Filed Pursuant to Rule 424(b)(2)

Registration No. 333-272447

The information

in this preliminary pricing supplement is not complete and may be changed. This preliminary pricing supplement and the accompanying prospectus

supplement and prospectus are not an offer to sell these securities and we are not soliciting an offer to buy these securities in any

jurisdiction where the offer or sale is not permitted.

| Subject to Completion, Dated July 23, 2024 |

|

| Pricing Supplement dated , 2024 |

| (To Prospectus Supplement dated September 5, 2023 |

| and Prospectus dated September 5, 2023) |

Canadian Imperial Bank of Commerce

Senior Global Medium-Term Notes

$ Fixed to Floating Rate Notes Linked to the Compounded

SOFR due January 26, 2027

We, Canadian Imperial Bank of Commerce (the “Bank” or “CIBC”),

are offering $ aggregate principal amount of Fixed to Floating Rate Notes Linked to the Compounded SOFR (“Compounded SOFR”

or the “Reference Rate”) due January 26, 2027 (CUSIP 13607XSQ1 / ISIN US13607XSQ15) (the “Notes”).

At maturity, you will receive a cash payment equal to 100% of the principal

amount, plus any accrued and unpaid interest. Interest will be paid quarterly on January 26, April 26, July 26 and October 26

of each year, commencing on October 26, 2024 and ending on the Maturity Date. The Notes will accrue interest during the following

periods of their term at the following rates per annum:

| · | From and including the Original Issue Date to but excluding January 26, 2025: 5.75%; |

| · | From and including January 26, 2025 to but excluding the Maturity Date: the sum of Compounded SOFR and 0.85%, subject to a Minimum

Rate of 0.00%. |

The Notes will be issued in minimum denominations

of $1,000, and integral multiples of $1,000 in excess thereof.

The Notes will not be listed on any securities

exchange.

The Notes are unsecured obligations of CIBC and all payments on

the Notes are subject to the credit risk of CIBC. The Notes will not constitute deposits insured by the Canada Deposit Insurance Corporation,

the U.S. Federal Deposit Insurance Corporation or any other government agency or instrumentality of Canada, the United States or any other

jurisdiction.

Neither the Securities and Exchange Commission (the “SEC”)

nor any state or provincial securities commission has approved or disapproved of these Notes or determined if this pricing supplement

or the accompanying prospectus supplement and prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The Notes are bail-inable debt securities (as defined in the accompanying

prospectus) and subject to conversion in whole or in part – by means of a transaction or series of transactions and in one or more

steps – into common shares of the Bank or any of its affiliates under subsection 39.2(2.3) of the Canada Deposit Insurance Corporation

Act (the “CDIC Act”) and to variation or extinguishment in consequence, and subject to the application of the laws of the

Province of Ontario and the federal laws of Canada applicable therein in respect of the operation of the CDIC Act with respect to the

Notes. See “Description of Senior Debt Securities — Special Provisions Related to Bail-inable Debt Securities” and

“— Canadian Bank Resolution Powers” in the accompanying prospectus and “Risk Factors — Risks Relating to

Bail-Inable Notes” in the accompanying prospectus supplement.

Investing in the Notes involves risks not

associated with an investment in ordinary debt securities. See the “Additional Risk Factors” beginning on page PS-7 of

this pricing supplement and the “Risk Factors” beginning on page S-1 of the accompanying prospectus supplement and page 1

of the prospectus.

| |

Price to Public (Original Issue Price)(1) |

Underwriting Discount (1)(2) |

Proceeds to Issuer |

| Per Note |

$1,000.00 |

Up to $1.30 |

At least $998.70 |

| Total |

$ |

$ |

$ |

|

| (1) | Because certain dealers who purchase the Notes for sale to certain fee-based advisory accounts may forgo some or all of their commissions

or selling concessions, the price to public for investors purchasing the Notes in these accounts may be between $998.70 and $1,000.00

per Note. |

|

| (2) | Morgan Stanley & Co. LLC (“MS&Co.”), acting as agent for the Bank, will receive a commission of up to $1.30

(0.13%) per $1,000 principal amount of the Notes. MS&Co. may use a portion or all of its commission to allow selling concessions to

other dealers in connection with the distribution of the Notes. The other dealers may forgo, in their sole discretion, some or all of

their selling concessions. See “Supplemental Plan of Distribution” on page PS-15 of this pricing supplement. |

We will deliver the Notes in book-entry form

through the facilities of The Depository Trust Company (“DTC”) on or about July 26, 2024 against payment in immediately

available funds.

Morgan Stanley

ABOUT THIS PRICING SUPPLEMENT

You should read this pricing supplement together with the prospectus

dated September 5, 2023 (the “prospectus”) and the prospectus supplement dated September 5, 2023 (the “prospectus

supplement”), each relating to our Senior Global Medium-Term Notes, of which these Notes are a part, for additional information

about the Notes. Information in this pricing supplement supersedes information in the prospectus supplement and the prospectus to the

extent it is different from that information. Certain defined terms used but not defined herein have the meanings set forth in the prospectus

supplement or the prospectus.

You should rely only on the information contained in or incorporated

by reference in this pricing supplement and the accompanying prospectus supplement and the prospectus. This pricing supplement may be

used only for the purpose for which it has been prepared. No one is authorized to give information other than that contained in this pricing

supplement and the accompanying prospectus supplement and the prospectus, and in the documents referred to in these documents and which

are made available to the public. We have not, and MS&Co. has not, authorized any other person to provide you with different or additional

information. If anyone provides you with different or additional information, you should not rely on it.

We are not, and MS&Co. is not, making an offer to sell the Notes

in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in or incorporated

by reference in this pricing supplement or the accompanying prospectus supplement or the prospectus is accurate as of any date other than

the date of the applicable document. Our business, financial condition, results of operations and prospects may have changed since that

date. Neither this pricing supplement nor the accompanying prospectus supplement or the prospectus constitutes an offer, or an invitation

on our behalf or on behalf of MS&Co., to subscribe for and purchase any of the Notes and may not be used for or in connection with

an offer or solicitation by anyone in any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom

it is unlawful to make such an offer or solicitation.

References to “CIBC,” “the Issuer,” “the

Bank,” “we,” “us” and “our” in this pricing supplement are references to Canadian Imperial Bank

of Commerce and not to any of our subsidiaries, unless we state otherwise or the context otherwise requires.

You may access the prospectus supplement and the prospectus on the

SEC website www.sec.gov as follows (or if such address has changed, by reviewing our filing for the relevant date on the SEC website):

| · | Prospectus supplement dated September 5, 2023: |

https://www.sec.gov/Archives/edgar/data/1045520/000110465923098166/tm2322483d94_424b5.htm

| · | Prospectus dated September 5, 2023: |

https://www.sec.gov/Archives/edgar/data/1045520/000110465923098163/tm2325339d10_424b3.htm

SUMMARY

The information in this “Summary” section is qualified

by the more detailed information set forth in the accompanying prospectus supplement and the prospectus. See “About This Pricing

Supplement” in this pricing supplement.

| Issuer: |

Canadian Imperial Bank of Commerce (the “Issuer” or the “Bank”) |

| Type of Note: |

Fixed to Floating Rate Notes Linked to the Compounded SOFR due January 26, 2027 |

Minimum

Denominations: |

$1,000 and integral multiples of $1,000 in excess thereof. |

| Principal Amount: |

$1,000 per Note |

Aggregate Principal

Amount of Notes: |

$ |

| Currency: |

U.S. Dollars (“$”) |

| Term: |

2.5 years |

| Trade Date: |

Expected to be July 23, 2024 |

| Original Issue Date: |

Expected to be July 26, 2024 (to be determined on the Trade Date and expected to be the third scheduled Business Day after the Trade Date) |

| Maturity Date: |

Expected to be January 26, 2027, subject to postponement as described in “—Business Day Convention” below. |

Interest Rate (per

Annum): |

For each Interest Period from and including the Original Issue Date

to but excluding January 26, 2025 (the “Fixed Rate Payment Period”): 5.75% per annum

For each Interest Period following the Fixed Rate Payment Period (the

“Floating Rate Payment Period”): the sum of Compounded SOFR and 0.85%, subject to the Minimum Rate. The Interest Rate for

each Interest Period during the Floating Rate Payment Period will be reset quarterly on the applicable Interest Determination Date. |

| Interest Period: |

Quarterly; the period from and including the Original Issue Date to but excluding the immediately following scheduled Interest Payment Date, and each successive period from and including a scheduled Interest Payment Date to but excluding the next scheduled Interest Payment Date. |

| Reference Rate: |

Compounded SOFR, with respect to any Interest Period, means the rate

of return of a daily compound interest investment computed in accordance with the following formula:

(Quarterly Compounded SOFR Factor - 1) × 360/Number of calendar

days in the Interest Period.

The Reference Rate is subject to the fallback provisions described

in “Description of the Notes We May Offer – Interest Rates – Floating Rate Notes – SOFR Notes – Effect

of a Benchmark Transition Event for Compounded SOFR Notes” in the accompanying prospectus supplement. |

Quarterly Compounded

SOFR Factor: |

Equal to the product of each Daily Compounded SOFR Factor observed in the Interest Period. |

Daily Compounded SOFR

Factor: |

With respect to any Banking Day during the Interest Period, the Daily

Compounded SOFR Factor will be equal to the following:

1 + (SOFR observed on the Lookback Date corresponding to such Banking

Day x number of calendar days from and including such Banking Day to, but excluding, the following Banking Day/360) |

| SOFR: |

SOFR means, with respect to any U.S. Government Securities Business

Day, (1) the Secured Overnight Financing Rate published for such U.S. Government Securities Business Day as such rate appears on

the SOFR Administrator’s website or any successor source at 3:00 p.m. (New York time) on the immediately following U.S. Government

Securities Business Day; (2) if the rate specified in (1) above does not so appear, the Secured Overnight Financing Rate as

published in respect of the first preceding U.S. Government Securities Business Day for which the Secured Overnight Financing Rate was

published on the SOFR Administrator’s website or any successor source.

SOFR will not be published in respect of any day that is not a U.S.

Government Securities Business Day, such as a Saturday, Sunday or holiday and, by definition, any Banking Day will constitute a U.S. Government

Securities Business Day. For this reason, in determining Compounded SOFR in accordance with the specified formula and other provisions

set forth herein, the daily SOFR rate applied for any Banking Day in the Interest Period that immediately precedes one or more days that

are not Banking Days in the Interest Period will be multiplied by the number of calendar days from and including such Banking Day to,

but excluding, the following Banking Day. |

| SOFR Administrator: |

The Federal Reserve Bank of New York (or a successor administrator of the Secured Overnight Financing Rate). |

| Lookback Date: |

With respect to any Banking Day during the Interest Period, the date that is five Banking Days prior to such Banking Day. |

| Banking Day: |

Any weekday that is a U.S. Government Securities Business Day. A “U.S. Government Securities Business Day” is any day, except for a Saturday, Sunday or a day on which the Securities Industry and Financial Markets Association recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in U.S. government securities. |

| Minimum Rate: |

0.00% per annum |

Interest Determination

Date: |

With respect to any Interest Period during the Floating Rate Payment Period, the fifth U.S. Government Securities Business Day immediately preceding the related Interest Reset Date. A “U.S. Government Securities Business Day” is any day, except for a Saturday, Sunday or a day on which the Securities Industry and Financial Markets Association (or a successor) recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in U.S. government securities. |

| Interest Reset Dates: |

Quarterly, on January 26, April 26, July 26 and October 26 of each year, commencing on January 26, 2025 and ending on October 26, 2026, each of which is the first day of the related Interest Period during the Floating Rate Payment Period. |

| Interest Payment Dates: |

Quarterly, payable in arrears on January 26, April 26, July 26 and October 26 of each year, commencing on October 26, 2024 and ending on the Maturity Date, subject to postponement as described in “—Business Day Convention” below. |

| Day Count Fraction: |

30/360, Unadjusted |

| Record Date: |

Interest will be payable to the persons in whose names the Notes are registered at the close of business on the Business Day immediately preceding each Interest Payment Date, which we refer to as a “regular record date,” except that the interest due at maturity will be paid to the persons in whose names the Notes are registered on the Maturity Date. |

| Canadian Bail-in Powers: |

The Notes are bail-inable debt securities and subject to conversion in whole or in part – by means of a transaction or series of transactions and in one or more steps – into common shares of the Bank or any of its affiliates under subsection 39.2(2.3) of the CDIC Act and to variation or extinguishment in consequence, and subject to the application of the laws of the Province of Ontario and the federal laws of Canada applicable therein in respect of the operation of the CDIC Act with respect to the Notes. See “Description of Senior Debt Securities — Special Provisions Related to Bail-inable Debt Securities” and “— Canadian Bank Resolution Powers” in the accompanying prospectus and “Risk Factors — Risks Relating to Bail-Inable Notes” in the accompanying prospectus supplement for a description of provisions and risks applicable to the Notes as a result of Canadian bail-in powers. |

Agreement with Respect

to the Exercise of

Canadian Bail-in Powers: |

By its acquisition of an interest in any Note, each holder or beneficial

owner of that Note is deemed to (i) agree to be bound, in respect of the Notes, by the CDIC Act, including the conversion of the

Notes, in whole or in part – by means of a transaction or series of transactions and in one or more steps – into common shares

of the Bank or any of its affiliates under subsection 39.2(2.3) of the CDIC Act and the variation or extinguishment of the Notes in consequence,

and by the application of the laws of the Province of Ontario and the federal laws of Canada applicable therein in respect of the operation

of the CDIC Act with respect to the Notes; (ii) attorn and submit to the jurisdiction of the courts in the Province of Ontario with

respect to the CDIC Act and those laws; and (iii) acknowledge and agree that the terms referred to in paragraphs (i) and (ii),

above, are binding on that holder or beneficial owner despite any provisions in the indenture or the Notes, any other law that governs

the Notes and any other agreement, arrangement or understanding between that holder or beneficial owner and the Bank with respect to the

Notes.

Holders and beneficial owners of Notes will have no further rights

in respect of their bail-inable debt securities to the extent those bail-inable debt securities are converted in a bail-in conversion,

other than those provided under the bail-in regime, and by its acquisition of an interest in any Note, each holder or beneficial owner

of that Note is deemed to irrevocably consent to the converted portion of the principal amount of that Note and any accrued and unpaid

interest thereon being deemed paid in full by the Bank by the issuance of common shares of the Bank (or, if applicable, any of its affiliates)

upon the occurrence of a bail-in conversion, which bail-in conversion will occur without any further action on the part of that holder

or beneficial owner or the trustee; provided that, for the avoidance of doubt, this consent will not limit or otherwise affect any rights

that holders or beneficial owners may have under the bail-in regime.

See “Description of Senior Debt Securities— Special Provisions

Related to Bail-inable Debt Securities” and “— Canadian Bank Resolution Powers” in the accompanying prospectus

and “Risk Factors — Risks Relating to Bail-Inable Notes” in the accompanying prospectus supplement for a description

of provisions and risks applicable to the Notes as a result of Canadian bail-in powers. |

| Calculation Agent: |

Canadian Imperial Bank of Commerce. We may appoint a different Calculation

Agent without your consent and without notifying you.

|

| |

All determinations made by the Calculation Agent will be at its sole

discretion, and, in the absence of manifest error, will be conclusive for all purposes and binding on us and you. All percentages and

other amounts resulting from any calculation with respect to the Notes will be rounded at the Calculation Agent’s discretion. The

Calculation Agent will have no liability for its determinations. |

| Ranking: |

Senior, unsecured |

| Business Day Convention: |

Following. If any scheduled payment date is not a Business Day, the payment will be made on the next succeeding Business Day. No additional interest will accrue on the Notes as a result of such postponement, and no adjustment will be made to the length of the relevant Interest Period. |

| Business Day: |

A Monday, Tuesday, Wednesday, Thursday or Friday that is neither a legal holiday nor a day on which banking institutions are authorized or required by law or regulation to close in New York, New York. |

| CUSIP/ISIN: |

13607XSQ1 / US13607XSQ15 |

| Fees and Expenses: |

The price at which you purchase the Notes includes costs that the Bank or its affiliates expect to incur and profits that the Bank or its affiliates expect to realize in connection with hedging activities related to the Notes. |

| Withholding: |

The Bank or the applicable paying agent will deduct or withhold from a payment on a Note any present or future tax, duty, assessment or other governmental charge that the Bank determines is required by law or the interpretation or administration thereof to be deducted or withheld. Payments on a Note will not be increased by any amount to offset such deduction or withholding. |

The Trade Date and the other dates set forth above are subject to change, and will be set forth in the final pricing supplement relating to the Notes.

ADDITIONAL

RISK FACTORS

An investment in the Notes involves significant risks. In addition

to the following risks included in this pricing supplement, we urge you to read “Risk Factors” beginning on page S-1

of the accompanying prospectus supplement and page 1 of the accompanying prospectus.

You should understand the risks of investing in the Notes and should

reach an investment decision only after careful consideration, with your advisers, of the suitability of the Notes in light of your particular

financial circumstances and the information set forth in this pricing supplement and the accompanying prospectus and prospectus supplement.

Structure Risks

The Interest Rate for Each Interest Period During the Floating Rate

Payment Period is Variable and May Be as Low as the Minimum Rate.

You will receive interest on the applicable Interest Payment Date during

the Floating Rate Payment Period at the Interest Rate calculated on the corresponding Interest Determination Date, which may be as low

as the Minimum Rate. The Interest Rate applicable to each Interest Payment Date during the Floating Rate Payment Period will fluctuate

because it is equal to the sum of Compounded SOFR calculated on the applicable Interest Determination Date and 0.85%, subject to the Minimum

Rate. If Compounded SOFR calculated on any Interest Determination Date were less than -0.85%, the Interest Rate for the relevant Interest

Period would be equal to the Minimum Rate. Compounded SOFR, on which the Interest Rate for each Interest Period during the Floating Rate

Payment Period is based, will vary and may be less than -0.85% for most or all of the Interest Determination Dates, and you may receive

interest at the Minimum Rate on most or all of the Interest Payment Dates during the Floating Rate Payment Period. The return on the Notes

may be lower than the return on conventional debt securities of comparable maturity.

You Will Not Know the Interest Rate for Each Interest Period During

the Floating Rate Payment Period Until the End of that Interest Period.

The Reference Rate is compounded in arrears. Unlike forward-looking

term rates, the Interest Rate for each Interest Period during the Floating Rate Payment Period will be calculated at the end of that Interest

Period.

The Repayment of the Principal Amount Applies Only at Maturity.

The Notes offer repayment of the principal amount only if you hold

your Notes until the Maturity Date. If you sell the Notes prior to maturity, you may lose some of the principal amount.

The Notes Will Be Subject to Risks, Including Conversion in

Whole or in Part — by Means of a Transaction or Series of Transactions and in One or More Steps — into Common Shares

of CIBC or Any of its Affiliates, Under Canadian Bank Resolution Powers.

Under Canadian bank resolution powers, the Canada Deposit Insurance

Corporation (the “CDIC”) may, in circumstances where CIBC has ceased, or is about to cease, to be viable, assume temporary

control or ownership of CIBC and may be granted broad powers by one or more orders of the Governor in Council (Canada), including the

power to sell or dispose of all or a part of the assets of CIBC, and the power to carry out or cause CIBC to carry out a transaction or

a series of transactions the purpose of which is to restructure the business of CIBC. If the CDIC were to take action under the Canadian

bank resolution powers with respect to CIBC, this could result in holders or beneficial owners of the Notes being exposed to losses and

conversion of the Notes in whole or in part — by means of a transaction or series of transactions and in one or more steps —

into common shares of CIBC or any of its affiliates.

As a result, you should consider the risk that you may lose all or

part of your investment, including the principal amount plus any accrued interest, if the CDIC were to take action under the Canadian

bank resolution powers, including the bail-in regime, and that any remaining outstanding Notes, or common shares of CIBC or any of its

affiliates into which the Notes are converted, may be of little value at the time of a bail-in conversion and thereafter. See “Description

of Senior Debt Securities—Special Provisions Related to Bail-inable Debt Securities” and “— Canadian Bank Resolution

Powers” in the accompanying prospectus and “Risk Factors — Risks Relating to Bail-Inable Notes” in the accompanying

prospectus supplement for a description of provisions and risks applicable to the Notes as a result of Canadian bail-in powers.

Reference Rate Risks

The Occurrence of a Benchmark Transition

Event Could Adversely Affect the Return (if any) on the Notes.

A Benchmark Transition Event (as defined in “Description of the

Notes We May Offer – Interest Rates – Floating Rate Notes – SOFR Notes – Effect of a Benchmark Transition

Event for Compounded SOFR Notes” in the accompanying prospectus supplement) could occur during the term of the Notes. Any resulting

alternative replacement and Calculation Agent adjustments and determinations, as described in “Description of the Notes We May Offer

– Interest Rates – Floating Rate Notes – SOFR Notes – Effect of a Benchmark Transition Event for Compounded SOFR

Notes” in the accompanying prospectus supplement, could adversely affect the value of and the return on your Notes.

The Secured Overnight Financing Rate (“SOFR”) Is a Relatively

New Market Index and as the Related Market Continues to Develop, There May Be an Adverse Effect on the Return on or Value of the

Notes; SOFR May Be Modified or Discontinued.

The Federal Reserve Bank of New York notes on its publication page for

SOFR that use of SOFR is subject to important limitations, indemnification obligations and disclaimers, including that the Federal Reserve

Bank of New York may alter the methods of calculation, publication schedule, rate revision practices or availability of SOFR at any time

without notice. There can be no guarantee that SOFR will not be discontinued or fundamentally altered in a manner that is materially adverse

to the interests of investors in the Notes. If the manner in which SOFR is calculated is changed or if SOFR is discontinued, that change,

or discontinuance may result in a reduction of the interest or other applicable payments payable on the Notes and a reduction in the trading

price of the Notes.

SOFR Has a Very Limited History, and the

Future Performance of SOFR Cannot Be Predicted Based on Historical Performance.

The publication of SOFR began in April 2018,

and, therefore, it has a very limited history. In addition, the future performance of SOFR cannot be predicted based on the limited historical

performance. Prior observed patterns, if any, in the behavior of market variables and their relation to SOFR, such as correlations, may

change in the future. While some pre-publication historical data have been released by the Federal Reserve Bank of New York,

such analysis inherently involves assumptions, estimates and approximations. The future performance of SOFR is impossible to predict and

therefore no future performance of SOFR may be inferred from any of the historical actual or historical indicative data. Hypothetical

or historical performance data are not indicative of, and have no bearing on, the potential performance of SOFR. You should not rely on

any historical changes or trends in SOFR as an indicator of the future performance of SOFR. Since the initial publication of SOFR, daily

changes in the rate have, on occasion, been more volatile than daily changes in comparable benchmark or market rates.

SOFR May Be More Volatile Than Other

Benchmark or Market Rates.

Since the initial publication of SOFR, daily

changes in the rate have, on occasion, been more volatile than daily changes in other benchmark or market rates, such as the U.S. dollar

LIBOR Rate, during corresponding periods, and SOFR may bear little or no relation to the historical actual or historical indicative data.

Any Failure of SOFR to Gain Market Acceptance

Could Adversely Affect the Notes.

SOFR was developed for use in certain U.S.

dollar derivatives and other financial contracts as an alternative to U.S. dollar LIBOR in part because it is considered a good representation

of general funding conditions in the overnight U.S. Treasury Repo market. However, as a rate based on transactions secured by U.S. Treasury

securities, it does not measure bank-specific credit risk and, as a result, is less likely to correlate with the unsecured short-term

funding costs of banks. This may mean that market participants would not consider SOFR a suitable replacement or successor for all of

the purposes for which U.S. dollar LIBOR historically has been used (including, without limitation, as a representation of the unsecured

short-term funding costs of banks), which may, in turn, lessen market acceptance of SOFR. Any failure of SOFR to gain market acceptance

could adversely affect the return on and value of the Notes and the price at which investors can sell the Notes in the secondary market.

The Secondary Trading Market for Securities

Linked to SOFR May Be Limited.

Since SOFR is a relatively new market index,

SOFR-linked securities likely will have no established trading market when issued or otherwise, and an established trading market may

never develop or may not be very liquid. If SOFR does not prove to be widely used as a benchmark in securities that are similar or comparable

to the Notes, the trading price of the Notes may be lower than those of securities that are linked to rates that are more widely used.

Similarly, market terms for securities that are linked to SOFR, including, but not limited to, the spread over the reference rate reflected

in the benchmark transition provisions, may evolve over time, and as a result, trading prices

of the Notes may be lower than those of later-issued

securities that are based on SOFR. Investors in the Notes may not be able to sell the Notes at all or may not be able to sell the Notes

at prices that will provide them with a yield comparable to similar investments that have a developed secondary market, and may consequently

suffer from increased pricing volatility and market risk.

Historical Levels of SOFR Do Not Guarantee Future Levels.

The historical levels of SOFR do not guarantee its future levels. It

is not possible to predict whether SOFR will rise or fall during the Floating Rate Payment Period.

Conflicts of Interest

Certain Business, Trading and Hedging Activities of Us, MS&Co.

and Our Respective Affiliates May Create Conflicts with Your Interests and Could Potentially Adversely Affect the Value of the Notes.

We, MS&Co. or one or more of our respective affiliates may engage

in trading and other business activities that are not for your account or on your behalf (such as holding or selling of the Notes for

our proprietary account or effecting secondary market transactions in the Notes for other customers). These activities may present a conflict

of interest between your interest in the Notes and the interests we, MS&Co. or one or more of our respective affiliates may have in

our or their proprietary accounts. We, MS&Co. and our respective affiliates may engage in any such activities without regard to the

Notes or the effect that such activities may directly or indirectly have on the value of the Notes.

Moreover, we, MS&Co. and our respective affiliates play a variety

of roles in connection with the issuance of the Notes, including hedging our obligations under the Notes. We expect to hedge our obligations

under the Notes through MS&Co., one of our respective affiliates and/or another unaffiliated counterparty, which may include any dealer

from which you purchase the Notes. In connection with such activities, the economic interests of us, MS&Co. and our respective affiliates

may be adverse to your interests as an investor in the Notes. Any of these activities may adversely affect the value of the Notes. In

addition, because hedging our obligations entails risk and may be influenced by market forces beyond our control, this hedging activity

may result in a profit that is more or less than expected, or it may result in a loss. We, MS&Co., one or more of our respective affiliates

or any unaffiliated counterparty will retain any profits realized in hedging our obligations under the Notes even if investors do not

receive a favorable investment return under the terms of the Notes or in any secondary market transaction. Any profit in connection with

such hedging activities will be in addition to any other compensation that we, MS&Co., our respective affiliates or any unaffiliated

counterparty receive for the sale of the Notes, which creates an additional incentive to sell the Notes to you. We, MS&Co., our respective

affiliates or any unaffiliated counterparty will have no obligation to take,refrain from taking or cease taking any action with respect

to these transactions based on the potential effect on an investor in the Notes.

There Are Potential Conflicts of Interest Between You and the Calculation

Agent.

The Calculation Agent will, among other things, determine the Interest

Rate and decide the amount of your payment for any Interest Payment Date on the Notes. The Calculation Agent will exercise its judgment

when performing its functions. The Calculation Agent will be required to carry out its duties in good faith and use its reasonable judgment.

However, because we will be the calculation agent, potential conflicts of interest could arise. None of us, MS&Co. or any of our respective

affiliates will have any obligation to consider your interests as a holder of the Notes in taking any action that might affect the value

of your Notes.

In addition, and without limiting the generality of the previous paragraph,

the Calculation Agent may make certain determinations if a “Benchmark Transition Event” (as discussed under “Additional

Terms of the Notes” below) occurs or it may administer a successor rate in certain circumstances as also described herein. For the

avoidance of doubt, any decision made by the Calculation Agent will be effective without consent from the holders of the Notes or any

other party. Potential conflicts of interest may exist between the Bank, the Calculation Agent and holders of the Notes. All determinations

made by the Calculation Agent in such a circumstance will be conclusive for all purposes and binding on the Bank and holders of the Notes.

In making these potentially subjective determinations, the Bank and/or the Calculation Agent may have economic interests that are adverse

to your interests, and such determinations may adversely affect the value of and return on your Notes. Because the continuation of SOFR

on the current basis cannot and will not be guaranteed, the Calculation Agent is likely to exercise more discretion in respect of calculating

interest payable on the Notes than would be the case in the absence of such a need to select a successor rate.

Tax Risks

The Tax Treatment of the Notes Is Uncertain.

Significant aspects of the tax treatment of the Notes are uncertain.

You should consult your tax advisor about your own tax situation. See “U.S. Federal Income Tax Considerations” and “Certain

Canadian Income Tax Considerations” in this pricing supplement.

General Risks

Payments on the Notes Are Subject to Our Credit Risk, and Actual

or Perceived Changes in Our Creditworthiness Are Expected to Affect the Value of the Notes.

The Notes are our senior unsecured debt obligations and are not, either

directly or indirectly, an obligation of any third party. As further described in the accompanying prospectus and prospectus supplement,

the Notes will rank on par with all of our other unsecured and unsubordinated debt obligations, except such obligations as may be preferred

by operation of law. All payments to be made on the Notes, including the interest payments and the return of the principal amount at maturity,

depend on our ability to satisfy our obligations as they come due. As a result, the actual and perceived creditworthiness of us may affect

the market value of the Notes and, in the event we were to default on our obligations, you may not receive the amounts owed to you under

the terms of the Notes. If we default on our obligations under the Notes, your investment would be at risk and you could lose some or

all of your investment. See “Description of Senior Debt Securities—Events of Default” in the accompanying prospectus.

The Inclusion of Dealer Spread and Projected Profit from Hedging

in the Original Issue Price Is Likely to Adversely Affect Secondary Market Prices.

Assuming no change in market conditions or any other relevant factors,

the price, if any, at which MS&Co. or any other party is willing to purchase the Notes at any time in secondary market transactions

will likely be significantly lower than the original issue price, since secondary market prices are likely to exclude underwriting commissions

paid with respect to the Notes and the cost of hedging our obligations under the Notes that are included in the original issue price.

The cost of hedging includes the projected profit that we and/or our affiliates may realize in consideration for assuming the risks inherent

in managing the hedging transactions. These secondary market prices are also likely to be reduced by the costs of unwinding the related

hedging transactions. In addition, any secondary market prices may differ from values determined by pricing models used by MS&Co.

as a result of dealer discounts, mark-ups or other transaction costs.

The Notes Will Not Be Listed on Any Securities Exchange and We Do

Not Expect a Trading Market for the Notes to Develop.

The Notes will not be listed on any securities exchange. Although MS&Co.

and/or its affiliates may purchase the Notes from holders, they are not obligated to do so and are not required to make a market for the

Notes. There can be no assurance that a secondary market will develop for the Notes. Because we do not expect that any market makers will

participate in a secondary market for the Notes, the price at which you may be able to sell your Notes is likely to depend on the price,

if any, at which MS&Co. and/or its affiliates are willing to buy your Notes.

If a secondary market does exist, it may be limited. Accordingly, there

may be a limited number of buyers if you decide to sell your Notes prior to maturity. This may affect the price you receive upon such

sale. Consequently, you should be willing to hold the Notes to maturity.

THE

SECURED OVERNIGHT FINANCING RATE

All information regarding SOFR set forth in this document has been

derived from publicly available information. Neither we nor any of our affiliates have independently verified the accuracy or the completeness

of all information regarding SOFR that we have derived from publicly available sources. Neither we nor any of our affiliates are under

any obligation to update, modify or amend all information regarding SOFR or the historical performance of SOFR.

Historical Performance of SOFR

The following graph sets forth of the historical performance of SOFR

for the period from January 1, 2019 to July 19, 2024. On July 19, 2024, the rate of SOFR was 5.34%. We obtained the rates

below from Bloomberg Professional® Service (“Bloomberg”) without independent verification. The historical performance

of should not be taken as an indication of its future performance, and no assurances can be given as to SOFR at any time during the Floating

Rate Payment Period. We cannot give you assurance that the sum of the Compounded SOFR calculated on any Interest Determination Date and

0.85% will outperform the Minimum Rate.

Historical Performance

of SOFR

Source: Bloomberg

U.S.

FEDERAL INCOME TAX CONSIDERATIONS

The following discussion is a brief summary of the material U.S. federal

income tax considerations relating to an investment in the Notes. The following summary is not complete and is both qualified and supplemented

by (although to the extent inconsistent supersedes) the discussion entitled “Material Income Tax Consequences—United States

Taxation” in the accompanying prospectus, which you should carefully review prior to investing in the Notes. It applies only to

those U.S. Holders who are not excluded from the discussion of United States Taxation in the accompanying prospectus.

You should consult your tax advisor concerning the U.S. federal

income tax and other tax consequences of your investment in the Notes in your particular circumstances, including the application of state,

local or other tax laws and the possible effects of changes in federal or other tax laws.

In the opinion of Mayer Brown LLP, the Notes should be treated as debt

instruments for U.S. federal income tax purposes. Assuming such treatment is respected, the coupon on a Note will be taxable to a U.S.

Holder as ordinary interest income at the time it accrues or is received in accordance with the U.S. Holder’s normal method of accounting

for tax purposes. Please see the discussion in the prospectus under the section entitled “Material Income Tax Consequences—United

States Taxation—Variable Interest Rate Securities” for a discussion of the OID consequences applicable to the Notes. Under

these rules, the Notes may be issued with OID. Whether the Notes will be treated as being issued with OID will depend on rates in effect

on the issue date and, in that event, the final pricing supplement will so specify.

Upon the sale, exchange, retirement or other disposition of a Note,

a U.S. Holder will recognize taxable gain or loss equal to the difference, if any, between the amount realized on the sale, exchange,

retirement or other disposition, other than accrued but unpaid interest which will be taxable as interest, and such U.S. Holder’s

adjusted tax basis in the Note. A U.S. Holder’s adjusted tax basis in a Note generally will equal the cost of the Note to such U.S.

Holder, increased by any OID previously included in income with respect to the Note, and decreased by the amount of any payment (other

than a payment of qualified stated interest) received in respect of the Note. Any gain or loss on the sale, exchange, retirement or other

disposition of a Note will generally be capital gain or loss. For a non-corporate U.S. Holder, under current law, the maximum marginal

U.S. federal income tax rate applicable to the gain will be generally lower than the maximum marginal U.S. federal income tax rate applicable

to ordinary income if the U.S. Holder’s holding period for the Notes exceeds one year (i.e., such gain is long-term capital gain).

Any gain or loss realized on the sale, exchange, retirement or other disposition of a Note generally will be treated as U.S. source gain

or loss, as the case may be. Consequently, a U.S. Holder may not be able to claim a credit for any non-U.S. tax imposed upon a disposition

of a Note. The deductibility of capital losses is subject to limitations.

CERTAIN

CANADIAN INCOME TAX CONSIDERATIONS

In the opinion of Blake, Cassels & Graydon LLP, our Canadian

tax counsel, the following summary describes the principal Canadian federal income tax considerations under the Income Tax Act (Canada)

and the regulations thereto (the “Canadian Tax Act”) generally applicable at the date hereof to a purchaser who acquires beneficial

ownership of a Note pursuant to this pricing supplement and who for the purposes of the Canadian Tax Act and at all relevant times: (a) is

neither resident nor deemed to be resident in Canada; (b) deals at arm’s length with the Issuer and any transferee resident

(or deemed to be resident) in Canada to whom the purchaser disposes of the Note; (c) acquires and holds Notes and any common shares

acquired on a bail-in conversion as capital property; (d) does not use or hold and is not deemed to use or hold the Note or any common

shares acquired on a bail-in conversion in, or in the course of, carrying on a business in Canada; (e) is entitled to receive all

payments (including any interest and principal) made on the Note; (f) is not a, and deals at arm’s length with any, “specified

shareholder” of the Issuer for purposes of the thin capitalization rules in the Canadian Tax Act; and (g) is not an entity

in respect of which the Issuer or any transferee resident (or deemed to be resident) in Canada to whom the purchaser disposes of, loans

or otherwise transfers the Note is a “specified entity”, and is not a “specified entity” in respect of such a

transferee, in each case, for purposes of the Hybrid Mismatch Rules, as defined below (a “Non-Resident Holder”). Special rules which

apply to non-resident insurers carrying on business in Canada and elsewhere are not discussed in this summary.

This summary assumes that no amount paid or payable to a holder described

herein will be the deduction component of a “hybrid mismatch arrangement” under which the payment arises within the meaning

of the rules in the Canadian Tax Act with respect to “hybrid mismatch arrangements” (the “Hybrid Mismatch Rules”).

Investors should note that the Hybrid Mismatch Rules are highly complex and there remains significant uncertainty as to their interpretation

and application.

This summary is supplemental to and should be read together with the

description of material Canadian federal income tax considerations relevant to a Non-Resident Holder owning Notes under “Material

Income Tax Consequences—Canadian Taxation” in the accompanying prospectus and a Non-Resident Holder should carefully read

that description as well.

For the purposes of the Canadian Tax Act, all amounts not otherwise

expressed in Canadian dollars must be converted into Canadian dollars based on the exchange rate as quoted by the Bank of Canada for the

applicable day or such other rate of exchange acceptable to the Minister of National Revenue (Canada).

This summary is of a general nature only and is not intended to

be, nor should it be construed to be, legal or tax advice to any particular Non-Resident Holder. Non-Resident Holders are advised to consult

with their own tax advisors with respect to their particular circumstances.

Notes

Interest payable on the Notes should not be considered to be “participating

debt interest” as defined in the Canadian Tax Act and accordingly, a Non-Resident Holder should not be subject to Canadian non-resident

withholding tax in respect of amounts paid or credited or deemed to have been paid or credited by the Issuer on a Note as, on account

of or in lieu of payment of, or in satisfaction of, interest.

In the event that a Note held by a Non-Resident Holder is converted

to common shares on a bail-in conversion, the amount (the “Excess Amount”), if any, by which the fair market value of the

common shares received on the conversion exceeds the sum of: (i) the price for which the Note was issued, and (ii) any amount

that is paid in respect of accrued and unpaid interest at the time of the conversion (the “Conversion Interest”) may be deemed

to be interest paid to the Non-Resident Holder. There is a risk that the Excess Amount (if any) and the Conversion Interest could be characterized

as “participating debt interest” and, therefore, subject to Canadian non-resident withholding tax unless certain exceptions

apply.

Non-Resident Holders should consult their own advisors regarding the

consequences to them of a disposition of Notes to a person with whom they are not dealing at arm’s length for purposes of the Canadian

Tax Act.

Common Shares Acquired on a Bail-in Conversion

Dividends

Dividends paid or credited or deemed to be paid or credited to a Non-Resident

Holder on common shares of the Issuer or of any affiliate of the Issuer that is a corporation resident or deemed to be resident in Canada

will be subject to Canadian non-resident withholding tax of 25% but such rate may be reduced under the terms of an applicable income tax

treaty.

Dispositions

A Non-Resident Holder will not be subject to tax under the Canadian

Tax Act on any capital gain realized on a disposition or deemed disposition of any common shares of the Issuer or of any affiliate unless

the common shares constitute “taxable Canadian property” to the Non-Resident Holder for purposes of the Canadian Tax Act at

the time of their disposition, and such Non-Resident Holder is not entitled to relief pursuant to the provisions of an applicable income

tax treaty.

Generally, the common shares of the Issuer or of any such affiliate

will not constitute taxable Canadian property to a Non-Resident Holder provided that they are listed on a designated stock exchange (which

includes the TSX and NYSE) at the time of the disposition, unless, at any particular time during the 60-month period that ends at that

time, the following conditions are met concurrently: (i) one or any combination of (a) the Non-Resident Holder, (b) persons

with whom the Non-Resident Holder did not deal at arm’s length, or (c) partnerships in which the Non-Resident Holder or a person

described in (b) holds a membership interest directly or indirectly through one or more partnerships, owned 25% or more of the issued

shares of any class or series of the applicable issuer’s share capital and (ii) more than 50% of the fair market value of the

common shares of such issuer was derived directly or indirectly from one or any combination of (a) real or immovable property situated

in Canada, (b) Canadian resource properties (as defined in the Canadian Tax Act), (c) timber resource properties (as defined

in the Canadian Tax Act), and (d) an option, an interest or right in any of the foregoing property, whether or not such property

exists. Notwithstanding the foregoing, a common share of the Issuer or of any such affiliate may be deemed to be “taxable Canadian

property” in certain other circumstances. Non-Resident Holders whose common shares of the Issuer or of any such affiliate may constitute

taxable Canadian property should consult their own tax advisers with respect to their particular circumstances.

SUPPLEMENTAL PLAN OF DISTRIBUTION

MS&Co. will purchase the Notes from CIBC at the price to public

less the underwriting discount set forth on the cover page of this pricing supplement for distribution to other registered broker-dealers,

or will offer the Notes directly to investors.

MS&Co. or other registered broker-dealers will offer the Notes

at the price to public set forth on the cover page of this pricing supplement. MS&Co. may receive a commission of up to $1.30

(0.13%) per $1,000 principal amount of the Notes and may use a portion or all of that commission to allow selling concessions to other

dealers in connection with the distribution of the Notes. The other dealers may forgo, in their sole discretion, some or all of their

selling concessions. The price to public for Notes purchased by certain fee-based advisory accounts may vary between 99.87% and 100.00%

of the principal amount of the Notes. Any sale of a Note to a fee-based advisory account at a price to public below 100.00% of the principal

amount will reduce the agent’s commission specified on the cover page of this pricing supplement with respect to such Note.

The price to public paid by any fee-based advisory account will be reduced by the amount of any fees assessed by the dealers involved

in the sale of the Notes to such advisory account but not by more than 0.13% of the principal amount of the Notes.

We expect to deliver the notes against payment therefor in New York,

New York on a date that is more than one business day following the Trade Date. Under Rule 15c6-1 of the Securities Exchange Act

of 1934, trades in the secondary market generally are required to settle in one business day, unless the parties to any such trade expressly

agree otherwise. Accordingly, purchasers who wish to trade the notes on any date prior to one business day before delivery will be required

to specify alternative settlement arrangements to prevent a failed settlement.

The Bank may use this pricing

supplement in the initial sale of the Notes. In addition, MS&Co. or any of our affiliates may use this pricing supplement in market-making

transactions in any Notes after their initial sale. Any use of this pricing supplement by MS&Co. in market-making transactions after

the initial sale of the Notes will be solely for the purpose of providing investors with the description of the terms of Notes that were

made available to investors in connection with the initial distributions of the Notes. Unless MS&Co. or we inform you otherwise in

the confirmation of sale, this pricing supplement is being used by MS&Co. or one of our affiliates in a market-making transaction.

While MS&Co. or one of our

affiliates may make markets in the Notes, it is under no obligation to do so and may discontinue any market-making activities at any time

without notice. See the section titled “Supplemental Plan of Distribution (Conflicts of Interest)” in the accompanying prospectus

supplement.

The price at which you purchase

the Notes includes costs that the Bank or its affiliates expect to incur and profits that the Bank or its affiliates expect to realize

in connection with hedging activities related to the Notes. These costs and profits will likely reduce the secondary market price, if

any secondary market develops, for the Notes. As a result, you may experience an immediate and substantial decline in the market value

of your Notes on the Original Issue Date.

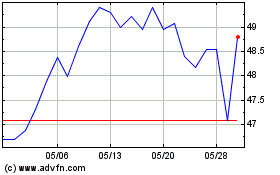

Canadian Imperial Bank o... (NYSE:CM)

過去 株価チャート

から 6 2024 まで 7 2024

Canadian Imperial Bank o... (NYSE:CM)

過去 株価チャート

から 7 2023 まで 7 2024