HBAR To Hit $100? Analyst Points To Utility And Market Cap Potential

2024年12月10日 - 9:30PM

NEWSBTC

Hedera’s native cryptocurrency, HBAR, has garnered the interest of

investors and cryptocurrency aficionados due to its remarkable

recent performance and increasing prominence in the blockchain

sector. Related Reading: Ethereum Surge Coming? Analyst Eyes

$16,000 Milestone Within 2 Years Hedera’s HBAR token, supported by

major technology companies like Google, IBM, and Boeing, has the

potential to revolutionize decentralized finance. In the preceding

month, HBAR has ascended by 430%, attaining a new peak of $0.392

and elevating its market capitalization to nearly $13 billion.

Despite some skeptics, analysts believe a $100 price tag for HBAR

is within the realm of possibility, although it would require

substantial growth in both market capitalization and real-world

adoption. 🌐 COULD $HBAR HIT $100? THE CASE FOR AN INSANE RUN-UP The

crypto space is finally waking up to what Hedera Hashgraph and

$HBAR bring to the table. But can $HBAR realistically hit $100? We

think so—and here’s how it’s entirely feasible based on math,

market cap, and real-world… pic.twitter.com/zGtCN2EmU0 — Block Axis

(@BlockAxis) December 8, 2024 HBAR Growth Potential HBAR’s rising

trend is predominantly linked to its standing within the wider

cryptocurrency market. For the network to attain a price point of

$100, it would require a market value of $5 trillion, analysts

said. Although it may appear improbable, the potential of HBAR to

penetrate the $110 trillion global stock market and the even larger

derivatives market appears increasingly credible when examined

closely. Tokenized assets, supply chain management, and

decentralized finance represent pivotal domains where Hedera’s

blockchain may generate value. The capacity to implement these

applications at scale, along with backing from prominent

corporations, positions HBAR as a formidable competitor in the

blockchain arena. Essential On-Chain Metrics Hedera’s latest

on-chain statistics show a mix of opportunity and challenge.

Growing user engagement has led to a peak in on-chain volume at $68

million on December 3rd. Although that was an increase, still, the

Total Value Locked on the network decreased from $211 million to

$196 million. This decline indicates that while the network is

active, investment in decentralized finance (DeFi) applications may

be waning, or investors are reallocating funds elsewhere.

Institutional Support Hedera is very distinct from many other

cryptocurrencies based on the involvement of various leading,

established companies, which are represented in its governing

council. This lends HBAR a strong credibility boost over other

decentralized tokens. As long as Hedera gets at least a fraction of

the industries that these firms are associated with, demand for

HBAR could skyrocket. Related Reading: Bitcoin Bet For Amazon? 5%

Stake Proposal Raises Eyebrows To achieve the ambitious $100 aim,

Hedera must concentrate on enhancing its ecosystem and persistently

drawing developers and enterprises to construct on its platform. A

crucial aspect of this will be guaranteeing scalability, as Hedera

can process 10,000 transactions per second. The scale, along with

minimal transaction fees, renders it a particularly appealing

choice for global adoption. Although the $100 price objective may

appear ambitious, Hedera’s robust fundamentals and cutting-edge

technology, supported by prominent industry figures, render it a

project worthy of attention. Should the market persist in adopting

decentralized finance and tokenized economies, HBAR may experience

significant growth in the forthcoming years. Featured image from

Pixabay, chart from TradingView

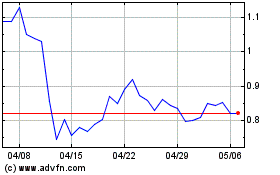

Mina (COIN:MINAUSD)

過去 株価チャート

から 11 2024 まで 12 2024

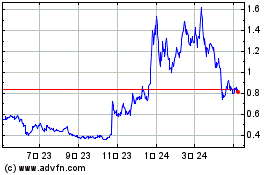

Mina (COIN:MINAUSD)

過去 株価チャート

から 12 2023 まで 12 2024