 2.03. |

Creation

of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The

information set forth in Item 1.01 regarding the Note is incorporated by reference into this Item 2.03.

|

Item

7.01. |

Regulation

FD Disclosure. |

On

October 28, 2024, the Company issued a press release regarding the Note, a copy of which is furnished as Exhibit 99.1 to this report

and incorporated herein by reference into this Item 7.01.

The

information in this Item 7.01 and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of

Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities

Act of 1933, except as shall be expressly set forth by specific reference in such filing.

|

Item 9.01. |

Financial

Statements and Exhibits |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MULLEN AUTOMOTIVE INC. |

| |

|

| Date: October 28, 2024 |

By: |

/s/ David Michery |

| |

|

David Michery |

| |

|

Chief Executive Officer |

Exhibit

10.1

AMENDED

AND RESTATED SECURED PROMISSORY NOTE

October

24, 2024

Bollinger

Motors, Inc., a Delaware corporation (the “Borrower”), hereby promises to pay to Robert Bollinger (the “Lender”)

on the Maturity Date, the principal amount of TEN MILLION AND 00/100 DOLLARS ($10,000,000.00) in accordance with the provisions of this

Amended and Restated Secured Promissory Note (this “Note”).

This

Note amends and restates in its entirety that certain Secured Promissory Note, dated and accepted as of October 22, 2024 (the “Original

Note”), and the Original Note is hereby superseded and replaced by this Note upon the effectiveness hereof. It is understood and

agreed any principal amounts funded by the Lender to the Borrower under the terms of the Original Note and prior to the date hereof shall

be credited towards, and be part of, the outstanding principal amount under and described in this Note.

1.

Interest. Interest will accrue on the unpaid principal amount of this Note at a per annum rate equal to fifteen percent (15.00%).

2.

Payments.

(a)

Payments. The first payment under this Note (which payment shall consist of interest only and shall be made in accordance with

the Payment Schedule) shall be made by the Borrower on November 29, 2024. Thereafter, beginning on January 1, 2025 and until October

30, 2026 (the “Maturity Date”), payments of interest only shall be due on the first day of each month (except as otherwise

provided by Section 20 of this Note) in accordance with the Payment Schedule set forth on Exhibit A hereto (the

“Payment Schedule”). On the Maturity Date, all remaining principal and unpaid interest shall be due and payable in

full.

(b)

Optional Prepayment. This Note may be prepaid at any time, in whole or in part, without premium or penalty. This Note shall become

immediately due and payable in full if the Borrower sells all, or substantially all, of its assets to a third party.

(c)

Application of Payments. Payments under this Note shall be applied (i) first, to any costs assessed hereunder, (ii) second,

to the payment of accrued interest hereunder until all such interest is paid, and (ii) third, to the repayment of the principal

outstanding hereunder until repaid in full.

3.

Security Interest.

(a)

Security Interest and Collateral. To secure the payment and performance of the Borrower’s obligations owing to the Lender

under this Note, the Borrower hereby assigns, transfers, and conveys to the Lender a security interest (the “Security Interest”)

in all of the right, title, and interest in all of the assets of the Borrower, now owned or hereafter acquired by the Borrower, or in

which the Borrower now has or at any time in the future may acquire, any right, title, or interest, including, but not limited to, the

following (in each case, excluding any Excluded Assets (as defined below)):

(i)

Machinery and Equipment: All Equipment, including all manufacturing equipment, machinery, tools, and production lines, including all

present and future fixtures, parts, and accessories related thereto.

(ii)

Vehicles: All automobiles, trucks, forklifts, and other vehicles owned by the Borrower and used for business operations.

(iii)

Intellectual Property: All present and future patents, trademarks, patent applications (whether pending or issued), trade names, service

marks, trade secrets, copyrights, licenses, design rights, know-how, inventions (whether patentable or not), mask works, confidential

information, databases, documentation, licenses, license rights, goodwill associated therewith, and all other intellectual property rights

or proprietary rights of any kind (including software and engineering designs) owned, used, or licensed by the Borrower in connection

with the development, production, sale, operation, maintenance, or commercialization of the B4, B5, or B6 commercial vehicles or any

derivative or successor models of such vehicles (the “Commercial Vehicles IP”).

(iv)

Proceeds: All Proceeds arising from the sale, lease, or other disposition of the above collateral, including insurance proceeds and any

other forms of compensation derived from loss or damage to the assets (the foregoing assets collectively, the “Collateral”).

(b)

Certain Excluded Assets. Notwithstanding anything contained herein to the contrary, the term “Collateral” shall not

include, and the Borrower is not pledging or granting any security interests hereunder in any of the following (collectively, “Excluded

Assets”): (a) any Inventory; and (b) any intellectual property and any related rights (including any patents, trademarks,

trade secrets, copyrights, licenses, and any related intellectual property rights (including software and engineering designs) whether

owned or licensed by the Borrower) other than the Commercial Vehicles IP, including, without limitation, any such rights that are exclusively

related to the Bl, B2, or related consumer vehicles or the Borrower’s name or brand generally; provided, that “Excluded

Assets” shall not include: (i) any Proceeds, products, substitutions, or replacements of Excluded Assets unless such Proceeds,

products, substitutions or replacements would otherwise constitute Excluded Assets; or (ii) for the avoidance of doubt, any intellectual

property that is related in whole or in part to the Commercial Vehicles IP.

(c)

Perfection and Priority. In order to perfect the Security Interest created by this Note, the Borrower authorizes the Lender to

file a UCC-1 Financing Statement with the Michigan Secretary of State, the Delaware Secretary of State, and any comparable office in

any other state in which the Collateral is located or as otherwise needed to perfect the Security Interest in the Collateral. The Borrower

will reimburse the Lender for all fees associates with such filings and any and all other regulatory filings or similar actions necessary

or advisable to perfect the Security Interest. The Lender will have, in addition to any and all applicable rights and remedies available

at law and in equity, all rights and remedies of a secured party with respect to the Collateral under the Uniform Commercial Code, as

adopted in the State of Delaware (the “UCC”), and all other similar and applicable codes and statutes. The Security

Interest shall, at all times, be perfected and shall be prior to any other interests in the Collateral (subject to Permitted Liens (as

defined in Section 20 hereof)). The Borrower shall, at its own expense, promptly procure, execute, and deliver to the Lender all

documents, instruments, and agreements and perform all acts that are reasonably necessary or desirable, or that the Lender may reasonably

request, to establish, maintain, preserve, protect, and perfect the Collateral and the Security Interest or to enable the Lender to exercise

and enforce its rights and remedies hereunder with respect to such Collateral and Security Interest.

(d)

Certain Terms as Defined in the UCC. All capitalized terms used in this Section 3 and not otherwise defined in this Note

shall have the meanings given to such terms in the UCC.

4.

Representations and Warranties. The Borrower hereby represents and warrants to the Lender that:

(a)

The Borrower: (i) has been duly organized and is validly existing under the laws of Delaware; and (ii) has the power to (x) own

its properties and carry on its business as now being conducted and (y) execute, deliver, and perform its obligations hereunder

and to borrow hereunder.

(b)

The execution, delivery, and performance by the Borrower of this Note and the borrowings hereunder: (i) have been duly authorized

by all necessary action on the part of the Borrower, including the Borrower’s Board of Directors (the “Board”);

(ii) except as would not reasonably be expected to result in a Material Adverse Effect, will not violate any provision of any statutes,

rules, regulations, and orders of any court or other agency of any federal, state, municipal, or other governmental department, commission,

board, bureau, agency, or instrumentality, or other court or arbitrator, in each case whether of the United States or any other jurisdiction

(“Governmental Authority”) applicable to Borrower or any of its properties or assets, and all effective orders and

decrees of all courts and arbitrators of Governmental Authorities in proceedings or actions to which Borrower is a party; and (iii) will

not violate any provision of Borrower’s governance documents.

(c)

All authorizations, approvals, registrations, or filings from or with any Governmental Authority required for the execution, delivery,

and performance by the Borrower of this Note have been duly obtained or made and are in full force and effect.

(d)

This Note, when executed, will constitute a legal, valid, and binding obligation of the Borrower, enforceable in accordance with its

terms, subject, as to the enforcement of remedies, to applicable bankruptcy, insolvency, and similar laws affecting creditors’

rights generally and to general principles of equity.

(e)

The Borrower has good, valid, and marketable title to (or valid leasehold or license interests in, as the case may be) the Collateral,

free and clear of all liens, security interests, pledges, mortgages, and other encumbrances of any nature whatsoever (other than the

Security Interest created hereunder and Permitted Liens). All of the Collateral is in good working order in all material respects.

(f)

The Borrower has no Indebtedness (as defined in Section 20 hereof) other than Permitted Debt (as defined in Section 20

hereof).

(g)

The Borrower does not have any current intent to: (i) file a voluntary petition under any Chapter of the Bankruptcy Code, 11 U.S.C.

§ 101 - 1532 (the “Bankruptcy Code”), or in any manner seek relief, protection, reorganization, liquidation,

dissolution, or similar relief for debts under any other local, state, federal, or other insolvency laws or laws providing for relief

of debtors in equity either at the present time or at any time hereafter; (ii) directly or indirectly cause any involuntary petition

under any Chapter of the Bankruptcy Code to be filed against the Borrower; or (iii) directly or indirectly cause the Borrower to

become the subject of any proceedings pursuant to any other state, federal, or other insolvency laws or laws providing for the relief

of debtors.

(h)

The filing of any such petition or the seeking of any such relief by the Borrower whether directly or indirectly, within the six (6)

months immediately following the date of this Note, would be in bad faith and solely for purposes of delaying, inhibiting, or otherwise

impeding the exercise by the Lender of the Lender’s rights and remedies at law or in equity against the Borrower and pursuant to

this Note.

(i)

The Borrower has delivered to the Lender, concurrent with a duly-executed version of this Note, copies of all resolutions or meeting

minutes of the Board, as appropriate, evidencing the Board’s approval of the Borrower’s entry into the transactions contemplated

by this Note.

(j)

The Borrower is current on all payment obligations to its employees, including any and all wages, overtime, and fringe benefits that

have become due on or before the date of this Note.

(k)

Except for the Specified Accounts Payable (as defined below) set forth in Schedule 20(d) to this Note, there are no trade payables

and accrued expenses or other accounts payable of the Borrower that are outstanding past the applicable due date therefor and that exist

as of the date of this Note.

(l)

The Borrower will deliver to the Lender within five (5) business days of the execution of this Note a Schedule 20(c) that

shall contain, except for Collateral having an individual value of $2,500 or less (the “De Minimis Collateral”), an

accurate and complete list of all Collateral for which the purchase price has been fully paid (the “Unencumbered Collateral”).

5.

Covenants. So long as any principal or interest shall remain outstanding hereunder, unless the Lender shall otherwise consent

in writing, the Borrower:

(a)

shall not take any actions that would impair the Collateral, including, but not limited to:

(i)

incurring additional Indebtedness that is secured by the Collateral, other than Permitted Debt;

(ii)

allowing any encumbrance with respect to the Collateral, other than Permitted Liens;

(iii)

disposing of any of the Collateral, other than (A) sales, abandonment, or other dispositions of equipment that is substantially

worn, obsolete or surplus, and (B) sales and other dispositions in the ordinary course of business and consistent with past or industry

practices; or

(iv)

a sale of substantially all of the assets or voting securities of the Borrower;

(b)

shall furnish to the Lender, no later than 15 calendar days after the end of each fiscal month, internally prepared monthly financial

statements, including a balance sheet, income statement, and statement of cash flows of the Borrower for such immediately preceding fiscal

month;

(c)

shall only use the funds borrowed hereunder exclusively to support ongoing operations, payroll, and for other general working capital

needs and shall not, in each case except in the ordinary course of business, use the proceeds for any other purpose, including, but not

limited to, repayment of other existing Indebtedness (other than Permitted Debt), acquisitions or mergers, purchase of speculative assets,

and the payment of dividends or distributions to shareholders;

(d)

shall, within five business days after entering into any Permitted Secured Transaction (as defined in Section 20 hereof), deliver

to the Lender in writing a disclosure schedule setting forth the relevant details of such Permitted Secured Transaction, including, but

not limited to, the names of the parties thereto, the transaction date, the amount of the Indebtedness, a detailed identification of

the covered Collateral (including any product number, serial number, or other unique identification number for such Collateral), and

a description of the security interest with respect to such Collateral; and

(e)

shall promptly inform the Lender if the Borrower experiences: (a) a material adverse change in the business, operations, results

of operations, assets, liabilities, or financial condition of the Borrower; (b) a material impairment of the ability of the Borrower

to perform its obligations under this Note or of the Lender’s ability to enforce any such obligations; or (c) a material impairment

of the enforceability or priority of the Lender’s liens with respect to the Collateral (as defined in this Note) as a result of

an action or failure to act on the part of the Borrower (each such event, a “Material Adverse Change”).

6.

Events of Default.

(a)

Definition. For purposes of this Note, an Event of Default shall be deemed to have occurred if:

(i)

the Borrower fails to pay when due and payable (whether on the Maturity Date or otherwise) the full amount of any payment as required

by the terms herein and, in the case of any payments other than any principal amounts under the Note, such failure continues for three

(3) business days;

(ii)

a breach of any representation, warranty, or covenant made by the Borrower hereunder and, other than with respect to any breach of Sections

5(a) or 5(c), such breach continues for ten (10) business days after the earlier of (A) the date on which the Borrower

first knew, or should reasonably have known, of such breach and (B) the date on which the Borrower receives written notice thereof

from the Lender;

(iii)

a material breach or default by Borrower of any other terms of this Note and such breach or default continues for ten (10) business days

after the earlier of (A) the date on which the Borrower first knew, or should reasonably have known, of such breach or default and

(B) the date on which the Borrower receives written notice thereof from the Lender;

(iv)

the Borrower makes an assignment for the benefit of creditors or admits in writing its inability to pay its debts generally as they become

due; or an order, judgment, or decree is entered adjudicating the Borrower bankrupt or insolvent; or any order for relief with respect

to the Borrower is entered under title 11 of the United States Code (the “Bankruptcy Code”); or the Borrower petitions

or applies to any tribunal for the appointment of a custodian, trustee, receiver, or liquidator of the Borrower, or of any substantial

part of the assets of the Borrower, or commences any proceeding relating to the Borrower under any bankruptcy reorganization, arrangement,

insolvency, readjustment of debt, dissolution, or liquidation law of any jurisdiction; or any such petition or application is filed,

or any such proceeding is commenced, against the Borrower and either (A) the Borrower by any act indicates its approval thereof,

consent thereto, or acquiescence therein or (B) such petition, application, or proceeding is not dismissed within sixty (60) days;

or

(v)

a Material Adverse Change shall have occurred.

The

foregoing shall constitute Events of Default, regardless of the reason or cause for any such Event of Default or whether it is voluntary

or involuntary or is effected by operation of law or pursuant to any judgment, decree, or order of any court or any order, rule, or regulation

of any Governmental Authority.

(b)

Consequences of Events of Default.

(i)

If an Event of Default has occurred, the aggregate principal amount of this Note (together with all accrued interest thereon and all

other amounts due and payable with respect thereto) shall become immediately due and payable without any action on the part of the Lender,

and the Lender may exercise one or more of the following rights or remedies: (i) foreclose the Security Interest on the Collateral;

(ii) pursue collection of this Note; or (iii) exercise or enforce any or all rights and remedies available upon default to

a secured party under the UCC and all other similar and applicable codes and statutes, including, but not limited to, the right to sell

the Collateral, or any part thereof, at a public or private sale. Such amounts and remedies shall be in addition to any such rights the

Lender has pursuant to Section 10 of this Note.

(ii)

Notwithstanding anything to the contrary contained in this Note, the UCC or any otherwise under any applicable law, the Borrower and

Lender hereby expressly acknowledge and agree that after the occurrence and during the continuance of an Event of Default, in no event

shall the Lender be entitled to receive any proceeds from the sale of Collateral or otherwise recover any amounts, in each case, in excess

of the aggregate amount necessary to repay and satisfy in full all outstanding obligations owing to the Lender under or related to this

Note.

7.

Amendment and Waiver. Except as otherwise expressly provided herein, the provisions of this Note may be amended only with

the prior written consent of the Borrower and the Lender, and notwithstanding the foregoing, the Borrower may take any action herein

prohibited, or omit to perform any act herein required to be performed by it, only with the prior written consent of the Lender.

8.

Assignment and Transfer. The Borrower may not sell, assign, or otherwise transfer its obligations under this Note. The Lender

may freely sell, assign, or otherwise transfer its rights under this Note without the consent of the Borrower.

9.

Indemnification. The Borrower shall indemnify, defend, and hold harmless the Lender, its affiliates and subsidiaries, and

their respective shareholders, officers, directors, managers, members, agents, affiliates, and each of their respective employees and

contractors (individually an “Indemnitee” and collectively, “Indemnitees”) for, from, and against

any and all damages, losses, liabilities (absolute and contingent), fines, penalties, costs, and expenses (including, without limitation,

reasonable and documented fees, costs, and expenses of a single firm of counsel for the Indemnitees, taken as a whole) incurred by any

Indemnitee or arising out of any third party demand, claim, inquiry, investigation, proceeding (whether civil, criminal, administrative,

or investigative), action, or cause of action (collectively, a “Third Party Claim”) that any Indemnitee may suffer

or incur in connection with this Note or any of the transactions contemplated herein; provided that such indemnity shall not,

as to any Indemnitee, be available to the extent that damages, losses, liabilities, fines, penalties, costs, or expenses are determined

by a court of competent jurisdiction by final and non-appealable judgment to have resulted from the gross negligence, bad faith, or willful

misconduct of such Indemnitee. The provisions of this Section 9 shall survive the termination of this Note.

10.

Reimbursement of the Lender. The Borrower agrees to pay to the Lender (or reimburse the Lender for) an amount equal to the

amount of all reasonable and documented out-of-pocket costs and expenses, including reasonable and documented legal fees, expenses, and

disbursements of a single firm of counsel, resulting from the administration and enforcement or exercise of any right or remedy granted

to the Lender hereunder. The foregoing includes any reasonable and documented costs incurred by the Lender in connection with any action

or proceeding which may be instituted in respect of the foregoing by the Lender, or by any other person or entity either against the

Lender or in connection with which any officer, agent, or employee of the Lender is called as a witness or deponent, including, but not

limited to, the reasonable and documented fees and disbursements of a single firm of counsel to the Lender and any reasonable and documented

out-of-pocket costs incurred by the Lender in appearing as a witness or in otherwise complying with legal process served upon it. To

the maximum extent permitted by applicable law, if the Borrower shall fail to do any act or thing which it has covenanted to do hereunder

or any representation or warranty of the Borrower shall be breached, the Lender may (but shall not be obligated to) do the same or cause

it to be done or remedy any such breach and there shall be added to the obligations secured hereby, the reasonable and documented cost

or expense incurred by the Lender in so doing, and any and all amounts expended by the Lender in taking such action shall be repayable

to it upon its demand therefor. All amounts due under this Section 10 shall be payable within 30 days (or such later date as may

be agreed by the Lender) after receipt by the Borrower of a written invoice or other summary related thereto.

11.

Payments. All payments to be made to the Lender shall be made in the lawful money of the United States of America in immediately

available funds.

12.

Method of Payment. Payments of principal and interest shall be delivered to the Lender as specified by prior written notice

by the Lender.

13.

Notices. Unless otherwise provided herein, any notice or other communication required or permitted to be given hereunder shall

be in writing and may be personally served or sent by electronic mail, facsimile, by registered or certified mail, postage prepaid, return

receipt requested or by a reputable and internationally recognized courier service, and shall be deemed to have been given when delivered

in person, upon receipt of facsimile or electronic mail, five business days after the date when sent by registered or certified mail,

postage prepaid, return receipt requested and properly addressed, or three business days after dispatch with a reputable and internationally

recognized courier service and properly addressed. All notices under this Note shall be sent to the parties hereto using the following

contact information (or to such other contact information as a party hereto shall specify in writing):

| |

(a) | if

to the Borrower: |

Bollinger

Motors, Inc.

|

| |

| |

Attn: |

Jason

Puscas |

| |

| |

Address: |

14925

W Eleven Mile Rd |

| |

| |

|

Oak

Park, MI 48237 |

| |

| |

Email: |

legal@bollingermotors.com |

| (b) | if

to the Lender: |

Robert

Bollinger |

| | | |

c/o

Winthrop & Weinstine, P.A. |

| | | |

Attn: |

Bill

Burdett |

| | | |

Address: |

225

South Sixth Street, Suite 3500 |

| | | |

|

Minneapolis,

Minnesota 55402 |

| | | |

Email: |

bbmdett@winthrop.com |

14.

Governing Law; Consent to Jurisdiction. All questions concerning the construction, validity, and interpretation of this Note

will be governed by and construed in accordance with the domestic laws of the State of Delaware, without giving effect to any choice

of law or conflict of law provision or rule (whether of the State of Delaware or any other jurisdiction) that would cause the application

of the laws of any jurisdiction other than the State of Delaware. With respect to any litigation based on, arising out of, or in connection

with this Note, the parties hereto expressly submit to the personal jurisdiction of the Circuit Court in and for the County of Oakland,

Michigan, or the United States District Court for the Eastern District of Michigan, and the parties hereto expressly waive, to the fullest

extent permitted by law, any objection that such party may now or later have to the laying of venue of any such litigation brought in

any such court referred to above, including without limitation, any claim that any such litigation has been brought in an inconvenient

forum.

15.

Entire Agreement; Superseding Agreement. This Note, together with all schedules and exhibits hereto, contains the entire agreement

and understanding among the parties hereto with respect to the subject matter hereof and supersedes all prior and contemporaneous agreements,

understandings, inducements, and conditions, express or implied, oral or written, of any nature whatsoever with respect to the subject

matter hereof. To the extent that this Note is ever found to be invalid, illegal, or unenforceable, the previous note shall remain in

full force and effect to the fullest extent permitted by law.

16.

Publicity. The Borrower agrees that no press release or other announcement concerning this Note, any exhibits or schedules

thereto, or any of the transactions contemplated thereby shall be issued without the advance written consent of the Lender, such discretion

not to be unreasonably withheld, conditioned, or delayed. Lender shall have a reasonable right to edit and revise any such release or

announcement prior to any such approval. In the event that such a release or announcement may be required by law, the Borrower shall

provide Lender with a written copy of the proposed release or announcement in advance of such release or announcement to allow a reasonable

amount of time, to the extent permitted by law, for the Lender’s review and comment.

17.

Waivers. To the maximum extent permitted by applicable law, the Borrower hereby waives presentment for payment, protest, demand,

notice of protest, notice of nonpayment, and diligence with respect to this Note, and waives and renounces all rights to the benefits

of any statute of limitations or any moratorium, appraisement, exemption, or homestead now provided or that hereafter may be provided

by any federal or applicable state statute, including but not limited to exemptions provided by or allowed under the Bankruptcy Code,

both as to itself and as to all of its property, whether real or personal, against the enforcement and collection of the obligations

evidenced by this Note and any and all extensions, renewals, and modifications hereof. The Borrower waives any right to require the Lender

to proceed against any guarantor, to proceed against or exhaust any other security for the amounts owing to the Lender, to pursue any

other remedy available to the Lender, or to pursue any remedy in any particular order or manner. The Borrower waives the benefits of

any legal or equitable doctrine or principle of marshalling. Nothing contained herein shall be construed as a waiver of any of the rights

and remedies that the Lender may have against the Borrower under this Note. The failure of the Lender to exercise all or any of its rights

or remedies at any time shall not constitute a waiver of any such rights or remedies.

18.

Business Days. If any payment is due, or any time period for giving notice or taking action expires, on a day which is not

a business day, the payment shall be due and payable on, and the time period shall automatically be accelerated to, the business day

immediately preceding such non-business day, and interest shall continue to accrue at the required rate hereunder until any such payment

is made.

19.

Waiver of Jury Trial. EACH OF THE BORROWER AND THE LENDER IRREVOCABLY WAIVE ALL RIGHTS TO A TRIAL BY JURY IN ANY SUIT, ACTION,

OR OTHER PROCEEDING INSTITUTED BY OR AGAINST SUCH PARTY IN RESPECT OF ITS, HIS, OR HER OBLIGATIONS HEREUNDER OR THE TRANSACTIONS CONTEMPLATED

HEREBY.

20.

Certain Defined Terms. As used in this Note, the following terms shall have the respective meanings indicated below

(a)

“Indebtedness” means any obligation, whether on-balance sheet or off-balance sheet, for the payment or repayment of

money, whether currently due or to become due, including, without limitation: (i) loans, bonds, notes, or other debt instruments;

(ii) capital leases, synthetic leases, or other financing arrangements; (iii) guarantees, letters of credit, or other contingent

obligations for the debt of another party; (iv) overdrafts, credit lines, or other extensions of credit; (i) any deferred payment

obligations or purchase price adjustments; and (vi) any accrued interest, fees, penalties, or costs related to the foregoing.

(b)

“Permitted Debt” means: (a) the obligations under this Note; (b) unsecured Indebtedness arising under cash

management services or similar arrangements in the ordinary course of business; (c) Indebtedness in respect of Permitted Secured

Transactions; (d) trade payables and accrued expenses or other accounts payable incurred in the ordinary course of business and

not outstanding for more than sixty (60) days after the date such payable was due; provided, that any such payables or expenses

pursuant to this clause (d) (other than, for the avoidance of doubt, payables and expenses that are not past due) that exist as of the

date of this Note shall be set forth on Schedule 20(d) attached hereto (the “Specified Accounts Payable”);

and (e) any other Indebtedness or obligations approved by the Lender in advance and in writing from time to time (in its sole discretion).

For the avoidance of doubt, “Permitted Debt” shall not include any Indebtedness or other obligation: (A) with respect

to any of the Unencumbered Collateral or the De Minimis Collateral; or (B) that is secured by any lien, mortgage, deed of trust,

pledge, security interest, assignment, hypothecation, charge, claim, encroachment, lease, conditional sale agreement, title retention

agreement, financing statement, easement, covenant, right of way, restriction, encumbrance, or any other interest or agreement that creates,

or purports to create, an interest in or restriction on the use, transfer, or ownership of any Collateral, other than Permitted Liens.

(c)

“Permitted Liens” means: (a) rights of setoff or bankers’ liens upon deposits of funds in favor of banks

or other depository institutions, solely to the extent incurred in connection with the maintenance of deposit accounts in the ordinary

course of business; (b) leases, licenses, subleases, or sublicenses granted to third parties in the ordinary course of business

and consistent with past or industry practice that do not (i) interfere in any material respect with the ordinary conduct of the

business of the Borrower and (ii) impair or rank senior to the Security Interest; (c) liens securing a Permitted Secured Transaction;

provided, that such liens extend solely to the applicable equipment or asset that is financed or leased (and do not, for the avoidance

of doubt, extend to any Unencumbered Collateral, any De Minimis Collateral, or any other Collateral or other assets); and (d) other

liens approved by the Lender in advance and in writing from time to time (in its sole discretion).

(d)

“Permitted Secured Transactions” means the certain equipment financing or capital lease transactions, which transactions,

as of the date hereof, have not yet been entered into and cannot be specifically identified or described, and in which the Borrower will

incur an aggregate outstanding principal amount of Indebtedness not to exceed $3,000,000 at any time; provided, that a “Permitted

Secured Transaction” shall not include any transaction with respect to Unencumbered Collateral or De Minimis Collateral.

21.

Miscellaneous. The relationship between the Borrower and the Lender is strictly a debtor and creditor relationship and is

not fiduciary in nature, nor is the relationship to be construed as creating any partnership or joint venture between the Borrower and

the Lender. The Lender owes no fiduciary duty or any other special duty to the Borrower, and the Borrower is exercising its own judgment

with respect to this Note and the transactions contemplated herein. All information supplied to the Lender is for the Lender’s

protection only and no other party is entitled to rely on such information. There is no duty for the Lender to review, inspect, supervise,

or inform the Borrower of any matter with respect to any of the Borrower’s business. The Lender may reasonably rely on all information

supplied by the Borrower, and any investigation or failure to investigate will not diminish the Lender’s right to rely on such

information. The parties hereto have negotiated, read, and approved the language of this Note, which language shall be construed in its

entirety according to its fair meaning and not strictly for or against any of the parties hereto, who have worked together in preparing

the final version of this Note. This Note shall be binding upon and inure to the benefit of and be enforceable by the parties hereto

and their respective permitted successors and assigns. Any photographic or xerographic copy of this Note shall be considered for all

purposes as if it were an executed original of this Note. Signatures may be given by facsimile or other electronic transmission, and

such signatures shall be fully binding on the party hereto sending the same. The headings of the various sections of this Note have been

inserted for reference only and shall not be deemed to be a part of this Note. If any provision of this Note, or the application of any

such provision to any person or circumstance, is held to be invalid, illegal, or unenforceable under applicable law, the remaining provisions

of this Note shall remain in full force and effect and shall be construed as if the invalid, illegal, or unenforceable provision had

never been included. To the extent permitted by law, the parties hereto shall negotiate in good faith to replace any invalid, illegal,

or unenforceable provision with a valid, legal, and enforceable provision that, as closely as possible, reflects the original intent

of the parties hereto.

[REMAINDER

OF PAGE INTENTIONALLY LEFT BLANK]

IN

WITNESS WHEREOF, the Borrower has executed and delivered this Note on the date first above written.

| |

Bollinger Motors, Inc. |

| |

|

|

| |

By: |

/s/ James Taylor |

| |

Name: |

James Taylor |

| |

Title: |

CEO |

EXHIBIT

A

Payment

Schedule

See

attached.

| Month | |

Interest

Payment | |

Principal

Payment | |

Remaining

Balance | |

Due

Date |

| 1 | |

125000 | |

0 | |

10000000 | |

11/29/2024 |

| 2 | |

125000 | |

0 | |

10000000 | |

01/01/2025 |

| 3 | |

125000 | |

0 | |

10000000 | |

01/31/2025 |

| 4 | |

125000 | |

0 | |

10000000 | |

02/28/2025 |

| 5 | |

125000 | |

0 | |

10000000 | |

04/01/2025 |

| 6 | |

125000 | |

0 | |

10000000 | |

05/01/2025 |

| 7 | |

125000 | |

0 | |

10000000 | |

05/30/2025 |

| 8 | |

125000 | |

0 | |

10000000 | |

07/01/2025 |

| 9 | |

125000 | |

0 | |

10000000 | |

08/01/2025 |

| 10 | |

125000 | |

0 | |

10000000 | |

09/01/2025 |

| 11 | |

125000 | |

0 | |

10000000 | |

10/01/2025 |

| 12 | |

125000 | |

0 | |

10000000 | |

10/31/2025 |

| 13 | |

125000 | |

0 | |

10000000 | |

12/01/2025 |

| 14 | |

125000 | |

0 | |

10000000 | |

01/01/2026 |

| 15 | |

125000 | |

0 | |

10000000 | |

01/30/2026 |

| 16 | |

125000 | |

0 | |

10000000 | |

02/27/2026 |

| 17 | |

125000 | |

0 | |

10000000 | |

04/01/2026 |

| 18 | |

125000 | |

0 | |

10000000 | |

05/01/2026 |

| 19 | |

125000 | |

0 | |

10000000 | |

06/01/2026 |

| 20 | |

125000 | |

0 | |

10000000 | |

07/01/2026 |

| 21 | |

125000 | |

0 | |

10000000 | |

07/31/2026 |

| 22 | |

125000 | |

0 | |

10000000 | |

09/01/2026 |

| 23 | |

125000 | |

0 | |

10000000 | |

10/01/2026 |

| 24 | |

125000 | |

10000000 | |

0 | |

10/30/2026 |

Exhibit 99.1

Mullen

Automotive Announces Robert Bollinger

Provides

Bollinger Motors $10M Financing

Founder’s financing

to support Bollinger’s production ramp-up

and sale of the Bollinger B4, Class 4 EV truck

BREA, Calif., Oct. 28,

2024 -- via IBN -- Mullen Automotive Inc. (Nasdaq: MULN), an electric vehicle (EV) manufacturer, today announces that Robert

Bollinger, founder of Bollinger Motors, has provided Bollinger with $10 million in non-dilutive debt financing to support Bollinger’s

production ramp-up and sale of the B4, Class 4 EV truck.

“Thanks to the incredible

achievements of this hardworking team our trucks are now shipping to customers and dealers nationwide,” said Bollinger. “We

are now truly an OEM.”

“Robert’s continued

support and participation in the growth of Bollinger Motors demonstrates his ongoing commitment and is key to building the brand that

carries his name,” said David Michery, CEO and chairman of Mullen Automotive.

Bollinger Motors started

full-scale production of its industry-leading, all-electric Class 4 truck, the Bollinger B4, in September. The trucks are assembled at

Roush Industries in Livonia, Michigan, with greater than 70% US-made content.

Further information about

the financing will be included in a Current Report on Form 8-K to be filed with the Securities and Exchange Commission at SEC.gov.

About Mullen

Mullen Automotive (NASDAQ:

MULN) is a Southern California-based automotive company building the next generation of commercial electric vehicles (“EVs”)

with two United States-based vehicle plants located in Tunica, Mississippi, (120,000 square feet) and Mishawaka, Indiana (650,000 square

feet). In August 2023, Mullen began commercial vehicle production in Tunica. In September 2023, Mullen received IRS approval for federal

EV tax credits on its commercial vehicles with a Qualified Manufacturer designation that offers eligible customers up to $7,500 per vehicle.

As of January 2024, both the Mullen ONE, a Class 1 EV cargo van, and Mullen THREE, a Class 3 EV cab chassis truck, are California Air

Resource Board (“CARB”) and EPA certified and available for sale in the U.S. Recently, CARB issued HVIP approval on the Mullen

THREE, Class 3 EV truck, providing up to $45,000 cash voucher at time of vehicle purchase. The Company has also recently expanded its

commercial dealer network to seven dealers with the addition of Papé Kenworth. Other previously announced dealers include Pritchard

EV, National Auto Fleet Group, Ziegler Truck Group, Range Truck Group, Eco Auto, and Randy Marion Auto Group, providing sales and service

coverage in key Midwest, West Coast, Pacific Northwest, New England and Mid-Atlantic markets. The Company has also announced Foreign

Trade Zone (“FTZ”) status approval for its Tunica, Mississippi, commercial vehicle manufacturing center. FTZ approval provides

a number of benefits, including deferment of duties owed and elimination of duties on exported vehicles.

To learn more about the

Company, visit www.MullenUSA.com.

About

Bollinger Motors

Founded in 2015 by Robert

Bollinger, Bollinger Motors, Inc. is a U.S.-based company headquartered in Oak Park, Michigan. Bollinger Motors produces Class

4 all-electric commercial chassis cab trucks. In September of 2022, Bollinger Motors became a majority-owned company of Mullen Automotive,

Inc. (NASDAQ: MULN).

Learn more at www.BollingerMotors.com.

Forward-Looking Statements

Certain statements in this

press release that are not historical facts are forward-looking statements within the meaning of Section 27A of the Securities Exchange

Act of 1934, as amended. Any statements contained in this press release that are not statements of historical fact may be deemed forward-looking

statements. Words such as “continue,” “will,” “may,” “could,” “should,” “expect,”

“expected,” “plans,” “intend,” “anticipate,” “believe,” “estimate,”

“predict,” “potential” and similar expressions are intended to identify such forward-looking statements. All

forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from those

expressed or implied in the forward-looking statements, many of which are generally outside the control of Mullen and are difficult to

predict. Examples of such risks and uncertainties include but are not limited to (i) Mullen’s ability (or inability) to obtain

additional financing in sufficient amounts or on acceptable terms when needed; (ii) Mullen’s ability to maintain existing, and

secure additional, contracts with manufacturers, parts and other service providers relating to its business; (iii) Mullen’s ability

to successfully expand in existing markets and enter new markets; (iv) Mullen’s ability to successfully manage and integrate any

acquisitions of businesses, solutions or technologies; (v) unanticipated operating costs, transaction costs and actual or contingent

liabilities; (vi) the ability to attract and retain qualified employees and key personnel; (vii) adverse effects of increased competition

on Mullen’s business; (viii) changes in government licensing and regulation that may adversely affect Mullen’s business;

(ix) the risk that changes in consumer behavior could adversely affect Mullen’s business; (x) Mullen’s ability to protect

its intellectual property; and (xi) local, industry and general business and economic conditions. Additional factors that could cause

actual results to differ materially from those expressed or implied in the forward-looking statements can be found in the most recent

annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K filed by Mullen with the Securities and Exchange

Commission. Mullen anticipates that subsequent events and developments may cause its plans, intentions and expectations to change. Mullen

assumes no obligation, and it specifically disclaims any intention or obligation, to update any forward-looking statements, whether as

a result of new information, future events or otherwise, except as expressly required by law. Forward-looking statements speak only as

of the date they are made and should not be relied upon as representing Mullen’s plans and expectations as of any subsequent date.

Contact:

Mullen Automotive Inc.

+1 (714) 613-1900

www.MullenUSA.com

Corporate Communications:

InvestorBrandNetwork

(IBN)

Los Angeles, California

www.InvestorBrandNetwork.com

310.299.1717 Office

Editor@InvestorBrandNetwork.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=muln_CommonStockParValue0.001Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=muln_RightsToPurchaseSeriesA1JuniorParticipatingPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

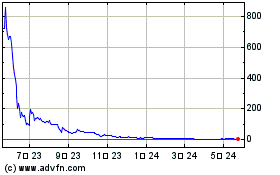

Mullen Automotive (NASDAQ:MULN)

過去 株価チャート

から 11 2024 まで 12 2024

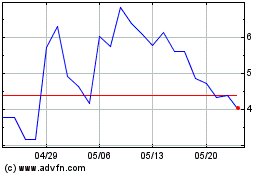

Mullen Automotive (NASDAQ:MULN)

過去 株価チャート

から 12 2023 まで 12 2024