Verde AgriTech Plc (TSX: “NPK”) (OTCMKTS:

“VNPKF”) ("

Verde” or the

“

Company”) is pleased to announce its financial

results for the full year ended December 31, 2022 (“

FY

2022”) and the fourth quarter 2022 (“

Q4

2022”).

FY 2022

Financials

- Revenue increased by 190% in FY 2022, to $80,271,000

compared to $27,709,000 in FY 2021.

- Revenue in Brazilian Real (“R$”) increased by

167% in FY 2022, to R$318,544,000, compared to R$119,310,000 in FY

2021.

- Sales of Verde's multinutrient potassium products, BAKS® and K

Forte® sold internationally as Super Greensand® (the “Product”) by

volume increased by 57% in FY 2022, to 628,000 tonnes compared

to 400,000 tonnes in FY 2021.

- Gross margin increased to 78% in FY 2022, compared to 74% in FY

2021.

- EBITDA before non-cash events increased by 271% in FY 2022, to

$23,912,000 compared to $6,450,000 in FY 2021.

- Net profit increased by 405%, to $17,804,000 in FY 2022

compared to $3,522,000 in FY 2021.

- Capital expenditures increased to $41,623,000 in FY 20222

compared to $2,179,000 in FY 2021.

"Our record results in 2022 demonstrate Verde's

commitment to growth and innovation. In parallel, we are proud to

have achieved important milestones throughout the year, including

the conclusion of our updated Pre-Feasibility Study, the

construction and expansion of Plant 2, the redomiciliation of our

Company to Singapore, and the renewal of our Board of Directors,

with Luciana de Oliveira Cezar Coelho, Madeleine Lee and Fernando

Prezzotto,” declared Verde’s Founder, President & CEO Cristiano

Veloso.

“We are proud to now be Brazil's largest potash

producer by capacity, with an installed capacity of 3 million

tonnes per year (“Mtpy”). However, our ambitions

do not stop here. We are determined to continue growing and reach

our goal of producing 50Mtpy as outlined in our PFS.1 To achieve

this, in 2022 we have filed an Environmental License Application to

extract up to 25 Mtpy and have already been granted multiple

easements by the Brazilian National Mining Agency to build and

access future mines. Moreover, we have requested authorization from

the National Land Transport Agency to build a railway branch

capable of transporting up to 50 Mtpy of our product, linking our

facilities to the Ferrovia Centro Atlântica, the largest railroad

network in Brazil. We are grateful for the tireless efforts and

dedication of our employees, without whom these milestones would

not have been possible. I want to express my sincere gratitude to

each and every one of them," concluded Mr. Veloso.

2022’s Key Milestones

On March 22, 2022, Verde announced its key

objectives for that year. A review of those objectives is detailed

below:

Launch a new technology in Q2 2022

In April 2022, Verde launched Bio Revolution, a

technology that enables the incorporation of microorganisms to

mineral fertilizers. K Forte® is the first fertilizer in the world

to use Bio Revolution technology. Bacillus aryabhattai will be the

first microorganism to be incorporated into Verde's Product, it is

a bacterial strain widely renowned in agriculture for its multiple

benefits.

Finish the expansion Pre-Feasibility Study

(“PFS”)

In May 2022, Verde concluded the expansion PFS for

the Cerrado Verde Project, which supplants the Pre-Feasibility

Study completed in December 2017, covering the financial economic

potential for the Brazilian agricultural market for potash,

sulphur, and the micronutrients zinc, boron, copper and manganese.

The expansion PFS contemplates three distinct and independent

production scenarios for Verde’s Product with annual productions of

10Mtpy, 23Mtpy and 50Mtpy.2

Reach Plant 2’s commercial production by Q3

2022

In August 2022, the Company announced the

commissioning of its second production plant (“Plant 2”), with

initial capacity to produce up to 1.2 Mtpy of Product. It achieved

its nameplate capacity in October 2022.

Expand Plant 2’s operational capacity from

1,200,000 to 2,400,000 tpy by Q4 2022, raising Verde’s overall

production capacity to 3,000,000 tpy

In November 2022, Verde announced that the

expansion of Plant 2 was complete, increasing the Company’s total

production capacity to 3Mtpy.

Upgrade local infrastructure to sustain Plant 2’s

logistics

As part of Plant 2’s logistics corridor, the

Company upgraded the road infrastructure, including 22 kms of

roads, 14 kms of asphalting, and the construction of a new bridge.

At its peak, the Company employed 350 people in the construction

works of Plant 2 and correlated infrastructure.

Reach 100 cities with Cultivando Amor – Verde’s

flagship social engagement program that donates part of Verde’s

sales proceeds to charities chosen by the Company’s clients in

their municipalities.

In 2022, Verde donated over R$262,900 to local

charities across 06 cities in Brazil.

2022 Overview

Fertilizer demand and commodities market

At the onset of the Ukrainian war, in February

2022, concerns that geopolitical sanctions against Russia would

cause significant shortage of potash fertilizers resulted in a 154%

surge in the average price of potash between March and July,

compared to 2021.3 However, this fear proved unfounded, as there

was actually a glut of potash in the market due to increased

availability, resulting in a 45% surge in potash imports by Brazil

over the same period, compared to 2021.4 This oversupply, combined

with a 15% drop in potash consumption in Brazil in 2022,5

contributed to a challenging market for fertilizer producers.

Brazil potassium chloride imports (‘000

tonnes)6

|

Month |

2021 |

2022 |

YoY |

2023 |

YoY |

| January |

738 |

695 |

-6 |

% |

501 |

-28 |

% |

|

February |

977 |

896 |

-8 |

% |

729 |

-19 |

% |

| March |

730 |

855 |

17 |

% |

- |

- |

|

| April |

643 |

1,181 |

84 |

% |

- |

- |

|

| May |

807 |

1,413 |

75 |

% |

- |

- |

|

| June |

987 |

1,552 |

57 |

% |

- |

- |

|

| July |

1,283 |

1,471 |

15 |

% |

- |

- |

|

| August |

1,454 |

944 |

-35 |

% |

- |

- |

|

|

September |

1,211 |

663 |

-45 |

% |

- |

- |

|

| October |

1,349 |

649 |

-52 |

% |

- |

- |

|

|

November |

1,409 |

458 |

-67 |

% |

- |

- |

|

|

December |

941 |

511 |

-46 |

% |

- |

- |

|

|

Year total |

12,529 |

11,288 |

-10 |

% |

N/A |

N/A |

The table below compares Brazil’s monthly average

KCl CFR prices from 2021 to 2023:

KCl CFR average spot price

(US$)7

|

Month |

2021 |

2022 |

YoY |

2023 |

YoY |

| January |

256 |

772 |

202 |

% |

510 |

-34 |

% |

|

February |

285 |

781 |

174 |

% |

498 |

-36 |

% |

| March |

309 |

1018 |

229 |

% |

473 |

-54 |

% |

| April |

338 |

1183 |

250 |

% |

- |

- |

|

| May |

366 |

1113 |

204 |

% |

- |

- |

|

| June |

449 |

1030 |

129 |

% |

- |

- |

|

| July |

617 |

943 |

53 |

% |

- |

- |

|

| August |

680 |

883 |

30 |

% |

- |

- |

|

|

September |

740 |

711 |

-4 |

% |

- |

- |

|

| October |

780 |

624 |

-20 |

% |

- |

- |

|

|

November |

788 |

571 |

-28 |

% |

- |

- |

|

|

December |

780 |

513 |

-34 |

% |

- |

- |

|

In 2022, the remaining fertilizer stock in Brazil

increased by 16% compared to the previous year, while the potash

stock saw a 23% increase during the same period. These figures

demonstrate a lower overall demand for these products over the

year.

Year-end stock in Brazil ('000

tonnes)8

|

|

2021 |

2022 |

YoY |

|

Fertilizers9 |

7,274 |

8,441 |

16 |

% |

|

Potassium Chloride |

1,740 |

2,148 |

23 |

% |

Potassium chloride production, imports

and consumption in Brazil ('000 tonnes)10

|

|

2021 |

2022 |

YoY |

| Nacional

production |

335 |

290 |

-13 |

% |

| Imports |

12,529 |

11,288 |

-10 |

% |

|

Consumption |

12,868 |

10,948 |

-15 |

% |

The price for Brazil’s main agricultural

commodities has also been following. Coffee and soybeans have

fallen 28% and 7%, respectively, from January to December

2022.11

Production capacity

In the first months of 2022, Verde faced record

demand for its Product from customers looking to build potash

inventories ahead of an expected market shortage. However, despite

the expected start date for Plant 2 operations and increase in

production capacity, the Company had to halt the sale of its

Product for Q3 and Q4 delivery due to anticipated inability to

supply the demand.

In addition to that, Verde could not fulfill all

the orders in its books during the peak season between Q3 and Q4

due to limited access to and from Plant 2, caused by unforeseen

groundwater issues that impacted the new road construction. As

agriculture is a seasonal business with a determined period for

applying fertilizers for each crop, some of Verde's customers had

to cancel their orders. This had an impact on the Company's

results, which could have been better if Plant 2 had started

producing and delivering on schedule.

Brazilian Economy and Elections

The presidential election in Brazil brought

additional challenges to farmers' purchasing decisions for the

2022/2023 harvests. The fertilizer market was stagnant before the

elections, with many customers holding off on purchasing. Following

the elections, the market remained stagnant due to concerns and

uncertainty surrounding the new government policies.

The Central Bank of Brazil (the

“Bank”) kept its monetary policy

interest rate (“SELIC”) unchanged at 13.75%

for the fifth consecutive meeting in March 2023. The Bank’s

Monetary Policy Committee (“Copom”) mentioned that

global activity and inflation remain resilient, and the monetary

tightening continues to advance in major economies. Copom decided

to maintain its strategy for a longer period to ensure the

convergence of inflation, while won't hesitate to resume the

tightening cycle if the disinflationary process does not proceed as

expected.

Most recent economic activity indicators continue

to corroborate the deceleration scenario. Annual inflation eased to

5.6% in February 2023, while inflation expectations for 2023 and

2024 have increased to 6.0% and 4.1%, respectively.12 The table

below shows the SELIC rates from 2018 to 2023:

SELIC interest rates13

| March

2018 |

March

2019 |

March

2020 |

March

2021 |

March

2022 |

March

2023 |

|

6.50 |

% |

6.50 |

% |

3.75 |

% |

2.75 |

% |

11.75 |

% |

13.75 |

% |

The Brazilian economy closed the year 2022 with an

accumulated growth of 2.9%, according to the Gross Domestic Product

(“GDP”) data released by the Brazilian Institute

of Geography and Statistics (“IBGE”). In the

fourth quarter of 2022, Brazilian GDP was negative after five

consecutive increases. The decrease was 0.2% in relation to the

immediate previous three months, which reflects a scenario of

deceleration of economic activity.14

Coffee sector impacts

The Brazilian coffee sector experienced

significant challenges in 2022 due to adverse climate conditions,

following on two years of frost and drought,15,16 which disrupted

global commodity markets and impacted crop productivity for years

to come. As a result, many farmers opted not to apply

fertilizers as they anticipated low yields in the next

harvests.

The biennial cycle is a characteristic of coffee

trees, which consists of an alternation of a year with a large

flowering followed by another with less intensity in July/August.

Recently, with the incidence of hail and strong winds in the main

coffee-growing regions,17 it can not only damage current

productivity levels but also alter the cycle of the next year,

when, despite being a positive biennial crop, it may present

reduced productivity levels, as in 2022.

In 2021, a lower production was already expected

compared to that observed in 2020 due to the productive biennial

cycle of Arabica coffee. However, the 2021 harvest was further

affected by negative bienniality due to adverse weather conditions,

with the incidence of water scarcity combined with frost during the

harvest. These occurrences brought about a significant reduction in

productivity levels for this harvest, which had a great impact on

next year's harvest.

The national average productivity was 27.7 sacks

per hectare (“scs/ha”), only 4.8% higher than that

of the 2021 harvest, a year of negative bienniality, and 19.3%

lower than that recorded in the 2020 harvest, a year of positive

bienniality, like 2022.

In Minas Gerais, the largest national producer,

the average productivity was 21.6 scs/ha, 4.6% lower than the 2021

harvest, a year of negative bienniality.

The adverse weather conditions recorded before the

start of this cycle, as well as throughout this season, affected

the crops to some extent. Prolonged periods of drought and cold

fronts that even resulted in frost in some areas affected crops in

important phenological phases, impacting flowering, load, and fruit

"catching," as well as their development. During the harvest, a

fruit load well below expectations was noticed, with fewer grains

than usual, and their weight below average.

Coffee productivity report in the

Southeast Region states of Brazil18

|

Southeast Region States |

2019 |

2020 |

YoY |

2021 |

YoY |

2022 |

YoY |

| ES |

34.27 |

34.87 |

1.8 |

% |

35.4 |

1.5 |

% |

41.5 |

17.4 |

% |

| RJ |

20.92 |

31.00 |

48.2 |

% |

20.7 |

-33.1 |

% |

28.1 |

32.4 |

% |

| SP |

21.55 |

30.67 |

42.3 |

% |

20.2 |

-34.1 |

% |

22.0 |

8.5 |

% |

| SUL |

25.83 |

26.40 |

2.2 |

% |

26.5 |

0.4 |

% |

18.4 |

-30.7 |

% |

|

MG |

24.96 |

33.27 |

33.3 |

% |

22.6 |

-32.1 |

% |

21.6 |

-4.6 |

% |

|

Brazilian average productivity |

27.20 |

33.48 |

23.1 |

% |

26.4 |

-21.2 |

% |

27.7 |

4.8 |

% |

The coffee sector is a major consumer of Product

during the last quarter of the year and Verde has a competitive

geographical advantage thanks to its proximity to major coffee

growers in Brazil, reducing freight costs and boosting margins.

Therefore, the decline in Product sales in the coffee sector had

and outsized impact on the Company's Q4 2022 results.

In 2021, Verde’s sales to the coffee sector in Q4

represented 9% of total sales in the quarter and in 2022, 5% of

total sales in the quarter. The total sales volume of the Company

decreased by 7% in Q4 2022 compared to Q4 2021, but the sales

volume made to the coffee sector had a decline of 43% in the same

period, as can be seen in the table below:

Percentage of sales made to the coffee

sector in the fourth quarter

|

Year |

Q4 total

sales (tonnes of K Forte) |

Q4 sales

made to the coffee sector (tonnes of K Forte) |

Sales made

to the coffee sector (% of total sales in Q4) |

|

2018 |

29,648 |

|

4,131 |

|

14 |

% |

|

2019 |

32,221 |

|

6,953 |

|

22 |

% |

|

2020 |

56,585 |

|

14,149 |

|

25 |

% |

|

2021 |

134,000 |

|

11,952 |

|

9 |

% |

|

2022 |

125,000 |

|

6,757 |

|

5 |

% |

|

YoY |

-7 |

% |

-43 |

% |

-4 |

% |

The total number of Verde's customers in the

coffee sector decreased from 98 in Q4 2021 to 49 in Q4 2022.

Despite that, the percentage of the clients’ total purchase

potential (in tonnes of Product) that was supplied by Verde

increased from 29% in Q4 2021 to 63% Q4 2022, demonstrating an

increase in market adoption due to customers applying Verde’s

product on a larger area of their farms.

Percentage of clients’ purchase potential

(in tonnes of Product) supplied by Verde

|

Year |

Number of customers from the coffee sector in

Q4 |

Percentage

of clients’ purchase potential supplied by Verde |

| 2021 |

98 |

29 |

% |

|

2022 |

49 |

63 |

% |

“When the war in Ukraine broke out, there were

concerns about a potential shortage of potash. In reality, however,

the market was oversupplied. Throughout 2022, many farmers

refrained from buying potash due to the unprecedented soaring

prices, resulting in a 15% Brazilian potash imports and,

consequently, a record inventory build-up.19 In Brazil, the last

quarter of 2022 saw the convergence of several unfavourable

factors, including pre and post-electoral tensions that drastically

reduced investments by farmers. Moreover, two years of bad weather

severely affected coffee harvests in Brazil, leading coffee growers

to reduce expenditure on inputs. Despite all these challenges,

which are unlikely to recur in 2023, I am proud to share Verde’s

record growth and financial results for the year”, commented Mr.

Veloso.

In 2022, Verde presented a growth of 386% in EPS,

271% in EBITDA, 190% in revenue and 57% in sales compared to the

previous year, as can be seen in the table below:

FY 2022 growth compared to FY

2021

|

Period |

Year |

EPS (C$) |

EBITDA20 (C$’000) |

Revenue (C$’000) |

Sales (tonnes) |

|

FY |

2021 |

0.07 |

|

6,450 |

|

27,709 |

|

400,133 |

|

|

2022 |

0.34 |

|

23,912 |

|

80,271 |

|

628,000 |

|

|

YoY |

386 |

% |

271 |

% |

190 |

% |

57 |

% |

Q4 2022 Financials

- Revenue increased by 55% in Q4 2022, to $16,837,000 compared to

$10,851,000 in Q4 2021.

- Revenue in R$ increased by 43% in Q4 2022, to R$66,814,000

compared to R$46,723,000 in Q4 2021.

- Sales by volume decreased by 7% in Q4 2022, to 125,000 tonnes,

compared to 134,000 tonnes in Q4 2021.

- Gross margin increased to 76% in Q4 2022, compared to 75% in Q4

2021.

- EBITDA before non-cash events decreased by 47% in Q4 2022 to

$1,293,000, compared to $2,452,000 in Q4 2021.

- Net loss was $1,312,000 in Q4 2022, compared to a $1,878,000

profit in Q4 2021.

2023 Guidance

As previously described, potash trends did not

meet the market's expectations after the Ukraine war, reflecting in

decreasing fertilizer prices and lower demand throughout 2022. The

price of potash has been on a downward trend since late 2022, with

a decrease of 47% in 2022 average KCl CFR Brasil price, compared to

the current price,21 leading farmers to holdback potash purchases

with the expectation of even lower prices in the near future.

In light of the aforementioned factors, Verde’s

guidance for 2023 is described in the table below:

FY 2023 guidance ranges

| FY

2023 Guidance |

Range |

| Sales target

(tonnes) |

800,000 -

1,200,000 |

| Revenue

(C$’000) |

78,135 -

115,332 |

| EBITDA

(C$’000)22 |

9,341 -

24,565 |

|

EPS (C$) |

0.04 - 0.29 |

The 2023 guidance is underpinned by the following

assumptions:

- Average Brazilian Real (“R$”) to Canadian dollar exchange rate:

C$1.00 = R$4.20

- Average KCl CFR Brazil price of US$450, with an overall

discount rate of 10%, resulting in the final price of US$405.

- Sales Incoterms: 70% CIF and 30% FOB

- Sales channels: 47% direct sales and 53% indirect sales

- Income taxes: 34% of the subsidiary net profit before

taxes

As of January 2023, the Brazilian Subsidiary

(Verde Fertilizantes) is subject to income taxes using the ‘Actual

Profits’ method (“Lucro Real”, in Portuguese), which is based on

taxable income (the tax in this method is approximately 34% of the

Net Profit), adjusted by certain additions and exclusions as

determined by the legislation. The Actual Profit will be calculated

quarterly.

Up to December 31, 2022, the Brazilian Subsidiary

was under the ‘Assumed Profits’ method.

Verde’s Key Objectives for

2023:

- Launch a range of BAKS® products customized for different types

of crops, with the addition of new nutrients.

- Launch a new microorganism to be added to Bio Revolution, in

addition to Verde’s currently inoculated microorganism Bacillus

Aryabhattai.

- Obtain environmental licence and mining permits for the

additional extraction of up to 25Mtpy.

- Launch a new technology and file its patent.

- Start engineering studies for Plant 3.

Environmental

Verde’s production process is sustainable. The

processing does not require tailings dams, nor does it generate any

waste by-products. In sum, the ore recovery rate is 100%.

The mined area is mainly composed of degraded

pasturelands that, once mined, Verde transforms into tropical

forest. To that end, the Company planted 4,300 trees in 2019, 5,000

in 2020, 9,888 in 2021 and 10,341 in 2022, totaling over 29,500

trees. In 2023, Verde intends to plant 5,000 trees.

All planted species are originally native to the

region, many of which are today deemed endangered species.

Selected Annual Financial

Information

The table below summarizes Q4 and FY 2022

financial results compared to Q4 and FY 2021:

| All

amounts in CAD $’000 |

Q4

2022 |

Q4

2021 |

FY

2022 |

FY

2021 |

|

Tonnes sold ‘000 |

125 |

|

134 |

|

628 |

|

400 |

|

|

Average revenue per tonne sold $ |

135 |

|

81 |

|

128 |

|

69 |

|

|

Average production cost per tonne sold $ |

(32 |

) |

(20 |

) |

(29 |

) |

(18 |

) |

|

Average gross profit per tonne sold $ |

103 |

|

61 |

|

99 |

|

51 |

|

|

Average gross margin |

76 |

% |

75 |

% |

78 |

% |

74 |

% |

| |

|

|

|

|

|

Revenue |

16,837 |

|

10,851 |

|

80,271 |

|

27,709 |

|

|

Production costs |

(3,967 |

) |

(2,691 |

) |

(18,022 |

) |

(7,131 |

) |

|

Gross Profit |

12,870 |

|

8,160 |

|

62,249 |

|

20,578 |

|

|

Gross Margin |

76 |

% |

75 |

% |

78 |

% |

74 |

% |

|

Sales and product delivery freight expenses |

(9,892 |

) |

(4,463 |

) |

(32,986 |

) |

(11,252 |

) |

|

General and administrative expenses |

(1,685 |

) |

(1,245 |

) |

(5,351 |

) |

(2,876 |

) |

|

EBITDA (1) |

1,293 |

|

2,452 |

|

23,912 |

|

6,450 |

|

|

Share Based, Equity and Bonus Payments (Non-Cash

Event) (2) |

(220 |

) |

(23 |

) |

(344 |

) |

(1,551 |

) |

|

Depreciation and Amortisation

(2) |

(33 |

) |

(18 |

) |

(181 |

) |

(53 |

) |

|

Profit on disposal of plant and equipment

(2) |

- |

|

- |

|

- |

|

9 |

|

|

Operating Profit after non-cash events |

1,040 |

|

2,411 |

|

23,387 |

|

4,855 |

|

|

Interest Income/Expense |

(1,812 |

) |

(173 |

) |

(2,964 |

) |

(402 |

) |

| Net

Profit before tax |

(772 |

) |

2,238 |

|

20,423 |

|

4,453 |

|

|

Income tax (3) |

(540 |

) |

(360 |

) |

(2,619 |

) |

(931 |

) |

|

Net Profit |

(1,312 |

) |

1,878 |

|

17,804 |

|

3,522 |

|

(1) – Non GAAP measure (2) – Included in General

and Administrative expenses in financial statements (3) – Please

see Income Tax notes

External Factors

Revenue and costs are affected by external factors

including changes in the exchange rates between the C$ and R$ along

with fluctuations in potassium chloride spot CFR Brazil. The table

below summarizes these changes:

| |

%

Δ |

Q4

2022 |

Q4

2021 |

%

Δ |

FY

2022 |

FY

2021 |

|

Canadian Dollar (C$) Average Exchange Rate |

-13 |

% |

R$3.87 |

R$4.43 |

-8 |

% |

R$3.97 |

R$4.31 |

|

Potassium Chloride CFR Brazil Lowest

Price(1) |

-34 |

% |

US$500 |

US$760 |

+104 |

% |

US$500 |

US$245 |

|

Potassium Chloride CFR Brazil Highest

Price(1) |

-19 |

% |

US$650 |

US$800 |

+50 |

% |

US$1200 |

US$800 |

(1) – Source: Acerto Limited Report.

FY and Q4 2022 compared with FY and Q4 2021

Net Profits and EPS

FY 2022

The Company generated a net profit of $17,804,000

in FY 2022, an increase of $14,282,000 compared to a net profit of

$3,522,000 in FY 2021, thanks to an increase of 57% in sales and an

increase of 59% in the average Potassium Chloride CFR Brazil price

in 2022, compared to 2021.

Earnings per share were $0.34 for FY 2022,

compared to $0.07 for FY 2021.

Q4 2022

The Company suffered a net loss of $1,312,000 for

Q4 2022, a decrease of $3,190,000 compared to $1,878,000 profit for

Q4 2021, mainly due to a $1,639,000 increase in interest

expenses.

Basic loss per share was $0.03 for Q4 2022,

compared to earnings of $0.04 for Q4 2021.

Product Sales

FY 2022

Sales increased by 57% in FY 2022, to

628,000 tonnes sold, compared to 400,000 tonnes FY 2021,

thanks to purchases from new clients and an increase in the

purchase of K Forte® and BAKS® among Verde’s returning

customers,

Q4 2022

Sales by volume decreased by 7% in Q4 2022, to

125,000 tonnes sold, compared to 134,000 tonnes sold in Q4 2021,

due to the circumstances summarized in the topics below. For

further details, please refer to the topic 2022 Overview of this

document.

- A glut of potash in the market due to increased availability,

resulted in a 45% surge in potash imports by Brazil over the same

period, compared to 2021.23 This oversupply, combined with a 15%

drop in potash consumption in Brazil in 2022,24 contributed to a

challenging market for fertilizer producers. The 23% increase in

the year-end stock of potash in Brazil demonstrate its lower

overall demand over the year.

- In the first months of 2022, Verde faced record demand for its

Product from customers looking to build potash inventories ahead of

an expected market shortage. However, the Company had to halt the

sale of its Product for Q3 and Q4 delivery due to anticipated

inability to supply the demand.

- In addition to that, Verde could not fulfill all the orders in

its books during the peak season between Q3 and Q4 due to limited

access to and from Plant 2, caused by unforeseen groundwater issues

that impacted the new road construction. Consequently, some of

Verde's customers had to cancel their orders, which had an impact

on the Company's results, that could have been better if Plant 2

had started producing and delivering on schedule.

- The presidential election in Brazil brought additional

challenges to farmers' purchasing decisions for the 2022/2023

harvests. The fertilizer market was stagnant before the elections,

with many customers holding off on purchasing. Following the

elections, the market remained stagnant due to concerns and

uncertainty surrounding the new government policies.

- The Brazilian coffee sector experienced significant challenges

in 2022 due to adverse climate conditions, following on two years

of frost and drought,25,26 which disrupted global commodity markets

and impacted crop productivity for years to come. In Minas Gerais,

the largest coffee producer in Brazil, the average productivity was

21.6 scs/ha, 4.6% lower than the 2021 harvest, a year of negative

bienniality. As a result, many farmers opted not

to apply fertilizers as they anticipated low yields in the next

harvests.

Revenue

FY 2022

Revenue from sales increased by 190% in FY 2022,

to $80,271,000 from the sale of 628,000 tonnes of K Forte® and

BAKS, at an average $128 per tonne sold; compared to $27,709,000 in

FY 2021 from the sale of 400,000 tonnes of Product, at an average

$69 per tonne sold.

Average revenue per tonne excluding freight

expenses (FOB price) improved by 77% in FY 2022, to $83 compared to

$47 in FY 2021.

Average revenue per tonne in FY 2022 was higher

than FY 2021 mainly due to:

- Product volume sold as CIF (Cost Insurance and Freight)

increased from 52% of total sales in FY 2021 to 71% in FY

2022.

- Potassium Chloride CFR Brazil price increased from

US$245-US$800 per tonne in FY 2021 to US$500-US$1200 per tonne in

FY 2022 (as reported by Acerto Limited).

- BAKS®, which has a higher sales price per tonne compared to K

Forte®, accounted for 11% of the total volume sold by the Company,

compared to 10% in FY 2021.

- Brazilian Real appreciated by 8% against the Canadian

Dollar.

Q4 2022

Revenue from sales increased by 55% in Q4 2022, to

$16,837,000 from the sale of 125,000 tonnes of Product, at average

$135 per tonne sold; compared to $10,851,000 in Q4 2021 from the

sale of 134,000 tonnes of Product, at average $81 per tonne

sold.

Average revenue per tonne excluding freight

expenses (FOB price) improved by 15% in Q4 2022, to $62 compared to

$53 in Q4 2021.

Average revenue per tonne in Q4 2022 was higher

than Q4 2021 mainly due to:

- Product volume sold as CIF (Cost Insurance and Freight)

increased from 63% of total sales in Q4 2021 to 74% in Q4

2022.

- Potassium Chloride CFR Brazil price decreased from

US$760-US$800 per tonne in Q4 2021 to US$500-US$650 per tonne in Q4

2022 (as reported by Acerto Limited, a market intelligence

firm).

- BAKS® has a higher sales price per tonne compared to K Forte®.

BAKS® accounted for 7% of the total volume sold by the Company

compared to 5% in 2021.

- Brazilian Real appreciated by 8% against the Canadian

Dollar.

Production costs

Production costs include all direct costs from

mining, processing, and the addition of other nutrients to the

Product, such as Sulphur and Boron. It also include the logistics

costs from the mine to the plant and related salaries.

Verde’s production costs and sales price are based

on the following assumptions:

- Micronutrients added to BAKS® increase its production cost,

rendering K Forte® less expensive to produce.

- Production costs vary based on packaging type, with bulk

packaging being less expensive than Big Bags.

- Plant 1 produces K Forte® Bulk, K Forte® Big Bag, BAKS® Bulk,

and BAKS® Big Bag, while Plant 2 exclusively produces K Forte®

Bulk. Therefore, Plant 2's production costs are lower than Plant

1's costs, which produces two types of Products and offers two

types of packaging options each.

- Non-controllable costs, such as transportation, electricity,

packaging, acquisition of other nutrients (especially Sulfur and

Boron), and depreciation, range from 30 to 80% of the Company's

total production cost, depending on the type of product, packaging,

and production site (Plant 1 or Plant 2).

The table below shows a breakdown of Verde’s

production costs for BAKS® and K Forte®, and what percentage of

those costs is not controllable by management:

| (+) |

(+) |

(=) |

|

Cost per tonne of product projected for 202327

(C$) |

Cash cost |

Assets depreciation |

Total cost expected for 202328 |

Non-controllable costs (% of total costs) |

| K Forte®

Bulk (Plant 1) |

20.2 |

3.8 |

24.0 |

61% |

| K Forte®

Bulk (Plant 2) |

10.2 |

2.8 |

13.0 |

58% |

| K Forte® Big

Bag (Plant 1) |

30.4 |

2.8 |

33.2 |

71% |

| BAKS® (2%S

0.2%B)29 Bulk (Plant 1) |

42.1 |

3.8 |

45.9 |

81% |

|

BAKS® (2%S 0.2%B) Big Bag (Plant 1) |

51.3 |

3.8 |

55.0 |

85% |

Verde calculates its total production costs as a

weighted average of the production costs for BAKS® and K Forte®,

taking into account the production site and packaging type for each

product. Therefore, comparing the Company's production costs on a

quarter-over-quarter basis may not be meaningful due to the varying

proportions of the cost factors that impact each quarter.

FY 2022

Production costs increased by 153% in FY 2022, to

$18,022,000 compared to $7,131,000 in FY 2021. This was due to a

57% increase in volume sold, from 400,000 tonnes in FY 2021 to

628,000 tonnes in FY 2022. Average cost per tonne increased by 61%

in FY 2022, to $29 compared to $18 in FY 2021. The cost increase

was due in large part to higher fuel prices, which increased by 66%

in FY 2022 compared to FY 2021 and Brazil’s inflation over the

twelve-month period of 6,6% In addition, volume sold on Big Bags,

which have a significantly higher cost than Bulk, increased from

21% to 32% year on year.

Q4 2022

Production costs increased by 47% in Q4 2022, to

$3,967,000 compared to $2,691,000 in Q4 2021. Average cost per

tonne increased by 59% in Q4 2022, to $32 compared to $20 in Q4

2021. Although the volume sold decreased by 7%, from 134,000 tonnes

in Q4 2021 to 125,000 tonnes in Q4 2022, the average production

costs increased due to:

- Diesel costs increased by 42% in Q4 2022 compared to Q4

2021.

- BAKS® accounted for 7% of the total volume sold by the Company,

compared to 5% in 2021.

- Brazil's inflation was over 6,5% in the twelve-month

period.

- The lower volume sold in Q4 2022, compared to Q4 2021, also

impacted the cost per tonne due to fixed cost dilution.

Sales Expenses

| CAD

$’000 |

Q4

2022 |

Q4

2021 |

FY

2022 |

FY

2021 |

| Sales and

marketing expenses |

(533 |

) |

(578 |

) |

(3,451 |

) |

(1,818 |

) |

| Fees paid to

independent sales agents |

(196 |

) |

(203 |

) |

(1,172 |

) |

(464 |

) |

| Product

delivery freight expenses |

(9,163 |

) |

(3,682 |

) |

(28,363 |

) |

(8,970 |

) |

|

Total |

(9,892 |

) |

(4,463 |

) |

(32,986 |

) |

(11,252 |

) |

Sales and marketing expenses

Sales and marketing expenses include employees’

salaries, car rentals, travel within Brazil, hotel expenses, and

the promotion of the Product in marketing events.

FY 2022

Expenses increased by 90% in FY 2022, with a total

of $3,451,000, compared to $1,818,000 in FY 2021, also mainly due

to a further expansion of Verde’s sales and marketing team. This

increase is in line with the Company's growth strategy. Q4 2022

In Q4 2022, Verde's expenses decreased by 8% to

$533,000, compared to $578,000 in Q4 2021. This was mainly due to

the provision reversion of $493,000 in bonuses and market programs

that occurred during the year. Despite the decrease in expenses,

the Company's sales and marketing team increased the professional

headcount, and additional investments were made in media as a

strategy to attract new customers.

Fees paid to independent sales agents

As part of Verde's marketing and sales strategy,

the Company pays out commissions to its independent sales

agents.

FY 2022

Fees paid to independent sales agents increased by

153% in FY 2022, to $1,172,000 compared to $464,000 in FY 2021, as

a direct result of increased sales in the year. The increase was

partially mitigated by the decrease in percentage of sales made by

sales agents, from 37% of total sales in FY 2021 to 32% in FY

2022.

Q4 2022

Fees paid to independent sales agents decreased by

3% in Q4 2022, to $196,000 compared to $203,000 in Q4 2021. Besides

revenue growth of 55% in the quarter, the percentage of sales made

by sales agents, decreased from 42% of total sales in Q4 2021 to

21% in Q4 2022.

Product delivery freight expenses

FY 2022

Expenses increased by 216% in FY 2022, to

$28,363,000 compared to $8,970,000 in FY 2021, as the Company has

significantly increased the volume sold as CIF (Cost Insurance and

Freight), up from 52% of total sales in FY 2021 to 71% in FY 2022

and due to higher fuel prices, which increased 66% in FY 2022

compared to FY 2021.

Q4 2022

Product delivery freight expenses increased by

149% in Q4 2022, to $9,163,000 compared to $3,682,000 in Q4 2021,

as the Company has significantly increased the volume sold as CIF

(Cost Insurance and Freight), up from 63% of total sales in Q4 2021

to 74% in Q4 2022, and due to higher fuel prices, which increased

by 42% in the period.

The Brazilian coffee sector continued to

experience challenges in 2022 due to adverse climate conditions,

with over two years of frost and drought,30 ,31 which disrupted

global commodity markets and have impacted crop productivity. As a

result, many farmers opted not to apply fertilizers as they

anticipated low yields in the next harvests. The coffee sector is a

significant consumer of Product, and Verde has a competitive

geographical advantage thanks to its proximity to major coffee

growers in Brazil, reducing freight costs and boosting margins.

Therefore, the decline in Product sales in the coffee sector had an

outsized impact on the Company's Q4 2022 results.

Furthermore, sales made to states located further

away from Verde’s production facilities also had a significant

impact on the logistics costs, with 48% of the total sales

delivered to the states of Pará, Mato Grosso and to the Northeast

region of Brazil in Q4 2022, compared to 40% in 2021, which

increased the freight cost per tonne in the quarter.

General and Administrative

Expenses

| CAD

$’000 |

3 months

ended Dec 31, 2022 |

3 months

ended Dec 31, 2021 |

12 months

ended Dec 31, 2022 |

12 months

ended Dec 31, 2021 |

| General

administrative expenses |

(1,270 |

) |

(612 |

) |

(3,166 |

) |

(1,621 |

) |

| Legal,

professional, consultancy and audit costs |

(188 |

) |

(516 |

) |

(1,343 |

) |

(915 |

) |

| IT/Software

expenses |

(219 |

) |

(103 |

) |

(788 |

) |

(307 |

) |

| Taxes and

licenses fees |

(8 |

) |

(14 |

) |

(54 |

) |

(33 |

) |

|

Total |

(1,685 |

) |

(1,245 |

) |

(5,351 |

) |

(2,876 |

) |

General administrative

expenses

These costs include general office expenses, rent,

bank fees, insurance, foreign exchange variances and remuneration

of executive and administrative staff in Brazil.

FY 2022

Expenses increased by 95% in FY 2022, to

$3,166,000 compared to $1,621,000 in FY 2021, as they include

additional administrative employees, and also due to an increase of

$689,000 in bonuses provision to employees, compared to the prior

year.

Q4 2022

Expenses increased by 108% in Q4 2022, to

$1,270,000 compared to $612,000 in Q4 2021, as they include

additional administrative employees, and also due to an increase of

$430,000 in bonus provision to employees, compared to the prior

year.

Legal, professional, consultancy and audit

costs

Legal and professional fees include legal,

professional, consultancy fees along with accountancy, audit and

regulatory costs. Consultancy fees are consultants employed in

Brazil, such as accounting services, patent process, lawyer’s fees

and regulatory consultants.

FY 2022

Expenses increased by 47% in FY 2022, to

$1,343,000 compared to $915,000 in FY 2021, mainly due to the costs

incurred with the Company’s redomiciliation from the UK to

Singapore, which involved hiring lawyers, accountants, and

consultants in Singapore, the UK, and Canada.

Q4 2022

Expenses decreased by 64% in Q4 2022, to $188,000

compared to $516,000 in Q4 2021. The decrease was due to a $347,000

provision in Q4 2021, set aside for a contested claim made by a

consultant retained by the Company in 2012. The consultancy

services were for an environmental report, the quality of which was

disputed by Verde and payment withheld. The court decision in Q4

2021 was favourable to the consultant.

IT/Software expenses

IT/Software expenses include software licenses

such as Microsoft Office, Customer Relationship Management (CRM)

software and enterprise resource planning (ERP).

FY 2022

Expenses increased by 157% in FY 2022, to $788,000

compared to $307,000 in FY 2021, due to an increase in third party

computing services and number of software licenses used by the

Company in Brazil. In addition to that, the Company has changed its

accountant ERP to SAP Business One, effective from July 1st, 2022,

which has a higher cost compared to the former ERP used.

Q4 2022

Expenses increased by 113% in Q4 2022, to $219,000

compared to $103,000 in Q4 2021, mainly due to CRM and ERP

consultants’ services. In addition to that, the Company has changed

its accountant ERP to SAP Business One, which has a higher cost

compared to the former ERP used.

Taxes and licences

Taxes and licence expenses include general taxes,

product branding and licence costs.

FY 2022

Expenses increased by 64% in FY 2022, to $54,000

compared to $33,000 in FY 2021, due to increased fees, taxes and

state contributions in line with the growth of the Company.

Q4 2022

Expenses decreased in Q4 2022, to $8,000 compared

to $14,000 in Q4 2021.

Share Based, Equity and Bonus Payments (Non-Cash

Events)

These costs represent the expense associated with

stock options granted to employees and directors along with equity

compensation and non-cash bonuses paid to key management.

FY 2022

Share Based, equity and bonus payments costs

decreased by 78% in FY 2022, to $344,000 compared to $1,551,000 in

FY 2021. In FY 2021, non-cash bonuses of $609,000 were paid along

with a share based payment charge of $855,000 for stock options

vesting.

Q4 2022

Share Based, equity and bonus payments costs

increased by 857% in Q4 2022, to $220,000 compared to $23,000 in Q4

2021. This increase is mainly a result of an equity compensation

accrual to the board of directors of $178,000 made in Q4 2022.

Q4 and FY 2022 Results Conference

Call

The Company will host a conference call on Friday,

March 31, 2023, at 10:00 am Eastern Time, to discuss Q4 and FY 2022

results and provide an update. Subscribe using the link below and

receive the conference details by email.

|

Date: |

Friday, March 31, 2023 |

|

Time: |

10:00 am Eastern Time |

|

Subscription link: |

https://bit.ly/Q4-FY_2022_ResultsPresentation |

The questions can be submitted in advance through

the following link up to 2 hours before the conference call:

https://bit.ly/Questions-Q4-FY2022-ResultsPresentation.

The Company’s full year and fourth quarter

financial statements and related notes for the period ended

December 31, 2022 are available to the public on SEDAR at

www.sedar.com and the Company’s website at

www.investor.verde.ag/.

About Verde AgriTech

Verde is an agricultural technology Company that

produces potash fertilizers. Our purpose is to improve the health

of all people and the planet. Rooting our solutions in nature, we

make agriculture healthier, more productive, and profitable.

Verde is a fully integrated Company: it mines

and processes its main feedstock from its 100% owned mineral

properties, then sells and distributes the Product.

Verde’s focus on research and development has

resulted in one patent and eight patents pending. Among its

proprietary technologies are Cambridge Tech, 3D Alliance, MicroS

Technology, N Keeper, and Bio Revolution.32 Currently, the Company

is fully licensed to produce up to 2.8 million tonnes per year of

its multinutrient potassium fertilizers K Forte® and BAKS®, sold

internationally as Super Greensand®. In 2022, it became Brazil's

largest potash producer by capacity.33 Verde has a combined

measured and indicated mineral resource of 1.47 billion tonnes at

9.28% K2O and an inferred mineral resource of 1.85 billion tonnes

at 8.60% K2O (using a 7.5% K2O cut-off grade).34 This amounts to

295.70 million tonnes of potash in K2O. For context, in 2021

Brazil’s total consumption of potash in K2O was 6.57 million35.

Brazil ranks second in global potash demand and

is its single largest importer, currently depending on external

sources for over 97% of its potash needs. In 2022, potash accounted

for approximately 3% of all Brazilian imports by dollar

value.36

Corporate Presentation

For further information on the Company, please

view shareholders’ deck:

https://verde.docsend.com/view/fzkwsugdix23kvzn

Investors Newsletter

Subscribe to receive the Company’s updates

at:

http://cloud.marketing.verde.ag/InvestorsSubscription

Cautionary Language and Forward-Looking

Statements

All Mineral Reserve and Mineral Resources

estimates reported by the Company were estimated in accordance with

the Canadian National Instrument 43-101 and the Canadian Institute

of Mining, Metallurgy, and Petroleum Definition Standards (May 10,

2014). These standards differ significantly from the requirements

of the U.S. Securities and Exchange Commission. Mineral Resources

which are not Mineral Reserves do not have demonstrated economic

viability.

This document contains "forward-looking

information" within the meaning of Canadian securities legislation

and "forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995. This

information and these statements, referred to herein as

"forward-looking statements" are made as of the date of this

document. Forward-looking statements relate to future events or

future performance and reflect current estimates, predictions,

expectations or beliefs regarding future events and include, but

are not limited to, statements with respect to:

(i) the estimated amount and grade of

Mineral Resources and Mineral Reserves;

(ii) the PFS representing a viable

development option for the Project;

(iii) estimates of the capital costs of

constructing mine facilities and bringing a mine into production,

of sustaining capital and the duration of financing payback

periods;

(iv) the estimated amount of future

production, both produced and sold;

(v) timing of disclosure for the PFS and

recommendations from the Special Committee;

(vi) the Company’s competitive position in

Brazil and demand for potash; and,

(vii) estimates of operating costs and

total costs, net cash flow, net present value and economic returns

from an operating mine.

Any statements that express or involve

discussions with respect to predictions, expectations, beliefs,

plans, projections, objectives or future events or performance

(often, but not always, using words or phrases such as "expects",

"anticipates", "plans", "projects", "estimates", "envisages",

"assumes", "intends", "strategy", "goals", "objectives" or

variations thereof or stating that certain actions, events or

results "may", "could", "would", "might" or "will" be taken, occur

or be achieved, or the negative of any of these terms and similar

expressions) are not statements of historical fact and may be

forward-looking statements.

All forward-looking statements are based on

Verde's or its consultants' current beliefs as well as various

assumptions made by them and information currently available to

them. The most significant assumptions are set forth above, but

generally these assumptions include, but are not limited to:

(i) the presence of and continuity of

resources and reserves at the Project at estimated grades;

(ii) the geotechnical and metallurgical

characteristics of rock conforming to sampled results; including

the quantities of water and the quality of the water that must be

diverted or treated during mining operations;

(iii) the capacities and durability of

various machinery and equipment;

(iv) the availability of personnel,

machinery and equipment at estimated prices and within the

estimated delivery times;

(v) currency exchange rates;

(vi) Super Greensand® and K Forte® sales

prices, market size and exchange rate assumed;

(vii) appropriate discount rates applied to

the cash flows in the economic analysis;

(viii) tax rates and royalty rates

applicable to the proposed mining operation;

(ix) the availability of acceptable

financing under assumed structure and costs;

(x) anticipated mining losses and

dilution;

(xi) reasonable contingency

requirements;

(xii) success in realizing proposed

operations;

(xiii) receipt of permits and other

regulatory approvals on acceptable terms; and

(xiv) the fulfilment of environmental

assessment commitments and arrangements with local communities.

Although management considers these assumptions

to be reasonable based on information currently available to it,

they may prove to be incorrect. Many forward-looking statements are

made assuming the correctness of other forward looking statements,

such as statements of net present value and internal rates of

return, which are based on most of the other forward-looking

statements and assumptions herein. The cost information is also

prepared using current values, but the time for incurring the costs

will be in the future and it is assumed costs will remain stable

over the relevant period.

By their very nature, forward-looking statements

involve inherent risks and uncertainties, both general and

specific, and risks exist that estimates, forecasts, projections

and other forward-looking statements will not be achieved or that

assumptions do not reflect future experience. We caution readers

not to place undue reliance on these forward-looking statements as

a number of important factors could cause the actual outcomes to

differ materially from the beliefs, plans, objectives,

expectations, anticipations, estimates assumptions and intentions

expressed in such forward-looking statements. These risk factors

may be generally stated as the risk that the assumptions and

estimates expressed above do not occur as forecast, but

specifically include, without limitation: risks relating to

variations in the mineral content within the material identified as

Mineral Resources and Mineral Reserves from that predicted;

variations in rates of recovery and extraction; the geotechnical

characteristics of the rock mined or through which infrastructure

is built differing from that predicted, the quantity of water that

will need to be diverted or treated during mining operations being

different from what is expected to be encountered during mining

operations or post closure, or the rate of flow of the water being

different; developments in world metals markets; risks relating to

fluctuations in the Brazilian Real relative to the Canadian dollar;

increases in the estimated capital and operating costs or

unanticipated costs; difficulties attracting the necessary work

force; increases in financing costs or adverse changes to the terms

of available financing, if any; tax rates or royalties being

greater than assumed; changes in development or mining plans due to

changes in logistical, technical or other factors; changes in

project parameters as plans continue to be refined; risks relating

to receipt of regulatory approvals; delays in stakeholder

negotiations; changes in regulations applying to the development,

operation, and closure of mining operations from what currently

exists; the effects of competition in the markets in which Verde

operates; operational and infrastructure risks and the additional

risks described in Verde's Annual Information Form filed with SEDAR

in Canada (available at www.sedar.com) for the year ended December

31, 2021. Verde cautions that the foregoing list of factors that

may affect future results is not exhaustive.

When relying on our forward-looking statements

to make decisions with respect to Verde, investors and others

should carefully consider the foregoing factors and other

uncertainties and potential events. Verde does not undertake to

update any forward-looking statement, whether written or oral, that

may be made from time to time by Verde or on our behalf, except as

required by law.

For additional information please

contact:

Cristiano Veloso, Founder,

Chairman & Chief Executive Officer

Tel: +55 (31) 3245 0205; Email:

investor@verde.ag

www.investor.verde.ag | www.supergreensand.com |

www.verde.ag

1 For further information on the PFS, see the press release at:

https://investor.verde.ag/verde-announces-pre-feasibility-study/ 2

For further information on the PFS, see the press release at:

https://investor.verde.ag/verde-announces-pre-feasibility-study/ 3

Acerto Limited Report. 4 Source: Brazilian Comex Stat, available

at: http://comexstat.mdic.gov.br/en/geral 5 Source: Brazilian

Fertilizer Mixers Association (from "Associação Misturadores de

Adubo do Brasil", in Portuguese). 6 Source: Brazilian Comex Stat,

available at: http://comexstat.mdic.gov.br/en/geral 7 Acerto

Limited Report. 8 Source: Brazilian Fertilizer Mixers Association

(from "Associação Misturadores de Adubo do Brasil", in Portuguese).

9 Fertilizers include: ammonium sulfate, urea, nitrate, diammonium

phosphate, monoammonium phosphate, single superphosphate, triple

superphosphate, thermophosphate, natural phosphate, potassium

chloride, NPKs and others. 10 Source: Brazilian Fertilizer Mixers

Association (from "Associação Misturadores de Adubo do Brasil", in

Portuguese). 11 Economic Research Center of the ESALQ/University of

São Paulo. Available at:

https://www.cepea.esalq.usp.br/br/indicador/soja.aspx 12 Copom

maintains the Selic rate at 13.75% p.a (Banco Central do Brasil).

Available at: https://www.bcb.gov.br/en/pressdetail/2467/nota 13

Source: Banco Central do Brasil. Available at:

https://www.bcb.gov.br/en 14 Brazil's GDP Grows 2.9% in 2022 but

Retreats 0.2% in 4th Quarter (Folha de São Paulo). Available

at:https://www1.folha.uol.com.br/internacional/en/business/2023/03/brazils-gdp-grows-29-in-2022-but-retreats-02-in-4th-quarter.shtml

15 Brazil’s Weather-Damaged Coffee Trees Will Take Years to Recover

(Bloomberg). Available at:

https://www.bloomberg.com/news/articles/2022-10-04/brazil-s-weather-damaged-coffee-trees-will-take-years-to-recover?leadSource=uverify%20wall

16 Coffee prices may face volatility amid unknown harvest figures

(Valor Internacional). Available at:

https://valorinternational.globo.com/agribusiness/news/2023/01/04/coffee-prices-may-face-volatility-amid-unknown-harvest-figures.ghtml

17 Source: INMET - National Institute of Meteorology (Brazilian

Ministry of Agriculture And Livestock). Status of the Climate in

Brazil in 2022. Available at:

https://portal.inmet.gov.br/uploads/notastecnicas/Estado-do-clima-no-Brasil-em-2022-OFICIAL.pdf

18 Source: Brazilian National Supply Company (CONAB), Ministry of

Agrarian Development and Family Agriculture. 4th Survey of the

Coffee Harvest (December). Available at: 2020, 2021 and 2022.

19 Source: Brazilian Fertilizer Mixers Association (from

"Associação Misturadores de Adubo do Brasil", in Portuguese). 20

Before non-cash events. 21 As of March 23, 2023. Source: Acerto

Limited report. 22 Before non-cash events. 23 Source: Brazilian

Comex Stat, available at: http://comexstat.mdic.gov.br/en/geral 24

Source: Brazilian Fertilizer Mixers Association (from "Associação

Misturadores de Adubo do Brasil", in Portuguese). 25 Brazil’s

Weather-Damaged Coffee Trees Will Take Years to Recover

(Bloomberg). Available at:

https://www.bloomberg.com/news/articles/2022-10-04/brazil-s-weather-damaged-coffee-trees-will-take-years-to-recover?leadSource=uverify%20wall

26 Coffee prices may face volatility amid unknown harvest figures

(Valor Internacional). Available at:

https://valorinternational.globo.com/agribusiness/news/2023/01/04/coffee-prices-may-face-volatility-amid-unknown-harvest-figures.ghtml

27 The costs were estimated based on the following assumptions:

Costs in line with Verde’s 2023 budget. Sales volume of 1.0Mt per

year. Crude Oil WTI (NYM U$/bbl) = US$80.00. Diesel price =

U$$1.26. Currency exchange rate: US$1.00 = R$5.25; C$1.00 = R$4.20.

Total cost per tonne includes all costs directly related to

production and feedstock extraction in addition to assets

depreciation 28 Total cost per tonne includes labor mining, mining,

crushing, processing, maintenance of support facilities, product

transportation from mine pits to production plants, laboratory

expenses, G&A, and environmental compensation expenses. 29

BAKS® can be customized according to the crop’s needs, so it can

have several compositions. The 2%S 0.2%B composition is responsible

for most of Verde’s sales. 30 Brazil’s Weather-Damaged Coffee Trees

Will Take Years to Recover (Bloomberg). Available at:

https://www.bloomberg.com/news/articles/2022-10-04/brazil-s-weather-damaged-coffee-trees-will-take-years-to-recover?leadSource=uverify%20wall

31 Source: Erica Polo, Agribusiness (Valor Internacional).

Available at:

https://valorinternational.globo.com/agribusiness/news/2023/01/04/coffee-prices-may-face-volatility-amid-unknown-harvest-figures.ghtml

32 Learn more about our technologies:

https://verde.docsend.com/view/yvthnpuv8jx6g4r9 33 See the release

at:

https://investor.verde.ag/verde-starts-ramp-up-of-plant-2s-second-stage-to-reach-production-of-2-4mtpy/

34 As per the National Instrument 43-101 Standards of Disclosure

for Mineral Projects within Canada (“NI 43 -101”), filed on SEDAR

in 2017. See the Pre-Feasibility Study at:

https://investor.verde.ag/wp-content/uploads/2021/01/NI-43-101-Pre-Feasibility-Technical-Report-Cerrado-Verde-Project.pdf

35 Source: Brazilian Fertilizer Mixers Association (from

"Associação Misturadores de Adubo do Brasil", in Portuguese). 36

Source: Brazilian Comex Stat, available at:

http://comexstat.mdic.gov.br/en/geral

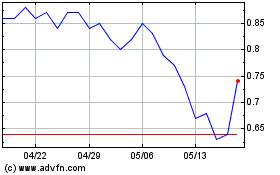

Verde Agritech (TSX:NPK)

過去 株価チャート

から 11 2024 まで 12 2024

Verde Agritech (TSX:NPK)

過去 株価チャート

から 12 2023 まで 12 2024