false000116330200011633022024-08-012024-08-010001163302exch:XNYS2024-08-012024-08-010001163302exch:XCHI2024-08-012024-08-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 1, 2024

United States Steel Corporation

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

| | | | |

Delaware | | 1-16811 | | 25-1897152 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| |

600 Grant Street,

Pittsburgh, PA 15219-2800

(Address of Principal Executive Offices, and Zip Code)

(412) 433-1121

Registrant’s Telephone Number, Including Area Code

____________________________________________

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| ☐ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| ☐ | Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| ☐ | Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock | X | New York Stock Exchange |

Common Stock | X | Chicago Stock Exchange |

| | | | | | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). |

| Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

Item 2.02. Results of Operations and Financial Condition

On August 1, 2024, United States Steel Corporation (the “Corporation”) issued a press release announcing its financial results for the second quarter 2024. Also on August 1, 2024, the Corporation posted to its website a presentation related to the Corporation’s financial results for the second quarter 2024.

In accordance with General Instruction B.2 of Form 8-K, the information contained in this Item 2.02, the press release and the presentation are being furnished under Item 2.02 of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information and exhibits be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing. The full text of the press release, together with related unaudited financial information and statistics, is furnished herewith as Exhibit 99.1. The earnings presentation is furnished with this current report on Form 8-K as Exhibit 99.2.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits:

| | | | | |

| Exhibit No. | Description |

| |

| Press release, dated August 1, 2024, titled “United States Steel Corporation Reports Second Quarter 2024 Results” together with related unaudited financial information and statistics. |

| |

| Second Quarter 2024 Earnings. |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

UNITED STATES STEEL CORPORATION

| | | | | |

| By | /s/ Manpreet S. Grewal |

| Manpreet S. Grewal |

| Vice President, Controller & Chief Accounting Officer |

Dated: August 1, 2024

| | | | | | | | | | | | | | | | | |

| |

CONTACTS:

Corporate Communications T - (412) 433-1300 E - media@uss.com | Emily Chieng Investor Relations Officer T - (412) 618-9554 E - ecchieng@uss.com |

|

NEWS RELEASE |

FOR IMMEDIATE RELEASE:

United States Steel Corporation Reports Second Quarter 2024 Results

•Second quarter 2024 net earnings of $183 million, or $0.72 per diluted share.

•Second quarter 2024 adjusted net earnings of $211 million, or $0.84 per diluted share.

•Second quarter 2024 adjusted EBITDA of $443 million.

PITTSBURGH, August 1, 2024 – United States Steel Corporation (NYSE: X) reported second quarter 2024 net earnings of $183 million, or $0.72 per diluted share. Adjusted net earnings was $211 million, or $0.84 per diluted share. This compares to second quarter 2023 net earnings of $477 million, or $1.89 per diluted share. Adjusted net earnings for the second quarter 2023 was $483 million, or $1.92 per diluted share.

Commenting on the Company’s second quarter performance, U. S. Steel President and Chief Executive Officer, David B. Burritt said, “We were pleased with our performance during the second quarter, as adjusted EBITDA of $443 million improved sequentially in spite of pricing headwinds that grew in the quarter across our operating segments. Most notable was better than forecasted results in our North American Flat-Rolled segment, in large part from enhanced product mix and cost management that kept earnings resilient in a dynamic market. Our Mini Mill segment performed well, delivering 17% EBITDA margin when adjusting for $30 million in one-time start-up costs for strategic projects. Both Tubular and USSE performed as expected in the second quarter.”

Burritt continued, “We expect third quarter adjusted EBITDA in the range of $275 million and $325 million, as recent pricing dynamics continue to impact our business. Our North American Flat-Rolled segment results should soften slightly, as lower spot prices more than offset continuing strength in our contract order book and lower spending. Our Mini Mill segment results will likely reflect lower spot prices and $30 million of related start-up and one-time construction costs ahead of a planned fourth quarter start-up of Big River 2 (BR2). In Europe, results are expected to be consistent with the second quarter reflecting lower

©2024 U. S. Steel. All Rights Reserved www.ussteel.com United States Steel Corporation

selling prices largely offset by lower raw material costs. Our Tubular segment results should be lower as selling prices decline in the third quarter.”

Commenting on the Company’s transaction with Nippon Steel Corporation, Burritt noted, “We continue to make progress on the U.S. regulatory processes ahead of the anticipated closing of our transaction with Nippon Steel Corporation later this year, which will bring advanced technologies to U. S. Steel to support a stronger domestic steel industry with enhanced competition and will strengthen national, economic, and job security.”

Commenting on the Company’s other strategic initiatives, Burritt concluded, “Separately, construction on BR2 is achieving key milestones as we target start-up in the fourth quarter. Also at Big River, the recently commissioned dual galvalume® / galvanized coating line is ramping as expected. Galvanized coils are being delivered to customers and the team is on-track to produce galvalume coils later this summer. You can find additional details and photos of these Big River Steel projects in the investor presentation posted today on our website.”

| | | | | | | | | | | | | | |

| Earnings Highlights | | |

| Three Months Ended June 30, | Six Months Ended June 30, |

| (Dollars in millions, except per share amounts) | 2024 | 2023 | 2024 | 2023 |

| Net Sales | $ | 4,118 | | $ | 5,008 | | $ | 8,278 | | $ | 9,478 | |

| Segment earnings (loss) before interest and income taxes | | | | |

| Flat-Rolled | $ | 183 | | $ | 231 | | $ | 217 | | $ | 224 | |

| Mini Mill | 28 | | 132 | | 127 | | 144 | |

| U. S. Steel Europe | (10) | | 72 | | 6 | | 38 | |

| Tubular | 29 | | 157 | | 86 | | 389 | |

| Other | (4) | | (12) | | (6) | | (9) | |

| Total segment earnings before interest and income taxes | $ | 226 | | $ | 580 | | $ | 430 | | $ | 786 | |

| Other items not allocated to segments | (45) | | (16) | | (95) | | (33) | |

| Earnings before interest and income taxes | $ | 181 | | $ | 564 | | $ | 335 | | $ | 753 | |

| Net interest and other financial benefits | (58) | | (57) | | (113) | | (118) | |

| Income tax expense | 56 | | 144 | | 94 | | 195 | |

| Net earnings | $ | 183 | | $ | 477 | | $ | 354 | | $ | 676 | |

| Earnings per diluted share | $ | 0.72 | | $ | 1.89 | | $ | 1.40 | | $ | 2.67 | |

| | | | |

Adjusted net earnings (a) | $ | 211 | | $ | 483 | | $ | 417 | | $ | 678 | |

Adjusted net earnings per diluted share (a) | $ | 0.84 | | $ | 1.92 | | $ | 1.64 | | $ | 2.68 | |

Adjusted earnings before interest, income taxes, depreciation and amortization (EBITDA) (a) | $ | 443 | | $ | 804 | | $ | 857 | | $ | 1,231 | |

(a) Please refer to the non-GAAP Financial Measures section of this document for the reconciliation of these amounts. |

©2024 U. S. Steel All Rights Reserved www.ussteel.com United States Steel Corporation

| | | | | | | | | | | | | | | | | | | | |

| UNITED STATES STEEL CORPORATION |

| PRELIMINARY SUPPLEMENTAL STATISTICS (Unaudited) |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | 2023 | | 2024 | 2023 |

| OPERATING STATISTICS | | | | | |

Average realized price: ($/net ton unless otherwise noted) (a) | | | | | |

| Flat-Rolled | 1,051 | | 1,088 | | | 1,052 | | 1,050 | |

| Mini Mill | 869 | | 1,011 | | | 923 | | 897 | |

| U. S. Steel Europe | 821 | | 965 | | | 826 | | 939 | |

| U. S. Steel Europe (€/net ton) | 762 | | 886 | | | 763 | | 868 | |

| Tubular | 2,108 | | 3,493 | | | 2,190 | | 3,636 | |

| | | | | | |

Steel shipments (thousands of net tons): (a) | | | | | |

| Flat-Rolled | 2,045 | | 2,235 | | | 4,094 | | 4,513 | |

| Mini Mill | 562 | | 587 | | | 1,130 | | 1,246 | |

| U. S. Steel Europe | 875 | | 1,034 | | | 1,947 | | 1,917 | |

| Tubular | 109 | | 111 | | | 223 | | 242 | |

| Total steel shipments | 3,591 | | 3,967 | | | 7,394 | | 7,918 | |

| | | | | | |

| Intersegment steel (unless otherwise noted) shipments (thousands of net tons): | | | | | |

| Mini Mill to Flat-Rolled | 92 | | 142 | | | 204 | | 225 | |

| Flat-Rolled to Mini Mill | — | | — | | | 1 | | — | |

| Flat-Rolled to Mini Mill (pig iron) | 88 | | 86 | | | 165 | | 115 | |

| | | | | | |

| Flat-Rolled to USSE (coal) | 139 | | 159 | | | 258 | | 458 | |

| | | | | | |

| Raw steel production (thousands of net tons): | | | | | |

| Flat-Rolled | 2,072 | | 2,529 | | | 4,183 | | 4,922 | |

| Mini Mill | 725 | | 749 | | | 1,442 | | 1,508 | |

| U. S. Steel Europe | 980 | | 1,213 | | | 2,059 | | 2,305 | |

| Tubular | 117 | | 129 | | | 263 | | 300 | |

| | | | | | |

Raw steel capability utilization: (b) | | | | | |

| Flat-Rolled | 63 | % | 77 | % | | 64 | % | 75 | % |

| Mini Mill | 88 | % | 91 | % | | 88 | % | 92 | % |

| U. S. Steel Europe | 79 | % | 97 | % | | 83 | % | 93 | % |

| Tubular | 52 | % | 57 | % | | 59 | % | 67 | % |

| | | | | | |

CAPITAL EXPENDITURES (dollars in millions) | | | | | |

| Flat-Rolled | 125 | | 104 | | | 264 | | 243 | |

| Mini Mill | 475 | | 488 | | | 938 | | 1,051 | |

| U. S. Steel Europe | 27 | | 16 | | | 55 | | 42 | |

| Tubular | 4 | | 5 | | | 14 | | 17 | |

| Other Businesses | — | | — | | | — | | — | |

| Total | $ | 631 | | $ | 613 | | | $ | 1,271 | | $ | 1,353 | |

(a) Excludes intersegment shipments. |

(b) Based on annual raw steel production capability of 13.2 million net tons for Flat-Rolled, 3.3 million net tons for Mini Mill, 5.0 million net tons for U. S. Steel Europe and 0.9 million net tons for Tubular. |

|

©2024 U. S. Steel All Rights Reserved www.ussteel.com United States Steel Corporation

| | | | | | | | | | | | | | | | | |

| UNITED STATES STEEL CORPORATION |

| CONDENSED STATEMENT OF OPERATIONS (Unaudited) |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| (Dollars in millions, except per share amounts) | 2024 | 2023 | | 2024 | 2023 |

| Net Sales | $ | 4,118 | | $ | 5,008 | | | $ | 8,278 | | $ | 9,478 | |

| | | | | |

| Operating expenses (income): | | | | | |

| Cost of sales | 3,629 | | 4,161 | | | 7,294 | | 8,114 | |

| Selling, general and administrative expenses | 105 | | 103 | | | 224 | | 202 | |

| Depreciation, depletion and amortization | 217 | | 224 | | | 427 | | 445 | |

| Earnings from investees | (45) | | (38) | | | (59) | | (25) | |

| Asset impairment charges | 12 | | — | | | 19 | | 4 | |

| Restructuring and other charges | — | | 2 | | | 6 | | 3 | |

| Other losses (gains), net | 19 | | (8) | | | 32 | | (18) | |

| Total operating expenses | 3,937 | | 4,444 | | | 7,943 | | 8,725 | |

| | | | | |

| Earnings before interest and income taxes | 181 | | 564 | | | 335 | | 753 | |

| Net interest and other financial benefits | (58) | | (57) | | | (113) | | (118) | |

| | | | | |

| Earnings before income taxes | 239 | | 621 | | | 448 | | 871 | |

| Income tax expense | 56 | | 144 | | | 94 | | 195 | |

| | | | | |

| Net earnings | 183 | | 477 | | | 354 | | 676 | |

| Less: Net earnings attributable to noncontrolling interests | — | | — | | | — | | — | |

| Net earnings attributable to United States Steel Corporation | $ | 183 | | $ | 477 | | | $ | 354 | | $ | 676 | |

| | | | | |

| COMMON STOCK DATA: | | | | | |

| Net earnings per share attributable to United States Steel Corporation Stockholders | | | | | |

| Basic | $ | 0.82 | | $ | 2.12 | | | $ | 1.58 | | $ | 2.99 | |

| Diluted | $ | 0.72 | | $ | 1.89 | | | $ | 1.40 | | $ | 2.67 | |

| Weighted average shares, in thousands | | | | | |

| Basic | 224,893 | | 225,538 | | | 224,496 | | 226,430 | |

| Diluted | 254,248 | | 254,155 | | | 254,428 | | 255,757 | |

| Dividends paid per common share | $ | 0.05 | | $ | 0.05 | | | $ | 0.10 | | $ | 0.10 | |

©2024 U. S. Steel All Rights Reserved www.ussteel.com United States Steel Corporation

| | | | | | | | | | | |

| UNITED STATES STEEL CORPORATION |

| CONDENSED CASH FLOW STATEMENT (Unaudited) |

| | Six Months Ended June 30, | Six Months Ended June 30, |

| (Dollars in millions) | 2024 | 2023 |

| Increase (decrease) in cash, cash equivalents and restricted cash |

| Operating activities: | | |

| Net earnings | $ | 354 | | $ | 676 | |

| Depreciation, depletion and amortization | 427 | | 445 | |

| Asset impairment charges | 19 | | 4 | |

| Restructuring and other charges | 6 | | 3 | |

| Pensions and other postretirement benefits | (62) | | (84) | |

| Active employee benefit investments | 41 | | 7 | |

| Deferred income taxes | 87 | | 135 | |

| Working capital changes | (219) | | (111) | |

| Income taxes receivable/payable | (42) | | 48 | |

| Other operating activities | (165) | | (229) | |

| Net cash provided by operating activities | 446 | | 894 | |

| | | |

| Investing activities: | | |

| Capital expenditures | (1,271) | | (1,353) | |

| Proceeds from sale of assets | 1 | | 3 | |

| Other investing activities | (5) | | — | |

| Net cash used in investing activities | (1,275) | | (1,350) | |

| | | |

| Financing activities: | | |

| Issuance of long-term debt, net of financing costs | — | | 238 | |

| Repayment of long-term debt | (33) | | (20) | |

| Common stock repurchased | — | | (150) | |

| Other financing activities | (43) | | (42) | |

| Net cash (used in) provided by financing activities | (76) | | 26 | |

| | | |

| Effect of exchange rate changes on cash | (10) | | 8 | |

| | | |

| Net decrease in cash, cash equivalents and restricted cash | (915) | | (422) | |

| Cash, cash equivalents and restricted cash at beginning of year | 2,988 | | 3,539 | |

| | | |

| Cash, cash equivalents and restricted cash at end of period | $ | 2,073 | | $ | 3,117 | |

©2024 U. S. Steel All Rights Reserved www.ussteel.com United States Steel Corporation

| | | | | | | | | | | |

| UNITED STATES STEEL CORPORATION |

| CONDENSED BALANCE SHEET (Unaudited) |

| | June 30, | December 31, |

| (Dollars in millions) | 2024 | 2023 |

| Cash and cash equivalents | $ | 2,031 | | $ | 2,948 | |

| Receivables, net | 1,678 | | 1,548 | |

| Inventories | 2,020 | | 2,128 | |

| Other current assets | 221 | | 319 | |

| Total current assets | 5,950 | | 6,943 | |

| | | |

| Operating lease assets | 90 | | 109 | |

| Property, plant and equipment, net | 11,222 | | 10,393 | |

| Investments and long-term receivables, net | 809 | | 761 | |

| Intangibles, net | 426 | | 436 | |

| Goodwill | 920 | | 920 | |

| Other noncurrent assets | 999 | | 889 | |

| Total assets | $ | 20,416 | | $ | 20,451 | |

| | | |

| Accounts payable and other accrued liabilities | 2,680 | | 3,028 | |

| Payroll and benefits payable | 333 | | 442 | |

| Short-term debt and current maturities of long-term debt | 162 | | 142 | |

| Other current liabilities | 281 | | 336 | |

| Total current liabilities | 3,456 | | 3,948 | |

| | | |

| Noncurrent operating lease liabilities | 58 | | 73 | |

| Long-term debt, less unamortized discount and debt issuance costs | 4,078 | | 4,080 | |

| Employee benefits | 117 | | 126 | |

| Deferred income tax liabilities | 679 | | 587 | |

| Other long-term liabilities | 542 | | 497 | |

| United States Steel Corporation stockholders' equity | 11,393 | | 11,047 | |

| Noncontrolling interests | 93 | | 93 | |

| Total liabilities and stockholders' equity | $ | 20,416 | | $ | 20,451 | |

©2024 U. S. Steel All Rights Reserved www.ussteel.com United States Steel Corporation

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| UNITED STATES STEEL CORPORATION |

| NON-GAAP FINANCIAL MEASURES |

| RECONCILIATION OF ADJUSTED NET EARNINGS |

| | Three Months Ended June 30, | Six Months Ended June 30, |

| (Dollars in millions) | 2024 | 2023 | 2024 | 2023 |

| Net earnings and diluted net earnings per share attributable to United States Steel Corporation, as reported | $ | 183 | | $ | 0.72 | | $ | 477 | | $ | 1.89 | | $ | 354 | | $ | 1.40 | | $ | 676 | | $ | 2.67 | |

| Restructuring and other charges | — | | | 2 | | | 6 | | | 3 | | |

| Stock-based compensation expense | 16 | | | 12 | | | 27 | | | 23 | | |

| Asset impairment charges | 12 | | | — | | | 19 | | | 4 | | |

| VEBA asset surplus adjustment | (8) | | | (8) | | | (12) | | | (30) | | |

| Environmental remediation charges | 1 | | | 2 | | | 3 | | | 2 | | |

| Strategic alternatives review process costs | 18 | | | — | | | 41 | | | — | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Other charges, net | (2) | | | — | | | (1) | | | 1 | | |

| Adjusted pre-tax net earnings to United States Steel Corporation | 220 | | | 485 | | | 437 | | | 679 | | |

| Tax impact of adjusted items (a) | (9) | | | (2) | | | (20) | | | (1) | | |

| Adjusted net earnings and diluted net earnings per share attributable to United States Steel Corporation | $ | 211 | | $ | 0.84 | | $ | 483 | | $ | 1.92 | | $ | 417 | | $ | 1.64 | | $ | 678 | | $ | 2.68 | |

| Weighted average diluted ordinary shares outstanding, in millions | 254.2 | | | 254.2 | | | 254.4 | | | 255.8 | | |

(a) The tax impact of adjusted items for both the three and six months ended June 30, 2024, and 2023 were calculated using a blended tax rate of 24%. |

| | | | | | | | | | | | | | | | | |

| UNITED STATES STEEL CORPORATION |

| NON-GAAP FINANCIAL MEASURES |

| RECONCILIATION OF ADJUSTED EBITDA |

| | Three Months Ended June 30, | Six Months Ended June 30, |

| (Dollars in millions) | 2024 | 2023 | 2024 | 2023 |

| Reconciliation to Adjusted EBITDA | | | | |

| Net earnings attributable to United States Steel Corporation | $ | 183 | | $ | 477 | | $ | 354 | | 676 | |

| Income tax expense | 56 | | 144 | | 94 | | 195 | |

| Net interest and other financial benefits | (58) | | (57) | | (113) | | (118) | |

| Depreciation, depletion and amortization expense | 217 | | 224 | | 427 | | 445 | |

| EBITDA | 398 | | 788 | | 762 | | 1,198 | |

| Restructuring and other charges | — | | 2 | | 6 | | 3 | |

| Stock-based compensation expense | 16 | | 12 | | 27 | | 23 | |

| Asset impairment charges | 12 | | — | | 19 | | 4 | |

| Environmental remediation charges | 1 | | 2 | | 3 | | 2 | |

| Strategic alternatives review process costs | 18 | | — | | 41 | | — | |

| | | | | |

| | | | | |

| | | | | |

| Other charges, net | (2) | | — | | (1) | | 1 | |

| Adjusted EBITDA | $ | 443 | | $ | 804 | | $ | 857 | | $ | 1,231 | |

| Net earnings margin (a) | 4.4 | % | 9.5 | % | 4.3 | % | 7.1 | % |

| Adjusted EBITDA margin (a) | 10.8 | % | 16.1 | % | 10.4 | % | 13.0 | % |

(a) The net earnings and adjusted EBITDA margins represent net earnings or adjusted EBITDA divided by net sales. |

©2024 U. S. Steel All Rights Reserved www.ussteel.com United States Steel Corporation

| | | | | | | | | | | | | | | | | |

| UNITED STATES STEEL CORPORATION |

| NON-GAAP FINANCIAL MEASURES |

| RECONCILIATION OF PAST TWELVE MONTHS OF FREE AND INVESTABLE CASH FLOW |

| 3rd | 4th | 1st | 2nd | |

| Quarter | Quarter | Quarter | Quarter | Total of the |

| (Dollars in millions) | 2023 | 2023 | 2024 | 2024 | Four Quarters |

| Net cash provided (used) by operating activities | $ | 817 | | $ | 389 | | $ | (28) | | $ | 474 | | $ | 1,652 | |

| Net cash used in investing activities | (585) | | (633) | | (645) | | (630) | | (2,493) | |

| Free cash flow | 232 | | (244) | | (673) | | (156) | | (841) | |

| Strategic capital expenditures | 423 | | 425 | | 468 | | 468 | | 1,784 | |

| Investable free cash flow | $ | 655 | | $ | 181 | | $ | (205) | | $ | 312 | | $ | 943 | |

©2024 U. S. Steel All Rights Reserved www.ussteel.com United States Steel Corporation

We present adjusted net earnings, adjusted net earnings per diluted share, earnings before interest, income taxes, depreciation and amortization (EBITDA), adjusted EBITDA and adjusted EBITDA margin, which are non-GAAP measures, as additional measurements to enhance the understanding of our operating performance. We believe that EBITDA, considered along with net earnings, is a relevant indicator of trends relating to our operating performance and provides management and investors with additional information for comparison of our operating results to the operating results of other companies.

Adjusted net earnings and adjusted net earnings per diluted share are non-GAAP measures that exclude the effects of items that include: restructuring and other charges, stock-based compensation expense, asset impairment charges, VEBA asset surplus adjustment, environmental remediation charges, strategic alternatives review process costs, tax impact of adjusted items and other charges, net (Adjustment Items). Adjusted EBITDA and adjusted EBITDA margins are also non-GAAP measures that exclude the effects of certain Adjustment Items. We present adjusted net earnings, adjusted net earnings per diluted share, adjusted EBITDA and adjusted EBITDA margin to enhance the understanding of our ongoing operating performance and established trends affecting our core operations by excluding the effects of events that can obscure underlying trends. U. S. Steel's management considers adjusted net earnings, adjusted net earnings per diluted share, adjusted EBITDA, and adjusted EBITDA margin as alternative measures of operating performance and not alternative measures of the Company's liquidity. U. S. Steel’s management considers adjusted net earnings, adjusted net earnings per diluted share, adjusted EBITDA, and adjusted EBITDA margin useful to investors by facilitating a comparison of our operating performance to the operating performance of our competitors. Additionally, the presentation of adjusted net earnings, adjusted net earnings per diluted share, adjusted EBITDA, and adjusted EBITDA margin provides insight into management’s view and assessment of the Company’s ongoing operating performance because management does not consider the Adjustment Items when evaluating the Company’s financial performance. Adjusted net earnings, adjusted net earnings per diluted share, adjusted EBITDA, and adjusted EBITDA margin should not be considered a substitute for net earnings, earnings per diluted share or other financial measures as computed in accordance with U.S. GAAP and are not necessarily comparable to similarly titled measures used by other companies.

We also present free cash flow, a non-GAAP measure of cash generated from operations after any investing activity and investable free cash flow, a non-GAAP measure of cash generated from operations after any investing activity adjusted for strategic capital expenditures. We believe that free cash flow and investable free cash flow provide further insight into the Company's overall utilization of cash. A condensed consolidated statement of operations (unaudited), condensed consolidated cash flow statement (unaudited), condensed consolidated balance sheet (unaudited) and preliminary supplemental statistics (unaudited) for U. S. Steel are attached.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This release contains information regarding the Company and NSC that may constitute “forward-looking statements,” as that term is defined under the Private Securities Litigation Reform Act of 1995 and other securities laws, that are subject to risks and uncertainties. We intend the forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in those sections. Generally, we have identified such forward-looking statements by using the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “target,” “forecast,” “aim,” “should,” “plan,” “goal,” “future,” “will,” “may” and similar expressions or by using future dates in connection with any discussion of, among other things, statements expressing general views about future operating or financial results, operating or financial performance, trends, events or developments that we expect or anticipate will occur in the future, anticipated cost savings, potential capital and operational cash improvements and changes in the global economic environment, the construction or operation of new or existing facilities or capabilities, statements regarding our greenhouse gas emissions reduction goals, as well as statements regarding the proposed transaction, including the timing of the completion of the transaction. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. Forward-looking statements include all statements that are not historical facts, but instead represent only the Company’s beliefs regarding future goals, plans and expectations about our prospects for the future and other events, many of which, by their nature, are inherently uncertain and outside of the Company’s or NSC’s control. It is possible that

©2024 U. S. Steel All Rights Reserved www.ussteel.com United States Steel Corporation

the Company’s or NSC’s actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these forward-looking statements. Management of the Company believes that these forward-looking statements are reasonable as of the time made. However, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date when made. In addition, forward looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from the Company’s or NSC's historical experience and our present expectations or projections. Risks and uncertainties include without limitation: the ability of the parties to consummate the proposed transaction on a timely basis or at all; the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the proposed transaction; the occurrence of any event, change or other circumstances that could give rise to the termination of the definitive agreement and plan of merger relating to the proposed transaction (the “Merger Agreement”); the risk that the parties to the Merger Agreement may not be able to satisfy the conditions to the proposed transaction in a timely manner or at all; risks related to disruption of management time from ongoing business operations due to the proposed transaction; certain restrictions during the pendency of the proposed transaction that may impact the Company’s ability to pursue certain business opportunities or strategic transactions; the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of the Company’s common stock; the risk of any unexpected costs or expenses resulting from the proposed transaction; the risk of any litigation relating to the proposed transaction; the risk that the proposed transaction and its announcement could have an adverse effect on the ability of the Company or NSC to retain customers and retain and hire key personnel and maintain relationships with customers, suppliers, employees, stockholders and other business relationships and on its operating results and business generally; and the risk the pending proposed transaction could distract management of the Company. The Company directs readers to its Quarterly Report on Form 10-Q for the quarter ended March 31, 2024 and Form 10-K for the year ended December 31, 2023, and the other documents it files with the SEC for other risks associated with the Company’s future performance. These documents contain and identify important factors that could cause actual results to differ materially from those contained in the forward-looking statements. All information in this report is as of the date above. The Company does not undertake any duty to update any forward-looking statement to conform the statement to actual results or changes in the Company’s expectations whether as a result of new information, future events or otherwise, except as required by law.

###

2024-030

Founded in 1901, United States Steel Corporation is a leading steel producer. With an unwavering focus on safety, the Company’s customer-centric Best for All® strategy is advancing a more secure, sustainable future for U. S. Steel and its stakeholders. With a renewed emphasis on innovation, U. S. Steel serves the automotive, construction, appliance, energy, containers, and packaging industries with high value-added steel products such as U. S. Steel’s proprietary XG3® advanced high-strength steel. The Company also maintains competitively advantaged iron ore production and has an annual raw steelmaking capability of 22.4 million net tons. U. S. Steel is headquartered in Pittsburgh, Pennsylvania, with world-class operations across the United States and in Central Europe. For more information, please visit www.ussteel.com.

©2024 U. S. Steel All Rights Reserved www.ussteel.com United States Steel Corporation

1 EARNINGS SECOND QUARTER 2024 August 1, 2024

2 FORWARD-LOOKING STATEMENTS This presentation contains information regarding the Company and NSC that may constitute “forward-looking statements,” as that term is defined under the Private Securities Litigation Reform Act of 1995 and other securities laws, that are subject to risks and uncertainties. We intend the forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in those sections. Generally, we have identified such forward-looking statements by using the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “target,” “forecast,” “aim,” “should,” “plan,” “goal,” “future,” “will,” “may” and similar expressions or by using future dates in connection with any discussion of, among other things, statements expressing general views about future operating or financial results, operating or financial performance, trends, events or developments that we expect or anticipate will occur in the future, anticipated cost savings, potential capital and operational cash improvements and changes in the global economic environment, the construction or operation of new or existing facilities or capabilities, statements regarding our greenhouse gas emissions reduction goals, as well as statements regarding the proposed transaction, including the timing of the completion of the transaction. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. Forward-looking statements include all statements that are not historical facts, but instead represent only the Company’s beliefs regarding future goals, plans and expectations about our prospects for the future and other events, many of which, by their nature, are inherently uncertain and outside of the Company’s or NSC’s control. It is possible that the Company’s or NSC’s actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these forward-looking statements. Management of the Company believes that these forward-looking statements are reasonable as of the time made. However, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date when made. In addition, forward looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from the Company’s or NSC's historical experience and our present expectations or projections. Risks and uncertainties include without limitation: the ability of the parties to consummate the proposed transaction on a timely basis or at all; the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the proposed transaction; the occurrence of any event, change or other circumstances that could give rise to the termination of the definitive agreement and plan of merger relating to the proposed transaction (the “Merger Agreement”); the risk that the parties to the Merger Agreement may not be able to satisfy the conditions to the proposed transaction in a timely manner or at all; risks related to disruption of management time from ongoing business operations due to the proposed transaction; certain restrictions during the pendency of the proposed transaction that may impact the Company’s ability to pursue certain business opportunities or strategic transactions; the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of the Company’s common stock; the risk of any unexpected costs or expenses resulting from the proposed transaction; the risk of any litigation relating to the proposed transaction; the risk that the proposed transaction and its announcement could have an adverse effect on the ability of the Company or NSC to retain customers and retain and hire key personnel and maintain relationships with customers, suppliers, employees, stockholders and other business relationships and on its operating results and business generally; and the risk the pending proposed transaction could distract management of the Company. The Company directs readers to its Quarterly Report on Form 10-Q for the quarter ended March 31, 2024 and Form 10-K for the year ended December 31, 2023, and the other documents it files with the SEC for other risks associated with the Company’s future performance. These documents contain and identify important factors that could cause actual results to differ materially from those contained in the forward-looking statements. All information in this report is as of the date above. The Company does not undertake any duty to update any forward-looking statement to conform the statement to actual results or changes in the Company’s expectations whether as a result of new information, future events or otherwise, except as required by law.

3 EXPLANATION OF USE OF NON-GAAP MEASURES We present adjusted net earnings, adjusted net earnings margin, adjusted net earnings per diluted share, earnings before interest, income taxes, depreciation and amortization (EBITDA), adjusted EBITDA and adjusted EBITDA margin, which are non-GAAP measures, as additional measurements to enhance the understanding of our operating performance. We believe that EBITDA, considered along with net earnings, is a relevant indicator of trends relating to our operating performance and provides management and investors with additional information for comparison of our operating results to the operating results of other companies. Adjusted net earnings and adjusted net earnings per diluted share are non-GAAP measures that exclude the effects of items that include: asset impairment charges, restructuring and other charges, stock-based compensation expense, VEBA asset surplus adjustment, environmental remediation charges, strategic alternatives review process costs, Granite City idling costs, tax impact of adjusted items and other changes, net (Adjustment Items). Adjusted EBITDA and adjusted EBITDA margin are also non- GAAP measures that exclude the effects of certain Adjustment Items. We present adjusted net earnings, adjusted net earnings per diluted share, adjusted EBITDA and adjusted EBITDA margin to enhance the understanding of our ongoing operating performance and established trends affecting our core operations by excluding the effects of events that can obscure underlying trends. U. S. Steel's management considers adjusted net earnings, adjusted net earnings per diluted share, adjusted EBITDA and adjusted EBITDA margin as alternative measures of operating performance and not alternative measures of the Company's liquidity. U. S. Steel’s management considers adjusted net earnings, adjusted net earnings per diluted share, adjusted EBITDA and adjusted EBITDA margin useful to investors by facilitating a comparison of our operating performance to the operating performance of our competitors. Additionally, the presentation of adjusted net earnings, adjusted net earnings per diluted share, adjusted EBITDA and adjusted EBITDA margin provides insight into management’s view and assessment of the Company’s ongoing operating performance because management does not consider the Adjustment Items when evaluating the Company’s financial performance. Adjusted net earnings, adjusted net earnings per diluted share, adjusted EBITDA and adjusted EBITDA margin should not be considered a substitute for net earnings or other financial measures as computed in accordance with U.S. GAAP and are not necessarily comparable to similarly titled measures used by other companies. We also present net debt, a non-GAAP measure calculated as total debt less cash and cash equivalents. We believe net debt is a useful measure in calculating enterprise value. A condensed consolidated statement of operations (unaudited), condensed consolidated cash flow statement (unaudited), condensed consolidated balance sheet (unaudited) and preliminary supplemental statistics (unaudited) for U. S. Steel are attached.

4 SUMMARY: ADVANCING TOWARDS OUR BEST FOR ALL® FUTURE Current Landscape Progressing towards second half 2024 closing of the transaction with Nippon Steel Corporation (NSC) Tracking towards a Q4 2024 Big River 2 (BR2) start-up Challenges Successfully navigating a dynamic steel industry backdrop Solution Progressing towards becoming the ‘best steelmaker with world- leading capabilities’ Moving closer to completing our in-flight capital projects Path Forward Closing the NSC transaction at $55 per share in the second half 2024 Creating a global steel leader in value and innovation

5 NSC & U. S. STEEL: PROGRESSING TOWARDS DEAL CLOSING Merger approved by shareholders Progressing towards regulatory approval ~99% of shareholder votes cast were in favor of the deal Receipt of all non-U.S. regulatory approvals: both antitrust and CFIUS reviews are underway Expected closing in H2 2024 Advancing towards creating the “Best Steelmaker with World-leading Capabilities”

6 NSC & U. S. STEEL: BEST STEELMAKER WITH WORLD-LEADING CAPABILITIES BEST FOR EMPLOYEES BEST FOR COMMUNITIES BEST FOR INVESTORS + BEST FOR CUSTOMERS

7 NSC & U. S. STEEL: BEST FOR EMPLOYEES Investing more in USW facilities NSC has committed to investing an additional $1.4 billion in capital expenditures into facilities covered by the current basic labor agreement (BLA) with the United Steelworkers (USW), above and beyond what is required in the BLA Evaluating growth plans for USW facilities NSC is assessing opportunities to invest to enhance sustainability and competitiveness Committed to safety, jobs and footprint NSC has an unwavering commitment to safety and is promising to maintain jobs, production and operating footprint and honor all agreements with the USW

8 NSC & U. S. STEEL: BEST FOR CUSTOMERS Expanded capabilities, innovation and a global platform Sharing NSC’s and U. S. Steel’s world-leading technologies and manufacturing capabilities for the benefit of customers Accelerating decarbonization goals Collaborating on alternative technologies in decarbonization to deliver innovative steel solutions Committed to Mined, Melted and Made in America Further advancing the technical capabilities of U. S. Steel’s portfolio of products with NSC’s technology and products; better supporting the evolving demand of customers in the United States

9 NSC & U. S. STEEL: BEST FOR COMMUNITIES Driving the global steel industry towards carbon neutrality Advancing NSC’s breakthrough technologies to progress towards carbon neutrality: (1) hydrogen injection in BFs; (2) hydrogen use in DRI; and (3) high-grade steel through large size EAFs Moving Nippon Steel North America’s headquarters to Pittsburgh Relocating NSC’s existing U.S. headquarters from Houston, Texas Retaining U. S. Steel’s iconic name and brand NSC is committed to maintaining strong relationships in the communities where we live and work Note: BF = blast furnace; DRI = direct reduced iron; EAF = electric arc furnace

10 NSC & U. S. STEEL: BEST FOR INVESTORS Maximizing stockholder value $55 per share transaction price, all-cash deal; ~$15 billion total enterprise value Significant premium for stockholders +40% premium to U. S. Steel’s closing stock price on December 15, 2023; +142% premium to the undisturbed price prior to the announcement of the strategic alternatives review process Not subject to any financing conditions Transaction to be funded through proceeds mainly from borrowings; NSC has already secured financing commitments from leading global financial institutions

11 CGL2: STEADY PROGRESS TOWARDS RUN-RATE PRODUCTION Successful CGL2 ramp-up Progressing as-expected; commercial sales of galvanized product already achieved / galvalume coils expected later this summer On-track for value creation Tracking towards expected in-year and run-rate EBITDA contributions; $10-$15M in 2024; run-rate 2026 of $60M Applying start-up success to BR2 Implementing a similar start-up cadence to BR2 based on recent success Note: CGL = Continuous galvanizing line. CGL2 is a dual coating line with both Galvalume® and Galvanized capabilities.

12 BR2: APPROACHING START-UP First column set at BR2 Q4 2022 Approaching start-up First coil expected in Q4 2024

13 BR2: PLANNED FOURTH QUARTER 2024 START-UP; REVISED CAPEX Note: DR = Direct Reduced; NGO = Non-grain Oriented. CGL2 COMPLETE NGO COMPLETE GARY PIG COMPLETE DR PELLET COMPLETE On track for fourth quarter 2024 start-up Updated total capex = $3.35B BR2 ON TRACK 2024 enterprise capital expenditure forecast is $1.85 billion

14 BR2: PLANNED FOURTH QUARTER 2024 START-UP Endless Strip Production induction furnaces Endless Strip Production downcoiler Hot Autonomous Coil Storage coil staging area

15 Q2 2024 FINANCIAL PERFORMANCE: SUMMARY $443M Adjusted EBITDA ~11% EBITDA margin Second quarter performance $183M Reported Net Earnings $0.72 per diluted share Note: For reconciliation of non-GAAP amounts, see Appendix. $211M Adjusted Net Earnings $0.84 per diluted share $4.3B Liquidity Including $2.0B cash

16 Q2 2024 FINANCIAL PERFORMANCE: EACH SEGMENT CONTRIBUTING Meaningful contributions from each operating segment Million Adjusted EBITDA $443 N. American Flat-Rolled Segment Resilient average selling prices and volumes reflect successful fixed price contract negotiations and a diverse product mix; managing costs to keep earnings resilient Mini Mill Segment Reflects weaker spot selling prices and $30 million of one- time start-up costs at Big River Steel; Mini Mill adjusted EBITDA margin for Q2 2024 was 17% excluding these one- time costs U.S. Steel Europe Segment Restarted blast furnace #2 due to improved customer demand; results as expected Tubular Segment Enhanced suite of proprietary connections and seamless pipe products serving a diverse oil and gas customer base Note: For reconciliation of non-GAAP amounts, see Appendix.

17 Q3 2024 OUTLOOK: $275 TO $325 MILLION ADJUSTED EBITDA North American Flat-Rolled Mini Mill1 U. S. Steel Europe Tubular Raw Materials No material change expected Operating Costs Favorable impact expected from reduced spending Commercial Unfavorable impact expected from lower average selling prices Raw Materials No material change expected Operating Costs No material change expected Commercial Unfavorable impact expected from lower average selling prices Raw Materials Favorable impact expected from lower CO2 accruals Operating Costs No material change expected Commercial Unfavorable impact expected from lower average selling prices Raw Materials No material change expected Operating Costs No material change expected Commercial Unfavorable impact expected from lower average selling prices Note: Commentary reflects the expected change versus Q2 2024. 1 Q3 2024 Mini Mill segment EBITDA is expected to include the impact of $30 million in construction and related start-up costs vs. $30 million in Q2 2024.

18 2024 S E C O N D Q U A R T E R U P D A T E

19 FINANCIAL UPDATES Reported Net Earnings (Loss) Adjusted Net Earnings Segment EBIT1 Adjusted EBITDA2 Profit Margin: 10% 7% (2%) 4% 4% $ Millions $ Millions $ Millions $ Millions 10% 8% 4% 5% 5% 12% 8% 2% 5% 5% Adjusted EBITDA Margin:2 16% 13% 8% 10% 11% Segment EBIT Margin:1 Note: For reconciliation of non-GAAP amounts, see Appendix. 1 Earnings (loss) before interest and income taxes. 2 Earnings (loss) before interest, income taxes, depreciation and amortization, and excluding adjustment items. Adjusted Profit Margin: $477 $299 -$80 $171 $183 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 $483 $350 $167 $206 $211 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 $580 $348 $89 $204 $226 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 $804 $578 $330 $414 $443 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024

20 KEY OPERATING STATISTICS TRENDS BY SEGMENT Flat-Rolled Operating Statistics Mini Mill Operating Statistics U. S. Steel Europe (USSE) Operating Statistics Tubular Operating Statistics Shipments: in 000s, net tons Production: in 000s, net tons Average Selling Price: $ / net ton Q2 2023 2,529 2,235 $1,088 Q3 2023 2,390 2,159 $1,036 Q4 2023 2,087 2,034 $978 Q1 2024 2,111 2,049 $1,054 Q2 2024 2,072 2,045 $1,051 Shipments: in 000s, net tons Production: in 000s, net tons Average Selling Price: $ / net ton Q2 2023 749 587 $1,011 Q3 2023 693 561 $901 Q4 2023 752 617 $807 Q1 2024 717 568 $977 Q2 2024 725 562 $869 Shipments: in 000s, net tons Production: in 000s, net tons Average Selling Price: $ / net ton Q2 2023 1,213 1,034 $965 Q3 2023 990 958 $852 Q4 2023 1,100 1,024 $770 Q1 2024 1,079 1,072 $830 Q2 2024 980 875 $821 Shipments: in 000s, net tons Production: in 000s, net tons Average Selling Price: $ / net ton Q2 2023 129 111 $3,493 Q3 2023 111 104 $2,927 Q4 2023 157 132 $2,390 Q1 2024 146 114 $2,267 Q2 2024 117 109 $2,108

21 EBITDA TRENDS BY SEGMENT EBITDA Margin: 12% 13% 5% 6% 12% 22% 13% 12% 21% 12% 9% 1% 0% 5% 3% EBITDA Margin: 42% 32% 38% 25% 17% EBITDA Margin: Note: For reconciliation of non-GAAP amounts, see Appendix. 1 Q4 2023 North American Flat-Rolled segment includes the impact of construction and related start-up costs of approximately $10 million related to the DR-grade pellet strategic project. 2 Mini Mill segment EBITDA includes the impact of construction and related start-up costs of $12M in Q2 2023, $17M in Q3 2023, $12M in Q4 2023, $20M in Q1 2024, and $30M in Q2 2024. EBITDA Margin: $377 $378 $128 $156 $310 Q2 2023 Q3 2023 Q4 20231 Q1 2024 Q2 2024 $173 $84 $74 $145 $74 Q2 20232 Q3 20232 Q4 20232 Q1 20242 Q2 20242 $97 $10 $3 $46 $21 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 $169 $99 $126 $69 $42 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Flat-Rolled Segment EBITDA Mini Mill Segment EBITDA$ Millions $ Millions USSE Segment EBITDA Tubular Segment EBITDA$ Millions $ Millions 17% EBITDA margin excluding $30M of Q2 2024 construction and related start-up costs

22 $ Millions, Q1 2024 vs. Q2 2024 FLAT-ROLLED SEGMENT EBITDA CHANGE ANALYSIS Commercial The unfavorable impact is primarily the result of lower shipment volumes and lower average realized prices. Raw Materials The favorable impact is primarily related to lower additions, coal, and scrap costs. Operating Costs The unfavorable impact is primarily the result of higher labor costs and outage spending. $377 $310 $89 $82 Q2 2023 ($153) Commercial Raw Materials ($85) Operating Costs Other Q2 2024 Other The favorable impact is primarily the result of lower profit-based payments and lower energy costs. Commercial The favorable impact is primarily the result of higher commercial pellet sales. Raw Materials The favorable impact is primarily the result of lower coal and scrap costs. Operating Costs The unfavorable impact is primarily the result of higher outage spending. Other The favorable impact is primarily the result of favorable derivative sales and lower energy costs, partially offset by higher profit-based payments. $ Millions, Q2 2023 vs. Q2 2024 $156 $310 $53 $26 $89 Q1 2024 Commercial Raw Materials ($14) Operating Costs Other Q2 2024

23 $ Millions, Q1 2024 vs. Q2 2024 MINI MILL SEGMENT EBITDA CHANGE ANALYSIS $173 $74 $13 Q2 2023 ($186) Commercial $87 Raw Materials Operating Costs ($13) Other Q2 2024 $ Millions, Q2 2023 vs. Q2 2024 $145 $74 $29 Q1 2024 ($102) Commercial Raw Materials $3 Operating Costs ($1) Other Q2 2024 Note: Q2 2024, Q1 2024, and Q2 2023 Mini Mill segment EBITDA includes the impact of $30 million, $20 million, and $12 million in construction and related start-up costs, respectively. Commercial The unfavorable impact is primarily the result of lower average realized prices and lower shipment volumes. Raw Materials The favorable impact is primarily the result of lower metallics costs. Operating Costs The favorable impact is primarily the result of lower spending and labor costs. Other The unfavorable impact is primarily the result of higher construction and related start-up costs associated with strategic projects partially offset by lower profit-based payments. Commercial The unfavorable impact is primarily the result of lower average realized prices. Raw Materials The favorable impact is primarily the result of lower metallics costs. Operating Costs The change is not material. Other The change is not material.

24 $46 $21 $16 $6 Q1 2024 ($39) Commercial Raw Materials ($8) Operating Costs Other Q2 2024 $ Millions, Q1 2024 vs. Q2 2024 U. S. STEEL EUROPE SEGMENT EBITDA CHANGE ANALYSIS $97 $21 Q2 2023 ($167) Commercial $58 Raw Materials ($1) Operating Costs $34 Other Q2 2024 $ Millions, Q2 2023 vs. Q2 2024 Commercial The unfavorable impact is primarily the result of lower average realized prices and lower shipment volumes. Raw Materials The favorable impact is primarily the result of lower coal and iron ore costs. Operating Costs The change is not material. Other The favorable impact is primarily the result of lower energy cost. Commercial The unfavorable impact is primarily the result of lower shipment volumes and lower average realized prices. Raw Materials The favorable impact is primarily the result of lower iron ore and coal costs. Operating Costs The unfavorable impact is primarily the result of higher spending and labor costs. Other The favorable impact is primarily the result of lower energy cost.

25 $ Millions, Q1 2024 vs. Q2 2024 TUBULAR SEGMENT EBITDA CHANGE ANALYSIS $169 $42$8 $14 Q2 2023 ($152) Commercial Raw Materials $3 Operating Costs Other Q2 2024 $ Millions, Q2 2023 vs. Q2 2024 $69 $42 $5 Q1 2024 ($27) Commercial Raw Materials ($2) Operating Costs ($3) Other Q2 2024 Commercial The unfavorable impact is primarily the result of lower average realized prices. Raw Materials The favorable impact is primarily the result of lower scrap costs. Operating Costs The change is not material. Other The favorable impact is primarily the result of lower profit-based payments. Commercial The unfavorable impact is primarily the result of lower average realized prices. Raw Materials The favorable impact is primarily the result of lower scrap costs. Operating Costs The change is not material. Other The change is not material.

26 Minntac M I N I M I L L T U B U L A R Clairton Keetac BF #4 BF #6 BF #8 BF #14 BF ‘A’ BF ‘B’ N O R T H A M E R I C A N F L A T - R O L L E D BF #1 BF #3 EAF #1 EAF #2 BF #1 BF #3BF #2 Seamless Pipe #1 ERW #2 ERW EAF Steelmaking / Seamless Pipe Indefinitely IdledOperating 1 Raw steel capability, except at Minntac and Keetac (DR-grade / iron ore pellet capability), Clairton (coke capability), Gary pig (pig iron) Lorain, and Lone Star (pipe capability). 2 Keetac’s DR-grade pellets investment is ramping up in 2024. Keetac can flex its capacity to produce either 6 million tons of blast furnace iron ore pellets or 4 million tons of DR-grade pellets. 3 If Keetac produces 4 million tons of DR-grade pellets and zero tons of blast furnace iron ore pellets, total iron ore production capacity would be 16.4 million. 22.43 3.6 7.5 2.8 2.9 - - - 2.8 - 0.90 0.38 0.79 - 0.38 0.79 5.0- 3.3- Iron Ore Pellets2 Cokemaking Gary Granite City Mon Valley Big River Steel Košice Lorain Lone Star Fairfield E U R O P E Idled Total Capability1 GLOBAL OPERATING FOOTPRINT Temporarily Idled GaryPig Iron - 0.5 Keetac 4.0-DR-grade Pellets2 All amounts shown in millions Planned 30-day outage beginning in August on BF #1 at USSE; planning to keep a BF off-line until demand improves

27 CASH AND LIQUIDITY Note: For reconciliation of non-GAAP amounts, see Appendix. 1 TTM = Trailing twelve months $138 $4,090 $3,505 $2,100 $1,652 FY 2020 FY 2021 FY 2022 FY 2023 TTM Q2 20241 $1,985 $2,522 $3,504 $2,948 $2,031 FY 2020 FY 2021 FY 2022 FY 2023 Q2 2024 $3,153 $4,971 $5,925 $5,174 $4,259 FY 2020 FY 2021 FY 2022 FY 2023 Q2 2024 $2,902 $1,369 $473 $1,274 $2,209 FY 2020 FY 2021 FY 2022 FY 2023 Q2 2024 Cash from Operations Cash and Cash Equivalents$ Millions $ Millions Total Estimated Liquidity Net Debt$ Millions $ Millions

28 APPENDIX

29 SUPPLEMENTAL INFORMATION HRC (30%) CRC (40%) Coated (25%) Tin (5%) HRC (60%) CRC (15%) Coated (25%) HRC (60%) CRC (10%) Coated (20%) Other (10%) Seamless (100%) Flat-Rolled Mini Mill1 U. S. Steel Europe Tubular 2023 Shipments by product mix 1 Mini Mill segment product mix, once Big River 2 (BR2) is fully ramped by 2026, is expected to be ~40% hot rolled coil (HRC) / ~15% cold rolled coil (CRC) / ~40% Coated / ~5% Non-grain oriented electrical steel.

30 SUPPLEMENTAL INFORMATION HRC (20%) CRC (40%) Coated (30%) Other (5%) HRC (55%) CRC (15%) Coated (30%) HRC (45%) CRC (10%) Coated (35%) Other (5%) Tubular Product (100%) Flat-Rolled Mini Mill U. S. Steel Europe Tubular 2023 Revenue by product mix Semi-finished (5%) Semi-finished (5%)

31 SUPPLEMENTAL INFORMATION Service Centers (17%) Converters (25%) Auto (33%) Construction (10%) Oil & Gas (94%) Flat-Rolled Mini Mill U. S. Steel Europe Tubular 2023 Shipments by major market Packaging (7%) Appliance & Electrical (5%) Other (3%) Service Centers (46%) Converters (30%) Auto (1%) Construction (20%) Appliance & Electrical (3%) Service Centers (22%) Converters (8%) Auto (16%) Construction (34%) Packaging (8%) Appliance & Electrical (4%) Other (8%) Construction (6%)

32 SUPPLEMENTAL INFORMATION Firm (23%) Market based quarterly (29%) Market based monthly (15%) Spot (33%) Firm (6%) Cost based (9%) Market based quarterly (5%) Market based monthly (38%) Spot (42%) Firm (31%) Cost based (2%) Market based quarterly (2%) Market based monthly (10%) Spot (55%) Program (78%) Spot (22%) Flat-Rolled Mini Mill U. S. Steel Europe Tubular 2023 Contract / spot mix by segment Note: Excludes intersegment shipments.

33 SUPPLEMENTAL INFORMATION Cost structure: Blast furnace steelmaking illustrative Coke (~35%) Natural Gas (~5%) Scrap (~30%) Raw Material Costs1 Iron ore (~30%) Key Inputs Ratio1 Pricing Convention Iron Ore 1.3 tons of pellets / ton of raw steel x raw steel volume (million tons) x iron ore price assumption ($/nt) NAFR: Vertically integrated USSE: Prices determined in long-term contracts with strategic suppliers or as spot prices negotiated monthly or quarterly Coke Scrap Natural Gas2 1.4 tons of met coal / ton of coke x met coal price assumption ($/nt) + $75 - $100 / ton conversion cost x 0.3 ton of coke / ton of raw steel 0.3 tons of scrap / ton of raw steel x raw steel volume (million tons) x scrap price assumption ($/nt) 6 mmbtus of nat gas / ton of raw steel x raw steel volume (million tons) x nat gas price assumption ($/nt) Labor 2 hours labor / ton of raw steel x raw steel volume (million tons) x hourly labor rate ($/hr) Other Variable Costs ~$150 - $300 / ton dependent on level of raw steel pricing, product mix, and maintenance activity USSE: Includes CO2 costs Miscellaneous: includes maintenance and services, tool, other fuel and energy, and alloy costs NAFR: Primarily annual met coal contracts USSE: Prices for European met coal contracts negotiated quarterly, annually or determined as index-based prices. NAFR & USSE: 60% generated internally; 40% purchased at market prices NAFR: 70% based on bids solicited monthly from various vendors; remainder daily or with term agreements USSE: Based on bids solicited primarily on a quarterly or monthly basis; remainder balanced on a daily basis 1 Raw material costs and ratios assume a blast furnace within the North American flat-rolled segment. 2 6 mmbtus per ton of raw steel production; 4 mmbtus per ton consumed for further process (primarily at the hot strip mill).

34 SUPPLEMENTAL INFORMATION Cost structure: Electric arc furnace steelmaking illustrative Prime Scrap (~30%) Pig Iron (~25%) HBI / DRI (~10%) Raw Material Costs Obsolete Scrap (~35%) Key Inputs Ratio Pricing Convention Scrap 0.8 tons of scrap / ton of raw steel x raw steel volume (million tons) x scrap price assumption ($/nt) Volumes secured annually; priced on a monthly or quarterly basis Pig Iron HBI Electricity 0.3 tons of pig iron / ton of raw steel x raw steel volume (million tons) x pig iron price assumption ($/nt) 0.1 tons of HBI / ton of raw steel x raw steel volume (million tons) x HBI price assumption ($/nt) 0.6 MKWH of electricity / ton of raw steel x raw steel volume (million tons) x electricity price assumption ($/nt) Internal pig iron transferred from the N. American Flat-rolled segment at a discounted market rate; 3rd party pig volumes secured annually; priced on a monthly or quarterly basis Volumes secured annually; priced on a monthly or quarterly basis based on a blended basket of external HBI production inputs and HBI/DRI substitutes Volume-discounted negotiated base price; adjusted quarterly based on regional electricity price fluctuations Labor 0.14 hours labor / ton of raw steel x raw steel volume (million tons) x hourly labor rate ($/hr)

35 RECONCILIATION TABLE Flat-Rolled ($ millions) Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Segment earnings (loss) before interest and income taxes $231 $225 ($31) $34 $183 Depreciation 146 153 159 122 127 Flat-Rolled Segment EBITDA $377 $378 $128 $156 $310 Segment EBIT Margin1 8% 8% (1%) 1% 7% Segment EBITDA Margin1 12% 13% 5% 6% 12% Tubular ($ millions) Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Segment earnings (loss) before interest and income taxes $157 $87 $113 $57 $29 Depreciation 12 12 13 12 12 Tubular Segment EBITDA $169 $99 $126 $69 $42 Segment EBIT Margin1 39% 28% 34% 21% 12% Segment EBITDA Margin1 42% 32% 38% 25% 17% Other ($ millions) Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Segment earnings (loss) before interest and income taxes ($12) $7 ($1) ($2) ($4) Depreciation 0 0 0 0 0 Other Segment EBITDA ($12) $7 ($1) ($2) ($4) Mini Mill ($ millions) Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Segment earnings (loss) before interest and income taxes $132 $42 $29 $99 $28 Depreciation 41 42 45 46 47 Mini Mill Segment EBITDA $173 $84 $74 $145 $74 Segment EBIT Margin1 17% 6% 5% 14% 5% Segment EBITDA Margin1 22% 13% 12% 21% 12% Segment EBITDA U. S. Steel Europe ($ millions) Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Segment earnings (loss) before interest and income taxes $72 ($13) ($21) $16 ($10) Depreciation 25 23 24 30 31 U. S. Steel Europe Segment EBITDA $97 $10 $3 $46 $21 Segment EBIT Margin1 7% (2%) (3%) 2% (1%) Segment EBITDA Margin1 9% 1% 0% 5% 3% 1 The segment EBIT and segment EBITDA margins represent EBIT or EBITDA divided by net sales.

36 SUPPLEMENTAL INFORMATION Big River Steel LLC1 Summary Table Customer Sales Intersegment Sales Net Sales EBIT2 $512M $91M $603M $57M Income Statement $ Millions Q2 2024 Cash and cash equivalents Total Assets 2029 Senior secured notes Environmental revenue bonds Financial leases and all other obligations Fair value step up3 Total Debt3 $108M $3,662M $720M $752M $23M $107M $1,602M Balance Sheet Depreciation and Amortization Capital Expenditures4 $42M $60M Cash Flow 1 Unless otherwise noted, amounts shown are reflected in Big River Steel LLC, the operating unit of the Big River Steel companies that reside within the Mini Mill segment. 2 Earnings before interest and income taxes. 3 The debt amounts reflect aggregate principal amounts. The fair value step up represents the excess of fair value over book value when Big River Steel was purchased. The fair value step-up is recorded in Big River Steel Holdings LLC. The fair value step up is shown as it is related to the debt amounts in Big River Steel LLC. 4 Excludes capital expenditures for BR2 and air separation unit.

37 RECONCILIATION TABLE Short-term debt and current maturities of long-term debt Long-term debt, less unamortized discount and debt issuance costs Net Debt $ millions YE 2023YE 2022YE 2021YE 2020 $192 $4,695 $28 $3,863 $63 $3,914 $142 $4,080 Total Debt $4,222$3,977$3,891$4,887 Less: Cash and cash equivalents 1,985 2,522 3,504 2,948 Net Debt $1,274$473$1,369$2,902 Net Debt Q2 2024 $162 4,078 $4,240 2,031 $2,209

38 RECONCILIATION TABLE Adjusted Net Earnings 1 The tax impact of the adjusted items in 2024 is calculated using a blended tax rate of 24%. The tax impact of adjusted items in 2023 is calculated for U.S. domestic items using a blended tax rate of 24% and for USSE items 21%. $167$350$483 Reported net earnings attributable to U. S. Steel Asset impairment charges Restructuring and other charges Stock-based compensation expense VEBA asset surplus adjustment Environmental remediation charges Strategic alternatives review process costs Granite City idling costs Other charges, net Tax impact of adjusted items1 $477 - 2 12 (8) 2 - - - (2) $299 - 18 14 (6) 9 16 14 1 (15) ($80) 123 15 14 (7) - 63 107 10 (78) Net Earnings Net earnings (loss) margin2 Adjusted net earnings margin2 10% 10% 7% 8% (2%) 4% 2 The net earnings and adjusted net earnings margins represent net earnings or adjusted net earnings divided by net sales. Q1 2024 $206 4% 5% Q4 2023Q3 2023Q2 2023$ Millions $171 7 6 11 (4) 2 23 - 1 (11) Q2 2024 $211 4% 5% $183 12 - 16 (8) 1 18 - (2) (9)

39 RECONCILIATION TABLE $ Millions Adjusted EBITDA Adjusted EBITDA Q4 2023Q3 2023Q2 2023 $330$578$804 Reported net earnings attributable to U. S. Steel Income tax expense Net interest and other financial costs Reported earning before interest and income taxes Depreciation, depletion and amortization expense EBITDA Asset impairment charges Restructuring and other charges Stock-based compensation expense Environmental remediation charges Strategic alternatives review process costs Granite City idling costs Other charges, net $477 144 (57) $564 224 $788 - 2 12 2 - - - $299 42 (64) $277 230 $507 - 18 14 9 16 14 - ($80) (85) (66) ($231) 241 $10 123 15 14 - 63 107 (2) Net earnings margin1 Reported EBIT margin1 Adjusted EBITDA margin1 10% 11% 16% 7% 6% 13% (2%) (6%) 8% 1 The net earnings, reported EBIT and adjusted EBITDA margins represent net earnings or EBITDA divided by net sales. Q1 2024 $414 $171 38 (55) $154 210 $364 7 6 11 2 23 - 1 4% 4% 10% Q2 2024 $443 $183 56 (58) $181 217 $398 12 - 16 1 18 - (2) 4% 4% 11%

40 Emily Chieng Investor Relations Officer ecchieng@uss.com 412-618-9554 Eric Linn Director – Investor Relations eplinn@uss.com 412-433-2385 INVESTOR RELATIONS

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNYS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XCHI |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

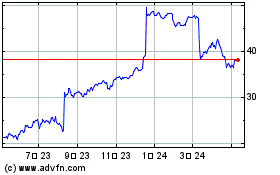

US Steel (NYSE:X)

過去 株価チャート

から 8 2024 まで 9 2024

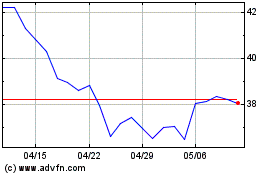

US Steel (NYSE:X)

過去 株価チャート

から 9 2023 まで 9 2024