0001534120false00015341202023-09-112023-09-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 11, 2023

AVALO THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

| | | | | | | | |

| 001-37590 | | 45-0705648 |

| (Commission File Number) | | (IRS Employer Identification No.) |

540 Gaither Road, Suite 400, Rockville, Maryland 20850

(Address of principal executive offices) (Zip Code)

Registrant’s Telephone Number, Including Area Code: (410) 522-8707

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

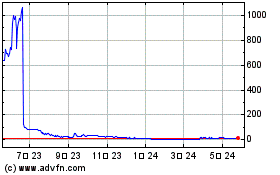

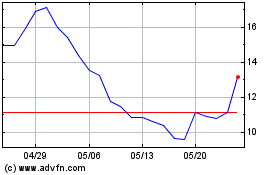

| Common Stock, $0.001 Par Value | AVTX | Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On September 11, 2023, Avalo Therapeutics, Inc. (the “Company”) entered into an Asset Purchase Agreement (the “Purchase Agreement”) with AUG Therapeutics, LLC (“AUG”) to sell the Company’s rights, title and interest in, assets relating to AVTX-801 (D-galactose), AVTX-802 (D-mannose) and AVTX-803 (L-fucose) (collectively, the “800 Series”). AUG will pay an upfront payment of $150,000, as well as, for each compound, make a contingent milestone payment of $15,000,000 (for a potential aggregate of $45 million) if the first FDA approval is for an indication other than a Rare Pediatric Disease (as defined in the Purchase Agreement), or up to 20% of certain payments, if any, granted to AUG upon any sale of any priority review voucher granted to AUG by the FDA, net of any selling costs. Additionally, AUG will assume up to $150,000 of certain liabilities incurred prior to the date of the Purchase Agreement and assume all costs relating to the 800 Series from the date of the Purchase Agreement. The transaction is expected to close in the fourth quarter of 2023, subject to customary closing conditions, including obtaining certain third-party consents.

The Purchase Agreement includes customary representations, warranties and covenants of the Company and AUG, including provisions that require the Company to indemnify AUG for losses resulting from any breach by the Company of its representations, warranties or covenants in the Purchase Agreement. Avalo and AUG also entered into a Transition Services Agreement, pursuant to which Avalo will provide assistance on a short-term basis in connection with the transfer of the 800 Series.

The Purchase Agreement contains certain customary termination rights for the Company and AUG, including a right by either party to terminate the Purchase Agreement if the Closing is not consummated within 60 days after the date of the Agreement.

The foregoing description of the Purchase Agreement is qualified in its entirety by reference to the complete text of the Purchase Agreement, which is attached as Exhibit 2.1 to this Current Report on Form 8-K and incorporated herein by reference.

The Purchase Agreement contains representations and warranties that the parties made to, and are solely for the benefit of, each other. Investors and security holders should not rely on the representations and warranties as characterizations of the actual state of facts, since they were made only as of the date of the Purchase Agreement. Moreover, information concerning the subject matter of such representations and warranties might change after the date of the Purchase Agreement, which subsequent information might or might not be fully reflected in public disclosures.

Item 7.01. Regulation FD Disclosure.

On September 12, 2023, the Company issued a press release announcing entering into the Purchase Agreement described above in Item 1.01. A copy of the press release is furnished herewith as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information contained in this Item 7.01 of this Current Report on Form 8-K (including Exhibit 99.1) is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information in this Current Report shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 2.1*# | | |

| | |

| 99.1 | | |

| | |

| 104 | | The cover pages of this Current Report on Form 8-K, formatted in Inline XBRL. |

| | |

*Certain exhibits and schedules to this exhibit have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company hereby undertakes to furnish supplemental copies of any of the omitted exhibits or schedules upon request by the U.S. Securities and Exchange Commission.

#Certain confidential portions to this exhibit have been omitted from this filing pursuant to Item 601(b)(2) of Regulation S-K. The Company will furnish copies of the unredacted exhibit to the SEC upon request.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| | | AVALO THERAPEUTICS, INC. |

| | | |

| Date: September 12, 2023 | | By: | /s/ Christopher Sullivan |

| | | Christopher Sullivan |

| | | Chief Financial Officer |

CERTAIN INFORMATION IDENTIFIED WITH THE MARK “(***)” HAS BEEN EXCLUDED FROM THIS EXHIBIT BECAUSE SUCH INFORMATION IS BOTH (I) NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED.

ASSET PURCHASE AGREEMENT

THIS ASSET PURCHASE AGREEMENT (this “Agreement”) is made as of September 11, 2023, by and between Avalo Therapeutics, Inc., a Delaware corporation (“Seller”), and AUG Therapeutics, LLC, a Delaware limited liability company (“Buyer”). Buyer and Seller may be referred to herein collectively as the “Parties” and individually as a “Party.”

RECITALS

WHEREAS, Seller owns the Assets (as defined below) related to (i) a product containing D-galactose known at Seller as “AVTX-801” (any product containing D-galactose, an “801 Product”), (ii) a product containing D-mannose known at Seller as “AVTX-802” (any product containing D-mannose, an “802 Product”), and (iii) a product containing L-fucose known at Seller as “AVTX-803” (any product containing L-fucose, an “803 Product”; each of an 801 Product, 802 Product, or 803 Product, a “Product” and, collectively, the “Products”); and

WHEREAS, Seller desires to sell, assign, transfer, convey and deliver to Buyer the Assets, and Buyer desires to purchase, acquire and accept from Seller all of Seller’s right, title and interest in and to the Assets, subject to the terms and conditions set forth in this Agreement.

NOW, THEREFORE, in consideration of these premises, the respective covenants of Buyer and Seller set forth below and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

ARTICLE 1

DEFINITIONS

1.1 Definitions. In addition to the other capitalized terms defined herein, the following capitalized terms shall have the following respective meanings:

“Action” means any claim, action, cause of action, demand, lawsuit, arbitration, inquiry, audit, notice of violation, proceeding, litigation, citation, summons, subpoena or investigation of any nature, civil, criminal, administrative, regulatory or otherwise, whether at law or in equity.

“Affiliate” means, with respect to any Party, any Person that, directly or indirectly, controls, is controlled by, or is under common control with such Party at any time during the period for which the determination of affiliation is being made. For the purposes of this definition, “control” (with correlative meanings for the terms “controlled by” and “under common control with”) means the possession by the applicable Person, directly or indirectly, of the power to direct or cause the direction of the management, policies and business affairs of a Person, whether through ownership of voting securities or general partnership or managing member interests, by contract or otherwise.

“Applicable Laws” means any and all applicable federal, state, local, municipal, provincial, territorial, foreign or other law, statute, constitution, principle of common law, directive, resolution, ordinance, code, edict, decree, order (including executive orders), rule, judgment, injunction, writ, regulation (or similar provision have the force or effect of law), ruling, guidance, treaties or requirement issues, enacted, adopted, promulgated, implemented or otherwise put into effect by or under the authority of any Governmental Authority.

“Business Day” means any day other than a Saturday, Sunday or a day on which banking institutions in the State of New York are authorized or obligated by law or executive order to close.

“Change of Control” means, with respect to a Party, (a) a merger or consolidation of such Party with a Third Party that results in the voting securities of such Party outstanding immediately prior thereto, or any securities into which such voting securities have been converted or exchanged, ceasing to represent more than fifty percent (50%) of the combined voting power of the surviving entity or the parent of the surviving entity immediately after such merger or consolidation, (b) a transaction or series of related transactions in which a Third Party, together with its Affiliates, becomes the beneficial owner of more than fifty percent (50%) of the combined voting power of the outstanding voting securities of such Party, or (c) the sale or other transfer to a Third Party of all or substantially all of such Party’s business to which the subject matter of this Agreement relates. For clarity, a Change of Control does not include (i) an internal consolidation, merger, share exchange or other reorganization of a Party between or among such Party and one or more of its Affiliates, (ii) a sale of assets, merger or other transaction effected exclusively for the purpose of changing the domicile of a Party, or (iii) any public offering of a Party’s equity securities or other issuance of stock by a Party in an equity financing.

“Confidential Information” means any confidential information disclosed by a Party to the other Party, including trade secrets, know-how, technical data, specifications, testing methods, products, formulas, and business or financial information. Confidential Information shall not include any information that (i) was publicly known prior to the time of disclosure by the disclosing Party, (ii) enters the public domain after the time of its disclosure hereunder through means other than an unauthorized disclosure resulting from an act or improper inaction or omission by the receiving Party, (iii) was already in the possession of the receiving Party prior to the time of disclosure by the disclosing Party, or (iv) is or was disclosed to the receiving Party at any time, whether prior to or after the time of its disclosure hereunder, by a third party having no fiduciary relationship with the disclosing Party and having no obligation of confidentiality or non-use with respect to such information. Notwithstanding anything in this Agreement to the contrary, the Parties acknowledge that Seller and its employees, contractors, agents, subsidiaries and Affiliates may continue to possess certain Confidential Information that was acquired by Buyer from Seller pursuant to the Purchase Agreement and Seller agrees that, as result of such acquisition, such Confidential Information belongs solely to Buyer and that Buyer will be the disclosing Party with respect to such Confidential Information under this Agreement despite Seller’s possession of such Confidential Information prior to the sale thereof to Buyer.

“Fair Market Value” means, with respect to any non-cash form of consideration, the price that would reasonably be expected to be obtained for the sale of such consideration, as reasonably determined in good faith by Buyer (including, in the case of publicly-traded securities, by reasonable and customary reference to recent trading price(s) thereof) and agreed to by Seller. In the absence of mutual agreement as to what constitutes Fair Market Value of a particular item of consideration, such value will be determined by an independent Third Party appraiser who has expertise in conducting such assessments, is reasonably acceptable to both Parties, and is paid for in equal portions by both Parties.

“FD&C Act” means U.S. Federal Food, Drug and Cosmetic Act, as amended.

“FDA” means the United States Food and Drug Administration and any successor governmental authority having substantially the same function.

“Fraud” means an actual and intentional fraud with respect to any material statement in any representation or warranty in Article 4 or Article 5. Under no circumstances will “Fraud”

include any equitable fraud, negligent misrepresentation, promissory fraud, unfair dealings, extra-contractual fraud or any other fraud or torts based on recklessness or negligence.

“GAAP” means United States generally accepted accounting principles as in effect from time to time.

“Governmental Authority” means any federal, state, local or foreign government or political subdivision thereof, or any agency or instrumentality of such government or political subdivision, or any self-regulated organization or other non-governmental regulatory authority or quasi-governmental authority (to the extent that the rules, regulations or orders of such organization or authority have the force of law), or any arbitrator, court or tribunal of competent jurisdiction.

“Gross PRV Proceeds” means (i) all cash proceeds received with respect to a PRV Sale and (ii) the Fair Market Value of all non-cash proceeds received with respect to a PRV Sale, regardless, in each case, of when received.

“Horizon Loan Agreement” means that certain Venture Loan and Security Agreement, dated as of June 4, 2021, by and among Horizon Technology Finance Corporation, as lender and collateral agent, Powerscourt Investments XVV, LP, as a lender, the Seller (f/k/a Cerecor Inc.), as borrower representative and a co-borrower, and the other co-borrowers party thereto.

“IND” means an Investigational New Drug Application as defined in the FD&C Act and applicable regulations promulgated thereunder by the FDA.

“Knowledge” with respect to Seller means the actual knowledge, after reasonable investigation, of Garry Neil, Christopher Sullivan and Michael McInaw.

“Liability” means, with respect to any Person, any liability or obligation of such Person of any kind, character or description, whether known or unknown, absolute or contingent, accrued or unaccrued, disputed or undisputed, liquidated or unliquidated, secured or unsecured, joint or several, due or to become due, vested or unvested, executory, determined or determinable, and whether or not the same is required to be accrued on the financial statements of such Person.

“Liens” means any mortgages, security interests, liens, options, pledges, equities, claims, charges, restrictions, conditions, conditional sale contracts and any other encumbrances of any kind whatsoever.

“NDA” means a New Drug Application, as defined in the FD&C Act, as amended, and applicable regulations promulgated thereunder by the FDA.

“Permits” means all permits, licenses, franchises, approvals, authorizations, registrations, certificates, variances and similar rights obtained, or required to be obtained, from Governmental Authorities.

“Person” means any individual, partnership, association, corporation, limited liability company, trust or other legal person, entity or Governmental Authority.

“Phase 3 Trial” means a clinical study of a Product in any country which satisfies the requirements of 21 C.F.R. § 312.21(c), as amended from time to time, or its equivalent in jurisdictions outside of the United States.

“Pivotal Trial” means (i) a Phase 3 Trial or (ii) any other adequate and well-controlled human clinical study the results of which are intended to form the basis for Regulatory Approval without the relevant Regulatory Authority requiring the conduct of any additional clinical trials prior to submission of the applicable application therefor. For the avoidance of doubt, a clinical trial that meets the foregoing criteria shall be deemed a Pivotal Trial regardless of whether it is characterized as a “Phase 2b”, or “Phase 2b/3”, “Phase 3” or otherwise.

“Priority Review Voucher” means a priority review voucher awarded by the FDA pursuant to Section 524 or Section 529 of the FD&C Act or otherwise.

“Regulatory Approval” means any and all approvals, licenses, registrations or authorizations of any Regulatory Authority, in each case that are necessary for the marketing and sale of a pharmaceutical product in a country or other jurisdiction for human therapeutic or prophylactic use (excluding pricing or reimbursement approvals).

“Regulatory Authority” means any applicable supra-national, federal, national, regional, state, provincial or local governmental or regulatory authority, agency, department, bureau, commission, council or other entities (including the FDA) regulating or otherwise exercising authority with respect to activities contemplated in this Agreement or involved in granting Regulatory Approvals.

“Taxes” means all federal, state, local, foreign and other income, gross receipts, sales, use, production, ad valorem, transfer, documentary, franchise, registration, profits, license, lease, service, service use, withholding, payroll, employment, unemployment, estimated, excise, severance, environmental, stamp, occupation, premium, property (real or personal), real property gains, windfall profits, customs, duties or other taxes, fees, assessments or charges of any kind whatsoever, together with any interest, additions or penalties with respect thereto and any interest in respect of such additions or penalties.

“Third Party” means any Person other than a Party and such Party’s Affiliates.

“Transaction Documents” means this Agreement, the Bill of Sale (as defined below), the Assignment and Assumption Agreement (as defined below), the Transition Services Agreement (as defined below), the Assignment of Patents (as defined below), the Assignment of Trademarks (as defined below) and all other agreements, instruments, certificates and other documents executed and delivered in connection with the transactions contemplated by this Agreement.

1.2 Interpretation. Unless the context of this Agreement otherwise requires, (a) words of any gender include each other gender, (b) words using the singular or plural number also include the plural or singular number, respectively, (c) the terms “hereof,” “herein,” “hereby” and derivative or similar words refer to this entire Agreement, (d) the terms “Article,” “Section” and “Exhibit” refer to the specified Article, Section and Exhibit of this Agreement and (e) the terms “include,” “includes” or “including,” shall be deemed to be followed by the words “without limitation” unless otherwise indicated. Whenever this Agreement refers to a number of days, unless otherwise specified, such number shall refer to calendar days. The headings in this Agreement are for reference purposes only and shall not affect in any way the meaning or interpretation of this Agreement.

ARTICLE 2

PURCHASE AND SALE OF ASSETS

2.1 Assets. Upon the terms and subject to the conditions of this Agreement, at the Closing, Seller shall irrevocably sell, assign, transfer, convey and deliver to Buyer, and Buyer

shall purchase, acquire and accept, free and clear of any and all Liens, all right, title and interest of Seller in and to the Products and all assets of Seller relating to the Products, wherever located, including, without limitation, the following assets (collectively, the “Assets”):

(a) All intellectual property rights owned by Seller that are solely related to the Products, including, without limitation, (i) any such inventions, patents, copyrights, domains, domain names or trademarks and any applications or registrations with respect or related thereto, and other IP Rights (other than those IP Rights licensed to the Seller) and (iii) any Proprietary Information that is solely related to the Products;

(b) All regulatory approvals and regulatory documentation owned by Seller relating to the Products, including all such INDs, NDAs or any foreign equivalents related to the Products and all other regulatory filings and documents related thereto;

(c) All correspondence between Seller and the FDA or foreign equivalents related to the Products or any INDs, NDAs or any foreign equivalents related to the Products;

(d) All pre-clinical and clinical data owned by Seller that are related to the Products;

(e) Analytical and manufacturing methods, trade secrets and know-how owned by Seller and used in the development or manufacture of the Products and the design and packaging of the Products;

(f) The contracts listed on Schedule 2.1(f) attached hereto (the “Assumed Contracts”);

(g) The monitoring reports, audits, safety reports and all other written or documented materials owned by Seller related to each study that has been or is being conducted by or on behalf of Seller under any INDs, NDAs or any foreign equivalents related to the Products;

(h) Seller’s entire current inventory of, or directly related to, the Products, including all clinical trial material and all active pharmaceutical ingredients, ingredients, supplies, formulations and related items, products and matter of or directly and solely related to the Products (the “Product Inventory”);

(i) Any and all other documentation, records, data, information and materials owned by Seller and directly and solely pertaining to the Products;

(j) All Permits which are held by Seller and required for the ownership and use of the Assets;

(k) All rights to any Actions of any nature available to or being pursued by Seller to the extent primarily related to the Products, whether arising by way of counterclaim or otherwise; and

(l) All goodwill and the going concern value of the Products.

2.2 Liabilities.

(a) Assumed Liabilities. Subject to the terms and conditions set forth herein, at the Closing, Buyer shall assume and agree to pay, perform and discharge only (i) the Liabilities arising out of or relating to Buyer’s ownership, operation or use of the Assets from

and after the Closing (including the obligations from and after the Closing under or related to the Assumed Contracts), but only to the extent that such Liabilities are required to be performed from and after the Closing and do not relate to any failure to perform, breach, default or violation by Seller on or prior to the Closing, (ii) all obligations under the Assumed Contracts to the extent due and payable on or after the Closing Date, (iii) $150,000 of the costs set forth on Schedule 2.2(a), and (iv) all costs relating to the operation of the Assets in the ordinary course of business to the extent due and payable between the date of this Agreement and the Closing Date (collectively, the “Assumed Liabilities”). On a biweekly basis between the date hereof and the Closing Date, Seller shall provide Buyer with a reasonably detailed summary of the costs reimbursable pursuant to Section 2.2(a)(iv) that have become due and payable during the immediately preceding two week period (each, a “Reimbursement Report”), provided, however, that Seller’s failure to timely include a cost otherwise reimbursable pursuant to Section 2.2(a)(iv) on a Reimbursement Report shall not discharge Buyer’s obligation to reimburse such cost so long as Seller promptly provides Buyer with reasonably detailed information regarding such reimbursable cost. Buyer’s obligations to pay the Assumed Liabilities shall be contingent upon the Closing of the transactions contemplated pursuant to this Agreement and shall be due on the Closing Date.

(b) Excluded Liabilities. Buyer shall not assume and shall not be responsible to pay, perform or discharge any Liabilities of Seller of any kind or nature whatsoever other than the Assumed Liabilities (the “Excluded Liabilities”).

2.3 Transfer Taxes and Fees; Bulk Sales. Any and all sales, excise, use, transfer, value-added and similar Taxes, fees or duties assessed, imposed or incurred by reason of the sale by Seller and the purchase by Buyer of the Assets hereunder shall be paid one-half by Buyer and one-half by Seller. Each of the Parties hereby waives compliance with the notification and all other requirements of the bulk sales laws in force in the jurisdiction in which such laws are applicable to the Assets or the transactions contemplated by this Agreement.

2.4 Procedures for Assets Not Transferable. With respect to any asset, property or right included in the Assets that is not assignable or transferable either by virtue of the provisions thereof or under applicable laws without the consent of any Person, and for which such consent is not obtained prior to the Closing, this Agreement shall not constitute an assignment or transfer thereof if an attempted assignment would constitute a breach thereof or be unlawful and, unless otherwise agreed between Buyer and Seller with respect to such Asset, Seller shall, at its expense, use commercially reasonable efforts to obtain all such consents, as promptly as practicable after the Closing. If any such consent shall not be obtained or if any attempted assignment pursuant hereto would be ineffective, Buyer and Seller shall negotiate an agency arrangement in good faith in order to obtain for Buyer the net benefits of such Asset. Notwithstanding any provision in this Section 2.4 to the contrary, Buyer shall not be deemed to have waived its rights under Section 7.2(a)(xii) unless and until Buyer either provides a written waiver thereof.

ARTICLE 3

CONSIDERATION

Subject to the terms and conditions of this Agreement, Buyer will pay the following consideration to Seller for the transfer and conveyance of the Assets to Buyer in accordance with Article 2:

3.1 Upfront Payments. At the Closing, Buyer shall pay to Seller a non-refundable amount in cash equal to $150,000 (the “Closing Cash Consideration”) by wire transfer of immediately available funds.

3.2 Contingent Payments. Seller may be entitled to certain additional payments from Buyer after the Closing, subject to the terms and conditions of this Section 3.2.

(a) Milestone Payment. With respect to each Product, Buyer shall pay to Seller $15,000,000 (the “Milestone Payment”) upon the first FDA approval for such Product if such approval is for an indication that is not a Rare Pediatric Disease. For clarification purposes, only up to one Milestone Payment shall be due with respect to each of an 801 Product, 802 Product or 803 Product (for a total of three (3) possible Milestone Payments hereunder) if the condition set forth above it met. “Rare Pediatric Disease” means a disease that meets the following criteria: (a) the disease is a serious or life-threatening disease in which the serious or life-threatening manifestations primarily affect individuals aged from birth to 18 years, including age groups often called neonates, infants, children, and adolescents and (b) the disease is a rare disease or condition, within the meaning of section 526 of the FD&C Act.

(b) Priority Review Voucher Payments

(i) If Buyer, one of its Affiliates, any assignee, transferee or other successor in interest of any of the foregoing with respect to any Product or rights thereto, or any licensees or sublicensees of any of the foregoing (each of the foregoing, a “Product Party”) receives a Priority Review Voucher from the FDA in respect of any of the Products and such Product Party transfers such Priority Review Voucher or the right to use or redeem such Priority Review Voucher in exchange for any cash or non-cash consideration (a “PRV Sale”), the Product Party shall pay to Seller, within thirty (30) days following such PRV Sale (or in the case of Gross Proceeds received by the Product Party following such PRV Sale, the date of receipt thereof) in cash an amount equal to 17.5% percent of the Net Proceeds that are directly attributable to such PRV Sale. “Net Proceeds” means the Gross PRV Proceeds less all reasonable, documented costs and expenses of legal counsel, third party consultants, and investment bankers incurred by such Product Party directly in connection with the negotiation and consummation of such sale, transfer or other disposition of the Priority Review Voucher). Notwithstanding anything in the preceding portion of this Section 3.2(b)(i) to the contrary, if (i) an Identified Patient is enrolled into a Pivotal Trial for the Product known as AVTX-803 prior to or within [***] ([***]) days after the Closing Date, (ii) data generated from the participation of the Identified Patient is reasonably necessary for the Regulatory Approval in the United States of the Product known as AVTX-803, and (iii) a Priority Review Voucher is received by a Product Party with respect to such Product or associated Regulatory Approval (or application therefor) (such a Priority Review Voucher issued under such circumstances, a “20% PRV”), Seller shall be entitled to receive, and Seller shall pay, 20.0% of the Net Proceeds of the PRV Sale of such Priority Review Voucher, payable as set forth above. “Identified Patient” means the pediatric patient identified by Seller prior to [***] who is described as having [***] and is located in [***].

(ii) If a Product Party receives a Priority Review Voucher from the FDA in respect of a Product and (i) no Product Party consummates a PRV Sale thereof on or before the one hundred eightieth (180th) day following the receipt of such Priority Review Voucher (the “PRV Sale Deadline”) or (ii) a Product Party (or any affiliate thereof) uses or redeems such Priority Review Voucher (“PRV Use”), Buyer shall, within thirty (30) days following the PRV Sale Deadline or PRV Use (whichever occurs first with respect to the applicable Priority Review Voucher), pay to Seller an amount equal to 17.5% (or, in the case of a 20% PRV, 20.0%) of the average price paid for the transfer or sale of the last three Priority Review Vouchers sold by Third Parties (other than PRV Sales subject to this Agreement) for which the sale, including the consideration paid, has been publicly disclosed.

(iii) The payments due Seller from Buyer pursuant to this Section 3.2(b) are hereafter referred to as the “PRV Sale Payments”. For clarity, and notwithstanding

anything to the contrary, if a Milestone Payment or PRV Sale Payment, respectively, has been made with respect to an 801 Product, 802 Product, or 803 Product, respectively, then no additional PRV Sale Payment or Milestone Payment, respectively, shall be due with respect to such 801 Product, 802 Product, or 803 Product, respectively (e.g., for an 801 Product, 802 Product and 803 Product, respectively, only one of a Milestone Payment or PRV Sale Payment shall be due, upon the earliest of the achievement of the milestone set forth in Section 3.2(a) by an 801 Product, 802 Product or 803 Product, respectively, or a PRV Sale, PRV Sale Deadline, or PRV Use with respect to a Priority Review Voucher issued to a Product Party with respect to an 801 Product, 802 Product or 803 Product, respectively).

(c) Transfer, License, or Sublicense of Products. Any agreement by which any Product Party obtains rights to any Product in the United States prior to the payment of the PRV Sale Payment or Milestone Payment with respect to such Product shall provide that (i) such Product Party expressly assumes all of the obligations to pay Seller the Milestone Payment or PRV Sale Payment upon the terms and conditions set forth in this Section 3.2, (ii) Seller is a third party beneficiary of such agreement with the right to enforce such payment obligations and (iii) such Product Party, and any successor in interest to such Product Party, shall not further assign, transfer, license, sublicense or otherwise transfer the rights to such Product unless such further assignment, transfer, license or sublicense is made in a written agreement incorporating the required terms set forth in this Section 3.2(c).

ARTICLE 4

REPRESENTATIONS AND WARRANTIES OF SELLER

Seller hereby represents and warrants to Buyer as of the date of this Agreement and as of the Closing Date, as follows:

4.1 Organization. Seller is a business entity duly incorporated, validly existing and in good standing under the laws of the jurisdiction in which it is formed or incorporated. Seller has the requisite power and authority to own, lease and operate the Assets. Seller is duly qualified to do business as a foreign entity in each jurisdiction in which the nature of its business or the character of its properties makes such qualification necessary, except where the failure to do so would not have a material adverse effect on Seller or any of the Assets.

4.2 Authority and Enforceability. Seller has the requisite power and authority to enter into this Agreement and the other Transaction Documents to which it is a party, and to perform its obligations hereunder and thereunder. Seller has taken all necessary action on its part to authorize the execution and delivery of this Agreement and the other Transaction Documents to which it is a party and the performance of its obligations hereunder and thereunder. This Agreement and the other Transaction Documents to which it is a party have been duly and validly executed and delivered by Seller and are the legal, valid and binding obligations of Seller, enforceable against Seller in accordance with their terms.

4.3 No Violation, Etc. Except as set forth on Schedule 4.3, the execution and delivery of this Agreement and the other Transaction Documents to which it is a party, and the performance of Seller’s obligations hereunder and thereunder by Seller does not and will not (a) violate or conflict with any provision of the organizational documents of Seller, (b) violate, or conflict with, or result in a breach of any provision of, or constitute a default or give rise to any right of termination, cancellation or acceleration (with the passage of time, notice or both) under any agreement, lease, instrument, obligation, understanding or arrangement, oral or written, to which Seller is a party or by which any of Seller’s properties or assets is subject, including the Assets, (c) violate any Applicable Laws to which Seller or any of its properties or assets are subject or (d) result in any Lien on the Assets. Without limiting the foregoing, Seller has not

granted any right, Lien or other interest to any Third Party which would conflict with the conveyance of the Assets to Buyer.

4.4 No Consents and Approvals. Except as set forth on Schedule 4.4, no Permit, consent, approval or authorization of, or notice, declaration, filing or registration with, any Governmental Authority or Third Party is or will be necessary in connection with the execution and delivery by Seller of this Agreement and the other Transaction Documents to which it is a party or the performance by Seller of its obligations hereunder and thereunder, except where any Permit, consent, approval, authorization, notice, declaration, filing or registration so required has been obtained or made by Seller prior to or at the Closing.

4.5 Litigation. Except as set forth on Schedule 4.5, there is no Action pending against Seller or, to Seller’s Knowledge, threatened, with respect to the Assets or the transactions contemplated herein.

4.6 Title to Assets. Except as set forth on Schedule 4.6 , (a) Seller (i) owns and holds, free and clear of all Liens, all right, title and interest in and to the Assets, (ii) has good, valid and marketable title to the Assets; (iii) has the exclusive right to use, sell, license or dispose of the Assets, and (iv) has the exclusive right to bring action for the infringement of any Assets, (b) from and after the Closing, Buyer will own the Assets free and clear of all Liens and (c) Seller is not obligated to make any payments to any Person with respect to the Assets, whether by way of royalties, fees or otherwise, which obligation would be transferred to Buyer by operation of law or otherwise, other than with respect to the Assumed Liabilities.

4.7 Intellectual Property.

(a) Schedule 4.7(a) contains a true and complete list of all patents, patent applications, trade names, trademarks, service marks, trademark and service mark registrations and applications, copyright registrations and applications, and grants of a license or right to Seller with respect to any of the foregoing, owned or claimed to be owned by or licensed to Seller and related to or used in connection with the Products or the Assets (the “IP Rights”), all of which are included in the Assets (except for those IP Rights licensed to the Seller, for which the agreements under which such licenses are granted shall be included in the Assets). Seller has taken reasonable security measures to protect the secrecy and confidentiality of the IP Rights (other than any patents or published patent applications included therein) and all of the non-public proprietary information (owned by Seller other than IP Rights which is required for the manufacture, use, sale or other exploitation of the Products, as such activities are currently conducted, which may include, without limitation, trade secrets, know-how, processes, discoveries, developments, designs, toolings, techniques, supplier lists, purchasing strategies, inventions, processes and confidential data (collectively, “Proprietary Information”). Seller has not sold, transferred, assigned, licensed or subjected to any Lien any IP Rights or Proprietary Information or any interest therein or entered into any agreement to do the foregoing, except as set forth in any Assumed Contract.

(b) Except as described on Schedule 4.7(b), no IP Rights or Proprietary Information is subject to any pending, or, to Seller’s Knowledge, threatened Action or other adverse claim of infringement, in either case by or against Seller, by any other Person. No Actions or claims have been asserted or are threatened by any Person against, in either case, Seller, alleging that the use of the IP Rights by Seller infringes upon any of such Person’s intellectual property rights. To Seller’s Knowledge, there are no facts that would reasonably lead Seller to believe any other Person has infringed or otherwise misappropriated the IP Rights or the Proprietary Information.

(c) The transactions contemplated by this Agreement will not violate or breach the terms of any license of intellectual property rights to which Seller is a party, or entitle any other party to any such license to terminate or modify it, or otherwise adversely affect Seller’s rights under it.

(d) Following the Closing, Buyer will be entitled to continue to use, practice and exercise rights in, all of the IP Rights to the same extent and in the same manner as Seller prior to Closing without financial obligation to any Person.

(e) Following the Closing, neither Seller nor any of its Affiliates will retain or use any of the IP Rights or Proprietary Information with respect to any Product other than as set forth in the Transition Services Agreement being executed between the Parties in connection herewith.

(f) All current and former employees of Seller whose duties or responsibilities directly relate to the Assets have entered into confidentiality, intellectual property assignment and proprietary information agreements with and in favor of Seller.

4.8 Contracts. True and complete copies of each of the Assumed Contracts and Related Documents have been made available to Buyer. The Assumed Contracts constitute all of the contracts to which Seller is a party that relate to the Assets and which after the Closing will be (on identical terms), legal, valid, binding, enforceable and in full force and effect in the form delivered to Buyer. Neither Seller nor, to Seller’s Knowledge, any other Person is in breach of or default under any Assumed Contract, and Seller has not received any written claim or assertion that Seller is in material breach of or default under any Assumed Contract. No event has occurred or, to Seller’s Knowledge, based on facts presently known to exist, is reasonably anticipated, which with notice or lapse of time or both would constitute a breach or default, or permit termination, acceleration or modification, under any Assumed Contract. The execution and delivery of this Agreement or the other Transaction Documents and the consummation of the transactions contemplated hereby or thereby will not result in any change or modification of any of the rights or obligations of any party under or violate or result in a breach or event of default under or result in termination of, any of the Assumed Contracts.

4.9 Regulatory Filings. Seller has made all required registrations and filings with and submissions to all applicable Governmental Authorities relating to the Products or the Assets, including the IND. All such registrations, filings and submissions were in compliance in all material respects with all Applicable Laws and other requirements when filed, no material deficiencies have been asserted by any such applicable Governmental Authorities with respect to such registrations, filings or submissions and no facts or circumstances exist which would indicate that a material deficiency may be asserted by any such authority with respect to any such registration, filing or submission. Seller has delivered to Buyer copies of (a) all material reports of inspection observations, (b) all material establishment inspection reports, (c) all material warnings letters and (d) any other material documents received by Seller from the FDA or any other Governmental Authority relating to the Products or the Assets that assert ongoing material lack of compliance with any laws (including regulations promulgated by the FDA and any other Governmental Authorities) by Seller.

4.10 Product Inventory. Schedule 4.10 contains a true and complete list of all Product Inventory. Seller has good and indefeasible title to such Product Inventory free of all Liens. The Product Inventory is not subject to any licensing, patent, royalty, trademark, trade name or copyright agreement with any third party. The completion of a sale or other disposition of the Product Inventory will not require the consent of any Person and shall not constitute a breach or default under any Contract.

4.11 Brokers. No broker, finder or investment banker is entitled to any brokerage, finder’s or other fee or commission in connection with the transactions contemplated by this Agreement or the transactions contemplated by this Agreement based upon arrangements made by or on behalf of Seller.

ARTICLE 5

REPRESENTATIONS AND WARRANTIES OF BUYER

Buyer hereby represents and warrants to Seller as of the date of this Agreement and as of the Closing Date, as follows:

5.1 Organization. Buyer is a business entity duly organized, validly existing and in good standing under the laws of the jurisdiction in which it is formed or incorporated. Buyer is duly qualified to do business as a foreign entity in each jurisdiction in which the nature of its business or the character of its properties makes such qualification necessary, except where the failure to do so would not have a material adverse effect on Buyer.

5.2 Authority and Enforceability. Buyer has the requisite power and authority to enter into this Agreement and the other Transaction Documents to which it is a party and to perform its obligations hereunder and thereunder. Buyer has taken all necessary action on its part to authorize the execution and delivery of this Agreement and the other Transaction Documents to which it is a party and the performance of its obligations hereunder and thereunder. This Agreement and the other Transaction Documents to which it is a party have been duly and validly executed and delivered by Buyer and are the legal, valid and binding obligations of Buyer, enforceable against Buyer in accordance with their terms.

5.3 No Violation, Etc. The execution and delivery of this Agreement and the performance of Buyer’s obligations hereunder does not and will not (a) violate or conflict with any provision of the organizational documents of Buyer, (b) violate, or conflict with, or result in a breach of any provision of, or constitute a default or give rise to any right of termination, cancellation or acceleration (with the passage of time, notice or both) under any agreement, lease, instrument, obligation, understanding or arrangement, oral or written, to which Buyer is a party or by which any of Buyer’s properties or assets is subject or (c) violate any Applicable Laws to which Buyer or any of its properties or assets are subject.

5.4 No Consents and Approvals. No Permit, consent, approval or authorization of, or notice, declaration, filing or registration with, any Governmental Authority or Third Party is or will be necessary in connection with the execution and delivery by Buyer of this Agreement or the performance by Buyer of its obligations hereunder.

5.5 Litigation. There is no Action pending against Buyer or, to Buyer’s knowledge, threatened, with respect to the transactions contemplated herein.

5.6 Brokers. No broker, finder or investment banker is entitled to any brokerage, finder’s or other fee or commission in connection with the transactions contemplated by this Agreement or the transactions contemplated by this Agreement based upon arrangements made by or on behalf of Buyer.

5.7 Independent Investigation; Disclaimer of Other Representations. Buyer has conducted its own independent investigation, review and analysis of the Assets and acknowledges that it has been provided adequate access to the personnel, properties, assets, premises, books and records, and other documents and data of the Seller for such purpose. Buyer acknowledges and agrees that (a) in making its decision to enter into this Agreement and to consummate the transactions contemplated hereby, it has relied solely upon its own investigation

and the express representations and warranties of the Seller set forth in Article 4 of this Agreement (including the related portions of the Disclosure Schedules), (b) the representations and warranties made by the Seller in Article 4 of this Agreement (and as qualified by the Disclosure Schedules) are the exclusive representations and warranties made by the Seller, or any other Person, with respect to the Seller or the Assets, or the subject matter of this Agreement, and (c) none of the Seller or any other Person has made any representation or warranty as to the Seller or the Assets, except as expressly set forth in Article 4 of this Agreement (including the related portions of the Disclosure Schedules). Buyer specifically disclaims that it is relying upon or has relied upon any such other representations or warranties that may have been made by any Person, and acknowledges that the Seller hereby specifically disclaims any such other representation or warranty made by any Person. Except as expressly set forth herein, the Seller makes no express or implied warranty of merchantability, suitability, adequacy, fitness for a particular purpose or quality with respect to the Assets or as to the condition or workmanship thereof or the absence of any defects therein, whether latent or patent.

ARTICLE 6

CONDUCT PRIOR TO THE CLOSING

6.1 Conduct of Business. From the date hereof until the Closing, except as otherwise provided in this Agreement or consented to in writing by Buyer, (a) Seller shall operate the Assets in the ordinary course of business consistent in all material respects with past practice, and shall not grant any Liens on any of the Assets or otherwise permit the Assets to become subject to any Liens, (b) Seller shall use its commercially reasonable efforts consistent in all material respects with past practices and policies to keep available in connection with the Products and the Assets the services of its present employees and preserve its relationships with customers, suppliers, distributors, and others having business dealings with it, to the end that its goodwill and ongoing business of the Products and Assets be substantially unimpaired on the Closing Date, (c) Seller shall not enter into, amend or terminate any Assumed Contract; and (d) Seller shall not sell, assign, transfer, lease or license any of the Assets.

6.2 Notices of Certain Events.

(a) Each Party shall promptly (and in no event more than three (3) Business Days after such Party becomes aware) notify the other Party of any notice or other communication from (i) any Person alleging that the consent of such Person is or may be required in connection with the transactions contemplated by this Agreement or any of the other Transaction Documents, and (ii) any Governmental Authority or Third Party in connection with the transactions contemplated by this Agreement or any of the other Transaction Documents; and

(b) Each Party shall promptly (and in no event more than three (3) Business Days after such Party becomes aware) notify the other Party of such Party’s material breach of any obligation, representation, warranty or covenant under this Agreement or any of the other Transaction Documents, or any fact that would cause any representation or other fact contained in this Agreement or any of the other Transaction Documents to be materially inaccurate or materially misleading.

6.3 No Competing Proposals. As of the date hereof and through the Closing or earlier termination of this Agreement, the Seller shall not, and shall not authorize or permit any of its Affiliates or other representatives to, (a) solicit, initiate or continue inquiries regarding a Competing Proposal; (b) enter into discussions or negotiations with, or provide any information to, any Person concerning a possible Competing Proposal; or (c) enter into any agreements or other instruments (whether or not binding) regarding a Competing Proposal. The Seller shall cease and cause to be terminated, and shall cause its Affiliates and other representatives to cease and cause to be terminated, all existing discussions or negotiations with any Persons conducted

heretofore with respect to, or that could lead to, a Competing Proposal (including by revoking access to any on-line or virtual data room). With respect to Persons with whom discussions or negotiations related to a Competing Proposal have been terminated, Seller shall not, and they shall cause its Affiliates and other representatives not to, directly or indirectly, amend, waive or terminate all or part of any applicable confidentiality agreements entered into with such Persons. For purposes hereof, “Competing Proposal” shall mean any inquiry, proposal or offer from any Person (other than Buyer or any of its Affiliates) concerning the sale, lease, exchange or other disposition of any of the Assets or Products, including by way of a change in control of Seller.

6.4 Access to Information. Buyer shall be entitled, through its personnel and representatives, subject to legal or regulatory requirements, to make such reasonable investigation of the Assets, and such examination of the books and records relating to the Products and the Assets as Buyer may reasonably request from the date hereof through the Closing or earlier termination of this Agreement. Any such investigation and examination shall be subject to reasonable advance written notice to Seller and conducted during regular business hours in a manner that does not unreasonably interfere with the business of Seller. Notwithstanding anything herein to the contrary, Seller shall not be required to furnish any information that Seller is under a legal obligation not to disclose; provided, however, that Seller shall notify Buyer of such inability to so supply such information and reasonable detail as to the nature of the information withheld.

6.5 Further Assurances. Subject to the terms and conditions of this Agreement, each of the Parties will use reasonable best efforts to take, or cause to be taken, all action, and to do, or cause to be done, all things necessary, proper or advisable under Applicable Laws for it to consummate and make effective the transactions contemplated by this Agreement and the other Transaction Documents, including without limitation (a) using commercially reasonable efforts to (i) in the case of Seller, cause the conditions precedent set forth in Section 7.2(a) to be satisfied, and in the case of Buyer, cause the conditions precedent set forth in Section 7.2(b) to be satisfied and (ii) obtain all required third-party consents and approvals, and (b) execute and deliver all certificates, agreements and other documents as the other Party may reasonably request.

ARTICLE 7

CLOSING

7.1 Closing. The closing of the transactions contemplated by this Agreement (the “Closing”) shall take place remotely through the electronic exchange of documents, no later than the second (2nd) Business Day after the date upon which all conditions set forth in this ARTICLE 7 (other than such conditions which, by their nature, are to be satisfied on the Closing Date, but subject to the satisfaction or waiver of such conditions) have been satisfied or waived, or at such other time, date and location as the parties hereto may agree in writing. The date on which the Closing occurs is referred to herein as the “Closing Date” and the Closing shall be deemed effective as of 12:01 a.m. on the Closing Date.

7.2 Closing Conditions.

(a) Conditions of Buyer. Notwithstanding any other provision of this Agreement, the obligations of Buyer to consummate the transactions contemplated hereby shall be subject to the satisfaction, at or prior to the Closing Date, of the following conditions, which may be waived by Buyer in its sole discretion:

(i) Each of the representations and warranties of Seller set forth in this Agreement shall be true and correct, in all material respects, as of the Closing Date with the same effect as though made at and as of such date (except those representations and warranties that

address matters only as of a specified date, which shall be true and correct in all respects as of that specified date), and Seller shall have performed all obligations, conditions and covenants required to be performed by it under this Agreement prior to the Closing Date;

(ii) Buyer shall have received a Bill of Sale, executed by Seller and dated as of the Closing Date, in the form of Exhibit A hereto (the “Bill of Sale”);

(iii) Buyer shall have received an Assignment and Assumption Agreement, executed by Seller and dated as of the Closing Date, in the form of Exhibit B hereto (the “Assignment and Assumption Agreement”);

(iv) Buyer shall have received a Transition Services Agreement, executed by Seller and dated as of the Closing Date, in the form of Exhibit C hereto (the “Transition Services Agreement”);

(v) Evidence of the transfer of ownership of European Patent No. 2 905 621 B1 to Seller shall have been filed in the appropriate office;

(vi) Buyer shall have received one or more Assignment of Patents, executed by Seller and dated as of the Closing Date, in a form reasonably acceptable to Buyer (the “Assignment of Patents”), and all powers of attorney and other documents needed in connection with the filing of the Assignment of Patents;

(vii) Buyer shall have received an Assignment of Trademarks, executed by Seller and dated as of the Closing Date, in the form of Exhibit D hereto (the “Assignment of Trademarks”);

(viii) Buyer shall have received evidence of the release of all Liens on the Assets granted under the Horizon Loan Agreement;

(ix) Buyer shall have received a certificate pursuant to Treasury Regulations Section 1.1445-2(b) that Seller is not a foreign person within the meaning of Section 1445 of the Internal Revenue Code of 1986, as amended, duly executed by Seller; and

(x) Since the date of this Agreement, there shall not have occurred a material adverse change or material adverse effect to the Products or the Assets that shall be continuing;

(xi) Buyer shall have received a certificate dated as of the Closing Date signed by an officer of Seller certifying that the conditions stated in Sections 7.2(a)(i) and 7.2(a)(x) have been satisfied; and

(xii) All consents, approvals, orders or authorizations set forth on Schedule 7.2(a)(xii) shall have been obtained and shall be in full force and effect, in each case in form and substance reasonably satisfactory to Buyer.

(b) Conditions of Seller. Notwithstanding any other provision of this Agreement, the obligations of Seller to consummate the transactions contemplated hereby shall be subject to the satisfaction, at or prior to the Closing Date, of the following conditions, which may be waived by Seller in its sole discretion:

(i) Each of the representations and warranties of Buyer set forth in this Agreement shall be true and correct, in all material respects, as of the Closing Date shall be true and correct in all respects as of the Closing Date with the same effect as though made at and as

of such date (except those representations and warranties that address matters only as of a specified date, which shall be true and correct in all respects as of that specified date) and Buyer shall have performed all obligations, conditions and covenants required to be performed by it under this Agreement prior to the Closing Date;

(ii) Seller shall have received a certificate dated as of the Closing Date signed by an officer of Buyer certifying that the conditions stated in Section 7.2(b)(i) have been satisfied;

(iii) Seller shall have received the Closing Cash Consideration;

(iv) Seller shall have received the Assignment and Assumption Agreement, executed by Buyer and dated as of the Closing Date; and

(v) Seller shall have received the Transition Services Agreement, executed by Buyer and dated as of the Closing Date.

ARTICLE 8

POST-CLOSING COVENANTS AND AGREEMENTS

8.1 Additional Deliveries. For no additional consideration, from time to time, on and after the Closing Date, at Buyer’s reasonable request, Seller shall execute and deliver such additional or confirmatory instruments, documents of conveyance, endorsements, assignments and acknowledgments as are reasonably necessary to evidence or vest in Buyer sole, exclusive, valid and marketable title in and to the Assets (subject to the terms of the licenses and contracts disclosed to Buyer).

8.2 Reports and Information Rights. Within thirty (30) Business Days following the first Business Day of each calendar year after the Closing Date, Buyer shall provide Seller with a reasonably detailed report with respect to the status of clinical development of the Products. In addition to the foregoing, after the Closing Date, Buyer shall promptly notify Seller of the occurrence of and provide Seller with reasonably detailed information regarding (i) meetings, notifications, letters, and other communications with any Regulatory Authority regarding the Products, (ii) material regulatory filings, (iii) receipt of any Regulatory Approval with respect to a Product, and (iv) any decision or anticipated decision to suspend clinical development of any Product.

8.3 Non-Competition. For a period of 48 months following the Closing, Seller shall not and shall not permit any of its controlled Affiliates to directly or indirectly (a) acquire, develop, manufacture, sell or market any human or animal pharmaceutical products containing D-galactose, D-mannose or L-fucose as the primary active pharmaceutical ingredient thereof (the “Restricted Business”) or have an interest in any Person that engages directly or indirectly in the Restricted Business in any capacity, including as a partner, shareholder, member, employee, principal, agent, trustee or consultant, or (b) intentionally cause, induce or encourage any Third Party that is a party to any Assumed Contract to terminate or modify any such relationship with Seller thereunder, provided that, notwithstanding anything to the contrary, (i) following any Change of Control of Seller, if the acquiring Third Party or any Affiliate thereof has a program (whether pre-clinical, clinical or commercial stage) that existed prior to such Change of Control that would otherwise violate clause (a) above (a “Competing Program”), then such clause (a) will not apply with respect to such Competing Program and such acquiring Third Party will be permitted to continue such Competing Program after such Change of Control and (ii) if Seller or an Affiliate thereof acquires a Competing Program, through an acquisition of, or a merger with, the whole or substantially the whole of the business or assets of a Third Party that does not result in a Change of Control, that is being exploited (whether pre-clinical, clinical or commercial

stage) in a way that would otherwise violate clause (a) above, then such clause (a) will not apply with respect to such Competing Program and Seller and its Affiliates will be permitted to continue such Competing Program so long as, solely with respect to clause (ii), such Competing Program does not involve any of the indications or conditions set forth on Schedule 8.3.

8.4 Confidentiality.

(a) Each Party will treat as confidential the Confidential Information of the other Party, and will take all commercially reasonable precautions to ensure the confidentiality of such Confidential Information. After the expiration or termination of this Agreement, upon request from the other Party, each Party agrees to return to the other Party or destroy all Confidential Information acquired from such other Party, except as to such information it may be required to retain under Applicable Laws, and except for one copy of such information to be retained by such Party solely to enable it to assess its compliance with the confidentiality provisions of this Section 8.4. Neither Party shall, without the other Party’s express prior written consent, use or disclose any such Confidential Information for any purpose other than to carry out its obligations hereunder. Each Party, prior to disclosure of Confidential Information of the other Party to any employee, consultant or advisor shall ensure that such Person is bound in writing to observe the confidentiality of such Party’s Confidential Information on terms no less restrictive than those contained herein. The obligations of confidentiality shall not apply to Confidential Information that the receiving Party is required by law or regulation to disclose (including, for the avoidance of doubt, any applicable requirements to disclose such information pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or any regulation promulgated thereunder); provided however, that the receiving Party shall so notify the disclosing Party of its intent and cooperate with the disclosing Party on reasonable measures to protect the confidentiality of the Confidential Information. The immediately preceding sentence of this Section 8.4(a) notwithstanding, Seller expressly reserves the right to disclose the existence of this Agreement, the transactions contemplated herein, and certain terms thereof, to the extent that Seller and its advisors determine, in their sole discretion, that such disclosure is necessary or advisable to comply with Seller’s public reporting obligations under the Exchange Act or is advisable for Seller to conduct an offering of debt or equity securities. Seller hereby acknowledges and agrees that any information that is Confidential Information of Seller prior to the Closing that is included in the Assets shall be Buyer’s Confidential Information from and after the Closing.

(b) Buyer acknowledges that Seller’s securities are registered with the Securities and Exchange Commission under the Exchange Act, and that such securities are publicly traded. Buyer agrees that so long as it or its Affiliates possess any Confidential Information about Buyer that may be considered “material non-public information” for purposes of the U.S. federal securities laws, none of Buyer or its Affiliates shall purchase, sell or otherwise trade in, directly or indirectly, publicly or privately, Seller’s securities.

8.5 Public Announcement. Notwithstanding any provision of Section 8.4 to the contrary, Buyer and Seller will mutually agree on the contents of the press releases that will be issued by Seller (i) on or after the date of this Agreement, to announce the signing of this Agreement, and (ii) at Closing, to announce the consummation of the transactions contemplated by this Agreement.

ARTICLE 9

INDEMNIFICATION

9.1 Survival. Except as expressly set forth herein, the representations and warranties contained in this Agreement shall survive the Closing. All covenants and obligations of the Parties contained herein or in any documents, certificate or instrument required to be delivered

hereunder in connection with the transactions contemplated hereby shall survive the Closing and continue in full force until performed in accordance with their terms.

9.2 Indemnification.

(a) Indemnification by Seller. Seller shall defend, indemnify and hold harmless Buyer, its Affiliates and their respective stockholders, directors, officers and employees from and against all actual, out-of-pocket claims, actions, obligations, awards, judgments, fines, penalties, damages, liabilities, settlements, losses, costs and expenses, including attorneys’ fees and disbursements (collectively, “Losses”) arising from or related to:

(i) Any inaccuracy in or breach of any of the representations and warranties of Seller contained in this Agreement or any of the other Transaction Documents to which it is a party;

(ii) Any breach or non-fulfillment of any covenant, agreement or obligation to be performed by Seller pursuant to this Agreement or any of the other Transaction Documents to which it is a party;

(iii) Any Excluded Liability;

(iv) Any claim related to the Assets based upon, resulting from or arising out of the business, operations, properties, assets or obligations of Seller or any of its Affiliates conducted, existing or arising on or prior to the Closing Date; and

(v) the matter set forth on Schedule 4.5, to the extent based upon, resulting from or arising out of the business, operations, properties, assets or obligations of Seller or any of its Affiliates conducted, existing or arising on or prior to the Closing Date.

(b) Indemnification by Buyer. Buyer shall defend, indemnify and hold harmless Seller, its Affiliates and their respective stockholders, directors, officers and employees from and against all Losses arising from or related to:

(i) Any inaccuracy in or breach of any of the representations and warranties of Buyer contained in this Agreement or any of the other Transaction Documents to which it is a party;

(ii) Any breach or non-fulfillment of any covenant, agreement or obligation to be performed by Buyer pursuant to this Agreement or any of the other Transaction Documents to which it is a party; and

(iii) Any Assumed Liability.

(c) Limitations on Indemnification. The indemnification provided for in this Article 9 shall be subject to the following limitations:

(i) Buyer’s sole remedy with respect to any indemnification claim pursuant to this Agreement shall be limited to the right to set off such indemnification losses against any Milestone Payment or PRV Sale Payment otherwise due pursuant to Section 3.2; and

(ii) In no event shall any Party be entitled to recover for any amounts in respect of punitive damages; provided, however, that the foregoing shall not apply to the extent any such damages are awarded in a proceeding brought or asserted by a third party against any Party.

9.3 Indemnification Procedures.

(a) If a Party (the “Indemnified Party”) receives notice of the assertion by any third party of any claim or of the commencement by any such third party of any claim or action (any such claim or action being referred to herein as an “Indemnifiable Claim”) with respect to which the other Party (the “Indemnifying Party”) is obligated to provide indemnification, the Indemnified Party shall promptly (and in any event within twenty (20) days) notify the Indemnified Party in writing of the Indemnifiable Claim; provided that the failure to provide such notice shall not relieve or otherwise affect the obligation of the Indemnifying Party to provide indemnification hereunder, except to the extent that any Losses directly resulted or were caused by such failure.

(b) The Indemnifying Party shall undertake, conduct and control, through counsel of its own choosing the settlement or defense of any Indemnifiable Claim, and the Indemnified Party shall reasonably cooperate with the Indemnifying Party in connection therewith; provided that the Indemnifying Party shall permit the Indemnified Party to participate in such settlement or defense through counsel chosen by the Indemnified Party; provided further that (i) the fees and expenses of such counsel shall not be borne by the Indemnifying Party; (ii) the Indemnifying Party shall not settle any Indemnifiable Claim without the Indemnified Party’s prior written consent, which consent shall not be unreasonably withheld if the settlement involved only the payment of money and no admission of liability.

9.4 Effect of Investigation. The Indemnified Party’s right to indemnification or other remedy based on the representations, warranties, covenants and agreements of the Indemnifying Party contained herein will not be affected by any investigation conducted by the Indemnified Party with respect to, or any knowledge acquired by the Indemnified Party at any time, with respect to the accuracy or inaccuracy of or compliance with, any such representation, warranty, covenant or agreement.

9.5 Exclusive Remedy. Notwithstanding anything to the contrary contained in this Agreement, except with respect to claims based on Fraud or claims for equitable remedies, the indemnification provided for in this Article 9 will be the sole and exclusive remedy of the Parties, whether in contract, tort or otherwise, for any and all claims of inaccuracy in or breach of any representation, warranty, covenant or agreement of the Parties set forth in this Agreement.

ARTICLE 10

TERMINATION

10.1 Termination. This Agreement may be terminated at any time prior to the Closing only as follows:

(a) by mutual written consent of Buyer and Seller;

(b) by Buyer or Seller if:

(i) the Closing does not occur on or before the date that is sixty (60) days after the date of this Agreement; provided that the right to terminate this Agreement under this Section 10.1(b)(i) shall not be available to any party whose breach of a representation, warranty, covenant or agreement under this Agreement has been the cause of or resulted in the failure of the Closing to occur on or before such date; or

(ii) a Governmental Authority shall have issued an order or taken any other action, in any case having the effect of permanently restraining, enjoining or otherwise

prohibiting the transactions contemplated by this Agreement, which order or other action is final and non-appealable;

(c) by Buyer if:

(i) any condition to the obligations of Buyer hereunder becomes incapable of fulfillment other than as a result of a breach by Buyer of any covenant or agreement contained in this Agreement, and such condition is not waived by Buyer; or

(ii) there has been a breach by Seller of any representation, warranty, covenant or agreement contained in this Agreement, or if any representation or warranty of the Seller shall have become untrue, in either case such that the conditions set forth in Section 7.2(a) would not be satisfied and, in either case, such breach is not curable, or, if curable, is not cured within fifteen (15) days after written notice of such breach is given to Seller by Buyer;

(d) by Seller if:

(i) any condition to the obligations of Seller hereunder becomes incapable of fulfillment other than as a result of a breach by Seller of any covenant or agreement contained in this Agreement, and such condition is not waived by Seller; or

(ii) there has been a breach by Buyer of any representation, warranty, covenant or agreement contained in this Agreement or if any representation or warranty of Buyer shall have become untrue, in either case such that the conditions set forth in Section 7.2(b) would not be satisfied and, in either case, such breach is not curable, or, if curable, is not cured within fifteen (15) days after written notice of such breach is given to Buyer by Seller.

(e) The party desiring to terminate this Agreement pursuant to Section 10.1(b), 10.1(c) or 10.1(d) shall give written notice of such termination to the other party hereto.

10.2 Effect of Termination. In the event of termination of this Agreement as provided in Section 10.1, this Agreement shall immediately become null and void and of no further force and effect; provided, that the provisions of Section 8.4 and Article 11 of this Agreement shall remain in full force and effect and survive any termination of this Agreement. Nothing in this Section 10.2 shall be deemed to release any Party from any Liability for any breach by such Party of the terms and provisions of this Agreement or to impair the right of any Party to compel specific performance by the other Party of its obligations under this Agreement.

ARTICLE 11

MISCELLANEOUS

11.1 Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed an original and all of which shall constitute a single document. Counterparts may be delivered via facsimile, electronic mail (including pdf or any electronic signature) or other transmission method and any counterpart so delivered shall be deemed to have been duly and validly delivered and be valid and effective for all purposes.

11.2 Entire Agreement. This Agreement and the other Transaction Documents contain the entire agreement between the Parties with respect to the subject matter hereof and supersede all previous agreements, negotiations, discussions, writings, understandings, commitments and conversations with respect to such subject matter.

11.3 Exhibits; Schedules. The Exhibits and Schedules referenced herein and attached hereto are incorporated into this Agreement by reference.

11.4 Governing Law; Forum. This Agreement and the relationship of the Parties shall be governed by and construed and interpreted in accordance with the laws of the State of Delaware irrespective of the choice of laws principles of the State of Delaware. Any disputes relating to the transactions contemplated by this Agreement shall be heard in the state and federal courts located in the State of Delaware.