false

0001854583

0001854583

2024-08-01

2024-08-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

Form 8-K

Pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934

August 1, 2024

Date of Report (Date of

earliest event reported)

COLLECTIVE AUDIENCE, INC.

(Exact Name of Registrant as Specified in

its Charter)

| Delaware |

|

001-40723 |

|

86-2861807 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

85 Broad Street 16-079

New York, NY 10004

(Address of Principal

Executive Offices and Zip Code)

Registrant’s telephone

number, including area code:

(808) 829-1057

(Former name or former

address, if changed since last report)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

CAUD |

|

The Nasdaq Stock Market LLC |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule

12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

☒

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive

Agreement

To the extent required, the information below

in Item 2.01 regarding the Purchase Agreement (as defined below) and the transactions contemplated thereby are incorporated herein by

reference.

Item 2.01 Completion of Acquisition or Disposition

of Assets.

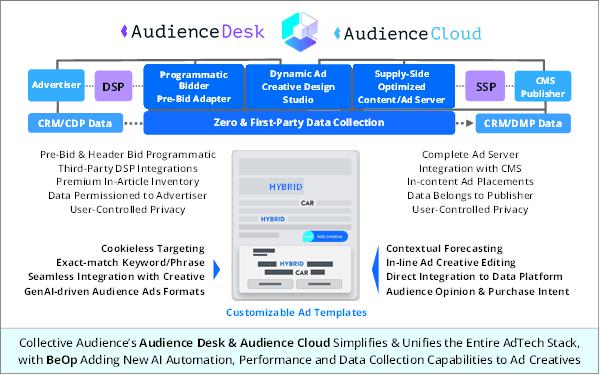

As previously reported in that certain Current

Report on Form 8-K dated March 1, 2024, Collective Audience, Inc. (the “Company”), a Delaware corporation, entered into two

agreements with The Odyssey SAS (dba BeOp) (“BeOp”), a company organized under the laws of France specializing in conversational

advertising. The first being a binding Letter of Intent (the “Binding LOI”) whereby the Company was bound to acquire 100%

of the ownership of BeOp, subject to certain closing conditions and the second being an interim exclusive joint venture and software license

agreement pursuant to which the Company obtained an exclusive license to commercialize the BeOp software in North America during the period

between signing the Binding LOI and the expected future closing of the acquisition (the “Interim License Agreement”).

On August 1, 2024, the Company entered into

a Share Exchange Agreement (the “Purchase Agreement”) by and among the Company, BeOp, and all shareholders of BeOp (the

“Sellers” and each a “Seller”), pursuant to which the Company purchased one hundred percent (100%) of the

outstanding equity interests in BeOp, resulting in BeOp becoming a wholly-owned subsidiary of the Company (the

“Acquisition”). The Acquisition closed concurrently on August 1, 2024 (the “Closing Date”).

In consideration for the Acquisition, the

Company issued a total of 3,006,667 shares of restricted Company common stock to the Sellers (the “Exchange

Consideration”), provided, however, the Company held-back 666,667 shares of the Exchange Consideration to be held for a period

of twelve (12) months following the Closing Date, to the extent not reduced by any indemnification claims as defined in the Purchase

Agreement. (the “Holdback Shares”).

Pursuant to the Purchase Agreement, the Sellers

have agreed to enter into lock-up agreements covering the Company common stock issued thereunder whereby such

Sellers shall not sell nor transfer any of the Company securities which they hold, subject to certain exceptions, during the Lock-Up Period

following the Closing Date. There are two lock-up periods: (i) six (6) months from the Closing Date for external investors of BeOp, (ii)

six (6) months from the Closing Date for management and employees of BeOp for 50% of each such Seller’s stock and twelve (12) months

from the Closing Date for management and employees of BeOp for the remaining 50% of each such Seller’s stock, (iii) a Change of

Control, or (iv) the written consent Company (collectively, the “Lock-Up Period”).

As further consideration for the Acquisition,

at the end of December 31, 2025, and upon BeOp reaching its currently forecasted gross revenue and EBITDA for 2024 and 2025, the Company

may issue to Sellers an additional €50,000 worth of Company common stock based on a 20-Day VWAP of the Company’s common stock

as of December 31, 2025 (the “Earnout Payment”).

As previously disclosed, the closing of the Acquisition

was conditioned, in part on BeOp’s debt restructuring proceedings with the Commercial Court of Paris, France (the “Restructured

Debt”). As part of the Binding LOI, the Company had contributed to an escrow account (at the direction of the Commercial Court of

Paris) €350,000 (the “Escrow”). As of the Closing Date, the Escrow, at the direction of the Commercial Court of Paris,

was released to the BeOp. Furthermore, as of the Closing Date, the Sellers and BeOp (within the limits of their respective powers and

positions in BeOp prior to the Closing), will continue their role in managing the insolvency procedure before the commercial Court of

Paris until its completion to facilitate the orderly completion of such proceedings, at no additional cost to Company. BeOp and the Sellers

agree to cooperate in good faith following the closing of the Purchase Agreement to effectuate the completion of said court proceedings

before the commercial Court of Paris. The Interim License Agreement was terminated as of the Closing Date as a result of the Acquisition

of 100% of BeOp by the Company.

The Purchase Agreement contains standard representations,

warranties, covenants, indemnification and other terms customary in similar transactions.

The foregoing description of the Purchase Agreement

and the transactions contemplated thereby does not purport to be complete, and is qualified in its entirety by reference to the complete

text of such Purchase Agreement, a copy of is filed as Exhibit 2.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 3.02 Unregistered Sales of Equity

Securities.

The information set forth in Item 2.01 of this

Current Report regarding the issuance of the Exchange Consideration is incorporated by reference into this Item 3.02.

The issuance of the shares of the Company’s

common stock in connection with the Acquisition is exempt from registration under the Securities Act of 1933, as amended (the “Securities

Act”), in reliance on exemptions from the registration requirements of the Securities Act in transactions not involved in a public

offering pursuant to Section 4(a)(2), Regulation D and/or Regulation S of the Securities Act.

Item 7.01 Regulation FD Disclosure

On August 7, 2024, the Company issued a press

release announcing the above referenced acquisition of BeOp. A copy of the press release is furnished as Exhibit 99.1 to this Current

Report.

The information set forth under Item 7.01 of this

Current Report, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of

Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities

of such section. The information in Item 7.01 of this Current Report, including Exhibit 99.1, shall not be deemed incorporated by reference

into any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any incorporation by reference language

in any such filing, except as expressly set forth by specific reference in such a filing. This Current Report will not be deemed an admission

as to the materiality of any information in this Current Report that is required to be disclosed solely by Regulation FD.

Forward Looking Statement

This Current Report, including Exhibit 99.1 attached

hereto, contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements

other than statements of historical fact contained in this Current Report, including statements regarding the Purchase Agreement, the

Acquisition, business strategy, and plans are forward-looking statements. These statements involve known and unknown risks, uncertainties

and other important factors that may cause the Company’s actual results, performance or achievements to be materially different

from any future results, performance or achievements expressed or implied by the forward-looking statements. In addition, projections,

assumptions and estimates of the Company’s future performance and the future performance of the markets in which the Company operates

are necessarily subject to a high degree of uncertainty and risk. In some cases, you can identify forward-looking statements by terms

such as “may,” “will,” “would,” “could,” “should,” “expect,” “plan,”

“anticipate,” “could,” “intend,” “target,” “project,” “contemplate,”

“believe,” “estimate,” “predict,” “potential” or “continue” or the negative

of these terms or other similar expressions. The forward-looking statements in this Current Report are only predictions. These forward-looking

statements speak only as of the date of this Current Report and are subject to a number of risks, uncertainties and assumptions. The events

and circumstances reflected in such forward-looking statements may not be achieved or occur and actual results could differ materially

from those projected in the forward-looking statements. Except as required by applicable law, the Company does not plan to publicly update

or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances

or otherwise.

Item 9.01. Financial Statements and Exhibits.

(a) Financial Statements of Business Acquired

As permitted by Item 9.01(a)(4)

of Form 8-K, the financial statements required by Item 9.01(a) of Form 8-K will be filed by the Company by an amendment to this Current

Report on Form 8-K not later than 71 days after the date upon which this Current Report on Form 8-K must be filed.

(b) Pro Forma Financial Information

As permitted by Item 9.01(b)(2)

of Form 8-K, the pro forma financial information required by Item 9.01(b) of Form 8-K will be filed by the Company by an amendment to

this Current Report on Form 8-K not later than 71 days after the date upon which this Current Report on Form 8-K must be filed.

(d) Exhibits

| * | The schedules and exhibits to the Purchase Agreement have been

omitted pursuant to Item 601(a)(5) of Regulation S-K. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Dated: August 7, 2024 |

COLLECTIVE AUDIENCE, INC. |

| |

|

| |

By: |

/s/ Peter Bordes |

| |

Name: |

Peter Bordes |

| |

Title: |

Chief Executive Officer |

3

Exhibit

2.1

SHARE

EXCHANGE AGREEMENT

THIS

SHARE EXCHANGE AGREEMENT (the “Agreement”) is made and entered into as of August 1st, 2024 by and among

COLLECTIVE AUDIENCE, INC., a Delaware corporation (“Buyer”), The Odyssey SAS (dba BeOp), a company organized under

the laws of France (the “Company”), and the shareholders of the Company, as set forth on Exhibit A (each

a “Seller” and collectively “Sellers”) acting severally but not jointly (“conjointement

mais sans solidarité entre eux”) for the purposes of this Agreement. Certain other capitalized terms used in this Agreement

are defined in Exhibit B attached hereto.

RECITALS

WHEREAS,

the Sellers own 100% of the fully diluted shares in the Company (the “Company Shares”) consisting of 36,728,486 ordinary

shares;

WHEREAS,

the Sellers desire to transfer to the Buyer and the Buyer desires to acquire from each Seller all of the Company Shares as of the Closing

Date, upon the terms and conditions set forth in this Agreement;

WHEREAS,

the Buyer desires to buy all of the Company Shares as of the Closing Date, in the context of a bankruptcy procedure before the commercial

Court of Paris, decided by the commercial Court of Paris on March 21, 2024, and pursuant to a restructured debt plan adopted by the commercial

Court on July 19, 2024, providing for the transfer of all of the Company Shares to the Buyer;

WHEREAS,

as of the date of this Agreement, the Buyer has carried out a due diligence on the Company, consisting in the review and analysis of

documents and writing information communicated by the Company, and has elaborated the draft restructured debt plan submitted to the commercial

Court for adoption on July 19, 2024; and

WHEREAS,

in exchange for the Company Shares, Buyer has agreed to issue to each Seller, as of the Closing Date, shares of restricted common stock,

par value $0.0001 per share, of the Buyer (the “Buyer Common Stock”) upon the terms and conditions set forth in this

Agreement.

AGREEMENT

NOW,

THEREFORE, in consideration of the foregoing and the mutual promises, representations, warranties, covenants and agreements herein

contained, the parties hereto, intending to be legally bound, hereby agree as follows:

ARTICLE

1

SHARE

EXCHANGE

1.1

Sale of the Company; Exchange of Shares. At the Closing, the Sellers shall sell, transfer, convey, assign and deliver to the Buyer

the Company Shares, free and clear of all Liens, in exchange for that number of shares of Buyer Common Stock equal to an aggregate of

One Million Three Hundred Fifty-Three Thousand Euros (€1,353,000), divided by the 20-day VWAP per share of the Buyer Common Stock

immediately prior to the Closing (the “Exchange Consideration”), to be issued as follows:

(a)

At the Closing, Buyer shall deliver to Sellers One Million Fifty-Three Thousand Euros €1,053,000 worth of the Exchange Consideration

(the “Closing Date Consideration”) in the amounts and allocation among the Sellers designated on Exhibit A;

and

(b)

At the Closing, Buyer shall retain €300,000 worth of the Exchange Consideration (the “Holdback Shares”), for

a period of twelve (12) months following Closing (defined below), to the extent not reduced pursuant to Section 7.6; Each Seller shall

contribute the Holdback Shares on a prorata basis as indicated in Exhibit A.

(c)

At the Closing, Sellers will have no right, title or interest in the Company or any of its Assets. In connection with the sale of the

Company Shares, Buyer and Sellers shall execute this Agreement and related exhibits.

(d)

If any payment or other amount is required to be converted into Euro for the purpose of determining the Closing Date Consideration (or

any payment to be made under this Agreement), the exchange rate to be applied for such conversion shall be mid-market rate at market

close (16:00 EST) as quoted by Bloomberg L.P. (“Bloomberg”) on the day before the Closing, or if such date is not a Business

Day, on the immediately preceding Business Day. If Bloomberg does not quote a spot rate at the relevant time and date, or if such quote

is not available for any reason, the exchange rate to be applied for such conversion shall be the ECB mid-market reference rate as quoted

by the European Central Bank at the relevant time and date. The Parties agree that the reference rate or the alternative exchange rate

determined as set forth above, as applicable, shall be conclusive and binding on them for the purposes of this Agreement, unless there

is a manifest error in the calculation or application of such rate.

1.2

Closing. The closing (the “Closing”) of the transactions contemplated by this Agreement (the “Transactions”)

shall take place simultaneously with the execution of this Agreement on the date hereof (the “Closing Date”), remotely

by exchange of documents and signatures (or their electronic counterparts). The consummation of the transactions contemplated by this

Agreement shall be deemed to occur at 12:01 a.m. EST on the Closing Date. At Closing, the Company will cause its transfer agent to issue

the Closing Date Consideration in book entry form as set forth in Exhibit A.

1.3

Lock-Up of Common Stock. Each share of Buyer Common Stock received in connection with this Agreement shall be subject to a lock-up

beginning on the Closing Date and ending on the earliest of (i) six (6) months for investors and half of each insider’s Exchange

Consideration, (ii) twelve (12) months for the other half of each insider’s Exchange Consideration, after the Closing Date, (ii)

a Change of Control, or (iii) the written consent of Buyer (the “Lock-Up Period”). During the Lock-Up Period, each

Seller shall enter into a lock-up agreement, substantially in the form attached hereto as Exhibit C, pursuant to which

Seller may not, directly or indirectly, (i) offer, sell, offer to sell, contract to sell, hedge, pledge, sell any option or contract

to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase or sell (or announce any offer,

sale, offer of sale, contract of sale, hedge, pledge, sale of any option or contract to purchase, purchase of any option or contract

of sale, grant of any option, right or warrant to purchase or other sale or disposition), or otherwise transfer or dispose of (or enter

into any transaction or device that is designed to, or could be expected to, result in the disposition by any person at any time in the

future), any Buyer Common Stock acquired pursuant to this Agreement or (ii) enter into any swap or other agreement or any transaction

that transfers, in whole or in part, directly or indirectly, the economic consequence of ownership of any Buyer Common Stock, whether

or not any such swap or transaction described in clause (i) or (ii) above is to be settled by delivery of any Buyer Common Stock. The

terms of this provision shall convey to any subsequent holder of the Buyer Common Stock. During the Lock-Up Period, the Company and each

Seller shall not execute any purchases or sales of Buyer Common Stock that would constitute Short Sales (as defined in Rule 200 of Regulation

SHO under the Exchange Act), including naked shorting, hard shorting or regular shorting.

1.4

Earnout Shares.

(a)

As additional consideration for the purchased assets, at the end of the Earnout Period, and upon the Company reaching its currently forecasted

gross revenue and EBITDA for 2024 and 2025, taking into account and including the Company’s sales under the Interim License Agreement,

as set forth on Exhibit F, Buyer shall pay to Sellers, in accordance with the pro rata allocations designated in Exhibit

A, the Earnout Payment. The parties agree that any payment of shares under this Section 1.4 shall be treated as an adjustment

to the consideration paid by Buyer pursuant to this Agreement for all tax purposes. The Earnout Payment shall not reduce the Closing

Date Consideration.

(b)

If the Sellers and the Buyer do not reach agreement within thirty (30) business days of receipt by the Buyer of the Earnout Payment calculation

(which it shall notify to the Sellers at the end of the Earnout Period), then the matters in dispute may be referred (on the application

of either the Sellers or the Buyer) for determination by such independent firm of accountants of international standing as the Sellers

and the Buyer shall agree or, failing agreement, by such independent firm of accountants of international standing (the “expert”)

as shall be appointed by the President of the Paris commercial Court (Tribunal de Commerce de Paris) ruling in summary proceedings upon

the request of the Buyer or the Sellers (whichever is the most diligent party).

ARTICLE

2

REPRESENTATIONS

AND WARRANTIES OF THE SELLERS

Except

as set forth in the corresponding sections or subsections of the Disclosure Schedules attached hereto, subject to the terms and conditions

of this Agreement, each Seller represents and warrants to the Buyer in respect of himself/itself only, the matters set forth below as

at the date of Closing, as follows:

2.1

Ownership of Company Shares. Each Seller has good and valid title to and beneficial ownership of the number of Company Shares, and

such are (i) validly issued, fully paid, and nonassessable, and (ii) free and clear of all Liens.

2.2

Purchase Entirely for Own Account. The Buyer Common Stock proposed to be acquired by each Seller hereunder will be acquired

for investment for their own account, and not with a view to the resale or “distribution” (within the meaning of the Securities

Act of 1933, as amended (the “Securities Act”)) of any part thereof, and each Seller has no present intention of selling

or otherwise distributing the Buyer Common Stock.

2.3

Available Information. Each Seller has reviewed all information such Seller considered necessary or appropriate for deciding

whether to acquire the Buyer Common Stock and has had an opportunity to ask questions and receive answers from Buyer regarding the terms

and conditions of this Agreement and the Transaction herein. Each Seller has such knowledge and experience in financial and business

matters that it is capable of evaluating the merits and risks of an investment in the Buyer. The foregoing, however, does not limit or

modify the representations and warranties of the Company and the Buyer in Article 4 of this Agreement, respectively, or the right of

the Seller to rely thereon. Each Seller acknowledges that an investment in the Buyer Common Stock involves a high degree of risk, is

speculative and there can be no assurance of any return on any such investment.

2.4

Non-Registration. Each Seller understands that the Exchange Consideration has not been registered under the Securities Act and, if

issued in accordance with the provisions of this Agreement, will be issued by reason of a specific exemption from the registration provisions

of the Securities Act which depends upon, among other things, the bona fide nature of the investment intent and the accuracy of the Seller’s

representations as expressed herein. The non-registration shall have no prejudice with respect to any rights, interests, benefits and

entitlements attached to the Exchange Consideration in accordance with the Buyer’s Organizational Documents or the laws of its

jurisdiction of incorporation.

2.5

Restricted Securities. Each Seller understands that the Exchange Consideration is characterized as “restricted securities”

under the Securities Act inasmuch as this Agreement contemplates that, if acquired by the Seller pursuant hereto, the Exchange Consideration

would be acquired in a transaction not involving a public offering. The Seller further acknowledges that if the Exchange Consideration

is issued to the Seller in accordance with the provisions of this Agreement, such Exchange Consideration may not be offered, resold,

or otherwise transferred without registration under the Securities Act or the existence of an exemption therefrom. Each Seller acknowledges

and is aware that the Buyer Common Stock may not be sold pursuant to Rule 144 adopted under the Securities Act unless certain conditions,

including applicable holding periods are met.

2.6

Accredited Investor. Each Seller represents that they are an “accredited investor” within the meaning of Rule 501(a)

under the Securities Act.

ARTICLE

3

REPRESENTATIONS

AND WARRANTIES OF THE COMPANY

Subject

to the terms and conditions of this Agreement, the Company represents and warrants to the Buyer, the matters set forth below as at the

date of Closing , except as set forth in the disclosure schedules attached hereto (the “Company Disclosure Schedule”):

3.1

Organization, Standing and Power. The Company is company duly organized, validly existing and in good standing under the Laws

of the country of France and has the requisite power and authority and all government licenses, authorizations, Permits, consents and

approvals required to own, lease and operate its properties and carry on its business as now being conducted. The Company is duly qualified

or licensed to do business and is in good standing in each jurisdiction in which the nature of its business or the ownership or leasing

of its properties makes such qualification or licensing necessary, other than in such jurisdictions where the failure to be so qualified

or licensed (individually or in the aggregate) would not have a Material Adverse Effect. Schedule 3.1 contains a correct

and complete list of the jurisdictions in which the Company is qualified or registered to do business as a foreign entity. The Sellers

and Company have made available to the Buyer correct and complete copies of (a) the Organizational Documents, including all amendments

thereto, (b) the ownership records of the Company and (c) the minutes and other records of the meetings and other proceedings (including

actions taken by written consent or otherwise without a meeting) of the owners of the Company.

3.2

Subsidiaries. The Company does not own directly or indirectly, any equity or other ownership interest in any company, corporation,

partnership, joint venture or otherwise, except as set forth on Schedule 3.2.

3.3

Capital Structure of the Company. Each Seller is the record and beneficial owners, and has good and marketable title to the Company

Shares being exchanged by such Seller pursuant to this Agreement, with the right and authority to sell and deliver such Company Shares

to Buyer as provided herein. The Company Shares constitute 100% of the total fully diluted shares in the Company. The Company Shares

have been duly authorized and are validly issued, fully paid and non-assessable. There are no outstanding or authorized options, warrants,

convertible securities or other rights, agreements, arrangements or commitments of any character relating to any membership interests

in the Company or obligating Seller or the Company to issue or sell any shares of the Company (including the Company Shares), or any

other interest in, the Company. Other than the Organizational Documents, there are no voting trusts, proxies or other agreements or understandings

in effect with respect to the voting or transfer of any of the Company Shares.

3.4

Corporate Authority. The Company has all requisite Societe par actions Simplifiee (SAS) and other power and authority to enter

into this Agreement and to consummate the Transactions contemplated hereunder. The execution and delivery of this Agreement by the Company

and the consummation by the Company of the Transactions have been (or at Closing will have been) duly authorized by all necessary SAS

action on the part of the Company. This Agreement has been duly executed and when delivered by the Company shall constitute a valid and

binding obligation of the Company, enforceable against the Company and the Seller in accordance with its terms, except as such enforcement

may be limited by bankruptcy, insolvency or other similar Laws affecting the enforcement of creditors’ rights generally or by general

principles of equity.

3.5

No Conflict. The execution and delivery of this Agreement do not, and the consummation of the Transactions and compliance with the

provisions hereof will not, conflict with, or result in any breach or violation of, or Default (with or without notice or lapse of time,

or both) under, or give rise to a right of termination, cancellation or acceleration of or “put” right with respect to any

obligation or to a loss of a material benefit under, or result in the creation of any Lien upon any of the properties or Assets of the

Company under, (i) the Organizational Documents of the Company, (ii) any, loan or credit agreement, note, bond, mortgage, indenture,

lease or other agreement, instrument or Permit, applicable to the Company or the Seller, theirs properties or Assets, or (iii) subject

to the governmental filings and other matters referred to in the following sentence, any judgment, Order, decree, statute, Law, ordinance,

rule, regulation or arbitration award applicable to the Company or the Seller, their properties or Assets.

3.6

Governmental Authorization. Other than the approval of the Company’s restructuring plan in the insolvency proceedings

in the courts of France, no consent, approval, Order or authorization of, or registration, declaration or filing with, or notice to,

any Governmental Entity, is required by or with respect to the Company in connection with the execution and delivery of this Agreement

by the Company or the consummation by the Company of the transactions contemplated hereby, except, with respect to this Agreement, any

filings under the Securities Act or Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder

(the “Exchange Act”).

3.7

Certain Fees. Except with respect to Yellion Partners, no brokerage or finder’s fees or commissions are or will be payable by

the Company, Seller or any of their respective Affiliates to any broker, financial advisor or consultant, finder, placement agent, investment

banker, bank or other person with respect to the Transactions. The broker’s fees of Yellion Partners are included in the restructured

debt plan adopted by the commercial Court on July 19, 2024..

3.8

Financial Statements. Copies of the Company’s financial statements consisting of the balance sheet of the Company as at December

31 in each of the years 2023 and 2022 and the related statements of income and retained earnings, members’ equity and cash flow for the

years then ended (collectively, the “Financial Statements”) have been delivered to Buyer and are attached as Schedule

3.8 hereto. The Financial Statements, to the Knowledge of the Company, are true, accurate and in all material respects have been

prepared in accordance with French accounting principles, from the books and records of the Company, and such books and records have

been maintained on a basis consistent with French accounting principles. The balance sheet of the Company as of December 31, 2023 is

referred to herein as the “Balance Sheet” and the date thereof as the “Balance Sheet Date”. The

Balance Sheet, to the Knowledge of the Company, fairly represents in all material respects the financial position of the Company as of

the date of such Balance Sheet, and the statement of income and cash flows included in the Financial Statements (including any related

notes and schedules) fairly presents, to the Knowledge of the Company, in all material respects the results of operations and changes

in cash flows of the Company for the periods set forth therein, in each case in accordance with French accounting principles (except

as expressly noted therein or as disclosed on Schedule 3.8). Since December 31, 2023, there has been no change in any accounting

(or tax accounting) policy, practice or procedure of the Company. The Company maintains accurate books and records reflecting its assets

and liabilities and maintains proper and adequate internal accounting controls sufficient to provide reasonable assurances regarding

the reliability of financial reporting and the preparation of annual financial statements for external purposes in accordance with French

accounting principles.

3.9

Cash in Bank, Indebtedness and Transaction Expenses. The amount of cash in the bank of the Company and its subsidiary de BeOP Inc.

is Three Hundred Eighty-Eight Thousand and Two Hundred Euros (€388,200), and all cash in the Company bank accounts shall remain

at Closing. The Indebtedness of the Company will not exceed Three Million Two Hundred Sixty-Nine Thousand Eight Hundred and Twenty-Four

Euros (€3,269,824). The Company will not have any unpaid, accrued or accruing Transaction Expenses at the Closing.

3.10

Bank Accounts. Schedule 3.10 sets forth a correct and complete list and description of any bank account used by the

Company.

3.11

Undisclosed Liabilities. The Company has no liabilities, obligations or commitments except those which have been incurred in the

ordinary course of business since December 31, 2023. The Company has no outstanding unpaid debt or payables owed by the Company pursuant

to Article L. 622-17 of the French Commercial Code in excess of the Restructured Debt.

3.12

Undisclosed Payments. Neither the Company nor any of its officers or members, nor anyone acting on behalf of any of them, to the

Knowledge of the Company, has made or received any payment not correctly categorized and fully disclosed in the Company’s books

and records in connection with or in any way relating to or affecting the Company.

3.13

Absence of Certain Changes. Since the Balance Sheet Date and except as set forth on Schedule 3.13, there has not been,

to the Knowledge of the Company and except for the bankruptcy procedure before the commercial Court of Paris, decided by the commercial

Court of Paris on March 21, 2024, (i) any Material Adverse Effect or (ii) any damage, destruction, loss or casualty to property or assets

of the Company with a value in excess of $25,000, whether or not covered by insurance. Since the date of the Balance Sheet and except

as set forth on Schedule 3.13, the Company has:

(a)

conducted its business in the ordinary course;

(b)

not disposed of or permitted to lapse any right to the use of any patent, trademark, trade name, service mark, license or copyright of

the Company (including any of the Company Intellectual Property), or disposed of or disclosed to any Person, any trade secret, formula,

process, Software, technology or know-how of the Company not heretofore a matter of public knowledge;

(c)

not (i) sold or transferred any asset, other than finished goods sold in the ordinary course, (ii) granted, created, incurred or suffered

to exist any Lien on any asset of the Company, (iii) written off as uncollectable any guaranteed check, note or account receivable, except

in the ordinary course, (iv) written down the value of any asset or investment on the books or records of the Company, except for depreciation

and amortization in the ordinary course or (v) cancelled any debt or waived any claim or right (except as provided in Section 3.11(a)

of this Agreement);

(d)

not increased in any manner the base compensation of, or entered into any new bonus or incentive agreement or arrangement with, any of

its employees, officers, directors or consultants other than in the ordinary course;

(e)

incurred any obligation or liability other than in the ordinary course;

(f)

entered into, amended, waived, failed to renew or terminated any contract required to be disclosed other than in the ordinary course;

(g)

made any change in accounting or cash management procedures, policies, practices or methods, except as required by applicable Law;

(h)

made any Tax election or changed an existing Tax election; or

(i)

entered into any contract or agreement to do any of the foregoing.

3.14

Litigation; Labor Matters; Compliance with Laws.

(a)

Except as set forth on Schedule 3.14(a), there is no suit, action or proceeding or investigation pending or, to the Knowledge

of the Company, threatened against or affecting the Company or the Seller or any basis for any such suit, action, proceeding or investigation.

None of the suits, actions, proceedings or investigations listed on Schedule 3.14(a), individually or in the aggregate, could reasonably

be expected to have a Material Adverse Effect with respect to the Company or the Seller or prevent, hinder or materially delay the ability

of the Company or the Seller to consummate the Transactions, and there is no judgment, decree, injunction, rule or Order of any Governmental

Entity or arbitrator outstanding against the Company having, or which, insofar as reasonably could be foreseen by the Company, in the

future could have, any such effect. Neither the Company, the Seller nor to the Company’s Knowledge, the Seller’s Knowledge any officer

or member of the Company thereof, is or has been the subject of any Order involving a claim of violation of or liability under federal

or state securities laws or a claim of breach of fiduciary duty. There has not been, and to the Knowledge of the Company, there is not

pending or contemplated, any investigation by the SEC involving the Company, the Seller or any current or former officer or member of

the Company.

(b)

Schedule 3.14(b) contains a correct and complete list of (a) all of the officers of the Company, specifying their position,

annual rate of compensation, work location, length of service, and other benefits provided to each of them, respectively and (b) all

of the employees (whether full-time, part-time or otherwise) and independent contractors of the Company, specifying their position, status,

annual salary, hourly wages, work location, length of service, other benefits provided to each of them, respectively, consulting or other

independent contractor fees. Except as set forth on Schedule 3.14(b), the Company is not a party to or bound by any Employment

Agreement. Each such Employment Agreement is legal, valid, binding and enforceable in accordance with its respective terms with respect

to the Company. There is no existing default or breach of the Company under any Employment Agreement (or event or condition that, with

notice or lapse of time or both, could constitute a default or breach) and, to the Knowledge of the Company, there is no such default

(or event or condition that, with notice or lapse of time or both, could constitute a default or breach) with respect to any third party

to any Employment Agreement. Neither the Company nor the Seller has received a claim from any Governmental Entity to the effect that

the Company has improperly classified as an independent contractor any Person named on Schedule 3.14(c). Neither the Company

nor the Seller has made any verbal commitments to any officer, employee, former employee, consultant or independent contractor of the

Company with respect to compensation, promotion, retention, termination, severance or similar matters in connection with the transactions

contemplated hereby or otherwise. Except as indicated on Schedule 3.14(b), all officers and employees of the Company are

active on the date hereof.

(c)

Except as set forth in Schedule 3.14(c), (a) the Company is not a party to any collective bargaining agreement, contract

or legally binding commitment to any trade union or employee organization or group in respect of or affecting employees; (b) the Company

is not currently engaged in any negotiation with any trade union or employee organization; (c) the Company has not engaged in any unfair

labor practice within the meaning of the National Labor Relations Act, and there is no pending or, to the Knowledge of the Company, threatened

complaint regarding any alleged unfair labor practices as so defined; (d) there is no strike, labor dispute, work slow down or stoppage

pending or, to the Knowledge of the Company, threatened against the Company; (e) there is no grievance or arbitration proceeding arising

out of or under any collective bargaining agreement which is pending or, to the Knowledge of the Company, threatened against the Company;

(f) the Company has not experienced any material work stoppage; (g) the Company is not the subject of any union organization effort;

(h) there are no claims pending or, to the Knowledge of the Company, threatened against the Company related to the status of any individual

as an independent contractor or employee; and (i) the Company has complied in all respects with the United States Worker Adjustment and

Retraining Notification Act, the rules and regulations promulgated thereunder, and applicable state equivalents. The Company has not

misclassified any person as (i) an independent contractor rather than as an employee, or with respect to any employee leased from another

employer, or (ii) an employee exempt from state, federal, provincial or other applicable overtime regulations.

(d)

The Company is (and has been at all times during the past three (3) years), to the Knowledge of the Company, in compliance in all respects

with all applicable Laws (including applicable Laws relating to zoning, environmental matters and the safety and health of employees).

Except as set forth on Schedule 3.14(d), (i) the Company has not been charged with, nor received any written notice that

it is under investigation with respect to, and the Company is not otherwise now under investigation with respect to, any violation of

any applicable Law or other requirement of a Governmental Entity, (ii) the Company is not a party to, or bound by, any Order and (iii)

the Company has filed all reports and has all licenses and permits required to be filed with any Governmental Entity on or prior to the

date hereof.

3.15

Benefit Plans. The Company is not a party to any Benefit Plan under which the Company currently has an obligation to provide

benefits to any current or former employee, officer or member of the Company. As used herein, “Benefit Plan” shall

mean any employee benefit plan, program, or arrangement of any kind, including any defined benefit or defined contribution plan, stock

ownership plan, executive compensation program or arrangement, bonus plan, vacation pay, medical or life insurance plan providing benefits

to employees, retirees, or former employees or any of their dependents, survivors, or beneficiaries, employee stock option or stock purchase

plan, severance pay, termination, salary continuation, or employee assistance plan.

3.16

Tax Returns and Tax Payments. Except as set forth in Schedule 3.16:

(a)

The Company has filed (taking into account any valid extensions) all material Tax Returns required to be filed by the Company. Such Tax

Returns are true, complete and correct in all material respects. The Company is not currently the beneficiary of any extension of time

within which to file any material Tax Return other than extensions of time to file Tax Returns obtained in the ordinary course of business.

All material Taxes due and owing by the Company have been paid or accrued.

(b)

No extensions or waivers of statutes of limitations have been given or requested with respect to any material Taxes of the Company.

(c)

There are no ongoing actions, suits, claims, investigations or other legal proceedings by any taxing authority against the Company.

(d)

The Company is not a party to any Tax-sharing agreement.

(e)

All material Taxes which the Company is obligated to withhold from amounts owing to any employee, creditor or third party have been paid

or accrued.

The

representations and warranties set forth in this Section 3.15 are the Seller’s sole and exclusive representations and warranties regarding

Tax matters.

3.17

Intellectual Property.

(a)

Schedule 3.17(a) sets forth a list and description of the Intellectual Property required for the Company to operate, or

used or held for use by the Company, in the operation of its business, including, but not limited to (i) all issued Patents and pending

Patent applications, registered Marks, pending applications for registration of Marks, unregistered Marks, registered Copyrights of the

Company and the record owner, registration or application date, serial or registration number, and jurisdiction of such registration

or application of each such item of Intellectual Property, (ii) all Software developed by or for the Company and (iii) any Software not

exclusively owned by the Company and incorporated, embedded or bundled with any Software listed in clause (ii) above (except for commercially

available software and so-called “shrink wrap” software licensed to the Company on reasonable terms through commercial distributors

or in consumer retail stores for a license fee of no more than $10,000).

(b)

The Company is the exclusive owner of or has a valid and enforceable right to use all Intellectual Property listed for the Company in Schedule

3.17(a) as the same are used, sold, licensed and otherwise commercially exploited by the Company, free and clear of all

Liens, security interests, encumbrances or any other obligations to others (other than obligations under the license agreements pursuant

to which such Intellectual Property is licensed to the Company), and no such Intellectual Property has been abandoned. The Intellectual

Property owned by the Company and the Intellectual Property licensed to it pursuant to valid and enforceable written license agreements

include all of the Intellectual Property necessary and sufficient to enable the Company to conduct its business in the manner in which

such business is currently being conducted. The Intellectual Property owned by the Company and its rights in and to such Intellectual

Property are valid and enforceable.

(c)

Neither the Company nor the Sellers have received, and neither are not aware of, any written or oral notice of any reasonable basis for

an allegation against the Company or the Sellers of any infringement, misappropriation, or violation by the Company or the Sellers of

any rights of any third party with respect to any Intellectual Property, and the Company and the Sellers are not aware of any reasonable

basis for any claim challenging the ownership, use, validity or enforceability of any Intellectual Property owned, used or held for use

by the Company. Neither the Company nor the Sellers have any Knowledge (a) of any third-party use of any Intellectual Property owned

by or exclusively licensed to the Company, (b) that any third-party has a right to use any such Intellectual Property, or (c) that any

third party is infringing, misappropriating, or otherwise violating (or has infringed, misappropriated or violated) any such Intellectual

Property.

3.18

Regulatory Permits. The Company possesses all certificates, authorizations and permits issued by the appropriate federal, state,

local or foreign regulatory authorities necessary to conduct its respective businesses, (“Material Permits”) all of

which are listed on Schedule 3.18, and the Company has not received any notice of proceedings relating to the revocation

or modification of any Material Permit.

3.19

Title to Assets; Real Property.

(a)

The Company has good and valid (and, in the case of owned real property, good and marketable fee simple) title to, or a valid leasehold

interest in, all real property and tangible personal property and other assets reflected in the Financial Statements or acquired after

the Balance Sheet Date, other than properties and assets sold or otherwise disposed of in the ordinary course of business since the Balance

Sheet Date. All such properties and assets (including leasehold interests) are free and clear of Liens.

(b)

Schedule 3.19(b) lists the street address of each parcel of real property owned, leased or subleased by the Company as

of the date of this Agreement.

(c)

The Company has a valid leasehold interest in the leased real property, and the leases granting such interests are in full force and

effect.

(d)

No portion of the leased real property, or any building or improvement located thereon, to the Knowledge of the Company, violates any

Law, including those Laws relating to zoning, building, land use, environmental, health and safety, fire, air, sanitation and noise control.

No leased real property is subject to (i) any decree or order of any Governmental Entity or (ii) any rights of way, building use restrictions,

exceptions, variances, reservations or limitations of any nature whatsoever.

(e)

There is no condemnation, expropriation or similar proceeding pending or threatened against any of the Leased Real Property or any improvement

thereon. The leased real property constitutes all of the real property utilized by the Company in the operation of the Company’s

business.

3.20

Material Agreements.

(a)

Schedule 3.20(a) lists each of the following contracts and other agreements of the Company (collectively, the “Material

Agreements”):

(i)

each agreement of the Company involving aggregate consideration in excess of $25,000 or requiring performance by any party more than

one year from the date hereof;

(ii)

all of the leases or subleases for each parcel of leased or subleased real property of the Company (collectively, “Leases”),

including the identification of the lessee and lessor thereunder;

(iii)

all agreements that relate to the sale of any of the Company’s assets, other than in the ordinary course of business, for consideration

in excess of $25,000;

(iv)

all agreements that relate to the acquisition of any business, a material amount of equity or assets of any other Person or any real

property (whether by merger, sale of stock or other equity interests, sale of assets or otherwise), in each case involving amounts in

excess of $25,000;

(v)

except for agreements relating to trade payables, all agreements relating to indebtedness (including, without limitation, guarantees)

of the Company, in each case having an outstanding principal amount in excess of $25,000;

(vi)

all agreements between or among the Company on the one hand and Seller or any Affiliate of Seller (other than the Company) on the other

hand; and

(vii)

all collective bargaining agreements or agreements with any labor organization, union or association to which the Company is a party.

(b)

Except as set forth in Schedule 3.19(b), the Company is not in breach of, or default under, any Material Agreement, except

for such breaches or defaults that would not have a Material Adverse Effect.

3.21

Data Privacy Compliance. To the Knowledge of the Company, the Company complies and has complied in all respects, with (i) the Company’s

written data privacy and security policies and applicable Privacy Laws, (ii) any privacy choices (including opt-out preferences) communicated

to the Company, and (iii) any obligations relating to Personal Data contained in any written agreements, except as would not cause a

Material Adverse Effect. The Company has taken commercially reasonable measures to ensure that Personal Data processed by or on behalf

of the Company is protected against loss, damage, and unauthorized access, use or modification. To the Knowledge of the Company, there

has been no (A) security breach or intrusion into the Company’s computer networks resulting in unauthorized access to, or disclosure

of, Personal Data, or (B) action or circumstance requiring the Company to notify a Governmental Entity of a data security breach or violation

of any Privacy Laws. No Person (including any Governmental Entity) has commenced any proceeding with respect to loss, damage, or unauthorized

access, use or modification of any Personal Data by or on behalf of the Company.

3.22

Third-Party Communications. To the extent required by Privacy Laws, recipients of any communications initiated by or for the Company

or its Subsidiaries have consented to receive such communications, and, with respect to such communications, the Company, its Subsidiaries

and all Persons sending such communications on behalf of the Company and its Subsidiaries otherwise materially comply, and have for the

past three (3) years otherwise materially complied, in all material respects, with the federal Controlling the Assault of Non-Solicited

Pornography and Marketing Act of 2003, the Privacy and Electronic Communications Directive 2002/58/EC (ePrivacy) (as amended), and all

other Laws relating to the transmission of unsolicited electronic communications.

3.23

Private Data. To the Knowledge of the Company, no material breach or violation of any security policy of the Company or its Subsidiaries

relating to the processing of Private Data maintained by the Company or its Subsidiaries has occurred in the past three (3) years, or

is currently threatened, and in the past three (3) years, there has been no material loss, damage or unauthorized or illegal use, disclosure,

modification, possession, interception, or other processing of or access to, or other misuse of, any of material Private Data maintained

by the Company or its Subsidiaries.

3.24

Privacy Policies and Privacy Laws. No statement by the Company regarding the Company’s processing of Personal Data published

on any Company Product or any Company Site, or in any Company Privacy Policy, or in any data processing agreements, is or in the past

three (3) years has been materially misleading, deceptive or in violation of any Privacy Laws. In the past three (3) years, the Company

and each of its Subsidiaries has complied, in all material respects, with all Company Privacy Policies, all Privacy Laws, and all filings,

registrations and certifications made by the Company with respect to such Privacy Laws with respect to their processing of Personal Data.

The Company has or will obtain any and all necessary rights for its transfer of Personal Data maintained by the Company as necessary

for the execution, delivery and performance of this Agreement and the Transaction Documents and the consummation of the Transactions.

In the past three (3) years, there is not and has not been any (i) complaint received by, or which the Company or its Subsidiaries have

been notified of, (ii) investigation (formal or informal) of, or (iii) Action against the Company or its Subsidiaries, or to the Knowledge

of the Company, any of their customers (in the case of customers, to the extent relating to any Company Product or Company Site or the

practices of the Company, its Subsidiaries or any Person performing for the Company or its Subsidiaries) by or from any private party,

the Federal Trade Commission, any state attorney general or any other Governmental Entity, in each case, with respect to the collection,

storage, hosting, use, disclosure, transmission, transfer, disposal, possession, interception, other processing or security of any Private

Data by the Company or its Subsidiaries. To the Knowledge of the Company, there are no facts or circumstances that could constitute a

reasonable basis for such an Action. There has been no Order or government or third-party settlement affecting the collection, storage,

hosting, use, disclosure, transmission, transfer, disposal, possession, interception, other Processing or security of any Private Data

by or for the Company or its Subsidiaries.

3.25

Private Data Processing. The conduct and operation of the business, including the operation of the Company Products and their distribution

to and use by customers, complies with the Regulation (EU) 2016/679 of the European Parliament and of the Council of 27 April 2016 on

the protection of natural persons with regard to the processing of personal data and on the free movement of such data, and repealing

Directive 95/46/EC (General Data Protection Regulation) (applicable as of 25 May 2018) (“GDPR”).

3.26

Transactions With Affiliates and Employees. None of the officers or members of the Company and, to the knowledge of the Company,

none of the employees of the Company is presently a party to any transaction with the Company (other than for services as employees and

officers), including any contract, agreement or other arrangement providing for the furnishing of services to or by, providing for rental

of real or personal property to or from providing for the borrowing of money from or lending of money to, or otherwise requiring payments

to or from any officer, member or such employee or, to the knowledge of the Company, any entity in which any officer, member, or any

such employee has a substantial interest or is an officer, director, trustee, stockholder, member or partner, in each case in excess

of $25,000 other than for: (i) payment of salary or consulting fees for services rendered, (ii) reimbursement for expenses incurred on

behalf of the Company and (iii) other employee benefits, including agreements under any equity compensation plan of the Company.

3.27

Certain Fees. Except as indicated in 3.7, no brokerage or finder’s fees or commissions are or will be payable by the Company

to any broker, financial advisor or consultant, finder, placement agent, investment banker, bank or other Person with respect to the

transactions contemplated by the Transaction Documents. The Company shall have no obligation with respect to any fees or with respect

to any claims made by or on behalf of other Persons for fees of a type contemplated in this Section that may be due in connection with

the transactions contemplated by the Transaction Documents. The Company will bear the legal fees due in connection with the transactions

contemplated by the Transaction Documents.

3.28

Insurance Policies. Schedule 3.28 sets forth a list of all policies of insurance maintained (currently maintained or held

within the last five (5) years), owned or held by the Company (collectively, the “Insurance Contracts”), including

the policy limits or amounts of coverage, deductibles or self-insured retentions, and annual premiums with respect thereto. Such Insurance

Contracts are valid and binding in accordance with their terms, are in full force and effect, and the Insurance Contracts will continue

in effect after the Closing Date. Similar coverage to the coverage set forth in the Insurance Contracts has been maintained on a continuous

basis for the last ten (10) years. The Company has not received written notice that (a) it has breached or defaulted under any of such

Insurance Contracts, or (b) that any event has occurred that would permit termination, modification, acceleration or repudiation of such

Insurance Contracts. Except as set forth in Schedule 3.28, the Company is not in default (including a failure to pay an

insurance premium when due) in any material respect with respect to any Insurance Contract, nor has the Company failed to give any notice

of any material claim under such Insurance Contract in due and timely fashion nor has the Company ever been denied or turned down for

insurance coverage.

3.29

Solvency. The Company is purchased in the context of an insolvency procedure as set forth on Schedule 3.29,

3.30

No other representations or warranties. Except for the Representations and Warranties of this ARTICLE 3, neither the Company, nor

the Sellers (nor their Affiliates), nor any other person makes any other express or implied representation or warranty with respect to

the Company or the Transaction, and the Sellers disclaim any other representations or warranties, whether made by the Sellers or any

of their Affiliates, or their officers, directors, employees, agents, representatives or advisers. Except for the Representations and

Warranties of this ARTICLE 3 the Sellers hereby disclaim all liability and responsibility for any representation, warranty, projection,

forecast, statement, or information made, communicated, or furnished (orally or in writing) to the Buyer or its Affiliates or their representatives

(including, the due diligence information, any opinion, information, business plan, projection, or advice that may have been or may be

provided to the Buyer by any director, officer, employee, agent, consultant, representative of the Seller, the Company or any of their

respective Affiliates).

ARTICLE

4

REPRESENTATIONS

AND WARRANTIES OF BUYER

Buyer

represents and warrants to the Company and to the Seller that, except as set forth in Disclosure Schedule attached hereto (“Buyer’s

Disclosure Schedule”):

4.1

Organization, Standing, Corporate Power. Buyer and each of its Subsidiaries is duly organized, validly existing and in good

standing under the laws of the jurisdiction of its incorporation, and has the requisite corporate power and authority and all government

licenses, authorizations, Permits, consents and approvals required to own, lease and operate its properties and carry on its business

as now being conducted. Buyer and each of its Subsidiaries is duly qualified or licensed to do business and is in good standing in each

jurisdiction in which the nature of its business or the ownership or leasing of its properties makes such qualification or licensing

necessary, other than in such jurisdictions where the failure to be so qualified or licensed (individually or in the aggregate) would

not have a Material Adverse Effect with respect to Buyer. If the Buyer has no Subsidiaries, all other references to the Subsidiaries

or any of them in this Agreement, shall be disregarded.

4.2

Subsidiaries. The Subsidiaries of the Buyer, and the authorized and outstanding capital stock of each are set forth on Schedule

4.2. All of the outstanding capital stock of the Buyer’s Subsidiaries is owned by Buyer, free and clear of all Liens. Other than

as set forth on Schedule 4.2, Buyer does not own directly or indirectly, any equity or other ownership interest in any

company, corporation, partnership, joint venture or otherwise.

4.3

Capital Structure of Buyer. Immediately prior to the issuance of the Exchange Consideration at Closing, the authorized capital stock

of Buyer will consist of 200,000,000 shares of Common Stock, $0.0001 par value, of which no more than 19,465,363 shares of Common Stock

will be issued and outstanding, 100,000,000 shares of Buyer Preferred Stock, of which none are issued and outstanding. No shares of capital

stock of Buyer will be issuable upon the exercise of outstanding warrants, convertible notes, options or otherwise (except as described

below). All outstanding shares of capital stock of Buyer and its Subsidiaries are, and all shares which may be issued pursuant to this

Agreement will be, when issued, duly authorized, validly issued, fully paid and nonassessable, not subject to preemptive rights, and

issued in compliance with all applicable state and federal Laws concerning the issuance of securities. Except for the Common Stock, there

are no outstanding bonds, debentures, notes or other indebtedness or other securities of Buyer having the right to vote (or convertible

into, or exchangeable for, securities having the right to vote). Other than as set forth in the Buyer SEC Documents, there are no outstanding

securities, options, warrants, calls, rights, commitments, agreements, arrangements or undertakings of any kind to which Buyer or any

of its Subsidiaries is a party or by which Buyer or any of its Subsidiaries is bound obligating Buyer or any of its Subsidiaries to issue,

deliver or sell, or cause to be issued, delivered or sold, additional shares of capital stock or other equity securities of Buyer or

any of its Subsidiaries or obligating Buyer or any of its Subsidiaries to issue, grant, extend or enter into any such security, option,

warrant, call, right, commitment, agreement, arrangement or undertaking. Other than as described in the Buyer SEC Documents, there are

no outstanding contractual obligations, commitments, understandings or arrangements of Buyer or any of its Subsidiaries to repurchase,

redeem or otherwise acquire or make any payment in respect of any shares of capital stock of Buyer or any of its Subsidiaries. Other

than as set forth in the Buyer SEC Documents, as hereinafter defined, there are no agreements or arrangements pursuant to which the Buyer

is or could be required to register shares of Common Stock or other securities under the Securities Act or other agreements or arrangements

with or among any security holders of the Buyer with respect to securities of the Buyer.

4.4

Corporate Authority. Buyer has all requisite corporate and other power and authority to enter into this Agreement and to consummate

the Transactions. The execution and delivery of this Agreement by Buyer and the consummation by Buyer of the transactions contemplated

hereby have been (or at Closing will have been) duly authorized by all necessary corporate action on the part of Buyer. This Agreement

has been duly executed and when delivered by Buyer, shall constitute a valid and binding obligation of Buyer, enforceable against Buyer

in accordance with its terms, except as such enforcement may be limited by bankruptcy, insolvency or other similar Laws affecting the

enforcement of creditors’ rights generally or by general principles of equity.

4.5

No Conflict. The execution and delivery of this Agreement do not, and the consummation of the Transactions and compliance with the

provisions hereof will not, conflict with, or result in any breach or violation of, or Default (with or without notice or lapse of time,

or both) under, or give rise to a right of termination, cancellation or acceleration of or “put” right with respect to any

obligation or to a loss of a material benefit under, or result in the creation of any Lien upon any of the properties or Assets of Buyer

under, (i) the Certificate of Incorporation, Bylaws, or other charter documents of Buyer, (ii) any loan or credit agreement, note, bond,

mortgage, indenture, lease or other agreement, instrument, Permit, concession, franchise or license applicable to Buyer, its properties

or Assets, or (iii) subject to the governmental filings and other matters referred to in the following sentence, any judgment, Order,

decree, statute, Law, ordinance, rule, regulation or arbitration award applicable to Buyer, its properties or Assets.

4.6

Government Authorization. No consent, approval, Order or authorization of, or registration, declaration or filing with, or notice

to, any Governmental Entity, is required by or with respect to Buyer in connection with the execution and delivery of this Agreement

by Buyer, or the consummation by Buyer of the transactions contemplated hereby, except, with respect to this Agreement, any filings under

the Securities Act or the Exchange Act.

4.7

SEC Documents; Undisclosed Liabilities; Financial Statements.

(a)

Except as disclosed in the Buyer Disclosure Schedules, Buyer has filed with the Securities and Exchange Commission (the “SEC”)

all reports, schedules, forms, statements and other documents as required under the Exchange Act and Buyer has delivered or made available

to the Company all reports, schedules, forms, statements and other documents filed with the SEC (collectively, and in each case including

all exhibits and schedules thereto and documents incorporated by reference therein, the “Buyer SEC Documents”). As

of their respective dates, the Buyer SEC Documents complied in all material respects with the requirements of the Securities Act or the

Exchange Act, as the case may be, and the rules and regulations of the SEC promulgated thereunder applicable to such Buyer SEC Documents.

Except to the extent revised or superseded by a subsequent filing with the SEC, none of the Buyer SEC Documents contained any untrue

statement of a material fact or omitted to state a material fact required to be stated therein or necessary in order to make the statements

therein, in light of the circumstances under which they were made, not misleading. The consolidated financial statements of Buyer included

in such Buyer SEC Documents comply as to form in all material respects with applicable accounting requirements and the published rules

and regulations of the SEC with respect thereto, have been prepared in accordance with GAAP (except, in the case of unaudited consolidated

quarterly statements, as permitted by Form 10-Q of the SEC) applied on a consistent basis during the periods involved (except as may

be indicated in the notes thereto) and fairly present the financial position of Buyer as of the dates thereof and the results of operations

and changes in cash flows for the periods then ended (subject, in the case of unaudited quarterly statements, to normal year-end audit

adjustments as determined by Buyer’s independent accountants). Except as set forth in the Buyer SEC Documents, at the date of the most

recent financial statements of Buyer included in the Buyer SEC Documents, Buyer has not incurred any liabilities or monetary obligations

of any nature (whether accrued, absolute, contingent or otherwise).

(b)

Except as disclosed in the Buyer Disclosure Schedules or in the Buyer SEC Documents filed prior to the date hereof or as set forth in

this Agreement, since December 31, 2023, there has been no Material Adverse Effect with respect to Buyer.

(c)

Except as disclosed in the Buyer SEC Documents filed prior to the date hereof or as provided in this Agreement, since the December 31,

2023, Buyer has not issued, sold or otherwise disposed of, or agreed to issue, sell or otherwise dispose of, any capital stock or any

other security of Buyer and, has not granted or agreed to grant any option, warrant or other right to subscribe for or to purchase any

capital stock or any other security of Buyer or has incurred or agreed to incur any indebtedness for borrowed money.

4.8

Absence of Certain Changes. Except as disclosed in the Buyer SEC Documents filed prior to the date hereof, since December 31,

2023, Buyer has conducted its business only in the ordinary course consistent with past practice in light of its current business circumstances,

and there is not and has not been any: (a) Material Adverse Effect with respect to Buyer; (b) condition, event or occurrence which could

reasonably be expected to prevent, hinder or materially delay the ability of Buyer to consummate the Transactions; (c) damage, destruction

or loss having, or reasonably expected to have, a Material Adverse Effect on Buyer; or (d) other condition, event or occurrence

which individually or in the aggregate could reasonably be expected to have a Material Adverse Effect or give rise to a Material Adverse

Effect with respect to Buyer.

4.9

Certain Fees. No brokerage or finder’s fees or commissions are or will be payable by Buyer to any broker, financial advisor

or consultant, finder, placement agent, investment banker, bank or other person with respect to the Transactions.

4.10

Litigation; Labor Matters; Compliance with Laws.

(a)

There is no suit, action or proceeding or investigation pending or, to the Knowledge of Buyer, threatened against or affecting Buyer

or any basis for any such suit, action, proceeding or investigation that, individually or in the aggregate, could prevent, hinder or

materially delay the ability of Buyer to consummate the Transactions, nor is there any judgment, decree, injunction, rule or Order of

any Governmental Entity or arbitrator outstanding against Buyer having, or which, insofar as reasonably could be foreseen by Buyer, in

the future could have, any such effect.

(b)

Buyer is not a party to, or bound by, any collective bargaining agreement, Contract or other agreement or understanding with a labor

union or labor organization, nor is it the subject of any proceeding asserting that it has committed an unfair labor practice or seeking

to compel it to bargain with any labor organization as to wages or conditions of employment nor is there any strike, work stoppage or

other labor dispute involving it pending or, to its Knowledge, threatened.

(c)

The conduct of the business of Buyer complies with all statutes, Laws, regulations, ordinances, rules, judgments, Orders, decrees or

arbitration awards applicable thereto.

(d)

Neither the Buyer nor to the Buyer’s Knowledge, any director or officer thereof, is or has been the subject of any Order involving a

claim of violation of or liability under federal or state securities laws or a claim of breach of fiduciary duty. There has not been,

and to the knowledge of the Buyer, there is not pending or contemplated, any investigation by the SEC involving the Buyer or any current

or former director or officer of the Buyer.

4.11

Benefit Plans. Buyer is not a party to any Benefit Plan under which Buyer currently has an obligation to provide benefits to

any current or former employee, officer or director of Buyer.

4.12

Tax Returns and Tax Payments.

(a)

Buyer has filed (taking into account any valid extensions) all material Tax Returns required to be filed by Buyer and its Subsidiaries.

Such Tax Returns are true, complete and correct in all material respects. Buyer is not currently the beneficiary of any extension of

time within which to file any material Tax Return other than extensions of time to file Tax Returns obtained in the ordinary course of

business. All material Taxes due and owing by Buyer have been paid or accrued. Since December 31, 2023, Buyer has not incurred any liability

for Taxes outside the ordinary course of business consistent with past custom and practice.

(b)

No material claim for unpaid Taxes has been made or become a Lien against the property of Buyer or any of its Subsidiaries or is being

asserted against Buyer or any of its Subsidiaries, no audit of any Tax Return of Buyer or any of its Subsidiaries is being conducted

by a tax authority, and no extension of the statute of limitations on the assessment of any Taxes has been granted by Buyer or any of

its Subsidiaries and is currently in effect. Buyer has withheld and paid all Taxes required to have been withheld and paid in connection

with amounts paid or owing to any employee, independent contractor, creditor, stockholder or other third party.

4.13

Environmental Matters. Buyer and each of its Subsidiaries is in compliance with all requisite Environmental Laws in all material

respects. Neither Buyer nor any of its Subsidiaries has received any written notice regarding any violation of any Environmental Laws,

including any investigatory, remedial or corrective obligations, which, if determined adversely to Buyer or any of its Subsidiaries,

would reasonably be expected to have, either individually or in the aggregate, a Material Adverse Effect. Buyer and each its Subsidiaries

holds all Permits and authorizations required under applicable Environmental Laws, unless the failure to hold such Permits and authorizations

would not have a Material Adverse Effect on Buyer, and is compliance with all terms, conditions and provisions of all such Permits and

authorizations in all material respects. No releases of Hazardous Materials have occurred at, from, in, to, on or under any real property

currently or formerly owned, operated or leased by Buyer or any of its Subsidiaries or any predecessor thereof and no Hazardous Materials

are present in, on, about or migrating to or from any such property which could result in any liability to Buyer or any of its Subsidiaries.

Neither Buyer nor any of its Subsidiaries has transported or arranged for the treatment, storage, handling, disposal, or transportation