UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

☑ ANNUAL REPORT PURSUANT TO SECTION

13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2024

or

☐ TRANSITION REPORT PURSUANT TO SECTION

13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to

___________

Commission File Number: 0-56615

LONGDUODUO COMPANY LIMITED

(Exact name of registrant as specified in its charter)

| Nevada | | 37-2018431 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification Number) |

G3-5-8016 Shui’an Town, Ruyi Headquarters

Base

Hohhot Economic Development Zone

Inner Mongolia 010000

P.R. China

Office: +86 (0472) 510 4980

(Address, including zip code, and telephone number,

including area code,

of Registrant’s principal executive offices)

Securities registered pursuant to Section 12(b)

of the Act:

| Title of Each Class |

|

Trading Symbol |

|

Name of Each Exchange on Which Registered |

| None |

|

None |

|

Not Applicable |

Securities registered pursuant to Section 12(g)

of the Act: Common Stock, $0.001 par value.

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has

filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. Yes ☐ No ☑

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark if disclosure of delinquent

filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to

the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this

Form 10-K or any amendment to this Form 10-K. ☑

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☑ |

| | | Emerging growth company | ☑ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report. ☐

If securities are registered pursuant to Section

12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction

of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error

corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s

executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12 b-2 of the Act). Yes ☐ No ☑

Indicate the number of shares outstanding of each

of the issuer’s classes of common stock, as of the latest practicable date.

As of the date of filing of this report, there

were outstanding 30,005,016 shares of the issuer’s common stock, par value $0.001 per share.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated

by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report

to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities

Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for

fiscal year ended December 24, 1980).

None

TABLE OF CONTENTS

PART I

Cautionary Statement Regarding Forward Looking

Statements

The discussion contained in this Annual Report

on Form 10-K contains “forward-looking statements” within the meaning of Section 27A of the United States Securities Act of

1933, as amended, and Section 21E of the United States Securities Exchange Act of 1934, as amended. Any statements about our expectations,

beliefs, plans, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements

are often, but not always, made through the use of words or phrases like “anticipate,” “estimate,” “plans,”

“projects,” “continuing,” “ongoing,” “target,” “expects,” “management

believes,” “we believe,” “we intend,” “we may,” “we will,” “we should,”

“we seek,” “we plan,” the negative of those terms, and similar words or phrases. We base these forward-looking

statements on our expectations, assumptions, estimates and projections about our business and the industry in which we operate as of the

date of this Form 10-K. These forward-looking statements are subject to a number of risks and uncertainties that cannot be predicted,

quantified or controlled and that could cause actual results to differ materially from those set forth in, contemplated by, or underlying

the forward-looking statements. Statements in this Form 10-K describe factors, among others, that could contribute to or cause these

differences. Actual results may vary materially from those anticipated, estimated, projected or expected should one or more of these risks

or uncertainties materialize, or should underlying assumptions prove incorrect. Because the factors discussed in this Form 10-K could

cause actual results or outcomes to differ materially from those expressed in any forward-looking statement made by us or on our behalf,

you should not place undue reliance on any such forward-looking statement. New factors emerge from time to time, and it is not possible

for us to predict which will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any

factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement.

Except as required by law, we undertake no obligation to publicly revise our forward-looking statements to reflect events or circumstances

that arise after the date of this Form 10-K.

NOTE REGARDING REVERSE STOCK SPLIT

Effective on September 26, 2023, Longduoduo Company

Limited implemented a one-for-ten reverse split of its common stock. To facilitate comparative analysis, all statements in this Report

regarding numbers of shares of common stock and all references to prices of a share of common stock, if referencing events or circumstances

occurring prior to September 26, 2023, have been modified to reflect the effect of the reverse stock split on a pro forma basis.

Item 1. Business

Corporate Structure

Longduoduo Company Limited (“Longduoduo”)

was incorporated in the State of Nevada on October 25, 2021. Longduoduo’s principal corporate address is G3-5-8016, Shui’an Town,

Ruyi Headquarters Base, Hohhot Economic Development District, Hohhot, Inner Mongolia, China, 010000. Our telephone number is +86 (0472)

510 4980. Our registered agent for service of process is Incorp Services, Inc., 3773 Howard Hughes Pkwy, Suite 500S, Las Vegas Nevada

89169-6014. Our website address is www.longduoduo.net. Our website and the information contained on, or that can be accessed through,

the website is not deemed to be incorporated by reference in, and is not considered part of, this report, and the inclusion of our website

address in this report is an inactive textual reference only. You should not rely on any such information in making your decision whether

to purchase our common stock.

LONGDUODUO IS A NEVADA CORPORATION THAT FUNCTIONS

EXCLUSIVELY AS A HOLDING COMPANY. ALL OF THE BUSINESS OPERATIONS THAT ARE DESCRIBED IN THIS REPORT AND REFLECTED IN THE FINANCIAL STATEMENTS

CONTAINED IN THIS REPORT ARE CARRIED OUT BY FIVE LIMITED COMPANIES ORGANIZED AND LOCATED IN THE PEOPLE’S REPUBLIC OF CHINA (“PRC”).

LONGDUODUO OWNS THE FIVE OPERATING COMPANIES THROUGH AN INTERMEDIARY HOLDING COMPANY REGISTERED IN HONG KONG.

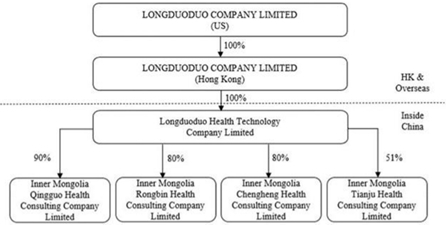

The following chart describes our current corporate

structure:

Longduoduo Company Limited (Hong Kong) (“Longduoduo

HK”), was established on July 26, 2021 under the laws of Hong Kong. On October 26, 2021, Longduoduo issued 30,000,000 shares of

its common stock to the original shareholders of Longduoduo HK, in exchange for 100% of the outstanding shares of Longduoduo HK (the “Share

Exchange”).

Longduoduo Health Technology Company Limited (“Longduoduo

Health Technology”), a privately held Limited Company, registered in Inner Mongolia, China on August 20, 2020. On August 16, 2021,

Longduoduo HK acquired 100% of Longduoduo Health Technology from the original shareholders of Longduoduo Health Technology.

Inner Mongolia Qingguo Health Consulting Company

Limited (“Qingguo”), a privately held Limited Company, registered in Inner Mongolia, China on June 18, 2020. On September

8, 2020, Longduoduo Health Technology acquired 90% of Qingguo from the original shareholders of Qingguo.

Inner Mongolia Rongbin Health Consulting Company

Limited (“Rongbin”), a privately held Limited Company, registered in Inner Mongolia, China on March 18, 2021. Longduoduo Health

Technology has controlled 80% of Rongbin since inception.

Inner Mongolia Chengheng Health Consulting Company

Limited (“Chengheng”), a privately held Limited Company, registered in Inner Mongolia, China on April 9, 2021. Longduoduo

Health Technology has controlled 80% of Chengheng since inception.

Inner Mongolia Tianju Health Consulting Company

Limited (“Tianju”), a privately held Limited Company registered in Inner Mongolia, China on July 5, 2021. Longduoduo Health

Technology has controlled 51% of Tianju since inception.

Considerations Relating to Regulation under

Chinese Law

Longduoduo is not a Chinese operating company

but a Nevada holding company with all of its operations conducted through five subsidiaries located in the PRC. Investors in the Company’s

common stock should be aware that they will not directly hold equity interests in a Chinese operating entity, but rather are purchasing

equity solely in a Nevada holding company that will be dependent upon distributions from its principal Chinese subsidiary to finance the

administrative expenses of the Nevada holding company and any cash distributions by the Nevada holding company to its shareholders. Our

ability to obtain contributions from the Company’s subsidiary is significantly affected by regulations promulgated by PRC authorities.

Chinese regulatory authorities could prevent our principal Chinese subsidiary from making distributions to its Nevada parent, which would

likely result in a material change in our operations and cause the value of our securities to significantly decline or become worthless.

Any change in the interpretation by the PRC government of existing rules and regulations or the promulgation of new rules and regulations

may materially affect our operations or cause the value of our securities to significantly decline or become worthless. For a detailed

description of the risks facing the Company as a result of its dependence on its Chinese operating subsidiaries, please refer to “Risk

Factors - Risks Relating to Doing Business in the PRC.”

Exposure to potential sanctions under the

HFCAA

Pursuant to the Holding Foreign Companies Accountable

Act (“HFCAA”), as adopted by the United States Congress in 2020, the Public Company Accounting Oversight Board (the “PCAOB”)

issued a Determination Report on December 16, 2021 which found that the PCAOB was unable to inspect or investigate completely registered

public accounting firms headquartered in the PRC because of a position taken by one or more authorities in mainland China. Under the HFCAA

(as amended by the Consolidated Appropriations Act – 2023), an issuer’s securities may be prohibited from trading on a U.S.

stock exchange or facility if its auditor is not inspected by the PCAOB for two consecutive years (reduced by Congress in 2023 from three

consecutive years in the original HFCAA).

On August 26, 2022, the China Securities Regulatory

Commission (“CSRC”), the Ministry of Finance of China, and the PCAOB signed a protocol governing inspections and investigations

of audit firms based in China and Hong Kong. On December 15, 2022, the PCAOB issued a new Determination Report which: (1) vacated

the December 16, 2021 Determination Report; and (2) concluded that the PCAOB had been able to conduct inspections and investigations completely

in the PRC in 2022. The December 15, 2022 Determination Report cautions, however, that authorities in the PRC might take positions at

any time that would prevent the PCAOB from continuing to inspect or investigate completely. As required by the HFCAA, if in the future

the PCAOB determines it no longer can inspect or investigate completely because of a position taken by an authority in the PRC, the PCAOB

will act expeditiously to consider whether it should issue a new determination. If the PCAOB is not able to fully conduct inspections

of our auditor’s work papers in the PRC, our securities may be prohibited from trading on a U.S. stock exchange or facility if our

auditor is not inspected by the PCAOB for two consecutive years, and this ultimately could result in our common stock being barred from

listing in the United States, which would likely prevent our shareholders from being able to sell their shares until the bar was lifted.

Longduoduo recently engaged Bush & Associates

CPA LLC as its independent auditor, replacing Michael T. Studer CPA P.C. in that role. Bush & Associates is headquartered in the State

of Nevada, and Michael T. Studer CPA P.C. is headquartered in the State of New York. The PCAOB is able to, and does, fully conduct inspections

of our auditor’s work papers. There remains a risk, however, that the government of the PRC might in the future impose restrictions

on the communication of information to auditors or by auditors of issuers whose operations are located within the PRC, in such a way that

investors in the securities of such issuers do not receive the full benefit of the audits. In that situation, it could occur that the

SEC would bar trading platforms subject to U.S. jurisdiction from listing Longduoduo’s securities for trading. Such an occurrence

would be likely to cause the value of Longduoduo’s securities to diminish significantly.

Exposure to restrictions on upstream distributions

of profits

Longduoduo is a Nevada holding company with no

business operations of its own. We conduct our operations in China through five subsidiaries. We will rely on dividends paid by our principal

PRC subsidiary to fund the cash requirements of Longduoduo, including the funds necessary to pay dividends and other cash distributions

to our shareholders, to service any debt we may incur and to pay our operating expenses. In order for us to pay dividends to our shareholders,

we will rely on payments made from our principal PRC subsidiary to Longduoduo Company Limited (Hong Kong) (“Longduoduo HK”).

If Longduduo is unable to receive profits from the operations of our PRC subsidiaries through Longduoduo HK, we will be unable to pay

dividends on our common stock.

The PRC government also imposes controls on the

conversion of RMB into foreign currencies and the remittance of currencies out of the PRC through the Administrative Regulations of the

PRC on Foreign Exchange (the “Foreign Exchange Regulations”), and the Notice of State Administration of Foreign Exchange on

Promulgation of the Provisions on Foreign Exchange Control on Direct Investments in China by Foreign Investors. Therefore, we may experience

difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from

our profits, if any. The Foreign Exchange Regulations will present a barrier to currency transactions between our U.S. parent company

and our Chinese operating subsidiary. If we raise funds in the U.S. dollars for the purpose of funding our operations in China, we will

be required to obtain SAFE approval of the conversion of the dollars into Renminbi, which could be denied.

Current PRC regulations permit Longduoduo’s

PRC subsidiaries to pay dividends to Longduoduo and its Hong Kong subsidiary only out of their accumulated profits, if any, determined

in accordance with Chinese accounting standards and regulations. In addition, each of our subsidiaries in China is required to set aside

at least 10% of its after-tax profits each year to fund a statutory reserve until such reserve reaches 50% of its registered capital.

Our subsidiaries in China are also required to further set aside a portion of their after-tax profits to fund their employee welfare fund,

although the amount to be set aside, if any, is determined at the discretion of the subsidiary’s board of directors. Although the

statutory reserves can be used, among other ways, to increase the registered capital and eliminate future losses in excess of retained

earnings of the PRC subsidiary, the reserve funds are not distributable as cash dividends except in the event of liquidation. If one or

more of our PRC subsidiaries incurs debt on its own behalf in the future, the instruments governing the debt may restrict its ability

to pay dividends or make other distributions to us.

If Longduoduo is considered a PRC tax resident

enterprise for tax purposes, any dividends its pays to our shareholders may be regarded as China-sourced income and, as a result, may

be subject to PRC withholding tax at a rate of up to 10.0%. Certain payments from Longduoduo Health Technology, our principal PRC subsidiary,

to Longduoduo HK are subject to PRC taxes. As of the date of this Report, Longduoduo Health Technology has not made any transfers or distributions.

Pursuant to the Arrangement between Mainland China

and the Hong Kong Special Administrative Region for the Avoidance of Double Taxation and Tax Evasion on Income, or the “Double Tax

Avoidance Arrangement,” the 10% withholding tax rate may be lowered to 5% if a Hong Kong resident enterprise owns no less than 25%

of the PRC entity during the 12 consecutive months preceding its receipt of the dividends. In current practice, a Hong Kong entity must

obtain a tax resident certificate from the Hong Kong tax authority to apply for the 5% lower PRC withholding tax rate. As the Hong Kong

tax authority will issue such a tax resident certificate on a case-by-case basis, we cannot assure you that we will be able to obtain

the tax resident certificate from the relevant Hong Kong tax authority and enjoy the preferential withholding tax rate of 5% under the

Double Taxation Arrangement with respect to dividends to be paid by Longduoduo Health Technology to its immediate holding company, Longduoduo

HK. As of the date of this Report, Longduoduo Health Technology does not plan to declare and pay dividends to Longduoduo HK and we have

not applied for the tax resident certificate from the relevant Hong Kong tax authority.

At the date of this Report, no subsidiary of Longduoduo

has paid any dividend or distribution to Longduoduo or any subsidiary of Longduoduo, nor has Longduoduo made any dividend or distribution

to any U.S. investor. There has been no transfer of cash or other assets between or among Longduoduo, Longduoduo HK and/or any Chinese

subsidiary of Longduoduo.

PRC Government Oversight

Changes in China’s internal regulatory mandates,

such as the M&A rules, Anti-Monopoly Law, and the Data Security Law, may target the Company’s corporate structure and impact

our ability to conduct business in China, accept foreign investments, or list on a U.S. or other foreign exchange. Recently, the PRC government

initiated a series of regulatory actions affecting business operations in China with little advance notice, including banning certain

activities in the securities market, enhancing supervision over China-based companies listed overseas using variable interest entity structure,

adopting new measures to extend the scope of cybersecurity reviews, and expanding its efforts in anti-monopoly enforcement. The business

of our subsidiaries until now has not been subject to cybersecurity review with the Cyberspace Administration of China, or CAC, given

that: (i) data processed in our business does not have a bearing on national security and thus may not be classified as core or important

data by the authorities; (ii) we have not yet approached the regulatory thresholds for holding personal information in our business operations.

In addition, we are not subject to merger control review by China’s anti-monopoly enforcement agency due to the level of our revenues

and the fact that we currently do not expect to propose or implement any acquisition of control of, or decisive influence over, any company

with revenues within China of more than RMB400 million. However, since these regulatory actions are new, it is uncertain how soon legislative

or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations

will be modified or promulgated, and the potential impact such modified or new laws and regulations will have on our daily business operation,

our ability to accept foreign investments and our ability to list our securities on an U.S. or other foreign exchange.

We intend to fund the growth of our business in

large part by raising capital in Longduoduo through its sale of securities outside of the PRC. The capital markets in the U.S. that we

might access for financing will depend in large part on our ability to secure a listing on Nasdaq, OTCQX or one of the registered securities

exchanges. The Trial Administrative Measures adopted by the China Securities Regulatory Commission (“CSRC”) on March 31, 2023

require that at the time we apply to an exchange (which for this purpose will include Nasdaq, OTCQB or OTCQX), we must file an extensive

application with the CSRC and await approval by CSRC of the listing. The CSRC has indicated an intent to use these applications in order

to protect the PRC from foreign control of (or significant influence over) important Chinese businesses. We cannot determine what criteria

the CSRC will apply for this purpose. The regulations, therefore, create for our investors a risk that our efforts to finance Longduoduo

Health Technology by selling Longduoduo securities abroad will be restricted, delayed or eliminated by CSRC’s implementation of

the listing requirements in the Trial Administrative Measures. That risk, if realized, could prevent us from expanding Longduoduo Health

Technology’s business, which could reduce or eliminate the value of Longduoduo common stock.

Summary of Addiitonal Risk Factors Pertaining

to Operations in China

There are additional risks associated with our

operations being in the PRC. The following summarizes certain additional risk factors that are discussed in detail in the section titled

“Risk Factors: Risks related to Doing Business in the PRC at page 17 et seq.

| ● | Changes in United States and China relations,

as well as relations with other countries, and/or regulations may adversely impact our business, our operating results, our ability to

raise capital and the market price of our shares. As a U.S.-listed public company, we may face heightened scrutiny, criticism

and negative publicity in the PRC, which could result in a material change in our operations and the value of our common stock. |

| ● | Uncertainties with respect to the PRC legal

system, including uncertainties regarding the enforcement of laws, and sudden or unexpected changes in laws and regulations in China could

adversely affect us and limit the legal protections available to your and us. The dramatic growth of China and rapid changes in

government policies since the 1980s cause change in the legal system that make compliance difficult and policies unpredictable. |

| ● | Because our principal assets are located

outside of the United States and because all of our directors and all our officers reside outside of the United States, it may be difficult

for you to use the United States Federal securities laws to enforce your rights against us and our officers or to enforce judgments of

United States courts against us or them in the PRC. |

| ● | The fluctuation of RMB may materially and

adversely affect your investment. If the Chinese government reduces the relative value of the RMB compared to the U.S. Dollar,

the value in Dollars of the Company will decline. |

| ● | We may become subject to a variety of laws

and regulations in the PRC regarding privacy, data security, cybersecutiry, and data protection. We may be liable for improper use or

appropriation of personal information provided by our customers. |

| ● | If Longduoduo common stock becomes listed

on the OTCQB or an exchange, we will be required to obtain the approval of the PRC government for a business combination, the issuance

of our common stock, or maintaining our status as a publicly listed company outside China. |

Our Business

Our operating subsidiaries, Longduoduo Health

Technology, Qingguo, Rongbin, Chengheng and Tianju, are each engaged in the business of providing high-quality preventive healthcare solutions

to customers in the Inner Mongolia Province of China. Our primary business at the present time involves our subsidiaries’ sales

on a commission basis of health maintenance services provided by Inner Mongolia Honghai Health Management Co., Ltd. Our operating subsidiaries

also provide customers preventive healthcare solutions that our subsidiaries purchase from one or more of five providers under contract.

These preventive healthcare solutions include a wide range of comprehensive preventive healthcare services, including disease screening,

healthcare treatments, healthcare products and other services. The Company mainly focuses on prevention of myocardial infarction, cerebral

infarction, hemiplegia, and cardiovascular and cerebrovascular diseases.

Commissioned Sales

Since June of 2023, our operating subsidiaries

have been primarily engaged in selling health maintenance services provided by Inner Mongolia Honghai Health Management Co., Ltd. (“Honghai”).

During the year ended June 30, 2024, over 95% of our gross revenue represented commissions paid to our operating subsidiaries by Honghai.

Each operating subsidiary is party to a separate Sales Agency Agreement with Honghai, each dated June 20, 2023 and expiring on June 20,

2026, although the content of the five Sales Agency Agreements are identical but for the name of the agent: Longduoduo Health Technology

Co., Ltd, Inner Mongolia Rongbin Health Consulting Co., Ltd, Inner Mongolia Chengheng Health Consulting Co., Ltd, Inner Mongolia Qinguo

Health Consulting Co., Ltd. or Inner Mongolia Tianju Health Consulting Company Limited. Among the principal terms of the Sales Agency

Agreements are:

| ● | Honghai is responsible for developing and providing

services, and our operating subsidiary (the “Agent”)

is responsible for promoting and selling the services. |

| ● | When the Sales Agency Agreement was signed, the

specific services to be marketed were: trioxygen autotransfusion, awakening brain and dredging collaterals, double blood purification

in German technology, hyperbaric trioxygen, colon hydrotherapy, intestinal flora transplantation, custom-made Juncao and combinations

of these services. |

| ● | If Honghai develops new services, the Agent will

have the option to market the new services at a price to be negotiated with Honghai in accordance with criteria set in the Sales Agency

Agreement. |

| ● | The Agent is responsible for collecting payment

on each sale, and forwarding the payment to Honghai net of the pre-approved settlement amount – i.e. commission. |

| ● | Honghai bears all responsibility for the quality

of the services and for any liability to customers arising from the services. |

Principal Sales

Before we entered the Sales Agency Agreements

with Honghai, our operating subsidiaries marketed healthcare services and products exclusively as principals, by purchasing and reselling

services and products from third-party healthcare service providers such as hospitals to serve customers located in Hohhot, Ordos, Baotou

and Ulanqab, cities in Inner Mongolia. We continue that business, although “service revenue” from these principal sales fell

by almost 82% in the year ended June 30, 2024 from the service revenue recorded in the year ended June 30, 2023. Our intention, after

we have built a firm foundation for our agency sales business, is to return our attention to principal sales and build a network of third-party

healthcare service providers, product suppliers and our sales agents so that we can offer a broader array of products and services to

potential customers.

Currently, working with our third-party healthcare

service providers, our operating subsidiaries provide, as principal, the preventive healthcare solutions including below:

| |

● |

Meridian-regulating and Consciousness-restoring Iatrotechnics- a traditional Chinese medicine treatment that is anti-thrombotic to prevent and treat cardiovascular and cerebrovascular diseases. |

| |

● |

Double Blood Purification – treatment for cardiovascular and cerebrovascular diseases that involves the removal of pathogens and toxins from the blood through physical means such as filtration. |

| |

● |

Immunological Ozonated Autohemotherapy; the Third-generation Ozone Therapy Device – Autologous Blood Immunotherapy - prevention and treatment of cardiovascular and cerebrovascular diseases relying on the use of an ozone therapy device to remove pathogens and toxins from the blood. |

| |

● |

PRP (platelet-rich plasma) – prevention and treatment of joint inflammation and injury through the use of platelet rich plasma. |

| |

● |

Relaxation therapy - a traditional Chinese medicine treatment that is used to treat joint function limitation caused by soft tissue adhesion such as periarthritis of shoulder |

| |

● |

Vegetative Nerve Regulation - a treatment for neck, shoulder, back and leg pain |

| |

● |

Microwave Therapy – through the use of specific

equipment, heat is provided deep into the skin to reduce inflammation, detumescence, relieve pain and improve tissue blood circulation,

prevent and cure lumbar muscle strain, arthritis, periarthritis of shoulders and other diseases.

|

All medical services above are provided by healthcare

service providers that are licensed medical institutions, such as hospitals or medical clinics. These medical services are provided directly

to our customer by our healthcare service providers, and our healthcare service providers bear the risk of liability related to the medical

procedures.

Our operating subsidiaries have contracted with

five third-party healthcare service providers. The contracts are set out below:

| |

● |

Cooperation Agreement, dated March 26, 2021 and expiring on March 31, 2026, by and between Inner Mongolia Qinguo Health Consulting Co., Ltd. and Hohhot Aihua Traditional Chinese Medicine Hospital, which is located in Hohhot. Under the terms of this agreement, Hohhot Aihua Traditional Chinese Medicine Hospital offers services such as “Immunological Ozonated Autohemotherapy”, “Meridian-regulating and Consciousness-restoring Iatrotechnics”, “PRP”, “Relaxation therapy”, “Vegetative Nerve Regulation (anterior)” and other conventional therapies. |

| |

● |

Leasing and Cooperation Agreement, dated October 15, 2020 and expiring on October 15, 2025, by and between Longduoduo Health Technology Co., Ltd and Baotou Jinshi Zhongyi Nephropathy Hospital, which is located in Baotou. Under the terms of this agreement, Baotou Jinshi Zhongyi Nephropathy Hospital offers services such as “Meridian-regulating and Consciousness-restoring Iatrotechnics”, “Double Blood Purification” and “Immunological Ozonated Autohemotherapy”. |

| |

● |

Cooperation Agreement, dated May 29, 2021 and expiring on May 28, 2026, by and between Inner Mongolia Chengheng Health Consulting Co., Ltd and Zhongyi Hospital Branch of Inner Mongolia Jiuzun Health Examination Co., Ltd, which is located in Ordos. Under the terms of this agreement, Zhongyi Hospital Branch of Inner Mongolia Jiuzun Health Examination Co., Ltd offers services such as “the Third-generation Ozone Therapy Device – Autologous Blood Immunotherapy”. |

| |

● |

Cooperation Agreement, dated June 20, 2021 and expiring on June 19, 2026, by and between Longduoduo Health Technology Co., Ltd and Ulanqab Mengzhong Rehabilitation TCM Hospital Co., Ltd, which is located in Ulanqab. Under the terms of this agreement, Ulanqab Mengzhong Rehabilitation TCM Hospital Co., Ltd offers services such as “Immunological Ozonated Autohemotherapy”, “Meridian-regulating and Consciousness-restoring Iatrotechnics”, “PRP”, “Relaxation therapy”, “Vegetative Nerve Regulation” and other conventional therapies |

| |

● |

Cooperation Agreement, dated September 5, 2021 and expiring on September 4, 2026, by and between Longduoduo Health Technology Co., Ltd and Ordos Xinhai Yihecheng Mengzhongyi Hospital, which is located in Ordos. Under the terms of this agreement, Ordos Xinhai Yihecheng Mengzhongyi Hospital offers services such as “Immunological Ozonated Autohemotherapy”, “2000ml Immunological Ozonated Autohemotherapy” and “Meridian-regulating and Consciousness-restoring Iatrotechnics” etc. |

Our operating subsidiaries pay service fees to

these third-party healthcare service providers based on the number of health products, medical examinations and the services they provide

for our customers. We carefully select our third-party healthcare service provider based on our internal assessment of the quality of

the provider’s institution and staff. We assess potential third-party healthcare service providers and chose future third-party

healthcare service providers that fit our business based on the following points:

| ● | Services:

whether service providers offer the required or complementary services, the venue & qualifications for the cooperation programs

as well as the management of medical quality & safety, medical staff, medicines and consumables; |

| ● | Location:

whether the venue is convenient for our customers. |

| ● | Price:

whether the medical examination and treatment price is acceptable. |

| ● | Reputation:

whether the providers have a good reputation. |

| ● | Equipment:

whether the provider possess advanced medical equipment. |

Our Plan for Growth

In the long run, by leveraging our growing network

of medical centers, large and loyal customer base, established demographic and disease information database, we plan to expand the scope

of our service offerings and ultimately establish our company as a leading health management service provider and sales agency in China.

We intend to achieve our goal by implementing the following strategies:

| |

● |

further expanding our product offerings; |

| |

● |

continuing to expand our network coverage nationwide; and |

| |

● |

further upgrading our service standards to enhance the customer experience. |

The successful execution of our business plan

is subject to risks and uncertainties related to our business and industry, including those relating to our ability to:

| |

● |

maintain and enhance the recognition and reputation of our operating subsidiaries; |

| |

● |

manage our growth and execute our strategies effectively; |

| |

● |

offer services at attractive prices to meet customer needs and preferences; |

| |

● |

manage and expand our relationships with suppliers and third-party service providers; and |

| |

● |

secure and retain the services of qualified personnel. |

We face significant competition from two main

types of competitors: the medical examination departments of major public hospitals and private medical examination companies. Some of

our current or future competitors may have longer operating histories, greater brand recognition, better supplier relationships, larger

customer bases or greater financial, technical or marketing resources than we do. There is no assurance that we will be able to successfully

compete against these larger and better funded competitors.

Our performance will be largely dependent on the

talents and efforts of highly skilled individuals. Future success depends on our continuing ability to identify, hire, develop, motivate

and retain highly qualified personnel for all areas of our organization. Competition for such qualified employees is intense. If we do

not succeed in attracting excellent personnel or in retaining or motivating them, we may be unable to grow effectively.

We rely on our third-party healthcare service

providers to provide services to our customers under cooperation arrangements with us. We require and expect these third-party healthcare

service providers to possess the licenses and qualifications that are required for their operations and to adhere to certain performance

standards both in terms of customer service and the quality of the medical care that they provide. We generally do not have control over

the quality of service or medical care that these third-parties provide. They may not at all times possess the permits or qualifications

required by laws and regulations or may fail to meet other regulatory requirements for their operations. In addition, they may engage

in conduct which our customers find unacceptable, including providing poor service, mishandling sensitive personal healthcare information

or committing medical malpractice.

Operating Licenses

Our products and services are subject to regulation

by governmental agencies in the PRC and Inner Mongolia Province. Business and company registrations are certified on a regular basis and

must be in compliance with the laws and regulations of the PRC and provincial and local governments and industry agencies, which are controlled

and monitored through the issuance of licenses. Our licenses include:

| ● | Longduoduo

Health Technology’s operating license enables it to undertake medical information consulting services, corporate management consulting,

health management consulting services and so on. The registration number is 91150104MA0QTDXG5T, which is valid from August 20, 2020,

and expires on August 19, 2050. |

| ● | Qingguo’s

operating license enables it to undertake sales of food, health management consulting services, and medical information consulting services.

The registration number is 91150104MA13Q5X152, which is valid from June 18, 2020, with no expiration date. |

| ● | Rongbin’s

operating license enables it to undertake medical information consulting services, corporate management consulting, and health management

consulting services. The registration number is 91150207MA13UKC301, which is valid from March 18, 2021, and expires on March 17, 2051. |

| ● | Chengheng’s

operating license enables it to undertake medical information consulting services, corporate management consulting, and health management

consulting services. The registration number is 91150602MA7YN4JE2Q, which is valid from April 09, 2021, and expires on April 08, 2051. |

| ● | Tianju’s

operating license enables it to undertake sales of class I medical equipment, pre-packaged food, hygiene products, cosmetics, and disinfection

products; health management consulting services; medical information consulting services; software development; biotechnology promotion

services; beauty services (excluding medical beauty), technical services, and technology Consultation; leasing of medical equipment.

The registration number is 91150902MA7YPWL408, which is valid from July 5, 2021 to July 4, 2051. |

The PRC legal system is based on written statutes.

Prior court decisions may be cited for reference but have limited precedential value. In 1979, the PRC government began to promulgate

a comprehensive system of laws and regulations governing economic matters in general, such as foreign investment, corporate organization

and governance, commerce, taxation and trade. However, since the PRC legal system continues to evolve rapidly, the interpretations of

many laws, regulations and rules are not always uniform and enforcement of these laws, regulations and rules involves uncertainties, which

may limit legal protections available to us. Uncertainties due to evolving laws and regulations could also impede the ability of a China-based

company, such as Longduoduo Health Technology, to obtain or maintain permits or licenses required to conduct business in China. In the

absence of required permits or licenses, governmental authorities could impose material sanctions or penalties on us or could revoke our

authority to carry on business. In addition, some regulatory requirements issued by certain PRC government authorities may not be consistently

applied by other PRC government authorities (including local government authorities), thus making strict compliance with all regulatory

requirements impractical, or in some circumstances impossible.

Competition

We face significant competition from two main

types of competitors: the medical examination departments of major public hospitals and private medical examination companies. The private

medical examination market is further segmented into (i) large national companies; (ii) regional providers; (iii) numerous local independent

medical examination centers located in nearly every city in China; and other sales agencies of health services.

We believe our primary competitive advantages

over our competitors include:

| |

● |

strong sales and marketing efforts; and |

| |

● |

the innovation of the market business idea and flexible management mechanism. |

We believe that we are well-positioned to effectively

compete on the basis of the factors listed above. However, some of our current or future competitors may have longer operating histories,

greater brand recognition, better supplier relationships, larger customer bases or greater financial, technical or marketing resources

than we do. There is no assurance that we will be able to successfully compete against these larger and better funded competitors.

Income Taxes

United States

Longduoduo Company Limited is subject to a tax

rate of 21% in the United States of America.

Hong Kong

Longduoduo HK was incorporated in Hong Kong

and is subject to Hong Kong profits tax. Longduoduo HK is subject to Hong Kong taxation on its activities conducted in Hong Kong and income

arising in or derived from Hong Kong. The applicable statutory tax rate is 16.5%. The Company did not have any income (loss) subject

to the Hong Kong profits tax.

China

Longduoduo Health Technology and subsidiaries

are subject to a 25% standard enterprise income tax in the PRC. The Company accrued $523,207 and $10,246 of PRC income tax for the years

ended June 30, 2024 and 2023.

Employees

The Company has 49 full-time employees. Of those

49, Qingguo has 10 full-time employees, Rongbin has 12 full-time employees, Chengheng has 7 full-time employees, Tianju has 4 full-time

employees and Longduoduo Health Technology has 16 full-time employees.

The Company’s employees include 10 with

management responsibilities, 20 with administrative and operations responsibilities, and 19 responsible for customer services.

All of our employees are located in the PRC. None

of our employees are represented by a labor union or similar collective bargaining organization.

Item 1A. Risk Factors.

An investment in our common stock involves a high

degree of risk. You should carefully consider the following risk factors and other information in this 10K before deciding to invest in

our Company. If any of the following risks actually occur, our business, financial condition and results of operations could be seriously

harmed. As a result, the trading price of our common stock could decline and you could lose all or part of your investment.

Risks Related to Our Business

95% of our revenue during the year ended

June 30, 2024 came from a single source: Inner Mongolia Honghai Health Management Co., Ltd. Termination of our relationship with Honghai

would likely have serious adverse effects on our financial results.

In June 2023 each of our operating subsidiaries

entered into identical Sales Agency Agreements with Inner Mongolia Honghai Health Management Co., Ltd. (“Honghai”), pursuant

to which our operating subsidiaries serve as sales agents for services provided by Honghai and receive commissions on the sales they initiate.

During the year ended June 30, 2024, commissions from sales on behalf of Honghai represented over 95% of our Company’s revenues,

while revenues from principal sales, our focus before engaging with Honghai, fell by almost 82%.

The Sales Agency Agreements terminate in June

2026, and there is no certainty that our relationship with Honghai will continue past that date In addition, any number of factors could

interfere with our relationship with Honghai: adverse events in Honghai’s business could make our sales efforts unprofitable; Honghai

could decide to engage competitive or replacement sales agents; licensing problems or adverse government regulation could interfere with

Honghai’s business or our ability to market Honghai’s services. In the event that any of these risks was realized, our financial

results could be significantly less profitable unless and until we were able to replace Honghai as the primary source of our revenue.

COVID-19 has adversely impacted our

business and may further impact our business, financial results and liquidity for an unknown period of time.

The COVID-19 pandemic has led government

and other authorities to impose measures intended to control its spread, including restrictions on freedom of movement, gatherings of

large numbers of people, and temporary closure of business operations. With respect to the Longduoduo business, the primary adverse result

of the COVID-19 pandemic has been a serious interruption from time to time caused by temporary closure of business operations,

especially the third-party healthcare service providers who were required to temporarily close. In particular, as our third-party healthcare

service provider are the key to patients’ treatment, our inability to supply third-party healthcare services due to COVID-19 restrictions

seriously delayed the growth of our business.

In response to COVID-19, we took steps to

reduce operating costs and improve efficiency, including slowing down our business plan. The interruption of our third-party healthcare

services supply and the steps we took to reduce the risk to our employees from COVID-19 both negatively impacted our schedule for achieving

development of our business.

Since December 2022, many of the restrictive measures

previously adopted by the PRC governments at various levels to control the spread of the COVID-19 virus have been revoked or replaced

with more flexible measures. The revocation or replacement of the restrictive measures to contain the COVID-19 pandemic could have a positive

impact on the Company’s normal operations.

We are unable to predict the extent to which the

pandemic and related impacts may adversely impact our business operations, financial performance, consolidated results of operations and

consolidated financial position in the future or interfere with the achievement of our strategic objectives.

We rely on third party providers to provide

our offered services and could be liable and suffer reputational harm if a third-party service provider provides inferior service or harms

a customer, which may have a material adverse effect on our business, financial condition, results of operations and prospects.

We rely on our third-party healthcare service

providers to provide services to our customers under cooperation arrangements with us. We require and expect these third-party healthcare

service providers to possess the licenses and qualifications that are required for their operations and to adhere to certain performance

standards both in terms of customer service and the quality of the medical care that they provide. We generally do not have control over

the quality of service or medical care that these third-parties provide. They may not at all times possess the permits or qualifications

required by laws and regulations or may fail to meet other regulatory requirements for their operations. In addition, they may engage

in conduct which our customers find unacceptable, including providing poor service, mishandling sensitive personal healthcare information

and committing medical malpractice. We could be exposed to reputational harm and possible liability as a result of our having serviced

a customer through a third-party service provider that performs unsatisfactorily, which may result in a materially adverse effect on our

business, financial condition, results of operations and prospects.

A computer system failure, security breach

or a breach of data privacy or security obligations may disrupt our business, damage our reputation and adversely affect our results of

operations, financial condition and cash flows.

We rely on computer and information systems and

internet and network connectivity to conduct a large portion of our business operations. This includes the need to securely store, process

and transmit confidential information, including personal information. In many cases this also includes transmission and processing to

or through commercial customers, business partners and third-party service providers. The introduction of new technologies, computer system

failures, cyber-crime attacks or security or privacy breaches may materially disrupt our business operations, damage our reputation, result

in regulatory and litigation exposure, investigation and remediation costs, and materially and adversely affect our results of operations,

financial condition and cash flows.

The information security risk that we face includes

the risk of malicious outside forces using public networks and other methods, including social engineering and the exploitation of targeted

offline processes, to attack our systems and information. It also includes inside threats, both malicious and accidental. For example,

human error and lack of sufficiently automated processing can result in improper information exposure or use. We also face risk in this

area due to our reliance in many cases on third-party systems, all of which may face cyber and information security risks of their own.

Third-party administrators or distribution partners used by us or our subsidiaries may not adequately secure their own information systems

and networks, or may not adequately keep pace with the dynamic changes in this area. Potential bad actors that target us and our applicable

third parties may include, but are not limited to, criminal organizations, foreign government bodies, political factions, and others.

There is no guarantee that the measures that we take will be sufficient to stop all types of attacks or mitigate all types of information

security or privacy risks.

If we fail to maintain adequate processes and

controls or if we or our business partners fail to comply with relevant laws and regulations, policies and procedures, misappropriation

or intentional or unintentional inappropriate disclosure or misuse of personal information or other confidential information could occur.

Such control inadequacies or non-compliance could cause disrupted operations and misstated or unreliable financial data, materially damage

our reputation or lead to increased regulatory scrutiny or civil or criminal penalties or litigation, which, in turn, could have a material

adverse effect on our business, financial condition and results of operations. In addition, we analyse personal information and customer

data to better manage our business, subject to applicable laws and regulations and other restrictions. It is possible that additional

regulatory or other restrictions regarding the use of such techniques may be imposed. Such restrictions and obligations could have material

impacts on our business, financial conditions and/or results of operations.

We operate in a competitive environment

and competing facilities and services could harm our business, financial condition, results of operations and prospects.

There are numerous hospitals and private clinics

providing medical examination services and, at the high end of the market, many Chinese hospitals have VIP wards that cater to affluent

customers. We face significant competition from two main types of competitors: the medical examination departments of major public hospitals

and private medical examination companies. The private preventive healthcare market is further segmented into large franchise companies,

regional providers and numerous local independent medical examination centers located in nearly every city in China. We compete primarily

on the basis of price, quality of service, convenience, location, brand recognition and reputation. We do not have the same level of brand

recognition as some of the medical examination centers of large public hospitals, and in some regional markets our brand is not as established

and our geographical coverage is not as extensive as that of our private competitors. Furthermore, we lack the equipment necessary for

certain highly technical medical tests. Many competing hospitals that are government-owned are exempt from income taxes on their medical

income, which provides them with a significant competitive advantage over us. Furthermore, competing hospitals, clinics or other facilities

may commence new operations or expand existing operations, which would increase their competitive position and potentially erode our business,

financial condition, results of operations and prospects.

We may not be able to effectively control

and manage our planned growth.

We have limited operational, administrative and

financial resources, which may be inadequate to sustain the growth we want to achieve. If our business and markets grow and develop, it

will be necessary for us to finance and manage expansion accordingly. In addition, we may face challenges in managing our expanding service

offerings. Such growth would place increased demands on our existing management, employees and facilities. Our failure to meet these demands

could interrupt or adversely affect our operations and cause administrative inefficiencies. Additionally, failure to execute our planned

growth strategy could have a material adverse effect on our financial condition and results of operation.

Expansion of our healthcare services could

be affected by the expansion of government-sponsored social medical insurance available to the Chinese population that is not available

now.

Most government-sponsored social medical insurance

in China does not cover medical examinations. In certain locations where government-sponsored social medical insurance covers medical

examinations, we have cooperating hospitals that are qualified institutions under such insurance coverage. Currently, most of our individual

customers pay directly for medical examinations. If government-sponsored social medical insurance is further expanded to cover medical

examinations in more geographical locations, and Longduoduo does not become a qualified institution for such coverage, certain of our

customers may discontinue or terminate their relationship with us, and certain individual customers may opt to use other medical institutions

covered by such medical insurance rather than pay for our services. As a result, the expansion of government-sponsored social medical

insurance could materially and adversely affect our business, financial condition and results of operations.

Additional capital, if needed, may not be

available on acceptable terms, if at all, and any additional financing may be on terms adverse to your interests.

We may need additional cash to fund our operations.

Our capital needs will depend on numerous factors, including market conditions and our profitability. We cannot be certain that we will

be able to obtain additional financing on favorable terms, if at all. If additional financing is not available when required or is not

available on acceptable terms, we may be unable to fund expansion, successfully promote our brand name, develop or enhance our services,

take advantage of business opportunities, or respond to competitive pressures or unanticipated requirements, any of which could seriously

harm our business and reduce the value of your investment.

If we are able to raise additional funds if and

when needed by issuing additional equity securities, you may experience significant dilution of your ownership interest and holders of

these new securities may have rights senior to yours as a holder of our common stock. If we obtain additional financing by issuing debt

securities, the terms of those securities could restrict or prevent us from declaring dividends and could limit our flexibility in making

business decisions. In this case, the value of your investment could be reduced.

There is no assurance that we will be able to

obtain additional funding if it is needed, or that such funding, if available, will be obtainable on terms and conditions favorable to

or affordable by us. If we cannot obtain needed funds, we may be forced to curtail our activities.

Risks Relating to our Management

The loss of the services of any of our officers

or our failure to timely identify and retain competent personnel could negatively impact our ability to develop our products and sales.

The development of our business will continue

to place a significant strain on our limited personnel, management, and other resources. Our future success depends upon the continued

services of our executive officers, Xu Huibo, our President and Chairman of the Board of Director, Zhou Hongxiao, Chief Executive Officer

(CEO), Secretary and director, and our Chief Financial Officer, Kang Liping. They are developing our business, which will depend on our

ability to identify and retain competent employees with the skills required to execute our business objectives. The loss of the services

of any of our officers or our failure to timely identify and retain competent personnel could negatively impact our ability to develop

our products and services, which could adversely affect our financial results and impair our growth.

If we are unable to hire, retain or motivate

qualified personnel, consultants, independent contractors, and advisors, we may not be able to grow effectively.

Our performance will be largely dependent on the

talents and efforts of highly skilled individuals. Future success depends on our continuing ability to identify, hire, develop, motivate

and retain highly qualified personnel for all areas of our organization. Competition for such qualified employees is intense. If we do

not succeed in attracting excellent personnel or in retaining or motivating them, we may be unable to grow effectively. In addition, all

future success depends largely on our ability to retain key consultants and advisors. We cannot assure that any skilled individual will

agree to become an employee, consultant, or independent contractor of Longduoduo Company Limited. Our inability to retain their services

could negatively impact our business and our ability to execute our business strategy.

Our internal controls over financial reporting

may not be effective and our independent registered public accounting firm may not be able to certify as to their effectiveness, which

could have a significant and adverse effect on our business and reputation.

As a new public reporting company, we will be

in a continuing process of developing, establishing, and maintaining internal controls and procedures that will allow our management to

report on, and our independent registered public accounting firm to attest to, our internal controls over financial reporting if and when

required to do so under Section 404 of the Sarbanes-Oxley Act of 2002. Although our independent registered public accounting firm is not

required to attest to the effectiveness of our internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley

Act until the date we are no longer an emerging growth company, our management will be required to report on our internal controls over

financial reporting under Section 404. If we fail to achieve and maintain the adequacy of our internal controls, we would not be able

to conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with Section 404. At such

time, our independent registered public accounting firm may issue a report that is adverse in the event it is not satisfied with the level

at which our controls are documented, designed or operating. Moreover, our testing, or the subsequent testing by our independent registered

public accounting firm that must be performed may reveal other material weaknesses or that the material weaknesses have not been fully

remediated. If we do not remediate our material weaknesses, or if other material weaknesses are identified or we are not able to comply

with the requirements of Section 404 in a timely manner, our reported financial results could be materially misstated or could subsequently

require restatement, we could receive an adverse opinion regarding our internal controls over financial reporting from our independent

registered public accounting firm and we could be subject to investigations or sanctions by regulatory authorities, which would require

additional financial and management resources, and the market price of our stock could decline.

Limitations on director and officer liability

and indemnification of our Company’s officers and directors by us may discourage shareholders from bringing a lawsuit against an

officer or director.

Our Company’s certificate of incorporation

and bylaws provide, with certain exceptions as required by governing state law, that a director or officer shall not be personally liable

to us or our shareholders for breach of fiduciary duty as a director or officer, except for acts or omissions which involve intentional

misconduct, fraud or knowing violation of law, or unlawful payments of dividends. These provisions may discourage shareholders from bringing

a lawsuit against a director or officer for breach of fiduciary duty and may reduce the likelihood of derivative litigation brought by

shareholders on the Company’s behalf against a director or officer.

Our management has limited experience managing

a public company.

At the present time, our management has limited

experience in managing a public company. This may hinder our ability to establish effective controls and systems and comply with all applicable

requirements associated with being a public company. If compliance problems result, these problems could have a material adverse effect

on our business, financial condition or results of operations. As a public company, we will incur significant legal, accounting and other

expenses that we did not incur as a private company. In addition, the Sarbanes-Oxley Act of 2002, or Sarbanes-Oxley Act, and the Dodd-Frank

Act of 2010, as well as rules subsequently implemented by the SEC, have imposed various requirements on public companies, including requiring

changes in corporate governance practices. Our management and other personnel will need to devote a substantial amount of time to our

new compliance requirements. Moreover, these requirements will increase our legal, accounting and financial compliance costs and will

make some activities more time-consuming and costly. For example, we expect it will be difficult and expensive for us to obtain director

and officer liability insurance. These requirements could also make it more difficult for us to attract and retain qualified persons to

serve on our board of directors, our board committees or as executive officers.

We may have difficulty establishing adequate

management, legal and financial controls in the PRC.

We may have difficulty in hiring and retaining

a sufficient number of qualified employees to serve as our management staff. As a result of these factors, we may experience difficulty

in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account

and corporate records and instituting business practices that meet western standards. Therefore, we may, in turn, experience difficulties

in implementing and maintaining adequate internal controls as will be required under Section 404 of the Sarbanes Oxley Act of 2002.

Risks Related to Doing Business in the PRC

Changes in United States and China relations,

as well as relations with other countries, and/or regulations may adversely impact our business, our operating results, our ability to

raise capital and the market price of our shares.

The U.S. government, including the SEC, has made

statements and taken certain actions that led to changes to United States and international relations, and will impact companies with

connections to the United States or China, including imposing several rounds of tariffs affecting certain products manufactured in China,

imposing certain sanctions and restrictions in relation to China and issuing statements indicating enhanced review of companies with significant

China-based operations. It is unknown whether and to what extent new legislation, executive orders, tariffs, laws or regulations will

be adopted, or the effect that any such actions would have on companies with significant connections to the U.S. or to China, our industry

or on us. Any unfavorable government policies on cross-border relations and/or international trade, including increased scrutiny on companies

with significant China-based operations, capital controls or tariffs, may affect our ability to raise capital and the market price of

our shares.

Furthermore, the SEC has issued statements primarily

focused on companies with significant China-based operations, such as us. For example, on July 30, 2021, Gary Gensler, Chairman of the

SEC, issued a Statement on Investor Protection Related to Recent Developments in China, pursuant to which Chairman Gensler stated that

he has asked the SEC staff to engage in targeted additional reviews of filings for companies with significant China-based operations.

The statement also addressed risks inherent in companies with a Variable Interest Entity, or a VIE structure. We do not have a VIE structure

and are not in an industry that is subject to foreign ownership limitations by China. Further, we believe that we have robust disclosures

relating to our operations in China, including the relevant risks noted in Chairman Gensler’s statement. However, it is possible

that the Company’s periodic reports and other filings with the SEC may be subject to enhanced review by the SEC and this additional

scrutiny could affect our ability to effectively raise capital in the United States.

In response to the SEC’s July 30 statement,

the China Securities Regulatory Commission (CSRC) announced on August 1, 2021, that “it is our belief that Chinese and U.S. regulators

shall continue to enhance communication with the principle of mutual respect and cooperation, and properly address the issues related

to the supervision of China-based companies listed in the U.S. so as to form stable policy expectations and create benign rules framework

for the market.” While the CSRC will continue to collaborate “closely with different stakeholders including investors, companies,

and relevant authorities to further promote transparency and certainty of policies and implementing measures,” it emphasized that

it “has always been open to companies’ choices to list their securities on international or domestic markets in compliance

with relevant laws and regulations.”

If any new legislation, executive orders, tariffs,

laws and/or regulations are implemented, if existing trade agreements are renegotiated or if the U.S. or Chinese governments take retaliatory

actions due to the recent U.S.-China tension, such changes could have an adverse effect on our business, financial condition and results

of operations, our ability to raise capital and the market price of our shares.

The operations of our subsidiaries in China,

as well as our financial operations in the U.S. to the extent that they affect our subsidiaries in China, will be subject to a high level

of control by the national and provincial bureaucracies in the PRC. Exercise by government authorities of that control could significantly

interfere with our ability to conduct our operations in the best interests of our company and its shareholders, which could cause the

value of our common stock to decline and limit or prevent our efforts to finance the operations of Longduoduo Health Technology.

The government of the PRC is highly bureaucratized,

as are the provincial governments in China. Whereas the authority of agencies in the U.S. government is restricted to a stated mandate

by principles and regulations of administrative law, agencies of the PRC government have broad authority to impose and administer regulations,

and to collect information, as they deem in the best interests of the nation. As a result, our Company’s Board of Directors may

find its ability to develop and implement a business plan constrained by the regulatory activities of government agencies in the PRC,

which are able to exert substantial and wide-ranging control over our Company’s operations, both those of Longduoduo Health Technology,

our principal Chinese subsidiary, and the financial operations of Longduoduo.

The PRC agencies that will exercise have significant

control over our Company’s operations include:

| |

● |

China Securities Regulatory Commission (“CSRC”), which since March 2023 has imposed extensive reporting requirements and other regulations on companies structured as ours: offshore holding companies with operations based in China. The CSRC now requires that such companies obtain pre-approval of offshore securities listings and offshore securities offerings, and the CSRC, in reviewing such filings, has broad discretion to limit or prevent offshore financing activities that CSRC believes put the interests of China at risk, including risks attendant to indirect offshore investment in companies that control significant data, personal or otherwise, and companies involved in a wide range of industries that CSRC deems essential to the PRC. |

| |

● |

State Administration of Foreign Exchange (“SAFE”), which governs inflows and outflows of capital with respect to the PRC, and has broad authority to regulate or restrict, by registration requirements or prohibitions, cross-border transactions and currency exchange as needed to protect the interests of the PRC. |

| |

● |

Cyberspace Administration of China (“CAC”), which has broad authority to regulate conduct within the PRC and offshore as it relates to cyberspace activities touching on the PRC. Among the proposed regulations under review by the CAC are a requirement that China-based enterprises holding significant user data be required to undergo review and approval by CAC before soliciting offshore investment. |

| |

● |

Ministry of Commerce (“MOFCOM”), which has broad regulatory authority over commercial activity in the PRC, with particular focus on foreign-invested commercial activity. Among MOFCOM’s activities is reviewing offshore investments in Chinese enterprises to assure the capital is used for purposes that fall within the pre-approved business plan of the Chinese recipient. |

Investors considering investment in Longduoduo,

therefore, should understand that the control of our Board of Directors over the plans and operations of our Company will be subject to

the extensive control that the government of China may exercise over both Longduoduo Health Technology, our principal Chinese subsidiary,

and the activities of its U.S. parent company as they involve Longduoduo Health Technology. Our Board may find, at times, that actions

it considers in the best interests of our Company and its shareholders are restricted or prevented by policies of one or more Chinese

government agencies. These restrictions, in turn, may make our public securities less valuable and interfere with our efforts to raise

capital for the operations of Longduoduo Health Technology.

The government of China will make a direct

intervention into the operations of a China-based company and take control of its operations or significantly restrict its operations

if the government believes such action is in the best interests of the Chinese nation.

The Chinese government may intervene or influence

our operations at any time, or may exert control over operations of our business, which could result in a material change in our operations

and/or the value of our securities. Any actions by the Chinese government to exert more oversight and control over offerings that are

conducted overseas and/or foreign investment in China-based issuers could significantly limit or completely hinder our ability to offer

or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. The government

of the PRC is not bound by principles of substantive due process similar to those binding on the U.S. government. Therefore, the government

of the PRC considers itself charged with unrestricted responsibility for the well-being of its nation, and will intervene in the economy

of the PRC in general or in the affairs of an individual enterprise within the PRC, as it deems appropriate to protect the well-being

of the PRC. Such intervention can take the form of restrictions on the operations of the enterprise, denial of approvals required under

Chinese law to conduct the business of the enterprise, influence exerted on the appointment of management, and has in some cases involved