Hidden Bitcoin Agenda? CryptoQuant CEO Weighs In On Ongoing Rise In BTC Accumulation

2024年8月8日 - 12:30PM

NEWSBTC

Over the past few days, Bitcoin (BTC) has seen a significant surge

in whale accumulation. Ali highlighted that the “number of BTC

addresses holding 100+ BTC increased from 15,913 to 16,006 during

the recent correction. While this trend is noteworthy because it

suggests whales bought the dip, Ki Young Ju, the CEO of

CryptoQuant, an on-chain data aggregator, has spotlighted that it

also suggests a calculated buildup of Bitcoin by influential

players in the shadows. Related Reading: Bitcoin Bull Run Still

Intact? Here’s What On-Chain Data Says The Hidden Bitcoin Agenda

Revealed Ki Young Ju’s observations stem from his analysis of

Bitcoin transactions over the last month, revealing a massive shift

of nearly half a million BTC into what is described as “permanent

holder wallets.” Ju noted: I’m pretty sure something is happening

behind the scenes. 404,448 Bitcoin have moved to permanent holder

addresses over the past 30 days, and it’s clearly accumulation.

We’ll know within a year. This transfer, amounting to roughly

$22.94 billion, signals routine market behavior and a strategic

accumulation that hints at plans by major financial entities or

even state actors. This activity was first hinted at three weeks

prior when Ju reported an unusual movement of 385,000 BTC into cold

storage, highlighting a pattern of behavior among Bitcoin whales

that diverges from typical market operations. #Bitcoin is in an

accumulation phase. Over the past month, 358K BTC has moved to

permanent holder addresses. In July, global spot ETF inflows were

53K BTC. Though not all remaining BTC is in custody wallets, whales

are clearly accumulating. And it’s an unprecedented level.

pic.twitter.com/Cyl2ZVhIIX — Ki Young Ju (@ki_young_ju) July 24,

2024 What Are The Consequences? The implications of such heavy

accumulation are quite profound. Ju said this could be the prelude

to a major revelation, where traditional financial institutions,

companies, or even governments might disclose substantial Bitcoin

acquisitions made during this period. He suggests that within a

year, the public could learn that these entities have been quietly

building their Bitcoin reserves throughout the third quarter of

2024. This strategic accumulation, Ju theorizes, could be a move to

secure a substantial stake in the world’s flagship cryptocurrency

in anticipation of or in response to broader economic shifts. This

theory is further boosted by distractions in the crypto space, such

as the German government’s sale of BTC and the U.S. government’s

disposal of Bitcoin related to the Mt. Gox debacle. Related

Reading: $0 Flows: BlackRock Unshaken Despite Recent Bitcoin Market

Crash, Data Shows These events may have diverted retail investors’

attention from the more significant, ongoing accumulation by larger

institutional actors. So here’s what’s going to happen: Within a

year, some entities—whether they’re TradFi institutions, companies,

governments, or others—will announce that they’ve acquired #Bitcoin

in Q3 2024. And retail investors will regret not buying it because

they were worried about the… — Ki Young Ju (@ki_young_ju) August 6,

2024 Featured image created with DALL-E, Chart from TradingView

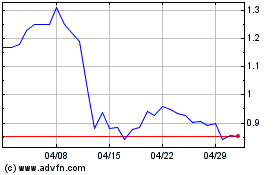

Flow (COIN:FLOWUSD)

過去 株価チャート

から 10 2024 まで 11 2024

Flow (COIN:FLOWUSD)

過去 株価チャート

から 11 2023 まで 11 2024