Mount Logan Capital Inc. Announces Continued Partnership with Specialized Credit Manager. Separately Announces Closing of Debenture Units Offering

2024年1月29日 - 9:00PM

Mount Logan Capital Inc. (NEO: MLC) (“Mount Logan,” “our,” “we,” or

the “Company”) is pleased to announce the appointment of Mount

Logan’s CEO, Ted Goldthorpe, to Marret’s Board of Directors during

January 2024. Marret is a prominent Canadian asset manager

specializing in global fixed-income investing and alternative

strategies on behalf of institutional, high net worth and retail

clients. Marret advises total assets of approximately C$5 billion.

In June 2023, Mount Logan purchased a strategic minority stake in

Marret from certain minority shareholders.

Separately, Mount Logan today announced the

closing of an opportunistic $18.8 million privately placed

debenture units offering through the issuance of 18,752 debenture

units (“Debenture Units”) on a non-brokered private placement basis

(the “Offering”). Each Debenture Unit consists of: (i) one 8.85%

paid-in-kind unsecured debenture of the Company in the principal

amount of $1,000, and (ii) 50 common share purchase warrants of the

Company, each of which is exercisable to acquire one common share

of Mount Logan at a price of C$2.75 per share. The net proceeds

from the Offering will be used for general corporate purposes

including the complete refinancing of $13.6 million of existing

indebtedness at Lind Bridge, a wholly-owned subsidiary of Mount

Logan, with the balance being used for general corporate purposes,

including supporting Mount Logan’s working capital position,

enabling Mount Logan to focus on its growth initiatives through

2024 and beyond.

Key Commentary

- Mount Logan acquired a

minority stake in Marret in June 2023 from a group of minority

shareholders. There have been no changes following the

close of the acquisition to the management team, day-to-day

operations, or majority ownership structure. Marret remains

majority owned by CI Financial Corp (“CI Financial”), a publicly

listed diversified global asset and wealth management company.

- Since Mount Logan’s

investment, Marret and Mount Logan have each benefited from access

to broader credit investing skillsets. Ted Goldthorpe

appointed to the Marret Board of Directors in January 2024

following the collaboration among the respective teams throughout

2023.

- Mount Logan looks forward

to working closely with Marret’s best-in-class management team and

majority shareholder, CI Financial, to capitalize on the

opportunities available in the North American credit

markets.

- Mount Logan maintains two

minority investments in Canadian credit managers through

its July 2021 investment in Crown Private Credit Partners Inc., a

Canadian alternative corporate financing business, and the June

2023 minority stake purchase of Marret herein referenced. Mount

Logan views each business as highly complementary to its core asset

management offering.

- Additionally, the $18.8

million capital raise and opportunistic refinancing represents an

important milestone for the business as it simplifies Mount Logan’s

capital structure at an attractive fixed-rate over the next 8

years. $13.6 million of the net proceeds of the Offering

will refinance existing indebtedness at Lind Bridge, a wholly owned

subsidiary of Mount Logan. Following completion of the Offering and

refinancing, Mount Logan will have no outstanding indebtedness at

Lind Bridge, which existing indebtedness had previously been raised

to support direct growth investment into Ability Insurance Company,

Mount Logan’s wholly-owned insurance company. The refinancing has

no impact on previous investments in Ability or Ability's

risk-based capital ratios (“RBC”). The balance of the proceeds of

the Offering after refinancing existing indebtedness will be used

for general corporate purposes, primarily supporting the Company’s

working capital position, and paying related transaction fees and

expenses.

- The Offering mentioned

herein has no relation to the Marret minority stake purchase nor

Ted Goldthorpe’s appointment to Marret’s board of directors and

each of these events are separate and distinct.

Opportunistic Refinancing

DetailsMount Logan raised $18.8 million in aggregate

principal amount of debentures. Each Debenture Unit was issued at a

price of US$1,000 and consisted of: (a) one 8.85% unsecured

debenture of the Corporation having a principal amount of US$1,000

(a “Debenture”); and (b) 50 common share purchase warrants

(“Warrants”). Each Debenture matures eight (8) years following the

closing of the Offering (the “Maturity Date”) and bears interest at

a rate of 8.85% per annum from the date of issue, accruing

quarterly and compounded annually and payable on the Maturity Date.

Each Warrant is exercisable into one common share of the Company at

a price of C$2.75 per share until January 25, 2032, provided that

the Warrants are not exercisable prior January 25, 2025.

Management Commentary

-

Ted Goldthorpe, Chief Executive Officer and Chairman of

Mount Logan, said, “A lot of strong momentum to start 2024

for Mount Logan. I am grateful and excited for the opportunity to

join the Marret board and help drive value for Marret stakeholders.

Separately, we are pleased to complete the $18.8 million debenture

units offering, which fully refinances our Lind Bridge indebtedness

at an attractive fixed rate with an 8-year tenor. The debenture

unit offering positions us well to focus on high-priority

opportunities for the business across the asset management and

insurance solutions landscape.”

- Roberto Katigbak, Chief Executive Officer at Marret

said, “We are extremely excited by the investment Mount

Logan has made into Marret. Mount Logan shares our philosophy of

delivering strong risk adjusted returns, and this partnership can

create tremendous value for our clients. We view our individual

strengths in both private credit and in liquid public fixed income

markets to be highly complementary. We look forward to working

closely with Mount Logan to expand our businesses while providing

truly unique solutions for investors to navigate challenging

markets.”

-

Darie Urbanky, Chief Operating Officer and President of CI

Financial added, “CI Financial is excited about Mount

Logan’s investment into Marret and Ted’s increased role through his

appointment to Marret’s board of directors. We see ample

opportunities to grow Marret in the current market and believe

Mount Logan’s experience and additional credit capabilities will

further reinforce Marret as a best-in-class credit manager.”

About Mount Logan Capital

Inc.

Mount Logan Capital Inc. is an alternative asset

management and insurance solutions company that is focused on

public and private debt securities in the North American market and

the reinsurance of annuity products primarily through its wholly

owned subsidiaries Mount Logan Management LLC and Ability Insurance

Company. The Company also actively sources, evaluates, underwrites,

manages, monitors and primarily invests in loans, debt securities,

and other credit-oriented instruments that present attractive

risk-adjusted returns and present low risk of principal impairment

through the credit cycle.

Ability is a Nebraska domiciled insurer and reinsurer of

long-term care policies and annuity products acquired by Mount

Logan in the fourth quarter of fiscal year 2021. Ability is unique

in the insurance industry in that its long-term care portfolio’s

morbidity risk has been largely reinsured to third-parties. Ability

is also no longer insuring new long-term care risk and will

continue to expand and diversify its business including through the

reinsurance of annuity products which commenced in the second

quarter of fiscal 2022.

About Marret Asset

Management

Marret Asset Management Inc. is a specialist

fixed-income manager. With mandates in investment grade credit,

short-term cash alternatives, high yield and opportunistic

distressed securities, Marret’s focus is on achieving positive

absolute returns with emphasis on risk management.

Cautionary Statement Regarding

Forward-Looking Statements

This press release contains forward-looking

statements and information within the meaning of applicable

securities legislation. Forward-looking statements can be

identified by the expressions "seeks", "expects", "believes",

"estimates", "will", "target" and similar expressions. The

forward-looking statements are not historical facts but reflect the

current expectations of the Company regarding future results or

events and are based on information currently available to it.

Certain material factors and assumptions were applied in providing

these forward-looking statements. The forward-looking statements

discussed in this release include, but are not limited to,

statements relating to the Company’s business strategy, model,

approach and future activities; portfolio composition, size and

performance, asset management activities and related income,

capital raising activities, future credit opportunities of the

Company, portfolio realizations, the protection of stakeholder

value, the expansion of the Company’s loan portfolio, including

through its investment in Marret, synergies to be achieved by both

the Company and Marret through their partnership and relationship

with CI Financial, any future growth and expansion of each of both

the Company and Marret, any change in earnings potential for the

Company as a result of any growth of Marret, future fundraising

activities of Marret; the business and future activities and

prospects of Marret and the Company and the use of proceeds of the

Offering. All forward-looking statements in this press release are

qualified by these cautionary statements. The Company believes that

the expectations reflected in forward-looking statements are based

upon reasonable assumptions; however, the Company can give no

assurance that the actual results or developments will be realized

by certain specified dates or at all. These forward-looking

statements are subject to a number of risks and uncertainties that

could cause actual results or events to differ materially from

current expectations, including that the expected synergies of the

investment in Marret may not be realized as expected; the risk that

each of the Company and Marret may require a significant investment

of capital and other resources in order to expand and grow their

respective businesses; the Company has a limited operating history

with respect to an asset management oriented business model and the

matters discussed under "Risk Factors" in the most recently filed

annual information form and management discussion and analysis for

the Company. Readers, therefore, should not place undue reliance on

any such forward-looking statements. Further, a forward-looking

statement speaks only as of the date on which such statement is

made. The Company undertakes no obligation to publicly update any

such statement or to reflect new information or the occurrence of

future events or circumstances except as required by securities

laws. These forward-looking statements are made as of the date of

this press release.

This press release is not, and under no

circumstances is it to be construed as, a prospectus or an

advertisement and the communication of this release is not, and

under no circumstances is it to be construed as, an offer to sell

or an offer to purchase any securities in the Company or in any

fund or other investment vehicle. This press release is not

intended for U.S. persons. The Company’s shares are not registered

under the U.S. Securities Act of 1933, as amended, and the Company

is not registered under the U.S. Investment Company Act of 1940

(the “1940 Act”). U.S. persons are not permitted to purchase the

Company’s shares absent an applicable exemption from registration

under each of these Acts. In addition, the number of investors in

the United States, or which are U.S. persons or purchasing for the

account or benefit of U.S. persons, will be limited to such number

as is required to comply with an available exemption from the

registration requirements of the 1940 Act.

Contacts:Mount Logan Capital

Inc.365 Bay Street, Suite 800Toronto, ON M5H 2V1

Jason RoosChief Financial

OfficerJason.Roos@mountlogancapital.ca

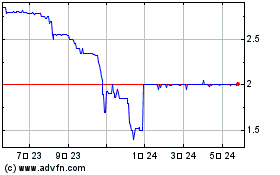

Mount Logan Capital (NEO:MLC)

過去 株価チャート

から 4 2024 まで 5 2024

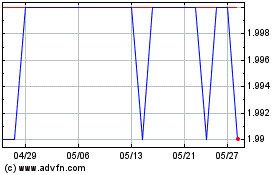

Mount Logan Capital (NEO:MLC)

過去 株価チャート

から 5 2023 まで 5 2024