U.S. Dollar Extends Rise Amid Declining Prospects Of U.S. Fed Rate Cut, Middle East Tensions

2024年10月3日 - 11:13AM

RTTF2

The U.S. dollar continued to trade higher against other major

currencies in the Asian session on Thursday, after data showed that

the stronger-than-expected U.S. private sector employment data

dimmed prospects of aggressive rate cuts by the U.S. Fed.

Data from payroll processor ADP on Tuesday showed that private

sector employment climbed by 143,000 jobs in September after rising

by an upwardly revised 103,000 jobs in August.

Traders remain cautious about escalating tensions in the Middle

East following Iran's ballistic missile attack against Israel and

await key U.S. data for additional clues on the Fed's rate

trajectory.

Multiple airstrikes were reported in Beirut earlier today with

explosions heard in the Lebanese capital. Authorities said at least

six people were killed.

Amid West Asia conflict escalation, several countries have

issued advisories, and some have evacuated their citizens.

The U.S. Labour Department is due to release its more closely

watched report on employment for September on Friday. Economists

currently expect the report to show employment climbed by 140,000

jobs in September after an increase of 142,000 jobs in August. The

unemployment rate is expected to hold at 4.2 percent.

Trading later in the day may be impacted by reaction to the

latest U.S. economic data, including reports on weekly jobless

claims, service sector activity and factory orders.

The safe-haven dollar started to trade higher against its major

counterparts from last Friday.

In the Asian trading today, the greenback advanced to nearly a

1-1/2-month high of 147.24 against the yen, from Wednesday's

closing value of 146.46. The next possible upside target for the

greenback is seen around the 151.00 region.

In economic news, the services sector in Japan continued to

expand in September, albeit at a slower pace, the latest survey

from Jibun Bank revealed on Thursday with a services PMI score of

53.1. That's down from 53.7 in August, although it remains above

the boom-or-bust line of 50 that separates expansion from

contraction. The data also said the composite PMI slipped to 52.0

in September from 52.9 in August.

Japan's newly appointed Prime Minister Shigeru Ishiba said that

the nation is not prepared for additional rate hikes, following a

meeting with the central bank governor.

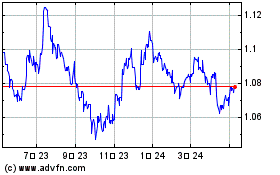

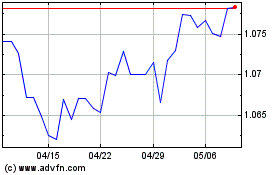

The greenback rose to a 3-week high of 1.1032 against the euro

and a 1-week high of 0.8511 against the Swiss franc, from

yesterday's closing quotes of 1.1045 and 0.8497, respectively. If

the greenback extends its uptrend, it is likely to find resistance

around 1.09 against the euro and 0.86 against the franc.

The greenback edged up to 1.3245 against the pound, from

yesterday's closing value of 1.3267. On the upside, 1.30 is seen as

the next resistance level for the greenback.

Against Australia, the New Zealand and the Canadian dollars, the

greenback advanced to a 2-day high of 0.6860, nearly a 2-week high

of 0.6236 and a 2-day high of 1.3524 from Wednesday's closing

quotes of 0.6884, 0.6262 and 1.3501, respectively. On the upside,

0.67 against the aussie, 0.61 against the kiwi and 1.36 against the

loonie are seen as the next resistance levels for the

greenback.

Looking ahead, Switzerland CPI data for September is due to be

released in the pre-European session at 2:30 am ET.

In the European session, PMI reports from various European

economies and U.K. for September and Eurozone PPI data for August

are slated for release.

In the New York session, U.S. weekly jobless claims, Canada and

U.S. PMI reports for September and U.S. factory orders for August

are set to be released.

Euro vs US Dollar (FX:EURUSD)

FXチャート

から 11 2024 まで 12 2024

Euro vs US Dollar (FX:EURUSD)

FXチャート

から 12 2023 まで 12 2024