Hampton Financial Corporation

(“

Hampton” or the “

Company”,

TSXV:HFC) advises that it has concluded its negotiations of the

terms upon which it will acquire a controlling interest in Oxygen

Working Capital Corp.(“

OCC”) of Oakville, Ontario,

representing Hampton’s first foray into the Commercial Lending

sector. Hampton anticipates closing the acquisition of

OCC on April 1, 2024. OCC is a specialized lender focused on the

commercial factoring business with clients across Canada, with

prospects for expanded reach and continued growth. The definitive

purchase agreement will be executed on closing.

Pursuant to the terms of the acquisition, which

differ from those of the non-binding letter of intent described in

the Company’s November 7, 2023 press release, the Company will

acquire from the shareholders of OCC 100% of the outstanding common

shares of OCC, having an aggregate value of $9,783,250 in exchange

for 21,755,071 subordinate voting shares of the Issuer to be issued

to OCC shareholders at $0.45 per share, together with approximately

5,438,779 warrants of OCC, each such warrant entitling the holder

thereof to purchase one common share of OCC at the price of $0.50

per share for a period of 36 months. If all of the OCC warrants are

exercised Hampton will own a fully diluted 80% equity stake in OCC.

The acquisition will not result in a change of control of Hampton.

The acquisition is not subject to approval by shareholders of

Hampton, though it is subject to final approval by the TSX Venture

Exchange.

OCC has assets including loan receivables of

approximately $12,400,000 and commercial liabilities of

approximately $9,000,000. OCC unaudited financial results for the

12-month period ending April 2023 are as follows:

- Total Assets of $10,068,000

- Total Liabilities of

$17,060,000

- Revenue of $2,418,000

- Net Loss of $3,953,000

The commercial factoring business of OCC has

grown since it was established in 2015. Under the leadership of its

experienced and current management team, and as part of the broader

Hampton business platform, OWC is expected to contribute to the

growth of Hampton’s consolidated revenues and earnings while

benefiting from Hampton’s existing capital markets capabilities to

further grow its lending capacity while being able to service a

broader range of commercial lending clients.

“This acquisition will serve as a

significant step for Hampton Financial as we begin the first phase

of the company’s development into a broader financial services

group. We expect this transaction to be accretive to fully diluted

earnings in the coming year,” said Hampton Executive

Chairman & CEO, Peter Deeb.

About Hampton Financial

Corporation

Hampton is a unique private equity firm that

seeks to build shareholder value through long-term strategic

investments.

Through HSL, Hampton is actively engaged in

family office, wealth management, institutional services and

capital markets activities. HSL is a full-service investment

dealer, regulated by CIRO and registered in Alberta, British

Columbia, Manitoba, Saskatchewan, Nova Scotia, Northwest

Territories, Ontario, and Quebec. In addition, the Company, through

HSL, provides investment banking services, which include assisting

companies with raising capital, advising on mergers and

acquisitions, and aiding issuers in obtaining a listing on

recognized securities exchanges in Canada and abroad and HSL’s

Corporate Finance Group provides early stage, growing companies the

capital, they need to create value for investors. HSL continues to

develop its Wealth Management, Advisory Team and Principal-Agent

programs which offers to the industry’s most experienced wealth

managers a unique and flexible operating platform that provides

additional freedom, financial support, and tax effectiveness as

they build and manage their professional practice.

The Company is also exploring opportunities to

diversify its sources of revenue by way of strategic investments in

both complimentary business and non-core sectors that can leverage

the expertise of its Board and the diverse experience of its

management team.

For more information, please contact:

Olga JuravlevChief Financial OfficerHampton

Financial Corporation(416) 862-8701

Or

Peter M. DeebExecutive Chairman & CEOHampton

Financial Corporation(416) 862-8651

The TSXV has in no way approved nor

disapproved the contents of this press release. Neither

the TSXV nor its Regulation Services Provider

(as that term is defined in the policies of the

TSXV) accepts responsibility for the adequacy

or accuracy of this press release.

No securities regulatory authority has

either approved or disapproved of the contents of

this press release. This press release does

not constitute or form a part of any offer or solicitation

to buy or sell any securities in the United

States or any other jurisdiction outside of Canada.

The securities being offered have not been

and will not be registered under the United

States Securities Act of 1933, as amended

(the "U.S. Securities Act"), or the securities laws of any

state of the United States and may not be

offered or sold within the United States or to a U.S.

person absent registration or pursuant to an

available exemption from the registration requirements

of the U.S. Securities Act and applicable

state securities laws. There will be no public offering

of securities in the United

States.

Forward-Looking Statements

This press release contains certain

forward-looking statements and forward-looking information

(collectively referred to herein as "forward-looking

statements") within the meaning of applicable Canadian

securities laws, which may include, but are not limited to,

information and statements regarding or inferring the future

business, operations, financial performance, prospects, and other

plans, intentions, expectations, estimates, and beliefs of the

Company. All statements other than statements of present or

historical fact are forward-looking statements. Forward-looking

statements are often, but not always, identified by the use of

words such as “should”, “hopeful”, “recovery”, "anticipate",

"achieve", "could", "believe", "plan", "intend", "objective",

"continuous", "ongoing", "estimate", "outlook", "expect", "may",

"will", "project" or similar words, including negatives thereof,

suggesting future outcomes.

Forward-looking statements involve and are

subject to assumptions and known and unknown risks, uncertainties,

and other factors beyond the Company’s ability to predict or

control which may cause actual events, results, performance, or

achievements of the Company to be materially different from future

events, results, performance, and achievements expressed or implied

by forward-looking statements herein. Forward-looking statements

are not a guarantee of future performance. Although the Company

believes that any forward-looking statements herein are reasonable,

in light of the use of assumptions and the significant risks and

uncertainties inherent in such statements, there can be no

assurance that any such forward-looking statements will prove to be

accurate. Actual results may vary, and vary materially, from those

expressed or implied by the forward-looking statements herein.

Accordingly, readers are advised to rely on their own evaluation of

the risks and uncertainties inherent in forward-looking statements

herein and should not place undue reliance upon such

forward-looking statements. All forward-looking statements herein

are qualified by this cautionary statement. Any forward-looking

statements herein are made only as of the date hereof, and except

as required by applicable laws, the Company assumes no obligation

and disclaims any intention to update or revise any forward-looking

statements herein or to update the reasons that actual events or

results could or do differ from those projected in any

forward-looking statements herein, whether as a result of new

information, future events or results, or otherwise, except as

required by applicable laws.

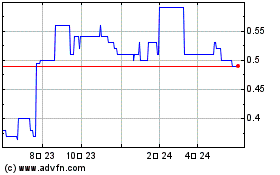

Hampton Financial (TSXV:HFC)

過去 株価チャート

から 11 2024 まで 12 2024

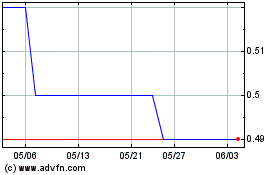

Hampton Financial (TSXV:HFC)

過去 株価チャート

から 12 2023 まで 12 2024