As filed with the Securities and Exchange Commission

on November 15, 2024

Registration No. 333-283104

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1 to

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

ALLIED GAMING & ENTERTAINMENT INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

82-1659427 |

| (State or jurisdiction of |

|

(I.R.S. Employer |

| incorporation or organization) |

|

Identification No.) |

745 Fifth Avenue, Suite 500

New York, New York 10151

Telephone: (646) 768-4240

(Address, including zip code, and telephone number,

including area code,

of registrant’s principal executive offices)

|

Yinghua Chen

Chief Executive Officer

745 Fifth Avenue, Suite 500

New York, New York 10151

Telephone: (646) 768-4240

(Name, address, including zip code, and telephone

number, including area code, of agent for service) |

|

Copy to:

Albert Lung, Esq.

Morgan, Lewis &

Bockius LLP

1400 Page Mill Road

Palo Alto, California

94304

Telephone: (650) 843-4000 |

Approximate date of commencement of proposed

sale to the public: As soon as practicable after the effective date of the registration statement.

If the only securities being registered on this

Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered

only in connection with dividend or interest reinvestment plans, check the following box: ☒

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant

to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant

to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to

a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities

pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

|

Accelerated filer ☐ |

| Non-accelerated filer ☒ |

|

Smaller reporting company ☒ |

| |

|

Emerging growth company ☐ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which

specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section

8(a), may determine.

EXPLANATORY

NOTE

This Pre-Effective Amendment No. 1 to the Registration

Statement on Form S-3 (File No. 333-283104) of Allied Gaming & Entertainment Inc. (the “Registration Statement”) is being

filed solely for the purpose of filing a revised Exhibit 5.1 to the Registration Statement. Accordingly, this Pre-Effective Amendment

No. 1 consists only of a facing page, this explanatory note and Part II of the Registration Statement on Form S-3 setting forth the exhibits

to the Registration Statement. This Pre-Effective Amendment No. 1 does not modify any other part of the Registration Statement.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

ITEM 14. OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION

The following table sets forth

the fees and expenses payable in connection with the registration of securities hereunder. All amounts are estimates except for the SEC

registration fee.

| Securities and Exchange Commission registration fee | |

$ | 2,121.97 | |

| Accounting fees and expenses | |

$ | 5,000 | |

| Legal fees and expenses | |

$ | 10,000 | |

| Miscellaneous | |

$ | — | |

| Total | |

$ | 17,121.97 | |

ITEM 15. INDEMNIFICATION OF DIRECTORS AND OFFICERS

Section 102 of the Delaware

General Corporation Law, or the DGCL, permits a corporation to eliminate the personal liability of its directors to the corporation or

its stockholders for monetary damages for a breach of fiduciary duty as a director, except where the director breached his or her duty

of loyalty, failed to act in good faith, engaged in intentional misconduct or knowingly violated a law, authorized the payment of a dividend

or approved a stock repurchase in violation of Delaware corporate law or obtained an improper personal benefit. Our Certificate of Incorporation

that will be effective upon the closing of this offering provides that no director shall be personally liable to us or our stockholders

for monetary damages for any breach of fiduciary duty as a director, notwithstanding any provision of law imposing such liability, except

to the extent that the DGCL prohibits the elimination or limitation of liability of directors for breaches of fiduciary duty.

Section 145 of the DGCL provides

that a corporation has the power to indemnify a director, officer, employee or agent of the corporation and certain other persons serving

at the request of the corporation in related capacities against expenses (including attorneys’ fees), judgments, fines and amounts

paid in settlements actually and reasonably incurred by the person in connection with an action, suit or proceeding to which he or she

is or is threatened to be made a party by reason of such position, if such person acted in good faith and in a manner he or she reasonably

believed to be in or not opposed to the best interests of the corporation, and, in any criminal action or proceeding, had no reasonable

cause to believe his or her conduct was unlawful, except that, in the case of actions brought by or in the right of the corporation, no

indemnification shall be made with respect to any claim, issue or matter as to which such person shall have been adjudged to be liable

to the corporation unless and only to the extent that the Court of Chancery or other adjudicating court determines that, despite the adjudication

of liability but in view of all of the circumstances of the case, such person is fairly and reasonably entitled to indemnification for

such expenses which the Court of Chancery or such other court shall deem proper.

Our Certificate of Incorporation,

as amended, provides that the Company shall indemnify all persons whom it may indemnify pursuant to Section 145 of DGCL. Further, expenses

(including attorneys’ fees) incurred by an officer or director of the Company in defending any civil, criminal, administrative,

or investigative action, suit or proceeding for which such officer or director may be entitled to indemnification under our Certificate

of Incorporation, as amended, shall be paid by the Company in advance of the final disposition of such action, suit or proceeding upon

receipt of an undertaking by or on behalf of such director or officer to repay such amount if it shall ultimately be determined that he

is not entitled to be indemnified by the Company.

Our Bylaws also provided that

the Company shall indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed

action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of the Company)

by reason of the fact that he/she is or was a director, officer, employee or agent of the Company, or is or was serving at the request

of the Company as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise,

against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by

him /her in connection with such action, suit or proceeding if he/she acted in good faith and in a manner he/she reasonably believed to

be in or not opposed to the best interests of the Company, and, with respect to any criminal action or proceeding, had no reasonable cause

to believe his/her conduct was unlawful. The termination of any action, suit or proceeding by judgment, order, settlement, conviction,

or upon a plea of nolo contendere or its equivalent, shall not, of itself, create a presumption that the person did not act in good faith

and in a manner which he/she reasonably believed to be in or not opposed to the best interests of the Company, and, with respect to any

criminal action or proceeding, had reasonable cause to believe that his/her conduct was unlawful.

Our Bylaws further provide

that the Company shall indemnify any person who was or is a party, or is threatened to be made a party to any threatened, pending or completed

action or suit by or in the right of the Company to procure a judgment in its favor by reason of the fact that he/she is or was a director,

officer, employee or agent of the Company, or is or was serving at the request of the Company as a director, officer, employee or agent

of another corporation, partnership, joint venture, trust or other enterprise against expenses (including attorneys’ fees) actually

and reasonably incurred by him/her in connection with the defense or settlement of such action or suit if he she acted in good faith and

in a manner he/she reasonably believed to be in or not opposed to the best interests of the Company and except that no indemnification

shall be made in respect of any claim, issue or matter as to which such person shall have been adjudged to be liable to the Company unless

and only to the extent that the Court of Chancery or the court in which such action or suit was brought shall determine upon application

that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled

to indemnity for such expenses which the Court of Chancery or such other court shall deem proper.

We maintain a general liability

insurance policy that covers certain liabilities of our directors and officers arising out of claims based on acts or omissions in their

capacities as directors or officers.

Insofar as the foregoing provisions

permit indemnification of directors, executive officers, or persons controlling us for liability arising under the Securities Act, we

have been informed that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and

is therefore unenforceable.

ITEM 16. EXHIBITS

The following exhibits are

filed as part of this registration statement:

|

Exhibit No. |

|

Description |

| 3.1 |

|

Second Amended and Restated Certificate of Incorporation (incorporated by reference to Exhibit 3.1 to the Registrant’s Current Report on Form 8-K filed August 15, 2019) |

| 3.2 |

|

Amendment to the Second Amended and Restated Certificate of Incorporation of Allied Esports Entertainment, Inc. (incorporated by reference to Exhibit 3.1 to the Registrant’s Current Report on Form 8-K filed July 27, 2020) |

| 3.3 |

|

Second Amendment to the Second Amended and Restated Certificate of Incorporation of Allied Esports Entertainment, Inc. (incorporated by reference to Exhibit 3.1 to the Registrant’s Quarterly Report on Form 10-Q filed November 9, 2020) |

| 3.4 |

|

Certificate of Amendment to the Second Amended and Restated Certificate of Incorporation of Allied Esports Entertainment, Inc. (incorporated by reference to Exhibit 3.1 to the Registrant’s Current Report on Form 8-K filed on December 1, 2022) |

| 3.5 |

|

Amended and Restated Bylaws (incorporated by reference to Exhibit 3.2 to the Registrant’s Current Report on Form 8-K filed December 1, 2022) |

| 4.1 |

|

Specimen common stock certificate (incorporated by reference to Exhibit 4.2 to the Registrant’s Form S-1/A filed September 22, 2017) |

| 4.2 |

|

Specimen warrant certificate (incorporated by reference to Exhibit 4.3 to the Registrant’s Form S-1/A filed September 22, 2017) |

| 4.3 |

|

Specimen rights certificate (incorporated by reference to Exhibit 4.4 to the Registrant’s Form S-1/A filed September 22, 2017) |

| 4.4 |

|

Form of Warrant Agreement between Continental Stock Transfer & Trust Company and the Registrant (incorporated by reference to Exhibit 4.5 to the Registrant’s Form S-1/A filed September 22, 2017) |

| 4.5 |

|

Form of Common Stock Purchase Warrant issued June 8, 2020 (incorporated by reference to Exhibit 4.1 to the Registrant’s Current Report on Form 8-K filed June 8, 2020) |

| 4.6 |

|

Warrant issued October 18, 2024 (incorporated by reference to Exhibit 4.1 to the Registrant’s Current Report on Form 8-K filed October 23, 2024) |

| 4.7 |

|

Description of Registrant’s Securities (incorporated by reference to Exhibit 4.5 to the Company’s Annual Report on Form 10-K, filed with the Commission on March 28, 2024) |

| 5.1** |

|

Opinion of Morgan, Lewis & Bockius LLP as to the validity of the securities being registered |

| 23.1* |

|

Consent of ZH CPA, LLC |

| 23.2** |

|

Consent of Morgan, Lewis & Bockius LLP (included as part of Exhibit 5.1) |

| 24.1*** |

|

Power of Attorney (included on signature page) |

| 107* |

|

Filing Fee Table |

| *** | Previously included on the signature page of the original filing of this Form S-3 Registration Statement, filed on November 8, 2024. |

ITEM 17. UNDERTAKINGS

The undersigned registrant

hereby undertakes:

(1) To file, during any period

in which offers or sales are being made, a post-effective amendment to this registration statement:

| (i) | To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933; |

| (ii) | To reflect in the prospectus any facts or events arising after the effective date of the registration

statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change

in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities

offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or

high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule

424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent change in the maximum aggregate offering

price set forth in the “Calculation of Registration Fee” table in the effective registration statement; |

| (iii) | To include any material information with respect to the plan of distribution not previously disclosed

in the registration statement or any material change to such information in the registration statement; |

provided, however, that the undertakings

set forth in paragraphs (1)(i), (1)(ii) and (1)(iii) above do not apply if the information required to be included in a post-effective

amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section

13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in this registration statement or is contained

in a form of prospectus filed pursuant to Rule 424(b) that is part of this registration statement.

(2) That, for the purpose

of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration

statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide offering thereof.

(3) To remove from registration

by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose

of determining liability under the Securities Act of 1933 to any purchaser:

| (i) | Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration

statement as of the date the filed prospectus was deemed part of and included in the registration statement; and |

| (ii) | Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration

statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing

the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration

statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of

sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any

person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating

to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall

be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or

prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the

registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale

prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part

of the registration statement or made in any such document immediately prior to such effective date. |

(5) That, for the purpose

of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities,

the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration

statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to

such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will

be considered to offer or sell such securities to such purchaser: (i) any preliminary prospectus or prospectus of the undersigned registrant

relating to the offering required to be filed pursuant to Rule 424; (ii) any free writing prospectus relating to the offering prepared

by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant; (iii) the portion of any other free

writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided

by or on behalf of the undersigned registrant; and (iv) any other communication that is an offer in the offering made by the undersigned

registrant to the purchaser.

(6) That, for purposes of

determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a)

or 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report

pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall

be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time

shall be deemed to be the initial bona fide offering thereof.

Insofar as indemnification

for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant

pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Commission such indemnification

is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification

against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling

person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling

person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been

settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against

public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements

of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements

for filing on Form S-3 and has duly caused this pre-effective amendment to registration statement to be signed on its behalf by the undersigned,

thereunto duly authorized, in the City of New York, State of New York, on November 15, 2024.

| |

Allied Gaming & Entertainment, Inc. |

| |

|

| |

By: |

/s/ Yinghua Chen |

| |

|

Yinghua Chen

|

| |

|

Chief Executive Officer |

| |

|

| |

Dated: November 15, 2024 |

Pursuant to the requirements

of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates

indicated below.

| Name |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Yinghua Chen |

|

Chief Executive Officer |

|

November 15, 2024 |

| Yinghua Chen |

|

(principal executive officer) and Director |

|

|

| |

|

|

|

|

| /s/ Roy Anderson |

|

Chief Financial Officer |

|

November 15, 2024 |

| Roy Anderson |

|

(principal financial and accounting officer) |

|

|

| |

|

|

|

|

| * |

|

Director |

|

November 15, 2024 |

| Yangyang Li |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

November 15, 2024 |

| Zongmin (Philip) Ding |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

November 15, 2024 |

| Jingsheng (Jason) Lu |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

November 15, 2024 |

| Mao Sun |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

November 15, 2024 |

| Guanzhou (Jerry) Qin |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

November 15, 2024 |

| Yushi Guo |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

November 15, 2024 |

| Yuanfei (Cliff) Qu |

|

|

|

|

| |

|

|

|

|

| * |

|

Director |

|

November 15, 2024 |

| Chi Zhao |

|

|

|

|

Yinghua Chen has signed this pre-effective amendment to registration

statement on behalf of the above-named persons specified by an asterisk (*) pursuant to a power of attorney duly executed by such person

and previously filed with the SEC.

| By: |

/s/ Yinghua Chen |

|

| Name: |

Yinghua Chen |

|

| Title: |

Attorney-in-Fact |

|

II-6

Exhibit 5.1

November 15, 2024

Allied Gaming & Entertainment

Inc.

745 Fifth Avenue, Suite 500

New York, NY 10151

| RE: | Allied Gaming & Entertainment Inc. Registration Statement on Form S-3 |

Ladies and Gentlemen:

We have acted as counsel for Allied Gaming & Entertainment Inc.

(the “Company”), in connection with the filing of Amendment No. 1 to a registration statement on Form S-3 (as amended, the

“Registration Statement”) with the Securities and Exchange Commission (the “Commission”) under the Securities

Act of 1933, as amended (the “Act”), and the prospectus included in the Registration Statement (the “Prospectus”),

on the date hereof. The Registration Statement relates to the offer and resale by certain selling securityholder of the Company identified

in the Prospectus (the “Selling Securityholder”) of (i) up to 6,000,000 shares (the “PIPE Shares”) of the Company’s

common stock, par value $0.0001 per share (the “Common Stock”), (ii) a warrant to purchase up to 6,000,000 shares of Common

Stock (the “PIPE Warrant”), and (iii) up to 6,000,000 shares of Common Stock issuable upon exercise of the PIPE Warrant (the

“Warrant Shares”). The PIPE Shares, PIPE Warrant, and Warrant Shares are collectively referred to herein as the “Securities.”

In connection with this opinion letter, we have examined and relied

upon the Registration Statement and the Prospectus and originals, or copies certified or otherwise identified to our satisfaction, of

the Company’s Second Amended and Restated Certificate of Incorporation, as amended (the “Certificate of Incorporation”),

and Amended and Restated Bylaws (the “Bylaws”), each as currently in effect, certain resolutions of the Company’s Board

of Directors relating to the Registration Statement and such other records, documents, certificates, memoranda and other instruments as

in our judgment are necessary or appropriate to enable us to render the opinion expressed below.

We have assumed the genuineness of all signatures, the legal capacity

of natural persons, the authenticity of the documents submitted to us as originals, the conformity to the original documents of all documents

submitted to us as certified, facsimile or photostatic copies, and the authenticity of the originals of all documents submitted to us

as copies.

For the purpose of the opinions set forth below, we have also assumed,

without independent investigation or verification, that:

| ● | the issuance, sale, number or amount, as the case may be, and terms of Securities have been duly authorized and established by the

authorizing resolutions of the Board of Directors of the Company, in accordance with the Certificate of Incorporation and the Bylaws and

applicable law of the State of Delaware (each, a “Corporate Action”), and did not conflict with or constitute a breach of

the terms of any agreement or instrument to which the Company is subject; |

| ● | the PIPE Warrant has been issued pursuant to a securities purchase agreement (the “Purchase Agreement”) between the Company

and the Selling Securityholder; and that the execution, delivery and performance of the Purchase Agreement will be duly authorized by

Corporate Action, and will not conflict with or constitute a breach of the terms of any agreement or instrument to which the Company is

subject; |

Allied Gaming & Entertainment Inc.

November 15, 2024

Page 2

| ● | to the extent that the obligations of the Company under the Purchase Agreement may depend upon such matters, each of the parties thereto,

other than the Company, will be duly organized, validly existing and in good standing under the laws of its jurisdiction of organization

and will be duly qualified to engage in the activities contemplated by such Purchase Agreement; that such Purchase Agreement will have

been duly authorized, executed and delivered by such party and will constitute the legal, valid and binding obligation of such party,

enforceable against such party in accordance with its terms; that such party will be in compliance, generally and with respect to acting

as a party with respect to its obligations under such Purchase Agreement, with all applicable laws and regulations; and that such party

will have the requisite organizational and legal power and authority to perform its obligations under such Purchase Agreement; |

| ● | the Registration Statement and any amendments thereto (including post-effective amendments) will have become effective and such effectiveness

shall not have been terminated or rescinded and will comply with all applicable federal and state laws at the time the Securities are

offered and issued and the Securities are sold as contemplated by the Registration Statement; |

| ● | all Securities will be issued and sold in compliance with applicable federal and state securities laws. |

Except as specifically set forth herein, we have not undertaken any

independent investigation to determine the accuracy of facts material to any such statement or opinion, and no inference as to such statement

or opinion should be drawn from the fact of our representation of the Company.

Based upon and subject to the foregoing, and to the limitations and

qualifications described below, we are of the opinion that:

| 1. | the PIPE Shares have been validly issued, are fully paid and non-assessable; |

| 2. | The Warrant Shares have been duly authorized by all requisite Corporate Actions on the part of the Company under the General Corporation

Law of the State of Delaware (DGCL) and, when issued in accordance with the terms of the PIPE Warrant by the Company against payment of

the exercise price therefor and registered in the Company’s share registry, will be validly issued, fully paid and non-assessable,

provided that the consideration therefor is not less than $1.80 per share; and |

Allied Gaming & Entertainment Inc.

November 15, 2024

Page 3

| 3. | The PIPE Warrant constitute valid and binding obligations of the Company, enforceable against the Company in accordance with their

terms under the laws of the State of New York. |

Our opinion expressed above are subject to the following additional

limitations, exceptions, qualifications and assumptions:

We do not express any opinion with respect to the effect on the opinions

stated herein of any bankruptcy, insolvency, reorganization, moratorium, fraudulent transfer, preference and other similar laws affecting

creditors’ rights generally, and the opinions stated herein are limited by such laws and by general principles of equity (regardless

of whether enforcement is sought in equity or at law).

The opinions expressed herein are limited to the DGCL and the laws

of the State of New York, and we express no opinion with respect to the laws of any other state or jurisdiction.

This opinion letter is effective only as of the date hereof. We do

not assume responsibility for updating this opinion letter as of any date subsequent to its date, and we assume no responsibility for

advising you of any changes with respect to any matters described in this opinion letter that may occur, or facts that may come to our

attention, subsequent to the date hereof.

This opinion letter is furnished by us solely for the benefit of the

Company in connection with the transactions contemplated by the Registration Statement and may not be relied upon by any person for any

other purpose, nor may it be furnished to or relied upon by any other person or entity for any purpose whatsoever. This opinion letter

is not to be quoted in whole or in part or otherwise referred to or used, nor is it to be filed with any governmental agency or any other

person, without our express written consent.

Finally, we consent to the reference to our firm under the caption

“Legal Matters” in the Prospectus included in the Registration Statement and to the filing of this opinion as an exhibit to

the Registration Statement.

Very truly yours,

/s/ Morgan, Lewis & Bockius LLP

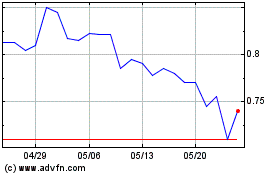

Allied Gaming and Entert... (NASDAQ:AGAE)

過去 株価チャート

から 12 2024 まで 1 2025

Allied Gaming and Entert... (NASDAQ:AGAE)

過去 株価チャート

から 1 2024 まで 1 2025