Brixton Metals Corporation

(TSX-V: BBB, OTCQB:

BBBXF) (the “

Company” or

“

Brixton”) is pleased to announce the remaining

2023 drill results from its Camp Creek Copper Porphyry Target on

its wholly owned Thorn Project. The project is located in Northwest

British Columbia, 90km east of Juneau, Alaska and within the Taku

River Tlingit and Tahltan First Nation’s traditional territory.

Highlights

- Step-out drilling in 2023 has

expanded copper porphyry mineralization to a 950m by 1050m area at

the Camp Creek Target which remains open in multiple

directions

- THN23-285 intersected 717.00m of

0.50% CuEq (0.20% Cu, 0.05 g/t Au, 1.92 g/t Ag, 458 ppm Mo)

- Including 248.05m of 0.60% CuEq (0.37% Cu, 0.10 g/t Au, 3.32

g/t Ag, 255 ppm Mo)

- Hole THN23-277 ended in strong

copper mineralization (2m of 0.66% Cu) with strong porphyry

indicators and while the hole failed to reach its target depth, it

is set up to wedge from 900m depth as a daughter hole early next

drill season

Chairman and CEO Gary Thompson stated: “2023

proved to be another successful year on the Camp Creek Copper

Porphyry Target. We have what appears to be a large mineralized and

alteration footprint with limited deep holes testing a buried

system. In collaboration with MDRU (UBC’s Mineral Deposit Research

Unit) and the recent oversubscribed $14.5 million financing, we

look forward to further drill-testing this target during the 2024

field season.”

Figure 1. Thorn Project and Copper Target

Location Map with Copper Geochemistry.

Discussion

The 2023 program at the Camp Creek Porphyry

Target totaled 10,099.68m of drilling from nine holes. This News

Release covers the remaining four drill holes for Camp Creek. For

previous assays from the 2023 program at Camp Creek see News

Release dated September 21st, 2023. Camp Creek is a newly

discovered, blind calc-alkalic copper-gold-silver-molybdenum

porphyry target with only seventeen holes testing greater than 800m

depth since 2019.

Drill hole THN23-285 was drilled as a 170m step

out to the east from THN22-201 (967.71m of 0.43% CuEq) and a 200m

step out to the southeast from THN21-184 (318.25m of 1.03% CuEq

within 821.25m of 0.54% CuEq). THN23-285 was drilled to 1602.00m,

making it the second deepest hole on the property, with broad

vein-hosted and disseminated chalcopyrite-molybdenite

mineralization within the Cretaceous aged Porphyry X unit and

Triassic Stuhini Group sediments. THN23-285 intersected 717.00m of

0.50% CuEq, including 248.05m of 0.60% CuEq, all within 1564.50m of

0.35% CuEq. In addition to Cu-Mo porphyry mineralization,

near-surface high-sulphidation epithermal veins at 173.0m yielded

10.39 g/t Au and 76.82 g/t Ag over 1.00m.

Table 1. Select Mineralized Intervals from

THN23-285.

|

Hole |

From |

To |

Interval |

Cu (%) |

Au (g/t) |

Ag (g/t) |

Mo (ppm) |

CuEq (%) |

|

THN23-285 |

37.50 |

1602.00 |

1564.50 |

0.15 |

0.08 |

2.09 |

246 |

0.35 |

|

including |

173.00 |

174.00 |

1.00 |

0.03 |

10.39 |

76.82 |

10 |

7.69 |

|

and including |

426.00 |

1602.00 |

1176.00 |

0.19 |

0.07 |

1.96 |

324 |

0.44 |

|

including |

807.00 |

1309.80 |

502.80 |

0.29 |

0.07 |

2.73 |

342 |

0.55 |

|

and including |

885.00 |

1602.00 |

717.00 |

0.20 |

0.05 |

1.92 |

458 |

0.50 |

|

including |

885.00 |

1133.05 |

248.05 |

0.37 |

0.10 |

3.32 |

255 |

0.60 |

|

and including |

1159.20 |

1309.80 |

150.60 |

0.25 |

0.03 |

2.27 |

638 |

0.64 |

The true width of the mineralized intervals have not yet been

determined.

Copper Equivalent (CuEq) is calculated based on

US$ 3.82/lb Cu, US$ 1863.32/oz Au, US$ 22.59/oz Ag, $US 23.19/lb

Mo. These prices represent the approximate 1 year moving averages

of metal prices and calculations assume 95% recovery.

CuEq % = (Cu % + (0.711384* Au g/t) + (0.008624 *

Ag g/t) + (0.000607 * Mo ppm)) * 0.95

Figure 2: Hole THN23-285 Core Photograph at

976.75m Depth from a 1.00m Interval that Assayed 0.35% Cu, 207 ppm

Mo.

THN23-277 was planned as a follow up to

THN23-261 (855.00m of 0.52% CuEq), stepping out 250m to the

west-southwest towards THN22-201. Due to poor ground conditions

which led to delays in drilling, THN23-277 was only drilled to a

total depth of 1041.00m. The hole ended in strong Cu-Mo

mineralization with 84.00m of 0.42% CuEq, within 724.00m of 0.22%

CuEq starting at 317.00m. Intercepts of Porphyry X began at 705.50m

and continued to end of hole. THN23-277 encountered some of the

most abundant mineralized quartz veining observed at Camp Creek

with stockwork vein densities of up to 60%. Given the encouraging

visuals from the core, casing and drill rods were left in the hole

to re-enter and continue drilling as a daughter wedge hole at the

start of the 2024 field season. A 2.00m interval from 1032.00m

depth assayed 0.66% Cu, 112 ppm Mo, 12.0 g/t Ag, 0.24 g/t Au.

THN23-276 was a 250m step out to the

east-northeast from THN23-261. The objective was to test between

previous deep mineralized porphyry intercepts and the Oban Breccia,

where drilling in 2019 yielded 554.70m of 0.97% CuEq from

THN19-150. THN23-276 was drilled to a depth of 1470.00m and

intersected multiple intervals of Porphyry X. THN23-276 yielded

1087.48m of 0.15% CuEq, including 506.00m of 0.21% CuEq, and

including 34.41m 0.47% CuEq. While PX intervals hosted consistent

Cu-Mo mineralization, overall grades were diluted by a series of

late-mineralization feldspar-porphyry intrusions.

THN23-263 was planned as a 450m step-out to the

east from THN22-221 (779.65m of 0.41% CuEq) to test whether copper

porphyry mineralization extends to the northeast along Camp Creek

where strong argillic alteration is observed on surface. THN23-263

was drilled to a depth of 1425.00m and intersected dominantly

Stuhini Group sediments, Cretaceous aged Porphyry Y unit, and a

polymictic mineralized breccia starting at 1240.00m to end of hole.

Hole 263 yielded 726.00m of 0.14% CuEq including 189.00m of 0.21%

CuEq, with increasing grades at the bottom of the hole within the

brecciated unit. While no Porphyry X was intersected in hole 263,

it was successful in expanding the copper porphyry mineralization

footprint at Camp Creek to a 950m x 1050m area, which remains open

in multiple directions.

Figure 3. Camp Creek Drill Hole Intersections at

-400m Elevation Below Sea Level.

Figure 4. Cross Section of the Camp Creek Drill

Target.

Table 2. Select Mineralized Intervals.

|

Hole |

From |

To |

Interval |

Cu (%) |

Au (g/t) |

Ag (g/t) |

Mo (ppm) |

CuEq (%) |

|

THN23-277 |

317.00 |

1041.00 |

724.00 |

0.13 |

0.05 |

2.85 |

66 |

0.22 |

|

including |

445.50 |

1041.00 |

595.50 |

0.15 |

0.06 |

2.31 |

80 |

0.24 |

|

including |

556.27 |

1041.00 |

484.73 |

0.15 |

0.06 |

2.27 |

92 |

0.26 |

|

including |

646.50 |

1041.00 |

394.50 |

0.16 |

0.06 |

2.27 |

93 |

0.27 |

|

including |

957.00 |

1041.00 |

84.00 |

0.25 |

0.09 |

3.78 |

142 |

0.42 |

|

|

|

|

|

|

|

|

|

|

|

THN23-276 |

382.52 |

1470.00 |

1087.48 |

0.09 |

0.03 |

1.82 |

52 |

0.15 |

|

including |

595.00 |

1447.00 |

852.00 |

0.10 |

0.03 |

1.63 |

65 |

0.17 |

|

including |

815.00 |

1321.00 |

506.00 |

0.13 |

0.04 |

1.72 |

84 |

0.21 |

|

including |

940.00 |

1321.00 |

381.00 |

0.15 |

0.04 |

1.35 |

93 |

0.23 |

|

including |

940.00 |

974.41 |

34.41 |

0.30 |

0.09 |

2.99 |

169 |

0.47 |

|

and including |

1289.50 |

1321.00 |

31.50 |

0.20 |

0.06 |

1.54 |

288 |

0.41 |

|

|

|

|

|

|

|

|

|

|

|

THN23-263 |

42.00 |

1425.00 |

1383.00 |

0.05 |

0.04 |

2.44 |

18 |

0.11 |

|

including |

699.00 |

1425.00 |

726.00 |

0.09 |

0.03 |

2.31 |

32 |

0.14 |

|

including |

1063.00 |

1425.00 |

362.00 |

0.12 |

0.03 |

1.81 |

52 |

0.18 |

|

including |

1236.00 |

1425.00 |

189.00 |

0.15 |

0.03 |

1.90 |

65 |

0.21 |

|

including |

1270.50 |

1425.00 |

154.50 |

0.17 |

0.03 |

2.12 |

74 |

0.24 |

|

including |

1306.00 |

1425.00 |

119.00 |

0.20 |

0.03 |

2.50 |

83 |

0.28 |

Figure 5: Hole THN23-277 Photograph of

Mineralized Core at 1032.88m Depth from a 2.00m Interval that

Assayed 0.66% Cu, 112 ppm Mo, 12.0 g/t Ag, 0.24 g/t Au.

Figure 6. Hole THN23-263 Photograph of

Mineralized Core at 1324.60m Depth from a 1.00m Interval that

Assayed 2.64% Cu, 473 ppm Mo, 34.7 g/t Ag, 0.27 g/t Au.

MDRU Collaboration

Brixton Metals is collaborating with the

University of British Columbia’s Mineral Deposit Research Unit as

part of the BC Porphyry Study. An M.Sc. research project has

commenced on the Camp Creek Porphyry Target with the goal of

establishing geochemical and alteration vectors towards blind

porphyry mineralization. In addition, an alteration mapping project

is underway to characterize and map the large 4.1km x 3.9km

alteration footprint centered around Camp Creek. With porphyry

deposits frequently found in clusters, the use of petrographic,

geochemical, and mineral spectrometer analyses will be used on

drill core and 177 hand specimens collected within the alteration

footprint during the 2023 field season to aid with further

vectoring outside of the currently drilled area.

Table 3. Collar Information of Current News

Release.

|

Hole ID |

Easting |

Northing |

Elevation (m) |

Azimuth |

Dip |

Depth (m) |

Zone |

|

THN23-263 |

628425 |

6492218 |

828 |

105 |

-83 |

1425 |

Camp Creek |

|

THN23-276 |

628614 |

6492065 |

773 |

216 |

-82 |

1470 |

Camp Creek |

|

THN23-277 |

628139 |

6491800 |

774 |

343 |

-80 |

1041 |

Camp Creek |

|

THN23-285 |

627876 |

6491944 |

672 |

110 |

-84 |

1602 |

Camp Creek |

Quality Assurance & Quality

Control

Quality assurance and quality control protocols

for drill core sampling was developed by Brixton. Core samples were

mostly taken at 1.0 – 2.0m intervals. Blank, duplicate (lab pulp)

and certified reference materials were inserted into the sample

stream for at least every 20 drill core samples. Core samples were

cut in half, bagged, zip-tied and sent directly to ALS Minerals

preparation facility in Langley, British Columbia. ALS Minerals

Laboratories is registered to ISO 9001:2008 and ISO 17025

accreditations for laboratory procedures. Samples were analyzed at

ALS Laboratory Facilities in North Vancouver, British Columbia for

gold by fire assay with an atomic absorption finish, whereas Ag,

Pb, Cu and Zn and 48 additional elements were analyzed using four

acid digestion with an ICP-MS finish. Over limits for gold were

analyzed using fire assay and gravimetric finish. The standards,

certified reference materials, were acquired from CDN Resource

Laboratories Ltd., of Langley, British Columbia and the standards

inserted varied depending on the type and abundance of

mineralization visually observed in the primary sample. Blank

material used consisted of non-mineralized siliceous landscaping

rock. A copy of the QAQC protocols can be viewed at the Company’s

website.

Qualified Person

Mr. Daniel Guestrin, P.Geo., is a Senior Project

Geologist for the company and a qualified person as defined by

National Instrument 43-101. Mr. Guestrin has verified the data

disclosed in this press release, including the sampling,

analytical and test data underlying the technical information and

has approved this press release.

About Brixton Metals

Corporation

Brixton Metals is a Canadian exploration company

focused on the advancement of its mining projects. Brixton wholly

owns four exploration projects: Brixton’s flagship Thorn

copper-gold-silver-molybdenum Project, the Hog Heaven

copper-silver-gold Project in NW Montana, USA, which is optioned to

Ivanhoe Electric Inc., the Langis-HudBay silver-cobalt-nickel

Project in Ontario and the Atlin Goldfields Project located in

northwest BC. Brixton Metals Corporation shares trade on the TSX-V

under the ticker symbol BBB, and on the OTCQB

under the ticker symbol BBBXF. For more

information about Brixton, please visit our website at

www.brixtonmetals.com.

On Behalf of the Board of Directors

Mr. Gary R. Thompson, Chairman and CEOTel:

604-630-9707 or email: info@brixtonmetals.com

For Investor Relations inquiries, please

contact: Mr. Jason Shepherd, VP Investor Relations Tel:

604-630-9707 or email: jason@brixtonmetals.com

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Information set forth in this news release may

involve forward-looking statements under applicable securities

laws. Forward-looking statements are statements that relate to

future, not past, events. In this context, forward-looking

statements often address expected future business and financial

performance, and often contain words such as “anticipate”,

“believe”, “plan”, “estimate”, “expect”, and “intend”, statements

that an action or event “may”, “might”, “could”, “should”, or

“will” be taken or occur, including statements that address

potential quantity and/or grade of minerals, potential size and

expansion of a mineralized zone, proposed timing of exploration and

development plans, or other similar expressions. All statements,

other than statements of historical fact included herein including,

without limitation, statements regarding the use of proceeds. By

their nature, forward-looking statements involve known and unknown

risks, uncertainties and other factors which may cause our actual

results, performance or achievements, or other future events, to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Such factors include, among others, the following

risks: the need for additional financing; operational risks

associated with mineral exploration; fluctuations in commodity

prices; title matters; and the additional risks identified in the

annual information form of the Company or other reports and filings

with the TSXV and applicable Canadian securities regulators.

Forward-looking statements are made based on management’s beliefs,

estimates and opinions on the date that statements are made and the

Company undertakes no obligation to update forward-looking

statements if these beliefs, estimates and opinions or other

circumstances should change, except as required by applicable

securities laws. Investors are cautioned against attributing undue

certainty to forward-looking statements.

Figures accompanying this announcement are available at:

https://brixtonmetals.com/wp-content/uploads/2023/12/Figure-1-NR_13Dec2023.png

https://brixtonmetals.com/wp-content/uploads/2023/12/Figure-2-NR-13Dec2023-scaled.jpg

https://brixtonmetals.com/wp-content/uploads/2023/12/Figure-3-NR-13Dec2023-scaled.jpg

https://brixtonmetals.com/wp-content/uploads/2023/12/Figure-4-NR-13Dec2023-scaled.jpg

https://brixtonmetals.com/wp-content/uploads/2023/12/Figure-5-NR-13Dec2023-scaled.jpg

https://brixtonmetals.com/wp-content/uploads/2023/12/Figure-6-NR-13Dec2023-scaled.jpg

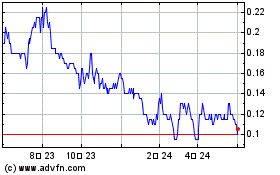

Brixton Metals (TSXV:BBB)

過去 株価チャート

から 11 2024 まで 12 2024

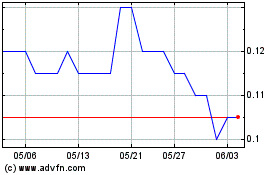

Brixton Metals (TSXV:BBB)

過去 株価チャート

から 12 2023 まで 12 2024