By Anna Isaac and Pat Minczeski

With two Brexit deadlines already passed and a third expected to

be extended, the uncertainty that has weighed on the economy and

financial markets for three years looks set to drag on.

While lawmakers backed Prime Minister Boris Johnson's Brexit

deal this week, they didn't approve his accelerated timetable,

making a departure from the European Union by Oct. 31 unlikely and

extending a political deadlock that has eroded economic growth and

business investment.

"I can't think of another sovereign in our rated universe that

has withdrawn from such an integrated trading relationship," said

Colin Ellis, U.K. managing director at credit-ratings company

Moody's Investors Service. "There are a few places -- like business

investment, like the exchange rate -- where we can look at the

behavior of some of those variables to have a sense of the

effect."

A Subdued Pound

Since the Brexit referendum in 2016, the pound has lost about

13% of its value against the U.S. dollar and briefly touched

multidecade lows in recent months. On Wednesday evening, one pound

bought $1.2914. Sterling has also depreciated against the

currencies of its major trading partners, including the EU and

China.

That is good news for some of the U.K.'s biggest companies,

which generate a substantial portion of their revenue overseas,

because their foreign income is worth more in pounds.

For manufacturers whose exports become more competitive because

of the cheaper pound, the benefits have been largely muted by the

higher costs of imported parts and other costs.

Despite the sharp drop in the value of the pound immediately

after the referendum result, some foreign-exchange strategists and

traders say the currency has been largely rangebound in recent

years.

"There has been no trend in the pound after the Brexit vote, the

only trend has been sideways," said Jordan Rochester, currency

strategist at Nomura Bank. "It's a big range for people who zoom in

on the screen like traders, but if you take a longer view, like the

1970s, it's gone nowhere."

Lawmakers' support for a Brexit deal for the first time on

Tuesday has further pared expectations of sterling-dollar

volatility over the next month because it signaled that the U.K.

may be able to avoid leaving the bloc without an agreement.

Banks' Borrowing Costs

Borrowing costs for U.K. banks such as Lloyds Banking Group PLC

climbed steeply at times when a disorderly exit from the EU seemed

most likely. Those spikes were partly triggered by large investors

offloading the lenders' bonds.

The credit outlook for the U.K.-focused banks was also clouded

for a time by their perceived exposure to the domestic economy, as

growth slowed because the Brexit uncertainty led businesses to

defer investment decisions or move operations elsewhere.

The so-called "Brexit premium" -- whereby increased uncertainty

led to higher borrowing costs for U.K. banks than it did for

European lenders such as Société Générale SA -- has diminished in

recent weeks as investors bet that a no-deal Brexit may be

avoided.

Economic Growth Stalls

By the fourth quarter of 2017, just over a year after the

referendum, economic growth in the U.K. had fallen behind that of

the lethargic eurozone. This was partly explained by a reluctance

among businesses to invest in operations amid the prolonged

political uncertainty.

"There is an incentive for anyone spending money to delay that

decision, whether that is spending money as a consumer or making an

investment in a business," Mr. Ellis said. More recently, both

economies have felt the pressure of a global slowdown and trade

tensions between the U.S. and its partners.

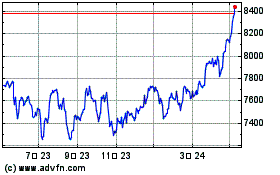

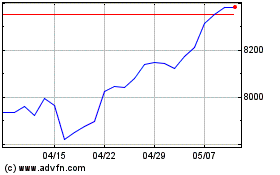

Stocks in a Slump

The U.K.'s main benchmark stock index, the FTSE 100, has failed

to match the bullish rally in U.S. or even European equities as

investors remain wary of the outlook for British businesses.

Smaller companies in the FTSE 350 benchmark are seen to be even

more vulnerable to the vagaries of the Brexit proceedings, because

of the impact of currency fluctuations on their operations and the

perceived risk of future trade friction with the EU.

There is a 20-25% gap in the valuations of companies that rely

on the U.K. for the majority of their revenue compared with those

with bigger international operations, said Simon French, chief

economist at merchant bank Panmure Gordon.

Only the finer details of a future trading relationship with the

EU will allow for a proper assessment of the outlook for the U.K.

and better pricing of its assets, according to economists and

analysts.

The range of possible outcomes has been narrowed as both the

best- and the worst-case scenarios have been avoided, according to

Kallum Pickering, senior economist at Berenberg Bank. In other

words, the chances of either leaving the EU without a deal or

remaining in the bloc have both fallen.

"If Brexit was a book, at the start it was impossible to guess

what the ending was," said Mr. Pickering. "Now the worst-case

scenario is ruled out, markets are less likely to be spooked by the

rest of the book. It's less likely to be a horror story."

--Caitlin Ostroff contributed to this article.

Write to Anna Isaac at anna.isaac@wsj.com

(END) Dow Jones Newswires

October 24, 2019 08:00 ET (12:00 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

FTSE 100

指数チャート

から 3 2024 まで 4 2024

FTSE 100

指数チャート

から 4 2023 まで 4 2024