UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event

reported): January 3, 2025

Arch

Resources, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

1-13105 |

|

43-0921172 |

(State

or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer Identification No.) |

CityPlace

One

One

CityPlace Drive, Suite 300

St.

Louis, Missouri

63141

(Address, including zip code, of principal executive offices)

Registrant’s telephone number, including

area code: (314) 994-2700

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common

Stock, $.01 par value |

|

ARCH |

|

New

York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

As previously disclosed, on

August 20, 2024, Arch Resources, Inc., a Delaware corporation (“Arch”), entered into an Agreement and Plan of Merger

(as it may be amended from time to time, the “merger agreement”) with CONSOL Energy Inc., a Delaware corporation (“CONSOL”),

and Mountain Range Merger Sub Inc., a Delaware corporation and a wholly owned subsidiary of CONSOL (“Merger Sub”). The merger

agreement provides that, upon the terms and subject to the conditions set forth therein, Merger Sub will merge with and into Arch (the

“merger”), with Arch continuing as the surviving corporation in the merger and a wholly owned subsidiary of CONSOL. The merger

agreement was unanimously approved by the board of directors of each of Arch and CONSOL.

In connection with the merger,

CONSOL filed a Registration Statement on Form S-4 (as amended, the “Registration Statement”) with the Securities and

Exchange Commission (the “SEC”) that also includes a prospectus of CONSOL and a joint proxy statement of Arch and CONSOL,

as amended. The Registration Statement was declared effective on November 26, 2024, after which Arch filed a definitive joint proxy

statement and CONSOL filed a final prospectus. Arch and CONSOL commenced mailing of the definitive joint proxy statement/prospectus to

their respective stockholders on or about November 26, 2024.

Following the

announcement of the merger agreement, as of the date of this Current Report on Form 8-K, three lawsuits challenging the merger

have been filed (each, a “Lawsuit” and, collectively, the “Lawsuits”). The first Lawsuit, captioned Robert

Garfield v. James Brock et al. (Case No. 2024-CV-08379), was filed in the Supreme Court of Pennsylvania for Dauphin county

on December 12, 2024. The second Lawsuit, captioned Nathan Turner v. Arch Resources, Inc. et al. (Case

No. 659683/2024), was filed in the Supreme Court of the State of New York for the county of New York on December 16, 2024.

The third Lawsuit, captioned Michael Lewis v. Arch Resources, Inc. et al. (Case No. 659716/2024), was filed in the

Supreme Court of the State of New York for the county of New York on December 17, 2024. In addition, Arch and CONSOL received

demand letters from counsel representing individual stockholders of Arch and CONSOL, respectively (the “Demand Letters”

and, together with the Lawsuits, the “Matters”). The Matters each generally allege that the joint proxy

statement/prospectus filed by Arch and CONSOL, and their respective directors and officers, in connection with the proposed merger

contains false and misleading statements and/or omissions, and demand that the parties issue corrective disclosures.

Arch and CONSOL believe that

the allegations asserted in the Matters are without merit and additional disclosures are not required or necessary under applicable laws.

However, in order to avoid the risk that the Matters delay or otherwise adversely affect the merger, and to minimize the cost, risk and

uncertainty inherent in litigation, and without admitting any liability or wrongdoing, Arch and CONSOL have agreed to voluntarily supplement

the joint proxy statement/prospectus as described in this Current Report on Form 8-K. Arch and CONSOL deny that they have violated

any laws or breached any duties to Arch’s stockholders or CONSOL’s stockholders, as applicable. Nothing in this Current Report

on Form 8-K shall be deemed an admission of the legal necessity or materiality under applicable laws of any of the disclosures set

forth herein. To the contrary, Arch and CONSOL specifically deny all allegations in the Matters that any additional disclosure was or

is required. To the extent that the information set forth herein differs from or updates information contained in the joint proxy statement/prospectus,

the information set forth herein shall supersede or supplement the information in the joint proxy statement/prospectus. All page references

are to pages in the joint proxy statement/prospectus, and terms used below, unless otherwise defined, have the meanings set forth

in the joint proxy statement/prospectus. For clarity, new text within restated disclosures from the joint proxy statement/prospectus is

highlighted with bold, underlined text, while deleted text is bold and stricken-through.

Supplemental

Disclosures to Joint Proxy Statement/Prospectus in Connection with the Matters

The additional disclosures

(the “supplemental disclosures”) in this Current Report on Form 8-K supplement the disclosures contained in the joint

proxy statement/prospectus and should be read in conjunction with the disclosures contained in the joint proxy statement/prospectus, which

should be read in its entirety. To the extent that information set forth in the supplemental disclosures differs from or updates information

contained in the joint proxy statement/prospectus, the information in this Current Report on Form 8-K shall supersede or supplement

the information contained in the joint proxy statement/prospectus. Page references in the below disclosures are to the joint proxy

statement/prospectus, and defined terms used but not defined herein shall have the meanings set forth in the joint proxy statement/prospectus.

The fourth paragraph

on page 84 under the heading “Background of the Merger” is amended as follows:

Also on August 16, 2024,

Messrs. Lang, Brock and Thakkar met to discuss and agree upon the pro forma headquarters, name and management team of the combined

company as well as other governance matters. At this meeting, it was discussed that Mr. Lang would serve as Chief Executive

Officer of the combined company and Mr. Brock would serve as Executive Chair of the combined company. In addition, between

August 16, 2024, and August 18, 2024, Messrs. Lang, Brock and Navarre, as well as representatives of PWP and Moelis, had

several conversations regarding the proposed exchange ratio to be used in the possible transaction between Arch and CONSOL. During such

discussions, Messrs. Lang and Navarre and representatives of PWP each proposed using an exchange ratio based on a trailing volume-weighted-average

price of the companies rather than a current trading price.

The following paragraph

is added after the fourth paragraph on page 84 under the heading “Background of the Merger”:

On August 16, 2024,

representatives of Moelis provided customary relationship disclosures to the CONSOL board with respect to CONSOL and Arch, which included

disclosure that as of the date of such disclosure Moelis did not own or trade any securities of CONSOL or Arch and that none of the Moelis

managing directors working on the potential transaction owned any securities of CONSOL or Arch.

The

penultimate paragraph on page 94 under the heading “Discounted Cash Flow Analysis—Standalone—CONSOL”

is amended as follows:

Moelis utilized a range of

discount rates of 9.25% to 12.00% based on an estimated range of CONSOL’s weighted average cost of capital (the “WACC”).

The estimated WACC range reflected a derived cost of equity range using the capital asset pricing model (“CAPM”)

(a) a risk-free rate based on 20-year U.S. government bonds, (b) a selected range of unlevered betas and debt to total capitalization

ratios informed by the Selected Companies described below, (c) an equity risk premium and (d) a size premium.

Moelis used the foregoing range of discount rates to calculate estimated present values as of June 30, 2024 of (i) estimated

unlevered free cash flows of CONSOL for the second half of the calendar year ending December 31, 2024 through the end of the calendar

year ending December 31, 2028 (in each case, discounted using a mid-year discounting convention) and (ii) estimated terminal

values derived by applying a range of selected terminal multiples of 4.00x to 5.00x to CONSOL’s terminal year LL-Adjusted EBITDA

(which was equal to LL-Adjusted EBITDA for the calendar year ending December 31, 2028).

The

first full paragraph on page 95 under the heading “Discounted Cash Flow Analysis—Standalone—CONSOL”

is amended as follows:

In calculating the implied

equity value of CONSOL, Moelis removed the income statement and free cash flow impacts of the legacy liabilities for CONSOL (which

CONSOL management estimated to be $557 million on a tax-affected and net of assets basis) and treated these liabilities as net

debt adjustments.

The

fourth full paragraph on page 95 under the heading “Discounted Cash Flow Analysis—Standalone—Arch”

is amended as follows:

Moelis utilized a range of

discount rates of 9.25% to 12.00% based on an estimated range of Arch’s WACC. The estimated WACC range reflected a derived cost

of equity range using CAPM (a) a risk-free rate based on 20-year U.S. government bonds, (b) a selected

range of unlevered betas and debt to total capitalization ratios informed by the Selected Companies described below, (c) an equity

risk premium and (d) a size premium. Moelis used the foregoing range of discount rates to calculate estimated

present values as of June 30, 2024 of (i) estimated unlevered free cash flows of Arch for the second half of the calendar year

ending December 31, 2024 through the end of the calendar year ending December 31, 2028 (in each case, discounted using a mid-year

discounting convention) and (ii) estimated terminal values derived by applying a range of selected terminal multiples of 4.50x to

5.50x to Arch’s terminal year LL-Adjusted EBITDA (which was equal to LL-Adjusted EBITDA for the calendar year ending December 31,

2028).

The

last sentence of the first paragraph on page 96 under the heading “Discounted Cash Flow Analysis—Standalone—Arch”

is amended as follows:

Moelis also removed the income

statement and free cash flow impacts of the legacy liabilities for Arch (which CONSOL management estimated to be $244 million on

a tax-affected and net of assets basis) and treated these liabilities as net debt adjustments.

The

third and fourth full paragraphs on page 101 under the heading “Other Information—Equity Research

Share Price Targets” is amended as follows:

Moelis reviewed publicly available

consensus estimate stock price targets for shares of CONSOL common stock published as provided by Bloomberg or

Wall Street research reports as of August 9, 2024, which ranged from $103.00 to $120.00 per share (which implied a range

of equity values for CONSOL of $3,078 million to $3,586 million). Moelis compared this range with the closing trading price of the CONSOL

common stock of $95.81 per share on August 19, 2024 (which implied an equity value of CONSOL of $2,863 million).

Moelis also reviewed publicly

available consensus estimate stock price targets for shares of Arch common stock as provided by Bloomberg or Wall Street Research

reports as of August 19, 2024, which ranged from $155.00 to $200.00 per share (which implied a range of equity values for

Arch of $2,862 million to $3,693 million). Moelis compared this range with the closing trading price of the Arch common stock of $127.00

per share on August 19, 2024 (which implied an equity value of Arch of $2,345 million).

The third and fourth

paragraphs under the heading “Opinion of Perella Weinberg Partners LP, Arch’s Financial Advisor—Summary of PWP’s Financial

Analyses—Selected Public Companies Analysis” on pages 110 through 111 are amended and restated as follows:

The financial information

reviewed included enterprise value as a multiple of normalized adjusted EBITDA, which we calculate as the average of actual 2023, estimated

2024, and estimated 2025 adjusted EBITDA. and which wWe refer to this

as “Normalized EBITDA,.” and Additionally, we considered estimated

2024 and 2025 adjusted EBITDA, which we refer to as “2024E EBITDA” and “2025E EBITDA,” respectively,.

These estimates are based on median broker consensus estimates and, with respect to Arch and CONSOL, the Arch Forecasts and CONSOL

Forecasts, with balance sheet items in each case as of June 30, 2024. The low to high of observed following

table summarizes EV / Normalized EBITDA multiples, for the selected public companies was 2.9x to 4.5x with a median of 4.3x.

The low to high of observed EV / 2024E EBITDA multiples for the selected public companies was 3.3x to 5.8x with a median

of 4.6x. The low to high of observed and EV / 2025E EBITDA multiples for of each of

the selected public companies was 3.5x to 4.9x with a median of 4.4x.

| Selected Public

Companies | |

EV / Normalized

EBITDA

Multiple (2023A

-2025E Avg.) | |

EV/ 2024E

EBITDA

Multiple | |

EV/ 2025E

EBITDA

Multiple |

| Alliance Resource Partners Inc. | |

4.3x | |

4.5x | |

4.4x |

| Alpha Metallurgical Resources, Inc. | |

4.2x | |

5.8x | |

4.9x |

| Coronado Global Resources Inc. | |

4.3x | |

4.6x | |

3.7x |

| Peabody Energy Corporation | |

2.9x | |

3.3x | |

3.5x |

| Warrior Met Coal, Inc. | |

4.5x | |

5.0x | |

4.6x |

| Median | |

4.3x | |

4.6x | |

4.4x |

Based on the ranges observed

among the selected public companies, including those identified above, PWP applied selected EV / normalized adjusted EBITDA

multiple ranges to the applicable Arch and CONSOL financial metrics, including analyst consensus estimates, the Arch Forecasts and the

CONSOL Forecasts, to derive implied enterprise values for Arch and CONSOL. To calculate the implied equity value of Arch from its implied

enterprise value, PWP added cash and cash equivalents of $279 million, subtracted debt (including capital leases) of

$135 million, subtracted pension, other post-employment benefits and black lung liabilities (on a post-tax basis) and

of $157 million, and subtracted net asset reclamation obligations (on a post-tax basis) of $87 million,

in each case as provided by Arch management. To calculate the implied equity value of CONSOL from its implied enterprise value, PWP added

cash and cash equivalents of $299 million, subtracted debt (including capital leases) of $192 million, subtracted

pension and other post-employment benefits (on a post-tax basis) of $191 million, subtracted black lung and long-term disability

liabilities (on a post-tax basis) of $147 million and subtracted asset reclamation obligations (on a post-tax basis) of

$210 million, in each case as provided by CONSOL management. PWP calculated implied values per share by dividing the implied equity

values by the applicable diluted shares (based upon the number of issued and outstanding shares as of August 14, 2024), which

was 18.466 million for Arch and 29.883 million for CONSOL, based on information provided by Arch management and CONSOL management,

as applicable, and with respect to Arch, including restricted stock units, and with respect to CONSOL, including restricted stock units

and performance share units. PWP applied a selected multiple range of 4.0x to 5.0x to Arch’s 2023A-2025E Average EBITDA, resulting

in implied reference ranges per share of Arch common stock of $129 to $162 and $125 to $158, based the Arch Forecasts and on analyst consensus

estimates, respectively. PWP applied a selected multiple range of 4.0x to 5.0x to CONSOL’s 2023A-2025E Average EBITDA, resulting

in implied reference ranges per share of CONSOL common stock of $99 to $127 and $91 to $117, based the CONSOL Forecasts and on analyst

consensus estimates, respectively.

The first paragraph

under the heading “Opinion of Perella Weinberg Partners LP, Arch’s Financial Advisor—Summary of PWP’s Financial Analyses—Discounted

Cash Flow Value Analysis” on pages 111 through 112 is amended as follows:

PWP conducted a discounted

cash flow analysis for each of Arch and CONSOL based on the Forecasts to derive a range of implied enterprise values for Arch and CONSOL

by:

| · | calculating the present value as of August 20, 2024 of the estimated standalone unlevered free cash

flows in the case of Arch, calculated as Adjusted EBITDA (as defined in in the section entitled “The Merger

Agreement—Arch Unaudited Prospective Financial Information” beginning on page 1189 of

this joint proxy) minus cash taxes, plus/minus the change in net working capital, minus capital invested in equity investments, minus

capital expenditures, minus non-operating expenses, minus other operating and investing activities, plus certain legacy liability costs,

minus dividends forecasted to be paid in the third quarter of 2024 and fourth quarter of 2024, minus the cash tax benefit from net operating

losses and in the case of CONSOL, calculated as Adjusted EBITDA (as defined in in the section entitled “The

Merger Agreement—CONSOL Unaudited Prospective Financial Information” beginning on page 115 of this joint proxy) minus

stock based compensation, plus annual non-service costs related to pension, supplemental executive retirement plan (SERP), other post-employment

benefits, black lung liabilities and long term disability benefits, minus cash taxes, plus/minus the change in net working capital, minus

capital expenditures, minus gains attributable to asset sales, plus changes in other assets and liabilities, minus employee-related long-term

liabilities, minus dividends forecasted to be paid in the third quarter of 2024 and fourth quarter of 2024, expected to be generated by

Arch and CONSOL for the six months ending December 31, 2024 and the years ending December 31, 2025 through December 31,

2028, as included in the Forecasts, using discount rates ranging from, in the case of Arch, 9.5% to 10.75% and, in the case of CONSOL,

9.75% to 11.00%, and a mid-year convention for discounting; and |

| · | adding the present value as of August 20, 2024 of the terminal value of Arch and CONSOL at the end

of calendar year 2028 (which terminal values were calculated to be $2,786-3,482 million for Arch and $3,696-4,620 million for CONSOL)

using an implied terminal EBITDA multiple range of, in the case of Arch, 4.0x to 5.0x 2028E Adjusted EBITDA (as defined in in

the section entitled “The Merger Agreement—Arch Unaudited Prospective Financial Information” beginning on page 1189

of this joint proxy) and, in the case of CONSOL, 4.0x to 5.0x 2028E Adjusted EBITDA (as defined in in the section

entitled “The Merger Agreement—CONSOL Unaudited Prospective Financial Information” beginning on page 115 of this

joint proxy) minus stock based compensation, plus annual non-service costs related to pension, supplemental executive retirement plan

(SERP), other post-employment benefits, black lung liabilities and long term disability benefits, and discount rates ranging from, in

the case of Arch, 9.5% to 10.75% and, in the case of CONSOL, 9.75% to 11.00%. “Present value” refers to the current value

of future cash flows or amounts and is obtained by discounting those future cash flows or amounts to a specific point in time by a discount

rate that takes into account macroeconomic assumptions and estimates of risk, the opportunity cost of capital, capital structure, income

taxes, expected returns and other appropriate factors taken into account based on the professional judgment and experience of PWP. |

The third and fourth

paragraphs under the heading “Opinion of Perella Weinberg Partners LP, Arch’s Financial Advisor-Summary of PWP’s Financial

Analyses—Discounted Cash Flow Value Analysis” on page 112 are amended and restated as follows:

PWP

used tThe discount rates as used by PWP for each of Arch and CONSOL were

determined based on PWP’s analysis an estimated range of Arch’s and CONSOL’s respective

weighted average cost of capital., which was derived by application of the Capital Asset Pricing Model, which takes

into account certain company-specific metrics, including Arch’s and CONSOL’s respective target capital structure, the cost

of long-term debt, forecasted tax rate and unlevered and levered (Barra) beta, as well as certain financial metrics for the United States

financial markets generally, including market risk premium and the 20-year treasury rate (30-day average) as of August 19, 2024.

From

the range of implied enterprise values, PWP derived a range of implied equity values for Arch and CONSOL. To calculate the implied

equity value of Arch from its implied enterprise value, PWP added cash and cash equivalents of

$279 million, subtracted debt (including capital leases) of $135

million, subtracted pension, other post-employment benefits and black lung liabilities (on a post-tax basis) of

$157 million, subtracted net asset reclamation obligations (on a post-tax basis) of

$87 million, and added the present value of net operating losses (using a discount rate of approximately 6.50%, which

rate reflects the midpoint of Arch’s post-tax cost of debt as of August 19, 2024) of

$77 million, in each case as provided by Arch management. To calculate the implied equity value of CONSOL from its

implied enterprise value, PWP added cash and cash equivalents of $299

million, subtracted debt (including capital leases) of $192

million, subtracted pension and other post-employment benefits (on a post-tax basis) of

$191 million, subtracted black lung and long-term disability liabilities (on a post-tax basis) of

$147 million and subtracted asset reclamation obligations (on a post-tax basis) of

$210 million, in each case as provided by CONSOL management. PWP calculated implied values per share by dividing the

implied equity values by the applicable diluted shares (based upon the number of issued and outstanding shares as of August 14,

2024), which was 18.466 million for Arch and 29.883 million for CONSOL,

based on information provided by Arch management and CONSOL management, as applicable, and with respect to Arch, including

restricted stock units, and with respect to CONSOL, including restricted stock units and performance share units.

The third paragraph

under the heading “Opinion of Perella Weinberg Partners LP, Arch’s Financial Advisor-Summary of PWP’s Financial Analyses-Equity

Research Analysists’ Price Targets” on page 113 is amended as follows:

Based on comparisons of

the high and low research analyst price targets for Arch and CONSOL, PWP derived a range of implied exchange ratios of shares of

Arch common stock to shares of CONSOL common stock of 1.483x to 1.931x. PWP compared this exchange ratio range to the exchange ratio

of 1.326 shares of CONSOL common stock to be received for each share of Arch common stock as provided for in the merger agreement. The

five price targets for Arch observed, when discounted for a period of one year using a cost of equity of 10.50%, were $140, $145,

$154, $163 and $179 per share. The two price targets for Arch observed, when discounted for a period of one year using a cost of

equity of 11.00%, were $93 and $95 per share. The price targets published by equity research analysts do not necessarily

reflect current market trading prices for shares of Arch common stock or CONSOL common stock and these estimates are subject to

uncertainties, including the future financial performance of Arch, CONSOL and future financial market conditions.

The last paragraph on

page 124 under the heading “Board of Directors and Management of the Combined Company Following the Completion of the Merger”

is amended as follows:

Under the terms of the merger

agreement, CONSOL has agreed to take all actions as may be necessary to cause (1) the number of directors constituting the combined

company’s board as of the effective time of the merger to be eight and (2) the combined company’s board as of the effective

time of the merger to be composed of (A) four directors designated by CONSOL, one of whom will be James A. Brock, and (B) four

directors designated by Arch, two of whom will be Paul A. Lang and Richard A. Navarre. From and after the effective time of the merger,

each person designated as a director of the combined company will serve as a director until such person’s successor has been appointed

and qualified or elected or such person’s earlier death, resignation or removal in accordance with the organizational documents

of the combined company. Directors of the combined company board will be selected by the membership of the current CONSOL board

and Arch board based on their individual experience and skill sets, the overall skill set and composition of the resulting combined company

board, and their willingness to serve on the combined company board.

The paragraph on page 133

under the heading “Mr. Brock’s Role with the Combined Company following Completion of the Merger” is amended as

follows:

On

August 20, 2024, Mr. Brock entered into a Waiver, Acknowledgment and Amendment, pursuant to which Mr. Brock has agreed

to serve as Executive Chair of the combined company, reporting to the combined company’s board, following completion of the merger.

Mr. Lang will serve as Chief Executive Officer of the combined company following the merger, reporting to Mr. Brock. Mr. Brock

has further agreed that the change in his duties upon completion of the merger will not constitute “Good Reason” for purposes

of and as defined in the Brock Employment Agreement. Mr. Brock will also serve on the combined company’s board as of

the effective time of the merger. Other than as described in this joint proxy statement/prospectus, no changes to Mr. Brock’s

compensation arrangements or the Brock Employment Agreement (described under the heading “CEO Employment Agreement” on page 58

of CONSOL’s annual proxy statement for CONSOL’s 2024 Annual Meeting of Stockholders, filed on April 1, 2024) have been

agreed to or approved. Each of CONSOL and Arch has begun working with its third party advisors, including existing compensation consultants,

to prepare materials regarding post-closing compensation arrangement alternatives. Following the merger, the combined company’s

board and/or compensation committee will be presented with recommendations related to future executive officer compensation and will make

all decisions relating to any such arrangements, including whether to grant any emergence or similar awards.

Cautionary Statement Regarding Forward-Looking Information

This report contains certain

“forward-looking statements” within the meaning of federal securities laws. Forward-looking statements may be identified by

words such as “anticipates,” “believes,” “could,” “continue,” “estimate,”

“expects,” “intends,” “will,” “should,” “may,” “plan,” “predict,”

“project,” “would” and similar expressions. Forward-looking statements are not statements of historical fact and

reflect CONSOL’s and Arch’s current views about future events. Such forward-looking statements include, without limitation,

statements about the benefits of the proposed transaction involving CONSOL and Arch, including future financial and operating results,

CONSOL’s and Arch’s plans, objectives, expectations and intentions, the expected timing and likelihood of completion of the

proposed transaction, and other statements that are not historical facts, including estimates of coal reserves, estimates of future production,

assumptions regarding future coal pricing, planned delivery of coal to markets and the associated costs, future results of operations,

projected cash flow and liquidity, business strategy and other plans and objectives for future operations. No assurances can be given

that the forward-looking statements contained in this report will occur as projected, and actual results may differ materially from those

projected. Forward-looking statements are based on current expectations, estimates and assumptions that involve a number of risks and

uncertainties that could cause actual results to differ materially from those projected. These risks and uncertainties include, without

limitation, the ability to obtain the requisite CONSOL and Arch stockholder approvals; the risk that an event, change or other circumstance

could give rise to the termination of the proposed transaction; the risk that a condition to closing of the proposed transaction may not

be satisfied; the risk of delays in completing the proposed transaction; the risk that the businesses will not be integrated successfully;

the risk that the cost savings and any other synergies from the proposed transaction may not be fully realized or may take longer to realize

than expected; the risk that any announcement relating to the proposed transaction could have adverse effects on the market price of CONSOL’s

common stock or Arch’s common stock; the risk of litigation related to the proposed transaction; the risk that the credit ratings

of the combined company or its subsidiaries may be different from what the companies expect; the diversion of management time from ongoing

business operations and opportunities as a result of the proposed transaction; the risk of adverse reactions or changes to business or

employee relationships, including those resulting from the announcement or completion of the proposed transaction; the dilution caused

by CONSOL’s issuance of additional shares of its capital stock in connection with the proposed transaction; changes in coal prices,

which may be caused by numerous factors, including changes in the domestic and foreign supply of and demand for coal and the domestic

and foreign demand for steel and electricity; the volatility in commodity and capital equipment prices for coal mining operations; the

presence or recoverability of estimated reserves; the ability to replace reserves; environmental and geological risks; mining and operating

risks; the risks related to the availability, reliability and cost-effectiveness of transportation facilities and fluctuations in transportation

costs; foreign currency, competition, government regulation or other actions; the ability of management to execute its plans to meet its

goals; risks associated with the evolving legal, regulatory and tax regimes; changes in economic, financial, political and regulatory

conditions; natural and man-made disasters; civil unrest, pandemics, and conditions that may result from legislative, regulatory, trade

and policy changes; and other risks inherent in CONSOL’s and Arch’s businesses.

All such factors are difficult

to predict, are beyond CONSOL’s and Arch’s control, and are subject to additional risks and uncertainties, including those

detailed in CONSOL’s annual report on Form 10-K for the year ended December 31, 2023, quarterly reports on Form 10-Q,

and current reports on Form 8-K that are available on its website at https://investors.consolenergy.com/sec-filings and on the SEC’s

website at http://www.sec.gov, and those detailed in Arch’s annual report on Form 10-K for the year ended December 31,

2023, quarterly reports on Form 10-Q and current reports on Form 8-K that are available on Arch’s website at https://investor.archrsc.com/sec-filings/

and on the SEC’s website at http://www.sec.gov.

Forward-looking statements

are based on the estimates and opinions of management at the time the statements are made. Neither CONSOL nor Arch undertakes any obligation

to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required

by law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

No Offer or Solicitation

This report is not intended

to be, and shall not constitute, an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation

of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would

be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall

be made, except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Additional Information about the Transaction

and Where to Find It

In connection with the proposed

transaction, CONSOL filed with the SEC a registration statement on Form S-4 that includes a joint proxy statement of Arch and CONSOL

and that also constitutes a prospectus of CONSOL. The registration statement was declared effective by the SEC on November 26, 2024,

and Arch and CONSOL commenced mailing the definitive joint proxy statement/prospectus to their respective shareholders on or around November 26,

2024. Each of Arch and CONSOL may also file other relevant documents with the SEC regarding the proposed transaction. This document is

not a substitute for the definitive joint proxy statement/prospectus or registration statement or any other document that Arch or CONSOL

may file with the SEC. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, JOINT PROXY STATEMENT/PROSPECTUS AND

ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, CAREFULLY

AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT ARCH, CONSOL

AND THE PROPOSED TRANSACTION.

Investors and security holders

will be able to obtain free copies of the registration statement, definitive joint proxy statement/prospectus and other documents containing

important information about Arch, CONSOL and the proposed transaction, once such documents are filed with the SEC through the website

maintained by the SEC at http://www.sec.gov. Copies of the registration statement, definitive joint proxy statement/prospectus and other

documents filed with the SEC by Arch may be obtained free of charge on Arch’s website at https://investor.archrsc.com/sec-filings/

or, alternatively, by directing a request by mail to Arch’s Corporate Secretary at One CityPlace Drive, Suite 300, St. Louis,

Missouri, 63141. Copies of the registration statement, definitive joint proxy statement/prospectus and other documents filed with the

SEC by CONSOL may be obtained free of charge on CONSOL’s website at https://investors.consolenergy.com/sec-filings or, alternatively,

by directing a request by mail to CONSOL’s Corporate Secretary at 275 Technology Drive, Suite 101, Canonsburg, Pennsylvania

15317.

Participants in the Solicitation

Arch, CONSOL and certain of

their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed

transaction. Information about the directors and executive officers of Arch, including a description of their direct or indirect interests,

by security holdings or otherwise, is set forth in Arch’s proxy statement for its 2024 Annual Meeting of Stockholders, which was

filed with the SEC on March 27, 2024, including under the headings “Executive Compensation,” “Director Compensation,”

“Equity Compensation Plan Information,” and “Security Ownership of Directors and Executive Officers.” To the extent

holdings of Arch common stock by the directors and executive officers of Arch have changed from the amounts of Arch common stock held

by such persons as reflected therein, such changes have been or will be reflected on Initial Statements of Beneficial Ownership of Securities

on Form 3 (“Form 3”), Statements of Changes in Beneficial Ownership on Form 4 (“Form 4”) or

Annual Statements of Changes in Beneficial Ownership of Securities on Form 5 (“Form 5”), in each case filed with

the SEC, including: the Form 3 filed by George John Schuller on March 19, 2024; and the Forms 4 filed by Pamela Butcher on March 13, 2024, March 18, 2024, June 17, 2024, September 16, 2024 and November 27, 2024, James Chapman on March 11, 2024,

Paul Demzik on March 5, 2024, John Eaves on March 8, 2024, Patrick Kriegshauser on March 18, 2024, June 17, 2024,

September 16, 2024 and November 27, 2024, Holly Koeppel on March 18, 2024, June 17, 2024, September 16, 2024

and November 27, 2024, Richard Navarre on March 18, 2024, June 17, 2024, September 16, 2024 and November 27, 2024, George John Schuller on March 21, 2024, Peifang Zhang on March 18, 2024, June 17, 2024, September 16, 2024 and

November 27, 2024, John Ziegler on March 8, 2024, John Drexler on October 15, 2024, Rosemary Klein on October 15, 2024, Deck Slone on October 15, 2024 and Matthew Giljum on October 15, 2024. Information about the directors and executive officers

of CONSOL, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in CONSOL’s

proxy statement for its 2024 Annual Meeting of Stockholders, which was filed with the SEC on April 1, 2024, including under the headings

“Board of Directors and Compensation Information,” “Executive Compensation Information” and “Beneficial

Ownership of Securities.” To the extent holdings of CONSOL common stock by the directors and executive officers of CONSOL have changed

from the amounts of CONSOL common stock held by such persons as reflected therein, such changes have been or will be reflected on Forms

3, Forms 4 or Forms 5, in each case filed with the SEC, including: the Forms 4 filed by James Brock on May 24, 2024 and July 1, 2024, John Mills on May 9, 2024, Cassandra Chia-Wei Pan on May 9, 2024, Valli Perera on May 9, 2024, Joseph Platt on May 9, 2024 and John Rothka on March 8, 2024. Other information regarding the participants in the proxy solicitations and a description

of their direct and indirect interests, by security holdings or otherwise, are contained in the registration statement and joint proxy

statement/prospectus and may be contained in other relevant materials to be filed with the SEC regarding the proposed transaction when

such materials become available. Investors and security holders should read the registration statement and joint proxy statement/prospectus

carefully before making any voting or investment decisions. You may obtain free copies of any of the documents referenced herein from

Arch or CONSOL using the sources indicated above.

Signatures

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: January 3, 2025 |

Arch Resources, Inc. |

| |

| |

By: |

/s/ Rosemary L. Klein |

| |

|

Rosemary L. Klein |

| |

|

Senior Vice President—Law, General Counsel and Secretary |

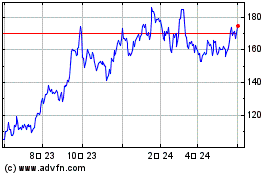

Arch Resources (NYSE:ARCH)

過去 株価チャート

から 12 2024 まで 1 2025

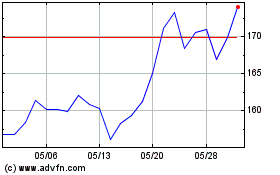

Arch Resources (NYSE:ARCH)

過去 株価チャート

から 1 2024 まで 1 2025