false000170834100017083412024-11-142024-11-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 14, 2024

Allied Gaming & Entertainment Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-38226

|

|

82-1659427

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

745 Fifth Avenue, Suite 500

New York, New York 10151

(Address of principal executive offices, including zip code)

(646) 768-4240

(Registrant's telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425

under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12

under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to

Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to

Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

Common Stock

|

AGAE

|

NASDAQ

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter):

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On November 14, 2024, Allied Gaming & Entertainment Inc. (the “Company”) issued a press release

announcing its financial results for the fiscal quarter ended September 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Form 8-K.

The information in this Item 2.02, including the information contained in the press release furnished as

Exhibit 99.1, is deemed to be “furnished” and not “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), is not otherwise subject to the liabilities of that Section, and shall not be deemed

incorporated by reference into any filing of the Company under the Exchange Act or the Securities Act of 1933, as amended, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

Press release dated November 14, 2024

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed

on its behalf by the undersigned hereunto duly authorized.

|

|

ALLIED GAMING & ENTERTAINMENT, INC.

|

|

|

|

|

|

Date: November 14, 2024

|

By:

|

/s/ Roy Anderson

|

|

|

|

Roy Anderson

|

|

|

|

Chief Financial Officer

|

EXHIBIT 99.1

Allied Gaming & Entertainment Announces Third Quarter 2024 Financial Results

New York, NY (November 14, 2024) – Allied Gaming & Entertainment, Inc. (NASDAQ: AGAE) (the “Company” or “AGAE”), a global experiential entertainment company, today announced financial results for the

third quarter ended September 30, 2024.

“It was a productive quarter at AGAE as we grew revenues by 93% year-over-year and continued to lay the foundation for our business to capitalize on the significant

assets available to us,” said Yinghua Chen, Chief Executive Officer of AGAE. “With our inaugural World Mahjong Tour events taking place starting next month, more new mobile games titles being developed and continued strong demand at HyperX Arena and

our mobile arena, we are confident that we are right on the cusp of more visible progress on both the top and bottom lines of our company.”

Third Quarter 2024 Financial Results

Revenues: Total revenues of $2.2 million increased 93% compared to $1.1 million in the third quarter of 2023. The year-over-year increase was primarily attributable to

a $0.2 million increase in In-person event revenues at our HyperX arena and an $0.8 million increase in casual mobile gaming revenues following the Company’s strategic investment in Z-Tech in the fourth quarter of 2023.

Total costs and expenses for the third quarter were $3.3 million, an increase from $1.8 million in the prior-year period. The increase in costs and expenses were also

primarily driven by our investment in Z-Tech along with an Employee Retention Credit that was received and recorded as a reduction of payroll tax expense in the prior year period. These increases were partially offset by a D&O insurance

reimbursement and professional fees related to prior year M&A activities.

Net loss for the third quarter of 2024 was $4.0 million compared to net income of $0.1 million in the prior year period. The change was primarily the result of a

settlement agreement and release with BPR Cumulus LLC (“BPR”) under which $3.0 million held on AGAE’s balance sheet as restricted cash was returned to BPR, as well as net unrealized foreign currency transaction losses of $1.2 million based on

fluctuations in exchange rates between the dates the transactions were initiated and September 30, 2024. Almost all of the net unrealized foreign currency transaction loss was reversed in October 2024.

Adjusted EBITDA loss was $0.1 million for the third quarter of 2024 compared to a loss of $1.4 million in the prior quarter and a loss of $0.3 million in the third

quarter of 2023. A reconciliation of the GAAP-basis net income (loss) to adjusted EBITDA is provided in the table at the end of this press release.

Balance Sheet

As of September 30, 2024, the Company had a cash and short-term investments position of $80.2 million, compared to $78.6 million at December

31, 2023. At September 30, 2024, the Company had a working capital position of $62.8 million compared to $66.4 million at December 31, 2023. As of September 30, 2024, the Company had approximately 38.1 million shares of outstanding common stock.

Operational Update

HyperX Arena hosted 61 event days in the third quarter of 2024, with 34 proprietary event days and 27 third-party event days. Third-party

events were highlighted by Netflix’s Chestnut vs. Kobayashi: Unfinished Beef, Epic’s HackerOne Live Hacking Event, The Global Gaming League’s Inaugural Event, Charlotte Hornets’ team outing, Southern

Glazers Launch Party and Esports with Air Force. Our mobile arena, the Omen Truck, has had its most active quarter since 2023, hosting a multi-stop event series for the Rally Cry Championship Tour, celebrating the highly anticipated return of EA College Football 2025.

Corporate Developments

Subsequent to the end of the quarter, the Company announced a strategic investment by Yellow River Global Capital, an alternative private

equity manager with deep expertise in large-scale, long-term investments in digital technologies, new media and entertainment. This partnership will further enhance AGAE’s ability to identify growth opportunities in location-based entertainment

chains and the creation and acquisition of entertainment content intellectual property, and the Company is working actively with Yellow River to pursue and negotiate several potentially accretive opportunities.

Third Quarter 2024 Conference Call

The Company will host a conference call today at 2:00 p.m. Pacific Time / 5:00 p.m. Eastern Time to discuss its third quarter 2024 financial

results. Participants may join the conference call by dialing 1-877-407-0792 (United States) or 1-201-689-8263 (international).

A live webcast of the conference call will also be available on Allied Gaming & Entertainment’s Investor Relations site at ir.alliedgaming.gg. Additionally, financial information presented on the call will be available on Allied Gaming & Entertainment’s Investor Relations site. For those unable to participate in the

conference call, a telephonic replay of the call will also be available shortly after the completion of the call, until 11:59 p.m. Eastern Time on Thursday, November 28, 2024, by dialing 1-844-512-2921 (United States) or 1-412-317-6671

(International) and using the replay passcode:13749398.

About Allied Gaming & Entertainment

Allied Gaming & Entertainment Inc. (Nasdaq: AGAE) is a global experiential entertainment company focused on providing a growing world of

gamers and concertgoers with unique experiences through renowned assets, products and services. For more information, visit alliedgaming.gg.

Non-GAAP Financial Measures

As a supplement to our financial measures presented in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”), the Company presents certain non-GAAP

measures of financial performance. These non-GAAP financial measures are not intended to be considered in isolation from, as a substitute for, or as more important than, the financial information prepared and presented in accordance with GAAP. In

addition, these non-GAAP measures have limitations in that they do not reflect all of the items associated with the company’s results of operations as determined in accordance with GAAP. Non-GAAP financial measures are not an alternative to the

Company’s GAAP financial results and may not be calculated in the same manner as similar measures presented by other companies.

The Company provides net income (loss) and earnings (loss) per share in accordance with GAAP. In addition, the Company provides EBITDA (defined as GAAP net income

(loss) from continuing operations before interest (income) expense, income taxes, depreciation, and amortization). The Company defines “Adjusted EBITDA” as EBITDA excluding certain non-cash, non-recurring, and unusual items, such as stock-based

compensation, non-recurring legal fees, repayments of restricted cash, and unrealized foreign currency transactions.

In the future, the Company may also consider whether other items should also be excluded in calculating the non-GAAP financial measures used by the Company.

Management believes that the presentation of these non-GAAP financial measures provides investors with additional useful information to measure the Company’s financial and operating performance. In particular, these measures facilitate comparison of

our operating performance between periods and help investors to better understand the operating results of the Company by excluding certain items that may not be indicative of the Company’s core business, operating results, or future outlook.

Additionally, we consider quantitative and qualitative factors in assessing whether to adjust for the impact of items that may be significant or that could affect an understanding of our ongoing financial and business performance or trends.

Internally, management uses these non-GAAP financial measures, along with others, in assessing the Company’s operating results, measuring compliance with any applicable requirements of the Company’s debt financing agreements in place at such time, as

well as in planning and forecasting.

The Company’s non-GAAP financial measures are not based on a comprehensive set of accounting rules or principles, and our non-GAAP definitions of the “EBITDA” and

“Adjusted EBITDA” do not have a standardized meaning. Therefore, other companies may use the same or similarly named measures, but include or exclude different items, which may not provide investors a comparable view of the Company’s performance in

relation to other companies.

Management compensates for the limitations resulting from the exclusion of these items by considering the impact of the items separately and by considering the

Company’s GAAP, as well as non-GAAP, financial results and outlook, and by presenting the most comparable GAAP measures directly ahead of non-GAAP measures, and by providing a reconciliation that indicates and describes the adjustments made.

Forward Looking Statements

This communication contains certain forward-looking statements under federal securities laws. Forward-looking statements includes, but are not limited to, statements

relating to strategic investment by Yellow River, potential growth opportunities and other statements regarding our goals, beliefs, strategies, objectives, plans, product and service developments, future financial conditions, results or projections or

current expectations. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “intend” or “continue,” the negative of such

terms, or other comparable terminology. These statements are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause actual results to be materially different from those contemplated by the forward-looking

statements. These forward- looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside our

control, that could cause actual results or outcomes to differ materially from those discussed in these forward-looking statements. The inclusion of such information should not be regarded as a representation by the Company, or any person, that the

objectives of the Company will be achieved. Important factors, among others, that may affect actual results or outcomes include: risks associated with the future direction or governance of the Company; our ability to execute on our strategic and

business plans; the substantial uncertainties inherent in the acceptance of existing and future products and services; the ability to retain key personnel; current and potential litigation and related legal expenses; general economic and market

conditions impacting demand for our services; our inability to enter into one or more future acquisition or strategic transactions; and our ability, or a decision not to pursue strategic options for the esports business. You should consider the areas

of risk described in connection with any forward-looking statements that may be made herein. The business and operations of AGAE are subject to substantial risks, which increase the uncertainty inherent in the forward-looking statements contained in

this communication. Except as required by law, we undertake no obligation to release publicly the result of any revision to these forward-looking statements that may be made to reflect events or circumstances after the date hereof or to reflect the

occurrence of unanticipated events. Further information on potential factors that could affect our business and results is described under “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the

U.S. Securities and Exchange Commission (the “SEC”) on March 28, 2024, as amended by the Form 10-K/A filed with the SEC on April 29, 2024, as well as subsequent reports we file with the SEC. Readers are also urged to carefully review and consider the

various disclosures we made in such Annual Report on Form 10-K and in subsequent reports with the SEC.

# # #

Investor Contact:

Addo Investor Relations agae@addo.com

310-829-5400

Allied Gaming & Entertainment, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

| |

|

September 30,

|

|

|

December 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

Assets

|

|

|

|

|

|

|

|

Current Assets

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

10,992,235

|

|

|

$

|

16,320,583

|

|

|

Short-term investments

|

|

|

66,739,322

|

|

|

|

56,500,000

|

|

|

Interest receivable

|

|

|

2,432,372

|

|

|

|

792,223

|

|

|

Accounts receivable

|

|

|

297,025

|

|

|

|

529,369

|

|

|

Insurance recovery receivable

|

|

|

3,700,000

|

|

|

|

-

|

|

|

Loans receivable

|

|

|

14,429,317

|

|

|

|

-

|

|

|

Deposits, current portion

|

|

|

3,700,000

|

|

|

|

3,700,000

|

|

|

Prepaid expenses and other current assets

|

|

|

515,430

|

|

|

|

498,886

|

|

|

Total Current Assets

|

|

|

102,805,701

|

|

|

|

78,341,061

|

|

|

Restricted cash

|

|

|

-

|

|

|

|

5,000,000

|

|

|

Property and equipment, net

|

|

|

3,189,350

|

|

|

|

3,834,193

|

|

|

Digital assets

|

|

|

49,300

|

|

|

|

49,300

|

|

|

Intangible assets, net

|

|

|

5,875,048

|

|

|

|

6,254,731

|

|

|

Deposits, non-current portion

|

|

|

376,324

|

|

|

|

392,668

|

|

|

Operating lease right-of-use asset

|

|

|

4,668,461

|

|

|

|

5,415,678

|

|

|

Goodwill

|

|

|

12,863,072

|

|

|

|

12,729,056

|

|

|

Total Assets

|

|

$

|

129,827,256

|

|

|

$

|

112,016,687

|

|

|

Liabilitie s and Stockholders' Equity

|

|

|

|

|

|

|

|

|

|

Current Liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

365,509

|

|

|

$

|

371,830

|

|

|

Accrued expenses and other current liabilities

|

|

|

453,901

|

|

|

|

763,512

|

|

|

Deferred revenue

|

|

|

413,238

|

|

|

|

103,748

|

|

|

Operating lease liability, current portion

|

|

|

1,550,004

|

|

|

|

1,482,977

|

|

|

Loans payable

|

|

|

37,256,831

|

|

|

|

9,230,168

|

|

|

Total Current Liabilities

|

|

|

40,039,483

|

|

|

|

11,952,235

|

|

|

Deferred rent

|

|

|

-

|

|

|

|

-

|

|

|

Accrued expenses, non-current portion

|

|

|

-

|

|

|

|

-

|

|

| |

|

|

|

|

|

|

|

|

|

Operating lease liability, non-current portion

|

|

|

4,443,362

|

|

|

|

5,560,251

|

|

|

Deferred tax liability

|

|

|

774,839

|

|

|

|

1,096,160

|

|

|

Total Liabilities

|

|

|

45,257,684

|

|

|

|

18,608,646

|

|

|

Commitments and Contingencies (Note 9)

|

|

|

|

|

|

|

|

|

|

Preferred stock, $0.0001 par value, 1,000,000 shares authorized, none issued and outstanding

|

|

|

-

|

|

|

|

-

|

|

|

Series A Preferred stock, $0.0001 par value, 50,000 shares designated, none issued and outstanding

|

|

|

-

|

|

|

|

-

|

|

Common stock, $0.0001 par value; 100,000,000 shares authorized, 40,385,798 and 39,085,470 shares issued at September 30, 2024 and December 31, 2023, and 38,106,014 and 36,805,686 shares outstanding at September 30, 2024 and December 31,

2023, respectively

|

|

|

4,039

|

|

|

|

3,909

|

|

|

Additional paid in capital

|

|

|

199,401,299

|

|

|

|

198,677,132

|

|

|

Accumulated deficit

|

|

|

(123,201,338

|

)

|

|

|

(113,671,029

|

)

|

|

Accumulated other comprehensive income

|

|

|

504,914

|

|

|

|

433,565

|

|

|

Treasury stock, at cost, 2,279,784 shares at June 30, 2024

|

|

|

|

|

|

|

|

|

|

and December 31, 2023

|

|

|

(2,693,653

|

)

|

|

|

(2,693,653

|

)

|

|

Total Allied Gaming & Entertainment Inc. Stockholders' Equity

|

|

|

74,015,261

|

|

|

|

82,749,924

|

|

|

Non-controlling interest

|

|

|

10,554,311

|

|

|

|

10,658,117

|

|

|

Total Stockholders' Equity

|

|

|

84,569,572

|

|

|

|

93,408,041

|

|

|

Total Liabilities and Stockholders' Equity

|

|

$

|

129,827,256

|

|

|

$

|

112,016,687

|

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

Allied Gaming & Entertainment, Inc. and Subsidiaries

Condensed Consolidated Statements of Operations

(unaudited)

| |

|

For the Three Months Ended

September 30,

|

|

|

For the Nine Months Ended

September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In-person

|

|

$

|

1,345,484

|

|

|

$

|

1,119,865

|

|

|

$

|

3,518,044

|

|

|

$

|

3,580,968

|

|

|

Multiplatform content

|

|

|

71

|

|

|

|

94

|

|

|

|

182

|

|

|

|

2,000,518

|

|

|

Casual mobile gaming

|

|

|

817,986

|

|

|

|

-

|

|

|

|

3,664,244

|

|

|

|

-

|

|

|

Total Revenues

|

|

|

2,163,541

|

|

|

|

1,119,959

|

|

|

|

7,182,470

|

|

|

|

5,581,486

|

|

|

Costs and Expenses:

In-person (exclusive of depreciation and amortization)

|

|

|

682,652

|

|

|

|

575,176

|

|

|

|

1,820,818

|

|

|

|

1,891,229

|

|

|

Multiplatform content (exclusive of depreciation and amortization)

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

1,517,707

|

|

|

Casual mobile gaming (exclusive of depreciation and amortization)

|

|

|

700,918

|

|

|

|

-

|

|

|

|

3,198,988

|

|

|

|

-

|

|

|

Research and development expenses

|

|

|

158,162

|

|

|

|

-

|

|

|

|

526,906

|

|

|

|

-

|

|

|

Selling and marketing expenses

|

|

|

90,512

|

|

|

|

51,448

|

|

|

|

198,561

|

|

|

|

172,987

|

|

|

General and administrative expenses

|

|

|

1,310,418

|

|

|

|

894,181

|

|

|

|

9,401,900

|

|

|

|

5,660,553

|

|

|

Depreciation and amortization

|

|

|

401,452

|

|

|

|

239,413

|

|

|

|

1,181,620

|

|

|

|

1,030,191

|

|

|

Total Costs and Expenses

|

|

|

3,344,114

|

|

|

|

1,760,218

|

|

|

|

16,328,793

|

|

|

|

10,272,667

|

|

|

Loss From Operations

|

|

|

(1,180,573

|

)

|

|

|

(640,259

|

)

|

|

|

(9,146,323

|

)

|

|

|

(4,691,181

|

)

|

|

Other Income (Expense):

Other income (expense), net

|

|

|

(827

|

)

|

|

|

(388

|

)

|

|

|

414

|

|

|

|

15,954

|

|

|

Loss on excrow settlement

|

|

|

(3,000,000

|

)

|

|

|

-

|

|

|

|

(3,000,000

|

)

|

|

|

-

|

|

|

Loss on foreign currency transactions

|

|

|

(1,213,446

|

)

|

|

|

-

|

|

|

|

(862,012

|

)

|

|

|

-

|

|

|

terest income, net

|

|

|

1,033,362

|

|

|

|

715,893

|

|

|

|

2,934,035

|

|

|

|

2,165,468

|

|

|

Pre-Tax Net Loss

|

|

|

(4,361,484

|

)

|

|

|

75,246

|

|

|

|

(10,073,886

|

)

|

|

|

(2,509,759

|

)

|

|

Income tax benefit

|

|

|

332,862

|

|

|

|

-

|

|

|

|

332,862

|

|

|

|

-

|

|

|

Net (Loss) Income

|

|

|

(4,028,622

|

)

|

|

|

75,246

|

|

|

|

(9,741,024

|

)

|

|

|

(2,585,005

|

)

|

|

Less: net loss attributable to non-controlling interest

|

|

|

(681

|

)

|

|

|

-

|

|

|

|

(210,715

|

)

|

|

|

-

|

|

|

Net (Loss) Income Attributable to Common Stockholders

|

|

$

|

(4,027,941

|

)

|

|

$

|

75,246

|

|

|

$

|

(9,530,309

|

)

|

|

$

|

(2,585,005

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss per Common Share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

(0.11

|

)

|

|

$

|

0.00

|

|

|

$

|

(0.24

|

)

|

|

$

|

(0.07

|

)

|

|

Diluted

|

|

$

|

(0.11

|

)

|

|

$

|

0.00

|

|

|

$

|

(0.24

|

)

|

|

$

|

(0.07

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighte d Average Number of Common Shares Outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

37,253,520

|

|

|

|

36,942,149

|

|

|

|

39,765,239

|

|

|

|

37,351,735

|

|

|

Diluted

|

|

|

37,253,520

|

|

|

|

37,134,457

|

|

|

|

39,765,239

|

|

|

|

37,351,735

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

Allied Gaming & Entertainment, Inc. and Subsidiaries

Non-GAAP Financial Measures

EBITDA and Adjusted EBITDA are non-GAAP financial measures and should not be considered as a substitute for net income (loss), operating income

(loss) or any other performance measure derived in accordance with United States generally accepted accounting principles (“GAAP”) or as an alternative to net cash provided by operating activities as a measure of AGAE’s profitability or liquidity.

AGAE’s management believes EBITDA and Adjusted EBITDA are useful because they allow external users of its financial statements, such as industry analysts, investors, lenders and rating agencies, to more effectively evaluate its operating performance,

compare the results of its operations from period to period and against AGAE’s peers without regard to AGAE’s financing methods, hedging positions or capital structure and because it highlights trends in AGAE’s business that may not otherwise be

apparent when relying solely on GAAP measures. AGAE presents EBITDA and Adjusted EBITDA because it believes EBITDA and Adjusted EBITDA are important supplemental measures of its performance that are frequently used by others in evaluating companies

in its industry. Because EBITDA and Adjusted EBITDA exclude some, but not all, items that affect net income (loss) and may vary among companies, the EBITDA and Adjusted EBITDA AGAE presents may not be comparable to similarly titled measures of other

companies. AGAE defines EBITDA as earnings before interest, income taxes, depreciation and amortization of intangibles. AGAE defines Adjusted EBITDA as EBITDA excluding stock-based compensation and non-recurring, infrequent or unusual items.

The following table presents a reconciliation of EBITDA and Adjusted EBITDA from net loss, AGAE’s most directly comparable financial measure

calculated and presented in accordance with GAAP.

| |

|

Three Months Ended September 30,

|

|

|

Nine Months Ended September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Net (loss) income

|

|

$

|

(4,028,622

|

)

|

|

$

|

75,246

|

|

|

$

|

(9,741,024

|

)

|

|

$

|

(2,585,005

|

)

|

|

Interest income, net

|

|

|

(1,033,362

|

)

|

|

|

(715,893

|

)

|

|

|

(2,934,035

|

)

|

|

|

(2,165,468

|

)

|

|

Depreciation and amortization

|

|

|

401,452

|

|

|

|

239,413

|

|

|

|

1,181,620

|

|

|

|

1,030,191

|

|

|

EBITDA

|

|

|

(4,660,532

|

)

|

|

|

(401,234

|

)

|

|

|

(11,493,439

|

)

|

|

|

(3,720,282

|

)

|

|

Non-recurring legal fees (1)

|

|

|

102,854

|

|

|

|

-

|

|

|

|

2,161,605

|

|

|

|

-

|

|

|

Loss on foreign currency (2)

|

|

|

1,213,446

|

|

|

|

-

|

|

|

|

862,012

|

|

|

|

-

|

|

|

Loss on settlement of Brookfield agreement (3)

|

|

|

3,000,000

|

|

|

|

-

|

|

|

|

3,000,000

|

|

|

|

-

|

|

|

Stock compensation

|

|

|

229,731

|

|

|

|

64,623

|

|

|

|

903,639

|

|

|

|

136,605

|

|

|

Adjusted EBITDA

|

|

$

|

(114,501

|

)

|

|

$

|

(336,611

|

)

|

|

$

|

(4,566,183

|

)

|

|

$

|

(3,583,677

|

)

|

Footnotes

(1) Represents defense costs related to a shareholder complaint filed in the Court of Chancery of the State of Delaware on March 7, 2024.

(2) Driven by fluctuations in exchange rates between the dates certain twelve-month loans denominated in a foreign currency were initiated and September 30, 2024.

(3) Represents a payment from an escrow account established in January 2020.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

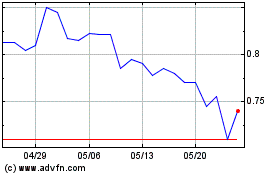

Allied Gaming and Entert... (NASDAQ:AGAE)

過去 株価チャート

から 10 2024 まで 11 2024

Allied Gaming and Entert... (NASDAQ:AGAE)

過去 株価チャート

から 11 2023 まで 11 2024