(All figures are in Canadian dollars, unless

stated otherwise. Average exchange rate in 2020: C$1.00 =

R$3.84)

Verde AgriTech Plc (TSX: “NPK”) (OTCQB: “AMHPF”)

("Verde” or the “Company”) is pleased to announce its

financial results for the fourth quarter (“Q4 2020”) and

full year ended December 31, 2020 (“FY 2020”).

Q4 2020 Financials

- Sales increased by 76% with 56,585 tonnes sold, compared to

32,221 tonnes in the fourth quarter of 2019 (“Q4

2019”).

- Gross margin increased to 59% in Q4 2020, compared to 36% in Q4

2019.

- The Company recognised revenue of $2,209,000, an increase of

48% compared to $1,491,000 in Q4 2019 despite a 14% decline in the

price of potash delivered to Brazil.

- In Brazilian Real (“R$”), revenue increased by 92%, to

R$8,489,000 compared to R$4,429,000 in Q4 2019.

- The Company recorded a net loss of $192,000, compared to a net

loss of $11,000 in Q4 2019.

- Cash held by the Company increased by 236%, to a total of

$2,237,000, compared to $666,000 in Q4 2019.

FY 2020 Financials

- Sales increased by 103% with 243,707 tonnes sold, compared to

119,809 tonnes in the year ended December 31,2019 (“FY

2019”).

- Gross margin increased to 62% in FY 2020, compared to 48% in FY

2019.

- The Company recorded a gross profit of $5,652,000, compared to

a $2,863,000 gross profit in FY 2019, an increase of 97%.

- Revenue increased by 52%, with a total of $9,167,000, compared

to $6,029,000 in 2019, despite a 27% decline in the price of potash

delivered to Brazil.

- In R$, revenue increased by 97%, to R$35,232,000, compared to

R$17,913,000 in FY 2019.

- Revenue per tonne was $38, compared to $50 in FY 2019. The

Product price is based on the current US Dollar (“US$”)

Potassium Chloride price. Therefore, the reduction of the average

revenue per tonne was mainly due to the decline of the Potassium

Chloride CFR (Brazil) price.

- Production costs were $14, compared to $26 in FY 2019. The

production cost reduction of 45% was due to enhanced production

efficiency and the devaluation of the Brazilian Real by 29% against

the Canadian Dollar.

- The Company recorded an operating profit of $1,126,000 and net

profit of $550,000 after taxes, compared to an operating loss of

$784,000 and net loss of $1,107,000 after taxes in FY 2019. 2020

was therefore the first year that the Company recorded a net

profit.

Subsequent Events

- In February 2021, the Company has been certified as a Great

Place to Work® ("GPTW"). The GPTW acknowledgment is an

annual certification granted to companies that have most of its

employees with a positive perception of its work environment.

- In March 2021, 1,385,057 warrants issued pursuant to the March

2019 private placement were exercised generating $1,385,057

proceeds for the Company.

“Thanks to Verde's team, we achieved both our sales and revenue

targets for 2020. This continues our trend of strong operating and

financial performance, as aligned with our strategic plan and

financial objectives, as we continue to pursue development and

growth opportunities in our target markets,” said Cristiano Veloso,

Verde’s Founder, President, CEO and Chairman.

“We are very proud of our employees’ hard work during the year

of 2020 for their dedication and professionalism during these

challenging times. The Company remains committed to operating

safely and abiding by the most stringent COVID-19 health and safety

protocols so that our operations can continue to perform well

despite all the challenges,” Mr Veloso concluded.

2021 Guidance

As stated in the press release disclosed on November 15, 2020,

the Company’s target for 2021 is to achieve R$50 million revenue in

2021. Product sales target for full year 2021 is 350,000 tonnes,

which represents 44% growth, compared to FY 2020 sales.

Pre-Feasibility Study:

Verde’s new product BAKS® will potentially enable the Company to

increase its share of the Brazilian potash and sulfur markets, with

further upside from other nutrients.

As stated in the press release filed on SEDAR on March 01, 2021,

a new Pre-Feasibility Study (“PFS”) will be elaborated by

the Company in 2021. It is expected to be finished by the end of

the year.

The new PSF has the objective of correctly assessing sulfur’s

potential market in Brazil and the opportunities that it opens up,

as well as updating the information disclosed in the NI 43-101

Pre-Feasibility Technical Report Cerrado Verde Project filed by the

Company on SEDAR in 2017, which was based on the following

assumptions:

- Potassium Chloride (“KCl”) price of US$250 CIF Brazil as

reference for the product pricing, versus a current average of

US$312 price (Acerto Limited Report).

- US$-R$ exchange rate of US$1.00 = R$3.28, versus a current rate

of US$1.00 = R$5.771.

Verde’s Key Objectives for 2021:

- Achieving 10% of the Company’s total sales as BAKS®.

- Launching a new technology in the second quarter of 2021.

- Getting ISO 9001 and ISO 14001 certified.

- Obtaining the Mining Concession for 2.5M tonnes per year

(“tpy”) for Mine Pit 2, a milestone in our path to achieving

the target of 25M tonnes annual production, which represents a NPV

per share of $49.78, based on the previous SEDAR filed

Pre-Feasibility Study2 considering a KCl price of US$250, instead

of US$312 currently negotiated.

- Initiating the construction of Plant 2, with the completion of

the necessary infrastructure for its development, such as the

plant's power grid connection, access routes improvement and

preliminary civil construction.

______________________

1 As of March 29, 2021. 2 Based on $2.607

billion NPV after tax divided by 50,364,858 shares outstanding as

of December 31, 2020. Estimated Net Present Value after tax of

US$1.99 billion, with 8% discount rate and Internal Rate of Return

of 287% (see NI 43-101 Pre-Feasibility Technical Report Cerrado

Verde Project, MG, Brazil, page 207). Currency exchange: US$1.00 =

C$1.26.

Selected Annual Financial Information

The table below summarizes Q4 and FY 2020 financial results

compared to Q4 and FY 2019.

$’000

Q4 2020

Q4 2019

FY 2020

FY 2019

Tonnes sold ‘000

57

32

244

120

Revenue per tonne sold $

39

47

38

50

Production cost per tonne sold $

(16)

(30)

(14)

(26)

Gross Profit per tonne sold $

23

17

23

24

Gross Margin

59%

36%

62%

48%

Revenue

2,209

1,491

9,167

6,029

Production costs

(912)

(960)

(3,515)

(3,166)

Gross Profit

1,297

531

5,652

2,863

Gross Margin

59%

36%

62%

48%

Sales and product delivery freight

expenses

(673)

(202)

(2,270)

(1,303)

General and administrative expenses

(588)

(381)

(1,791)

(1,535)

Operating Profit/(Loss) before non-cash

events

36

(52)

1,591

25

Share Based and Bonus Payments / (Non-Cash

Event) *

(18)

113

(425)

(787)

Depreciation and Amortisation *

(4)

(2)

(23)

(22)

Loss on disposal of plant and equipment

*

-

-

(17)

-

Operating Profit/(Loss) after non-cash

events

14

59

1,126

(784)

Corporation tax**

(79)

(41)

(330)

(186)

Interest Income/Expense

(127)

(29)

(246)

(137)

Net Profit / (Loss)

(192)

(11)

550

(1,107)

* - Included in General and Administrative

expenses in financial statements

** - The Company companies in Brazil are

currently under “presumed profit” taxation method, which is the

most efficient method at this time. Under “presumed profit” method,

it is not possible to utilise prior period losses to reduce

corporation tax. When the Company switches to “real profit” method,

these losses can be utilised.

Q4 and FY 2020 compared with Q4 and FY

2019

The Company generated a net loss for Q4 2020 of $192,000, an

increase of $181,000 compared to Q4 2019. The loss per share was

$0.003, compared to zero for Q4 2019.

For FY 2020, the Company reported a net profit of $550,000

compared to a net loss of $1,107,000, an increase of $1,657,000 for

the year. The increase was due to the continued growth of the

Company. 2020 was the first year that the Company recorded a net

profit.

Product Sales

In Q4 2020, the Company sold 56,585 tonnes, an increase of 76%

in comparison to Q4 2019.

For FY 2020, the Company sold 243,707 an increase of 103% in

comparison to FY 2019 as the Company’s product continues to grow in

the market.

Revenue

Revenue from sales for Q4 2020 was $2,209,000 from the sale of

56,585 tonnes of the Product, at $39 per tonne sold. Average

revenue per tonne was lower than Q4 2019 ($46 per tonne sold). The

Product price is based on the current US$ Potassium Chloride price.

Therefore, the reduction of the average revenue per tonne was

mainly due to the decline of the Potassium Chloride CFR (Brazil)

price, from US$290 per tonne in Q4 2019 to US$250 per tonne in Q4

2020 (Acerto Limited Report).

For FY 2020, total Revenue from sales was $9,167,000 an increase

of 52% compared to FY 2019.

Production costs

Production costs include all costs directly from mining,

processing, logistics from the mine to the factory and supply chain

salaries, which are paid in R$. Cost per tonne for the quarter was

$16 compared to $30 for the same period in 2019. The reduction of

46% was due to cost efficiency enhancement of 17% and as a result

of devaluation of the R$ by 29% against the Canadian Dollar in Q4

2020 compared to Q4 2019.

For FY 2020, production costs per tonne were $14, compared to

$26 in FY 2019, a reduction of 45%. This was due to cost efficiency

improvements and the devaluation of the Brazilian Real against the

Canadian Dollar.

Sales Expenses

CAD $’000

Q4 2020

Q4 2019

FY 2020

FY 2019

Sales and marketing expenses

(195)

(57)

(1,137)

(932)

Product delivery freight expenses

(478)

(145)

(1,133)

(371)

Total

(673)

(202)

(2,270)

(1,303)

Sales and marketing expenses

Sales and marketing expenses include sales and marketing

salaries, the promotion of the Product such as fees paid to sales

agents, marketing events, car rentals, travel within Brazil, hotel

expenses and Customer Relationship Management (CRM) Software

licenses. Expenses increased by $139,000 in Q4 2020 compared to Q4

2019 mainly due to additional sales and marketing staff to support

the Company growth from an average of 13 employees in 2019 to an

average of 32 employees in 2020, along with increased commissions

paid to consultants.

Product delivery freight

expenses

Product delivery freight expenses were $333,000 higher in Q4

2020 compared to the same quarter last year.

For FY 2020, the costs have increased by $762,000 compared to FY

2019 as the Company has increased significantly the volume sold as

CIF (Cost Insurance and Freight), from 2% of total sales in 2019 to

13% in 2020.

General and Administrative Expenses

CAD $’000

Q4 2020

Q4 2019

FY 2020

FY 2019

General administrative expenses

(494)

(227)

(1,149)

(901)

Legal, professional, consultancy and audit

costs

(75)

(91)

(520)

(496)

IT/Software expenses

(23)

(33)

(98)

(79)

Taxes and licenses fees

4

(30)

(24)

(59)

Total

(588)

(381)

(1,791)

(1,535)

General administrative expenses

These costs include general office expenses, rent, bank fees,

insurance, foreign exchange variances and remuneration of the

executives and administrative staff in Brazil. The costs have

increased by $266,000 in Q4 2020 compared to Q4 2019. For FY 2020,

the costs have increased by $248,000 compared to FY 2019 as they

include management bonuses at the year end.

Legal, professional, consultancy and audit

costs

Legal and professional fees include legal, professional,

consultancy fees along with accountancy, audit and regulatory

costs. Consultancy fees are consultants employed in Brazil, such as

accounting services, patent process, lawyer’s fee and regulatory

consultants.

The costs in Q4 2020 are comparable with Q4 2019 and for FY

2020, the figures were $24,000 higher than in FY 2019. This is due

to increased consultancy support as the Company continues to

grow.

IT/Software expenses

IT/Software expenses include software licenses such as Microsoft

Office and enterprise resource planning (ERP). In Q4 2020 expenses

were $23,000, a decrease of $10,000 compared to the same period

last year. For FY 2020, expenses were $98,000 an increase of

$19,000 compared to FY 2019 due to increased third party computing

services provided in Brazil.

Taxes and licences

Taxes and licence expenses include general taxes, product

branding and licence costs. In Q4 2020, expenses were credit $4,000

compared to $30,000 expense in Q4 2019. During Q4 2020, an amount

of $15,000 was credited to licence costs for the reversal expenses

which should have been capitalised in a previous quarter. For FY

2020, expenses were $24,000 compared to $59,000 in FY 2019, a

decrease of $35,000. The decrease is a result of reduced general

taxes.

Share Based and Bonus Payments/ (Non-Cash

Event)

These costs represent the expense associated with stock options

granted to employees and directors along with non-cash bonuses paid

to the board to exercise share options.

The amount for Q4 2020 was $18,000, compared to a credit of

$113,000 in Q4 2019. The credit in Q4 2019 related to an over

calculated share based payment charge in an earlier period.

For FY 2020, the charge was $425,000 compared to $787,000 in

2019. The decrease is a result of less options vesting in the

year.

Investors Newsletter

Subscribe to receive the Company’s monthly updates at:

http://cloud.marketing.verde.ag/InvestorsSubscription

The last edition of the newsletter can be accessed at:

http://bit.ly/InvestorsNL-February2021

Q4 and FY 2020 Results Conference Call

The Company will host a conference call on Wednesday, April 7,

2021 at 11:00 pm Eastern Time (4:00 pm Greenwich Mean Time), to

discuss Q4 and FY 2020 results and provide an update. Subscribe

using the link below and receive the conference details by

email.

Date:

Wednesday, April 7, 2021

Time:

11:00 am Eastern Time (4:00 pm Greenwich

Mean Time)

Subscription link:

http://bit.ly/VerdeAgriTechQ4-FY-2020

The Company’s full year and fourth quarter financial statements

and related notes for the period ended December 31, 2020 are

available to the public on SEDAR at www.sedar.com and the Company’s

website at www.investor.verde.ag/.

About Verde AgriTech

Verde AgriTech promotes sustainable and profitable agriculture

through the development of its Cerrado Verde Project. Cerrado

Verde, located in the heart of Brazil’s largest agricultural

market, is the source of a potassium-rich deposit from which the

Company intends to produce solutions for crop nutrition, crop

protection, soil improvement and increased sustainability.

Cautionary Language and Forward-Looking

Statements

This news release contains “forward-looking information” and

“forward-looking statements” (collectively, “forward-looking

statements”) within the meaning of the applicable Canadian

securities legislation. The Cautionary Language and Forward-Looking

Statements can be accessed at this link.

www.investor.verde.ag | www.supergreensand.com

| www.verde.ag

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210331005311/en/

Cristiano Veloso, President & Chief Executive Officer

Tel: +55 (31) 3245 0205; Email: cv@verde.ag

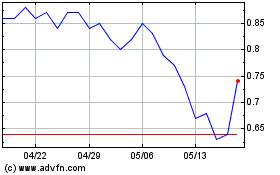

Verde Agritech (TSX:NPK)

過去 株価チャート

から 11 2024 まで 12 2024

Verde Agritech (TSX:NPK)

過去 株価チャート

から 12 2023 まで 12 2024