Regulatory News:

Séché Environnement (Paris:SCHP) announces the signature of

an SPA1 with a view to acquiring ECO Industrial Environmental

Engineering Pte Ltd (“ECO”), the leading player in the hazardous

industrial waste market in Singapore.

With the widest range of products and services on offer, a

loyal customer base of core industries and the latest

high-performance industrial facilities, ECO will give Séché a major

position in a dynamic industrial region where the Group was

previously less active.

This acquisition is fully in line with Séché's ambition to

support its core industrial customers in the dynamic hazardous

industrial waste markets of Southeast Asia.

An accretive transaction, this acquisition reinforces the

Group's prospects for growth and profitability.

Present since 1995 across the entire value chain in the

hazardous waste business, and with a market share of around 32%,

ECO is today the number one operator in Singapore’s hazardous waste

recovery and treatment markets, well ahead of its main competitors

in terms of installed capacity, volumes handled, service offerings

and customer portfolio.

A major player in the circular economy applied to hazardous

waste.

A true "all-in-one" recovery and treatment center for hazardous

industrial waste, ECO is located on a single site of 68,400 m2,

where its facilities (incinerators with or without energy recovery,

industrial water treatment plant, stabilization plant, etc.), all

recent and with complementary technologies, have a total annual

capacity of almost 440 Kt.

ECO has all the authorizations required to manage various types

of solid, gaseous, and liquid hazardous waste - including

industrial wastewater treatment plant sludge - from a diversified

customer base of blue-chip industrials belonging to the core target

sectors of chemicals, pharmaceuticals, energy and renewables and

semiconductors.

With around 300 employees, ECO is present for its customers at

every stage of the hazardous waste management value chain in

Singapore, providing collection, transportation, recovery, and

treatment services for hazardous waste.

ECO also holds stakes in two joint ventures active in the

circular economy, one specializing in activated carbon reactivation

with a global chemicals manufacturer, and the other in precious

metals regeneration in partnership with a global precious metals

recycling manufacturer.

In 2023, almost 80% of the Company's sales were generated by the

recovery and treatment of hazardous waste and 10% by the treatment

of sewage sludge from Singapore's Water Reclamation Plants.

For the balance, ECO provides its customers with several

complementary, high value-added services, such as integrated waste

management, depollution (including environmental emergency services

and asbestos removal), trading in the by-products of materials

recovery, deconstruction and decontamination, or even promising

niche activities such as the treatment of carbon soot waste from

synthesis gas production or the recovery of activated carbon.

The company also has a fleet of around 35 vehicles to provide

all its collection, transportation, and depollution services.

With its recognized technical capabilities and know-how, the

Company is responding to the prospects of a Singaporean hazardous

waste market with high barriers to entry, driven by the chemical,

energy and renewable energies industries.

As a result, ECO has developed solid commercial relationships

with a diversified industrial customer base, resulting in a high

rate of contract renewals and generating a solid revenue base and a

high level of visibility on its revenue profile.

In 2023, the Company generated sales of around SGD 96 million2

and an adjusted3 EBITDA of around SGD 41 million.

An accretive transaction that opens up new markets and

accelerates Séché's profitable growth strategy.

For Séché Environnement, this acquisition gives the Group a

major position with its target customers in the buoyant

environmental markets of Singapore and, more broadly, in the

markets of the APAC region.

Commenting on the acquisition, Maxime Séché, Chief Executive

Officer, said: "Our Group has seized a rare opportunity to invest

in a regional leader in hazardous waste management. With its

comprehensive hazardous waste management offering, ECO enables us

to serve a core customer base in a dynamic industrial region.

Thanks to its commercial dynamism, cutting-edge know-how and

high-performance technological tools, ECO will provide us with a

platform for significant growth in the APAC region in all our

businesses, from the circular economy to hazard management and

environmental services. This is a major operation that will

accelerate our strategy of profitable growth".

This acquisition is subject to a favorable vote by Beijing

Capital Eco-Environment Protection Group Co., Ltd.'s Extraordinary

General Meeting of Shareholders.

This acquisition concerns 100% of the shares and represents a

purchase price of around SGD 605 million4, the financing of which

has already been secured by a committed financing facility from a

bank.

In the event of a favorable vote, this acquisition would be

carried out through a Singapore acquisition company ("SPV") Séché

Holdings (SG) Pte. Ltd.

Séché Environnement hired BNP Paribas as financial advisor and

Latham & Watkins as legal advisor for this transaction.

Next communication

Consolidated results to June 30, 2024: September 4, 2024 after

market close

About Séché Environnement

Séché Environnement is a benchmark player in waste management,

including the most complex and hazardous waste, and in

environmental services, particularly in the event of environmental

emergencies. Thanks to its expertise in the creation of circular

economy loops, decarbonization and hazard control, the Group has

been contributing to the ecological transition of industries and

territories, as well as to the protection of living organisms, for

almost 40 years. A family-owned French industrial group, Séché

Environnement deploys the cutting-edge technologies developed by

its R&D at the heart of the territories, in more than 120 sites

in 16 countries, including some 50 industrial sites in France. With

over 6,100 employees, including more than 2,900 in France, Séché

Environnement generated sales of €1,013.5 million in 2023, 26% of

which outside France. Séché Environnement has been listed on

Eurolist by Euronext (compartment B) since November 27, 1997. The

stock is included in the CAC Mid&Small, EnterNext Tech 40 and

EnterNext PEA-PME 150 indices. ISIN: FR 0000039139 - Bloomberg:

SCHP.FP - Reuters: CCHE.PA

___________________________ 1 Share Purchase Agreement 2 For

information, approximate FX rate EUR/SGD =1.45 3 Based on ECO

EBITDA 2023 figures of SGD 37.4m + non-consolidated EBITDA from JV

of SGD 3.9m 4 Subject to adjustments at closing

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240617221442/en/

SÉCHÉ ENVIRONNEMENT

Analyst / Investor Relations Manuel ANDERSEN Investor

Relations Director m.andersen@groupe-seche.com +33 (0)1 53 21 53

60

Media Relations Anna JAEGY Deputy Communications Director

a.jaegy@groupe-seche.com +33 (0)1 53 21 53 53

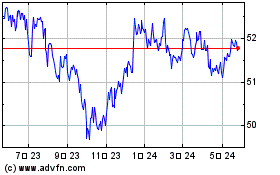

Schwab US TIPs (AMEX:SCHP)

過去 株価チャート

から 5 2024 まで 6 2024

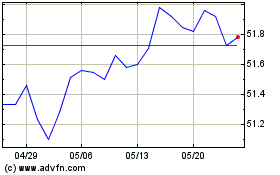

Schwab US TIPs (AMEX:SCHP)

過去 株価チャート

から 6 2023 まで 6 2024