000159929812/312024Q2FALSEhttp://fasb.org/us-gaap/2024#RelatedPartyMemberhttp://fasb.org/us-gaap/2024#RelatedPartyMemberhttp://fasb.org/us-gaap/2024#RelatedPartyMemberhttp://fasb.org/us-gaap/2024#RelatedPartyMemberP5Dxbrli:sharesiso4217:USDiso4217:USDxbrli:sharessmmt:segmentsmmt:countrysmmt:contractutr:sqftxbrli:puresmmt:promissory_note00015992982024-01-012024-06-3000015992982024-07-3000015992982024-06-3000015992982023-12-3100015992982024-04-012024-06-3000015992982023-04-012023-06-3000015992982023-01-012023-06-300001599298us-gaap:CommonStockMember2024-03-310001599298us-gaap:AdditionalPaidInCapitalMember2024-03-310001599298us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001599298us-gaap:RetainedEarningsMember2024-03-3100015992982024-03-310001599298us-gaap:CommonStockMember2024-04-012024-06-300001599298us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300001599298us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300001599298us-gaap:RetainedEarningsMember2024-04-012024-06-300001599298us-gaap:CommonStockMember2024-06-300001599298us-gaap:AdditionalPaidInCapitalMember2024-06-300001599298us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300001599298us-gaap:RetainedEarningsMember2024-06-300001599298us-gaap:CommonStockMember2023-12-310001599298us-gaap:AdditionalPaidInCapitalMember2023-12-310001599298us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001599298us-gaap:RetainedEarningsMember2023-12-310001599298us-gaap:CommonStockMember2024-01-012024-06-300001599298us-gaap:AdditionalPaidInCapitalMember2024-01-012024-06-300001599298us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-06-300001599298us-gaap:RetainedEarningsMember2024-01-012024-06-300001599298us-gaap:CommonStockMember2023-03-310001599298us-gaap:AdditionalPaidInCapitalMember2023-03-310001599298us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001599298us-gaap:RetainedEarningsMember2023-03-3100015992982023-03-310001599298us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001599298us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001599298us-gaap:RetainedEarningsMember2023-04-012023-06-300001599298us-gaap:CommonStockMember2023-06-300001599298us-gaap:AdditionalPaidInCapitalMember2023-06-300001599298us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001599298us-gaap:RetainedEarningsMember2023-06-3000015992982023-06-300001599298us-gaap:CommonStockMember2022-12-310001599298us-gaap:AdditionalPaidInCapitalMember2022-12-310001599298us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001599298us-gaap:RetainedEarningsMember2022-12-3100015992982022-12-310001599298us-gaap:CommonStockMember2023-01-012023-06-300001599298us-gaap:AdditionalPaidInCapitalMember2023-01-012023-06-300001599298us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-06-300001599298us-gaap:RetainedEarningsMember2023-01-012023-06-300001599298smmt:RightsOfferingMember2024-01-012024-06-300001599298smmt:RightsOfferingMember2023-01-012023-06-300001599298smmt:AkesoLicenseAgreementMember2024-01-012024-06-300001599298smmt:AkesoLicenseAgreementMember2023-01-012023-06-300001599298country:GB2024-06-300001599298country:GB2023-12-310001599298country:US2024-06-300001599298country:US2023-12-310001599298stpr:FL2024-06-300001599298stpr:CA2024-01-012024-06-3000015992982021-05-012021-05-3100015992982021-05-012024-06-300001599298us-gaap:CollaborativeArrangementTransactionWithPartyToCollaborativeArrangementMember2023-01-012023-03-060001599298smmt:CollaborativeArrangementTransactionWithPartyToCollaborativeArrangementUpfrontPaymentOneMember2023-01-012023-01-310001599298smmt:CollaborativeArrangementTransactionWithPartyToCollaborativeArrangementUpfrontPaymentTwoMember2023-03-062023-03-060001599298us-gaap:CollaborativeArrangementTransactionWithPartyToCollaborativeArrangementMember2024-06-030001599298us-gaap:CollaborativeArrangementTransactionWithPartyToCollaborativeArrangementMember2024-06-300001599298us-gaap:CollaborativeArrangementTransactionWithPartyToCollaborativeArrangementMember2024-01-012024-06-300001599298us-gaap:CollaborativeArrangementTransactionWithPartyToCollaborativeArrangementMember2024-04-012024-06-300001599298us-gaap:CollaborativeArrangementTransactionWithPartyToCollaborativeArrangementMember2023-01-012023-06-300001599298smmt:CollaborativeArrangementTransactionWithPartyToCollaborativeArrangementUpfrontPaymentOneMember2023-01-012023-06-300001599298srt:ChiefExecutiveOfficerMembersmmt:DugganSeptemberNoteMember2022-12-060001599298smmt:NotePurchaseAgreementMembersmmt:ChiefExecutiveOfficerAndChiefExecutiveOfficerAndPresidentMember2022-12-060001599298us-gaap:EmployeeStockOptionMember2024-01-012024-06-300001599298us-gaap:EmployeeStockOptionMember2023-01-012023-06-300001599298us-gaap:WarrantMember2024-01-012024-06-300001599298us-gaap:WarrantMember2023-01-012023-06-300001599298us-gaap:EmployeeStockMember2024-01-012024-06-300001599298us-gaap:EmployeeStockMember2023-01-012023-06-300001599298us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2024-06-300001599298us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2024-06-300001599298us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2024-06-300001599298us-gaap:MoneyMarketFundsMember2024-06-300001599298us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasurySecuritiesMember2024-06-300001599298us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMember2024-06-300001599298us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasurySecuritiesMember2024-06-300001599298us-gaap:USTreasurySecuritiesMember2024-06-300001599298us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel1Member2024-06-300001599298us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel2Member2024-06-300001599298us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasurySecuritiesMember2024-06-300001599298us-gaap:USTreasurySecuritiesMember2024-06-300001599298us-gaap:FairValueInputsLevel1Member2024-06-300001599298us-gaap:FairValueInputsLevel2Member2024-06-300001599298us-gaap:FairValueInputsLevel3Member2024-06-300001599298us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2023-12-310001599298us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2023-12-310001599298us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2023-12-310001599298us-gaap:MoneyMarketFundsMember2023-12-310001599298us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasurySecuritiesMember2023-12-310001599298us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMember2023-12-310001599298us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasurySecuritiesMember2023-12-310001599298us-gaap:USTreasurySecuritiesMember2023-12-310001599298us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-12-310001599298us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-12-310001599298us-gaap:FairValueInputsLevel3Memberus-gaap:USTreasurySecuritiesMember2023-12-310001599298us-gaap:USTreasurySecuritiesMember2023-12-310001599298us-gaap:FairValueInputsLevel1Member2023-12-310001599298us-gaap:FairValueInputsLevel2Member2023-12-310001599298us-gaap:FairValueInputsLevel3Member2023-12-310001599298stpr:FL2024-01-012024-03-310001599298stpr:FL2024-02-010001599298srt:AffiliatedEntityMember2024-04-012024-04-010001599298srt:AffiliatedEntityMembersmmt:GeniusSubleaseAgreementMember2024-04-012024-04-010001599298smmt:InvestmentsResearchSubleaseAgreementMembersrt:AffiliatedEntityMember2024-04-012024-04-010001599298srt:AffiliatedEntityMembersmmt:GeniusSubleaseAgreementMember2024-04-010001599298smmt:InvestmentsResearchSubleaseAgreementMembersrt:AffiliatedEntityMember2024-04-010001599298smmt:PromissoryNotesMemberus-gaap:RelatedPartyMember2024-06-300001599298smmt:PromissoryNotesMemberus-gaap:RelatedPartyMember2023-12-310001599298srt:ChiefExecutiveOfficerMembersmmt:DugganFebruaryNoteMember2022-12-060001599298smmt:ChiefExecutiveOfficerAndPresidentMembersmmt:ZanganehNoteMember2022-12-060001599298smmt:ChiefExecutiveOfficerAndChiefExecutiveOfficerAndPresidentMembersmmt:DugganFebruaryNoteAndZanganehNoteMember2022-12-062022-12-060001599298srt:ChiefExecutiveOfficerMembersmmt:DugganPromissoryNotesMember2023-01-192023-01-190001599298smmt:ChiefExecutiveOfficerAndPresidentMembersmmt:ZanganehNoteMember2023-02-152023-02-150001599298smmt:NotePurchaseAgreementMembersmmt:ChiefExecutiveOfficerAndChiefExecutiveOfficerAndPresidentMember2022-12-062022-12-0600015992982022-12-060001599298smmt:NotePurchaseAgreementMembersmmt:ChiefExecutiveOfficerAndChiefExecutiveOfficerAndPresidentMembersmmt:VariableRatePeriodOneMember2022-12-062022-12-060001599298smmt:NotePurchaseAgreementMembersmmt:ChiefExecutiveOfficerAndChiefExecutiveOfficerAndPresidentMembersmmt:VariableRatePeriodTwoMember2022-12-062022-12-060001599298srt:ChiefExecutiveOfficerMembersmmt:DugganFebruaryNoteMember2024-02-172024-02-170001599298srt:ChiefExecutiveOfficerMembersmmt:DugganFebruaryNoteMember2024-06-300001599298smmt:ChiefExecutiveOfficerAndPresidentMembersmmt:ZanganehNoteMember2024-06-300001599298srt:ChiefExecutiveOfficerMembersmmt:DugganSeptemberNoteMember2024-06-300001599298smmt:PromissoryNotesMemberus-gaap:RelatedPartyMember2024-04-012024-06-300001599298smmt:PromissoryNotesMemberus-gaap:RelatedPartyMember2024-01-012024-06-300001599298smmt:PromissoryNotesMemberus-gaap:RelatedPartyMember2023-04-012023-06-300001599298smmt:PromissoryNotesMemberus-gaap:RelatedPartyMember2023-01-012023-06-300001599298us-gaap:RelatedPartyMembersmmt:PromissoryNotesAccruedInterestMember2024-06-300001599298us-gaap:RelatedPartyMembersmmt:PromissoryNotesAccruedInterestMember2023-12-3100015992982024-06-062024-06-0600015992982024-06-0600015992982024-06-032024-06-030001599298smmt:A2024InducementPoolMember2024-05-030001599298smmt:A2024InducementPoolMember2024-06-300001599298smmt:EmployeeStockOptionTimeBasedMember2023-12-310001599298smmt:EmployeeStockOptionTimeBasedMember2024-01-012024-06-300001599298smmt:EmployeeStockOptionTimeBasedMember2024-06-300001599298smmt:EmployeeStockOptionPerformanceAndMarketBasedMember2023-12-310001599298smmt:EmployeeStockOptionPerformanceAndMarketBasedMember2024-01-012024-06-300001599298smmt:EmployeeStockOptionPerformanceAndMarketBasedMember2024-06-300001599298smmt:EmployeeStockOptionPerformanceAndMarketBasedExpectedToVestMember2024-06-300001599298smmt:EmployeeStockOptionPerformanceAndMarketBasedNotExpectedToVestMember2024-06-300001599298us-gaap:ResearchAndDevelopmentExpenseMember2024-04-012024-06-300001599298us-gaap:ResearchAndDevelopmentExpenseMember2023-04-012023-06-300001599298us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-06-300001599298us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-06-300001599298us-gaap:GeneralAndAdministrativeExpenseMember2024-04-012024-06-300001599298us-gaap:GeneralAndAdministrativeExpenseMember2023-04-012023-06-300001599298us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-06-300001599298us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-06-300001599298smmt:EmployeeStockOptionTimeBasedMember2024-04-012024-06-300001599298smmt:EmployeeStockOptionTimeBasedMember2023-04-012023-06-300001599298smmt:EmployeeStockOptionTimeBasedMember2023-01-012023-06-300001599298smmt:EmployeeStockOptionPerformanceAndMarketBasedMember2024-04-012024-06-300001599298smmt:EmployeeStockOptionPerformanceAndMarketBasedMember2023-04-012023-06-300001599298smmt:EmployeeStockOptionPerformanceAndMarketBasedMember2023-01-012023-06-300001599298us-gaap:EmployeeStockMember2024-04-012024-06-300001599298us-gaap:EmployeeStockMember2023-04-012023-06-300001599298us-gaap:EmployeeStockMember2024-01-012024-06-300001599298us-gaap:EmployeeStockMember2023-01-012023-06-300001599298smmt:SubleaseAgreementFirstAmendmentMembersrt:AffiliatedEntityMember2022-07-250001599298smmt:SubleaseAgreementFirstAmendmentMembersrt:AffiliatedEntityMember2024-04-012024-06-300001599298smmt:SubleaseAgreementFirstAmendmentMembersrt:AffiliatedEntityMember2024-01-012024-06-300001599298smmt:SubleaseAgreementFirstAmendmentMembersrt:AffiliatedEntityMember2023-04-012023-06-300001599298smmt:SubleaseAgreementFirstAmendmentMembersrt:AffiliatedEntityMember2023-01-012023-06-300001599298srt:AffiliatedEntityMembersmmt:SubleaseAgreementSecondAmendmentMember2022-07-290001599298srt:AffiliatedEntityMembersmmt:SubleaseAgreementSecondAmendmentMember2024-04-012024-06-300001599298srt:AffiliatedEntityMembersmmt:SubleaseAgreementSecondAmendmentMember2024-01-012024-06-300001599298srt:AffiliatedEntityMembersmmt:SubleaseAgreementSecondAmendmentMember2023-04-012023-06-300001599298srt:AffiliatedEntityMembersmmt:SubleaseAgreementSecondAmendmentMember2023-01-012023-06-300001599298srt:AffiliatedEntityMembersmmt:GeniusSubleaseAgreementAndInvestmentsResearchSubleaseAgreementMember2024-04-012024-06-300001599298srt:AffiliatedEntityMembersmmt:GeniusSubleaseAgreementAndInvestmentsResearchSubleaseAgreementMember2024-01-012024-06-300001599298srt:AffiliatedEntityMembersmmt:GeniusSubleaseAgreementAndInvestmentsResearchSubleaseAgreementMember2024-06-300001599298smmt:SubleaseAgreementThirdAmendmentMemberus-gaap:SubsequentEventMembersrt:AffiliatedEntityMember2024-08-010001599298smmt:SubleaseAgreementThirdAmendmentMemberus-gaap:SubsequentEventMembersrt:AffiliatedEntityMember2024-08-012024-08-010001599298smmt:RightsOfferingMember2023-03-010001599298smmt:RightsOfferingMember2023-03-012023-03-010001599298srt:ChiefExecutiveOfficerMembersmmt:RightsOfferingMember2023-03-012023-03-010001599298srt:ChiefOperatingOfficerMember2023-10-132023-10-130001599298us-gaap:PrivatePlacementMembersrt:ChiefOperatingOfficerMember2023-10-130001599298us-gaap:PrivatePlacementMembersrt:ChiefOperatingOfficerMember2023-10-132023-10-130001599298smmt:AcquiredInProcessResearchAndDevelopmentMember2024-06-30

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 10-Q

_________________

| | | | | |

(Mark One) |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

For the quarterly period ended June 30, 2024

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from _________ to _________ |

Commission File Number: 001-36866

_______________________________

Summit Therapeutics Inc.

(Exact name of registrant as specified in its charter)

_____________________

| | | | | | | | |

Delaware | | 37-1979717 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

| | |

| | |

601 Brickell Key Drive, Suite 1000,

Miami, FL

(Address of principal executive offices)

305-203-2034

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address and former fiscal year, if changed since last report)

_________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

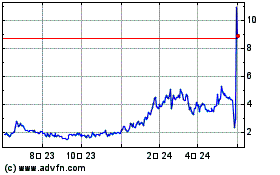

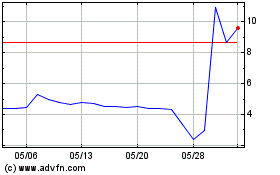

Common Stock, $0.01 par value per share | SMMT | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| | | |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | | |

| Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of July 30, 2024, there were 724,537,751 shares of common stock, par value $0.01 per share, outstanding.

| | | | | | | | |

| | Page |

| |

| PART I | |

| Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| PART II | |

| Item 1. | | |

| Item 1A. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| Item 5 | | |

| Item 6. | | |

| | |

| | |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, regarding the future financial performance, business prospects and growth of Summit Therapeutics Inc., that involve substantial risks and uncertainties. All statements contained in this Quarterly Report on Form 10-Q, other than statements of historical fact, including statements regarding our strategy, future operations, future financial position, future revenues, projected costs, prospects, plans and objectives of management, are forward-looking statements. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. The forward-looking statements in this Quarterly Report on Form 10-Q include, among other things, statements about:

•the ability to develop a successful product candidate under the License Agreement (as defined below);

•our ability to raise sufficient additional funds to make payments under the License Agreement, and fund ongoing operations and capital needs;

•the timing of and the ability to effectively execute clinical development of ivonescimab;

•the timing, costs, conduct and outcomes of clinical trials for any product candidates;

•our plans with respect to possible future collaborations and partnering arrangements;

•the potential benefits of possible future acquisitions or investments in other businesses, products or technologies;

•our plans to pursue research and development of other future product candidates;

•our estimates regarding the potential market opportunity and patient population for commercializing our product candidates, if approved for commercial use;

•our sales, marketing and distribution capabilities and strategy;

•our ability to establish and maintain arrangements with third parties, such as contract research organizations, contract manufacturing organizations, suppliers, and distributors;

•the costs and timing of preparing, filing and prosecuting patent applications, maintaining and protecting our intellectual property rights and defending against any intellectual property-related claims;

•our estimates regarding expenses, future revenues, capital requirements and needs for additional financing;

•the impact of government laws and regulations in the United States and in foreign countries;

•the timing and likelihood of regulatory filings and approvals for our product candidates;

•whether regulatory authorities determine that additional trials or data are necessary in order to accept a new drug application for review and/or approval;

•our competitive position;

•our use of our existing cash, cash equivalents and marketable securities;

•our ability to attract and retain key scientific or management personnel;

•the impact of public health epidemics, the response to such epidemics and the potential effects of such epidemics on our clinical trials, business, financial results, supply chain and market; and

•other risks and uncertainties, including those described under the heading “Risk Factors” included in our most recent Annual Report on Form 10-K for the year ended December 31, 2023, filed with the U.S. Securities and Exchange Commission ("SEC") on February 20, 2024.

We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. We have included important factors in the cautionary statements included in this Report, particularly in the “Risk Factors” section in this Report, that we believe could cause actual results or events to differ materially from the forward-looking statements that we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

You should read this Report and the documents that we have filed as exhibits to this Report completely and with the understanding that our actual future results may be materially different from what we expect. We do not assume any obligation to update any forward-looking statements.

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements.

Summit Therapeutics Inc.

Condensed Consolidated Balance Sheets

(in thousands, except share and per share data)

(Unaudited)

| | | | | | | | | | | | | | |

| | June 30, 2024 | | December 31, 2023 |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 28,434 | | | $ | 71,425 | |

| Restricted cash | | 320 | | | — | |

| Short-term investments | | 297,035 | | | 114,817 | |

| | | | |

Prepaid expenses and other current assets | | 2,052 | | | 2,622 | |

| | | | |

| Research and development tax credit receivable | | 953 | | | 848 | |

| Total current assets | | 328,794 | | | 189,712 | |

| | | | |

| Non-current assets: | | | | |

| Property and equipment, net | | 223 | | | 204 | |

| Right-of-use assets | | 8,716 | | | 5,859 | |

| Goodwill | | 1,880 | | | 1,893 | |

| | | | |

| Research and development tax credit receivable | | 364 | | | 959 | |

| Other assets | | 1,879 | | | 4,322 | |

| Total assets | | $ | 341,856 | | | $ | 202,949 | |

| | | | |

| Liabilities and stockholders' equity | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 3,340 | | | $ | 2,667 | |

Accrued liabilities | | 12,457 | | | 8,783 | |

| Accrued compensation | | 4,877 | | | 5,429 | |

Accrued acquired in-process research and development | | 15,000 | | | — | |

| Lease liabilities | | 3,688 | | | 2,809 | |

| | | | |

| Other current liabilities | | 806 | | | 717 | |

| Promissory note payable to a related party | | 100,000 | | | — | |

| Total current liabilities | | 140,168 | | | 20,405 | |

| | | | |

| Non-current liabilities: | | | | |

| Lease liabilities, net of current portion | | 5,017 | | | 3,290 | |

| Other non-current liabilities | | 1,596 | | | 1,562 | |

| Promissory note payable to a related party | | — | | | 100,000 | |

| Total liabilities | | 146,781 | | | 125,257 | |

| | | | |

Commitments and contingencies (Note 18) | | | | |

| | | | |

| Stockholders' equity: | | | | |

Preferred stock, $0.01 par value, 20,000,000 shares authorized; none issued and outstanding at June 30, 2024 and December 31, 2023, respectively | | — | | | — | |

Common stock, $0.01 par value: 1,000,000,000 shares authorized; 724,320,201 and 701,660,053 shares issued and outstanding at June 30, 2024 and December 31, 2023, respectively | | 7,243 | | | 7,017 | |

| Additional paid-in capital | | 1,287,447 | | | 1,066,381 | |

| Accumulated other comprehensive loss | | (2,499) | | | (2,448) | |

| Accumulated deficit | | (1,097,116) | | | (993,258) | |

| Total stockholders' equity | | 195,075 | | | 77,692 | |

| Total liabilities and stockholders' equity | | $ | 341,856 | | | $ | 202,949 | |

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

Summit Therapeutics Inc.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(in thousands, except share and per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | |

| Operating expenses: | | | | | | | | |

| Research and development | | $ | 30,798 | | | $ | 9,451 | | | $ | 61,671 | | | $ | 19,334 | |

| Acquired in process research and development | | 15,007 | | | — | | | 15,007 | | | 520,915 | |

| | | | | | | | |

| General and administrative | | 13,971 | | | 6,316 | | | 25,700 | | | 13,256 | |

| | | | | | | | |

| Total operating expenses | | 59,776 | | | 15,767 | | | 102,378 | | | 553,505 | |

Other operating income (expense), net | | 159 | | | (27) | | | 372 | | | 557 | |

| Operating loss | | (59,617) | | | (15,794) | | | (102,006) | | | (552,948) | |

Other (expense) income, net | | (768) | | | 1,077 | | | (1,852) | | | (4,145) | |

| | | | | | | | |

| | | | | | | | |

| Net loss | | $ | (60,385) | | | $ | (14,717) | | | $ | (103,858) | | | $ | (557,093) | |

| | | | | | | | |

| Net loss per share: | | | | | | | | |

| Basic and diluted | | $ | (0.09) | | | $ | (0.02) | | | $ | (0.15) | | | $ | (1.03) | |

| Weighted-average shares used to compute net loss per share: | | | | | | | | |

| Basic and diluted | | 707,904,643 | | | 697,685,365 | | | 704,844,946 | | | 538,807,328 | |

| | | | | | | | |

| Comprehensive loss: | | | | | | | | |

| Net loss | | $ | (60,385) | | | $ | (14,717) | | | $ | (103,858) | | | $ | (557,093) | |

| | | | | | | | |

| Other comprehensive (loss) income: | | | | | | | | |

| Foreign currency translation adjustments | | 92 | | | (76) | | | 82 | | | (128) | |

| Reclassification of cumulative currency translation gain to other expense, net | | — | | | — | | | — | | | (419) | |

Reclassification of unrealized loss on investments to other expense, net | | 3 | | | — | | | 3 | | | — | |

| Net changes related to short-term investments | | (45) | | | (965) | | | (34) | | | 3 | |

| Comprehensive loss | | $ | (60,335) | | | $ | (15,758) | | | $ | (103,807) | | | $ | (557,637) | |

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

Summit Therapeutics Inc.

Condensed Consolidated Statements of Stockholders' Equity

(in thousands, except share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, 2024 |

| | Common Stock | | Additional Paid-In Capital | | Accumulated Other Comprehensive Loss | | Accumulated Deficit | | Total Stockholders' Equity |

| | Shares | | Amount | | | | |

| Balance at March 31, 2024 | | 701,974,596 | | | $ | 7,020 | | | $ | 1,076,370 | | | $ | (2,449) | | | $ | (1,036,731) | | | $ | 44,210 | |

| | | | | | | | | | | | |

| Private placement of common stock | | 22,222,222 | | | 222 | | | 199,778 | | | — | | | — | | | 200,000 | |

| Issuance of common stock under stock purchase plans and exercise of stock options and warrants | | 123,383 | | | 1 | | | 211 | | | — | | | — | | | 212 | |

| Stock-based compensation | | — | | | — | | | 11,088 | | | — | | | — | | | 11,088 | |

| Net other comprehensive loss | | — | | | — | | | — | | | (50) | | | — | | | (50) | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Net loss | | — | | | — | | | — | | | — | | | (60,385) | | | (60,385) | |

Balance at June 30, 2024 | | 724,320,201 | | | $ | 7,243 | | | $ | 1,287,447 | | | $ | (2,499) | | | $ | (1,097,116) | | | $ | 195,075 | |

| | | | | | | | | | | | |

| | Six Months Ended June 30, 2024 |

| | Common Stock | | Additional Paid-In Capital | | Accumulated Other Comprehensive Loss | | Accumulated Deficit | | Total Stockholders' Equity |

| | Shares | | Amount | | | | |

Balance at December 31, 2023 | | 701,660,053 | | | $ | 7,017 | | | $ | 1,066,381 | | | $ | (2,448) | | | $ | (993,258) | | | $ | 77,692 | |

| | | | | | | | | | | | |

| Private placement of common stock | | 22,222,222 | | | 222 | | | 199,778 | | | — | | | — | | | 200,000 | |

| Issuance of common stock under stock purchase plans and exercise of stock options and warrants | | 437,926 | | | 4 | | | 693 | | | — | | | — | | | 697 | |

| Stock-based compensation | | — | | | — | | | 20,595 | | | — | | | — | | | 20,595 | |

| | | | | | | | | | | | |

| Net other comprehensive loss | | — | | | — | | | — | | | (51) | | | — | | | (51) | |

| Net loss | | — | | | — | | | — | | | — | | | (103,858) | | | (103,858) | |

| Balance at June 30, 2024 | | 724,320,201 | | | $ | 7,243 | | | $ | 1,287,447 | | | $ | (2,499) | | | $ | (1,097,116) | | | $ | 195,075 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, 2023 |

| | Common Stock | | Additional Paid-In Capital | | Accumulated Other Comprehensive Loss | | Accumulated Deficit | | Total Stockholders' Equity |

| | Shares | | Amount | | | | |

| Balance at March 31, 2023 | | 697,685,365 | | | $ | 6,976 | | | $ | 1,048,608 | | | $ | (1,396) | | | $ | (920,706) | | | $ | 133,482 | |

| Stock-based compensation | | — | | | — | | | 1,875 | | | — | | | — | | | 1,875 | |

| Net changes related to short-term investments | | — | | | — | | | — | | | (965) | | | — | | | (965) | |

| Foreign currency translation adjustment | | — | | | — | | | — | | | (76) | | | — | | | (76) | |

| Net loss | | — | | | — | | | — | | | — | | | (14,717) | | | (14,717) | |

| Balance at June 30, 2023 | | 697,685,365 | | | $ | 6,976 | | | $ | 1,050,483 | | | $ | (2,437) | | | $ | (935,423) | | | $ | 119,599 | |

| | | | | | | | | | | | |

| | Six Months Ended June 30, 2023 |

| | Common Stock | | Additional Paid-In Capital | | Accumulated Other Comprehensive Loss | | Accumulated Deficit | | Total Stockholders' Equity |

| | Shares | | Amount | | | | |

| Balance at December 31, 2022 | | 211,091,425 | | | $ | 2,110 | | | $ | 504,767 | | | $ | (1,893) | | | $ | (378,330) | | | $ | 126,654 | |

Rights offering of common stock, net of offering costs of $619 | | 476,190,471 | | | 4,762 | | | 494,619 | | | — | | | — | | | 499,381 | |

| Issuance of common stock under stock purchase plans and exercise of stock options | | 403,469 | | | 4 | | | 647 | | | — | | | — | | | 651 | |

| Issuance of common stock in lieu of cash for Akeso upfront payment | | 10,000,000 | | | 100 | | | 45,800 | | | — | | | — | | | 45,900 | |

| Stock-based compensation | | — | | | — | | | 4,650 | | | — | | | — | | | 4,650 | |

| Net changes related to short-term investments | | — | | | — | | | — | | | 3 | | | — | | | 3 | |

Reclassification of cumulative translation gain (Note 8) | | — | | | — | | | — | | | (419) | | | — | | | (419) | |

| Foreign currency translation adjustment | | — | | | — | | | — | | | (128) | | | — | | | (128) | |

| Net loss | | — | | | — | | | — | | | — | | | (557,093) | | | (557,093) | |

Balance at June 30, 2023 | | 697,685,365 | | | $ | 6,976 | | | $ | 1,050,483 | | | $ | (2,437) | | | $ | (935,423) | | | $ | 119,599 | |

| | | | | | | | | | | | |

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

Summit Therapeutics Inc.

Condensed Consolidated Statements of Cash Flows

(in thousands)

(Unaudited)

| | | | | | | | | | | |

| Six Months Ended

June 30, |

| 2024 | | 2023 |

Cash flows from operating activities: | | | |

| Net loss | $ | (103,858) | | | $ | (557,093) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Non-cash interest expense | — | | | 6,087 | |

| Amortization of discount on short-term investments | (2,007) | | | (2,901) | |

| Unrealized foreign exchange (gain) | (115) | | | (864) | |

| Reclassification of currency translation gain | — | | | (419) | |

| Impairment of fixed assets | — | | | 474 | |

| | | |

| Depreciation | 47 | | | 136 | |

| | | |

| Gain on disposal of assets | — | | | (122) | |

| Stock-based compensation | 20,595 | | | 4,650 | |

Acquired in-process research and development expense | 15,000 | | | 520,915 | |

| Change in operating assets and liabilities: | | | |

| Accounts receivable | — | | | 356 | |

| Prepaid expenses | 753 | | | (4,565) | |

| Other current and long-term assets | 2,256 | | | (923) | |

| Research and development tax credit receivable | 478 | | | 897 | |

| | | |

| Accounts payable | 674 | | | 605 | |

| Accrued liabilities | 3,798 | | | (7,528) | |

| | | |

Other long-term liabilities | 46 | | | — | |

| Accrued compensation | (551) | | | (2,135) | |

Operating lease right-of-use assets and lease liabilities, net | (252) | | | 26 | |

| Net cash used in operating activities | (63,136) | | | (42,404) | |

| | | |

Cash flows from investing activities: | | | |

| Purchases of property and equipment | (67) | | | (73) | |

| Proceeds from sale of property. plant and equipment | — | | | 226 | |

| Purchase of short-term investments | (362,995) | | | (208,165) | |

| Maturities and sales of short-term investments | 182,854 | | | 38,171 | |

Payments to Akeso for upfront milestone payments and associated

direct transaction costs | — | | | (475,015) | |

Net cash used in investing activities | (180,208) | | | (644,856) | |

| | | |

Cash flows from financing activities: | | | |

| Proceeds from the issuance of common stock for rights offering | — | | | 104,686 | |

| | | |

| | | |

| Transaction costs related to the issuance of common stock for rights offering | — | | | (619) | |

| Proceeds from the issuance of common stock via private placement | 200,000 | | | — | |

Repayment of related party promissory notes | — | | | (24,686) | |

Proceeds received related to the exercise of warrants | 101 | | | — | |

| | | |

| | | |

| | | |

| Proceeds received related to employee stock awards | 596 | | | 651 | |

| Net cash provided by financing activities | 200,697 | | | 80,032 | |

| Effect of exchange rate changes on cash | (24) | | | 737 | |

Decrease in cash and cash equivalents | (42,671) | | | (606,491) | |

Cash, cash equivalents and restricted cash at beginning of period | 71,425 | | | 648,607 | |

Cash, cash equivalents and restricted cash at end of period | $ | 28,754 | | | $ | 42,116 | |

| | | |

| |

| | | |

| | | |

| Supplemental Disclosure of Cash Flow Information: | | | |

| Cash paid for interest on related party promissory notes | $ | 1,501 | | | $ | 4,794 | |

| Cash paid for income taxes | $ | — | | | $ | 52 | |

| Supplemental Disclosure of Non-Cash Investing and Financing Activities: | | | |

Consideration for the issuance of common stock for rights offering used to satisfy a portion of a related party promissory note (Note 14) | $ | — | | | $ | 395,314 | |

Upfront consideration to Akeso for Second Amendment (Note 7) | $ | 15,000 | | | $ | — | |

Issuance of common stock pursuant to the Akeso License Agreement (Note 7) | $ | — | | | $ | 45,900 | |

| | | |

| Lease assets obtained in exchange for operating lease liabilities | $ | 4,216 | | | $ | 4,245 | |

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

Summit Therapeutics Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

(in thousands, except share and per share data)

1. Nature of Business and Operations

Nature of Business and Operations

Summit Therapeutics Inc. (“we”, “Summit” or the “Company”) is a biopharmaceutical company focused on the discovery, development, and commercialization of patient-, physician-, caregiver- and societal-friendly medicinal therapies intended to improve quality of life, increase potential duration of life, and resolve serious unmet medical needs.

The Company’s current lead development candidate is ivonescimab, a novel, potential first-in-class bispecific antibody intending to combine the effects of immunotherapy via a blockade of PD-1 with the anti-angiogenesis effects of an anti-VEGF compound into a single molecule. On December 5, 2022, the Company entered into a Collaboration and License Agreement (the “License Agreement”) with Akeso, Inc. and its affiliates (“Akeso”) pursuant to which the Company has in-licensed ivonescimab as further described in Note 7. Through the License Agreement, the Company obtained the rights to develop and commercialize ivonescimab in the United States, Canada, Europe, Japan, and through the subsequent amendment with Akeso signed on June 3, 2024, expanded the Company's licensed territories to include the Latin America, Middle East and Africa regions (collectively, and as expanded, the “Licensed Territory”). The License Agreement and transaction closed in January 2023 following customary waiting periods. The Company’s operations are focused on the development of ivonescimab and other future activities, as the Company determines.

The Company has begun its development for ivonescimab in non-small cell lung cancer (“NSCLC”), specifically launching Phase III clinical trials in the following indications:

a) ivonescimab combined with chemotherapy in patients with epidermal growth factor receptor (“EGFR”)-mutated, locally advanced or metastatic non-squamous NSCLC who have progressed after treatment with a third-generation EGFR tyrosine kinase inhibitor (“TKI”) (“HARMONi”); and

b) ivonescimab combined with chemotherapy in first-line metastatic squamous NSCLC patients (“HARMONi-3”)

As of the date of these financial statements, both studies are enrolling patients.

The entry into the License Agreement with Akeso represented a significant change in the Company’s strategy and its future operations are focused on the development of ivonescimab and other future activities as the Company determines. The Company’s portfolio also includes ridinilazole, a product candidate for treating patients suffering from Clostridioides difficile infection, also known as C. difficile infection, or CDI, and SMT-738, the first of a novel class of precision antibiotics for combating multidrug resistant infections, specifically carbapenem-resistant Enterobacteriaceae (“CRE”) infections. All prior development activities related to ridinilazole and SMT-738 have been terminated; the Company will continue to pursue partnerships for both assets.

2. Basis of Presentation and Use of Estimates

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States ("U.S. GAAP") and pursuant to the rules and regulations of the SEC. Accordingly, certain information and disclosures required by U.S. GAAP for complete consolidated financial statements are not included herein. All intercompany accounts and transactions have been eliminated in consolidation. The interim financial data as of June 30, 2024 and for the three and six months ended June 30, 2024 are unaudited; however, in the opinion of management, the interim data includes all adjustments, consisting of normal recurring adjustments, necessary for a fair statement of the results for the interim periods. The condensed consolidated balance sheet presented as of December 31, 2023 has been derived from the consolidated audited financial statement as of that date. The results of the period are not necessarily indicative of full year results or any other interim period. These unaudited interim condensed consolidated financial statements should be read in conjunction with the audited financial statements and notes thereto of the Company which are included in the Company's Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on February 20, 2024. The financial results of the Company's activities are reported in United States Dollars.

Summit Therapeutics Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

(in thousands, except share and per share data)

Use of Estimates

The preparation of these unaudited condensed consolidated financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent liabilities at the date of the unaudited condensed consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. On an on-going basis, management evaluates its estimates and judgments, including those related to accrued research and development expenses, stock-based compensation, goodwill, other long-lived assets and income taxes. Management bases its estimates and judgments on historical experience and on various other factors that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

3. Summary of Significant Accounting Policies and Recently Issued or Adopted Accounting Pronouncements

Summary of Accounting Policies

The significant accounting policies used in the preparation of these condensed consolidated financial statements for the six months ended June 30, 2024 are consistent with those discussed in Note 4 to the consolidated financial statements in the Company's Annual Report on Form 10-K for the year ended December 31, 2023, except as updated below:

Marketable Securities

Marketable securities consist of investments with original maturities greater than ninety days from the date of acquisition. The Company classifies investments with maturities of greater than 90 days as short-term, based on the liquid nature of the securities and because such marketable securities represent the investment of cash that is available for current operations. The Company considers its investment portfolio of investments as available-for-sale. Accordingly, these investments are recorded at fair value, which is based on quoted market prices or other observable inputs. Unrealized gains and losses are recorded as a component of other comprehensive income (loss). Realized gains and losses are determined on a specific identification basis and are included in other (expense) income. Amortization and accretion of discounts and premiums are also recorded in other (expense) income.

When the fair value is below the amortized cost of the asset, an estimate of expected credit losses is made. This estimate is limited to the amount by which fair value is less than amortized cost. The credit-related impairment amount is recognized in the condensed consolidated statements of operations and comprehensive loss and the remaining impairment amount and unrealized gains are reported as a component of accumulated other comprehensive income (loss) in shareholders’ equity. Credit losses are recognized through the use of an allowance for credit losses account and subsequent improvements in expected credit losses are recognized as a reversal of the allowance account. If the Company has the intent to sell the security or it is more likely than not that the Company will be required to sell the security prior to recovery of its amortized cost basis the allowance for credit loss is written off and the excess of the amortized cost basis of the asset over its fair value is recorded in the condensed consolidated statements of operations and comprehensive loss.

Recently Issued or Adopted Accounting Pronouncements

In November 2023, the FASB issued Accounting Standards Update ("ASU 2023-07"), Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures, to provide more disaggregated expense information about a public entity’s reportable segments. The amendments in this update should be applied retrospectively and are effective for fiscal years beginning after December 15, 2023, and interim periods beginning after December 15, 2024. The Company is currently assessing the impact of the adoption of this guidance on its financial statements and disclosures.

4. Liquidity and Capital Resources

During the three and six months ended June 30, 2024, the Company incurred a net loss of $60,385 and $103,858, respectively, and cash flows used in operating activities for the six months ended June 30, 2024 was $63,136. As of June 30, 2024, the Company had an accumulated deficit of $1,097,116, cash and cash equivalents of $28,434, short-term investments in U.S. treasury securities of $297,035 and current and long-term U.K. research and development tax credits receivable of $1,317. The Company expects to continue to generate operating losses for the foreseeable future.

Summit Therapeutics Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

(in thousands, except share and per share data)

The Company has evaluated whether its cash, cash equivalents, short-term investments, and U.K. research and development tax credits provide sufficient cash to fund its operating cash needs for at least the next twelve months from the date of issuance of these condensed consolidated financial statements. The Company is investing in the clinical development of ivonescimab, including its ongoing clinical trials. In addition, the Company has a $100,000 promissory note and interest payable to a related party (refer to Note 14 for further details) that matures on April 1, 2025. Based upon the Company’s cash, cash equivalents and short term investments as of June 30, 2024 and after factoring in the repayment of the $100,000 promissory note, the Company has capital resources to fund its operating plan for approximately 12 months from the date of issuance of these condensed consolidated financial statements, however, the Company will need to raise additional equity or debt capital to further fund its operating cash needs for the period shortly after approximately 12 months from the date of issuance of these condensed consolidated financial statements. As of the date of issuance of these condensed consolidated financial statements, additional capital has not yet been secured. These conditions raise substantial doubt about the Company’s ability to continue as a going concern.

Until the Company can generate substantial revenue and achieve profitability, the Company will need to raise additional capital to fund its ongoing operations and capital needs. The Company continues to evaluate options to further finance its operating cash needs for its product candidates through a combination of some, or all, of the following: equity and debt offerings, collaborations, strategic alliances, grants and clinical trial support from government entities, philanthropic, non-government and not-for-profit organizations, and marketing, distribution or licensing arrangements. There is no assurance, however, that additional financing will be available when needed or that management of the Company will be able to obtain financing on terms acceptable to the Company. If the Company is unable to obtain funding when required in the future, the Company could be required to delay, reduce, or eliminate research and development programs, product portfolio expansion, or future commercialization efforts, which could adversely affect its business prospects.

The accompanying condensed consolidated financial statements are prepared assuming the Company will continue as a going concern, which contemplates the realization of assets and satisfaction of liabilities in the normal course of the business. The condensed consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or the amounts and classifications of liabilities that might result from the outcome of this uncertainty.

5. Segment Reporting

The Company's chief operating decision makers (the "CODM function"), which are the Company's CEOs, Mr. Duggan and Dr. Zanganeh, utilize consolidated financial information to make decisions about allocating resources and assessing performance for the entire Company. The CODM function approves of key operating and strategic decisions, including key decisions in clinical development and clinical operating activities, entering into significant contracts, such as revenue contracts and collaboration agreements and approves the Company's consolidated operating budget. The CODM function views the Company's operations and manages its business as a single reportable operating segment. The Company's single operating segment covers the Company’s research and development activities, primarily comprising of oncology product research activities (including ivonescimab). As the Company operates as one operating segment, all required financial segment information can be found in these condensed consolidated financial statements.

The Company operates in two geographic regions: the U.K. and the U.S. The following table summarizes the Company's long-lived assets, which include the Company's property and equipment, net and right-of-use assets by geography:

| | | | | | | | | | | | | | |

| | June 30, 2024 | | December 31, 2023 |

| United Kingdom | | $ | 684 | | | $ | 808 | |

United States(1) | | 8,255 | | | 5,254 | |

| | $ | 8,939 | | | $ | 6,062 | |

(1) The increase in long-lived assets as of June 30, 2024 as compared to December 31, 2023, is primarily due to $3,937 of net right-of use assets recorded as a result of the Company entering into a new lease agreement for its Miami, FL headquarters, partially offset by $1,234 of amortization expense for right-of-use assets relating to lease agreements for its office space in Menlo Park, CA.

Summit Therapeutics Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

(in thousands, except share and per share data)

6. Other Operating Income (Loss), net

The following table sets forth the components of other operating income, net by category:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

Other operating income (loss), net by category: | | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | |

| Research and development tax credits | | $ | 159 | | | $ | (39) | | | $ | 372 | | | $ | 503 | |

| Grant income from CARB-X (as defined below) | | — | | | 11 | | | — | | | 45 | |

| Other income | | — | | | 1 | | | — | | | 9 | |

| | $ | 159 | | | $ | (27) | | | $ | 372 | | | $ | 557 | |

Research and development tax credits

Income from tax credits consist of R&D tax credits received in the U.K. The Company benefits from the Small and Medium Enterprise Program ("SME Program") U.K. research and development tax credit cash rebate regime, and The Research and Development Expenditure Credit ("The RDEC scheme"), a UK government tax incentive that promotes innovation amongst UK's larger businesses. Qualifying expenditures largely comprise of employment costs for research staff, consumables, a proportion of relevant, permitted sub-contract costs and certain internal overhead costs incurred as part of research projects for which the Company does not receive income. Tax credits related to the SME Program and The RDEC scheme are recorded as other operating income in the consolidated statements of operations and other comprehensive loss. Under these schemes, the Company receives cash payments that are not dependent on the Company’s pre-tax net income levels.

Based on criteria established by His Majesty’s Revenue and Customs ("HMRC"), a portion of expenditures being carried out in relation to the Company's pipeline research and development, clinical trials management and third-party manufacturing development activities are eligible for the SME regime and the Company expects such elements of research and development expenditure incurred in its UK entities will also continue to be eligible for the SME regime for future periods.

As of June 30, 2024, the current and non-current research and development tax credit receivable was $953 and $364, respectively. As of December 31, 2023, the current and non-current research and development tax credit receivable was $848 and $959, respectively.

CARB-X (as defined below)

In May 2021, the Company announced the selection of a new preclinical candidate, SMT-738, from the DDS-04 series for development in the fight against multi-drug resistant infections, specifically Carbapenem-resistant Enterobacteriaceae ("CRE") infections. Simultaneously, the Company announced it had received an award from the Trustees of Boston University under the Combating Antibiotic Resistant Bacteria Biopharmaceutical Accelerator program ("CARB-X") to progress this candidate through preclinical development and Phase Ia clinical trials. The award committed initial funding of up to $4,100, with the possibility of up to another $3,700 based on the achievement of future milestones. As of June 30, 2024, based on translation of historical foreign currency amounts in the period, the Company has recognized $2,920 of cumulative income since contract inception.

7. Akeso Collaboration and License Agreement

On December 5, 2022, the Company entered into a Collaboration and License Agreement (the “License Agreement”) with Akeso, Inc. and its affiliates (“Akeso”) pursuant to which the Company is in-licensing Akeso's breakthrough bispecific antibody, ivonescimab. The License Agreement and transaction closed in January 2023 following customary waiting periods.

Ivonescimab, known as AK112 in China and Australia, and also as SMT112 in the United States, Canada, Europe, and Japan, is a novel, potential first-in-class bispecific antibody intending to combine the effects of immunotherapy via a blockade of PD-1 with the anti-angiogenesis effects of an anti-VEGF into a single molecule. Ivonescimab was engineered to bring two well established oncology targeted mechanisms together. Ivonescimab is currently in clinical development and, pursuant to the terms of the License Agreement, Summit will design and conduct the clinical trial activities to support regulatory filings in the Licensed Territory that Summit will submit.

Summit Therapeutics Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

(in thousands, except share and per share data)

Pursuant to the terms of the License Agreement, Summit will have final decision-making authority with respect to clinical development strategy and execution in the Licensed Territory. For co-joined studies in which both Summit and Akeso participate, mutual agreement is required for material decisions; Summit retains the exclusive decision making with respect to participating in, and continuing its participation in, co-joined studies. Pursuant to the terms of the License Agreement, Summit will have final decision-making authority with respect to commercial strategy, pricing and reimbursement and other commercialization matters in the Licensed Territory. In connection with the License Agreement, the Company has also entered into a Supply Agreement with Akeso, pursuant to which Summit agrees to purchase a certain portion of drug substance for clinical and commercial supply. Summit is not assuming any liabilities (including contingent liabilities), acquiring any physical assets or trade names, or hiring or acquiring any employees from Akeso in connection with the License Agreement. Through the License Agreement, the Company obtained the rights to develop and commercialize ivonescimab in the United States, Canada, Europe, and Japan.

In exchange for the rights obtained, an upfront payment of $500,000 was made to Akeso, of which $274,900 was paid in cash and, pursuant to the License Agreement and Issuance Agreement, Akeso elected to receive 10,000,000 shares of the Company's common stock in lieu of $25,100 cash. The remaining $200,000 amount of the upfront payment was paid on March 6, 2023.

Effective June 3, 2024, the Company and Akeso entered into an amendment (the “Second Amendment”) to the License Agreement to expand the Company’s territories covered under the License Agreement to include the Latin America, Middle East and Africa regions. Pursuant to the Second Amendment, the Company agreed to make an upfront payment to Akeso in the amount of $15,000 which is expected to be paid out in the third quarter of 2024. Akeso will also be eligible to receive up to an additional $55,000 upon the achievement of certain commercial milestones. Except as specifically modified by the Second Amendment, the terms and conditions of the License Agreement remain in full force and effect.

The Company has accounted for the License Agreement and Second Amendment to acquire the rights to develop and commercialize ivonescimab as the acquisition of an asset. All of the consideration relates to ivonescimab and technological feasibility of the asset has not yet been established since ivonescimab is in clinical development. As such, the Company has expensed the consideration as acquired in-process research and development upon closing of the transaction in the condensed consolidated statement of operations and comprehensive loss. Acquired in-process research and development expense for the three and six months ended June 30, 2024 was $15,007, which is comprised of the upfront payment of $15,000 and immaterial transaction costs, and for the six months ended June 30, 2023, $520,915, which is comprised of the $474,900 paid in cash, the fair value of the 10,000,000 shares of common stock on the date of closing the transaction of $45,900, and $115 of direct transactions costs incurred.

In addition to the payments already made to Akeso, under the License Agreement and Second Amendment, there are additional potential milestone payments of up to $4,555,000, as Akeso will be eligible to receive regulatory milestones of up to $1,050,000 and commercial milestones of up to $3,505,000. In addition, Akeso will be eligible to receive low double-digit royalties on net sales.

8. Other (Expense) Income, net

The following table sets forth the components of other (expense) income:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Foreign currency (losses)/gains | | $ | (244) | | | $ | 311 | | | $ | (36) | | | $ | 819 | |

| Interest expense on promissory notes payable to related parties | | (3,102) | | | (2,515) | | | (6,223) | | | (10,842) | |

Investment income | | 2,578 | | | 3,286 | | | 4,407 | | | 5,543 | |

Reclassification of cumulative currency translation gain(1) | | — | | | — | | | — | | | 419 | |

| | | | | | | | |

Other expense, net | | — | | | (5) | | | — | | | (84) | |

| | $ | (768) | | | $ | 1,077 | | | $ | (1,852) | | | $ | (4,145) | |

(1) During the six months ended June 30, 2023, the Company dissolved certain dormant entities and as a result, $419 of cumulative foreign currency translation adjustments were re-classified from accumulated other comprehensive loss relating to these entities.

Summit Therapeutics Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

(in thousands, except share and per share data)

For the three and six months ended June 30, 2024, other expense, net primarily consisted of loan interest expense incurred related to the $100,000 promissory note as described in Note 14. For the three and six months ended June 30, 2023, other expense, net primarily consisted of loan interest expense incurred related to the $520,000 promissory notes, as described in Note 14. These amounts for all periods presented are partially offset by investment income related to the Company's money market funds and short-term investments in U.S. treasury securities.

9. Net Loss per Share

The following table sets forth the computation of basic and diluted net loss per share:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Net loss | | $ | (60,385) | | | $ | (14,717) | | | $ | (103,858) | | | $ | (557,093) | |

| | | | | | | | |

| Basic weighted average number of shares of common stock outstanding | | 707,904,643 | | | 697,685,365 | | | 704,844,946 | | | 538,807,328 | |

| Diluted weighted average number of shares of common stock outstanding | | 707,904,643 | | | 697,685,365 | | | 704,844,946 | | | 538,807,328 | |

| | | | | | | | |

| Basic net loss per share | | $ | (0.09) | | | $ | (0.02) | | | $ | (0.15) | | | $ | (1.03) | |

| Diluted net loss per share | | $ | (0.09) | | | $ | (0.02) | | | $ | (0.15) | | | $ | (1.03) | |

Basic net loss per share is computed by dividing the net loss by the weighted-average number of common shares outstanding for the period. Diluted net loss per share is computed by dividing the diluted net loss by the weighted-average number of common shares outstanding for the period, including potentially dilutive common shares. Since the Company was in a loss position for all periods presented, basic net loss per share is the same as diluted net loss per share for all periods, as the inclusion of all potential common share equivalents outstanding would have been anti-dilutive.

The following potentially dilutive securities were excluded from the computation of the diluted net loss per share of common stock for the periods presented because their effect would have been anti-dilutive:

| | | | | | | | | | | | | | |

| | June 30, |

| | 2024 | | 2023 |

| Options to purchase common stock | | 59,485,356 | | 20,322,585 |

| Warrants | | 4,945,669 | | 5,821,137 |

| Shares expected to be purchased under employee stock purchase plan | | 121,505 | | | 185,963 | |

| | 64,552,530 | | 26,329,685 |

Stock options that are outstanding and contain performance-based or market-based vesting criteria for which the performance or market conditions have not been met are excluded from the presentation of common stock equivalents outstanding in the table above.

10. Fair Value Measurements and Short-Term Investments

In accordance with the provisions of fair value accounting, a fair value measurement assumes that the transaction to sell an asset or transfer a liability occurs in the principal market for the asset or liability or, in the absence of a principal market, the most advantageous market for the asset or liability and defines fair value based on the exit price model.

The fair value measurement guidance establishes a fair value hierarchy, which requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. The guidance describes three levels of inputs that may be used to measure fair value:

Summit Therapeutics Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

(in thousands, except share and per share data)

Level 1

Quoted prices in active markets for identical assets or liabilities as of the reporting date. Active markets are those in which transactions for the asset or liability occur in sufficient frequency and volume to provide pricing information on an ongoing basis.

Level 2

Observable inputs other than Level 1 prices, such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities. Level 2 assets and liabilities include debt securities with quoted prices that are traded less frequently than exchange-traded instruments or securities or derivative contracts that are valued using a pricing model with inputs that are observable in the market or can be derived principally from or corroborated by observable market data.

Level 3

Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities. Level 3 assets and liabilities include financial instruments whose value is determined using pricing models, discounted cash flow methodologies, or similar techniques, as well as instruments for which the determination of fair value requires significant management judgment or estimation.

In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, the Company categorizes such assets and liabilities based on the lowest level input that is significant to the fair value measurement in its entirety. The Company’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment and considers factors specific to the asset.

The following tables sets forth the Company’s fair value hierarchy for its assets and liabilities that are measured at fair value on a recurring basis as of June 30, 2024 and December 31, 2023:

| | | | | | | | | | | | | | | | | | | | | | | |

| Fair Value Measurements as of June 30, 2024 using: |

| Level 1 | | Level 2 | | Level 3 | | Total |

| Cash equivalents: | | | | | | | |

| Money market funds | $ | 2,571 | | | $ | — | | | $ | — | | | $ | 2,571 | |

| U.S. Government treasury bills | — | | | 10,167 | | | — | | | 10,167 | |

| Short-term investments: | | |

| | | | |

| U.S. Government treasury bills | — | | | 297,035 | | | — | | | 297,035 | |

| Total financial assets | $ | 2,571 | | | $ | 307,202 | | | $ | — | | | $ | 309,773 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Fair Value Measurements as of December 31, 2023 using: |

| Level 1 | | Level 2 | | Level 3 | | Total |

| Cash equivalents: | | | | | | | |

| Money market funds | $ | 21,016 | | | $ | — | | | $ | — | | | $ | 21,016 | |

| U.S. Government treasury bills | — | | | 39,341 | | | — | | | 39,341 | |

Short-term investments | | | | | | | |

| U.S. Government treasury bills | — | | | 114,817 | | | — | | | 114,817 | |

| Total financial assets | $ | 21,016 | | | $ | 154,158 | | | $ | — | | | $ | 175,174 | |

The tables above do not include cash at June 30, 2024 and December 31, 2023 of $15,697 and $11,068, respectively.

The Company believes that the carrying amounts of prepaid expenses, other current assets, accounts payable, and accrued expenses approximates their fair values due to the short-term nature of those instruments. The carrying value of the

Summit Therapeutics Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

(in thousands, except share and per share data)

Company’s promissory note approximates its fair value and the current interest rate of the note outstanding when compared to market interest rates (which represents a Level 2 measurement). Refer to Note 14 for further details.

The following table sets forth the Company’s short-term investments as of June 30, 2024 and December 31, 2023, which have a contractual maturity of less than one year:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | June 30, 2024 |

| | Amortized Cost | | Unrealized Gains | | Unrealized (Losses) | | Credit (Loss) | | Fair Value |

| Assets | | | | | | | | | | |

| U.S. Government treasury bills | | $ | 297,070 | | | $ | — | | | $ | (35) | | | $ | — | | | $ | 297,035 | |

| Total | | $ | 297,070 | | | $ | — | | | $ | (35) | | | $ | — | | | $ | 297,035 | |

| | | | | | | | | | |

| | December 31, 2023 |

| | Amortized Cost | | Unrealized Gains | | Unrealized (Losses) | | Credit (Loss) | | Fair Value |

| Assets | | | | | | | | | | |

| U.S. Government treasury bills | | $ | 114,781 | | | $ | 36 | | | $ | — | | | $ | — | | | $ | 114,817 | |

| Total | | $ | 114,781 | | | $ | 36 | | | $ | — | | | $ | — | | | $ | 114,817 | |

Realized gains and losses for the three and six months ended June 30, 2024 were immaterial.

11. Goodwill

Goodwill

As of June 30, 2024 and December 31, 2023, goodwill was $1,880 and $1,893, respectively. Changes in the gross carrying amount of goodwill during the three and six months ended June 30, 2024 as compared to December 31, 2023, are the result of changes in foreign currency. As of December 31, 2023, the Company performed its annual impairment assessment of goodwill and determined that it is more likely than not that the fair value of the reporting unit exceeds its carrying amount. There have been no cumulative goodwill impairments recognized during the three and six months ended June 30, 2024.

12. Leases

The Company has operating leases for real estate. The Company does not have any finance leases.

In the first fiscal quarter of 2024, the Company recorded $4,216 of additional right-of-use assets related to a new lease for office space that commenced during the period for its Miami, Florida headquarters location ("Miami HQ"). Total future lease payments as of June 30, 2024, which include base rent and sales tax, are approximately $4,579 on an undiscounted basis. This lease commenced on February 1, 2024 and has a term of 64 months. As of June 30, 2024 the Company has $320 of restricted cash associated with an irrevocable letter of credit required by the landlord to enter into this lease. The carrying value of the right-of-use assets as of June 30, 2024 and December 31, 2023 was $8,716 and $5,859, respectively.

Sublease to Related Parties

Effective April 1, 2024, the Company entered into two sublease agreements of its Miami HQ location, one with Genius 24C Inc. ("Genius"), an affiliate of Robert W. Duggan (the "Genius Sublease Agreement") and one with Duggan Investments Research LLC ("Investments Research"), an affiliate of Robert W. Duggan (the "Investments Research Sublease Agreement"). Pursuant to the Genius Sublease Agreement, Genius will sublease from the Company 848 square feet of office space in the Miami HQ for a sixty-two month term for total rental payments of approximately $446. Pursuant to the Investments Research Sublease Agreement, Investments Research will sublease from the Company 848 square feet of office space in the Miami HQ for a sixty-two month term for total rental payments of approximately $446. Refer to Note 17 Related Party Transactions for further details.

Summit Therapeutics Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

(in thousands, except share and per share data)

13. Research and Development Prepaid Expenses and Accrued Liabilities

Included within prepaid expenses and other current assets at June 30, 2024 and December 31, 2023 is $498 and $1,466, respectively, of prepayments relating to research and development expenditures. Included within accrued liabilities at June 30, 2024 and December 31, 2023 is $6,279 and $7,289, respectively, relating to research and development expenditures.

These amounts are determined based on the estimated costs to complete each study or activity related to the ongoing clinical trials for ivonescimab, the estimation of the current stage of completion and the invoices received, as well as predetermined milestones which are not reflective of the current stage of development for prepaid expenses. However, prepaid expenses decrease and accrued liabilities increase as the activities progress, and if actual costs incurred exceed the prepaid expenses, an accrual will be recorded for the liability. The key sensitivity is the estimated current stage of completion of each study or activity, which is based on information received from the supplier and the Company’s operational knowledge of the work completed under those contracts.

14. Promissory Note Payable to Related Parties

Current promissory note payable to a related party was $100,000 as of June 30, 2024 and non-current as of December 31, 2023.

December 2022 Promissory Note

On December 6, 2022, the Company entered into a Note Purchase Agreement (the "Note Purchase Agreement"), with Mr. Duggan and Dr. Zanganeh, pursuant to which the Company agreed to sell to each of Mr. Duggan and Dr. Zanganeh unsecured promissory notes in the aggregate amount of $520,000. Pursuant to the Note Purchase Agreement, the Company issued to Mr. Duggan and Dr. Zanganeh unsecured promissory notes in the amount of $400,000 (the "Duggan February Note") and $20,000 (the "Zanganeh Note"), respectively, which would mature and become due on February 15, 2023 and an unsecured promissory note to Mr. Duggan in the amount of $100,000 (the “Duggan September Note” and together with the Duggan February Note and the Zanganeh Note, the “December 2022 Notes”), which was originally due on September 15, 2023. The maturity dates of the December 2022 Notes could be extended one or more times at the Company’s election, but in no event to a date later than September 6, 2024. In addition, if the Company consummates a public offering, then upon the later to occur of (i) five business days after the Company receives the net cash proceeds therefrom or (ii) May 15, 2023, the Duggan February Note and the Zanganeh Note shall be prepaid by an amount equal to the lesser of (a) 100% of the amount of the net proceeds of such offering and (b) the outstanding principal amount on such Notes.

On January 19, 2023, the Company provided notice to extend the term of the Duggan February Note and Duggan September Note to a maturity date of September 6, 2024. Furthermore, on January 19, 2023, the Company and Mr. Duggan rectified the Duggan February Note and Duggan September Note in order to correctly reflect the parties’ intent that the Company may only prepay (i) the Duggan February Note following the completion of a public rights offering to be conducted by Summit in the approximate amount of $500,000, or a similar capital raise, in an amount equal to the lesser of (x) the net proceeds of the Rights Offering or such capital raise or (y) the full amount outstanding of the Duggan February Note, and (ii) Duggan September Note following the completion of a capital raising transaction subsequent to the 2023 Rights Offering in an amount equal to the lesser of (A) the net proceeds of such capital raise or (B) the full amount outstanding of the Duggan September Note. Following the issuance of the two new Promissory Notes (the “Duggan Promissory Notes”), the Duggan February Note and Duggan September Note were marked as “cancelled” on their face and replaced in their entirety by the Duggan Promissory Notes (together with the Zanganeh Note, the "Notes").

On February 15, 2023, the $20,000 Zanganeh Note matured and the Company repaid the outstanding principal balance. In connection with the closing of the 2023 Rights Offering, the $400,000 Duggan Promissory Note matured and became due, and the Company satisfied all principal and accrued interest thereunder using a combination of a portion of the cash proceeds from the 2023 Rights Offering and the extinguishment of a portion of the amount due equal to the subscription price for shares subscribed by Mr. Duggan in the 2023 Rights Offering.

Summit Therapeutics Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

(in thousands, except share and per share data)

The Notes accrued interest at an initial rate of 7.5%. All interest on the Notes was paid on the date of signing for the period through February 15, 2023. Such prepaid interest was paid in a number of shares of the Company’s common stock, par value $0.01 (“Common Stock”) equal to the dollar amount of such prepaid interest, divided by $0.7913 (the consolidated closing bid price immediately preceding the time the Company entered into the Note Purchase Agreement, plus $0.01), which was 9,720,291 shares. For all applicable periods following February 15, 2023, interest shall accrue on the outstanding principal balance of the Notes at the US prime interest rate, as reported in the Wall Street Journal, plus 50 basis points, as adjusted monthly, for three months immediately following February 15, 2023, and thereafter at the US prime rate plus 300 basis points, as adjusted monthly. Such accrued interest shall be paid in cash, quarterly in arrears, on each of March 31, June 30, September 30 and December 31.

Debt issuance costs associated with the Notes were $44 and were capitalized as part of the carrying value of the promissory notes payable to related parties.

On February 17, 2024, the Duggan February Note was amended and restated to extend the maturity date from September 6, 2024 to April 1, 2025. For all applicable periods commencing February 17, 2024, interest shall accrue on the outstanding principal balance at the greater of 12% or the US prime interest rate, as reported in the Wall Street Journal plus 350 basis points, as adjusted monthly, compounded quarterly. Interest shall be paid upon maturity of the loan.