(All amounts in US$ unless otherwise

indicated)

Lithium Americas Corp. (TSX: LAC) (NYSE: LAC) (“Lithium

Americas” or the “Company”) has reported its financial

and operating results for the nine months ended September 30, 2024

(“Q3 2024”) and has filed its condensed consolidated interim

financial statements (“Financials”) and management’s

discussion and analysis (“MD&A”).

Jonathan Evans, President and Chief Executive Officer of Lithium

Americas said, “This past year has been pivotal in moving Thacker

Pass forward toward production, including entering into a new joint

venture agreement with GM and closing of the DOE Loan. We are

working to FID the project by the end of the year to move Thacker

Pass into major construction and start executing on the

well-detailed plan the team has been focused on for the past year.

We are excited to start creating new jobs and bringing economic

activity to northern Nevada. There has been a lot of heavy lifting

done by our team and we have received a lot of support from our

local community and business partners to get Thacker Pass to this

advanced stage. We look forward to moving Thacker Pass forward to

support a North American lithium supply chain.”

HIGHLIGHTS

Thacker Pass

- On October 28, 2024, the Company and the U.S. Department of

Energy’s Loan Programs Office closed a $2.26 billion loan under the

Advanced Technology Vehicles Manufacturing Loan Program for

financing the construction of the processing facilities at Thacker

Pass, to produce an initial 40,000 tonnes per annum of battery

grade lithium carbonate.

- The Company continues to focus on de-risking project execution

by advancing project planning, detailed engineering (currently at

approximately 40% design complete) and procurement packages for the

top seven pieces of long-lead equipment have been awarded.

Contracts for key construction materials have been awarded and

field purchases of goods and services have commenced.

- Major earth works for the all-inclusive housing facility for

construction workers (the Workforce Hub) have been completed. The

current focus is on finalizing engineering and permitting for

utilities and preparing to award contracts for the detailed

earthworks, foundation installation and erection of the housing

units.

- During the three months ended September 30, 2024, $34.4 million

of construction capital costs and other project-related costs were

capitalized.

Corporate

- As of September 30, 2024, the Company had approximately $341.2

million in cash and cash equivalents.

- On August 30, 2024, the Company and General Motors Holdings LLC

(“GM”) agreed to extend the outside date for the second

tranche subscription agreement until the end of the year to provide

time for the parties to explore alternative structures for GM’s

additional investment, of at least $330 million, in a mutually

beneficial manner.

- On October 15, 2024, the Company and GM entered into a new

investment agreement (“Investment Agreement”) to establish a

joint venture (“JV”) for the purpose of funding, developing,

constructing and operating Thacker Pass (“JV Transaction”).

The JV Transaction will deliver $625 million of cash and letters of

credit from GM to Thacker Pass. Under the terms of the Investment

Agreement, GM will acquire a 38% asset-level ownership stake in

Thacker Pass. The Company and GM terminated the Tranche 2

subscription agreement concurrent with the execution of the JV

Investment Agreement.

- Pablo Mercado, Executive Vice President and Chief Financial

Officer (“CFO”) is leaving the Company on November 22, 2024,

for another career opportunity outside the sector. April Hashimoto,

Senior Vice President, Finance and Administration, will assume the

additional role of Interim CFO.

Mr. Evans added, “On behalf of the Company’s Board of Directors,

we are thankful for everything the team has accomplished during

Pablo’s tenure as CFO, including the separation transaction that

resulted in Lithium Americas becoming an independent pure play

North American company, the recent signing of the GM JV Investment

Agreement and the closing of the DOE Loan. We wish Pablo the best

in his future endeavors and welcome April to her expanded

role.”

TECHNICAL INFORMATION

The scientific and technical information in this news release

has been reviewed and approved by Rene LeBlanc, PhD, SME, Vice

President, Growth and Product Strategy of the Company, and a

“qualified person” as defined under National Instrument 43-101 and

Subpart 1300 of Regulation S-K under the United States Securities

Act of 1933.

FINANCIALS

Selected consolidated financial information is presented as

follows:

(in US$ million except per share

information)

Nine months ended September

30,

2024

2023

$

$

Expenses

17.4

13.9

Net loss/(income)

20.3

(9.0

)

Loss/(Income) per share - basic

0.10

(0.06

)

(in US$ millions)

As at September 30, 2024

As at December 31, 2023

$

$

Cash and cash equivalents

341.2

195.5

Total assets

693.0

439.5

Total long-term liabilities

9.1

7.5

During the nine months ended September 30, 2024, there was

higher net loss than during the nine months ended September 30,

2023 due to the recognition of a loss on the fair value of

financial instruments compared with a gain in the comparable

year-earlier period and higher general and administrative and

equity compensation expenses reflecting the full costs of the

Company operating as a stand-alone entity subsequent to the

separation transaction on October 3, 2023, partially offset by

increased interest income on higher cash balances.

At September 30, 2024, total assets increased due to higher cash

and cash equivalent balances reflecting net proceeds from the

completion of an underwritten public offering in April 2024.

Expenditures capitalized for Thacker Pass were offset by a

reduction in cash and net settlement of prepaids at December 31,

2023 that were capitalized as Thacker Pass construction costs in

the nine months ended September 30, 2024.

This news release should be read in conjunction with the

Company’s Financial Statements and MD&A for the nine months

ended September 30, 2024, which are available on the Company’s

issuer profile on SEDAR+ at www.sedarplus.ca and on EDGAR at

www.sec.gov.

ABOUT LITHIUM AMERICAS

Lithium Americas is committed to responsibly developing the

Thacker Pass project located in Humboldt County in northern Nevada,

which hosts the largest known Measured and Indicated lithium

resource in North America. The Company is focused on advancing

Thacker Pass Phase 1 toward production; targeting nameplate

capacity of 40,000 tonnes per annum of battery-quality lithium

carbonate. The Company and its engineering, procurement and

construction management contractor, Bechtel, entered into a

National Construction Agreement (Project Labor Agreement) with

North America’s Building Trades Unions for construction of Thacker

Pass. The three-year construction build is expected to create

approximately 1,800 direct jobs. Lithium Americas’ shares are

listed on the Toronto Stock Exchange and New York Stock Exchange

under the symbol LAC. To learn more, visit www.lithiumamericas.com

or follow @LithiumAmericas on social media.

FORWARD-LOOKING INFORMATION

This news release contains certain “forward-looking information”

within the meaning of applicable Canadian securities legislation,

and “forward-looking statements” within the meaning of applicable

United States securities legislation (collectively referred to as

“forward-looking information” (“FLI”)). All statements,

other than statements of historical fact, are FLI and can be

identified by the use of statements that include, but are not

limited to, words, such as “anticipate,” “plan,” “continue,”

“estimate,” “expect,” “may,” “will,” “project,” “predict,”

“propose,” “potential,” “target,” “implement,” “schedule,”

“forecast,” “intend,” “would,” “could,” “might,” “should,”

“believe” and similar terminology, or statements that certain

actions, events or results “may,” “could,” “would,” “might” or

“will” be taken, occur or be achieved. FLI in this news release

includes, but is not limited to: statements relating to the JV

Transaction with GM and the Department of Energy (“DOE”)

Loan from the DOE, including statements regarding completion of the

JV Transaction and satisfaction of draw-down conditions on the DOE

Loan; the expectation that the Company and GM will enter into an

additional offtake agreement upon closing the JV Transaction; the

expected timetable for completing the JV Transaction and the DOE

Loan; anticipated timing for a final investment decision and

issuance of full notice to proceed in respect of Thacker Pass;

expectation about the extent that the JV Transaction, DOE Loan and

cash on hand have de-risked funding for the development and

construction of Thacker Pass and the ability of the Company to

complete all supplementary financing in order to draw-down on the

DOE Loan and make a final investment decision; expectations and

timing on the commencement of major construction; expectations and

timing on the commencement of production; project de-risking

initiatives and extent to which work to date has de-risked project

execution; the expected operations, financial results and condition

of the Company; the Company’s future objectives and strategies to

achieve those objectives, including the future prospects of the

Company; the estimated cash flow, capitalization and adequacy

thereof for the Company; the estimated costs of the development of

Thacker Pass, including timing, progress, approach, continuity or

change in plans, construction, commissioning, milestones,

anticipated production and results thereof and expansion plans;

cost and expected benefits of the transloading terminal;

anticipated timing to resolve, and the expected outcome of, any

complaints or claims made or that could be made concerning the

permitting process in the United States for Thacker Pass;

estimates, and any change in estimates, of the mineral resources

and mineral reserves at Thacker Pass; development of mineral

resources and mineral reserves; the realization of mineral

resources and mineral reserves estimates, including whether certain

mineral resources will ever be developed into mineral reserves, and

information and underlying assumptions related thereto; government

regulation of mining operations and treatment under governmental

and taxation regimes; the future price of commodities, including

lithium; the creation of a battery supply chain in the United

States to support the electric vehicle market; the timing and

amount of future production; currency exchange and interest rates;

the Company’s ability to raise capital; expected expenditures to be

made by the Company on Thacker Pass; ability to produce high purity

battery grade lithium products; settlement of agreements related to

the operation and sale of mineral production as well as contracts

in respect of operations and inputs required in the course of

production; the timing, cost, quantity, capacity and product

quality of production at Thacker Pass; successful development of

Thacker Pass, including successful results from the Company’s

testing facility and third-party tests related thereto; capital

costs, operating costs, sustaining capital requirements, after tax

net present value and internal rate of return, payback period,

sensitivity analyses, and net cash flows of Thacker Pass;

anticipated job creation and the completion of the Workforce Hub;

the expectation that the National Construction Agreement (Project

Labor Agreement)will minimize construction risk, ensure

availability of skilled labor, address the challenges associated

with Thacker Pass’ remote location and be effective in prioritizing

employment of local and regional skilled craft workers, including

members of underrepresented communities; the expected workforce

development training program being prepared with Great Basin

College; the Company’s commitment to sustainable development,

minimizing the environmental impact at Thacker Pass and plans for

phased reclamation during the life of mine including use benefits

of growth media; ability to achieve capital cost efficiencies; as

well as other statements with respect to management’s beliefs,

plans, estimates and intentions, and similar statements concerning

anticipated future events, results, circumstances, performance or

expectations that are not historical facts.

FLI involves known and unknown risks, assumptions and other

factors that may cause actual results or performance to differ

materially. FLI reflects the Company’s current views about future

events, and while considered reasonable by the Company as of the

date of this news release, are inherently subject to significant

uncertainties and contingencies. Accordingly, there can be no

certainty that they will accurately reflect actual results.

Assumptions upon which such FLI is based include, without

limitation: the completion of the JV Transaction and DOE Loan prior

to the end of 2024, or at all, and the absence of material adverse

events affecting the Company during this time; the ability of the

Company to satisfy all closing conditions for the JV Transaction

and DOE Loan in a timely manner; the ability of the Company to

enter into an additional offtake agreement with GM; a cordial

business relationship between the Company and third party strategic

and contractual partners; the risk of tax liabilities as a result

of the Arrangement, and general business and economic uncertainties

and adverse market conditions; unforeseen technological and

engineering problems; political factors, including the impact of

the 2024 U.S. presidential election on, among other things, the

extractive resource industry, the green energy transition and the

electric vehicle market; uncertainties inherent to feasibility

studies and mineral resource and mineral reserve estimates; the

ability of the Company to secure sufficient additional financing,

advance and develop Thacker Pass, and to produce battery grade

lithium; the respective benefits and impacts of Thacker Pass when

production operations commence; settlement of agreements related to

the operation and sale of mineral production as well as contracts

in respect of operations and inputs required in the course of

production; the Company’s ability to operate in a safe and

effective manner, and without material adverse impact from the

effects of climate change or severe weather conditions;

uncertainties relating to receiving and maintaining mining,

exploration, environmental and other permits or approvals in

Nevada; demand for lithium, including that such demand is supported

by growth in the electric vehicle market; current technological

trends; the impact of increasing competition in the lithium

business, and the Company’s competitive position in the industry;

continuing support of local communities and the Fort McDermitt

Paiute and Shoshone Tribe for Thacker Pass; continuing constructive

engagement with these and other stakeholders, and any expected

benefits of such engagement; the stable and supportive legislative,

regulatory and community environment in the jurisdictions where the

Company operates; impacts of inflation, currency exchanges rates,

interest rates and other general economic and stock market

conditions; the impact of unknown financial contingencies,

including litigation costs, environmental compliance costs and

costs associated with the impacts of climate change, on the

Company’s operations; increased attention to environmental, social

and governance (“ESG”) and sustainability-related matters,

risks related to the Company’s public statements with respect to

such matters that may be subject to heightened scrutiny from public

and governmental authorities related to the risk of potential

“greenwashing,” (i.e., misleading information or false claims

overstating potential sustainability-related benefits); risks that

the Company may face regarding potentially conflicting anti-ESG

initiatives from certain U.S. state or other governments; estimates

of and unpredictable changes to the market prices for lithium

products; development and construction costs for Thacker Pass, and

costs for any additional exploration work at the project; estimates

of mineral resources and mineral reserves, including whether

mineral resources not included in mineral reserves will be further

developed into mineral reserves; reliability of technical data;

anticipated timing and results of exploration, development and

construction activities, including the impact of ongoing supply

chain disruptions and availability of equipment and supplies on

such timing; timely responses from governmental agencies

responsible for reviewing and considering the Company’s permitting

activities at Thacker Pass; availability of technology, including

low carbon energy sources and water rights, on acceptable terms to

advance Thacker Pass; government regulation of mining operations

and mergers and acquisitions activity, and treatment under

governmental, regulatory and taxation regimes; ability to realize

expected benefits from investments in or partnerships with third

parties; accuracy of development budgets and construction

estimates; that the Company will meet its future objectives and

priorities; that the Company will have access to adequate capital

to fund its future projects and plans; that such future projects

and plans will proceed as anticipated; as well as assumptions

concerning general economic and industry growth rates, commodity

prices, currency exchange and interest rates and competitive

conditions. Although the Company believes that the assumptions and

expectations reflected in such FLI are reasonable, the Company can

give no assurance that these assumptions and expectations will

prove to be correct.

Readers are cautioned that the foregoing lists of factors is not

exhaustive. There can be no assurance that FLI will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such information. As such,

readers are cautioned not to place undue reliance on this

information, and that this information may not be appropriate for

any other purpose, including investment purposes. The Company’s

actual results could differ materially from those anticipated in

any FLI as a result of the risk factors set out herein, and in the

Company’s other continuous disclosure documents available on SEDAR+

at www.sedarplus.ca and EDGAR at www.sec.gov. Readers are further

cautioned to review the full description of risks, uncertainties

and management’s assumptions in the aforementioned documents and

other disclosure documents available on SEDAR+ and on EDGAR.

The Company expressly disclaims any obligation to update FLI as

a result of new information, future events or otherwise, except as

and to the extent required by applicable securities laws.

Forward-looking financial information also constitutes FLI within

the context of applicable securities laws and as such, is subject

to the same risks, uncertainties and assumptions as are set out in

the cautionary note above.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107537025/en/

INVESTOR CONTACT Virginia Morgan, VP, IR and ESG

+1-778-726-4070 ir@lithiumamericas.com

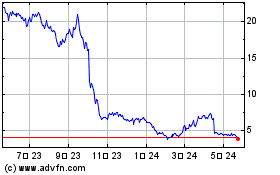

Lithium Americas (NYSE:LAC)

過去 株価チャート

から 12 2024 まで 1 2025

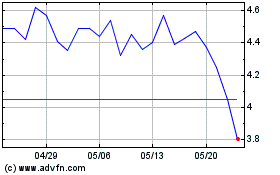

Lithium Americas (NYSE:LAC)

過去 株価チャート

から 1 2024 まで 1 2025