0001227500false00012275002024-04-162024-04-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 16, 2024

EQUITY BANCSHARES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

Kansas |

001-37624 |

72-1532188 |

(State or other jurisdiction of incorporation or organization) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

|

|

|

7701 East Kellogg Drive, Suite 300 Wichita, KS |

|

67207 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: 316.612.6000

Former name or former address, if changed since last report: Not Applicable

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class Class A, Common Stock, par value $0.01 per share |

Trading Symbol EQBK |

Name of each exchange on which registered New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02 Results of Operations and Financial Condition.

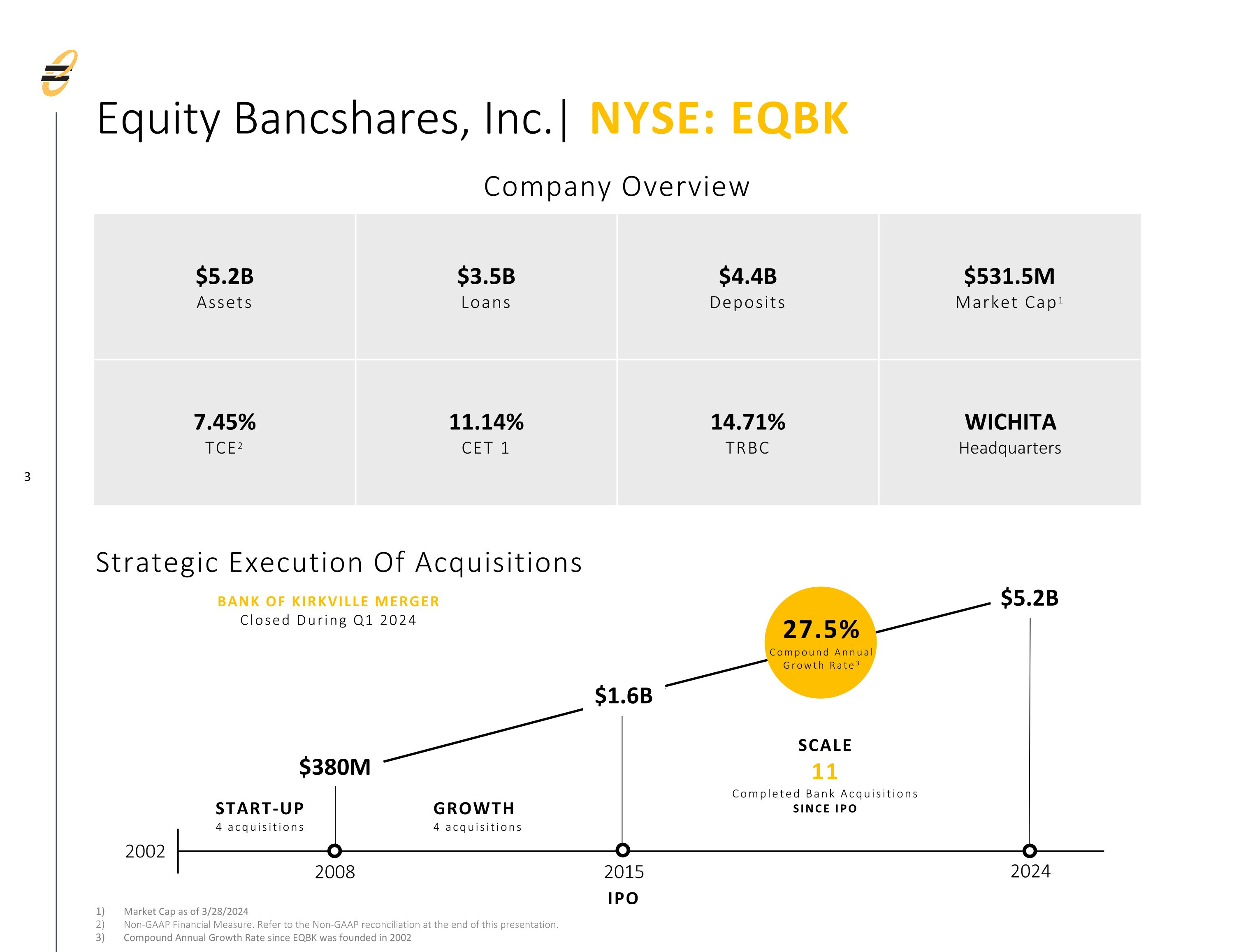

On April 16, 2024. Equity Bancshares, Inc. (the “Company”) issued a press release announcing its financial results for the first quarter ended March 31, 2024. A copy of the press release is furnished as Exhibit 99.1 and is incorporated by reference herein.

The information in this Item 2.02, including Exhibit 99.1, is being furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, unless specifically identified therein as being incorporated therein by reference.

Item 7.01 Regulation FD Disclosure.

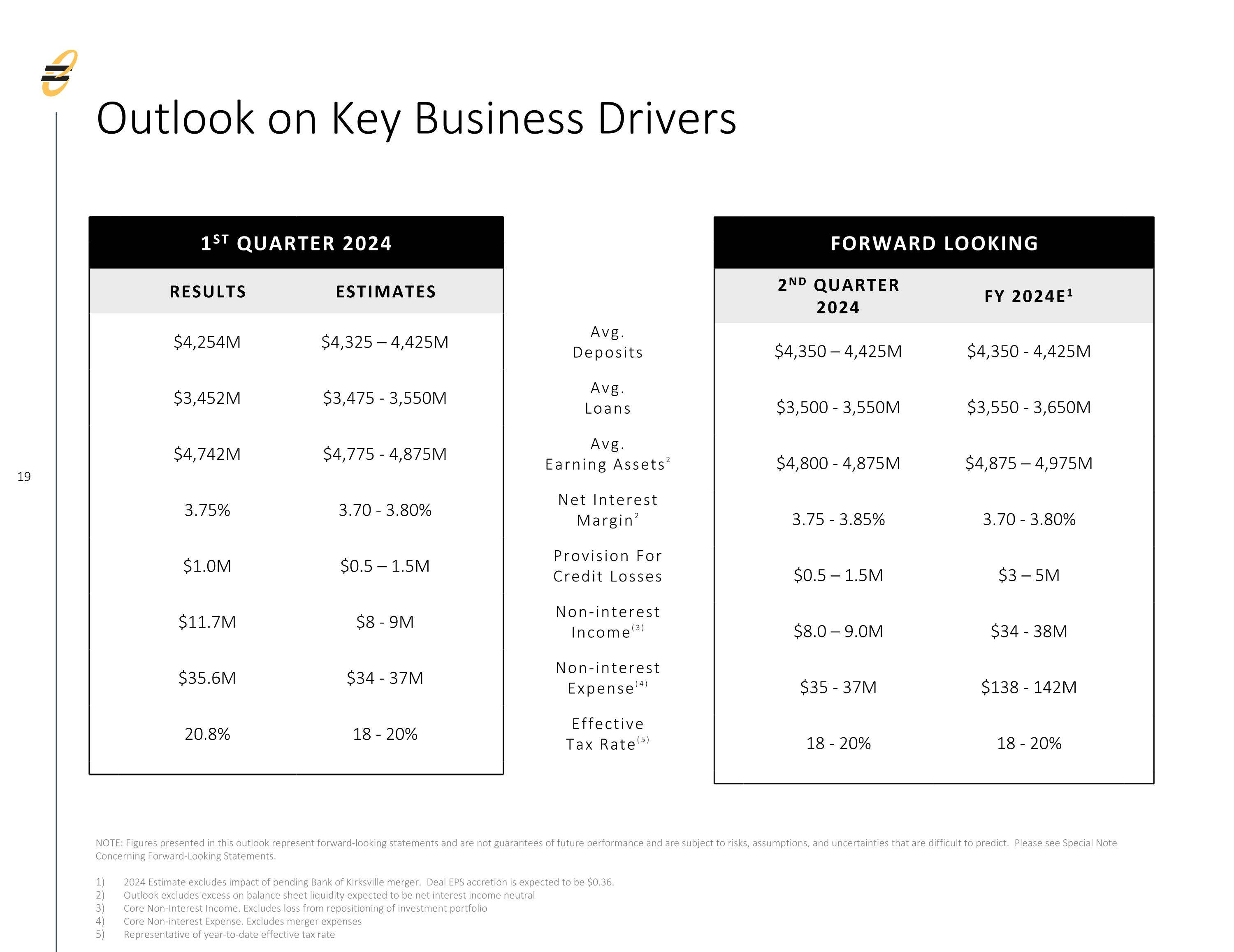

The Company intends to hold an investor call and webcast to discuss its financial results for the first quarter ended March 31, 2024, on Wednesday, April 17, 2024, at 9:00 a.m. Central Time. The Company’s presentation to analysts and investors contains additional information about the Company’s financial results for the first quarter ended March 31, 2024, and is furnished as Exhibit 99.2 and is incorporated by reference herein.

The information in this Item 7.01, including Exhibit 99.2, is being furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act or the Exchange Act, unless specifically identified therein as being incorporated therein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

Equity Bancshares, Inc. |

|

|

Date: April 16, 2024 |

By: /s/ Chris M. Navratil |

|

Chris M. Navratil |

|

Executive Vice President and Chief Financial Officer |

Equity Bancshares, Inc. Exhibit 99.1

PRESS RELEASE

Equity Bancshares, Inc. First Quarter Results Highlighted by Record Net Interest Income and Net Interest Margin Expansion

Reports NIM of 3.75%, Completes Merger with Rockhold Bancorp, Adding to Missouri Franchise

WICHITA, Kansas, April 16, 2024 (BUSINESSWIRE) – Equity Bancshares, Inc. (NYSE: EQBK), (“Equity”, “the Company”, “we,” “us,” “our”), the Wichita-based holding company of Equity Bank, reported net income of $14.1 million or $0.90 earnings per diluted share for the quarter ended March 31, 2024.

“Our Company entered the year positioned to take advantage of opportunities which we expect will drive our operating growth in the future,” said Brad S. Elliott, Chairman and CEO of Equity. “With our team’s proven, strategic skillset and cultivated relationships within our banking community, we were able to complete our merger with the Bank of Kirksville on February 9, 2024, just 67 days after announcement of the formal agreement. We are excited about our Company’s capacity to continue to leverage our skills and position to grow our franchise.”

"In addition, our retail and commercial teams throughout our footprint continued to build customer relationships and provide value to business and consumer customers in the quarter," Mr. Elliott said. "Our classified asset ratio continues to be historically low, while both capital and on balance sheet reserves remain high, positioning Equity to continue to pursue strategic growth opportunities, both organically and through mergers.”

Notable Items:

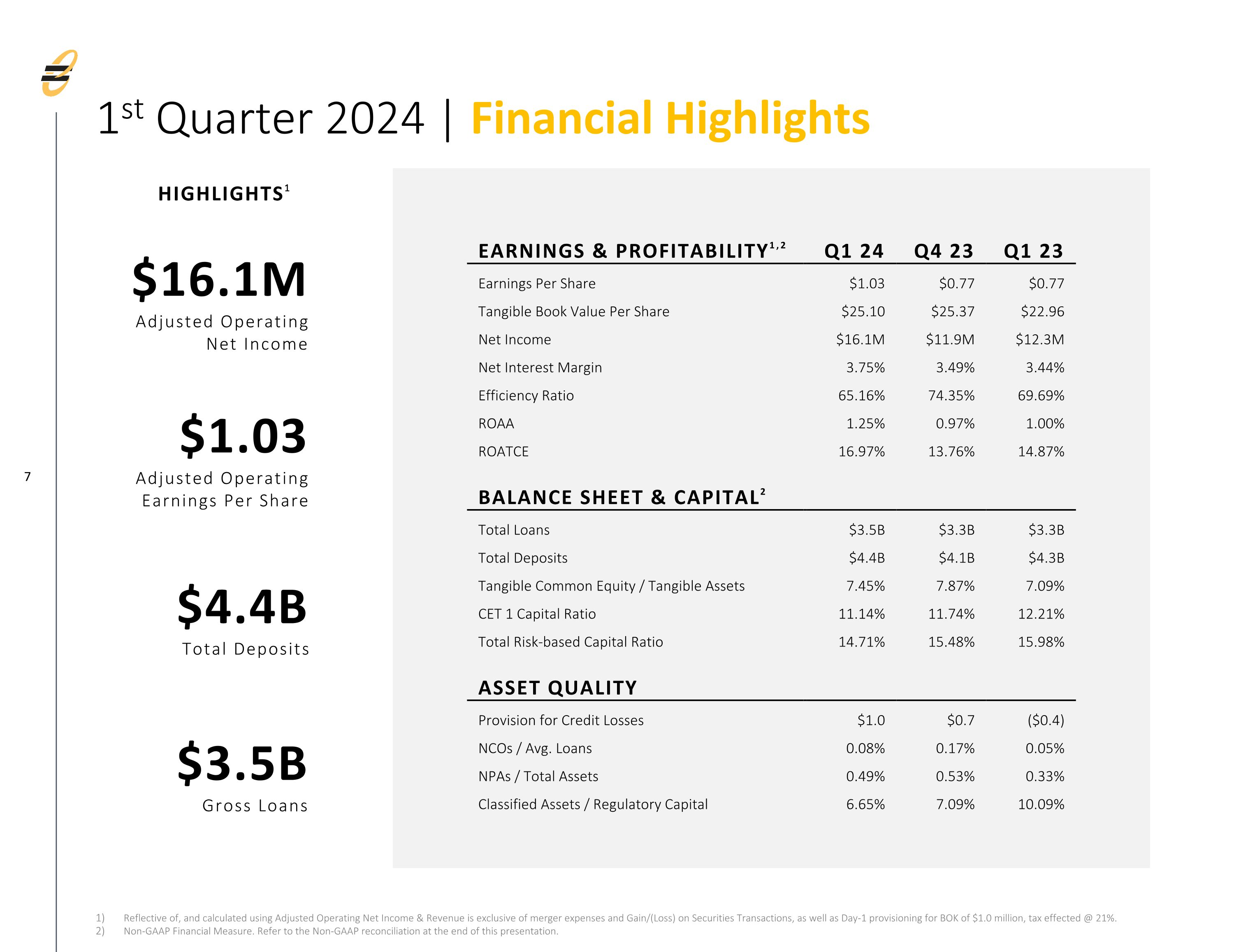

•The Company realized earnings per diluted share of $0.90, adjusted to exclude merger expenses of $1.6 million and opening balance sheet provisioning of $1.0 million, earnings per share were $1.03.

•The Company completed its all-cash acquisition (“the acquisition”) of Rockhold Bancorp, the parent company of the Bank of Kirksville adding eight locations, $118.7 million in loans, and $349.6 million in deposits. A gain on acquisition of $1.2 million was recorded with the closing of the transaction.

•The Company realized linked quarter gross loans held-for-investment expansion of $149.3 million. Excluding the impact of the acquisition, loans grew by $30.6 million, or 3.70% annualized

•The Company realized expansion in net interest income and net interest margin, as the benefits of previously announced strategic transactions were realized. Total net interest income for the quarter was $44.2 million, an all-time high for the Company.

•The Company was active in its share repurchase plan during the quarter, purchasing 209,591 shares at a weighted average cost of $32.24. Under the repurchase plan announced in the fourth quarter of 2023, 790,409 shares remain available for purchase.

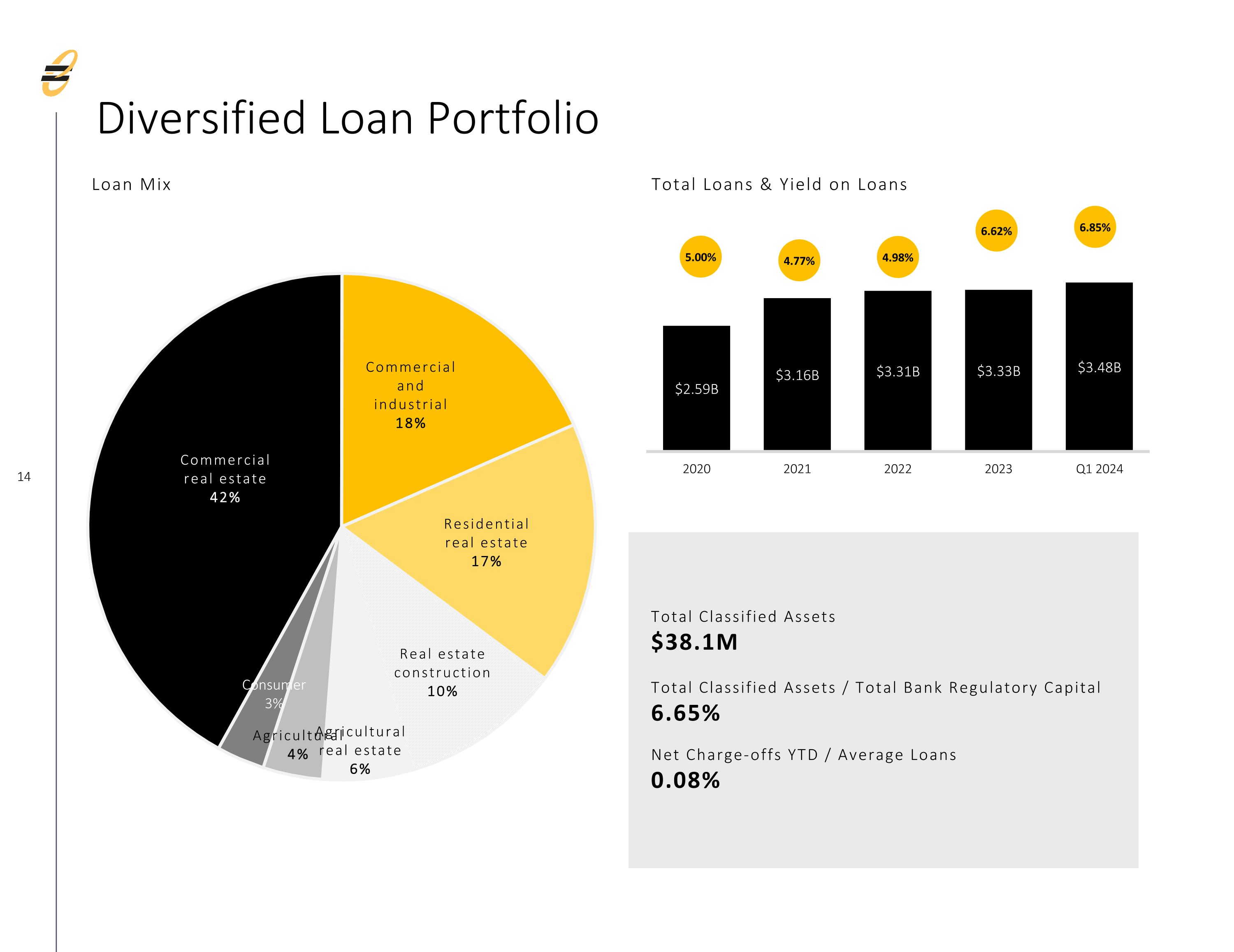

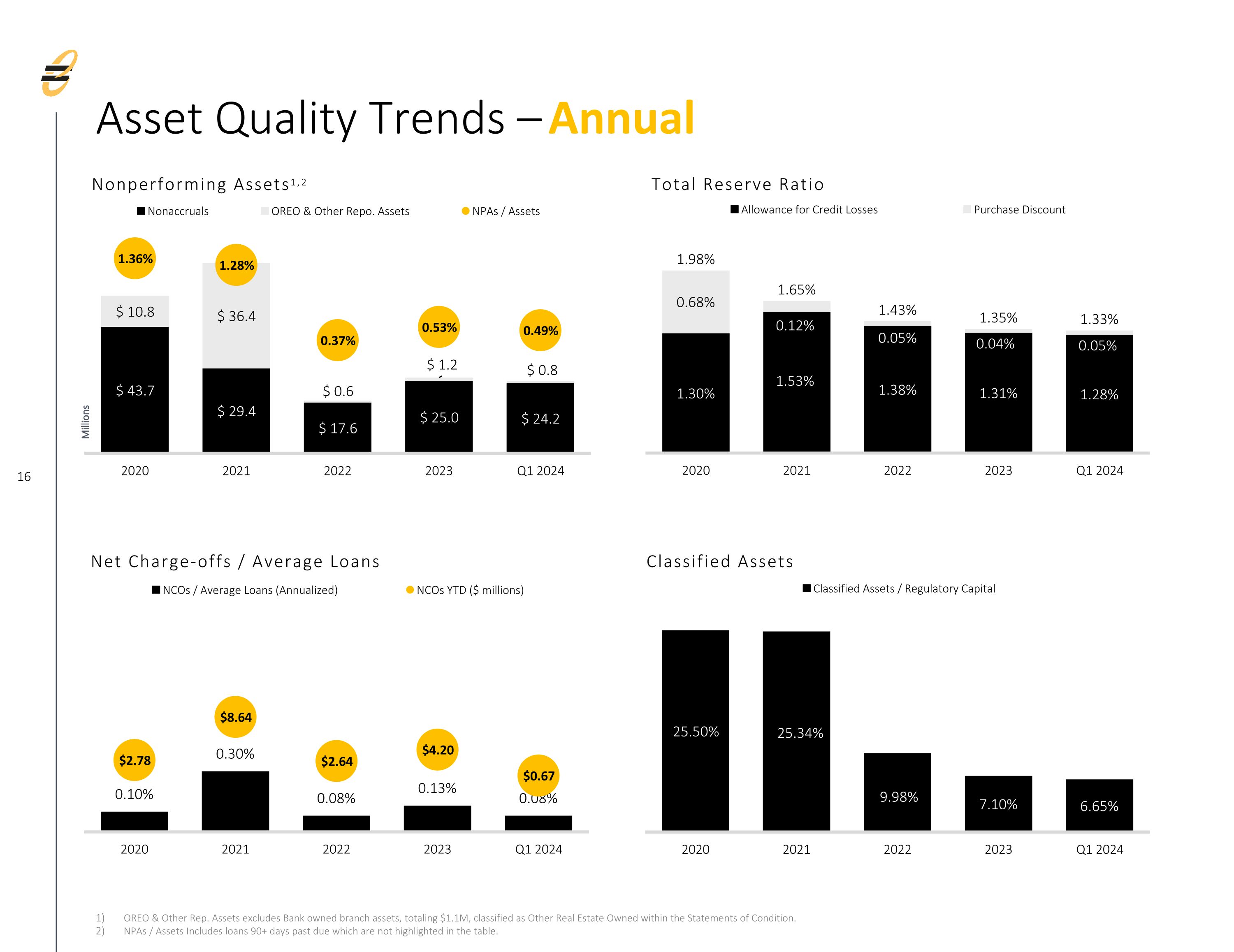

•Classified assets as a percentage of total risk based capital at Equity Bank closed the period at 6.65% while non-performing assets remained historically low. The allowance for credit losses closed the quarter at 1.28% of total loans.

Financial Results for the Quarter Ended March 31, 2024

Net income allocable to common stockholders was $14.1 million, or $0.90 per diluted share, for the three months ended March 31, 2024. Excluding merger expenses and the required provisioning for performing loans acquired in the acquisition, net income was $16.1 million, or $1.03 per diluted share. Excluding the impact of the merger expenses and

Equity Bancshares, Inc.

PRESS RELEASE

the loss on sale of securities taken by the Company during the previous quarter, operating net income was $12.1 million. The drivers of the periodic change are discussed in detail in the following sections.

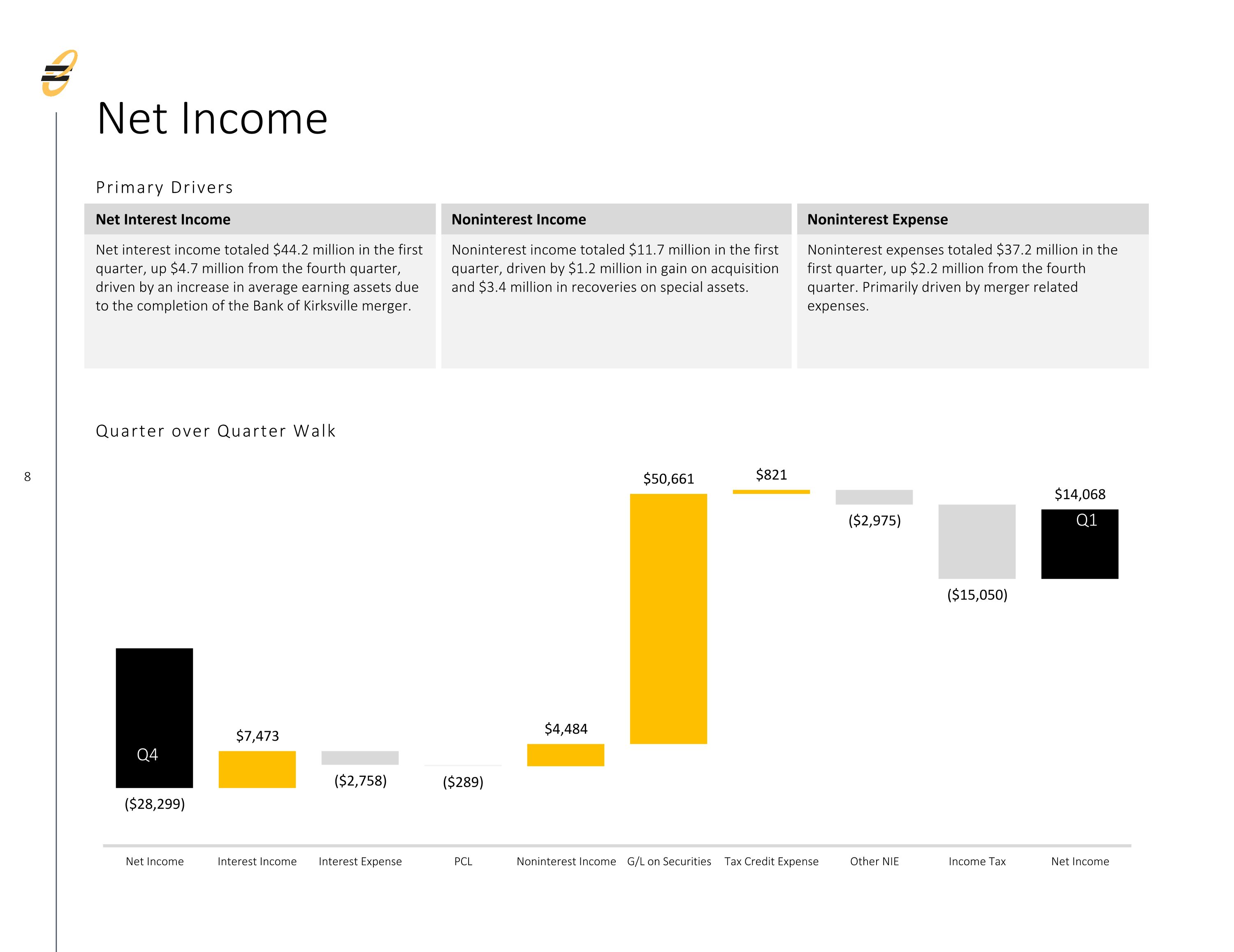

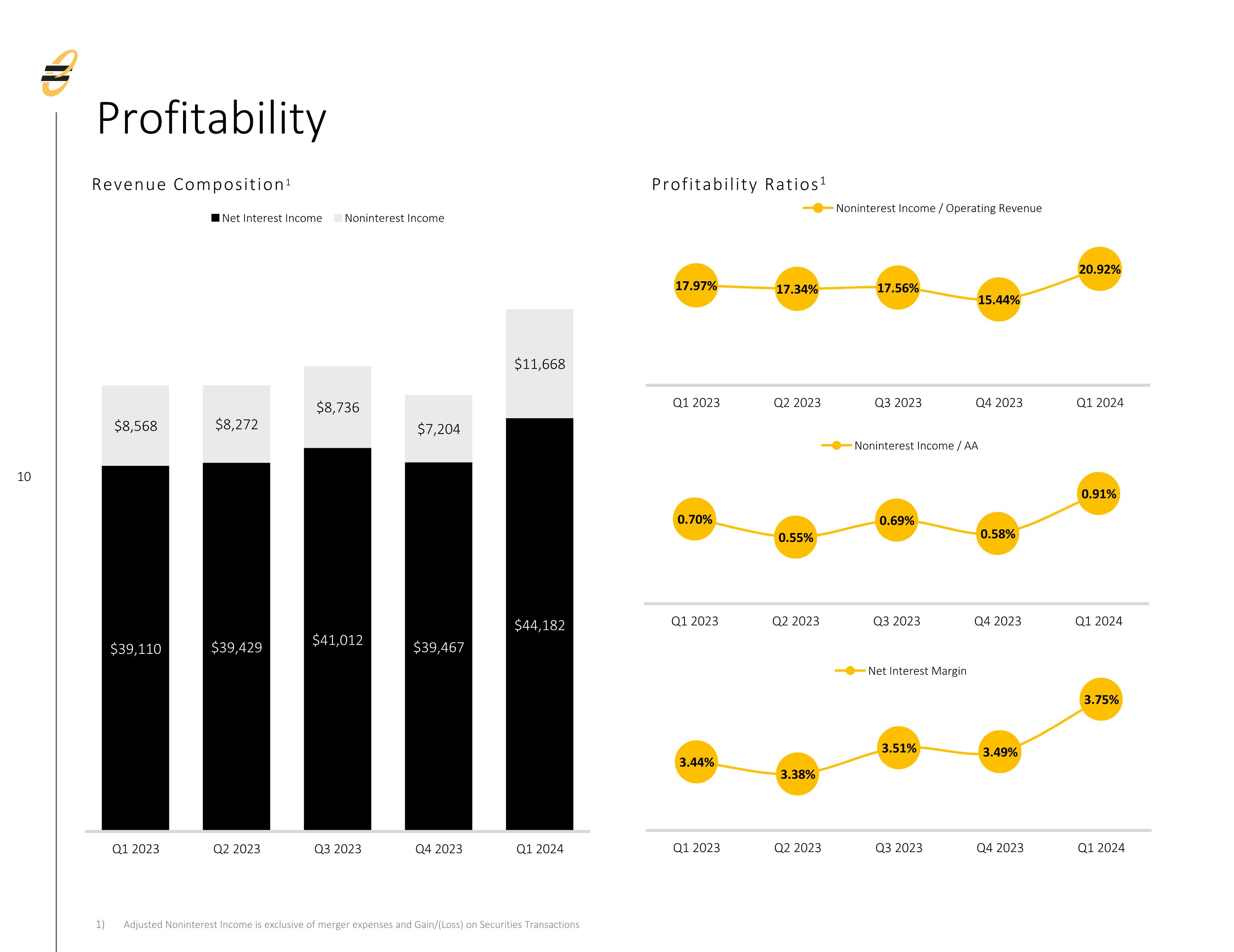

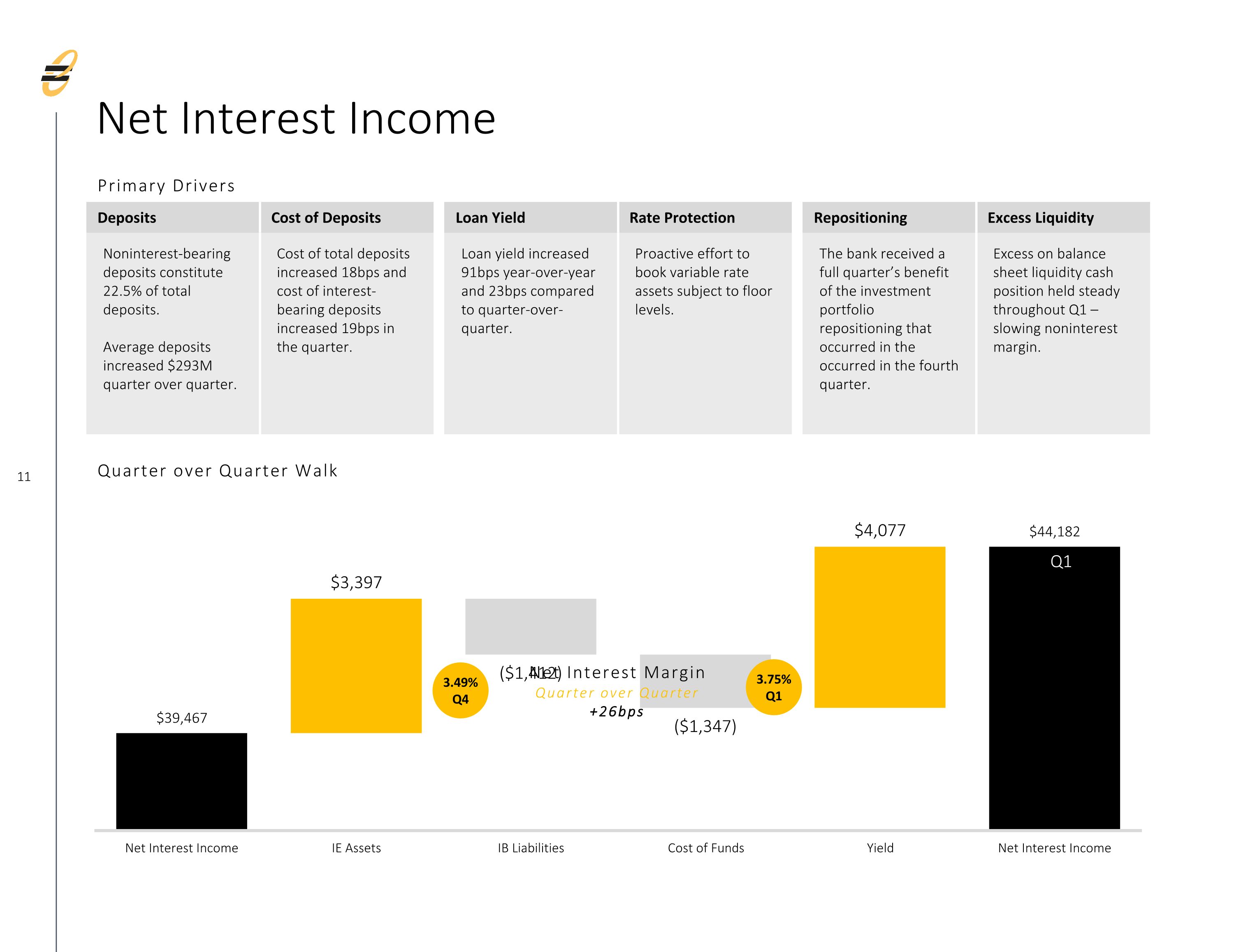

Net Interest Income

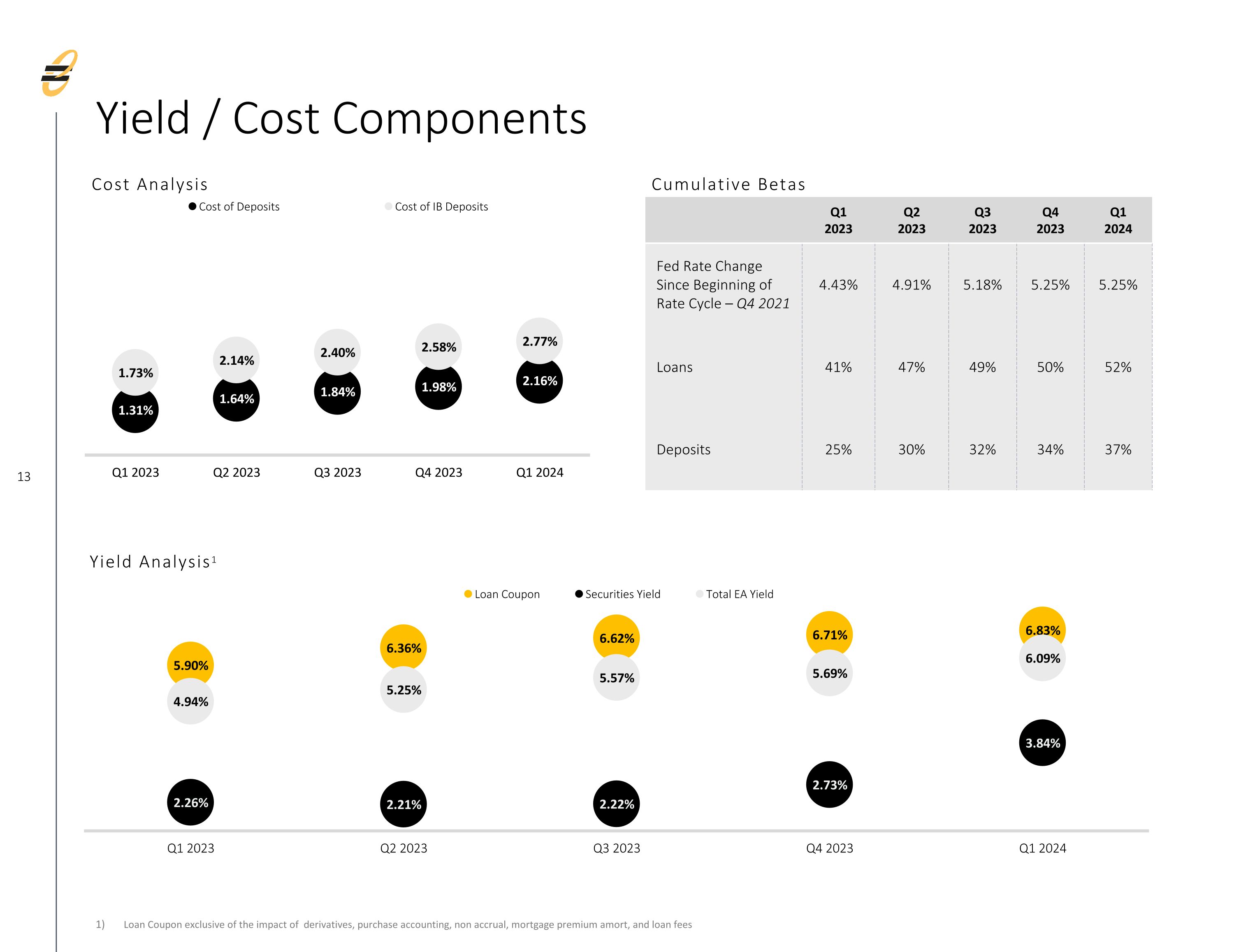

Net interest income was $44.2 million for the three months ended March 31, 2024, as compared to $39.5 million for the three months ended December 31, 2024, the increase was driven by increasing average assets as well as positive trend in margin. Net interest margin increased to 3.75% from 3.49% as the yield on interest-earning assets increased 40 basis points to 6.09% and the cost of interest-bearing deposits increased 19 basis points to 2.77%. The earning asset improvement was driven by the Bank’s bond portfolio re-positioning as well as purchase accounting accretion associated with the marks on the acquisition. Additionally, loan coupons continued to improve partially offsetting pressures in funding costs. Further, the addition of non-interest bearing deposits positively impacted total deposit costs during the quarter, limiting expansion to 18 basis points and comparatively improving net interest income.

Provision for Credit Losses

During the three months ended March 31, 2024, there was a provision of $1.0 million compared to a provision of $711 thousand in the previous quarter. The provision for the quarter is entirely attributable to the establishment of reserve on loan acquired in the acquisition. The Company continues to estimate the allowance for credit loss with assumptions that anticipate slower prepayment rates and continued market disruption caused by elevated inflation, supply chain issues and the impact of monetary policy on consumers and businesses. For the three months ended March 31, 2024, we had net charge-offs of $668 thousand as compared to $1.4 million for the three months ended December 31, 2023.

Non-Interest Income

Total non-interest income was $11.7 million for the three months ended March 31, 2024, as compared to $(43.4) million for the three months ended December 31, 2023. Adjusted for the loss realized on re-positioning our bond portfolio of $50.7 million, non-interest income for the previous period ended was $7.3 million. The comparative increase for the current quarter ended is driven by positive outcomes on resolution of specific loan assets adding $3.0 million as well as the gain recognized on the acquisition of $1.2 million. In addition to these non-recurring benefits, the Bank saw expansion in service fee revenue line items, including service charges, treasury, mortgage banking and wealth management during the period.

The gain on acquisition is primarily attributable to the improvement in the fair value position of the Bank of Kirksville’s bond portfolio between announcement of the transaction and close.

Non-Interest Expense

Total non-interest expense for the quarter ended March 31, 2024, was $37.1 million as compared to $35.0 million for the quarter ended December 31, 2023, an increase of $2.1 million. Adjusting for merger expenses in both periods, the increase quarter over quarter was $1.0 million due to the addition of Bank of Kirksville expenses, annual compensation rate adjustments and early year payroll tax dynamics. The conversion of systems related to the acquisition will not be completed until the middle of the second quarter 2024. Following conversion, cost saves are expected to be fully realized.

Income Tax Expense

At March 31, 2024, the effective tax rate for the quarter was 20.8% as compared to a normalized rate of 7.5% for the quarter ended December 31, 2023. The prior quarter's tax rate was normalized to exclude pre-tax losses recognized in the quarter related to the sale of investment securities. The increase in rate from December 31, 2023, to the quarter ending March 31, 2024, was the result of a reduction in the tax benefit related to investments in tax credit structures offset by the tax benefit recognized in the current quarter related to the bargain purchase gain recorded on the acquisition completed during the quarter. At the end of the quarter, the Company has additional capacity for investments in tax credit structures

Equity Bancshares, Inc.

PRESS RELEASE

which would positively impact the Company's tax rate. As these investments have not been made as of the end of the quarter, they are not considered in establishing the quarterly tax expense reserve.

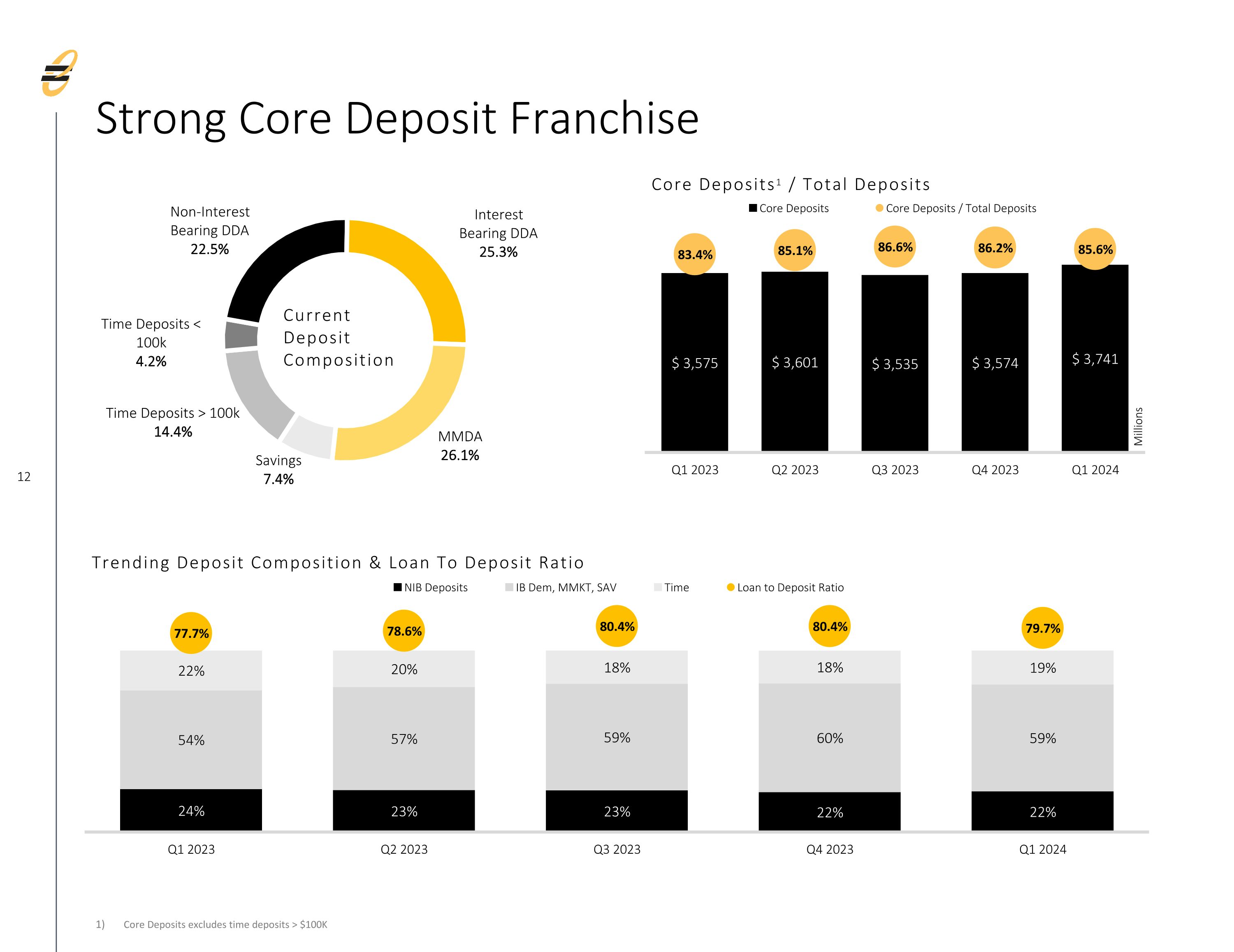

Loans, Total Assets and Funding

Loans held for investment were $3.48 billion at March 31, 2024, increasing $149.3 million compared to the previous quarter. Included in this growth figure is $118.7 million in total loans added through the acquisition. Total assets were $5.20 billion as of March 31, 2024, increasing $204.4 million or 4.1% during the quarter.

Total deposits were $4.4 billion at March 31, 2024, increasing $225.6 million from the previous quarter end. Included in the growth figure is $349.6 million added through the acquisition. Of the total deposit balance, non-interest-bearing accounts comprise approximately 22.5%. During the quarter, the Company’s $140.0 million Federal Reserve Bank borrowing matured and was replaced with borrowing from the Federal Home Loan Bank. Total Federal Home Loan Bank borrowings were $219.9 million as of the end of the quarter, up $119.9 million as compared to December 31, 2023.

Asset Quality

As of March 31, 2024, Equity’s allowance for credit losses to total loans remained materially consistent at 1.3% as compared to December 31, 2023. Nonperforming assets were $25.3 million as of March 31, 2024, or 0.5% of total assets, compared to $26.5 million at December 31, 2023, or 0.5% of total assets. Non-accrual loans were $24.2 million at March 31, 2024, as compared to $25.0 million at December 31, 2023. Total classified assets, including loans rated special mention or worse, other real estate owned, excluding previous branch locations, and other repossessed assets were $38.1 million, or 6.65% of regulatory capital, down from $40.5 million, or 7.1% of regulatory capital as of December 31, 2023.

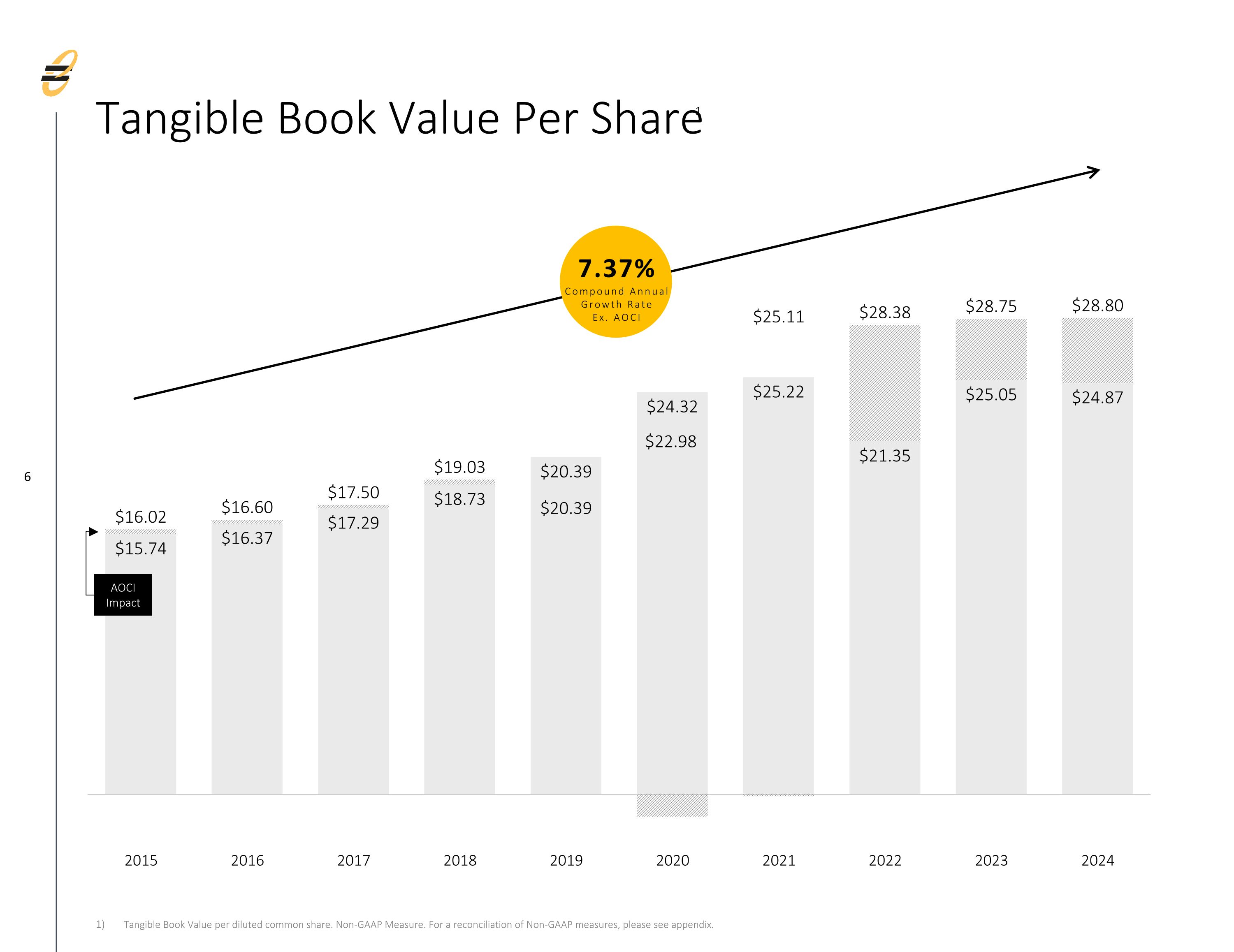

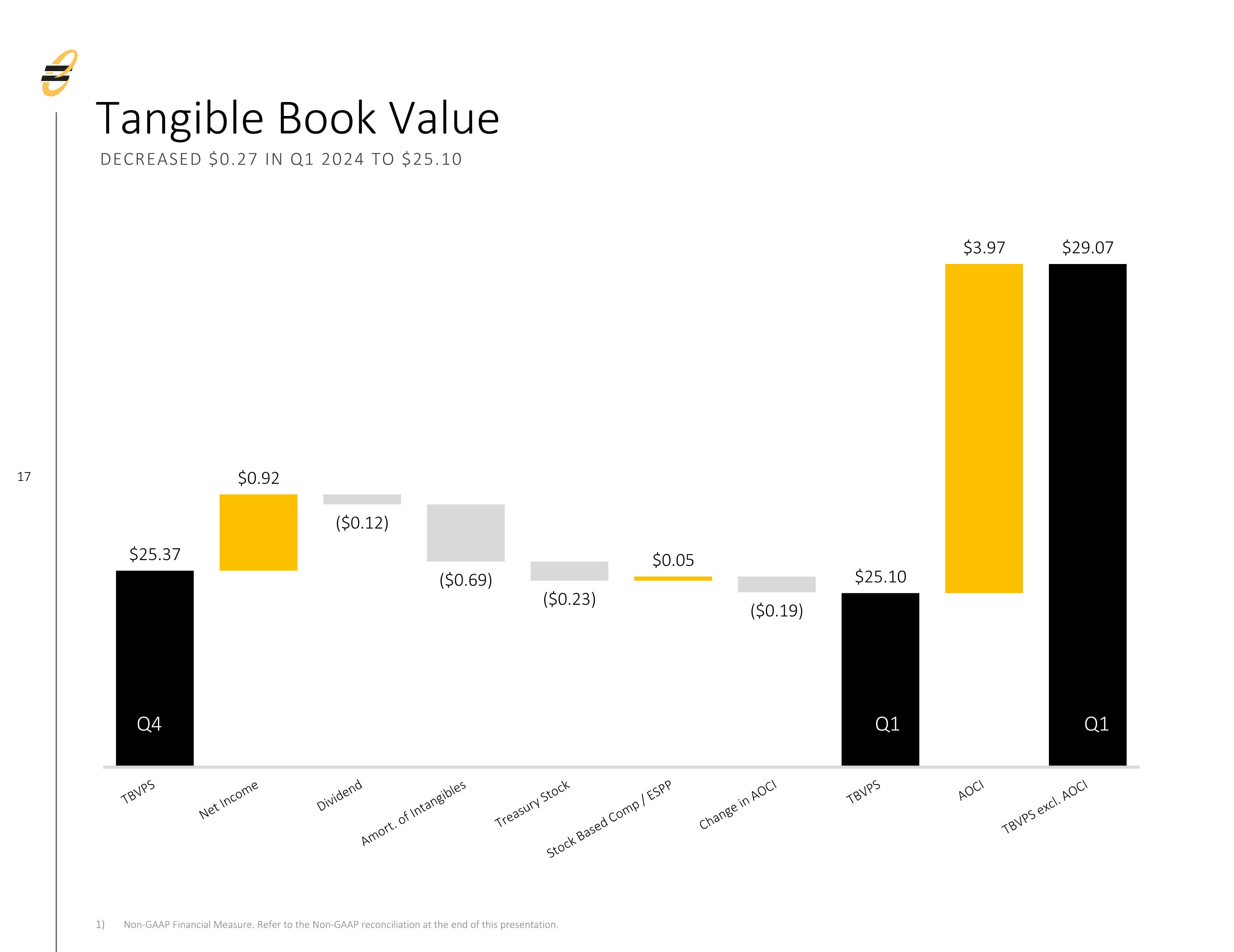

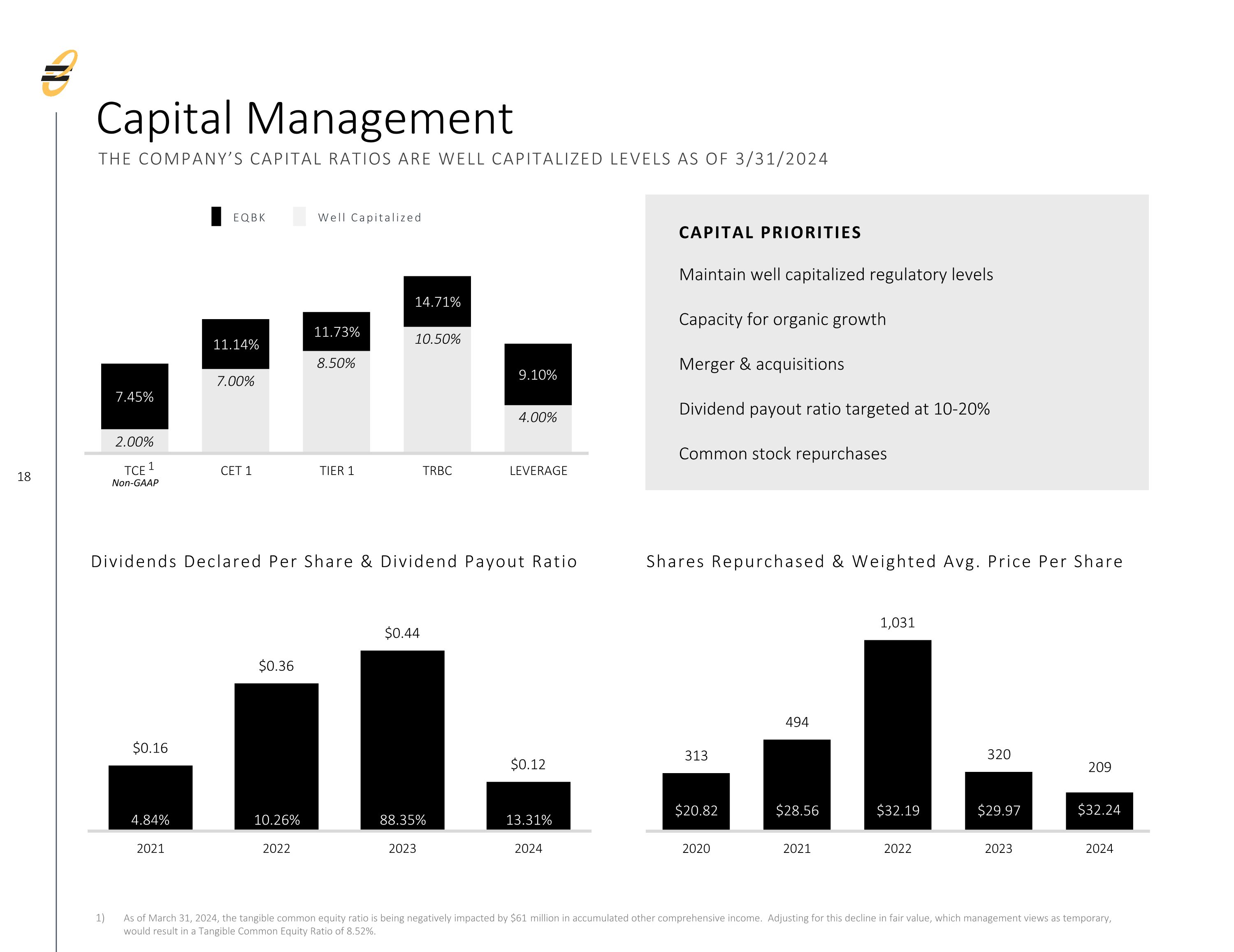

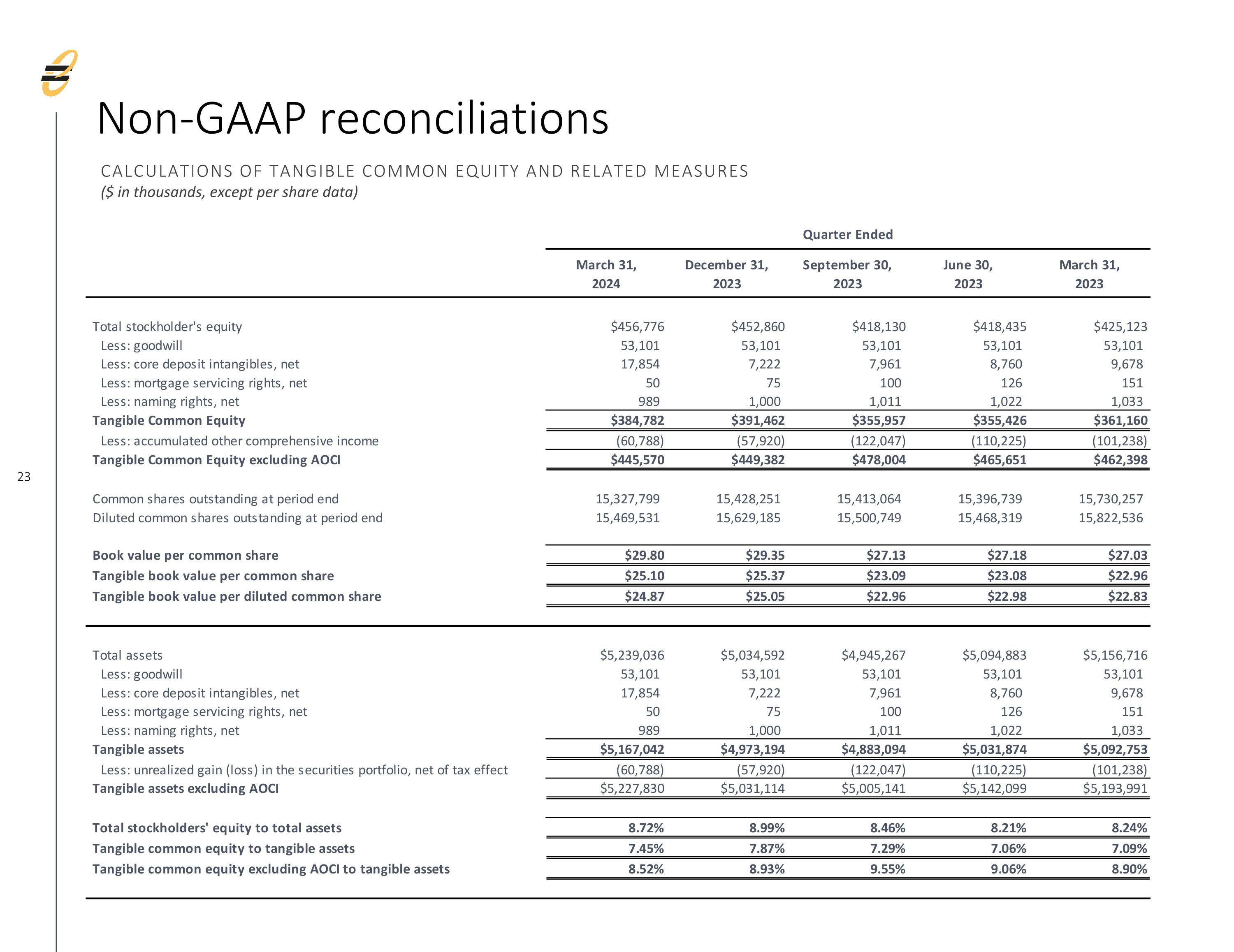

Capital

Quarter over quarter, book capital increased $3.9 million to $456.8 million and tangible capital decreased $6.7 million to $384.8 million. The increase in book capital is primarily due to earnings, partially offset by treasury share purchases of $6.7 million, increase in unrealized loss on bonds and cash flow hedges of $2.9 million and dividends declared of $1.9 million. The comparative reduction in tangible capital is due to the addition of $11.5 million in core deposit intangible associated with the acquisition.

The Company’s ratio of common equity tier 1 capital to risk-weighted assets was 11.1%, the total capital to risk-weighted assets was 14.7% and the total leverage ratio was 9.1% at March 31, 2024. At December 31, 2023, the Company’s common equity tier 1 capital to risk-weighted assets ratio was 11.7%, the total capital to risk-weighted assets ratio was 15.5% and the total leverage ratio was 9.5%.

Equity Bank's ratio of common equity tier 1 capital to risk-weighted assets was 13.2%, total capital to risk-weighted assets was 14.3% and the total leverage ratio was 10.2% at March 31, 2024. At December 31, 2023, Equity Bank’s ratio of common equity tier 1 capital to risk-weighted assets was 13.9%, the ratio of total capital to risk-weighted assets was 15.1% and the total leverage ratio was 10.6%.

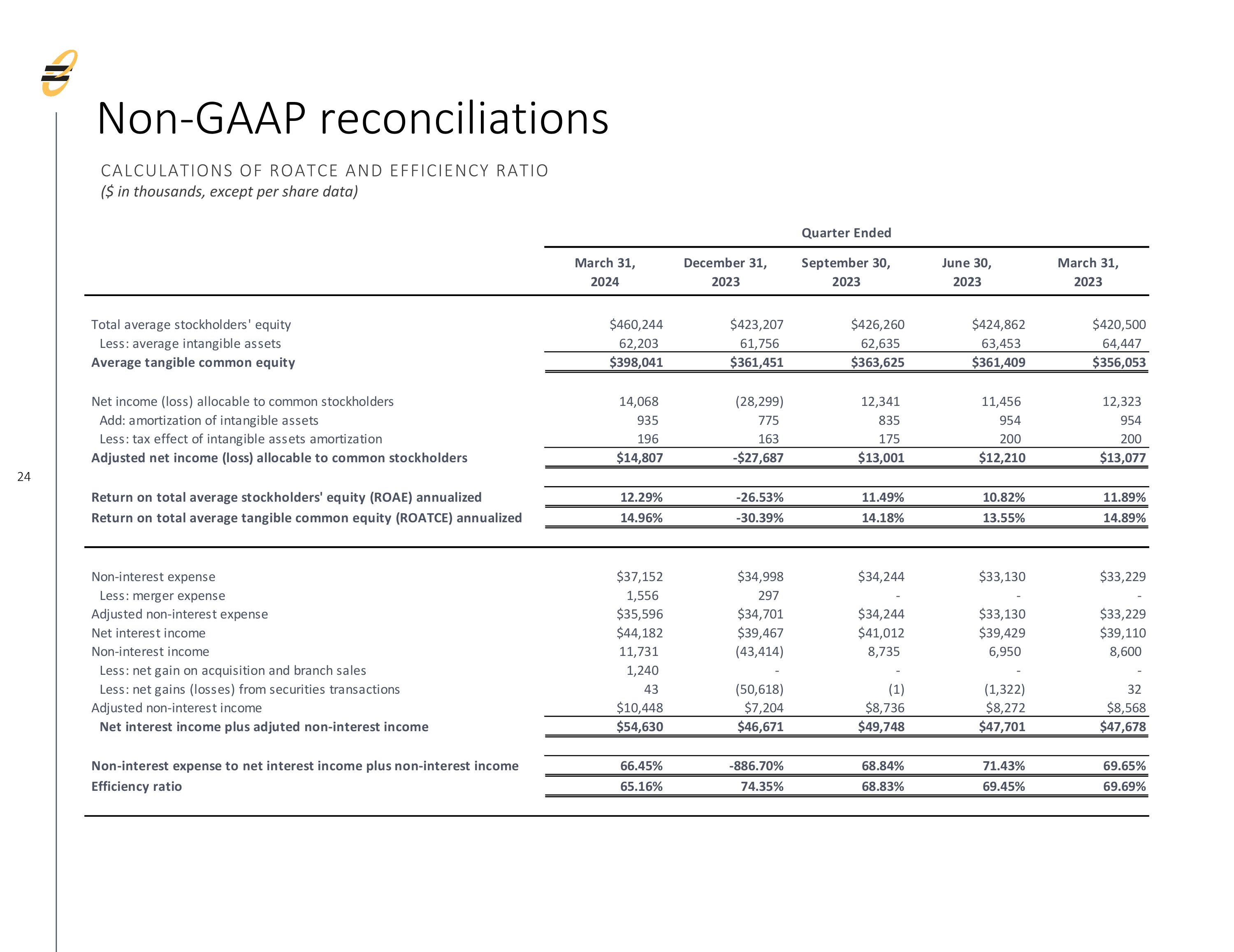

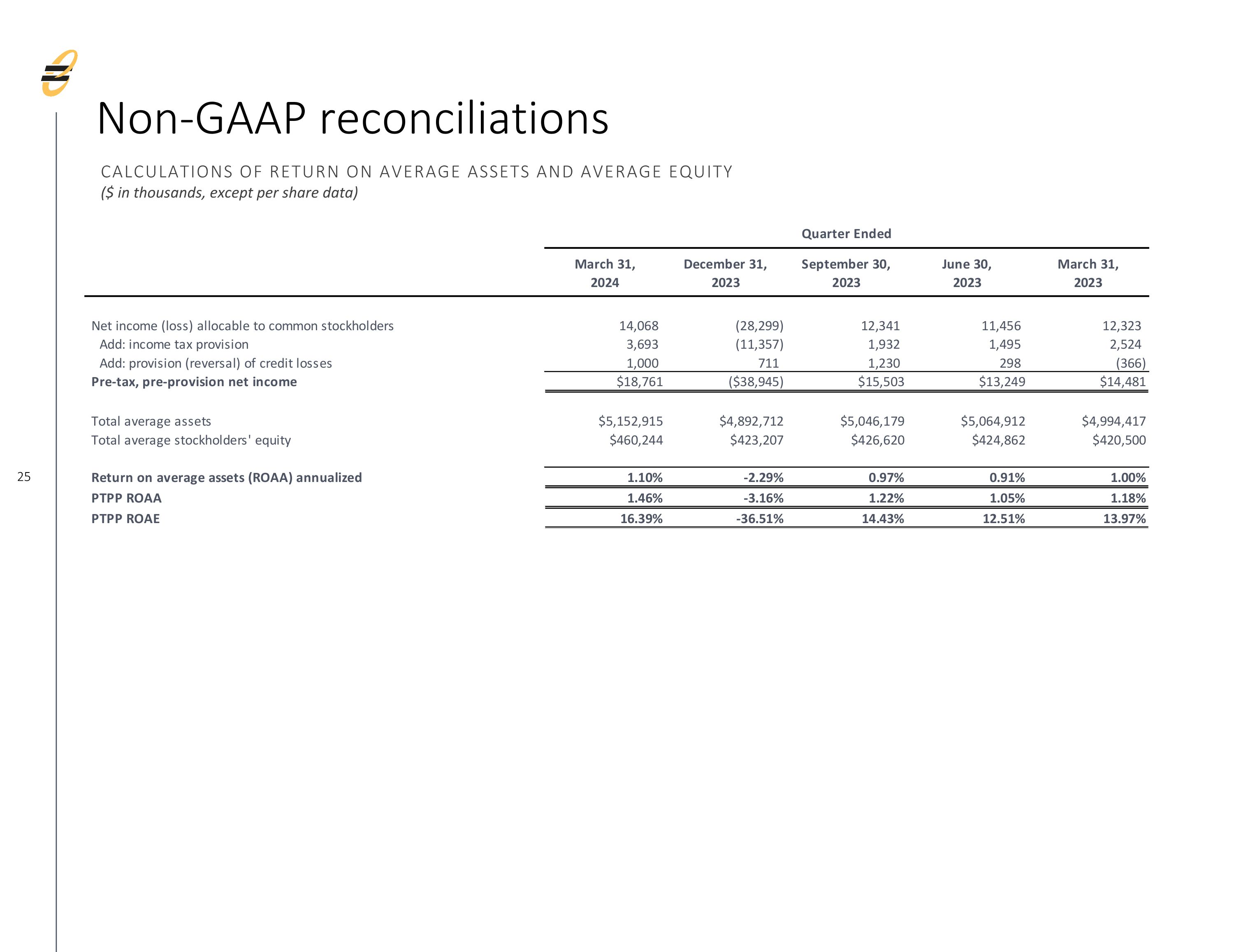

Non-GAAP Financial Measures

In addition to evaluating the Company’s results of operations in accordance with accounting principles generally accepted in the United States of America (“GAAP”), management periodically supplements this evaluation with an analysis of certain non-GAAP financial measures that are intended to provide the reader with additional perspectives on operating results, financial condition and performance trends, while facilitating comparisons with the performance of other financial institutions. Non-GAAP financial measures are not a substitute for GAAP measures, rather, they should be read and used in conjunction with the Company’s GAAP financial information.

Equity Bancshares, Inc.

PRESS RELEASE

The efficiency ratio is a common comparable metric used by banks to understand the expense structure relative to total revenue. In other words, for every dollar of total revenue recognized, how much of that dollar is expended. To improve the comparability of the ratio to our peers, non-core items are excluded. To improve transparency and acknowledging that banks are not consistent in their definition of the efficiency ratio, we include our calculation of this non-GAAP measure.

Return on average assets before income tax provision and provision for loan losses is a measure that the Company uses to understand fundamental operating performance before these expenses. Used as a ratio relative to average assets, we believe it demonstrates “core” performance and can be viewed as an alternative measure of how efficiently the Company services its asset base. Used as a ratio relative to average equity, it can function as an alternative measure of the Company’s earnings performance in relationship to its equity.

Tangible common equity and related measures are non-GAAP financial measures that exclude the impact of intangible assets, net of deferred taxes, and their related amortization. These financial measures are useful for evaluating the performance of a business consistently, whether acquired or developed internally. Return on average tangible common equity is used by management and readers of our financial statements to understand how efficiently the Company is deploying its common equity. Companies that are able to demonstrate more efficient use of common equity are more likely to be viewed favorably by current and prospective investors.

The Company believes that disclosing these non-GAAP financial measures is both useful internally and is expected by our investors and analysts in order to understand the overall performance of the Company. Other companies may calculate and define their non-GAAP financial measures and supplemental data differently. A reconciliation of GAAP financial measures to non-GAAP measures and other performance ratios, as adjusted, are included in Table 6 in the following press release tables.

Conference Call and Webcast

Equity’s Chairman and Chief Executive Officer, Brad Elliott, and Chief Financial Officer, Chris Navratil, will hold a conference call and webcast to discuss first quarter results on Wednesday, April 17, 2024, at 10 a.m. eastern time or 9 a.m. central time.

A live webcast of the call will be available on the Company’s website at investor.equitybank.com. To access the call by phone, please go to this registration link, and you will be provided with dial in details. Investors, news media, and other participants are encouraged to dial into the conference call ten minutes ahead of the scheduled start time.

A replay of the call and webcast will be available two hours following the close of the call until May 1, 2024, accessible at investor.equitybank.com.

About Equity Bancshares, Inc.

Equity Bancshares, Inc. is the holding company for Equity Bank, offering a full range of financial solutions, including commercial loans, consumer banking, mortgage loans, trust and wealth management services and treasury management services, while delivering the high-quality, relationship-based customer service of a community bank. Equity’s common stock is traded on the NYSE National, Inc. under the symbol “EQBK.” Learn more at www.equitybank.com.

Special Note Concerning Forward-Looking Statements

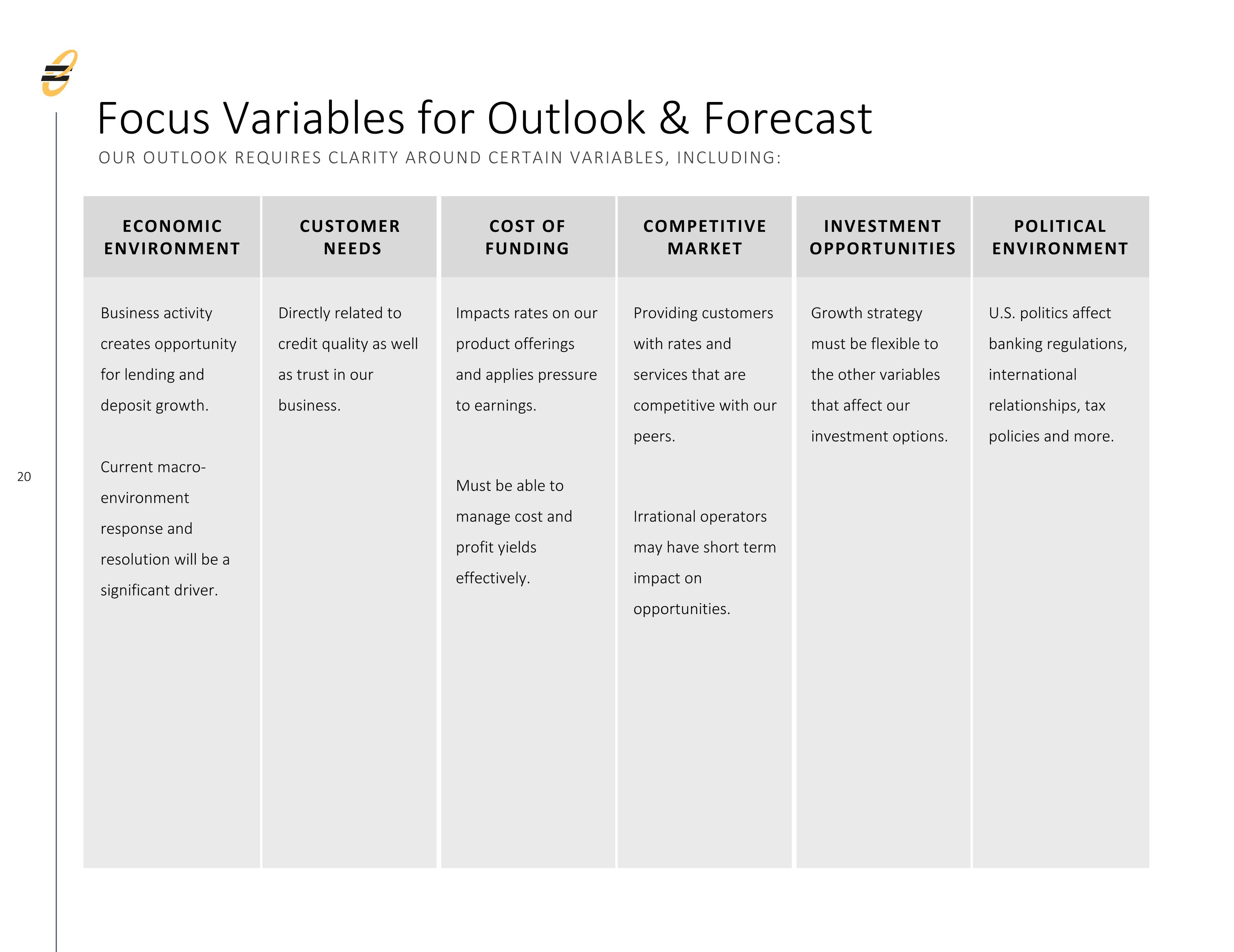

This press release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements reflect the current views of Equity’s management with respect to, among other things, future events and Equity’s financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “project,” “positioned,” “forecast,” “goal,” “target,” “would” and “outlook,” or the negative variations of those words or other comparable words of a future or forward-looking nature. These forward-looking statements are not

Equity Bancshares, Inc.

PRESS RELEASE

historical facts, and are based on current expectations, estimates and projections about Equity’s industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond Equity’s control. Accordingly, Equity cautions you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although Equity believes that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. Factors that could cause actual results to differ materially from Equity’s expectations include competition from other financial institutions and bank holding companies; the effects of and changes in trade, monetary and fiscal policies and laws, including interest rate policies of the Federal Reserve Board; changes in the demand for loans; fluctuations in value of collateral and loan reserves; inflation, interest rate, market and monetary fluctuations; changes in consumer spending, borrowing and savings habits; and acquisitions and integration of acquired businesses; and similar variables. The foregoing list of factors is not exhaustive.

For discussion of these and other risks that may cause actual results to differ from expectations, please refer to “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in Equity’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 7, 2024, and any updates to those risk factors set forth in Equity’s subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. If one or more events related to these or other risks or uncertainties materialize, or if Equity’s underlying assumptions prove to be incorrect, actual results may differ materially from what Equity anticipates. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and Equity does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law. New risks and uncertainties arise from time to time and it is not possible for us to predict those events or how they may affect us. In addition, Equity cannot assess the impact of each factor on Equity’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements, expressed or implied, included in this press release are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that Equity or persons acting on Equity’s behalf may issue.

Investor Contact:

Brian J. Katzfey

VP, Director of Corporate Development and Investor Relations

Equity Bank

(316) 858-3128

bkatzfey@equitybank.com

Media Contact:

John J. Hanley

Chief Marketing Officer

Equity Bancshares, Inc.

(913) 583-8004

jhanley@equitybank.com

Equity Bancshares, Inc.

PRESS RELEASE

Unaudited Financial Tables

•Table 1. Quarterly Consolidated Statements of Income

•Table 2. Consolidated Balance Sheets

•Table 3. Selected Financial Highlights

•Table 4. Quarter-To-Date Net Interest Income Analysis

•Table 5. Quarter-Over-Quarter Net Interest Income Analysis

•Table 6. Non-GAAP Financial Measures

Equity Bancshares, Inc.

PRESS RELEASE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TABLE 1. QUARTERLY CONSOLIDATED STATEMENTS OF INCOME (Unaudited) |

|

(Dollars in thousands, except per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of and for the three months ended |

|

|

|

March 31,

2024 |

|

|

December 31,

2023 |

|

|

September 30,

2023 |

|

|

June 30,

2023 |

|

|

March 31,

2023 |

|

Interest and dividend income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans, including fees |

|

$ |

58,829 |

|

|

$ |

54,932 |

|

|

$ |

55,152 |

|

|

$ |

52,748 |

|

|

$ |

48,381 |

|

Securities, taxable |

|

|

9,877 |

|

|

|

6,417 |

|

|

|

5,696 |

|

|

|

5,813 |

|

|

|

5,947 |

|

Securities, nontaxable |

|

|

391 |

|

|

|

354 |

|

|

|

369 |

|

|

|

568 |

|

|

|

669 |

|

Federal funds sold and other |

|

|

2,670 |

|

|

|

2,591 |

|

|

|

3,822 |

|

|

|

2,127 |

|

|

|

1,126 |

|

Total interest and dividend income |

|

|

71,767 |

|

|

|

64,294 |

|

|

|

65,039 |

|

|

|

61,256 |

|

|

|

56,123 |

|

Interest expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits |

|

|

22,855 |

|

|

|

20,074 |

|

|

|

19,374 |

|

|

|

17,204 |

|

|

|

13,821 |

|

Federal funds purchased and retail repurchase agreements |

|

|

326 |

|

|

|

298 |

|

|

|

246 |

|

|

|

192 |

|

|

|

195 |

|

Federal Home Loan Bank advances |

|

|

1,144 |

|

|

|

1,005 |

|

|

|

968 |

|

|

|

953 |

|

|

|

1,018 |

|

Federal Reserve Bank borrowings |

|

|

1,361 |

|

|

|

1,546 |

|

|

|

1,546 |

|

|

|

1,528 |

|

|

|

135 |

|

Subordinated debt |

|

|

1,899 |

|

|

|

1,904 |

|

|

|

1,893 |

|

|

|

1,950 |

|

|

|

1,844 |

|

Total interest expense |

|

|

27,585 |

|

|

|

24,827 |

|

|

|

24,027 |

|

|

|

21,827 |

|

|

|

17,013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income |

|

|

44,182 |

|

|

|

39,467 |

|

|

|

41,012 |

|

|

|

39,429 |

|

|

|

39,110 |

|

Provision (reversal) for credit losses |

|

|

1,000 |

|

|

|

711 |

|

|

|

1,230 |

|

|

|

298 |

|

|

|

(366 |

) |

Net interest income after provision (reversal) for credit losses |

|

|

43,182 |

|

|

|

38,756 |

|

|

|

39,782 |

|

|

|

39,131 |

|

|

|

39,476 |

|

Non-interest income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Service charges and fees |

|

|

2,569 |

|

|

|

2,299 |

|

|

|

2,690 |

|

|

|

2,653 |

|

|

|

2,545 |

|

Debit card income |

|

|

2,447 |

|

|

|

2,524 |

|

|

|

2,591 |

|

|

|

2,653 |

|

|

|

2,554 |

|

Mortgage banking |

|

|

188 |

|

|

|

125 |

|

|

|

226 |

|

|

|

213 |

|

|

|

88 |

|

Increase in value of bank-owned life insurance |

|

|

828 |

|

|

|

925 |

|

|

|

794 |

|

|

|

757 |

|

|

|

1,583 |

|

Net gain on acquisition and branch sales |

|

|

1,240 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Net gains (losses) from securities transactions |

|

|

43 |

|

|

|

(50,618 |

) |

|

|

(1 |

) |

|

|

(1,322 |

) |

|

|

32 |

|

Other |

|

|

4,416 |

|

|

|

1,331 |

|

|

|

2,435 |

|

|

|

1,996 |

|

|

|

1,798 |

|

Total non-interest income |

|

|

11,731 |

|

|

|

(43,414 |

) |

|

|

8,735 |

|

|

|

6,950 |

|

|

|

8,600 |

|

Non-interest expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

|

18,097 |

|

|

|

16,598 |

|

|

|

15,857 |

|

|

|

15,237 |

|

|

|

16,692 |

|

Net occupancy and equipment |

|

|

3,535 |

|

|

|

3,244 |

|

|

|

3,262 |

|

|

|

2,940 |

|

|

|

2,879 |

|

Data processing |

|

|

4,828 |

|

|

|

4,471 |

|

|

|

4,553 |

|

|

|

4,493 |

|

|

|

3,916 |

|

Professional fees |

|

|

1,392 |

|

|

|

1,413 |

|

|

|

1,312 |

|

|

|

1,645 |

|

|

|

1,384 |

|

Advertising and business development |

|

|

1,238 |

|

|

|

1,598 |

|

|

|

1,419 |

|

|

|

1,249 |

|

|

|

1,159 |

|

Telecommunications |

|

|

655 |

|

|

|

460 |

|

|

|

502 |

|

|

|

516 |

|

|

|

485 |

|

FDIC insurance |

|

|

571 |

|

|

|

660 |

|

|

|

660 |

|

|

|

515 |

|

|

|

360 |

|

Courier and postage |

|

|

606 |

|

|

|

577 |

|

|

|

548 |

|

|

|

463 |

|

|

|

458 |

|

Free nationwide ATM cost |

|

|

494 |

|

|

|

508 |

|

|

|

516 |

|

|

|

524 |

|

|

|

525 |

|

Amortization of core deposit intangibles |

|

|

899 |

|

|

|

739 |

|

|

|

799 |

|

|

|

918 |

|

|

|

918 |

|

Loan expense |

|

|

109 |

|

|

|

155 |

|

|

|

132 |

|

|

|

136 |

|

|

|

117 |

|

Other real estate owned |

|

|

(84 |

) |

|

|

224 |

|

|

|

128 |

|

|

|

71 |

|

|

|

119 |

|

Merger expenses |

|

|

1,556 |

|

|

|

292 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Other |

|

|

3,256 |

|

|

|

4,059 |

|

|

|

4,556 |

|

|

|

4,423 |

|

|

|

4,217 |

|

Total non-interest expense |

|

|

37,152 |

|

|

|

34,998 |

|

|

|

34,244 |

|

|

|

33,130 |

|

|

|

33,229 |

|

Income (loss) before income tax |

|

|

17,761 |

|

|

|

(39,656 |

) |

|

|

14,273 |

|

|

|

12,951 |

|

|

|

14,847 |

|

Provision for income taxes (benefit) |

|

|

3,693 |

|

|

|

(11,357 |

) |

|

|

1,932 |

|

|

|

1,495 |

|

|

|

2,524 |

|

Net income (loss) and net income (loss) allocable to common stockholders |

|

$ |

14,068 |

|

|

$ |

(28,299 |

) |

|

$ |

12,341 |

|

|

$ |

11,456 |

|

|

$ |

12,323 |

|

Basic earnings (loss) per share |

|

$ |

0.91 |

|

|

$ |

(1.84 |

) |

|

$ |

0.80 |

|

|

$ |

0.74 |

|

|

$ |

0.78 |

|

Diluted earnings (loss) per share |

|

$ |

0.90 |

|

|

$ |

(1.84 |

) |

|

$ |

0.80 |

|

|

$ |

0.74 |

|

|

$ |

0.77 |

|

Weighted average common shares |

|

|

15,425,709 |

|

|

|

15,417,200 |

|

|

|

15,404,992 |

|

|

|

15,468,378 |

|

|

|

15,858,808 |

|

Weighted average diluted common shares |

|

|

15,569,225 |

|

|

|

15,417,200 |

|

|

|

15,507,172 |

|

|

|

15,554,255 |

|

|

|

16,028,051 |

|

Equity Bancshares, Inc.

PRESS RELEASE

Equity Bancshares, Inc.

PRESS RELEASE

TABLE 2. CONSOLIDATED BALANCE SHEETS (Unaudited)

(Dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31,

2024 |

|

|

December 31,

2023 |

|

|

September 30,

2023 |

|

|

June 30,

2023 |

|

|

March 31,

2023 |

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and due from banks |

|

$ |

217,611 |

|

|

$ |

363,289 |

|

|

$ |

183,404 |

|

|

$ |

262,604 |

|

|

$ |

249,982 |

|

Federal funds sold |

|

|

17,407 |

|

|

|

15,810 |

|

|

|

15,613 |

|

|

|

15,495 |

|

|

|

384 |

|

Cash and cash equivalents |

|

|

235,018 |

|

|

|

379,099 |

|

|

|

199,017 |

|

|

|

278,099 |

|

|

|

250,366 |

|

Available-for-sale securities |

|

|

1,091,717 |

|

|

|

919,648 |

|

|

|

1,057,009 |

|

|

|

1,094,748 |

|

|

|

1,183,247 |

|

Held-to-maturity securities |

|

|

2,205 |

|

|

|

2,209 |

|

|

|

2,212 |

|

|

|

2,216 |

|

|

|

1,944 |

|

Loans held for sale |

|

|

1,311 |

|

|

|

476 |

|

|

|

627 |

|

|

|

2,456 |

|

|

|

648 |

|

Loans, net of allowance for credit losses(1) |

|

|

3,437,714 |

|

|

|

3,289,381 |

|

|

|

3,237,932 |

|

|

|

3,278,126 |

|

|

|

3,285,515 |

|

Other real estate owned, net |

|

|

1,465 |

|

|

|

1,833 |

|

|

|

3,369 |

|

|

|

4,362 |

|

|

|

4,171 |

|

Premises and equipment, net |

|

|

116,792 |

|

|

|

112,632 |

|

|

|

110,271 |

|

|

|

106,186 |

|

|

|

104,789 |

|

Bank-owned life insurance |

|

|

125,693 |

|

|

|

124,865 |

|

|

|

124,245 |

|

|

|

123,451 |

|

|

|

122,971 |

|

Federal Reserve Bank and Federal Home Loan Bank stock |

|

|

27,009 |

|

|

|

20,608 |

|

|

|

20,780 |

|

|

|

21,129 |

|

|

|

33,359 |

|

Interest receivable |

|

|

27,082 |

|

|

|

25,497 |

|

|

|

23,621 |

|

|

|

21,360 |

|

|

|

20,461 |

|

Goodwill |

|

|

53,101 |

|

|

|

53,101 |

|

|

|

53,101 |

|

|

|

53,101 |

|

|

|

53,101 |

|

Core deposit intangibles, net |

|

|

17,854 |

|

|

|

7,222 |

|

|

|

7,961 |

|

|

|

8,760 |

|

|

|

9,678 |

|

Other |

|

|

102,075 |

|

|

|

98,021 |

|

|

|

105,122 |

|

|

|

100,889 |

|

|

|

86,466 |

|

Total assets |

|

$ |

5,239,036 |

|

|

$ |

5,034,592 |

|

|

$ |

4,945,267 |

|

|

$ |

5,094,883 |

|

|

$ |

5,156,716 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Demand |

|

$ |

981,623 |

|

|

$ |

898,129 |

|

|

$ |

936,217 |

|

|

$ |

978,968 |

|

|

$ |

1,012,671 |

|

Total non-interest-bearing deposits |

|

|

981,623 |

|

|

|

898,129 |

|

|

|

936,217 |

|

|

|

978,968 |

|

|

|

1,012,671 |

|

Demand, savings and money market |

|

|

2,574,871 |

|

|

|

2,483,807 |

|

|

|

2,397,003 |

|

|

|

2,397,524 |

|

|

|

2,334,463 |

|

Time |

|

|

814,532 |

|

|

|

763,519 |

|

|

|

748,950 |

|

|

|

854,458 |

|

|

|

939,799 |

|

Total interest-bearing deposits |

|

|

3,389,403 |

|

|

|

3,247,326 |

|

|

|

3,145,953 |

|

|

|

3,251,982 |

|

|

|

3,274,262 |

|

Total deposits |

|

|

4,371,026 |

|

|

|

4,145,455 |

|

|

|

4,082,170 |

|

|

|

4,230,950 |

|

|

|

4,286,933 |

|

Federal funds purchased and retail repurchase agreements |

|

|

43,811 |

|

|

|

43,582 |

|

|

|

39,701 |

|

|

|

44,770 |

|

|

|

45,098 |

|

Federal Home Loan Bank advances and Federal Reserve Bank borrowings |

|

|

219,931 |

|

|

|

240,000 |

|

|

|

240,000 |

|

|

|

240,000 |

|

|

|

251,222 |

|

Subordinated debt |

|

|

97,058 |

|

|

|

96,921 |

|

|

|

96,787 |

|

|

|

96,653 |

|

|

|

96,522 |

|

Contractual obligations |

|

|

18,493 |

|

|

|

19,315 |

|

|

|

29,019 |

|

|

|

29,608 |

|

|

|

19,372 |

|

Interest payable and other liabilities |

|

|

31,941 |

|

|

|

36,459 |

|

|

|

39,460 |

|

|

|

34,467 |

|

|

|

32,446 |

|

Total liabilities |

|

|

4,782,260 |

|

|

|

4,581,732 |

|

|

|

4,527,137 |

|

|

|

4,676,448 |

|

|

|

4,731,593 |

|

Commitments and contingent liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock |

|

|

208 |

|

|

|

207 |

|

|

|

207 |

|

|

|

207 |

|

|

|

206 |

|

Additional paid-in capital |

|

|

490,533 |

|

|

|

489,187 |

|

|

|

488,137 |

|

|

|

487,225 |

|

|

|

486,658 |

|

Retained earnings |

|

|

153,201 |

|

|

|

141,006 |

|

|

|

171,188 |

|

|

|

160,715 |

|

|

|

150,810 |

|

Accumulated other comprehensive income (loss), net of tax |

|

|

(60,788 |

) |

|

|

(57,920 |

) |

|

|

(122,047 |

) |

|

|

(110,225 |

) |

|

|

(101,238 |

) |

Treasury stock |

|

|

(126,378 |

) |

|

|

(119,620 |

) |

|

|

(119,355 |

) |

|

|

(119,487 |

) |

|

|

(111,313 |

) |

Total stockholders’ equity |

|

|

456,776 |

|

|

|

452,860 |

|

|

|

418,130 |

|

|

|

418,435 |

|

|

|

425,123 |

|

Total liabilities and stockholders’ equity |

|

$ |

5,239,036 |

|

|

$ |

5,034,592 |

|

|

$ |

4,945,267 |

|

|

$ |

5,094,883 |

|

|

$ |

5,156,716 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Allowance for credit losses |

|

$ |

44,449 |

|

|

$ |

43,520 |

|

|

$ |

44,186 |

|

|

$ |

44,544 |

|

|

$ |

45,103 |

|

Equity Bancshares, Inc.

PRESS RELEASE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TABLE 3. SELECTED FINANCIAL HIGHLIGHTS (Unaudited) |

|

(Dollars in thousands, except per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of and for the three months ended |

|

|

|

March 31, |

|

|

December 31, |

|

|

September 30, |

|

|

June 30, |

|

|

March 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

2023 |

|

Loans Held For Investment by Type |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial real estate |

|

$ |

1,797,192 |

|

|

$ |

1,759,855 |

|

|

$ |

1,721,761 |

|

|

$ |

1,764,460 |

|

|

$ |

1,746,834 |

|

Commercial and industrial |

|

|

649,035 |

|

|

|

598,327 |

|

|

|

585,129 |

|

|

|

583,664 |

|

|

|

605,576 |

|

Residential real estate |

|

|

581,988 |

|

|

|

556,328 |

|

|

|

558,188 |

|

|

|

560,389 |

|

|

|

563,791 |

|

Agricultural real estate |

|

|

198,291 |

|

|

|

196,114 |

|

|

|

205,865 |

|

|

|

202,317 |

|

|

|

202,274 |

|

Agricultural |

|

|

149,312 |

|

|

|

118,587 |

|

|

|

103,352 |

|

|

|

104,510 |

|

|

|

106,169 |

|

Consumer |

|

|

106,345 |

|

|

|

103,690 |

|

|

|

107,823 |

|

|

|

107,330 |

|

|

|

105,974 |

|

Total loans held-for-investment |

|

|

3,482,163 |

|

|

|

3,332,901 |

|

|

|

3,282,118 |

|

|

|

3,322,670 |

|

|

|

3,330,618 |

|

Allowance for credit losses |

|

|

(44,449 |

) |

|

|

(43,520 |

) |

|

|

(44,186 |

) |

|

|

(44,544 |

) |

|

|

(45,103 |

) |

Net loans held for investment |

|

$ |

3,437,714 |

|

|

$ |

3,289,381 |

|

|

$ |

3,237,932 |

|

|

$ |

3,278,126 |

|

|

$ |

3,285,515 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asset Quality Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowance for credit losses on loans to total loans |

|

|

1.28 |

% |

|

|

1.31 |

% |

|

|

1.35 |

% |

|

|

1.34 |

% |

|

|

1.35 |

% |

Past due or nonaccrual loans to total loans |

|

|

1.09 |

% |

|

|

1.10 |

% |

|

|

1.03 |

% |

|

|

0.78 |

% |

|

|

0.66 |

% |

Nonperforming assets to total assets |

|

|

0.48 |

% |

|

|

0.53 |

% |

|

|

0.42 |

% |

|

|

0.31 |

% |

|

|

0.33 |

% |

Nonperforming assets to total loans plus other

real estate owned |

|

|

0.73 |

% |

|

|

0.79 |

% |

|

|

0.63 |

% |

|

|

0.47 |

% |

|

|

0.51 |

% |

Classified assets to bank total regulatory capital |

|

|

6.65 |

% |

|

|

7.09 |

% |

|

|

6.27 |

% |

|

|

7.94 |

% |

|

|

10.09 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selected Average Balance Sheet Data (QTD Average) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment securities |

|

$ |

1,074,101 |

|

|

$ |

985,591 |

|

|

$ |

1,085,905 |

|

|

$ |

1,155,971 |

|

|

$ |

1,185,482 |

|

Total gross loans receivable |

|

|

3,452,553 |

|

|

|

3,293,755 |

|

|

|

3,281,483 |

|

|

|

3,337,497 |

|

|

|

3,305,681 |

|

Interest-earning assets |

|

|

4,742,200 |

|

|

|

4,480,279 |

|

|

|

4,635,384 |

|

|

|

4,678,744 |

|

|

|

4,611,019 |

|

Total assets |

|

|

5,152,915 |

|

|

|

4,892,712 |

|

|

|

5,046,179 |

|

|

|

5,064,912 |

|

|

|

4,994,417 |

|

Interest-bearing deposits |

|

|

3,319,907 |

|

|

|

3,092,637 |

|

|

|

3,206,300 |

|

|

|

3,226,965 |

|

|

|

3,235,557 |

|

Borrowings |

|

|

390,166 |

|

|

|

391,691 |

|

|

|

385,125 |

|

|

|

385,504 |

|

|

|

247,932 |

|

Total interest-bearing liabilities |

|

|

3,710,073 |

|

|

|

3,484,328 |

|

|

|

3,591,425 |

|

|

|

3,612,469 |

|

|

|

3,483,489 |

|

Total deposits |

|

|

4,254,883 |

|

|

|

4,019,362 |

|

|

|

4,177,332 |

|

|

|

4,204,334 |

|

|

|

4,279,451 |

|

Total liabilities |

|

|

4,692,670 |

|

|

|

4,469,504 |

|

|

|

4,619,919 |

|

|

|

4,640,050 |

|

|

|

4,573,917 |

|

Total stockholders' equity |

|

|

460,244 |

|

|

|

423,207 |

|

|

|

426,260 |

|

|

|

424,862 |

|

|

|

420,500 |

|

Tangible common equity* |

|

|

398,041 |

|

|

|

361,451 |

|

|

|

363,625 |

|

|

|

361,409 |

|

|

|

356,053 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

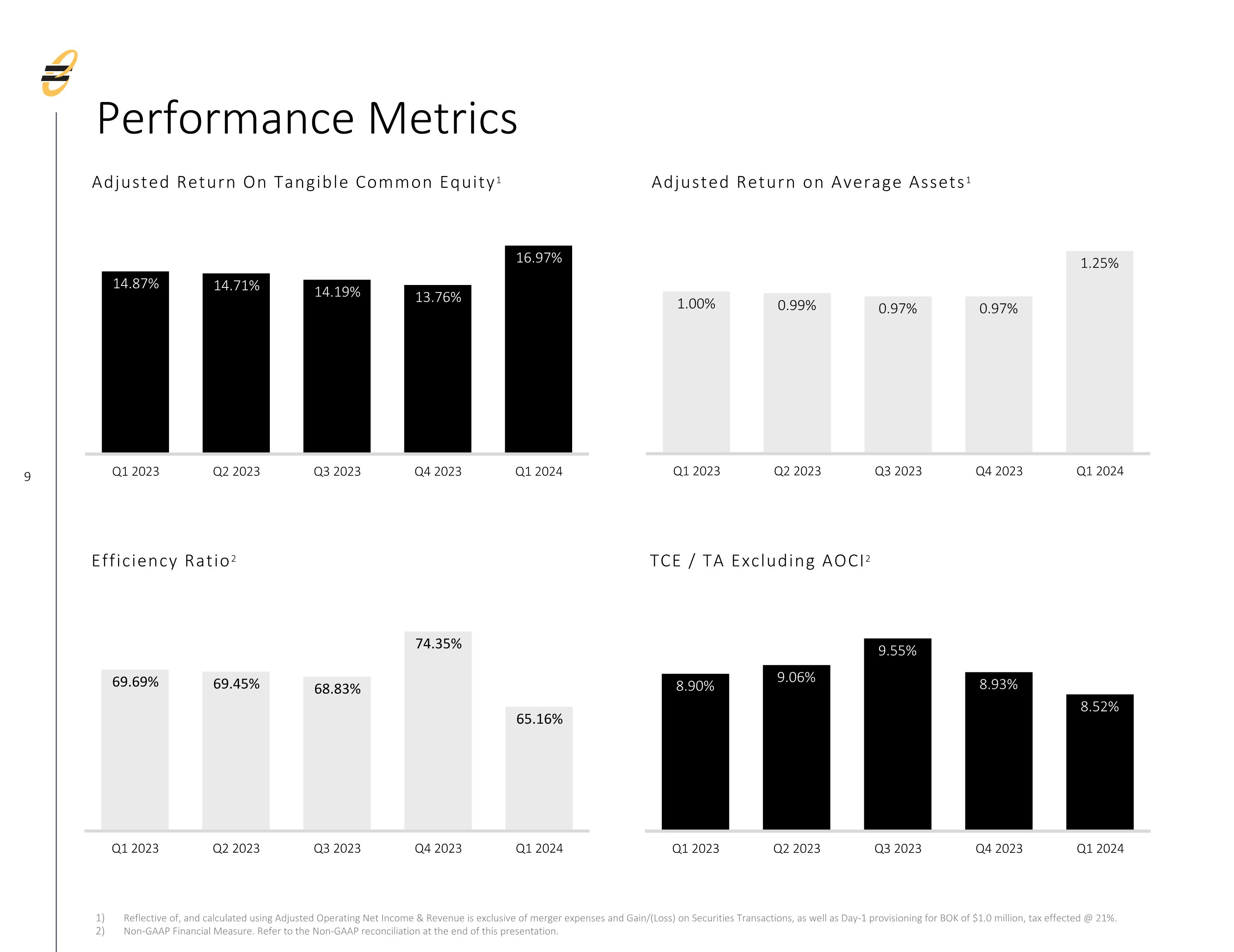

Performance ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on average assets (ROAA) annualized |

|

|

1.10 |

% |

|

|

(2.29 |

)% |

|

|

0.97 |

% |

|

|

0.91 |

% |

|

|

1.00 |

% |

Return on average assets before income tax and

provision for loan losses* |

|

|

1.46 |

% |

|

|

(3.16 |

)% |

|

|

1.22 |

% |

|

|

1.05 |

% |

|

|

1.18 |

% |

Return on average equity (ROAE) annualized |

|

|

12.29 |

% |

|

|

(26.53 |

)% |

|

|

11.49 |

% |

|

|

10.82 |

% |

|

|

11.89 |

% |

Return on average equity before income tax and

provision for loan losses* |

|

|

16.39 |

% |

|

|

(36.51 |

)% |

|

|

14.43 |

% |

|

|

12.51 |

% |

|

|

13.97 |

% |

Return on average tangible common equity

(ROATCE) annualized* |

|

|

14.96 |

% |

|

|

(30.39 |

)% |

|

|

14.18 |

% |

|

|

13.55 |

% |

|

|

14.89 |

% |

Yield on loans annualized |

|

|

6.85 |

% |

|

|

6.62 |

% |

|

|

6.67 |

% |

|

|

6.34 |

% |

|

|

5.94 |

% |

Cost of interest-bearing deposits annualized |

|

|

2.77 |

% |

|

|

2.58 |

% |

|

|

2.40 |

% |

|

|

2.14 |

% |

|

|

1.73 |

% |

Cost of total deposits annualized |

|

|

2.16 |

% |

|

|

1.98 |

% |

|

|

1.84 |

% |

|

|

1.64 |

% |

|

|

1.31 |

% |

Net interest margin annualized |

|

|

3.75 |

% |

|

|

3.49 |

% |

|

|

3.51 |

% |

|

|

3.38 |

% |

|

|

3.44 |

% |

Efficiency ratio* |

|

|

65.16 |

% |

|

|

74.35 |

% |

|

|

68.83 |

% |

|

|

69.44 |

% |

|

|

70.00 |

% |

Non-interest income / average assets |

|

|

0.92 |

% |

|

|

(3.52 |

)% |

|

|

0.69 |

% |

|

|

0.55 |

% |

|

|

0.74 |

% |

Non-interest expense / average assets |

|

|

2.90 |

% |

|

|

2.84 |

% |

|

|

2.69 |

% |

|

|

2.62 |

% |

|

|

2.74 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tier 1 Leverage Ratio |

|

|

9.10 |

% |

|

|

9.46 |

% |

|

|

9.77 |

% |

|

|

9.54 |

% |

|

|

9.60 |

% |

Common Equity Tier 1 Capital Ratio |

|

|

11.14 |

% |

|

|

11.74 |

% |

|

|

12.65 |

% |

|

|

12.23 |

% |

|

|

12.21 |

% |

Tier 1 Risk Based Capital Ratio |

|

|

11.73 |

% |

|

|

12.36 |

% |

|

|

13.28 |

% |

|

|

12.84 |

% |

|

|

12.83 |

% |

Total Risk Based Capital Ratio |

|

|

14.71 |

% |

|

|

15.48 |

% |

|

|

16.42 |

% |

|

|

15.96 |

% |

|

|

15.98 |

% |

Equity Bancshares, Inc.

PRESS RELEASE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total stockholders' equity to total assets |

|

|

8.72 |

% |

|

|

8.99 |

% |

|

|

8.46 |

% |

|

|

8.21 |

% |

|

|

8.24 |

% |

Tangible common equity to tangible assets* |

|

|

7.45 |

% |

|

|

7.87 |

% |

|

|

7.29 |

% |

|

|

7.06 |

% |

|

|

7.09 |

% |

Dividend payout ratio |

|

|

13.31 |

% |

|

|

(6.65 |

)% |

|

|

15.13 |

% |

|

|

13.53 |

% |

|

|

10.49 |

% |

Book value per common share |

|

$ |

29.80 |

|

|

$ |

29.35 |

|

|

$ |

27.13 |

|

|

$ |

27.18 |

|

|

$ |

27.03 |

|

Tangible book value per common share* |

|

$ |

25.10 |

|

|

$ |

25.37 |

|

|

$ |

23.09 |

|

|

$ |

23.08 |

|

|

$ |

22.96 |

|

Tangible book value per diluted common share* |

|

$ |

24.87 |

|

|

$ |

25.05 |

|

|

$ |

22.96 |

|

|

$ |

22.98 |

|

|

$ |

22.83 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* The value noted is considered a Non-GAAP financial measure. For a reconciliation of Non-GGAP financial measures, see Table 8. Non-GAAP Financial Measures. |

|

Equity Bancshares, Inc.

PRESS RELEASE

TABLE 4. QUARTER-TO-DATE NET INTEREST INCOME ANALYSIS (Unaudited)

(Dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended |

|

|

For the three months ended |

|

|

March 31, 2024 |

|

|

March 31, 2023 |

|

|

Average Outstanding Balance |

|

|

Interest Income/ Expense |

|

|

Average

Yield/Rate(3)(4) |

|

|

Average Outstanding Balance |

|

|

Interest Income/ Expense |

|

|

Average

Yield/Rate(3)(4) |

|

Interest-earning assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial and industrial |

$ |

634,637 |

|

|

$ |

12,412 |

|

|

|

7.87 |

% |

|

$ |

577,452 |

|

|

$ |

9,634 |

|

|

|

6.77 |

% |

Commercial real estate |

|

1,449,177 |

|

|

|

24,601 |

|

|

|

6.83 |

% |

|

|

1,344,727 |

|

|

|

20,112 |

|

|

|

6.07 |

% |

Real estate construction |

|

354,801 |

|

|

|

7,775 |

|

|

|

8.81 |

% |

|

|

404,016 |

|

|

|

6,695 |

|

|

|

6.72 |

% |

Residential real estate |

|

580,426 |

|

|

|

6,461 |

|

|

|

4.48 |

% |

|

|

570,139 |

|

|

|

5,802 |

|

|

|

4.13 |

% |

Agricultural real estate |

|

197,023 |

|

|

|

3,468 |

|

|

|

7.08 |

% |

|

|

202,901 |

|

|

|

3,114 |

|

|

|

6.22 |

% |

Agricultural |

|

131,035 |

|

|

|

2,391 |

|

|

|

7.34 |

% |

|

|

100,251 |

|

|

|

1,478 |

|

|

|

5.98 |

% |

Consumer |

|

105,454 |

|

|

|

1,721 |

|

|

|

6.56 |

% |

|

|

106,195 |

|

|

|

1,546 |

|

|

|

5.91 |

% |

Total loans |

|

3,452,553 |

|

|

|

58,829 |

|

|

|

6.85 |

% |

|

|

3,305,681 |

|

|

|

48,381 |

|

|

|

5.94 |

% |

Securities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable securities |

|

1,011,466 |

|

|

|

9,877 |

|

|

|

3.93 |

% |

|

|

1,083,645 |

|

|

|

5,947 |

|

|

|

2.23 |

% |

Nontaxable securities |

|

62,635 |

|

|

|

391 |

|

|

|

2.51 |

% |

|

|

101,837 |

|

|

|

669 |

|

|

|

2.67 |

% |

Total securities |

|

1,074,101 |

|

|

|

10,268 |

|

|

|

3.84 |

% |

|

|

1,185,482 |

|

|

|

6,616 |

|

|

|

2.26 |

% |

Federal funds sold and other |

|

215,546 |

|

|

|

2,670 |

|

|

|

4.98 |

% |

|

|

119,856 |

|

|

|

1,126 |

|

|

|

3.81 |

% |

Total interest-earning assets |

$ |

4,742,200 |

|

|

|

71,767 |

|

|

|

6.09 |

% |

|

$ |

4,611,019 |

|

|

|

56,123 |

|

|

|

4.94 |

% |

Interest-bearing liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Demand, savings and money market deposits |

$ |

2,520,521 |

|

|

|

15,660 |

|

|

|

2.50 |

% |

|

$ |

2,350,042 |

|

|

|

8,453 |

|

|

|

1.46 |

% |

Time deposits |

|

799,386 |

|

|

|

7,195 |

|

|

|

3.62 |

% |

|

|

885,515 |

|

|

|

5,368 |

|

|

|

2.46 |

% |

Total interest-bearing deposits |

|

3,319,907 |

|

|

|

22,855 |

|

|

|

2.77 |

% |

|

|

3,235,557 |

|

|

|

13,821 |

|

|

|

1.73 |

% |

FHLB advances |

|

113,348 |

|

|

|

1,144 |

|

|

|

4.06 |

% |

|

|

89,078 |

|

|

|

1,018 |

|

|

|

4.64 |

% |

Other borrowings |

|

276,818 |

|

|

|

3,586 |

|

|

|

5.21 |

% |

|

|

158,854 |

|

|

|

2,174 |

|

|

|

5.55 |

% |

Total interest-bearing liabilities |

$ |

3,710,073 |

|

|

|

27,585 |

|

|

|

2.99 |

% |

|

$ |

3,483,489 |

|

|

|

17,013 |

|

|

|

1.98 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income |

|

|

|

$ |

44,182 |

|

|

|

|

|

|

|

|

$ |

39,110 |

|

|

|

|

Interest rate spread |

|

|

|

|

|

|

|

3.10 |

% |

|

|

|

|

|

|

|

|

2.96 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest margin (2) |

|

|

|

|

|

|

|

3.75 |

% |

|

|

|

|

|

|

|

|

3.44 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Average loan balances include nonaccrual loans. |

|

(2) Net interest margin is calculated by dividing annualized net interest income by average interest-earning assets for the period. |

|

(3) Tax exempt income is not included in the above table on a tax-equivalent basis. |

|

(4) Actual unrounded values are used to calculate the reported yield or rate disclosed. Accordingly, recalculations using the amounts in thousands as disclosed in this report may not produce the same amounts. |

|

Equity Bancshares, Inc.

PRESS RELEASE

TABLE 5. QUARTER-OVER-QUARTER NET INTEREST INCOME ANALYSIS (Unaudited)

(Dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended |

|

|

For the three months ended |

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

|

Average Outstanding Balance |

|

|

Interest Income/ Expense |

|

|

Average

Yield/Rate(3)(4) |

|

|

Average Outstanding Balance |

|

|

Interest Income/ Expense |

|

|

Average

Yield/Rate(3)(4) |

|

Interest-earning assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial and industrial |

$ |

634,637 |

|

|

$ |

12,412 |

|

|

|

7.87 |

% |

|

$ |

580,726 |

|

|

$ |

11,397 |

|

|

|

7.79 |

% |

Commercial real estate |

|

1,449,177 |

|

|

|

24,601 |

|

|

|

6.83 |

% |

|

|

1,309,588 |

|

|

|

21,630 |

|

|

|

6.55 |

% |

Real estate construction |

|

354,801 |

|

|

|

7,775 |

|

|

|

8.81 |

% |

|

|

439,708 |

|

|

|

9,000 |

|

|

|

8.12 |

% |

Residential real estate |

|

580,426 |

|

|

|

6,461 |

|

|

|

4.48 |

% |

|

|

561,382 |

|

|

|

5,866 |

|

|

|

4.15 |

% |

Agricultural real estate |

|

197,023 |

|

|

|

3,468 |

|

|

|

7.08 |

% |

|

|

196,468 |

|

|

|

3,421 |

|

|

|

6.91 |

% |

Agricultural |

|

131,035 |

|

|

|

2,391 |

|

|

|

7.34 |

% |

|

|

100,226 |

|

|

|

1,928 |

|

|

|

7.63 |

% |

Consumer |

|

105,454 |

|

|

|

1,721 |

|

|

|

6.56 |

% |

|

|

105,657 |

|

|

|

1,690 |

|

|

|

6.35 |

% |

Total loans |

|

3,452,553 |

|

|

|

58,829 |

|

|

|

6.85 |

% |

|

|

3,293,755 |

|

|

|

54,932 |

|

|

|

6.62 |

% |

Securities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable securities |

|

1,011,466 |

|

|

|

9,877 |

|

|

|

3.93 |

% |

|

|

932,376 |

|

|

|

6,417 |

|

|

|

2.73 |

% |

Nontaxable securities |

|

62,635 |

|

|

|

391 |

|

|

|

2.51 |

% |

|

|

53,215 |

|

|

|

354 |

|

|

|

2.64 |

% |

Total securities |

|

1,074,101 |

|

|

|

10,268 |

|

|

|

3.84 |

% |

|

|

985,591 |

|

|

|

6,771 |

|

|

|

2.73 |

% |

Federal funds sold and other |

|

215,546 |

|

|

|

2,670 |

|

|

|

4.98 |

% |

|

|

200,933 |

|

|

|

2,591 |

|

|

|

5.12 |

% |

Total interest-earning assets |

$ |

4,742,200 |

|

|

|

71,767 |

|

|

|

6.09 |

% |

|

$ |

4,480,279 |

|

|

|

64,294 |

|

|

|

5.69 |

% |

Interest-bearing liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Demand savings and money market deposits |

$ |

2,520,521 |

|

|

|

15,660 |

|

|

|

2.50 |

% |

|

$ |

2,351,663 |

|

|

|

13,918 |

|

|

|

2.35 |

% |

Time deposits |

|

799,386 |

|

|

|

7,195 |

|

|

|

3.62 |

% |

|

|

740,974 |

|

|

|

6,156 |

|

|

|

3.30 |

% |

Total interest-bearing deposits |

|

3,319,907 |

|

|

|

22,855 |

|

|

|

2.77 |

% |

|

|

3,092,637 |

|

|

|

20,074 |

|

|

|

2.58 |

% |

FHLB advances |

|

113,348 |

|

|

|

1,144 |

|

|

|

4.06 |

% |

|

|

102,432 |

|

|

|

1,005 |

|

|

|

3.89 |

% |

Other borrowings |

|

276,818 |

|

|

|

3,586 |

|

|

|

5.21 |

% |

|

|

289,259 |

|

|

|

3,748 |

|

|

|

5.14 |

% |

Total interest-bearing liabilities |

$ |

3,710,073 |

|

|

|

27,585 |

|

|

|

2.99 |

% |

|

$ |

3,484,328 |

|

|

|

24,827 |

|

|

|

2.83 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income |

|

|

|

$ |

44,182 |

|

|

|

|

|

|

|

|

$ |

39,467 |

|

|

|

|

Interest rate spread |

|

|

|

|

|

|

|

3.10 |

% |

|

|

|

|

|

|

|

|

2.86 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest margin (2) |

|

|

|

|

|

|

|

3.75 |

% |

|

|

|

|

|

|

|

|

3.49 |

% |

|

|

|

|

|

|

|

|