SigmaTron International, Inc. Reports Financial Results For First Quarter Fiscal 2024

2023年9月11日 - 9:00PM

SigmaTron International, Inc. (NASDAQ: SGMA), an electronic

manufacturing services company (the “Company”), today reported

revenues and earnings for the fiscal quarter ended July 31, 2023.

Revenues from continuing operations decreased $7.1 million, or 7

percent, to $98.1 million in the first quarter of fiscal 2024,

compared to $105.2 million for the same quarter in the prior year.

Net income from continuing operations for the first quarter ended

July 31, 2023, was $0.3 million, compared to net income of $3.1

million for the same quarter in the prior year. Diluted income per

share from continuing operations for the quarter ended July 31,

2023 was $0.04, compared to $0.50 income per share for the same

quarter in the prior year.

As previously reported, the Company sold a majority position of

its wholly owned subsidiary, Wagz, Inc. (“Wagz”), effective April

1, 2023. As a result, the Company has reported results from Wagz

for fiscal 2023 as discontinued operations. For the first quarter

ended July 31, 2022, net loss from discontinued operations was $1.7

million. Diluted net loss per share from discontinued operations

for the first quarter ended July 31, 2022 was $0.28.

Commenting on SigmaTron’s first quarter fiscal 2024 results,

Gary R. Fairhead, Chief Executive Officer, and Chairman of the

Board, said, “I’m disappointed to report what is essentially a

breakeven quarter to begin our fiscal 2024. Our pre-tax profit was

$107,964 for the quarter. As mentioned in our fiscal year-end press

release, there was a significant amount of uncertainty with the

general economy and our customers. It appears that the effort by

the Federal Reserve to slow inflation has weakened the economy

which has resulted in lower demand from some of our customers. We

have certain customers whose demand remains quite strong and others

who have experienced short-term softness. I’m expecting this

uncertainty to continue through calendar year-end as those

customers are indicating to us that they view this softness as a

short-term condition and expect their requirements to pick up by

year-end.

“While disappointing, we remain enthusiastic about the long-term

prospects for our customers. We have several customers that

participate in the infrastructure programs coming out of Washington

D.C. and we have others in markets where they have a strong

position and forecast future upside. Couple this with several new

opportunities and we think that we can generate later this fiscal

year, the revenue levels we have recently reported in the preceding

fiscal year.

“The electronic component marketplace has modestly improved with

the slowing of the economy. That’s encouraging from a supply chain

perspective and should allow us to continue our focus on reducing

inventory. That remains one of our important objectives during

fiscal 2024. The geopolitical situation, specifically in Asia

remains uncertain and may have an impact of how this fiscal year

will proceed. The trade war with China does not seem to have any

short-term solution so our focus remains working on Chinese

domestic opportunities and other opportunities outside of sales

directly to the United States. Regardless we will continue to grow

our business while utilizing our experienced employees and our

desirable footprint.”

About SigmaTron International, Inc.

Headquartered in Elk Grove Village, Illinois, SigmaTron

International, Inc. operates in one reportable segment as an

independent provider of electronic manufacturing services (“EMS”).

The EMS segment includes printed circuit board assemblies,

electro-mechanical subassemblies and completely assembled

(box-build) electronic products. The Company and its wholly-owned

subsidiaries operate manufacturing facilities in Elk Grove Village,

Illinois; Acuna, Chihuahua, and Tijuana Mexico; Union City,

California; Suzhou, China; and Biên Hòa City, Vietnam. In addition,

the Company maintains an International Procurement Office and

Compliance and Sustainability Center in Taipei, Taiwan. The Company

also provides design services in Elgin, Illinois, U.S.

Forward-Looking Statements

Note: This press release contains forward-looking statements.

Words such as “continue,” “anticipate,” “will,” “expect,”

“believe,” “plan,” and similar expressions identify forward-looking

statements. These forward-looking statements are based on the

current expectations of the Company. Because these forward-looking

statements involve risks and uncertainties, the Company’s plans,

actions and actual results could differ materially. Such statements

should be evaluated in the context of the direct and indirect risks

and uncertainties inherent in the Company’s business including, but

not necessarily limited to, the Company’s continued dependence on

certain significant customers; the continued market acceptance of

products and services offered by the Company and its customers;

pricing pressures from the Company’s customers, suppliers and the

market; the activities of competitors, some of which may have

greater financial or other resources than the Company; the

variability of the Company’s operating results; the results of

long-lived assets and goodwill impairment testing; the risks

inherent in any merger, acquisition or business combination,

including the ability to achieve the expected benefits of

acquisitions as well as the expenses of acquisitions; the

collectability of aged account receivables; the variability of the

Company’s customers’ requirements; the impact of inflation on the

Company’s operating results; the availability and cost of necessary

components and materials; the impact acts of war may have to the

supply chain; the ability of the Company and its customers to keep

current with technological changes within its industries;

regulatory compliance, including conflict minerals; the continued

availability and sufficiency of the Company’s credit arrangements;

the costs of borrowing under the Company’s senior and subordinated

credit facilities, including under the rate indices that replaced

LIBOR; increasing interest rates; the ability to meet the Company’s

financial and restrictive covenants under its loan agreements;

changes in U.S., Mexican, Chinese, Vietnamese or Taiwanese

regulations affecting the Company’s business; the turmoil in the

global economy and financial markets; public health crises,

including COVID-19 and variants; the continued availability of

scarce raw materials, exacerbated by global supply chain

disruptions, necessary for the manufacture of products by the

Company; the stability of the U.S., Mexican, Chinese, Vietnamese

and Taiwanese economic, labor and political systems and conditions;

global business disruption caused by the Russian invasion of

Ukraine and related sanctions; currency exchange fluctuations; and

the ability of the Company to manage its growth. These and other

factors which may affect the Company’s future business and results

of operations are identified throughout the Company’s Annual Report

on Form 10-K, and as risk factors, may be detailed from time to

time in the Company’s filings with the Securities and Exchange

Commission. These statements speak as of the date of such filings,

and the Company undertakes no obligation to update such statements

in light of future events or otherwise unless otherwise required by

law.

For Further Information Contact:SigmaTron International,

Inc.James J. Reiman1-800-700-9095

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

CONDENSED CONSOLIDATED STATEMENT OF

OPERATIONS |

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

Three

Months |

|

Three Months |

|

| |

|

|

Ended |

|

Ended |

|

| |

|

|

July

31, |

|

July 31, |

|

| |

|

|

|

2023 |

|

|

|

2022 |

|

|

| |

|

|

|

|

|

|

| |

Net

sales |

|

|

98,130,356 |

|

|

|

105,189,979 |

|

|

| |

|

|

|

|

|

|

| |

Cost of

products sold |

|

|

88,479,136 |

|

|

|

93,612,759 |

|

|

| |

|

|

|

|

|

|

| |

Gross

profit |

|

|

9,651,220 |

|

|

|

11,577,220 |

|

|

| |

|

|

|

|

|

|

| |

Selling and

administrative expenses |

|

|

6,842,805 |

|

|

|

6,529,842 |

|

|

| |

|

|

|

|

|

|

| |

Operating

income |

|

|

2,808,415 |

|

|

|

5,047,378 |

|

|

| |

|

|

|

|

|

|

| |

Other

expense |

|

|

(2,700,451 |

) |

|

|

(917,742 |

) |

|

| |

|

|

|

|

|

|

| |

Income

before income tax |

|

|

107,964 |

|

|

|

4,129,636 |

|

|

| |

|

|

|

|

|

|

| |

Income tax

benefit (expense) |

|

|

154,135 |

|

|

|

(1,008,296 |

) |

|

| |

|

|

|

|

|

|

| |

Net income

from continuing operations |

|

$ |

262,099 |

|

|

$ |

3,121,340 |

|

|

| |

|

|

|

|

|

|

| |

Discontinued

operations: |

|

|

|

|

|

| |

Loss before

tax from discontinued operations |

|

|

- |

|

|

|

(2,223,561 |

) |

|

| |

Tax benefit

from discontinued operations |

|

|

- |

|

|

|

478,896 |

|

|

| |

|

|

|

|

|

|

| |

Net loss

from discontinued operations |

|

|

- |

|

|

|

(1,744,665 |

) |

|

| |

|

|

|

|

|

|

| |

Net

income |

|

$ |

262,099 |

|

|

$ |

1,376,675 |

|

|

| |

|

|

|

|

|

|

| |

Net income

(loss) per common share - basic |

|

|

|

|

|

| |

Net income

per common share - basic from continuing operations |

|

|

0.04 |

|

|

|

0.52 |

|

|

| |

Net loss per

common share - basic from discontinued operations |

|

|

- |

|

|

|

(0.29 |

) |

|

| |

|

|

|

|

|

|

| |

Net income

per common share - basic |

|

$ |

0.04 |

|

|

$ |

0.23 |

|

|

| |

|

|

|

|

|

|

| |

Net income

(loss) per common share - diluted |

|

|

|

|

|

| |

Net income

per common share - diluted from continuing operations |

|

|

0.04 |

|

|

|

0.50 |

|

|

| |

Net loss per

common share - diluted from discontinued operations |

|

|

- |

|

|

|

(0.28 |

) |

|

| |

|

|

|

|

|

|

| |

Net income

per common share - diluted |

|

$ |

0.04 |

|

|

$ |

0.22 |

|

|

| |

|

|

|

|

|

|

| |

Weighted

average number of common equivalent |

|

|

|

|

|

| |

shares outstanding - assuming dilution |

|

|

6,100,284 |

|

|

|

6,191,395 |

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

July

31, |

|

April 30, |

|

| |

|

|

|

2023 |

|

|

|

2023 |

|

|

| |

|

|

|

|

|

|

| |

Assets: |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

Current

assets |

|

|

212,583,718 |

|

|

|

220,466,442 |

|

|

| |

|

|

|

|

|

|

| |

Machinery

and equipment-net |

|

|

35,903,317 |

|

|

|

35,788,357 |

|

|

| |

|

|

|

|

|

|

| |

Deferred

income taxes |

|

|

2,460,689 |

|

|

|

2,640,902 |

|

|

| |

Intangibles |

|

|

1,227,615 |

|

|

|

1,311,030 |

|

|

| |

Other

assets |

|

|

7,659,769 |

|

|

|

8,420,468 |

|

|

| |

|

|

|

|

|

|

| |

Total

assets |

|

$ |

259,835,108 |

|

|

$ |

268,627,199 |

|

|

| |

|

|

|

|

|

|

| |

Liabilities

and stockholders' equity: |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

Current

liabilities |

|

|

143,460,398 |

|

|

|

152,308,599 |

|

|

| |

|

|

|

|

|

|

| |

Long-term

obligations |

|

|

47,836,767 |

|

|

|

48,227,573 |

|

|

| |

|

|

|

|

|

|

| |

Stockholders' equity |

|

|

68,537,943 |

|

|

|

68,091,027 |

|

|

| |

|

|

|

|

|

|

| |

Total

liabilities and stockholders' equity |

|

$ |

259,835,108 |

|

|

$ |

268,627,199 |

|

|

| |

|

|

|

|

|

|

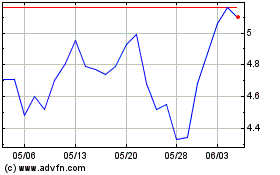

Sigmatron (NASDAQ:SGMA)

過去 株価チャート

から 11 2024 まで 12 2024

Sigmatron (NASDAQ:SGMA)

過去 株価チャート

から 12 2023 まで 12 2024