0001606757false00016067572024-07-312024-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) July 31, 2024

KIMBALL ELECTRONICS, INC.

________________________________________________________________________________________________________

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | | |

| Indiana | | 001-36454 | | 35-2047713 |

| (State or other jurisdiction of | | (Commission File | | (IRS Employer Identification No.) |

| incorporation) | | Number) | | |

| | | | | | | | |

| | | |

1205 Kimball Boulevard, Jasper, Indiana | | 47546 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (812) 634-4000

| | |

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each Class | Trading Symbol | Name of each exchange on which registered |

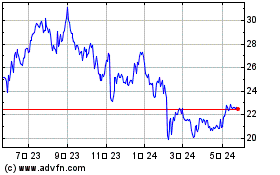

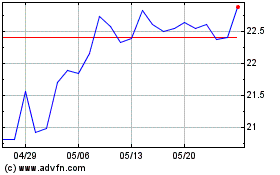

| Common Stock, no par value | KE | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (Section 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Section 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 1.01 Entry into a Material Definitive Agreement

On July 31, 2024, Kimball Electronics, Inc. (the “Company”) entered into and closed the transaction contemplated by a Stock Purchase Agreement (the “Agreement”) with Averna Test Systems Inc., a subsidiary of Averna Technologies Inc. (“Averna”), for the Company’s Automation, Test, and Measurement (AT&M) business. Pursuant to the Agreement, Averna acquired all of the issued and outstanding capital stock of Kimball Electronics Indiana, Inc. d/b/a GES, the Company’s AT&M subsidiary. The Company’s divestiture of the AT&M business will allow the Company to increase its focus on and support for its EMS operations.

Averna paid the Company initial consideration of approximately $24.3 million in cash at closing, consisting of (i) the Unadjusted Purchase Price, plus (ii) the Closing Cash, minus (iii) the Closing Indebtedness, minus (iv) the Closing Transaction Expenses, plus (v) the Net Working Capital Adjustment, with each capitalized term as defined in the Agreement. The Agreement contains representations, warranties, limited indemnification obligations for breaches of the representations and warranties, and other clauses and provisions usual and customary for agreements of this type. The Company expects to use the proceeds from the transaction to support future organic growth, debt reduction, and share repurchases.

The foregoing description of the Agreement is a summary of the terms of the Stock Purchase Agreement that are material to the Company, it does not purport to be complete and is qualified by its entirety by reference to the full text of the Agreement, which is attached hereto as Exhibit 2.1 and is incorporated herein by reference. The Agreement contains customary representations and warranties made by and to the parties thereto as to specific dates. The assertions embodied in those representations and warranties are qualified by information contained in confidential disclosure schedules that the parties exchanged in connection with negotiating the terms of the Agreement. Accordingly, investors and Company shareholders should not rely on such representations and warranties as characterizations of the actual state of facts or circumstances, since they were only made as of the date of the Agreement and are modified in important part by the underlying disclosure schedules. Moreover, information concerning the subject matter of such representations and warranties may change after the date of the Agreement, which subsequent information may or may not be fully reflected in the Company’s public disclosures. In addition, certain representations and warranties may be subject to a contractual standard of materiality different from what might be viewed as material to shareholders, or may have been used for the purpose of allocating risk between the respective parties rather than establishing matters as facts. For the foregoing reasons, no person should rely on the representations and warranties as statements of factual information at the times they were made or otherwise.

The Company’s press release announcing the completion of the AT&M divestiture is attached as Exhibit 99.1 and is incorporated herein by reference.

Forward-Looking Statements

Certain statements contained within this document are considered forward-looking under the Private Securities Litigation Reform Act of 1995. The statements may be identified by the use of words such as “allow,” “expects,” “future,” “may,” “might,” “should,” “will,” and similar expressions. These forward-looking statements are subject to risks and uncertainties including, but not limited to, global economic conditions, geopolitical environment and conflicts, global health emergencies, availability or cost of raw materials and components, foreign exchange fluctuations, and our ability to convert new business opportunities into customers and revenue. Additional cautionary statements regarding other risk factors that could have an effect on the future performance of Kimball Electronics are contained in our Annual Report on Form 10-K for the year ended June 30, 2023.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Effective as of the July 31, 2024 closing of the Agreement and the Company’s divestiture of the AT&M business, Christopher J. Thyen, Vice President, New Platforms, became affiliated with Averna and is no longer employed by Kimball Electronics. The Company is extremely grateful to Mr. Thyen for his service and has valued his contributions to the Company throughout his long tenure, and in particular his contributions to the AT&M business. Mr. Thyen’s departure in conjunction with the closing did not result from any disagreement with the Company.

In connection with Mr. Thyen’s departure, he became eligible to receive, pursuant to a Transition and Retention Agreement and General Release (the “Transition Agreement”), a cash incentive of $260,000. The cash incentive is payable in a lump sum as soon as administratively practicable after the effective date of the general release that is Exhibit A to the Transition Agreement. The Transition Agreement includes a release of claims in favor of the Company and customary confidentiality and restrictive covenant provisions. The Transition Agreement also states that it supplements and does not replace or supersede, and is not superseded by, the Kimball Electronics, Inc. Leadership Team Severance and Change of Control Plan (the “Plan”). Mr. Thyen remained entitled to participate in and be eligible for benefits under the Plan pursuant to the terms and conditions therein. The foregoing summary of the Transition Agreement is qualified in its entirety by reference to the full text of the Transition Agreement, a copy of which is filed as Exhibit 10.1 hereto and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

The following exhibits are filed as part of this report:

| | | | | | | | |

| Exhibit | | |

| Number | | Description |

2.1 (a)(b) | | |

10.1 (b) | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (formatted in Inline XBRL) |

(a) Certain schedules and exhibits have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Registrant will supplementally furnish any of the omitted schedules or exhibits to the Securities and Exchange Commission upon request.

(b) Certain information contained in Exhibit 2.1 and Exhibit 10.1 has been excluded pursuant to Regulation S-K Item 601(b)(2) and (10) because it is both (1) not material and (2) of the type that the Company treats as private or confidential. The Registrant will supplementally furnish a copy of the unredacted exhibit to the Securities and Exchange Commission upon request; provided, however, that the Registrant may request confidential treatment.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| | |

| | KIMBALL ELECTRONICS, INC. |

| | |

| By: | /s/ Douglas A. Hass |

| | DOUGLAS A. HASS

Chief Legal and Compliance Officer, Secretary |

Date: August 1, 2024

Exhibit 2.1

Execution Version

| | |

| Certain information contained in this Exhibit has been excluded pursuant to Regulation S-K Item 601(b) because it is both (1) not material and (2) of the type that the Company treats as private or confidential. The redaction of such information is indicated by “[***]”. |

STOCK PURCHASE AGREEMENT

BY AND AMONG

KIMBALL ELECTRONICS, INC. (“SELLER”), THE SOLE STOCKHOLDER OF KIMBALL ELECTRONICS INDIANA, INC. (“COMPANY”);

AND

AVERNA TEST SYSTEMS INC. (“BUYER”);

AND

COMPANY

DATED AS OF

JULY 31, 2024

277494.00058/305713869.33

TABLE OF CONTENTS

| | | | | | | | | | | |

| Article I. Definitions. | 1 |

| Section 1.1. | Definitions. | 1 |

| Section 1.2. | Interpretation. | 13 |

| Section 1.3. | Accounting Terms and Definitions. | 13 |

| Section 1.4. | Dollar Amounts Not Materiality Admissions. | 13 |

| Section 1.5. | Schedules. | 14 |

| Section 1.6. | Making | 14 |

| Article II. Closing; Purchase Price; Adjustments and Related Matters. | 14 |

| Section 2.1. | Closing. | 14 |

| Section 2.2. | Purchase and Sale of Equity. | 14 |

| Section 2.3. | Purchase Price. | 14 |

| Section 2.4. | Post-Closing Adjustment of Purchase Price. | 15 |

| Section 2.5. | Treatment of Equity Awards. | 16 |

| Section 2.6. | Vietnam VAT Receivable. | 16 |

| Article III. Representations and Warranties of Seller. | 17 |

| Section 3.1. | Execution and Delivery; Valid and Binding Agreements. | 17 |

| Section 3.2. | Authority. | 17 |

| Section 3.3. | No Breach. | 17 |

| Section 3.4. | Ownership. | 17 |

| Section 3.5. | Litigation. | 17 |

| Section 3.6. | Approvals and Consents. | 17 |

| Section 3.7. | Brokerage. | 18 |

| Section 3.8. | Competition Law Matters (Vietnam). | 18 |

| Section 3.9. | No Other Representations and Warranties. | 18 |

| Article IV. Representations and Warranties of the Company. | 18 |

| Section 4.1. | Organization and Corporate Power. | 19 |

| Section 4.2. | Capitalization. | 19 |

| Section 4.3. | Subsidiaries. | 19 |

| Section 4.4. | Corporate Authorization. | 20 |

| Section 4.5. | Non-Contravention; Filings and Consents. | 20 |

| Section 4.6. | Consents and Approvals. | 21 |

| Section 4.7. | Financial Statements. | 21 |

| Section 4.8. | Absence of Certain Changes. | 21 |

| Section 4.9. | Employee Benefit Plans. | 22 |

| Section 4.10. | Labor and Employment Matters. | 24 |

| Section 4.11. | Litigation. | 26 |

| Section 4.12. | Tax Matters. | 26 |

| Section 4.13. | Compliance with Laws; Permits. | 29 |

| Section 4.14. | Environmental Matters. | 30 |

| Section 4.15. | Intellectual Property. | 30 |

| Section 4.16. | Real Property. | 33 |

| Section 4.17. | Material Contracts. | 34 |

| Section 4.18. | Anticorruption. | 35 |

| Section 4.19. | Insurance. | 36 |

| Section 4.20. | Brokers. | 36 |

| Section 4.21. | Customers and Suppliers. | 36 |

| Section 4.22. | Transactions with Affiliates and Related Parties. | 37 |

| Section 4.23. | Inventory. | 37 |

277494.00058/305713869.33

| | | | | | | | | | | |

| Section 4.24. | Books and Records. | 37 |

| Section 4.25. | Constating Records. | 37 |

| Section 4.26. | Accounts Receivable. | 37 |

| Section 4.27. | Title to Assets. | 37 |

| Section 4.28. | Condition of Assets. | 38 |

| Section 4.29. | Grants and Subsidies. | 38 |

| Section 4.30. | Warranties and Product Liability. | 38 |

| Section 4.31. | No Other Representations and Warranties. | 38 |

| Article V. Representations and Warranties of Buyer | 39 |

| Section 5.1. | Organization. | 39 |

| Section 5.2. | Authority. | 39 |

| Section 5.3. | Consents and Approvals. | 39 |

| Section 5.4. | Non-Contravention. | 39 |

| Section 5.5. | Financing. | 39 |

| Section 5.6. | Investment Representations. | 39 |

| Section 5.7. | Finder's Fees. | 40 |

| Section 5.8. | Litigation. | 40 |

| Section 5.9. | CFIUS Foreign Person Status. | 40 |

| Section 5.10. | Limitations on Representations and Warranties. | 40 |

| Article VI. Covenants | 41 |

| Section 6.1. | Indemnification of Officers and Directors. | 41 |

| Section 6.2. | Employee Matters Covenants. | 41 |

| Section 6.3. | Cooperation Concerning Representation and Warranty Insurance. | 42 |

| Section 6.4. | Payment of Management Fees. | 43 |

| Article VII. Tax Matters | 43 |

| Section 7.1. | Tax Covenants. | 43 |

| Section 7.2. | Termination of Existing Tax Sharing Agreements. | 45 |

| Section 7.3. | Straddle Period Allocation. | 45 |

| Section 7.4. | Straddle Period Returns Liability. | 46 |

| Section 7.5. | Refunds. | 46 |

| Section 7.6. | Cooperation and Exchange of Information. | 46 |

| Section 7.7. | Transfer Taxes. | 46 |

| Article VIII. Survival; No Recourse; Limited Indemnification. | 47 |

| Section 8.1. | Survival. | 47 |

| Section 8.2. | No Recourse Against Seller and Affiliates. | 47 |

| Section 8.3. | Indemnification by Seller. | 48 |

| Section 8.4. | Indemnification by Buyer. | 49 |

| Section 8.5. | Representation, Settlement and Cooperation. | 49 |

| Section 8.6. | Notice and Satisfaction of Indemnification Claims. | 50 |

| Section 8.7. | Limits on Indemnification. | 50 |

| Section 8.8. | Exclusive Remedy. | 51 |

| Section 8.9. | Tax Treatment of Indemnification Payments. | 52 |

| Article IX. Miscellaneous. | 52 |

| Section 9.1. | Entire Agreement. | 52 |

| Section 9.2. | Successors, Assigns and Assignment. | 52 |

| Section 9.3. | Amendments. | 52 |

| Section 9.4. | Cumulative Remedies; Waiver. | 52 |

| Section 9.5. | Calculation of Time. | 52 |

| Section 9.6. | Severability. | 53 |

| Section 9.7. | Expenses. | 53 |

277494.00058/305713869.33

| | | | | | | | | | | |

| Section 9.8. | Further Assurances. | 53 |

| Section 9.9. | Governing Law | 53 |

| Section 9.10. | Enforcement of the Agreement; Jurisdiction; No Jury Trial. | 53 |

| Section 9.11. | Disclosure Schedule | 55 |

| Section 9.12. | Notices | 55 |

| Section 9.13. | Public Announcements | 56 |

| Section 9.14. | Descriptive Headings | 56 |

| Section 9.15. | Parties in Interest | 56 |

| Section 9.16. | Counterparts | 56 |

| Section 9.17. | Attorney-Client Privilege | 56 |

| Section 9.18. | Conflicts of Interest | 57 |

| Section 9.19. | Non-Recourse | 57 |

277494.00058/305713869.33

STOCK PURCHASE AGREEMENT

This STOCK PURCHASE AGREEMENT (this “Agreement”) is made and entered into as of July 31, 2024, by and among Averna Test Systems, Inc., a Georgia corporation (“Buyer”), and Kimball Electronics, Inc., an Indiana corporation (“Seller”), and Kimball Electronics Indiana, Inc., an Indiana corporation wholly owned by the Seller (the “Company” and together with Seller and Buyer, collectively the “Parties”).

RECITALS

WHEREAS the Company carries on the business of automation, test and measurement solutions, volume manufacturing, contract manufacturing services, global services and software for a variety of industries, including smart consumer electronics, semiconductor, automotive and medical (the “Business”);

WHEREAS, Seller owns all of the issued and outstanding capital stock of the Company, which consists of 100 shares of common stock, no par value per share (the “Company Common Stock”);

WHEREAS, Buyer desires to acquire from Seller, and Seller desires to sell to Buyer on the date hereof, all of the Company Common Stock, upon the terms and subject to the conditions set forth in this Agreement, as a result of which, the Company will, at the Closing, become a wholly-owned subsidiary of Buyer; and

NOW, THEREFORE, in consideration of the mutual representations, warranties, covenants and agreements contained in this Agreement, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

ARTICLE I. DEFINITIONS.

Section 1.1. Definitions. For purposes of this Agreement, the following terms shall have the definitions set forth below:

“Accounting Rules” means the rules, accounting principles, practices, procedures, policies, and methods (with consistent judgements, elections, and valuation and estimation methodologies), used and applied in the preparation of the Financial Statements; provided, however, that the rules, accounting principles, practices, procedures, policies, and methods used and applied in the preparation of the Financial Statements are in accordance with GAAP; and provided, further, that neither the Preliminary Closing Statement, nor the Proposed Closing Statement shall include any purchase accounting adjustments arising out of the consummation of the transactions contemplated hereby, provided, that, in the event of any conflict among the Accounting Rules and GAAP, then GAAP shall take precedence.

“Action” means any claim, action, cause of action, demand, lawsuit, arbitration, audit, notice of violation, proceeding, litigation, citation or investigation of any nature, civil, criminal, administrative, regulatory or otherwise, complaints, appeals, hearings, inquiries, assessments or reassessments (including for Tax), grievances, hearings whether at law or in equity, commenced, brought, conducted or heard by or before, or otherwise involving any Governmental Authority or arbitrator.

277494.00058/305713869.33

“Affiliate” means, with respect to any Person: (a) any director, officer, employee, stockholder, partner or principal of that Person; (b) any other Person of which that Person is a director, officer, employee, stockholder, partner or principal; (c) any Person who directly or indirectly controls or is controlled by, or is under common control with, that Person and for greater certainty includes a Subsidiary of such Person; and (d) with respect to any Person described above who is a natural person, any spouse and any relative (by blood, adoption or marriage) within the third degree of consanguinity of the Person. The term “control” means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by contract or otherwise, including the ability to elect the members of the board of directors or other Governing Body of such Person, and the terms “controlled” and “controlling” have meanings correlative thereto;

“Agreement” has the meaning set forth in the preamble.

“AI Products” means all Group Software that employ or make use of AI Technologies.

“AI Technologies” means any and all deep learning, machine learning, and other artificial intelligence technologies, including without limitation any and all: (a) proprietary algorithms, software, or systems that make use of or employ neural networks, statistical learning algorithms (such as linear and logistic regression, support vector machines, random forests, or k-means clustering), or reinforcement learning; and (b) proprietary embodied artificial intelligence and related hardware or equipment.

“Anticorruption Laws” has the meaning set forth in Section 4.18.

“Assessments” has the meaning set forth in Section 4.10(k).

“Books and Records” means any books, records and accounts of the Group (originals, to the extent they exist, or, if originals do not exist, copies thereof) related to the Business, the Company Common Stock and the employees of any member of the Group including, without limitation, databases, documents, correspondence with Governmental Authorities, equipment maintenance record and warranty information, manuals information related to the know-how or Intellectual Property, forms, advertising material, manuals, brochures, books and records relating to the purchase of materials and supplies, the services performed or provided, dealings with customers, invoices, customer lists, prospective customer lists, mailing lists, suppliers lists, telephone numbers, financial records, personnel records (to the extent permitted by Law) and Taxes.

“Business” has the meaning set forth in the recitals.

“Business Day” means any day on which national banks are open for business in the city of Wilmington, Delaware and Montreal, Quebec, other than a Saturday or a Sunday;

“Buyer” has the meaning set forth in the preamble.

“Buyer Indemnitee” has the meaning set forth in Section 8.3.

“CARES Act” means the Coronavirus Aid, Relief and Economic Security Act

“Cash” means the aggregate amount of all cash and cash equivalents (which are convertible into cash within thirty (30) days) of the Group held in the bank accounts of the Group, as determined

| | | | | | | | |

Stock Purchase Agreement – Averna/Kimball Electronics | 2 |

in accordance with GAAP, excluding (a) the aggregate amount of Restricted Cash, and (b) outbound checks, wires, drafts, and electronic funds transfers (EFT) not yet cleared, but only to the extent that such amounts in (a) and (b) are not reflected as a current liability in the determination of the Net Working Capital.

“Closing” has the meaning set forth in Section 2.1.

“Closing Date” has the meaning set forth in Section 2.1.

“Closing Cash” means the Cash of the Group as of the Effective Time plus the Vietnam VAT Receivable.

“Closing Indebtedness” means the Indebtedness of the Group as of the Effective Time.

“Closing Date Financial Statements” means the unaudited consolidated financial statements of the Group for the period ending as at the Closing Date.

“Closing Net Working Capital” means the Net Working Capital of the Group as of the Effective Time.

“Closing Transaction Expenses” means the Transaction Expenses of the Group as of the Effective Time.

“Code” means the Internal Revenue Code of 1986.

“Company” has the meaning set forth in the preamble.

“Company Common Stock” has the meaning set forth in the recitals.

“Computer Systems” means all hardware, software, networks and communication systems owned by any member of the Group that are material to carry on the Business or to carry on its day to day operations and affairs.

“Confidentiality Agreement” means that certain Confidentiality Agreement, dated as of October 30, 2023 by and between the Company and Averna Technologies Inc.

“Constating Records” means, in respect of any entity, the corporate and constating records of such entity, including (a) all articles, constituting and organizational documents and by-laws (including any partnership agreement, deed of trust or other); (b) all shareholders or equity holders agreements affecting such entity, (c) all minutes of meetings and resolutions of shareholders, equity holders and directors (and any committees); and (d) the share or equity certificate books, securities register, register of transfers and register of directors.

“Contract” means any legally binding written contract, subcontract, agreement, license, sublicense, lease, sublease, instrument, indenture, promissory note or other written and legally binding commitment or undertaking made by or to which any member of the Group is a party or by which any member of the Group is bound or under which any member of the Group has, or will have, any rights or obligations.

“COVID-19 Act” means, collectively, the Coronavirus Preparedness and Response Supplemental Appropriations Act of 2020, the Families First Coronavirus Response Act, the CARES Act, the Paycheck Protection Program and Health Care Enhancement Act, the Paycheck Protection Program Flexibility Act of 2020, the Consolidated Appropriations Act of 2021, and

| | | | | | | | |

Stock Purchase Agreement – Averna/Kimball Electronics | 3 |

the American Rescue Plan Act of 2021, as any of the same have been amended, and any current rules, regulations or official interpretations of any of the foregoing having the force of Law.

“Current Assets” means in relation to the Group, without duplication, all trade accounts receivables net of an allowance for doubtful accounts, accrued receivables, prepaid expenses, inventory net of a reserve, but excluding all Cash, deferred Tax assets, receivables from Seller, in each case determined in accordance with the Accounting Rules and the past practices of the Group.

“Current Financial Statements” has the meaning set forth in Section 4.7.

“Current Liabilities” means in relation to the Group, without duplication, all accounts payable, accrued expenses, wages payables, accrued vacations, accrued bonuses and goods and services Tax payable, but excluding the current portion of Indebtedness of the Group, deferred and future Tax liabilities, any payables to the Seller, the current portion of the operating lease liability measured at the present value under ASC 842 lease accounting standards, the incremental rebate settlement contingency accrual related to Apple Inc., the Transaction Expenses, in each case determined in accordance with GAAP and the past practices of the Group and in each case without duplication for any amounts included in Indebtedness.

“D&O Tail Policy” means a six (6)-year irrevocable “tail” directors’ and officers’ liability, employment practices liability, and fiduciary liability insurance policy effective as of the Closing, providing coverage for the individuals who were officers and directors of each member of the Group.

“Data Protection Law” shall mean all applicable Laws related to Personal Data, data protection, data privacy, data security, data breach notification, artificial intelligence, consumer marketing, or cross-border data transfer.

“Disclosure Schedule” has the meaning set forth in Section 4.3(a).

“Disputed Amounts” has the meaning set forth in Section 2.4(d).

“Dollars” or “$” means U.S. dollars.

“Effective Time” has the meaning set forth in Section 2.1.

“Employees” has the meaning set forth in Section 4.10.

“Employee Benefit Plan” has the meaning set forth in Section 4.9(a).

“Environmental Authorizations” means Permits, consents, agreements (including any sewer surcharge or discharge agreement), instructions, directions, or registrations issued, granted, conferred or required by a Governmental Authority with respect to any Environmental Law.

“Environmental Law” means any federal, state or local statute, Law, regulation, order, decree, permit or authorization in effect as of the date of this Agreement relating to: (a) the protection of health and safety or the environment or (b) the handling, use, transportation, disposal, release or threatened release of any Hazardous Substance, including such Laws relating to the withdrawal, contamination and use of groundwater and surface water, to management, excavation and soil contamination, the delivery of authorizations and Permits or to inspections and surveys, remedial actions and rehabilitation in connection with any presence, emission, discharge, emission,

| | | | | | | | |

Stock Purchase Agreement – Averna/Kimball Electronics | 4 |

generation, holding, handling, labelling, abatement, management, control, monitoring, existence, escape or disposal or threat of same of any Hazardous Substance, or relating to use, storage, disposal, transport or handling of any Hazardous Substance.

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended, and all regulations and rules promulgated thereunder, or any successor Law.

“ERISA Affiliate” means any entity which is (or at any relevant time was) a member of a controlled group of corporations, under common control or in an affiliated service group with the Company within the meaning of Section 414(b), (c) or (m) of the Code.

“Estimated Purchase Price” means an amount of $27,640,653.89, being the amount set forth in the Preliminary Closing Statement, being the amount equal to (a) the Unadjusted Purchase Price, plus (b) the Estimated Closing Cash, minus (c) the Estimated Closing Indebtedness, minus (d) the Estimated Transaction Expenses, plus (e) the Estimated Net Working Capital Adjustment.

“FCPA” has the meaning set forth in Section 4.18.

“Final Decision” means a conclusive determination or official ruling issued by a Governmental Authority that brings a legal dispute or administrative proceeding to a final and binding conclusion such that the conclusion is not subject to further appeal, challenge, review, or reconsideration by another Governmental Authority, court, tribunal, or other adjudicative body.

“Final Net Working Capital” means the Closing Net Working Capital included in the Final Purchase Price.

“Final Purchase Price” means the Purchase Price mutually agreed by the Parties, deemed to be agreed by the Parties under Section 2.4(c), or as determined by the Independent Accounting Firm under Section 2.4(g).

“Financial Statement Date” has the meaning set forth in Section 4.7.

“Financial Statements” has the meaning set forth in Section 4.7.

“Fraud” means the making of any representation or warranty contained in this Agreement where all of the following criteria are satisfied: (a) the representation or warranty made by the Seller and/or the Company is false; (b) the Seller and/or Company knew or believed the representation or warranty was false or made the representation or warranty with reckless indifference to the truth; (c) the Seller and/or Company intended the false or inaccurate representation or warranty to induce the Buyer to act or refrain from acting; (d) the Buyer acted or refrained from acting in justifiable reliance upon the representation or warranty; and (e) the Buyer incurred or suffered a Loss as a result of the reliance. For the avoidance of doubt, Fraud will not include any constructive fraud, negligent misrepresentation or omission, or any form of fraud premised on recklessness, gross negligence, or negligence.

“GAAP” means the United States generally accepted accounting principles in effect from time to time, applied on a consistent basis.

“Governing Body” means, with respect to any Person, the board of directors of such Person, and any Person or group of Persons exercising a similar authority.

| | | | | | | | |

Stock Purchase Agreement – Averna/Kimball Electronics | 5 |

“Governmental Authority” means (a) any national, state, federal, territorial, regional, municipal, local, domestic, or foreign government and any department, agency, bureau, commission, division, office, service, regulatory body or other instrumentality of such government; (b) any judicial, legislative, executive, administrative or regulatory authority, ministry, central bank, arbitral body, commission, agency, body, entity or commission or other governmental, quasi-governmental or regulatory authority or agency, domestic or foreign or international or private body exercising any regulatory, administrative, or expropriation authority under or for the account of any of the foregoing, including any private body having received a mandate to perform public services; (c) any self-regulated organization or other non-governmental regulatory authority or quasi-governmental authority to the extent that the rules, regulations or orders of such organization or authority have the force of law; and (d) any judiciary or quasi-judiciary tribunal, court or body.

“Group” means, collectively, the Company and all Subsidiaries thereof, and “member of the Group” means any one of them.

“Group Software” means Software designed and developed by a member of the Group.

“Hazardous Substance” means any material or substance, including an odour, a sound or a vibration, that is: (i) listed, classified, regulated or defined as hazardous, toxic, or words of similar import or regulatory effect pursuant to any Environmental Law or the Final Decision of a Governmental Authority (ii) any petroleum product or by-product, asbestos-containing material, polychlorinated biphenyls or radioactive material.

“Inbound Licenses” has the meaning set forth in Section 4.15(b).

“Indebtedness” means, in relation to the Group, without duplication, the following:

(a) the principal amount, plus any related accrued and unpaid interest, fees and prepayment premiums or penalties, of any obligation (i) for borrowed money or for the deferred purchase price of property or services, (ii) under any credit facility, (iii) evidenced by any note, bond, debenture or other debt security or similar instrument, (iv) under conditional sale or other title retention agreements relating to property purchased by such Person, (v) under letter of credit or letter of guaranty or similar facilities, (vi) for obligations required by GAAP to be categorized as capitalized leases (other than operating leases), or (vii) under interest rate cap, swap, collar or similar transaction or currency and other hedging transactions;

(b) any short term portion of long term indebtedness and any shareholders’ loans or advances, including amounts due to Seller;

(c) all obligations of any member of the Group as lessee under a capital lease and obligations under sale leasebacks of any member of the Group;

(d) pension-plan related liabilities;

(e) workers compensation liabilities;

(f) deferred revenue and customer deposits;

(g) unpaid income Taxes for any Pre-Closing Tax Period (which may be an amount less than zero and which shall include any offsets or reductions with respect to income Tax refunds or overpayments of Tax);

| | | | | | | | |

Stock Purchase Agreement – Averna/Kimball Electronics | 6 |

(h) all amounts payable relating to capital expenditures;

(i) all bonus amounts payable to directors, managers, officers, employees, agents and consultants of any member of the Group as a result of the transactions contemplated hereby, (ii) all termination and severance obligations, retention bonuses, “stay” bonuses and sale bonuses owed by any member of the Group to directors, managers, officers, employees, agents and consultants of any member of the Group triggered in whole or in part prior to or as a result of the transactions contemplated hereby and all termination and severance obligations accrued as of the date hereof; and (iii) the employer-portion of any contributions (including CPP/EI) and payroll, social security, unemployment or similar Taxes related to any payments described in each of clauses (i) and (ii); and

(j) any guarantees of such Person of any Indebtedness or obligations referred to in this definition of any other Person.

Indebtedness shall not include the amount of (i) indebtedness incurred by the Buyer or its Affiliates (and subsequently assumed by any member of the Group) on or after the Closing Date, and (ii) any amount reflected in the calculation of the Transaction Expenses or Net Working Capital.

“Indemnitee” has the meaning set forth in Section 8.5.

“Indemnitor” has the meaning set forth in Section 8.5.

“Independent Accounting Firm” has the meaning set forth in Section 2.4(d).

“Initial Consideration” has the meaning set forth in Section 2.3(b).

“Intellectual Property” means and includes (a) patents, applications for patents (including divisions, provisionals, continuations, continuations in-part and renewal applications), and any renewals, extensions or reissues thereof, in any jurisdiction; (b) inventions and discoveries, whether patentable or not in any jurisdiction; (c) registered and unregistered trademarks, service marks, brand names, certification marks, trade dress, assumed names, domain names, trade names and other indications of origin, the goodwill associated with the foregoing and registrations in any jurisdiction of, and applications in any jurisdiction to register, the foregoing, including any extension, modification or renewal of any such registration or application; (d) trade secrets, know-how, records of invention, whether patentable or not in any jurisdiction and (e) proprietary software, including all types of computer software programs, operating systems, application programs, software tools, firmware (including all types of firmware, firmware specifications, mask works, circuit layouts and hardware descriptions) and software imbedded in equipment, including both object code and source code, and all written or electronic data, documentation and materials that explain the structure or use of software or that were used in the development of software, including software specifications, or are used in the operation of the software (including logic diagrams, flow charts, procedural diagrams, error reports, manuals and training materials, look-up tables and databases), whether patentable or not in any jurisdiction and rights in any jurisdiction to limit the use or disclosure thereof and registrations thereof in any jurisdiction, and applications in any jurisdiction to register, the foregoing, including any extension, modification or renewal of any such registration or application.

“Intellectual Property Licenses” has the meaning set forth in Section 4.15(c).

| | | | | | | | |

Stock Purchase Agreement – Averna/Kimball Electronics | 7 |

“Intellectual Property Registrations” means all federal, state, regional, international and foreign: (a) patents, including applications therefore (including provisional applications), (b) registered trademarks, service marks and applications to register trademarks and service marks, including intent-to-use applications, (c) copyrights registrations and applications to register copyrights, (d) utility models, including applications therefore and (e) industrial designs and applications thereto; that are owned by any member of the Group.

“Inventories” or “Inventory” means all product held for sale by the Group and any materials (including components, finished goods, work in progress, raw materials, ingredients, packaging materials, production and shipping supplies, spare parts, maintenance items and advertising materials), in each case on hand, in transit, ordered but not delivered, warehoused or wherever situated.

“IRS” means the U.S. Internal Revenue Service.

“Knowledge of the Company” or “Company’s Knowledge” means the actual knowledge of [***] for all members of the Group, of [***] with respect to Kimball Electronics Indiana, Inc., of [***] with respect to Suzhou Kimball Electronics, Trading Limited and Suzhou Kimball Electronics Manufacturing Limited, of [***] with respect to Kimball Electronics (India), Private Limited and Kimball Electronics Japan G.K.; and of [***] with respect to Global Equipment Services & Manufacturing Vietnam Company Limited, after due and diligent internal inquiry, but without personal liability and without any obligation to make any independent investigation of, or any implied duty to investigate, such matters, or to make any inquiry of any other Person.

“Law” or “Laws” means all (a) laws (including common law, civil law and equity), statutes, codes, ordinances, decrees, rules, regulations, by-laws, statutory rules, Orders, decisions, from any Governmental Authority and (b) all policies, guidelines, notices, rulings or protocols of any Governmental Authority having the force of law, and the term “applicable” with respect to such Laws and in the context that refers to one or more Persons, means that such Laws apply to such Person or Persons or its or their business, undertaking, property or securities and emanate from a Person having or claiming to exercise legal jurisdiction over the Person or Persons or its or their business, undertaking, property or securities.

“Leased Real Property” has the meaning set forth in Section 4.16(a).

“Lien” means any lien (statutory or otherwise), pledge, mortgage, deed of trust, security interest, defect in title, vesting restriction, claim, lease, charge, option, right of first offer or refusal, easement, servitude, community or marital property interest, voting trust or agreement, transfer restriction under any stockholder or similar agreement, encumbrance or any similar restriction.

“Loss” or “Losses” means losses, damages, Taxes, liabilities, deficiencies, Actions, judgments, interest, awards, penalties or assessments, fines, costs or expenses of whatever kind, including reasonable attorneys' fees and the cost of enforcing any right to indemnification hereunder and the cost of pursuing any insurance providers.

“Material Adverse Effect” means an event, occurrence, change, fact or condition that, is materially adverse to (i) the business, assets, financial condition, or results of operations of the Company and its Subsidiaries, taken as a whole, or (ii) the ability of Seller to perform its obligations under this Agreement.

| | | | | | | | |

Stock Purchase Agreement – Averna/Kimball Electronics | 8 |

“Malicious Code” means any (a) “back door,” “drop dead device,” “time bomb,” “Trojan horse,” “virus,” or “worm” (as such terms are commonly understood in the software industry), (b) malware, ransomware, disabling codes or instructions, spyware, and/or (c) any other code or software routine able to: (i) perform an unauthorized process that will have adverse impact on the confidentiality, integrity, or availability of the Computer Systems, materially disrupt, disable, harm, cause security breaches, or otherwise impede in any manner the operation of, or provide unauthorized access to third parties who are not duly granted access pursuant to an applicable agreement, a Computer System or network or other device on which such code is stored or installed, or (ii) damage or destroy any material data or file without the user’s consent.

“Material Contract” has the meaning set forth in Section 4.17(a).

“Net Working Capital” means Current Assets (other than Cash) less Current Liabilities, in each case calculated in accordance with the Accounting Rules.

“Net Working Capital Adjustment” means the Closing Net Working Capital minus the Target Net Working Capital (whether a positive or negative number).

“Open Source License” means any “free software” license, “software libre” license, “public” license, or open-source software license, including without limitation the GNU General Public License, the GNU Lesser General Public License, the Mozilla Public License, the Apache license, the MIT license, the BSD and any BSD-like license, and any other license that is identified as an open-source license by the Open Source Initiative or meets the “Open Source Definition” promulgated by the Open Source Initiative.

“Open Source Software” means any Software that is subject to the terms and conditions of an Open Source License.

“Order” has the meaning set forth in Section 4.13(a).

“Outbound Licenses” means licenses under or the right to receive the services of (such as for example pursuant to a SaaS model) to any Owned Intellectual Property that any member of the Group has granted to third parties, except for customer agreements entered into in the ordinary course of business.

“Overpayment” has the meaning set forth Section 2.4(g).

“Owned Intellectual Property” has the meaning set forth in Section 4.15(a).

“Owned Real Property” has the meaning set forth in Section 4.16(a).

“Permits” has the meaning set forth in Section 4.13(b).

“Permitted Claims” has the meaning set forth in Section 8.2(a).

“Permitted Lien” means (a) liens for Taxes not yet due and payable or that are being contested in good faith and by appropriate proceedings and in respect of which adequate reserves are maintained in accordance with GAAP applied on a basis consistent with the application thereof to the Financial Statements; (b) mechanics', carriers', workmen's, repairmen's, materialmen's and other liens arising by operation of Law which have not at such time been filed pursuant to Law or which relate to obligations not due and payable or, if overdue, are being contested in good faith by appropriate proceedings and in respect of which adequate reserves are maintained in

| | | | | | | | |

Stock Purchase Agreement – Averna/Kimball Electronics | 9 |

accordance with GAAP applied on a basis consistent with the application thereof to the Financial Statements;; (c) pledges or deposits to secure obligations under workers' compensation Laws or similar Laws or to secure public or statutory obligations; (d) easements, encroachments, declarations, covenants, conditions, reservations, limitations and rights of way (unrecorded and of record) and other similar restrictions or encumbrances of record, zoning, building and other similar ordinances, regulations, variances and restrictions, and minor defects or minor irregularities in title, in each case which individually and/or in the aggregate do not materially affect, detract from or impair the occupation, use of enjoyment of the Real Property; and (e) liens specifically listed in Section 4.16 of the Disclosure Schedules.

“Person” means any individual, corporation (wherever incorporated), firm, joint venture, works council or employee representative body, limited liability company, partnership, association, trust, estate or other entity or organization including a government, state or agency of a state or Governmental Authority.

“Personal Data” means any data or other information that (i) relates to an individual and that directly or indirectly allows such individual to be identified; and (ii) is protected by or subject to any Data Protection Law applicable to the Group.

“Pre-Closing Tax Period” means any taxable period ending on or before the Closing Date and, with respect to any Straddle Period, the portion of such Straddle Period ending on and including the Closing Date.

“Pre-Closing Taxes” means Taxes of the Group for any Pre-Closing Tax Period.

“Pre-Closing Warranty” means the written contractual warranty between a member of the Group and the Group’s customer for products or services delivered prior to the Closing.

“Pre-Closing Warranty Claim” means a claim made by a Group customer (i) after Closing, (ii) during the period covered by the Pre-Closing Warranty, and (iii) that Buyer has reasonably determined is a valid claim for breach of the Pre-Closing Warranty.

“Pre-Closing Warranty Claim Reimbursement” means the reasonable, actual, direct costs incurred by Buyer (or relevant member of the Group) to (i) repair or replace the products or re-perform the services under a Pre-Closing Warranty Claim, or (ii) credit or refund the price of the products or services actually paid to the Group prior to Closing for the products or services in question.

“Preliminary Closing Statement” means the good faith estimate as of the Effective Time of (a) the Net Working Capital Adjustment (the “Estimated Net Working Capital Adjustment”), (b) the Closing Cash (the “Estimated Closing Cash”), (c) the Closing Indebtedness (the “Estimated Closing Indebtedness”), (d) the Closing Transaction Expenses (the “Estimated Transaction Expenses”), (e) the resulting Estimated Purchase Price, which has been prepared on behalf of Seller by its in accordance with the definitions of such terms set forth in this Agreement, including without limitation, the Accounting Rules, and is attached hereto as Schedule 2.

“Prior Period Returns” has the meaning set forth in Section 7.1.

“Proceeding” has the meaning set forth in Section 8.5.

| | | | | | | | |

Stock Purchase Agreement – Averna/Kimball Electronics | 10 |

“Proposed Closing Statement” has the meaning set forth in Section 2.4(a).

“Purchase Price” has the meaning set forth in Section 2.3(a).

“Real Property” has the meaning set forth in Section 4.16(a).

“Related Party” means (a) any partner, shareholder, director, officer, trust, trustee or similar fiduciary of Seller or any member of the Group, or (b) any Person not acting at arm’s length (as defined in any applicable Tax Law) with any member of the Group or Seller.

“Restricted Cash” means the aggregate amount of all cash or cash equivalents that are not freely usable by the Group because such cash or cash equivalents are subject to restrictions or limitations on use or distribution by applicable Laws, Contract or otherwise, including deposits under customer Contracts, restrictions or penalties on dividends or repatriation, and any cash held in escrow by a third party.

“Representative” means, with respect to any Person, any and all directors, officers, employees, and agents of such Person.

“Review Period” has the meaning set forth in Section 2.4(b).

“RWI Insurer” means the issuer of the RWI Policy.

“RWI Policy” means the bound buyer-side side representation and warranty insurance policy obtained by Buyer (or its Affiliate) on terms consistent with Schedule 3 insuring the representations and warranties set forth in Article III and Article IV and incepted at the time of execution of this Agreement.

“Securities Act” means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

“Seller” has the meaning set forth in the preamble.

“Seller Counsel” has the meaning set forth in Section 9.17.

“Seller Indemnitee” has the meaning set forth in Section 8.4.

“Seller Tax Claim” has the meaning set forth in Section 7.1(d).

“Software” means (a) computer programs and any other software, whether in Source Code, object code, or other form, (b) software implementations of algorithms, models, and methodologies, firmware, application programming interfaces, (c) descriptions, schematics, specifications, flow charts and other work product used to design, plan, organize and develop any of the foregoing, (d) software embodied in any sensor component or used in the design, test, and manufacture of any sensor component, (e) programmable logic and human readable or any intermediate hardware logic description language (including HDL and VHDL) that are used to program or configure a device such as an FPGA, a CPLD, or an ASIC, and (f) documentation, including user documentation, user manuals and training materials, files, and records relating to any of the foregoing.

“Source Code” means the human readable source code of the software to which it relates, in the programming language in which such software was written (including (a) statements in batch or scripting languages, (b) hardware definition languages such as VHDL, and (c) firmware code)

| | | | | | | | |

Stock Purchase Agreement – Averna/Kimball Electronics | 11 |

and any other source code, together with all related flow charts and technical documentation, including a description of the procedure for generating object code, all of a level sufficient to enable a programmer reasonably fluent in such programming language to understand, build, operate, support, maintain and develop modifications, upgrades, updates, adaptations, enhancements, new versions and other derivative works and improvements of, and to develop computer programs compatible with, such software.

“SPB” has the meaning set forth in Section 9.17.

“Straddle Period” has the meaning set forth in Section 7.3.

“Straddle Period Returns” has the meaning set forth in Section 7.1(c).

“Subrogation Waiver” has the meaning set forth in Section 6.3(b).

“Subsidiary” means an entity owned wholly or in part by another Person, which other Person, directly or indirectly, owns more than 50% of the stock or other equity interests of such entity having voting power to elect a majority of the board of directors or other governing body of such entity, and, in the case of the Company, those entities disclosed in Section 4.3(a) of the of the Disclosure Schedule.

“Target Net Working Capital” means $12,150,000.

“Tax” or “Taxes” means all federal, state, local or foreign income, gross receipts, profits, sales, use, production, occupation, value added, capital stock, social security and other compulsory employee or social insurance, worker’s compensation, net worth, ad valorem, transfer, franchise, escheat, registration, profits, license, lease, service, service use, withholding, payroll, employment, unemployment, estimated, excise, environmental, stamp occupation, premium, property (real or personal), real property gains, windfall profits, customs, duties, employment insurance, health insurance, Governmental Authority pension plan premiums or contributions and for greater certainty, all contributions payable under any tax Laws or other similar taxes, fees, assessments or charges of any kind in the nature of taxes, whether disputed or not, together with any interest, additions, surcharges, cess or penalties with respect thereto and any interest in respect of such additions or penalties.

“Tax Refunds” has the meaning set forth in Section 7.1(f).

“Tax Return” means any return, declaration, report, claim for refund, or information return or statement relating to Taxes, including any schedule or attachment thereto and any amendment thereof, filed with or to be filed with any Taxing Authority with respect to any Tax.

“Tax Return Procedures” means the procedures for preparing Tax Returns, including Prior Period Returns and Straddle Period Returns, described in Section 7.1.

“Taxing Authority” means, with respect to any Tax, the Governmental Authority that imposes such Tax and the agency (if any) charged with the collection of such Tax for such Governmental Authority, including the IRS.

“Third Party Claim” means any Action by any Person other than the Parties to this Agreement.

“Training Data” means training data, validation data, and test data or databases used to train or improve an algorithm or a model used in Group Software.

| | | | | | | | |

Stock Purchase Agreement – Averna/Kimball Electronics | 12 |

“Transaction Expenses” means the following third-party expenses, to the extent not already considered as Current Liabilities in the calculation of the Estimated Purchase Price or of the Final Purchase Price and to the extent not already paid by the Group or by the Seller: (a) the legal, broker, financial advisory and accounting costs and expenses and other advisory and services expenses incurred or to be incurred by or on behalf of any member of the Group in connection with the consummation of the transactions provided herein, including the preparation, execution and delivery of this Agreement and all ancillary documents; (b) 50% of the premium of the RWI Policy, and the underwriting fees and brokerage commission payable to Atlantic Global Risk LLC in connection with the RWI Policy; and (c) 100% of the premium of the D&O Tail Policy.

“Transfer Tax” has the meaning set forth in Section 7.7.

“Transfer Tax Filings” has the meaning set forth in Section 7.7.

“Unadjusted Purchase Price” means Twenty-One Million Dollars ($21,000,000).

“Underpayment” has the meaning set forth in Section 2.4(h).

“Vietnam VAT Receivable” means the $3,328,439 returned by the Socialist Republic of Vietnam to Global Equipment Services & Manufacturing Vietnam Company Limited in respect of sales made.

“WARN Act” has the meaning set forth in Section 4.10(i).

Section 1.2. Interpretation. The words “hereof,” “herein,” “hereby,” “herewith” and words of similar import shall, unless otherwise stated, be construed to refer to this Agreement as a whole and not to any particular provision of this Agreement, and article, section, paragraph, exhibit and schedule references are to the articles, sections, paragraphs, exhibits and schedules of this Agreement unless otherwise specified. Whenever the words “include,” “includes” or “including” are used in this Agreement they shall be deemed to be followed by the words “without limitation.” The words describing the singular number shall include the plural and vice versa, words denoting either gender shall include both genders and words denoting natural Persons shall include all Persons and vice versa. The phrases “the date of this Agreement,” “the date hereof,” “of even date herewith” and terms of similar import, shall be deemed to refer to the date set forth in the preamble to this Agreement. Any reference in this Agreement to a date or time shall be deemed to be such date or time in Wilmington, Delaware, unless otherwise specified. The Parties have participated jointly in the negotiation and drafting of this Agreement. In the event an ambiguity or question of intent or interpretation arises, this Agreement shall be construed as if drafted jointly by the Parties and no presumption or burden of proof shall arise favoring or disfavoring any Person by virtue of the authorship of any provision of this Agreement.

Section 1.3. Accounting Terms and Definitions. Unless otherwise specified herein, all accounting terms used herein shall be interpreted, and all accounting determinations hereunder shall be made, in accordance with GAAP, applicable as at the date on which such calculation or determination is made or taken or required to be made or taken in accordance with GAAP.

Section 1.4. Dollar Amounts Not Materiality Admissions. The specification of any dollar amount in the representations and warranties or otherwise in this Agreement or in the

| | | | | | | | |

Stock Purchase Agreement – Averna/Kimball Electronics | 13 |

Disclosure Schedules is not intended and shall not be deemed to be an admission or acknowledgment of the materiality of such amounts or items, nor shall the same be used in any dispute or controversy between the parties to determine whether any obligation, item or matter (whether or not described herein or included in any schedule) is or is not material for purposes of this Agreement.

Section 1.5. Schedules. The Schedules attached hereto are incorporated by reference and deemed to be part hereof, including:

Schedule 1 Permitted Liens

Schedule 2 Preliminary Closing Statement

Schedule 3 RWI Policy

Section 1.6. Making Available. Any reference to a document, information, or matter being “delivered” or “made available” to Buyer and similar expressions shall mean the posting of such document, information or matter on the virtual data room established by Seller or matters transmitted to Buyer or its Representatives via electronic mail or other electronic transfer means to which Buyer has had access (regardless of whether Buyer has viewed, accessed or downloaded the materials but provided that access to the same via the virtual data room shall have been granted to Buyer at least three (3) Business Days prior to the Closing Date).

ARTICLE II. CLOSING; PURCHASE PRICE; ADJUSTMENTS AND RELATED MATTERS.

Section 2.1. Closing. The closing of the transactions contemplated by this Agreement (the “Closing”) shall take place remotely via the electronic exchange of documents and executed signature pages at approximately 10:00 a.m., Eastern time, on the date hereof, or on another date as the parties may mutually agree. The date on which the Closing occurs is referred to in this Agreement as the “Closing Date”. All proceedings to be taken and all documents to be executed and delivered by the Parties at the Closing will be deemed to have been taken and executed simultaneously and no proceedings will be deemed to have been taken nor documents executed or delivered until all have been taken, executed and delivered. For accounting purposes, the effective time of the Closing shall be 11:59 p.m. Eastern Time on the Closing Date (the “Effective Time”).

Section 2.2. Purchase and Sale of Equity. Subject to the terms and conditions hereof, Seller hereby sells, transfers, assigns and conveys to Buyer, and Buyer hereby purchases and accepts from Seller, all of Seller's rights, title and interest in and to the Company Common Stock, free and clear of all Liens. Sellers have delivered to Buyer an electronic copy of the former stock certificate representing the Company Common Stock and at the Closing, Sellers shall deliver duly executed stock powers for the same.

Section 2.3. Purchase Price.

(a) Subject to the terms and conditions of this Agreement, the consideration to be paid by Buyer for the Company Common Stock shall be an amount equal to (i) the Unadjusted Purchase Price, plus (ii) the Closing Cash, minus (iii) the Closing Indebtedness, minus (iv) the Closing Transaction Expenses, plus (v) the Net Working Capital Adjustment (and as such

| | | | | | | | |

Stock Purchase Agreement – Averna/Kimball Electronics | 14 |

amount may be adjusted pursuant to the provisions of Section 2.4, the “Purchase Price”) it being understood that the adjustments referred to in paragraphs (ii) to (v) shall be calculated as of the Effective Time.

(b) At the Closing Buyer shall make or cause to be made by wire transfer of immediately available funds to the account specified by Seller to Buyer, an amount equal to $24,312,214.89 (the “Initial Consideration”).

Section 2.4. Post-Closing Adjustment of Purchase Price.

(a) As promptly as practicable, but in no event later than sixty (60) days following the Closing Date, Buyer shall deliver to Seller a statement setting forth Buyer’s calculation of (i) the Closing Cash, (ii) the Closing Indebtedness, (iii) the Closing Transaction Expenses, (iv) the Net Working Capital Adjustment, and (v) the Purchase Price resulting therefrom (collectively, the “Proposed Closing Statement”). The Proposed Closing Statement will be prepared in accordance with the Accounting Rules.

(b) Seller shall have a period of thirty (30) days after receipt of the Proposed Closing Statement to review it (the “Review Period”) and to notify Buyer of any disputes regarding the Proposed Closing Statement or the calculation of Closing Cash, Closing Indebtedness, Closing Transaction Expenses or Closing Net Working Capital. During the Review Period, Seller, Seller’s accountants, and Seller’s counsel shall have access to the Group’s books and, work papers and to the persons who prepared the Proposed Closing Statement, in accordance with customary protocols regarding such access.

(c) If Seller approves in writing of Buyer's determination of the Closing Cash, Closing Indebtedness, Transaction Expenses and Closing Net Working Capital as set forth on the Proposed Closing Statement, or if Seller fails to deliver an Objection Notice, as provided below, then Buyer's determinations as indicated in the Proposed Closing Statement will become binding on all Parties to this Agreement.

(d) If Seller disagrees with the computation of the Closing Cash, the Closing Indebtedness, Transaction Expenses or Closing Net Working Capital as reflected on the Proposed Closing Statement, Seller shall deliver a written notice ("Objection Notice") to Buyer, within the Review Period, setting forth Seller’s calculation of such items and the basis, with reasonable specificity, for the differences identified by Seller. Buyer and Seller will negotiate in good faith in an effort to resolve those disputes. If the Parties are unable to resolve any dispute within thirty (30) days after Seller delivers the Objection Notice, then Buyer and Seller will jointly retain a nationally recognized independent certified public accounting firm that is mutually acceptable to Buyer and Seller (the “Independent Accounting Firm”), acting as arbitrators and experts and not as auditors, to resolve the amounts still in dispute (the “Disputed Amounts”). The Parties shall make readily available to the Independent Accounting Firm all relevant books and records relating to the Proposed Closing Statement, and all other items reasonably requested by the Independent Accounting Firm.

(e) The Independent Accounting Firm shall not be entitled to consider any items or matters other than the Disputed Amounts and make any adjustments to the Proposed Closing Statement in connection therewith. The Parties agree that the Independent Accounting Firm’s decision regarding each Disputed Amount must be within the range of values assigned to such

| | | | | | | | |

Stock Purchase Agreement – Averna/Kimball Electronics | 15 |

item in the Proposed Closing Statement and the Objection Notice, respectively. The Independent Accounting Firm shall make its determination based solely on presentations and information provided by Buyer or Seller and not by independent review. The Independent Accounting Firm’s determination as to the resolution of the Disputed Amounts shall be in writing and the Parties shall direct the Independent Auditor to furnish such determination to Seller and Buyer as promptly as practicable after the Disputed Amounts have been referred to the Independent Accounting Firm (and in any event within thirty (30) days thereafter, unless the Parties shall agree in writing otherwise). Buyer and Seller each agrees that absent bad faith, Fraud, or manifest error on the part of the Independent Accounting Firm, they shall be bound by the determination of the Disputed Amounts and Final Purchase Price arising therefrom by the Independent Accounting Firm.

(f) The fees, costs and expenses of the Independent Accounting Firm shall be allocated between Seller and Buyer as determined (and as set forth in the final determination) by the Independent Accounting Firm based upon the relative success (in terms of percentages) of each of Buyer’s claim, on the one hand, and Seller’s claim, on the other hand. For example, if the final determination reflects a sixty-forty (60-40) compromise of the Parties’ claims, the Independent Accounting Firm would allocate expenses forty percent (40%) to the Party (i.e. either Buyer, on the one hand, or Seller, on the other hand) whose claims were determined to be sixty percent (60%) successful and sixty percent (60%) to the Party (i.e. either Buyer, on the one hand, or Seller, on the other hand) whose claims were determined to be forty percent (40%) successful.

(g) If the Final Purchase Price is less than the Estimated Purchase Price (such difference, represented by a negative number, being the “Overpayment”), then Seller shall pay to Buyer an amount equal to the Overpayment in immediately available funds to an account designated by Buyer.

(h) If the Final Purchase Price exceeds the Estimated Purchase Price (such difference represented by a positive number, being the “Underpayment”), then Buyer shall pay to Seller an amount equal to the Underpayment in immediately available funds to an account designated by Seller.

(i) The failure of Buyer to assert any matter that could have been asserted in the Proposed Closing Statement and that Buyer was aware or had knowledge of at shall constitute a waiver of Buyer of any right of Buyer to assert any such matter at any subsequent date as a breach of a representation and warranty against the Seller. For the avoidance of doubt, the Parties agree that the preceding sentence shall not in any way limit Buyer’s right under the RWI Policy.

Section 2.5. Treatment of Equity Awards. As of the date hereof, no Company Common Stock awards are due to any Person and the Company has no Company Common Stock award plans in effect. Any such Company Common Stock awards or plans deemed to exist shall terminate as of the date hereof.

Section 2.6. Vietnam VAT Receivable. Within 20 Business Days following the Closing, Buyer shall pay to Seller the amount of the Vietnam VAT Receivable in immediately available funds to an account designated by Seller.

| | | | | | | | |

Stock Purchase Agreement – Averna/Kimball Electronics | 16 |

ARTICLE III. REPRESENTATIONS AND WARRANTIES OF SELLER.

Seller represents and warrants to Buyer as of the date hereof (other than representations and warranties that are made as of a specific date which are made only as of such date) as follows:

Section 3.1. Execution and Delivery; Valid and Binding Agreements. This Agreement has been duly executed and delivered by Seller, and assuming that this Agreement is a valid and binding agreement of Buyer, this Agreement constitutes the valid and binding obligation of Seller, enforceable in accordance with its terms, except to the extent that enforceability may be limited by applicable bankruptcy, insolvency, reorganization, moratorium and similar Laws, now or hereafter in effect, affecting creditors' rights generally and by general principles of equity.

Section 3.2. Authority. The Seller has been duly incorporated or otherwise formed, under all applicable Laws, is organized and validly subsisting and is in good standing under the Laws of its jurisdiction of incorporation or other formation. Seller has all requisite power and authority and full legal capacity to execute and deliver this Agreement and to perform its obligations hereunder (including, without limitation, all right, power, capacity, and authority to sell, transfer, convey, and surrender the Company Common Stock owned by Seller as provided by this Agreement free and clear of all Liens.

Section 3.3. No Breach. The execution, delivery, and performance of this Agreement by Seller and the consummation of the transactions contemplated hereby do not conflict with, constitute a default under, or result in a violation under the provisions of Seller's governing organizational documents, if applicable, or Lien to which Seller is bound, or any Law or result in the creation of a Lien upon the Company Common Stock held by Seller, or require any authorization, consent, approval, exemption or other action by or notice to any court or other Governmental Authority.

Section 3.4. Ownership. Seller is the record and beneficial owner of all of the Company Common Stock, free and clear of any Liens, and, upon delivery of and payment for such Company Common Stock as herein provided, Buyer will acquire good and valid title thereto, free and clear of any Lien.

Section 3.5. Litigation. Except as set forth on Section 3.5 of the Disclosure Schedule, there is no complaint, claim, action, suit, litigation, proceeding or governmental or administrative investigation pending or, to Seller's Knowledge, threatened against or involving Seller, that would prevent or restrict Seller's performance of its obligations under this Agreement or the consummation of the transactions contemplated hereby.

Section 3.6. Approvals and Consents. Except as set forth in Section 3.6 of the Disclosure Schedule, no consent, approval, notice, Order, authorization, registration, declaration, filing, submission of information, waiver, sanction, license, exemption or Permit is necessary or otherwise required to be obtained by the Seller from any Governmental Authority or Person or pursuant to any Law in connection with the execution and delivery of this Agreement or the consummation by the Seller of the transactions contemplated hereby.

| | | | | | | | |

Stock Purchase Agreement – Averna/Kimball Electronics | 17 |

Section 3.7. Brokerage. Except for the fees and expenses of B. Riley Securities, Inc. which shall be the sole responsibility of Seller, there are no claims for brokerage commissions, finders' fees or similar compensation in connection with the transactions contemplated by this Agreement based on any arrangement or agreement made by or on behalf of Seller.

Section 3.8. Competition Law Matters (Vietnam). The Seller does not have, on a consolidated basis with the Group and the other affiliated enterprises of the Seller, (i) total assets in the Vietnam market equal to VND 3 trillion or more in the last financial year, and (ii) total sales turnover or input purchase turnover in the Vietnam market equal to VND 3 trillion or more in the last financial year (within the meaning given to the terms “assets”, “sales turnover” and “input purchase turnover” in Vietnam’s Law on Competition No. 23/2018/QH14 and the regulations promulgated thereunder). Furthermore, the combined market share of the members of the Group, together with the Seller, do not represent 20% or more in the relevant market in the last financial year (within the meaning given to the terms “combined market share” in Vietnam’s Law on Competition No. 23/2018/QH14 and the regulations promulgated thereunder).

Section 3.9. No Other Representations and Warranties. EXCEPT AS EXPRESSLY SET FORTH IN THIS ARTICLE III (AS MODIFIED BY THE DISCLOSURE SCHEDULE), THE REPRESENTATIONS AND WARRANTIES SET FORTH IN THIS ARTICLE III ARE SELLER’S SOLE AND EXCLUSIVE REPRESENTATIONS AND WARRANTIES AND NEITHER SELLER NOR ANY OTHER PERSON HAS MADE, OR SHALL BE DEEMED TO HAVE MADE, AND NO SELLER NOR ANY OF ITS DIRECTORS, MANAGERS, OFFICERS, EMPLOYEES, AGENTS OR REPRESENTATIVES IS LIABLE FOR OR BOUND IN ANY MANNER BY, ANY EXPRESS OR IMPLIED, AT LAW OR IN EQUITY, REPRESENTATIONS, WARRANTIES, GUARANTIES, PROMISES OR STATEMENTS PERTAINING TO THE COMPANY, THE COMPANY’S SUBSIDIARIES, THE SELLER OR THE COMPANY EQUITY, INCLUDING WITH RESPECT TO MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR PURPOSE, AND ANY SUCH REPRESENTATIONS OR WARRANTIES ARE HEREBY EXPRESSLY DISCLAIMED AND EXCLUDED FROM THIS AGREEMENT AS COMPREHENSIVELY AS CAN BE CONCEIVED AND THE LAW WILL ALLOW. EXCEPT AS EXPRESSLY SET FORTH IN THIS ARTICLE III AND ARTICLE IV (AS MODIFIED BY THE DISCLOSURE SCHEDULE), THE BUYER IS ACQUIRING THE COMPANY COMMON STOCK ON AN “AS IS, WHERE IS” BASIS. FOR THE AVOIDANCE OF DOUBT THE PRECEDING SENTENCE SHALL NOT IN ANY WAY LIMIT BUYER’S RIGHT UNDER THE RWI POLICY. NOTWITHSTANDING THE FOREGOING, THIS SECTION 3.9 DOES NOT CONSTITUTE A WAIVER OR RENUNCIATION BY THE BUYER OF ANY RIGHT OR RECOURSE EXPRESSLY SET FORTH IN THIS AGREEMENT, INCLUDING THE RIGHT TO BE INDEMNIFIED IN ACCORDANCE WITH Article VIII.

ARTICLE IV. REPRESENTATIONS AND WARRANTIES OF THE COMPANY.

The Company hereby represents and warrants to Buyer as of the date hereof (other than representations and warranties that are made as of a specific date which are made only as of such date) as follows.

| | | | | | | | |

Stock Purchase Agreement – Averna/Kimball Electronics | 18 |

Section 4.1. Organization and Corporate Power. The Company is a corporation duly incorporated, organized, validly existing and in good standing under the laws of the State of Indiana and has all corporate power and authority necessary to own, lease, and operate its properties and assets and to carry on its business as currently conducted. The Company is duly qualified or licensed to do business and is in good standing in each of the jurisdictions in which the character of the properties owned or held under lease by it or the nature of the business transacted by it makes such qualification necessary.

Section 4.2. Capitalization.

(a) The authorized capital stock of the Company consists of 100 shares of common stock, no par value per share. As of the date hereof, 100 shares of Company Common Stock were issued and outstanding.

(b) All of the outstanding Company Common Stock is held of record by Seller.

(c) On the date hereof, there are no outstanding shares of capital stock of, or other equity or voting interest in, the Company, and no outstanding (i) securities of the Company convertible into or exchangeable for shares of capital stock or voting securities or ownership interests in the Company, (ii) options, warrants, rights or other agreements or commitments to acquire from the Company, or obligations of the Company to issue, any capital stock, voting securities or other equity ownership interests in (or securities convertible into or exchangeable for capital stock or voting securities or other equity ownership interests in) the Company, (iii) obligations of the Company to grant, extend or enter into any subscription, warrant, right, convertible or exchangeable security or other similar agreement or commitment relating to any capital stock, voting securities or other ownership interests in the Company, or (iv) obligations (excluding Taxes and other fees) by the Company or any of its Subsidiaries to make any payments based on the market price or value of the Company Common Stock. As of the date of this Agreement, neither the Company nor any of its Subsidiaries has outstanding obligations to purchase, redeem or otherwise acquire any Company securities described in clauses (i), (ii) and (iii) hereof.

Section 4.3. Subsidiaries.